Statistiche di base

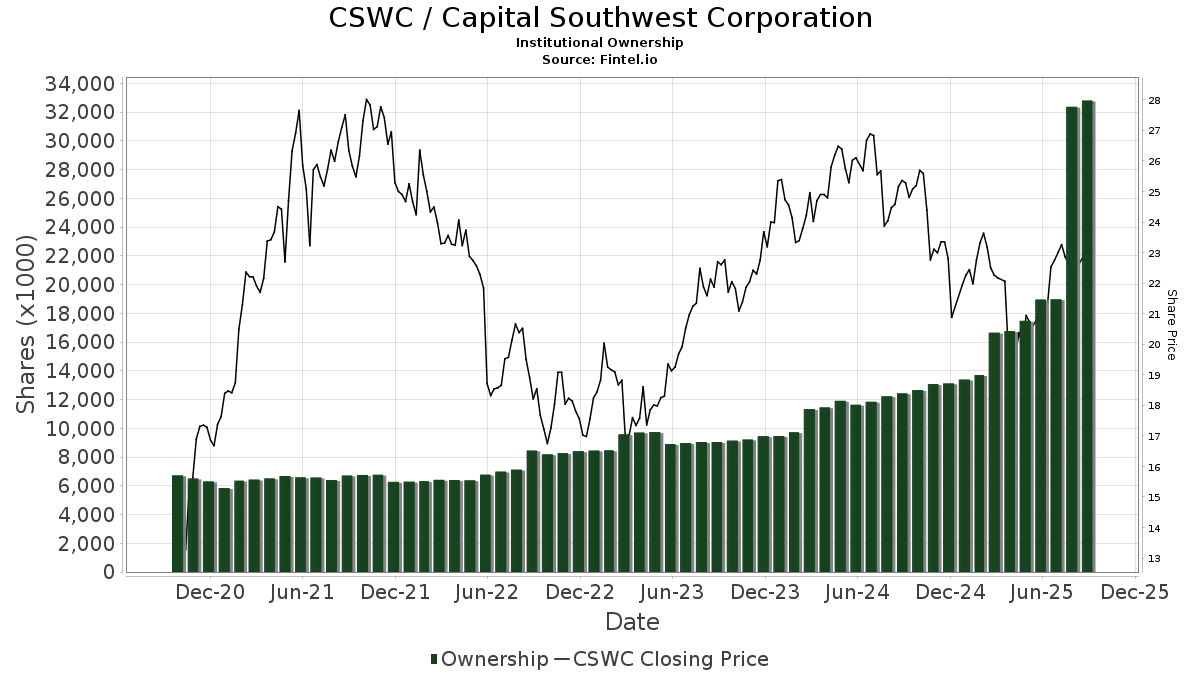

| Azioni istituzionali (Long) | 32.770.410 (ex 13D/G) - change of 13,82MM shares 72,91% MRQ |

| Valore istituzionale (Long) | $ 437.686 USD ($1000) |

Proprietà istituzionale e azionisti

Capital Southwest Corporation (US:CSWC) ha 192 proprietari istituzionali e azionisti che hanno presentato i moduli 13D/G o 13F alla Securities Exchange Commission (SEC). Queste istituzioni detengono un totale di 32,772,785 azioni. I maggiori azionisti includono Kingstone Capital Partners Texas, LLC, Sanders Morris Harris Llc, Van Eck Associates Corp, BIZD - VanEck Vectors BDC Income ETF, Two Sigma Advisers, Lp, UBS Group AG, Two Sigma Investments, Lp, Sound Income Strategies, LLC, Balyasny Asset Management Llc, and Millennium Management Llc .

(Capital Southwest Corporation (NasdaqGS:CSWC) la struttura proprietaria istituzionale mostra le attuali posizioni nella società da parte di istituzioni e fondi, nonché le ultime variazioni nella dimensione della posizione. I principali azionisti possono essere singoli investitori, fondi comuni, hedge fund o istituzioni. L'allegato 13D indica che l'investitore detiene (o ha detenuto) più del 5% della società e intende (o intendeva) perseguire attivamente un cambiamento nella strategia aziendale. L'allegato 13G indica un investimento passivo superiore al 5%.

The share price as of September 5, 2025 is 22,96 / share. Previously, on September 6, 2024, the share price was 24,99 / share. This represents a decline of 8,12% over that period.

Indice del sentiment dei fondi

L'indice del sentiment dei fondi (anche noto come "indice di accumulo di proprietà") individua i titoli più acquistati dai fondi. È il risultato di un sofisticato modello quantitativo multi-fattore che identifica le società con i più alti livelli di accumulo istituzionale. Il modello utilizza una combinazione dell'aumento totale dei proprietari dichiarati, delle variazioni nelle allocazioni di portafoglio di tali proprietari e di altre metriche. Il punteggio varia da 0 a 100: i numeri più alti indicano un livello di accumulo superiore ad altre società, mentre 50 rappresenta la media.

Frequenza di aggiornamento: giornaliera

Consulta Ownership Explorer per visualizzare l'elenco delle aziende con il ranking più alto.

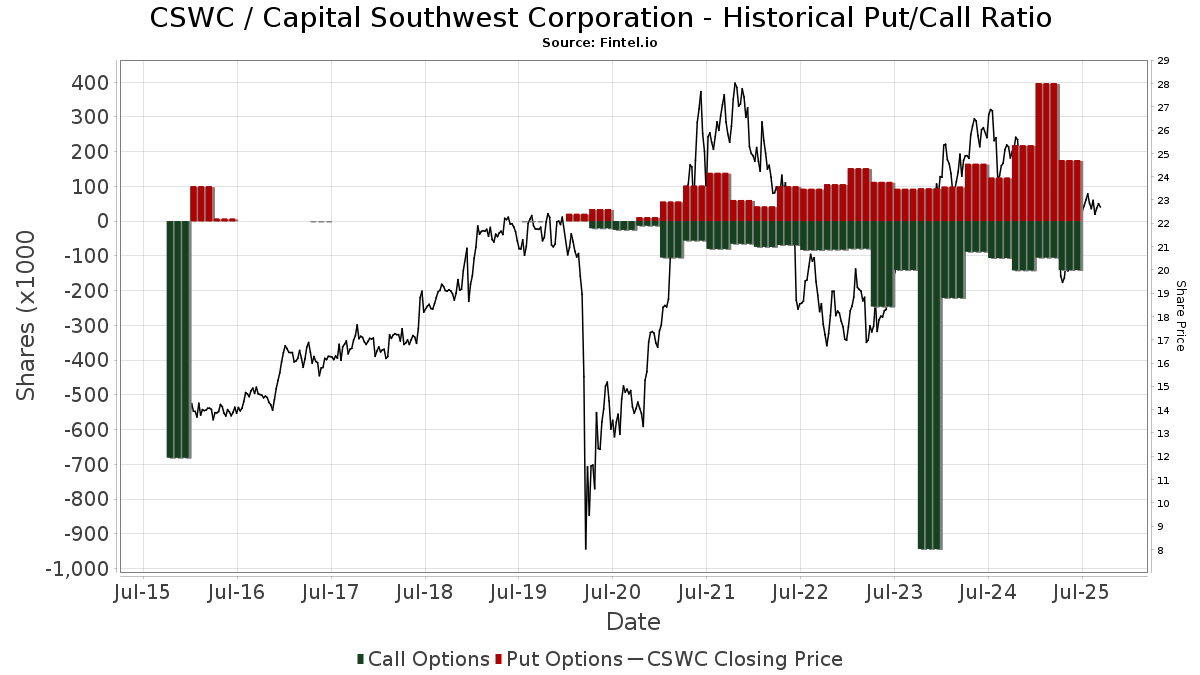

Rapporto put/call istituzionale

Oltre a segnalare le emissioni standard di titoli azionari e di debito, gli istituti con più di 100 milioni di asset in gestione devono anche dichiarare le loro partecipazioni in opzioni put e call. Poiché le opzioni put indicano generalmente un sentiment negativo e le opzioni call un sentiment positivo, possiamo avere un'idea del sentiment istituzionale complessivo attraverso il rapporto tra put e call. Il grafico a destra mostra il rapporto storico put/call per questo strumento.

L'utilizzo del rapporto put/call come indicatore del sentiment degli investitori consente di superare una delle principali lacune dell'utilizzo della proprietà istituzionale totale, ovvero il fatto che una quantità significativa di asset in gestione viene investita passivamente per seguire gli indici. Generalmente, i fondi a gestione passiva non acquistano opzioni, per cui il rapporto put/call riflette più fedelmente il sentiment dei fondi a gestione attiva.

Depositi 13F e NPORT

Le informazioni relative ai depositi 13F sono gratuite. Per accedere alle informazioni relative ai depositi NP è necessario un'abbonamento premium. Le righe verdi indicano le nuove posizioni. Le righe rosse indicano le posizioni chiuse. Fai clic sull'icona del link per visualizzare la cronologia completa delle transazioni.

Esegui l'upgrade

per sbloccare i dati premium ed esportarli in Excel ![]() .

.

| Data di deposito | Fonte | Investitore | Tipo | Prezzo medio (Stima) |

Azioni | Δ Azioni (%) |

Valore dichiarato ($ 1000) |

Δ Valore (%) |

Allocazione del portafoglio (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-27 | NP | JNL SERIES TRUST - JNL Multi-Manager Alternative Fund (A) | Short | -1.763 | -19,20 | -39 | -20,83 | |||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 35.219 | 776 | ||||||

| 2025-08-06 | 13F | Smh Capital Advisors Inc | 45.215 | -1,67 | 997 | -2,92 | ||||

| 2025-08-14 | 13F | FJ Capital Management LLC | 35.067 | -12,51 | 773 | -13,65 | ||||

| 2025-08-06 | 13F | Rialto Wealth Management, LLC | 4.809 | 0,00 | 106 | -1,87 | ||||

| 2025-08-14 | 13F | Voloridge Investment Management, Llc | 80.641 | 22,70 | 1.777 | 21,21 | ||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 112.511 | -24,27 | 2.480 | -25,22 | ||||

| 2025-08-14 | 13F | Brevan Howard Capital Management LP | 54.503 | 1.201 | ||||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 92.163 | 82,05 | 2.031 | 83,97 | ||||

| 2025-08-12 | 13F | Archer Investment Corp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 783.060 | 163,77 | 17.259 | 160,46 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 227.396 | 42,30 | 5.012 | 40,52 | ||||

| 2025-07-14 | 13F | Ridgewood Investments LLC | 500 | 0,00 | 11 | 0,00 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Grace & White Inc /ny | 174.597 | -1,13 | 3.848 | -2,36 | ||||

| 2025-08-04 | 13F | Muzinich & Co., Inc. | 225.790 | 64,37 | 4.976 | 62,30 | ||||

| 2025-08-07 | 13F | Samalin Investment Counsel, LLC | 25.864 | 7,97 | 570 | 6,74 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 31.500 | -6,73 | 694 | -7,84 | ||||

| 2025-06-18 | NP | Putnam ETF Trust - Putnam BDC ETF - | 267.259 | 5,63 | 5.447 | -4,37 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Denali Advisors Llc | 113.850 | -2,19 | 2.509 | -3,43 | ||||

| 2025-08-11 | 13F | Moerus Capital Management LLC | 73.983 | 0,00 | 1.631 | -1,27 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 8.423 | -74,44 | 186 | -74,83 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 1.566 | 0,00 | 35 | 0,00 | ||||

| 2025-07-30 | 13F | Sanders Morris Harris Llc | 1.390.339 | -2,98 | 30.643 | -4,20 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 37.229 | -5,10 | 812 | -7,20 | ||||

| 2025-07-25 | 13F | Total Clarity Wealth Management, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Harwood Advisory Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | SOA Wealth Advisors, LLC. | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Beacon Pointe Advisors, LLC | 226.212 | -45,42 | 4.986 | -46,11 | ||||

| 2025-08-15 | 13F | Prevail Innovative Wealth Advisors, Llc | 56.395 | 1.243 | ||||||

| 2025-08-12 | 13F | TCTC Holdings, LLC | 2.136 | 0,00 | 47 | 0,00 | ||||

| 2025-08-14 | 13F | Sovereign's Capital Management, LLC | 77.048 | 9,49 | 1.698 | 8,15 | ||||

| 2025-04-28 | 13F | Mainstream Capital Management LLC | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Melia Wealth LLC | 464.973 | 10,10 | 10.248 | 8,73 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 639 | -96,48 | 14 | -96,54 | ||||

| 2025-07-21 | 13F | Catalina Capital Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Punch & Associates Investment Management, Inc. | 0 | -100,00 | 0 | |||||

| 2025-04-29 | 13F | Raleigh Capital Management Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Naviter Wealth, LLC | 100.105 | 22,45 | 2.206 | 17,28 | ||||

| 2025-08-13 | 13F | PharVision Advisers, LLC | 11.249 | 248 | ||||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 3.176 | 70 | ||||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 19 | 0 | ||||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 9.738 | 215 | ||||||

| 2025-08-08 | 13F | Creative Planning | 9.114 | 201 | ||||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 212.781 | -17,42 | 4.690 | -18,47 | ||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 41.064 | -7,02 | 905 | -8,12 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 1.877 | 13.307,14 | 41 | |||||

| 2025-07-21 | 13F | Monticello Wealth Management, Llc | 18.272 | 0,00 | 403 | -1,23 | ||||

| 2025-05-12 | 13F | Fmr Llc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 75.546 | 22,73 | 1.665 | 21,27 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 107.201 | 98,47 | 2.363 | 96,02 | ||||

| 2025-08-13 | 13F | Jump Financial, LLC | 40.579 | 894 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 11.000 | 83,33 | 0 | ||||

| 2025-07-31 | 13F | Nisa Investment Advisors, Llc | 3.500 | 600,00 | 77 | 600,00 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 475 | 10 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 149.055 | 115,59 | 3.285 | 112,76 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 8.500 | -42,95 | 0 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 14.793 | 24,33 | 0 | |||||

| 2025-07-24 | NP | FNCMX - Fidelity Nasdaq Composite Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 11.251 | 0,00 | 234 | -10,69 | ||||

| 2025-05-15 | 13F | Wolverine Trading, Llc | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-14 | 13F | Nebula Research & Development LLC | 25.907 | 571 | ||||||

| 2025-07-11 | 13F | Caldwell Securities, Inc | 41.052 | -1,62 | 905 | -2,90 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 11.251 | 0,00 | 248 | -1,59 | ||||

| 2025-08-14 | 13F | Benjamin Edwards Inc | 87.765 | 3,52 | 1.934 | 2,22 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 2.787 | 18,14 | 61 | 17,31 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 41.379 | 111,26 | 912 | 108,47 | ||||

| 2025-05-14 | 13F | Brown Brothers Harriman & Co | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Franklin Resources Inc | 290.762 | -2,63 | 6.408 | -3,86 | ||||

| 2025-04-28 | 13F | Redmont Wealth Advisors Llc | 53.623 | -19,89 | 1.197 | -18,08 | ||||

| 2025-08-25 | 13F/A | Promus Capital, LLC | 1.384 | 0,00 | 31 | 0,00 | ||||

| 2025-08-12 | 13F | Change Path, LLC | 98.874 | 7,45 | 2.179 | 6,14 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 2.930 | 26,57 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 21.139 | -43,76 | 466 | -44,51 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 361.722 | 402,78 | 7.972 | 396,70 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 10.893 | 240 | ||||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 300 | -50,66 | 7 | -53,85 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 87.800 | 55,95 | 1.935 | 54,06 | |||

| 2025-07-23 | 13F | Columbus Macro, LLC | 290.704 | 6.407 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 63.100 | 50,96 | 1.391 | 49,14 | |||

| 2025-08-07 | 13F | Hodges Capital Management Inc. | 106.045 | 15,57 | 2.337 | 14,11 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 28.314 | 43,75 | 624 | 42,14 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | North Star Investment Management Corp. | 1.025 | 94,13 | 23 | 100,00 | ||||

| 2025-07-23 | 13F | Nbt Bank N A /ny | 30 | 0,00 | 1 | |||||

| 2025-07-28 | NP | PEX - ProShares Global Listed Private Equity ETF | 10.594 | 7,46 | 221 | -3,93 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 4.600 | 101 | ||||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 286.597 | -4,66 | 6.317 | -5,86 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 26.600 | 586 | |||||

| 2025-07-23 | 13F | Tectonic Advisors Llc | 521.686 | 18,44 | 11.498 | 16,95 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 20.497 | 102,28 | 452 | 99,56 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 3.148 | 6,24 | 69 | 4,55 | ||||

| 2025-08-14 | 13F | State Street Corp | 49.224 | 243,38 | 1.085 | 239,81 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 25.645 | -2,32 | 565 | -3,58 | ||||

| 2025-07-25 | NP | First Trust Specialty Finance & Financial Opportunities Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 71.000 | 0,00 | 1.478 | -10,59 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 3.698 | 786,81 | 82 | 800,00 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 24.717 | -83,89 | 1 | -100,00 | ||||

| 2025-08-15 | 13F | Caxton Associates Llp | 14.257 | 0,00 | 314 | -1,26 | ||||

| 2025-07-31 | 13F | Sumitomo Mitsui Trust Holdings, Inc. | 172.597 | 28,63 | 3.804 | 27,05 | ||||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 2.135 | 58,50 | 47 | 56,67 | ||||

| 2025-08-14 | 13F | Point72 Hong Kong Ltd | 2.189 | 48 | ||||||

| 2025-03-28 | NP | ESCQX - Embark Small Cap Equity Fund Retirement Class | 398.887 | 0,00 | 8.979 | -6,92 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 702.201 | 13,99 | 15.477 | 12,56 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 12.200 | 54,82 | 269 | 53,14 | ||||

| 2025-07-22 | 13F | Grimes & Company, Inc. | 13.303 | -28,47 | 293 | -29,40 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 2.628 | 1.214,00 | 58 | 1.325,00 | ||||

| 2025-08-11 | 13F | HHM Wealth Advisors, LLC | 500 | 0,00 | 11 | 0,00 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 19.087 | 6,06 | 421 | 4,74 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 78.808 | 1.737 | ||||||

| 2025-08-12 | 13F | Argent Trust Co | 123.348 | 52,63 | 2.719 | 50,75 | ||||

| 2025-08-14 | 13F | Dearborn Partners Llc | 15.787 | -14,31 | 348 | -15,57 | ||||

| 2025-07-09 | 13F | Harbor Capital Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 28.528 | -12,17 | 1 | |||||

| 2025-05-13 | 13F | Quadrant Capital Group Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 205.640 | 4,03 | 4.532 | 2,72 | ||||

| 2025-08-12 | 13F | Aigen Investment Management, Lp | 11.822 | 261 | ||||||

| 2025-04-24 | 13F | Wingate Wealth Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 546.280 | -31,98 | 12.040 | -32,83 | ||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 1.347.300 | 15,46 | 30 | 11,54 | ||||

| 2025-08-12 | 13F | Trexquant Investment LP | 46.630 | 1.028 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Legal & General Group Plc | 332.746 | 4,58 | 7.334 | 3,27 | ||||

| 2025-07-14 | 13F | U.S. Capital Wealth Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-07 | 13F | Runnymede Capital Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Northeast Financial Consultants Inc | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | PFG Investments, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Put | 10.100 | -15,83 | 223 | -16,85 | |||

| 2025-07-23 | 13F | Hager Investment Management Services, Llc | 500 | 0,00 | 11 | 0,00 | ||||

| 2025-08-14 | 13F | Quarry LP | 3.715 | 174,98 | 82 | 170,00 | ||||

| 2025-07-21 | 13F | DHJJ Financial Advisors, Ltd. | 5 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Legacy Capital Wealth Partners, LLC | 59.024 | -2,02 | 1.301 | -3,27 | ||||

| 2025-08-11 | 13F | Core Wealth Partners LLC | 11.520 | 0,00 | 254 | -1,56 | ||||

| 2025-05-14 | 13F | Mml Investors Services, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 13.756 | 0,00 | 303 | -1,30 | ||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Oxford Asset Management Llp | 11.392 | 254 | ||||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 24.606 | 6,50 | 542 | 5,24 | ||||

| 2025-05-15 | 13F | Lido Advisors, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 3.524 | 32,53 | 78 | 30,51 | ||||

| 2025-08-05 | 13F | Dunhill Financial, LLC | 400 | 9 | ||||||

| 2025-08-14 | 13F | Colony Group, LLC | 9.272 | -1,80 | 204 | -2,86 | ||||

| 2025-08-13 | 13F/A | DLD Asset Management, LP | Put | 0 | -100,00 | 0 | ||||

| 2025-04-29 | 13F | Concurrent Investment Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-11 | 13F | Kingstone Capital Partners Texas, LLC | 13.089.875 | 311 | ||||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 66.243 | -43,64 | 1.460 | -44,38 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 45.856 | -2,20 | 1.011 | -3,44 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 0 | -100,00 | 0 | |||||

| 2025-06-25 | NP | VPC - Virtus Private Credit Strategy ETF | 40.343 | 1,45 | 822 | -8,16 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 2 | 0,00 | 0 | |||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 11.613 | -1,76 | 256 | -3,04 | ||||

| 2025-08-14 | 13F | Point72 Asia (Singapore) Pte. Ltd. | 1.894 | 42 | ||||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | DRW Securities, LLC | 24.985 | 148,11 | 551 | 145,54 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 320.720 | 22,49 | 7.069 | 20,94 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 1.551 | -0,06 | 34 | 25,93 | ||||

| 2025-07-30 | 13F | Atlantic Edge Private Wealth Management, LLC | 200 | 0,00 | 4 | 0,00 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 34.003 | 21,84 | 749 | 20,42 | ||||

| 2025-06-30 | NP | PSP - Invesco Global Listed Private Equity ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 26.473 | -18,88 | 540 | -26,57 | ||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 13.329 | -42,49 | 294 | -43,33 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 2.685 | 2,64 | 0 | |||||

| 2025-08-14 | 13F | VPR Management LLC | 2.500 | 55 | ||||||

| 2025-07-23 | NP | FAAAX - Franklin K2 Alternative Strategies Fund Class A | Short | -612 | -37,30 | -13 | -45,45 | |||

| 2025-08-12 | 13F/A | Cozad Asset Management Inc | 49.161 | 4,26 | 1.084 | 2,95 | ||||

| 2025-06-27 | NP | LBO - WHITEWOLF Publicly Listed Private Equity ETF | 7.035 | 14,28 | 143 | 3,62 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 1.930 | 0,00 | 43 | -2,33 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 45.690 | 286,16 | 1.007 | 281,44 | ||||

| 2025-08-15 | 13F | Zuckerman Investment Group, LLC | 460.375 | 7,81 | 10.147 | 6,45 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 242.080 | 176,04 | 5 | 400,00 | ||||

| 2025-08-14 | 13F | Summit Trail Advisors, Llc | 10.630 | 234 | ||||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 23.797 | 10,69 | 524 | 9,39 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 63.474 | -73,19 | 1.399 | -73,54 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 761.221 | -4,67 | 16.777 | -5,86 | ||||

| 2025-07-01 | 13F | Confluence Investment Management Llc | 102.107 | 0,58 | 2.250 | -0,66 | ||||

| 2025-07-23 | 13F | Mraz, Amerine & Associates, Inc. | 42.958 | -1,77 | 947 | -3,27 | ||||

| 2025-08-21 | NP | BIZD - VanEck Vectors BDC Income ETF | 1.241.902 | 11,47 | 27.372 | 10,07 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Millennium Management Llc | 526.734 | 7,72 | 11.609 | 6,37 | ||||

| 2025-08-18 | 13F | Hollencrest Capital Management | 7.055 | 2,62 | 155 | 1,31 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 10.190 | 8,54 | 225 | 7,18 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 4.185 | -4,93 | 92 | -6,12 | ||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 20.873 | -2,29 | 460 | -3,36 | ||||

| 2025-05-14 | 13F | Comerica Bank | 0 | -100,00 | 0 | |||||

| 2025-05-07 | 13F | Spectrum Wealth Counsel, LLC | 230 | 0,00 | 5 | 0,00 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 983.500 | -3,09 | 21.676 | -4,31 | ||||

| 2025-08-07 | 13F | First Dallas Securities Inc. | 77.102 | 7,20 | 1.699 | 5,86 | ||||

| 2025-05-16 | 13F | Jones Financial Companies Lllp | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | Generali Investments CEE, investicni spolecnost, a.s. | 12.628 | 0,00 | 278 | -1,07 | ||||

| 2025-08-28 | NP | TRIFX - Catalyst/SMH Total Return Income Fund Class A | 20.000 | 0,00 | 441 | -1,35 | ||||

| 2025-07-18 | 13F | Union Bancaire Privee, UBP SA | 14.349 | 5,08 | 45.130 | 14.745,07 | ||||

| 2025-07-22 | 13F | Autumn Glory Partners, LLC | 26.000 | 0,00 | 573 | -1,21 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 48.215 | 1.063 | ||||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 12.695 | -50,37 | 280 | -50,00 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 28.036 | -54,51 | 618 | -55,13 | ||||

| 2025-08-05 | 13F | Bard Associates Inc | 17.256 | 0,00 | 380 | -1,30 | ||||

| 2025-08-13 | 13F | Lansforsakringar Fondforvaltning AB (publ) | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | Fortitude Family Office, LLC | 1.400 | 31 | ||||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 79.788 | 2,90 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 4.000 | -75,46 | 88 | -75,76 | |||

| 2025-07-03 | 13F | Garde Capital, Inc. | 2.401 | 0,00 | 53 | -1,89 | ||||

| 2025-07-09 | 13F | Epiq Partners, Llc | 266.800 | 4,46 | 5.880 | 3,16 | ||||

| 2025-07-09 | 13F | Lbmc Investment Advisors, Llc | 18.250 | 0,00 | 402 | -1,23 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 15.300 | -19,47 | 337 | -20,52 | |||

| 2025-07-16 | 13F | Signaturefd, Llc | 2.483 | 51,96 | 55 | 50,00 | ||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 24.975 | -36,13 | 1 | |||||

| 2025-07-25 | 13F | LRI Investments, LLC | 250 | 0,00 | 6 | 0,00 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 11.723 | 0 | ||||||

| 2025-07-31 | 13F | Washington Trust Advisors, Inc. | 5.000 | 0,00 | 110 | -0,90 | ||||

| 2025-08-14 | 13F | Sciencast Management LP | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 65.600 | -8,64 | 1.446 | -9,80 | |||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 17.874 | 0 | ||||||

| 2025-08-14 | 13F | Atom Investors LP | 19.751 | 435 | ||||||

| 2025-08-04 | 13F | Wolverine Asset Management Llc | Put | 25.600 | 564 | |||||

| 2025-08-13 | 13F | OMERS ADMINISTRATION Corp | 34.900 | 769 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 409.241 | 22,74 | 9.020 | 21,21 | ||||

| 2025-07-28 | 13F | Mutual Advisors, LLC | 9.244 | -46,81 | 216 | -38,75 | ||||

| 2025-08-11 | 13F | Delta Asset Management Llc/tn | 70 | 0,00 | 2 | 0,00 | ||||

| 2025-07-14 | 13F | Toth Financial Advisory Corp | 600 | -10,45 | 13 | -7,14 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 147.162 | -40,84 | 3.243 | -41,59 | ||||

| 2025-08-15 | 13F | Great West Life Assurance Co /can/ | 51.018 | 5,74 | 1 | 0,00 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 335.718 | 639,74 | 7.399 | 631,13 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 1.000 | 0,00 | 22 | 0,00 | ||||

| 2025-08-14 | 13F | First Manhattan Co | 258.986 | -9,80 | 5.708 | -10,92 | ||||

| 2025-07-23 | 13F | Tcfg Wealth Management, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | ProShare Advisors LLC | 9.909 | 0,51 | 218 | -0,91 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 10.830 | -2,93 | 239 | -4,42 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 26.960 | 5,42 | 594 | 4,21 | ||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 69.501 | -23,33 | 1.532 | -24,36 | ||||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 79.511 | -38,49 | 1.752 | -39,27 | ||||

| 2025-08-14 | 13F | Palisade Capital Management Llc/nj | 10.747 | 0,00 | 237 | -1,26 | ||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 118.196 | 10,80 | 2.605 | 9,45 | ||||

| 2025-08-12 | 13F | Cornerstone Wealth Management, LLC | 43.005 | 1,62 | 948 | 0,32 | ||||

| 2025-07-31 | 13F | Catalyst Capital Advisors LLC | 20.000 | 0,00 | 441 | -1,35 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 4.000 | 0,00 | 88 | -1,12 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 600 | 0,00 | 13 | 0,00 |

Other Listings

| DE:SFW | 19,83 € |