Statistiche di base

| Proprietari istituzionali | 219 total, 218 long only, 0 short only, 1 long/short - change of 4,78% MRQ |

| Allocazione media del portafoglio | 0.1058 % - change of -7,01% MRQ |

| Azioni istituzionali (Long) | 23.029.591 (ex 13D/G) - change of 2,92MM shares 14,50% MRQ |

| Valore istituzionale (Long) | $ 341.402 USD ($1000) |

Proprietà istituzionale e azionisti

Pearson plc - Depositary Receipt (Common Stock) (US:PSO) ha 219 proprietari istituzionali e azionisti che hanno presentato i moduli 13D/G o 13F alla Securities Exchange Commission (SEC). Queste istituzioni detengono un totale di 23,029,591 azioni. I maggiori azionisti includono Morgan Stanley, BlackRock, Inc., Goldman Sachs Group Inc, Millennium Management Llc, Dimensional Fund Advisors Lp, Northern Trust Corp, Arrowstreet Capital, Limited Partnership, Invesco Ltd., Renaissance Technologies Llc, and Qube Research & Technologies Ltd .

(Pearson plc - Depositary Receipt (Common Stock) (NYSE:PSO) la struttura proprietaria istituzionale mostra le attuali posizioni nella società da parte di istituzioni e fondi, nonché le ultime variazioni nella dimensione della posizione. I principali azionisti possono essere singoli investitori, fondi comuni, hedge fund o istituzioni. L'allegato 13D indica che l'investitore detiene (o ha detenuto) più del 5% della società e intende (o intendeva) perseguire attivamente un cambiamento nella strategia aziendale. L'allegato 13G indica un investimento passivo superiore al 5%.

The share price as of September 5, 2025 is 14,19 / share. Previously, on September 9, 2024, the share price was 13,80 / share. This represents an increase of 2,83% over that period.

Indice del sentiment dei fondi

L'indice del sentiment dei fondi (anche noto come "indice di accumulo di proprietà") individua i titoli più acquistati dai fondi. È il risultato di un sofisticato modello quantitativo multi-fattore che identifica le società con i più alti livelli di accumulo istituzionale. Il modello utilizza una combinazione dell'aumento totale dei proprietari dichiarati, delle variazioni nelle allocazioni di portafoglio di tali proprietari e di altre metriche. Il punteggio varia da 0 a 100: i numeri più alti indicano un livello di accumulo superiore ad altre società, mentre 50 rappresenta la media.

Frequenza di aggiornamento: giornaliera

Consulta Ownership Explorer per visualizzare l'elenco delle aziende con il ranking più alto.

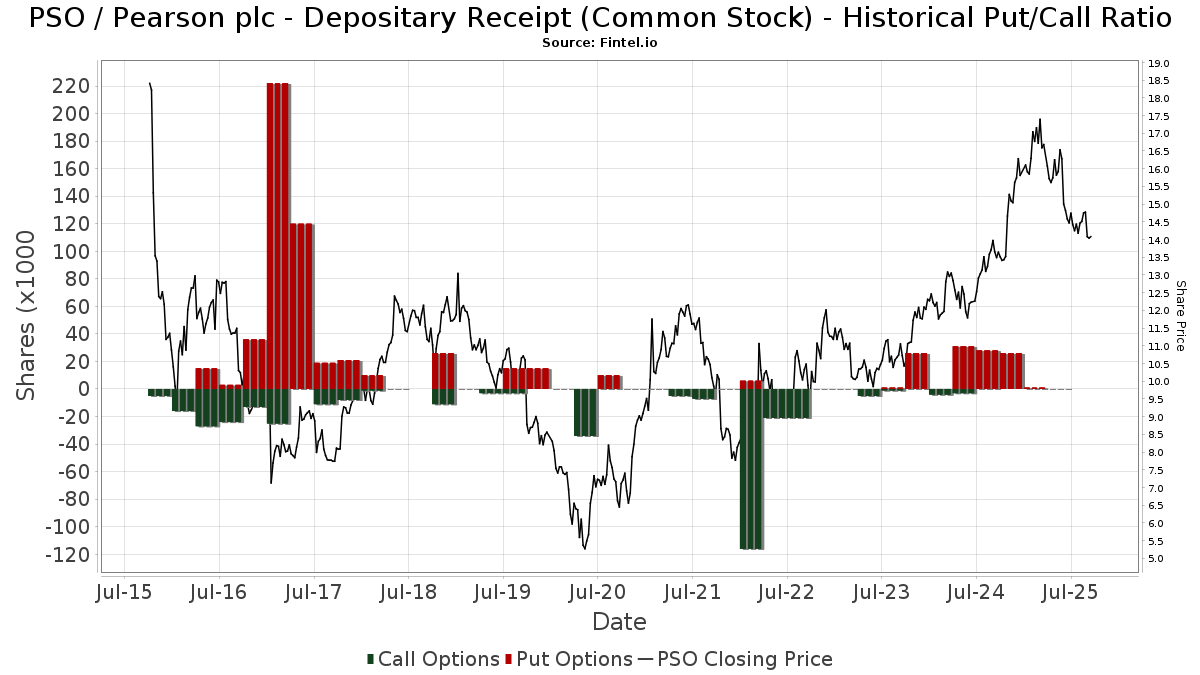

Rapporto put/call istituzionale

Oltre a segnalare le emissioni standard di titoli azionari e di debito, gli istituti con più di 100 milioni di asset in gestione devono anche dichiarare le loro partecipazioni in opzioni put e call. Poiché le opzioni put indicano generalmente un sentiment negativo e le opzioni call un sentiment positivo, possiamo avere un'idea del sentiment istituzionale complessivo attraverso il rapporto tra put e call. Il grafico a destra mostra il rapporto storico put/call per questo strumento.

L'utilizzo del rapporto put/call come indicatore del sentiment degli investitori consente di superare una delle principali lacune dell'utilizzo della proprietà istituzionale totale, ovvero il fatto che una quantità significativa di asset in gestione viene investita passivamente per seguire gli indici. Generalmente, i fondi a gestione passiva non acquistano opzioni, per cui il rapporto put/call riflette più fedelmente il sentiment dei fondi a gestione attiva.

Depositi 13F e NPORT

Le informazioni relative ai depositi 13F sono gratuite. Per accedere alle informazioni relative ai depositi NP è necessario un'abbonamento premium. Le righe verdi indicano le nuove posizioni. Le righe rosse indicano le posizioni chiuse. Fai clic sull'icona del link per visualizzare la cronologia completa delle transazioni.

Esegui l'upgrade

per sbloccare i dati premium ed esportarli in Excel ![]() .

.

| Data di deposito | Fonte | Investitore | Tipo | Prezzo medio (Stima) |

Azioni | Δ Azioni (%) |

Valore dichiarato ($ 1000) |

Δ Valore (%) |

Allocazione del portafoglio (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Bridgefront Capital, LLC | 11.970 | 179 | ||||||

| 2025-07-24 | 13F | PDS Planning, Inc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 13.197 | 83,67 | 197 | 71,30 | ||||

| 2025-07-16 | 13F | Formidable Asset Management, LLC | 22.891 | -5,40 | 342 | -11,89 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 4.031 | 10,53 | 65 | 10,34 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 3.038.760 | 12,80 | 45.369 | 5,19 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 408 | 0,00 | 6 | 0,00 | ||||

| 2025-06-26 | NP | DFAX - Dimensional World ex U.S. Core Equity 2 ETF | 89.400 | -3,82 | 1.453 | -6,26 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 11.796 | 0 | ||||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 187.733 | -4,16 | 2.803 | -10,65 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 14.397 | 2,55 | 215 | -4,46 | ||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 264 | 0,00 | 4 | -25,00 | ||||

| 2025-08-12 | 13F | Trexquant Investment LP | 58.232 | 869 | ||||||

| 2025-07-30 | 13F | Princeton Global Asset Management LLC | 767 | 11 | ||||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 25.056 | -4,95 | 374 | -11,37 | ||||

| 2025-07-29 | NP | RBB FUND, INC. - Aquarius International Fund | 15.198 | 0,00 | 242 | -7,63 | ||||

| 2025-08-12 | 13F | American Century Companies Inc | 71.990 | 7,74 | 1.075 | 0,47 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 10.432 | 68,20 | 156 | 56,57 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 47.462 | -0,44 | 709 | -7,21 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-21 | 13F | Hilltop National Bank | 5.585 | 0,00 | 83 | -7,78 | ||||

| 2025-08-14 | 13F | LMR Partners LLP | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 605.707 | 1.072,42 | 9.043 | 993,47 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 11.932 | 16,93 | 179 | 9,20 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - World ex U.S. Targeted Value Portfolio Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 18.663 | 0,00 | 303 | -2,57 | ||||

| 2025-08-13 | 13F | Grantham, Mayo, Van Otterloo & Co. LLC | 181.651 | -11,53 | 2.712 | -17,49 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 3.131 | -24,37 | 0 | |||||

| 2025-08-11 | 13F | Cornerstone Planning Group LLC | 82 | 82,22 | 1 | |||||

| 2025-07-17 | 13F | Crane Advisory, LLC | 13.705 | 0,00 | 197 | -8,41 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 780.369 | 8,89 | 11.651 | 1,54 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 2.378.336 | 6,00 | 35.509 | -1,16 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 41.744 | 19,83 | 623 | 11,85 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 0 | -100,00 | 0 | |||||

| 2025-07-28 | NP | AVSD - Avantis Responsible International Equity ETF | 6.095 | 0,00 | 97 | -7,62 | ||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 418 | 514,71 | 6 | 500,00 | ||||

| 2025-07-16 | 13F | Highline Wealth Partners Llc | 60 | 0,00 | 1 | |||||

| 2025-08-08 | 13F | Crossmark Global Holdings, Inc. | 155.771 | 0,69 | 2.326 | -6,10 | ||||

| 2025-06-27 | NP | PID - Invesco International Dividend Achievers ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 506.787 | -32,64 | 8.235 | -34,34 | ||||

| 2025-08-12 | 13F | Fca Corp /tx | 16.000 | 0,00 | 239 | -7,03 | ||||

| 2025-08-12 | 13F | Manchester Capital Management LLC | 30 | 0 | ||||||

| 2025-08-15 | 13F | WealthCollab, LLC | 1.742 | 0,00 | 26 | -3,70 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 1.351 | -23,06 | 20 | -28,57 | ||||

| 2025-07-15 | 13F | Ballentine Partners, LLC | 31.308 | -13,60 | 467 | -19,48 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 0 | -100,00 | 0 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 25.001 | 15,69 | 373 | 8,12 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 8.453 | -41,80 | 126 | -45,69 | ||||

| 2025-07-11 | 13F | UMA Financial Services, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 1.736 | 375,62 | 26 | 400,00 | ||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 9.320 | -41,91 | 139 | -45,70 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Eqis Capital Management, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Yousif Capital Management, Llc | 10.790 | 0,00 | 161 | -6,40 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 12.576 | 188 | ||||||

| 2025-08-06 | 13F | Savant Capital, LLC | 17.608 | 46,73 | 263 | 36,46 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 22.888 | -73,75 | 342 | -75,56 | ||||

| 2025-07-25 | 13F | JustInvest LLC | 119.193 | 7,46 | 1.780 | 0,23 | ||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 6.030 | 519,73 | 0 | |||||

| 2025-08-14 | 13F | Point72 Hong Kong Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 32.642 | -31,44 | 487 | -36,09 | ||||

| 2025-08-12 | 13F | Dimensional Fund Advisors Lp | 1.176.710 | -6,82 | 17.568 | -13,10 | ||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 520 | 0,00 | 8 | -12,50 | ||||

| 2025-08-13 | 13F | Natixis Advisors, L.p. | 99.686 | 13,93 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 1.449.535 | 101,00 | 21.642 | 87,45 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 58.923 | 1.025,56 | 880 | 959,04 | ||||

| 2025-05-05 | 13F | Eagle Bay Advisors LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 16.762 | -7,31 | 250 | -13,49 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 23.885 | 106,07 | 382 | 105,38 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 122.036 | 10.061,20 | 1.822 | 9.489,47 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 25.661 | -0,68 | 383 | -7,26 | ||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 128.574 | -10,02 | 1.920 | -16,20 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 147.174 | 19,78 | 2.197 | 11,69 | ||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 4.708 | 70 | ||||||

| 2025-04-30 | 13F | Genus Capital Management Inc. | Put | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 3.913 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 140.839 | 96,51 | 2.103 | 83,26 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - World ex U.S. Core Equity Portfolio Institutional Class Shares | 70.351 | -5,47 | 1.143 | -7,82 | ||||

| 2025-08-11 | 13F | Dorsey Wright & Associates | 78.634 | -38,35 | 1.174 | -42,51 | ||||

| 2025-08-14 | 13F | Fmr Llc | 273.186 | -6,06 | 4.079 | -12,40 | ||||

| 2025-08-05 | 13F | Ellevest, Inc. | 16.858 | -17,31 | 252 | -23,01 | ||||

| 2025-05-02 | 13F | Cable Hill Partners, LLC | 16.813 | 1,38 | 277 | 3,37 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 206.395 | 3,72 | 3.081 | -3,27 | ||||

| 2025-07-17 | 13F | Vermillion Wealth Management, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 19.985 | 1,45 | 298 | -6,58 | ||||

| 2025-08-07 | 13F | Sierra Ocean, Llc | 831 | 0,00 | 12 | -7,69 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 6.990 | 196,69 | 104 | 181,08 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 2.042.649 | -4,76 | 30.497 | -11,18 | ||||

| 2025-05-15 | 13F | Newbridge Financial Services Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Franklin Resources Inc | 16.817 | 0,50 | 251 | -5,99 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 445.228 | 109,58 | 6.647 | 95,44 | ||||

| 2025-07-21 | 13F | Qrg Capital Management, Inc. | 157.281 | 145,86 | 2.348 | 129,30 | ||||

| 2025-07-14 | 13F | U.S. Capital Wealth Advisors, LLC | 12.294 | 6,26 | 184 | -1,08 | ||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 21.892 | 327 | ||||||

| 2025-08-14 | 13F | Henry James International Management Inc. | 0 | -100,00 | 0 | |||||

| 2025-06-26 | NP | DFIC - Dimensional International Core Equity 2 ETF | 234.442 | 0,00 | 3.810 | -2,53 | ||||

| 2025-06-27 | NP | SPWO - SP Funds S&P World (ex-US) ETF | 2.165 | 54,75 | 35 | 52,17 | ||||

| 2025-08-12 | 13F | Seeds Investor Llc | 12.734 | -10,56 | 190 | -16,30 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 189.991 | 25,48 | 2.837 | 17,00 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 5.113 | 13,24 | 76 | 5,56 | ||||

| 2025-07-28 | 13F | Ritholtz Wealth Management | 17.761 | 265 | ||||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 3.484 | 0,00 | 52 | -5,45 | ||||

| 2025-05-02 | 13F | Bogart Wealth, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 730 | 0,00 | 11 | -9,09 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 100 | 0 | |||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 261.605 | 672,15 | 3.906 | 620,48 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 100 | 0 | |||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 23.895 | 245,45 | 357 | 223,64 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 2.133 | 3.131,82 | 32 | 3.000,00 | ||||

| 2025-08-14 | 13F | Principal Street Partners, LLC | 29.784 | 100,00 | 445 | 86,55 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 29.137 | 0,47 | 435 | -6,25 | ||||

| 2025-07-17 | 13F | Global Trust Asset Management, LLC | 4.300 | 64 | ||||||

| 2025-08-13 | 13F | Cerity Partners LLC | 156.978 | 1,93 | 2.344 | -4,95 | ||||

| 2025-08-01 | 13F | Shilanski & Associates, Inc. | 11.755 | 0,46 | 176 | -6,42 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 75.944 | -3,24 | 1.134 | -9,79 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 650.600 | 59,54 | 9.713 | 48,79 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 166.143 | 2.481 | ||||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 62 | 0,00 | 1 | |||||

| 2025-08-11 | 13F | United Capital Financial Advisers, Llc | 13.912 | -0,16 | 208 | -7,17 | ||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 208.111 | 19,98 | 3.319 | 10,89 | ||||

| 2025-08-29 | NP | MPLAX - Praxis International Index Fund Class A | 121.055 | 0,00 | 1.807 | -6,76 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 46.370 | 24,66 | 692 | 16,30 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 9.017 | -3,51 | 135 | -10,07 | ||||

| 2025-07-29 | NP | GBFFX - GMO Benchmark-Free Fund Class III | 21.329 | 34,20 | 340 | 24,09 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 51.946 | -1,52 | 776 | -8,18 | ||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 14.244 | 19,31 | 213 | 10,99 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 159.986 | -1,82 | 2.389 | -8,44 | ||||

| 2025-05-09 | 13F | GeoWealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 246.894 | 348,00 | 3.686 | 317,91 | ||||

| 2025-07-15 | 13F | Td Private Client Wealth Llc | 3.492 | 113,84 | 52 | 100,00 | ||||

| 2025-08-26 | NP | LST - Leuthold Select Industries ETF | 5.989 | 89 | ||||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 5.241 | 12,66 | 78 | 4,05 | ||||

| 2025-03-26 | NP | DFALX - Large Cap International Portfolio - Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 50.913 | -12,88 | 849 | -0,59 | ||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 700.902 | -15,18 | 10.464 | -20,90 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 10.633 | 159 | ||||||

| 2025-08-06 | 13F | Hallmark Capital Management Inc | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 7.353 | -28,17 | 110 | -33,13 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 3 | 0 | ||||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 24 | -96,30 | 0 | -100,00 | ||||

| 2025-05-15 | 13F | CAPROCK Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Addison Advisors LLC | 7.570 | 0,00 | 113 | -6,61 | ||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 33.968 | -23,57 | 507 | -28,69 | ||||

| 2025-07-29 | 13F | Salomon & Ludwin, LLC | 4 | 0 | ||||||

| 2025-08-04 | 13F | AdvisorShares Investments LLC | 54.740 | 18,31 | 817 | 9,81 | ||||

| 2025-08-06 | 13F | Genus Capital Management Inc. | 33.840 | -29,41 | 505 | -34,16 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 40.989 | 19,25 | 612 | 11,09 | ||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 222.595 | 34.680,47 | 3.323 | 23.635,71 | ||||

| 2025-07-29 | NP | GIMFX - GMO Implementation Fund | 40.218 | 16,40 | 641 | 7,55 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-08-14 | 13F | Diversify Advisory Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Diversify Wealth Management, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 70.845 | 61,78 | 1.058 | 50,78 | ||||

| 2025-08-14 | 13F | Point72 Asia (Singapore) Pte. Ltd. | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | Maseco Llp | 307 | 5 | ||||||

| 2025-08-14 | 13F | Alaska Permanent Fund Corp | 0 | -100,00 | 0 | |||||

| 2025-07-17 | 13F | Clean Yield Group | 137 | 0,00 | 2 | 0,00 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 431 | -23,72 | 0 | |||||

| 2025-08-27 | NP | FORH - Formidable ETF | 22.891 | -5,40 | 342 | -11,89 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Claro Advisors LLC | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Binnacle Investments Inc | 43 | 0,00 | 1 | |||||

| 2025-07-21 | 13F | Credential Qtrade Securities Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 693.250 | 34,61 | 10.350 | 25,53 | ||||

| 2025-08-05 | 13F | GHP Investment Advisors, Inc. | 699 | 1,30 | 10 | -9,09 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 190.870 | 129,05 | 2.850 | 113,57 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 26.923 | 402 | ||||||

| 2025-07-18 | 13F | Dogwood Wealth Management LLC | 288 | 4 | ||||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 81.604 | -2,80 | 1.218 | -9,37 | ||||

| 2025-07-17 | 13F | Albion Financial Group /ut | 252 | 0,00 | 4 | -25,00 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 9.296 | -63,53 | 139 | -66,18 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 24.549 | 367 | ||||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 21.244 | 317 | ||||||

| 2025-08-13 | 13F | M&t Bank Corp | 18.115 | 10,34 | 271 | 2,66 | ||||

| 2025-07-09 | 13F | Bruce G. Allen Investments, LLC | 249 | -41,13 | 4 | -50,00 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - International Vector Equity Portfolio Shares | 6.300 | 0,00 | 102 | -2,86 | ||||

| 2025-08-07 | 13F | Zions Bancorporation, National Association /ut/ | 64 | 0,00 | 1 | -100,00 | ||||

| 2025-06-26 | NP | DFIEX - International Core Equity Portfolio - Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 349.430 | -27,06 | 5.678 | -28,89 | ||||

| 2025-07-28 | NP | AVDEX - Avantis International Equity Fund Institutional Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 5.145 | 0,00 | 82 | -6,82 | ||||

| 2025-04-22 | 13F | Mendota Financial Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Graham Capital Management, L.P. | 43.848 | 655 | ||||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 209.273 | -6,50 | 3.124 | -12,81 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 7.909 | -2,50 | 118 | -8,53 | ||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 23.837 | 76,40 | 356 | 64,35 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 1.635 | -1,21 | 24 | -7,69 | ||||

| 2025-06-30 | NP | CNGLX - Commonwealth Global Fund | 16.000 | 0,00 | 260 | -2,26 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 47.612 | -16,45 | 762 | -16,99 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 79 | 0,00 | 1 | 0,00 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 50.683 | -10,44 | 757 | -16,46 | ||||

| 2025-06-26 | NP | DFSI - Dimensional International Sustainability Core 1 ETF | 32.917 | 0,00 | 535 | -2,55 | ||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 26.872 | 0,00 | 401 | -6,74 | ||||

| 2025-07-31 | 13F | MQS Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 21.161 | -13,06 | 316 | -19,02 | ||||

| 2025-07-21 | 13F | Cromwell Holdings LLC | 3.761 | 0,00 | 56 | -8,20 | ||||

| 2025-08-14 | 13F | Syon Capital Llc | 28.510 | 6,86 | 426 | -0,47 | ||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 265 | 4 | ||||||

| 2025-08-04 | 13F | Atria Investments Llc | 52.557 | 62,02 | 785 | 51,06 | ||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 33.590 | 501 | ||||||

| 2025-07-29 | 13F | Private Trust Co Na | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 54.312 | -8,49 | 811 | -14,74 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 19.041 | -9,21 | 284 | -16,22 | ||||

| 2025-07-28 | NP | AVDE - Avantis International Equity ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 59.103 | 50,65 | 943 | 39,14 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - International Sustainability Core 1 Portfolio Shares | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 7.843 | -16,63 | 117 | -22,00 | ||||

| 2025-07-30 | 13F | Ethic Inc. | 153.648 | -11,20 | 2.283 | -18,03 | ||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 10.344 | 154 | ||||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 499 | 134,27 | 7 | 133,33 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 21.879 | 24,19 | 327 | 15,60 | ||||

| 2025-07-31 | 13F | CVA Family Office, LLC | 96 | -49,74 | 1 | -66,67 | ||||

| 2025-08-14 | 13F | 13D Management LLC | 458.338 | -2,72 | 6.843 | -9,29 | ||||

| 2025-07-16 | 13F | ORG Wealth Partners, LLC | 225 | 0,00 | 3 | 0,00 | ||||

| 2025-07-15 | 13F | Mather Group, Llc. | 14.745 | 0,00 | 220 | -6,78 | ||||

| 2025-08-14 | 13F | UBS Group AG | 31.596 | -57,43 | 472 | -60,35 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 1.186 | 18 | ||||||

| 2025-08-06 | 13F | True Wealth Design, LLC | 31 | 6,90 | 0 | |||||

| 2025-06-26 | NP | FSGEX - Fidelity Series Global ex U.S. Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 223.811 | -15,84 | 3.637 | -17,96 | ||||

| 2025-07-24 | 13F | Lester Murray Antman dba SimplyRich | 47.975 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 32.800 | 490 | ||||||

| 2025-04-11 | 13F | First Affirmative Financial Network | 15.129 | 0,85 | 242 | 0,41 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 167 | 0,00 | 2 | 0,00 | ||||

| 2025-07-24 | 13F | JNBA Financial Advisors | 21.252 | -22,08 | 317 | -27,29 | ||||

| 2025-08-25 | NP | AADR - AdvisorShares Dorsey Wright ADR ETF | 54.740 | 18,31 | 817 | 10,41 | ||||

| 2025-06-26 | NP | Dfa Investment Trust Co - The Dfa International Value Series This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 373.096 | -12,63 | 6.063 | -14,84 | ||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 1.428 | -1,72 | 21 | -8,70 | ||||

| 2025-08-21 | NP | DDDAX - 13D Activist Fund Class A | 458.338 | 0,00 | 6.843 | -6,75 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 269 | -37,30 | 4 | -33,33 | ||||

| 2025-04-29 | 13F | Callan Capital, LLC | 18.626 | 3,68 | 298 | 3,11 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 84.703 | 18,20 | 1.265 | 10,20 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 1.947 | 37,99 | 29 | 31,82 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 1.768 | 2,79 | 26 | -3,70 | ||||

| 2025-08-12 | 13F | Gitterman Wealth Management, LLC | 15.150 | -1,76 | 226 | -8,13 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 1.620 | 0 | ||||||

| 2025-03-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - International Social Core Equity Portfolio Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 11.612 | -65,56 | 194 | -60,77 | ||||

| 2025-07-16 | 13F | ORG Partners LLC | 163 | 2 | ||||||

| 2025-08-12 | 13F | Personal Cfo Solutions, Llc | 10.473 | -2,96 | 156 | -9,30 | ||||

| 2025-07-30 | NP | ENDW - Cambria Endowment Style ETF | 13 | 0 | ||||||

| 2025-08-14 | 13F | Hrt Financial Lp | 39.519 | 220,46 | 1 | |||||

| 2025-07-11 | 13F | Pinnacle Bancorp, Inc. | 228 | 3 | ||||||

| 2025-08-11 | 13F | Renaissance Group Llc | 408.688 | 0,05 | 6.102 | -6,70 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 25.382 | 1,27 | 379 | -5,74 | ||||

| 2025-05-15 | 13F | Optiver Holding B.V. | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 607 | 1.858,06 | 9 | |||||

| 2025-08-14 | 13F | Barometer Capital Management Inc. | 10.011 | -66,86 | 149 | -69,15 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 51 | 5.000,00 | 1 | |||||

| 2025-07-17 | 13F | Park Place Capital Corp | 996 | 0,00 | 15 | 0,00 | ||||

| 2025-08-14 | 13F | Wetherby Asset Management Inc | 71.556 | 10,32 | 1.068 | 2,20 | ||||

| 2025-07-24 | 13F | Callan Family Office, LLC | 20.579 | 307 | ||||||

| 2025-05-09 | 13F | Abc Arbitrage Sa | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 12.456 | 0 | ||||||

| 2025-08-11 | 13F | GW&K Investment Management, LLC | 142 | 0,00 | 0 | |||||

| 2025-08-08 | 13F | Creative Planning | 95.716 | -3,70 | 1.429 | -10,18 | ||||

| 2025-07-11 | 13F | Great Waters Wealth Management | 18.244 | 21,74 | 272 | 13,81 | ||||

| 2025-06-26 | NP | SNTKX - Steward International Enhanced Index Fund Class A | 97.434 | 0,00 | 1.583 | -2,52 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 413 | 0,00 | 6 | 0,00 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 145.461 | -33,92 | 2.172 | -38,39 |

Other Listings

| DE:PESA | 12,20 € |