Statistiche di base

| Azioni istituzionali (Long) | 20.682.203 - 18,73% (ex 13D/G) - change of -8,60MM shares -29,37% MRQ |

| Valore istituzionale (Long) | $ 609.241 USD ($1000) |

Proprietà istituzionale e azionisti

AllianceBernstein Holding L.P. - Limited Partnership (US:AB) ha 311 proprietari istituzionali e azionisti che hanno presentato i moduli 13D/G o 13F alla Securities Exchange Commission (SEC). Queste istituzioni detengono un totale di 20,682,203 azioni. I maggiori azionisti includono Kingstone Capital Partners Texas, LLC, Fmr Llc, FCPVX - Fidelity Small Cap Value Fund, American Century Companies Inc, Bank Of America Corp /de/, TWEIX - Equity Income Fund Investor Class, PGOAX - PGIM JENNISON SMALL COMPANY FUND Class A, Morgan Stanley, Wells Fargo & Company/mn, and FDMLX - Fidelity Series Intrinsic Opportunities Fund .

(AllianceBernstein Holding L.P. - Limited Partnership (NYSE:AB) la struttura proprietaria istituzionale mostra le attuali posizioni nella società da parte di istituzioni e fondi, nonché le ultime variazioni nella dimensione della posizione. I principali azionisti possono essere singoli investitori, fondi comuni, hedge fund o istituzioni. L'allegato 13D indica che l'investitore detiene (o ha detenuto) più del 5% della società e intende (o intendeva) perseguire attivamente un cambiamento nella strategia aziendale. L'allegato 13G indica un investimento passivo superiore al 5%.

The share price as of September 9, 2025 is 38,02 / share. Previously, on September 10, 2024, the share price was 33,63 / share. This represents an increase of 13,05% over that period.

Indice del sentiment dei fondi

L'indice del sentiment dei fondi (anche noto come "indice di accumulo di proprietà") individua i titoli più acquistati dai fondi. È il risultato di un sofisticato modello quantitativo multi-fattore che identifica le società con i più alti livelli di accumulo istituzionale. Il modello utilizza una combinazione dell'aumento totale dei proprietari dichiarati, delle variazioni nelle allocazioni di portafoglio di tali proprietari e di altre metriche. Il punteggio varia da 0 a 100: i numeri più alti indicano un livello di accumulo superiore ad altre società, mentre 50 rappresenta la media.

Frequenza di aggiornamento: giornaliera

Consulta Ownership Explorer per visualizzare l'elenco delle aziende con il ranking più alto.

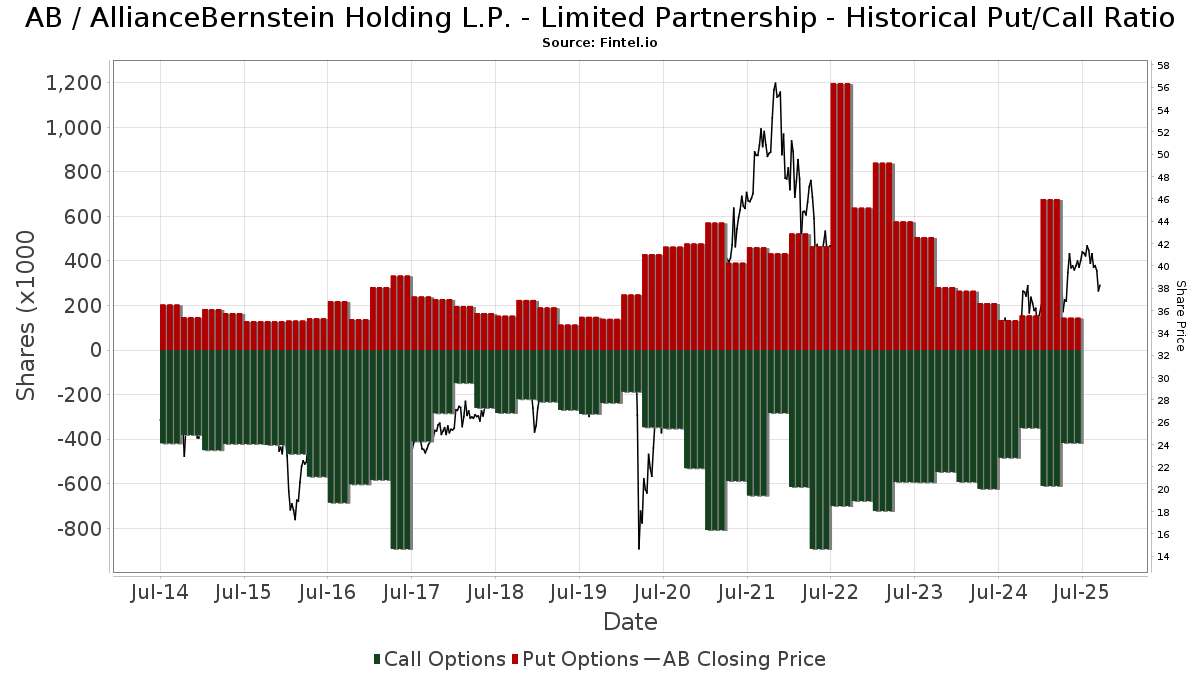

Rapporto put/call istituzionale

Oltre a segnalare le emissioni standard di titoli azionari e di debito, gli istituti con più di 100 milioni di asset in gestione devono anche dichiarare le loro partecipazioni in opzioni put e call. Poiché le opzioni put indicano generalmente un sentiment negativo e le opzioni call un sentiment positivo, possiamo avere un'idea del sentiment istituzionale complessivo attraverso il rapporto tra put e call. Il grafico a destra mostra il rapporto storico put/call per questo strumento.

L'utilizzo del rapporto put/call come indicatore del sentiment degli investitori consente di superare una delle principali lacune dell'utilizzo della proprietà istituzionale totale, ovvero il fatto che una quantità significativa di asset in gestione viene investita passivamente per seguire gli indici. Generalmente, i fondi a gestione passiva non acquistano opzioni, per cui il rapporto put/call riflette più fedelmente il sentiment dei fondi a gestione attiva.

Depositi 13D/G

Presentiamo i depositi 13D/G separatamente dai depositi 13F a causa del diverso trattamento da parte della SEC. I depositi 13D/G possono essere presentati da gruppi di investitori (con un unico leader), mentre i depositi 13F no. Ciò comporta situazioni in cui un investitore può depositare un documento 13D/G riportando un valore per il totale delle azioni (che rappresenta tutte le azioni possedute dal gruppo di investitori), e poi depositare un documento 13F riportando un valore diverso per il totale delle azioni (che rappresenta esclusivamente la propria proprietà). Ciò significa che la proprietà delle azioni nei depositi 13D/G e nei depositi 13F spesso non sono direttamente comparabili, pertanto le presentiamo separatamente.

Nota: a partire dal 16 maggio 2021, non mostriamo più i proprietari che non hanno depositato un documento 13D/G nellultimo anno. In precedenza, mostravamo lintero storico dei depositi 13D/G. In generale, le entità che sono tenute a depositare i documenti 13D/G devono farlo almeno una volta all'anno prima di presentare un deposito di chiusura. Tuttavia, a volte i fondi escono dalle posizioni senza presentare un deposito di chiusura (cioè, procedono a una liquidazione), per cui la visualizzazione dell'intero storico a volte generava confusione sull'attuale proprietà. Per evitare confusione, ora mostriamo solo i proprietari "attuali", ossia quelli che hanno effettuato un deposito nell'ultimo anno.

Upgrade to unlock premium data.

| Data di deposito | Modulo | Investitore | Azioni precedenti |

Ultime azioni |

Δ Azioni (Percentuale) |

Proprietà (Percentuale) |

Δ Proprietà (Percentuale) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-07-14 | Equitable Holdings, Inc. | 184,336,885 | 199,231,025 | 8.08 | 68.17 | 8.02 |

Depositi 13F e NPORT

Le informazioni relative ai depositi 13F sono gratuite. Per accedere alle informazioni relative ai depositi NP è necessario un'abbonamento premium. Le righe verdi indicano le nuove posizioni. Le righe rosse indicano le posizioni chiuse. Fai clic sull'icona del link per visualizzare la cronologia completa delle transazioni.

Esegui l'upgrade

per sbloccare i dati premium ed esportarli in Excel ![]() .

.

| Data di deposito | Fonte | Investitore | Tipo | Prezzo medio (Stima) |

Azioni | Δ Azioni (%) |

Valore dichiarato ($ 1000) |

Δ Valore (%) |

Allocazione del portafoglio (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 12.700 | -11,19 | 1 | ||||

| 2025-05-13 | 13F | Cresset Asset Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-03-21 | NP | AAARX - Strategic Allocation: Aggressive Fund R Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 5.572 | 9,75 | 223 | 18,62 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 911 | 0 | ||||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 12.500 | -63,45 | 1 | -100,00 | |||

| 2025-08-13 | 13F | Gabelli Funds Llc | 60.000 | -69,23 | 2.450 | -67,22 | ||||

| 2025-08-13 | 13F | Cary Street Partners Financial Llc | 7.860 | 0,87 | 321 | 7,38 | ||||

| 2025-07-14 | 13F | Armstrong Advisory Group, Inc | 503 | 0,00 | 21 | 11,11 | ||||

| 2025-08-14 | 13F | Ursa Fund Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | -100,00 | 0 | |||||

| 2025-07-11 | 13F | Caldwell Securities, Inc | 3.520 | -2,36 | 144 | 3,62 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | -100,00 | 0 | |||||

| 2025-05-07 | 13F | Sheaff Brock Investment Advisors, LLC | 6.680 | 0,00 | 256 | 3,24 | ||||

| 2025-08-14 | 13F | RBF Capital, LLC | 30.000 | 0,00 | 1.225 | 6,53 | ||||

| 2025-08-14 | 13F | RMB Capital Management, LLC | 7.575 | 309 | ||||||

| 2025-08-11 | 13F | FSA Wealth Management LLC | 604 | 0,00 | 25 | 4,35 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 27.115 | 1.255,75 | 1.107 | 1.356,58 | ||||

| 2025-05-12 | 13F | Sandy Spring Bank | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Regal Investment Advisors LLC | 7.290 | -10,10 | 298 | -4,19 | ||||

| 2025-08-19 | 13F | State of Wyoming | 8.599 | -3,03 | 351 | 3,54 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 6.615 | 1.102,73 | 270 | 1.250,00 | ||||

| 2025-08-14 | 13F | Peak6 Llc | Call | 34.100 | 3.000,00 | 1.392 | 3.214,29 | |||

| 2025-05-29 | NP | DSMC - Distillate Small/Mid Cash Flow ETF | 13.155 | -6,28 | 504 | 2,86 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 20.445 | 4,42 | 835 | 11,20 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 12.323 | 62,68 | 503 | 73,45 | ||||

| 2025-08-11 | 13F | Western Wealth Management, LLC | 9.599 | 0,05 | 392 | 6,54 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 255 | -16,67 | 10 | -9,09 | ||||

| 2025-08-05 | 13F | Fourth Dimension Wealth, LLC | 240 | 0,00 | 10 | 0,00 | ||||

| 2025-08-11 | 13F | Nicola Wealth Management Ltd. | 114.000 | -26,45 | 4.655 | -21,62 | ||||

| 2025-08-13 | 13F | Mackenzie Financial Corp | 13.430 | -8,14 | 548 | -2,14 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-06 | 13F | Equitec Proprietary Markets, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 19.973 | 79,87 | 815 | 91,76 | ||||

| 2025-08-06 | 13F | Equitec Proprietary Markets, Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-07-29 | 13F | Chevy Chase Trust Holdings, Inc. | 9.000 | 0,00 | 367 | 6,69 | ||||

| 2025-07-08 | 13F/A | Salem Investment Counselors Inc | 450 | 0,00 | 18 | 5,88 | ||||

| 2025-08-08 | 13F | TD Capital Management LLC | 226 | 0,00 | 9 | 12,50 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 444 | -10,12 | 18 | 0,00 | ||||

| 2025-07-17 | 13F/A | Capital Investment Advisors, LLC | 5.185 | -1,33 | 212 | 4,98 | ||||

| 2025-08-14 | 13F | Nomura Holdings Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | Put | 0 | -100,00 | 0 | ||||

| 2025-08-01 | 13F | Rossby Financial, LCC | 300 | 0,00 | 12 | 9,09 | ||||

| 2025-08-06 | 13F | Equitec Proprietary Markets, Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-07-17 | 13F | Sonora Investment Management Group, LLC | 8.927 | 0,89 | 364 | 7,69 | ||||

| 2025-08-13 | 13F | Callodine Capital Management, LP | 0 | -100,00 | 0 | |||||

| 2025-06-30 | NP | RIVSX - River Oak Discovery Fund | 21.518 | 0,00 | 848 | -1,74 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-08-07 | 13F | Americana Partners, LLC | 5.062 | 207 | ||||||

| 2025-08-14 | 13F | GWM Advisors LLC | 3.298 | 0,58 | 135 | 7,20 | ||||

| 2025-05-30 | NP | GABCX - The Gabelli Abc Fund Class Aaa | 120.000 | 207,69 | 4.597 | 217,91 | ||||

| 2025-05-27 | NP | Advanced Series Trust - Ast Prudential Growth Allocation Portfolio | 12.056 | -11,43 | 462 | -8,53 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 1 | -97,67 | 0 | -100,00 | ||||

| 2025-07-10 | 13F | Atticus Wealth Management, Llc | 2.345 | 0,00 | 96 | 6,74 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 15.267 | -0,01 | 623 | 6,68 | ||||

| 2025-08-13 | 13F | Four Tree Island Advisory LLC | 208.083 | 0,00 | 8.496 | 6,59 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 126 | -94,50 | 0 | |||||

| 2025-08-29 | NP | GCAEX - The Gabelli Equity Income Fund Class A | 20.000 | 0,00 | 817 | 6,53 | ||||

| 2025-07-18 | 13F/A | MJT & Associates Financial Advisory Group, Inc. | 187 | 0,00 | 8 | 0,00 | ||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | Call | 0 | -100,00 | 0 | ||||

| 2025-07-22 | 13F | Iron Horse Wealth Management, LLC | 286 | 12 | ||||||

| 2025-07-16 | 13F | Essex Financial Services, Inc. | 6.995 | 0,00 | 286 | 6,74 | ||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 16.201 | 13,34 | 661 | 20,84 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 124 | -87,44 | 5 | -86,49 | ||||

| 2025-04-14 | 13F | IMC-Chicago, LLC | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-13 | 13F | MONECO Advisors, LLC | 10.495 | -8,05 | 429 | -2,06 | ||||

| 2025-07-24 | 13F | Baldwin Brothers Inc/ma | 17.525 | 0,00 | 716 | 6,56 | ||||

| 2025-07-09 | 13F | Bank of New Hampshire | 300 | 12 | ||||||

| 2025-07-25 | NP | TEMGX - Templeton Global Smaller Companies Fund Class A | 375.765 | -1,67 | 15.012 | 4,30 | ||||

| 2025-08-14 | 13F | Beck Mack & Oliver Llc | 7.658 | -13,55 | 313 | -7,96 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 479 | -24,21 | 20 | -17,39 | ||||

| 2025-04-22 | 13F | Duncker Streett & Co Inc | 0 | -100,00 | 0 | |||||

| 2025-06-09 | NP | Bmc Fund Inc | 1.312 | 0,00 | 52 | -1,92 | ||||

| 2025-08-01 | 13F | Vision Financial Markets Llc | 5.800 | 0,00 | 237 | 6,31 | ||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 5.214 | 213 | ||||||

| 2025-07-17 | 13F | Oakworth Capital, Inc. | 0 | -100,00 | 0 | |||||

| 2025-03-21 | NP | AACRX - Strategic Allocation: Conservative Fund R Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1.530 | 27,39 | 61 | 38,64 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 4.001 | 0 | ||||||

| 2025-08-14 | 13F | 10Elms LLP | 15.460 | 0,00 | 631 | 6,59 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 4.135 | 0,00 | 169 | 6,33 | ||||

| 2025-05-30 | NP | Gabelli Global Utility & Income Trust | 5.000 | -28,57 | 192 | -26,25 | ||||

| 2025-05-02 | 13F | Fortis Group Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Compass Wealth Management LLC | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Formidable Asset Management, LLC | 22.320 | 0,00 | 855 | 0,00 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 27.882 | -2,64 | 1.138 | 3,74 | ||||

| 2025-08-08 | 13F | Sittner & Nelson, Llc | 8.100 | 0,00 | 331 | 6,45 | ||||

| 2025-08-15 | 13F | Resources Management Corp /ct/ /adv | 15.550 | -1,11 | 1 | |||||

| 2025-07-21 | 13F | DHJJ Financial Advisors, Ltd. | 16 | 0,00 | 1 | |||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 1.435 | 0,00 | 59 | 7,41 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 126.153 | -3,20 | 5.151 | 3,17 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 35.384 | 349,43 | 1.445 | 379,73 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 17.876 | -10,49 | 730 | -4,71 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 15.644 | -4,95 | 639 | 1,27 | ||||

| 2025-08-14 | 13F | American Trust Investment Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Ancora Advisors, LLC | 11.550 | 0,00 | 472 | 6,56 | ||||

| 2025-07-16 | 13F | Cadent Capital Advisors, LLC | 10.080 | 0,00 | 412 | 6,48 | ||||

| 2025-08-15 | NP | Guardian Variable Products Trust - Guardian Select Mid Cap Core VIP Fund | 20.934 | -1,91 | 855 | 4,53 | ||||

| 2025-06-26 | NP | FAFDX - Fidelity Advisor Financial Services Fund Class A This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 138.700 | -42,64 | 5.465 | -43,59 | ||||

| 2025-05-15 | 13F | Manufacturers Life Insurance Company, The | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 5.150 | 0,00 | 210 | 6,60 | ||||

| 2025-08-12 | 13F | Horizon Kinetics Asset Management Llc | 164.892 | 42,17 | 6.733 | 51,52 | ||||

| 2025-04-24 | NP | PFSAX - PGIM Jennison Financial Services Fund Class A | 27.126 | -53,91 | 1.022 | -52,16 | ||||

| 2025-08-15 | 13F | 44 Wealth Management Llc | 5.000 | 204 | ||||||

| 2025-07-31 | 13F | Richards, Merrill & Peterson, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-29 | NP | BPSIX - Boston Partners Small Cap Value Fund II INSTITUTIONAL | 36.797 | -3,62 | 1.470 | 2,30 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | 683 Capital Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 644.042 | -86,31 | 26.296 | -85,41 | ||||

| 2025-07-24 | 13F | Trust Co Of Toledo Na /oh/ | 500 | 20 | ||||||

| 2025-08-12 | 13F | Oak Associates Ltd /oh/ | 23.711 | 3,00 | 968 | 9,88 | ||||

| 2025-08-13 | 13F | Blue Fin Capital, Inc. | 26.717 | -33,45 | 1.091 | -26,80 | ||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 8.717 | 0,00 | 356 | 6,61 | ||||

| 2025-07-11 | 13F | Grove Bank & Trust | 500 | 20 | ||||||

| 2025-08-12 | 13F | Franklin Resources Inc | 384.740 | -1,14 | 15.709 | 5,37 | ||||

| 2025-08-13 | 13F | JBR Co Financial Management Inc | 13.605 | 13,06 | 555 | 20,65 | ||||

| 2025-04-03 | 13F | Central Pacific Bank - Trust Division | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-14 | 13F | Brown Brothers Harriman & Co | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Disciplined Equity Management, Inc. | 60.293 | 12,06 | 2.462 | 19,41 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 12.291 | -73,81 | 502 | -72,14 | ||||

| 2025-04-22 | 13F | Brown, Lisle/cummings, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-01 | 13F | Brookwood Investment Group LLC | 27.344 | 76,47 | 1.116 | 88,20 | ||||

| 2025-05-23 | NP | PGOAX - PGIM JENNISON SMALL COMPANY FUND Class A | 872.376 | 0,00 | 33.421 | 3,29 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 1.500 | 0,00 | 61 | 7,02 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 5.618 | -4,47 | 229 | 1,78 | ||||

| 2025-08-12 | 13F | Bokf, Na | 800 | 0,00 | 33 | 6,67 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 100 | 0,00 | 4 | 33,33 | ||||

| 2025-05-15 | 13F | Talon Private Wealth, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 7.525 | 0,56 | 307 | 6,99 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 1.000 | 0,00 | 41 | 5,26 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 1 | 0,00 | 0 | |||||

| 2025-07-24 | NP | FMCDX - Fidelity Advisor Stock Selector Mid Cap Fund Class A This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 245.809 | -28,90 | 9.820 | -24,57 | ||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 6.200 | 0,00 | 253 | 6,75 | ||||

| 2025-06-26 | NP | FCPVX - Fidelity Small Cap Value Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1.606.357 | 4,43 | 63.290 | 2,71 | ||||

| 2025-07-15 | 13F | Northside Capital Management, LLC | 13.625 | 556 | ||||||

| 2025-08-13 | 13F | Haverford Trust Co | 7.906 | 0,00 | 323 | 6,62 | ||||

| 2025-04-25 | NP | CFMCX - Column Mid Cap Fund | 17.395 | 0,68 | 655 | 4,63 | ||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 7.500 | 0,00 | 306 | 6,62 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Sit Investment Associates Inc | 40.200 | 0,00 | 2 | 0,00 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 22.079 | -2,65 | 901 | 3,92 | ||||

| 2025-08-14 | 13F | Alpine Global Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 12.901 | -2,61 | 527 | 3,75 | ||||

| 2025-08-14 | 13F | Williams Jones Wealth Management, LLC. | 81.600 | -2,04 | 3.332 | 4,39 | ||||

| 2025-04-22 | 13F | Center for Financial Planning, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Hrt Financial Lp | 108.143 | 438,08 | 4 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 456.156 | 1,67 | 18.625 | 8,35 | ||||

| 2025-07-15 | 13F | Tepp RIA, LLC | 7.683 | 0,00 | 314 | 6,46 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 149.922 | 1,44 | 6.121 | 8,13 | ||||

| 2025-08-14 | 13F | Ausdal Financial Partners, Inc. | 5.133 | 210 | ||||||

| 2025-08-14 | 13F | CoreFirst Bank & Trust | 600 | 24 | ||||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 1.129 | 4,93 | 46 | 17,95 | ||||

| 2025-08-14 | 13F | Peak6 Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | CFC Planning Co LLC | 5.633 | 230 | ||||||

| 2025-07-31 | 13F | Orion Capital Management LLC | 4 | 0,00 | 0 | |||||

| 2025-07-25 | 13F | Joel Adams & Associates, Inc. | 5.000 | 204 | ||||||

| 2025-05-02 | 13F | Cullen/frost Bankers, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F | Second Line Capital, LLC | 9.295 | 13,98 | 379 | 21,47 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 32.568 | 3,60 | 1.330 | 10,38 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 1.083.131 | -19,54 | 44.224 | -14,25 | ||||

| 2025-08-08 | 13F | WASHINGTON TRUST Co | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Scarborough Advisors, LLC | 279 | 11 | ||||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 8.973 | -4,33 | 366 | 1,95 | ||||

| 2025-07-23 | 13F | Tyche Wealth Partners LLC | 5.000 | 204 | ||||||

| 2025-07-18 | 13F | Consolidated Planning Corp | 7.051 | 0,00 | 288 | 6,30 | ||||

| 2025-08-14 | 13F | IPG Investment Advisors LLC | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Merrion Investment Management Co, LLC | 6.500 | 0,00 | 265 | 6,43 | ||||

| 2025-08-13 | 13F | Virtus ETF Advisers LLC | 0 | -100,00 | 0 | |||||

| 2025-05-13 | 13F | State of Tennessee, Treasury Department | 0 | -100,00 | 0 | |||||

| 2025-08-26 | NP | AZBAX - AllianzGI Small-Cap Fund Class A | 7.513 | -51,88 | 307 | -48,83 | ||||

| 2025-07-22 | 13F | Belpointe Asset Management LLC | 19.311 | -12,02 | 788 | -6,19 | ||||

| 2025-08-13 | 13F | Transce3nd, LLC | 670 | -0,74 | 27 | 8,00 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 17.654 | 0,87 | 721 | 7,46 | ||||

| 2025-07-25 | 13F | Johnson Investment Counsel Inc | 10.434 | 0,00 | 426 | 6,77 | ||||

| 2025-07-18 | 13F | CHURCHILL MANAGEMENT Corp | 314.844 | -2,01 | 12.855 | 4,44 | ||||

| 2025-08-14 | 13F | Sei Investments Co | 9.563 | -48,27 | 390 | -44,92 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 350 | 0,57 | 14 | 7,69 | ||||

| 2025-08-01 | 13F | Chilton Capital Management Llc | 31.190 | 0,00 | 1.273 | 6,62 | ||||

| 2025-08-11 | 13F | Delta Asset Management Llc/tn | 310 | 0,00 | 13 | 9,09 | ||||

| 2025-05-07 | 13F | Bastion Asset Management Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-15 | 13F | Virtus Investment Advisers, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | LRI Investments, LLC | 197 | 0,00 | 8 | 14,29 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Summit Trail Advisors, Llc | 8.755 | 0,00 | 357 | 6,57 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 1.992 | 1,17 | 81 | 8,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 56.800 | -51,54 | 2.319 | -48,34 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | 10.805 | -98,04 | 441 | -97,91 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 72.200 | -33,09 | 2.948 | -28,70 | |||

| 2025-08-18 | 13F | Old North State Trust, LLC | 6.035 | 0,00 | 0 | |||||

| 2025-07-18 | 13F | Chelsea Counsel Co | 95.330 | 807,90 | 3.892 | 868,16 | ||||

| 2025-08-14 | 13F | Herold Advisors, Inc. | 15.700 | 0,00 | 641 | 6,66 | ||||

| 2025-08-13 | 13F | Truvestments Capital Llc | 939 | 2,07 | 38 | 8,57 | ||||

| 2025-03-21 | NP | TWSMX - Strategic Allocation: Moderate Fund Investor Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 4.866 | 9,87 | 195 | 18,29 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 61.215 | 0,20 | 2.499 | 6,79 | ||||

| 2025-08-13 | 13F | M&t Bank Corp | 42.540 | 0,00 | 1.737 | 6,57 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 675 | 0,00 | 28 | 8,00 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 95.627 | 8,20 | 3.904 | 15,30 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 78.690 | -0,06 | 3.213 | 6,50 | ||||

| 2025-07-28 | 13F | Private Wealth Asset Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Infrastructure Capital Advisors, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-07 | 13F | Walnut Private Equity Partners, Llc | 25.949 | 0,00 | 1.059 | 6,54 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 7.821 | -4,62 | 319 | 1,59 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 7.152 | 104,28 | 289 | 115,67 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 1.829 | 0,00 | 75 | 5,71 | ||||

| 2025-04-21 | 13F | Ronald Blue Trust, Inc. | 0 | -100,00 | 0 | |||||

| 2025-04-29 | 13F | Hm Payson & Co | 1.000 | 0,00 | 38 | 2,70 | ||||

| 2025-08-01 | 13F | Gwn Securities Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Creative Planning | 14.669 | 19,50 | 599 | 27,23 | ||||

| 2025-08-15 | 13F | Prevail Innovative Wealth Advisors, Llc | 21.822 | 98,04 | 891 | 110,90 | ||||

| 2025-08-01 | 13F | Jennison Associates Llc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Epoch Investment Partners, Inc. | 25.038 | -83,32 | 1.022 | -82,23 | ||||

| 2025-08-14 | 13F | Harvest Management Llc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Northern Trust Corp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Hurley Capital, LLC | 186 | 2,20 | 8 | 16,67 | ||||

| 2025-05-14 | 13F | Basswood Capital Management, L.l.c. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-06 | 13F | Van Cleef Asset Management,Inc | 6.525 | -1,88 | 266 | 4,72 | ||||

| 2025-04-25 | 13F | Stonebridge Financial Group, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | PSI Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | BluePath Capital Management, LLC | 28.437 | 22,14 | 1.161 | 30,30 | ||||

| 2025-07-16 | 13F | PFS Partners, LLC | 190 | 0,00 | 8 | 0,00 | ||||

| 2025-04-14 | 13F | Beach Investment Counsel Inc/pa | 12.125 | 0,00 | 0 | |||||

| 2025-05-13 | 13F | Beacon Pointe Advisors, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 14.376 | 10,30 | 587 | 17,43 | ||||

| 2025-08-19 | 13F | Anchor Investment Management, LLC | 3.375 | 0,00 | 138 | 6,20 | ||||

| 2025-08-12 | 13F/A | Boston Partners | 37.264 | -0,95 | 1.521 | 5,55 | ||||

| 2025-04-29 | 13F | Lee Danner & Bass Inc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 17.256 | 2,77 | 705 | 9,49 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 100 | 0,00 | 4 | 33,33 | ||||

| 2025-08-07 | 13F | Proficio Capital Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Perigon Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | Mather Group, Llc. | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Highland Capital Management, Llc | 34.915 | 112,47 | 1.426 | 126,55 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 2.616 | 0,08 | 107 | 6,00 | ||||

| 2025-07-16 | 13F | FCG Investment Co | 8.873 | 362 | ||||||

| 2025-08-05 | 13F | Mission Wealth Management, Lp | 29.235 | 0,00 | 1.194 | 6,61 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 421.866 | 10,77 | 17.225 | 18,06 | ||||

| 2025-08-05 | 13F | Freestone Capital Holdings, LLC | 8.801 | 0,00 | 359 | 6,53 | ||||

| 2025-08-06 | 13F | Zevin Asset Management Llc | 6.863 | -33,42 | 0 | |||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 33.319 | 0,00 | 1.360 | 6,58 | ||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 150 | -40,00 | 6 | -33,33 | ||||

| 2025-07-28 | 13F | Nadler Financial Group, Inc. | 10.840 | 0,00 | 443 | 6,51 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 1.300 | 0,00 | 53 | 8,16 | ||||

| 2025-08-06 | 13F | Moors & Cabot, Inc. | 60.134 | -2,92 | 2.455 | 3,50 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 363.158 | -67,94 | 14.828 | -65,84 | ||||

| 2025-08-04 | 13F | Moody Aldrich Partners Llc | 59.294 | 0,00 | 2.421 | 6,56 | ||||

| 2025-08-12 | 13F | Change Path, LLC | 5.427 | 1,04 | 222 | 7,80 | ||||

| 2025-05-09 | 13F | Blair William & Co/il | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-23 | 13F | Sax Wealth Advisors, Llc | 6.117 | 0,00 | 250 | 6,41 | ||||

| 2025-05-15 | 13F | Barclays Plc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-15 | 13F | Peddock Capital Advisors, Llc | 5.780 | 0,00 | 236 | 6,33 | ||||

| 2025-07-24 | 13F | Costello Asset Management, INC | 1.900 | 0,00 | 78 | 6,94 | ||||

| 2025-08-14 | 13F | Lombard Odier Asset Management (Europe) Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-29 | NP | EMAAX - Enterprise Mergers and Acquisitions Fund Class A | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-05 | 13F | Crestwood Advisors Group LLC | 26.424 | 0,00 | 1.079 | 6,52 | ||||

| 2025-08-01 | 13F | GoalVest Advisory LLC | 783 | 0,00 | 32 | 6,90 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 221.278 | 4,28 | 9.035 | 11,15 | ||||

| 2025-08-12 | 13F | Segall Bryant & Hamill, Llc | 14.100 | 0,00 | 576 | 6,48 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 70.819 | -85,71 | 2.892 | -84,77 | ||||

| 2025-08-12 | 13F | American Century Companies Inc | 1.171.246 | -32,48 | 47.822 | -28,04 | ||||

| 2025-05-01 | 13F | Gateway Wealth Partners, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Argent Trust Co | 62.182 | -14,62 | 2.539 | -9,03 | ||||

| 2025-08-13 | 13F | F/M Investments LLC | 13.465 | 0,00 | 550 | 6,60 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 70.492 | -78,42 | 2.878 | -77,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 38.100 | -79,63 | 1.556 | -78,29 | |||

| 2025-08-14 | 13F | DRW Securities, LLC | 17.467 | 713 | ||||||

| 2025-07-01 | 13F | Cacti Asset Management Llc | 44.850 | 0,00 | 1.815 | 5,47 | ||||

| 2025-07-09 | 13F | New England Research & Management, Inc. | 9.900 | -14,66 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 207.300 | -12,83 | 8.464 | -7,09 | |||

| 2025-08-07 | 13F | BOK Financial Private Wealth, Inc. | 300 | 0,00 | 12 | 9,09 | ||||

| 2025-08-07 | 13F | Roberts Glore & Co Inc /il/ | 5.485 | 0,00 | 224 | 6,19 | ||||

| 2025-08-12 | 13F | Jaffetilchin Investment Partners, LLC | 15.571 | 0,74 | 636 | 7,26 | ||||

| 2025-08-13 | 13F | Jump Financial, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Natixis | 0 | -100,00 | 0 | |||||

| 2025-05-19 | 13F/A | Jane Street Group, Llc | Put | 0 | -100,00 | 0 | -100,00 | |||

| 2025-07-17 | 13F | Tritonpoint Wealth, Llc | 17.466 | 0,00 | 713 | 6,58 | ||||

| 2025-08-13 | 13F | Formula Growth Ltd | 43.090 | 1.759 | ||||||

| 2025-07-25 | 13F | Cwm, Llc | 71 | 115,15 | 0 | |||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 11.512 | 66,53 | 470 | 77,36 | ||||

| 2025-07-10 | 13F | Capital Advisory Group Advisory Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Thompson Investment Management, Inc. | 600 | 24 | ||||||

| 2025-08-11 | 13F | Independent Advisor Alliance | 9.136 | 9,28 | 373 | 16,56 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | Truist Financial Corp | 16.760 | 0,28 | 684 | 6,88 | ||||

| 2025-07-17 | 13F | Vermillion Wealth Management, Inc. | 300 | 0,00 | 12 | 9,09 | ||||

| 2025-07-11 | 13F | Mallini Complete Financial Planning LLC | 381 | 7,34 | ||||||

| 2025-08-14 | 13F | Bramshill Investments, LLC | 21.187 | -0,27 | 865 | 6,40 | ||||

| 2025-05-06 | 13F | Kovack Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-10 | 13F | Moody National Bank Trust Division | 8.406 | 0,91 | 343 | 7,52 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 33 | 1 | ||||||

| 2025-08-13 | 13F | Aristides Capital LLC | 40.920 | 0,00 | 1.671 | 6,57 | ||||

| 2025-08-14 | 13F | Sandia Investment Management LP | 0 | -100,00 | 0 | |||||

| 2025-04-21 | 13F | Beacon Capital Management, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-02 | 13F | Retirement Planning Co of New England, Inc. | 0 | -100,00 | 0 | |||||

| 2025-04-21 | 13F | Luken Investment Analytics, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-01 | 13F | Twin Lakes Capital Management, LLC | 2.529 | 2,02 | 103 | 9,57 | ||||

| 2025-08-12 | 13F | Bahl & Gaynor Inc | 0 | -100,00 | 0 | |||||

| 2025-07-28 | NP | SCAP - InfraCap Small Cap Income ETF | 3.770 | -53,31 | 151 | -50,66 | ||||

| 2025-07-21 | 13F | Vaughan Nelson Investment Management, L.p. | 2.600 | 0,00 | 106 | |||||

| 2025-05-16 | 13F | McIlrath & Eck, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 12.020 | 12,49 | 0 | |||||

| 2025-08-13 | 13F | Hudson Portfolio Management LLC | 9.450 | 0,00 | 386 | 6,35 | ||||

| 2025-07-18 | 13F | PFG Investments, LLC | 9.923 | 66,55 | 405 | 77,63 | ||||

| 2025-07-11 | 13F | Kingstone Capital Partners Texas, LLC | 5.168.578 | 194 | ||||||

| 2025-08-14 | 13F | Horizon Investments, LLC | 219 | 9 | ||||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 6.405 | 55,39 | 262 | 66,24 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 66.310 | -92,77 | 2.707 | -92,29 | ||||

| 2025-07-31 | 13F | FSM Wealth Advisors, LLC | 7.720 | 320 | ||||||

| 2025-08-15 | 13F | Northeast Financial Consultants Inc | 46.409 | 0,00 | 1.895 | 6,58 | ||||

| 2025-06-26 | NP | FDMLX - Fidelity Series Intrinsic Opportunities Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 434.800 | 8,16 | 17.131 | 6,38 | ||||

| 2025-08-13 | 13F | Nicolet Advisory Services, Llc | 8.598 | 0,00 | 349 | 13,68 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 10.380 | -29,00 | 424 | -24,46 | ||||

| 2025-07-28 | NP | KBWD - Invesco KBW High Dividend Yield Financial ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 319.804 | 40,61 | 12.776 | 49,17 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 39.120 | 2,25 | 1.597 | 9,01 | ||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 20.308 | 0,79 | 829 | 7,52 | ||||

| 2025-07-01 | 13F | Harbor Investment Advisory, Llc | 1.200 | -4,00 | 49 | 2,13 | ||||

| 2025-08-14 | 13F | Css Llc/il | Put | 0 | -100,00 | 0 | ||||

| 2025-08-19 | 13F | Cape Investment Advisory, Inc. | 567 | -23,38 | 23 | -17,86 | ||||

| 2025-08-13 | 13F | Gamco Investors, Inc. Et Al | 33.198 | -53,89 | 1.355 | -50,87 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 11.400 | 58,33 | 465 | 69,09 | |||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 1.500 | -96,16 | 61 | -95,93 | |||

| 2025-05-14 | 13F | Van Hulzen Asset Management, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 8.391 | 343 | ||||||

| 2025-05-22 | NP | MANNING & NAPIER FUND, INC. - Callodine Equity Income Series Class I | 174.060 | -3,30 | 6.668 | -0,12 | ||||

| 2025-08-11 | 13F | One Capital Management, LLC | 8.029 | 0,00 | 328 | 6,51 | ||||

| 2025-07-22 | 13F | Kessler Investment Group, LLC | 70 | 0,00 | 3 | 0,00 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 8.680 | -10,79 | 0 | |||||

| 2025-08-11 | 13F | Knott David M Jr | 48.000 | 0,00 | 1.960 | 6,58 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 1 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Wealth Preservation Advisors, LLC | 15.061 | 0,00 | 615 | 6,60 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 174.553 | -46,29 | 7.127 | -42,77 | ||||

| 2025-08-04 | 13F | Canton Hathaway, LLC | 27.000 | 25,73 | 1 | |||||

| 2025-08-14 | 13F | Css Llc/il | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | HFG Advisors, Inc. | 6.560 | -4,89 | 268 | 1,14 | ||||

| 2025-08-08 | 13F | Schwarz Dygos Wheeler Investment Advisors Llc | 6.095 | 0,00 | 249 | 6,44 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 183.021 | 0,16 | 7.522 | 7,46 | ||||

| 2025-04-29 | 13F | Envestnet Asset Management Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Peak6 Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-08-12 | 13F | Integrated Advisors Network LLC | 10.449 | -2,25 | 427 | 4,16 | ||||

| 2025-08-29 | NP | GATAX - The Gabelli Asset Fund Class A | 40.000 | 0,00 | 1.633 | 6,59 | ||||

| 2025-07-15 | 13F | Shulman DeMeo Asset Management LLC | 14.115 | 0,35 | 576 | 7,06 | ||||

| 2025-07-28 | 13F | Mutual Advisors, LLC | 14.405 | 0,88 | 618 | 14,90 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 59.829 | 0,72 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Fmr Llc | 2.445.741 | -26,23 | 99.860 | -21,37 | ||||

| 2025-08-28 | NP | TWEIX - Equity Income Fund Investor Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 982.139 | -33,00 | 40.101 | -28,59 | ||||

| 2025-07-14 | 13F | Opal Wealth Advisors, LLC | 7.111 | 0,00 | 290 | 6,62 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 38.236 | 3,54 | 1.561 | 10,24 | ||||

| 2025-08-20 | NP | AAIIX - Ancora Income Fund Class I | 4.200 | 0,00 | 171 | 6,88 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Put | 11.300 | 461 | |||||

| 2025-08-22 | NP | VARIABLE INSURANCE PRODUCTS FUND IV - Financial Services Portfolio Initial Class | 62.800 | -48,18 | 2.564 | -44,78 | ||||

| 2025-04-28 | 13F | Redmont Wealth Advisors Llc | 11.373 | 0,00 | 436 | 3,33 | ||||

| 2025-07-10 | 13F | Kozak & Associates, Inc. | 1.125 | 1,63 | 46 | 12,20 | ||||

| 2025-08-05 | 13F | Mountain Hill Investment Partners Corp. | 0 | -100,00 | 0 | |||||

| 2025-07-24 | NP | FIDSX - Financial Services Portfolio This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 215.000 | -56,09 | 8.589 | -53,42 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Whittier Trust Co Of Nevada Inc | 159 | 0,00 | 6 | 0,00 | ||||

| 2025-08-12 | 13F | Manchester Capital Management LLC | 407 | 0,00 | 15 | 0,00 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 12.619 | -4,61 | 515 | 1,78 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 76.786 | 14,98 | 3.135 | 26,58 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 103.869 | -3,58 | 4 | 0,00 | ||||

| 2025-05-08 | 13F | HHM Wealth Advisors, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 1.000 | 0,00 | 41 | 5,26 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 72.357 | 16,73 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 58.353 | -31,26 | 2.383 | -26,75 | ||||

| 2025-04-25 | 13F | K.J. Harrison & Partners Inc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-05 | 13F | GHP Investment Advisors, Inc. | 1.154 | 2,03 | 47 | 9,30 | ||||

| 2025-08-14 | 13F | TCG Advisory Services, LLC | 208.278 | -2,01 | 8.504 | 4,45 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | First National Trust Co | 26.824 | 0,00 | 1.095 | 6,62 | ||||

| 2025-08-13 | 13F | Manning & Napier Advisors Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 37.889 | -0,33 | 1.547 | 6,25 | ||||

| 2025-08-14 | 13F | First Foundation Advisors | 24.500 | 0,00 | 1.000 | 6,61 | ||||

| 2025-08-20 | NP | LSPAX - LoCorr Spectrum Income Fund Class A | 19.399 | 0,00 | 792 | 6,59 | ||||

| 2025-08-13 | 13F | Keystone Financial Group | 19.169 | 4,87 | 774 | 6,62 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 17.679 | 722 | ||||||

| 2025-04-22 | 13F | Mendota Financial Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | Chicago Partners Investment Group LLC | 6.833 | 0,00 | 285 | 1,79 | ||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 2.575 | 0,00 | 105 | 7,14 | ||||

| 2025-08-13 | 13F | Fiduciary Group LLC | 6.565 | -5,74 | 268 | 0,75 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 25.635 | 24,88 | 1.047 | 33,08 | ||||

| 2025-08-07 | 13F | Zions Bancorporation, National Association /ut/ | 2.000 | 0,00 | 82 | 6,58 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 159.673 | -3,86 | 6.520 | 2,47 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 388 | 0,00 | 16 | 7,14 | ||||

| 2025-07-23 | 13F | Birinyi Associates Inc | 10.261 | -8,64 | 0 | |||||

| 2025-08-07 | 13F | Future Fund LLC | 13.044 | 10,22 | 533 | 17,44 | ||||

| 2025-08-04 | 13F | Flagship Harbor Advisors, Llc | 9.185 | -1,24 | 375 | 5,34 | ||||

| 2025-07-14 | 13F | CHICAGO TRUST Co NA | 6.000 | 245 | ||||||

| 2025-08-12 | 13F | Skopos Labs, Inc. | 13 | 0,00 | 0 | |||||

| 2025-04-29 | NP | ICAP - InfraCap Equity Income Fund ETF | 40.806 | 8,12 | 1.537 | 12,28 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 90 | 0,00 | 4 | 0,00 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 173.692 | -2,91 | 7.092 | 3,47 | ||||

| 2025-08-14 | 13F/A | Zazove Associates Llc | Call | 67.400 | 0,00 | 88 | -81,99 | |||

| 2025-08-12 | 13F | Clear Street Markets Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-08-12 | 13F | Laurel Wealth Advisors LLC | 205 | 4.000,00 | 0 | |||||

| 2025-08-12 | 13F | Clear Street Markets Llc | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | DAVENPORT & Co LLC | 37.022 | 0,82 | 1.512 | 7,47 | ||||

| 2025-03-31 | NP | FIDAX - Financial Industries Fund Class A | 183.168 | 3,89 | 7.338 | 12,32 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 26.829 | -1,99 | 1.095 | 4,48 | ||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 9.525 | 13,65 | 389 | 20,87 | ||||

| 2025-07-29 | NP | FFND - The Future Fund Active ETF | 12.672 | 18,20 | 506 | 25,56 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 37.800 | -16,56 | 1.543 | -11,07 | |||

| 2025-07-15 | 13F | North Star Investment Management Corp. | 2.341 | 0,00 | 96 | 6,74 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 78.323 | -46,51 | 3.198 | -43,01 | ||||

| 2025-08-14 | 13F | UBS Group AG | 292.235 | -77,33 | 11.932 | -75,84 | ||||

| 2025-07-28 | 13F | Davidson Trust Co | 7.000 | 0,00 | 286 | 6,34 | ||||

| 2025-07-23 | 13F | Joel Isaacson & Co., LLC | 10.177 | 0,00 | 416 | 6,68 | ||||

| 2025-07-31 | 13F/A | Avion Wealth | 584 | 5,04 | 0 | |||||

| 2025-07-29 | 13F | Koshinski Asset Management, Inc. | 6.165 | 12,81 | 252 | 20,10 | ||||

| 2025-06-24 | NP | NLSAX - Neuberger Berman Long Short Fund Class A | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-04-16 | 13F | Fortitude Family Office, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Summit Asset Management, LLC | 5.450 | 0,00 | 223 | 6,73 | ||||

| 2025-07-15 | 13F | SJS Investment Consulting Inc. | 420 | 0,00 | 17 | 6,25 |