Statistiche di base

| Proprietari istituzionali | 166 total, 166 long only, 0 short only, 0 long/short - change of 9,21% MRQ |

| Allocazione media del portafoglio | 0.1492 % - change of -14,47% MRQ |

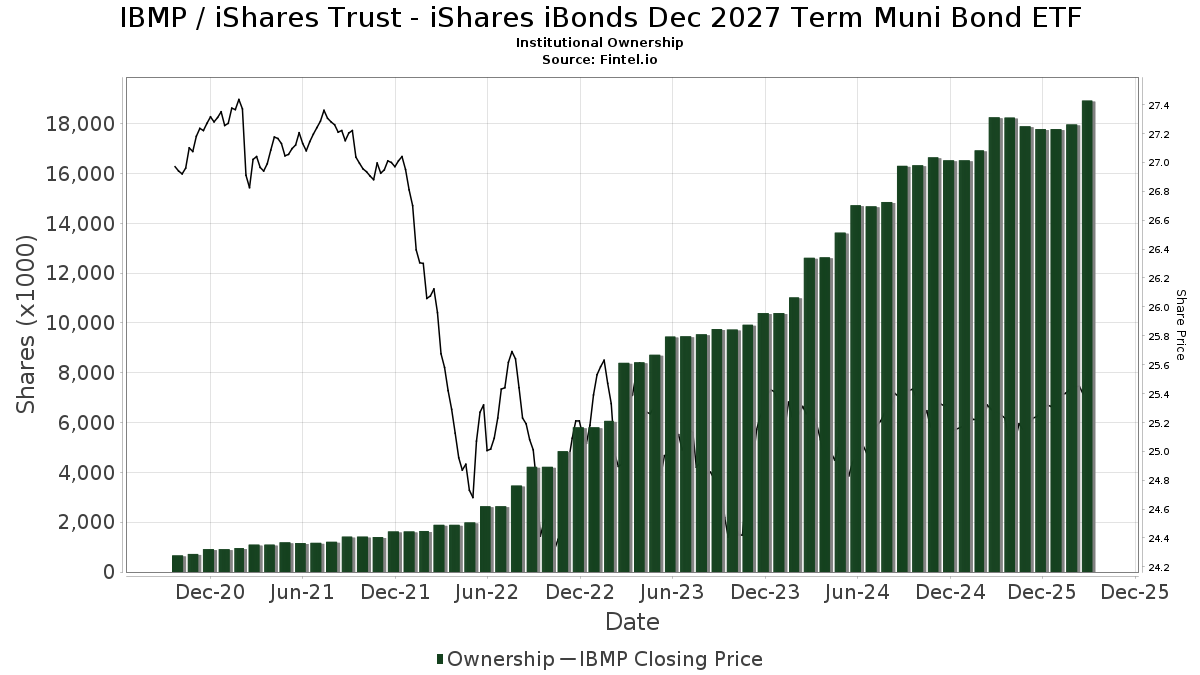

| Azioni istituzionali (Long) | 18.929.539 (ex 13D/G) - change of 1,14MM shares 6,43% MRQ |

| Valore istituzionale (Long) | $ 461.832 USD ($1000) |

Proprietà istituzionale e azionisti

iShares Trust - iShares iBonds Dec 2027 Term Muni Bond ETF (US:IBMP) ha 166 proprietari istituzionali e azionisti che hanno presentato i moduli 13D/G o 13F alla Securities Exchange Commission (SEC). Queste istituzioni detengono un totale di 18,929,539 azioni. I maggiori azionisti includono Bank Of America Corp /de/, Wells Fargo & Company/mn, HighTower Advisors, LLC, Mercer Global Advisors Inc /adv, Hartland & Co., LLC, Envestnet Asset Management Inc, Heartwood Wealth Advisors LLC, Us Bancorp \de\, Morgan Stanley, and LPL Financial LLC .

(iShares Trust - iShares iBonds Dec 2027 Term Muni Bond ETF (BATS:IBMP) la struttura proprietaria istituzionale mostra le attuali posizioni nella società da parte di istituzioni e fondi, nonché le ultime variazioni nella dimensione della posizione. I principali azionisti possono essere singoli investitori, fondi comuni, hedge fund o istituzioni. L'allegato 13D indica che l'investitore detiene (o ha detenuto) più del 5% della società e intende (o intendeva) perseguire attivamente un cambiamento nella strategia aziendale. L'allegato 13G indica un investimento passivo superiore al 5%.

The share price as of September 5, 2025 is 25,48 / share. Previously, on September 6, 2024, the share price was 25,45 / share. This represents an increase of 0,12% over that period.

Indice del sentiment dei fondi

L'indice del sentiment dei fondi (anche noto come "indice di accumulo di proprietà") individua i titoli più acquistati dai fondi. È il risultato di un sofisticato modello quantitativo multi-fattore che identifica le società con i più alti livelli di accumulo istituzionale. Il modello utilizza una combinazione dell'aumento totale dei proprietari dichiarati, delle variazioni nelle allocazioni di portafoglio di tali proprietari e di altre metriche. Il punteggio varia da 0 a 100: i numeri più alti indicano un livello di accumulo superiore ad altre società, mentre 50 rappresenta la media.

Frequenza di aggiornamento: giornaliera

Consulta Ownership Explorer per visualizzare l'elenco delle aziende con il ranking più alto.

Rapporto put/call istituzionale

Oltre a segnalare le emissioni standard di titoli azionari e di debito, gli istituti con più di 100 milioni di asset in gestione devono anche dichiarare le loro partecipazioni in opzioni put e call. Poiché le opzioni put indicano generalmente un sentiment negativo e le opzioni call un sentiment positivo, possiamo avere un'idea del sentiment istituzionale complessivo attraverso il rapporto tra put e call. Il grafico a destra mostra il rapporto storico put/call per questo strumento.

L'utilizzo del rapporto put/call come indicatore del sentiment degli investitori consente di superare una delle principali lacune dell'utilizzo della proprietà istituzionale totale, ovvero il fatto che una quantità significativa di asset in gestione viene investita passivamente per seguire gli indici. Generalmente, i fondi a gestione passiva non acquistano opzioni, per cui il rapporto put/call riflette più fedelmente il sentiment dei fondi a gestione attiva.

Depositi 13F e NPORT

Le informazioni relative ai depositi 13F sono gratuite. Per accedere alle informazioni relative ai depositi NP è necessario un'abbonamento premium. Le righe verdi indicano le nuove posizioni. Le righe rosse indicano le posizioni chiuse. Fai clic sull'icona del link per visualizzare la cronologia completa delle transazioni.

Esegui l'upgrade

per sbloccare i dati premium ed esportarli in Excel ![]() .

.

| Data di deposito | Fonte | Investitore | Tipo | Prezzo medio (Stima) |

Azioni | Δ Azioni (%) |

Valore dichiarato ($ 1000) |

Δ Valore (%) |

Allocazione del portafoglio (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-13 | 13F | Peloton Wealth Strategists | 10.000 | 0,00 | 0 | |||||

| 2025-07-24 | 13F | Cyndeo Wealth Partners, LLC | 117.402 | -8,35 | 2.976 | -8,09 | ||||

| 2025-08-13 | 13F | RIA Advisory Group LLC | 52.178 | 7,85 | 1.323 | 8,09 | ||||

| 2025-08-04 | 13F | Spinnaker Trust | 58.700 | 4,73 | 1.488 | 5,08 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 9.031 | 229 | ||||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 30.076 | 4,00 | 762 | 4,24 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 150 | 0,67 | 4 | 0,00 | ||||

| 2025-07-15 | 13F | Cora Capital Advisors Llc | 12.000 | 0,00 | 304 | 0,33 | ||||

| 2025-07-17 | 13F | Archford Capital Strategies, LLC | 12.042 | 5,12 | 305 | 5,54 | ||||

| 2025-07-16 | 13F | Kathmere Capital Management, LLC | 401.761 | -27,60 | 10.185 | -27,40 | ||||

| 2025-08-11 | 13F | Arrow Financial Corp | 9.517 | 0,00 | 241 | 0,42 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 973.274 | 28,92 | 24.672 | 29,27 | ||||

| 2025-07-30 | 13F | Rehmann Capital Advisory Group | 10.277 | 0,00 | 261 | 0,39 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 38.232 | -20,61 | 969 | -20,38 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 898.400 | 3,14 | 22.774 | 3,42 | ||||

| 2025-08-13 | 13F | Smith, Moore & Co. | 14.011 | 71,91 | 355 | 72,33 | ||||

| 2025-08-06 | 13F | Horan Securities, Inc. | 8.544 | 0,00 | 217 | 0,47 | ||||

| 2025-07-18 | 13F | Client 1st Advisory Group, Llc | 9.960 | 0,00 | 252 | 0,40 | ||||

| 2025-07-17 | 13F/A | Capital Investment Advisors, LLC | 62.074 | 12,67 | 1.574 | 13,00 | ||||

| 2025-08-11 | 13F | United Capital Financial Advisers, Llc | 109.726 | -0,24 | 2.782 | 0,04 | ||||

| 2025-07-22 | 13F | Partners Wealth Management, Llc | 11.604 | 0,00 | 293 | 0,00 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 49.050 | 148,10 | 1.243 | 149,10 | ||||

| 2025-07-30 | 13F | Strategic Blueprint, LLC | 8.633 | 219 | ||||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 911.065 | 9,25 | 23.095 | 9,56 | ||||

| 2025-08-04 | 13F | Jim Saulnier & Associates, Llc | 15.994 | 0,60 | 405 | 1,00 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 425.371 | 4,28 | 10.783 | 4,57 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 316.178 | 13,39 | 8.015 | 13,72 | ||||

| 2025-07-07 | 13F | Trust Co | 13.788 | -0,01 | 350 | 0,29 | ||||

| 2025-07-09 | 13F | Massmutual Trust Co Fsb/adv | 19.539 | 495 | ||||||

| 2025-07-08 | 13F | Heartwood Wealth Advisors LLC | 753.839 | 0,05 | 19.110 | 0,33 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 10.000 | 0,00 | 254 | 0,79 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 5.000 | -28,57 | 127 | -28,41 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 31.161 | 21,27 | 790 | 21,57 | ||||

| 2025-08-01 | 13F | James Investment Research Inc | 14.714 | 0,00 | 373 | 0,54 | ||||

| 2025-07-17 | 13F | Hengehold Capital Management Llc | 396.612 | 3,19 | 10.054 | 3,48 | ||||

| 2025-07-16 | 13F | Evergreen Private Wealth LLC | 44.722 | -1,85 | 1.134 | -1,56 | ||||

| 2025-07-17 | 13F | Coastline Trust Co | 4.716 | 0,00 | 120 | 0,00 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 19.181 | -7,96 | 486 | -7,60 | ||||

| 2025-07-15 | 13F | Postrock Partners Llc | 96.609 | 4,01 | 2.449 | 4,30 | ||||

| 2025-07-11 | 13F | Quantum Financial Advisors, LLC | 142.423 | 3,32 | 3.610 | 3,62 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 14.599 | 0,00 | 370 | 0,27 | ||||

| 2025-07-31 | 13F | Leavell Investment Management, Inc. | 178.143 | 2,01 | 4.516 | 2,29 | ||||

| 2025-07-08 | 13F | Legacy Private Trust Co. | 9.395 | 0,00 | 238 | 0,42 | ||||

| 2025-07-15 | 13F | Droms Strauss Advisors Inc /mo/ /adv | 14.266 | 7,21 | 362 | 7,44 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 40.560 | 25,62 | 1.028 | 25,98 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 92.193 | -37,62 | 2.337 | -37,38 | ||||

| 2025-07-18 | 13F | Precision Wealth Strategies, LLC | 10.417 | 264 | ||||||

| 2025-08-14 | 13F | Comerica Bank | 18.331 | -0,87 | 465 | -0,64 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 42.647 | -5,59 | 1.081 | -5,34 | ||||

| 2025-07-08 | 13F | Prism Advisors, Inc. | 44.715 | 0,00 | 1.134 | 0,27 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 103.126 | -0,27 | 2.614 | 0,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 26.392 | 31,91 | 669 | 32,48 | ||||

| 2025-08-11 | 13F | Avantax Planning Partners, Inc. | 13.043 | -0,78 | 331 | -0,60 | ||||

| 2025-07-31 | 13F | Resonant Capital Advisors, LLC | 13.914 | 0,00 | 353 | 0,28 | ||||

| 2025-08-06 | 13F | Rialto Wealth Management, LLC | 962 | 0,00 | 24 | 0,00 | ||||

| 2025-08-14 | 13F | UBS Group AG | 393.517 | -4,28 | 9.976 | -4,01 | ||||

| 2025-04-11 | 13F | First Affirmative Financial Network | 16.862 | 4,22 | 426 | 4,93 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 46.828 | 19,59 | 1 | |||||

| 2025-08-12 | 13F | PSI Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Covington Investment Advisors Inc. | 329.115 | 1,37 | 8 | 0,00 | ||||

| 2025-08-01 | 13F | First National Trust Co | 8.319 | 211 | ||||||

| 2025-05-12 | 13F | Sandy Spring Bank | 45.616 | 2,54 | 1.153 | 3,13 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 812 | 0,00 | 21 | 0,00 | ||||

| 2025-08-13 | 13F | MONECO Advisors, LLC | 10.943 | 0,00 | 277 | 0,36 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Benjamin Edwards Inc | 42.051 | -3,35 | 1.066 | -3,09 | ||||

| 2025-07-17 | 13F | Catalytic Wealth RIA, LLC | 31.354 | -2,04 | 795 | -1,85 | ||||

| 2025-07-29 | 13F | Roof Eidam & Maycock/adv | 32.174 | 0,15 | 816 | 0,37 | ||||

| 2025-07-30 | 13F | Granite Harbor Advisors, Inc. | 45.187 | -8,67 | 1.145 | -8,40 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 155.497 | 1,19 | 3.942 | 1,47 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 34.890 | 12,49 | 884 | 12,76 | ||||

| 2025-07-01 | 13F | Harbor Investment Advisory, Llc | 1.115 | -55,82 | 28 | -55,56 | ||||

| 2025-08-06 | 13F | Atlantic Union Bankshares Corp | 50.995 | 1.293 | ||||||

| 2025-08-14 | 13F | Garden State Investment Advisory Services LLC | 0 | -100,00 | 0 | |||||

| 2025-07-09 | 13F | Praetorian Wealth Management, Inc. | 244.449 | -0,90 | 6.197 | -0,63 | ||||

| 2025-07-11 | 13F | Financial Advisory Corp | 27.254 | 691 | ||||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 156.883 | 10,35 | 4 | 0,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 221.147 | 375,30 | 5.606 | 376,70 | ||||

| 2025-04-24 | 13F | Aspect Partners, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Beacon Pointe Advisors, LLC | 30.410 | -10,39 | 771 | -10,15 | ||||

| 2025-07-22 | 13F | Valley National Advisers Inc | 6.923 | 0 | ||||||

| 2025-08-04 | 13F | ArborFi Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 2.725 | 0,00 | 69 | 1,47 | ||||

| 2025-07-23 | 13F | Valmark Advisers, Inc. | 64.563 | 8,46 | 1.637 | 8,78 | ||||

| 2025-08-08 | 13F | Wrapmanager Inc | 14.004 | -4,33 | 355 | -4,05 | ||||

| 2025-07-21 | 13F | Crews Bank & Trust | 30.738 | 0,00 | 779 | 0,26 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 2.258 | 0,00 | 57 | 0,00 | ||||

| 2025-07-22 | 13F | Woodmont Investment Counsel Llc | 77.590 | 8,80 | 1.967 | 9,10 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 13.221 | 335 | ||||||

| 2025-07-30 | 13F | Phillips Financial Management, Llc | 56.799 | 20,90 | 1.440 | 21,23 | ||||

| 2025-08-05 | 13F | American Capital Advisory, LLC | 2.231 | 0,00 | 57 | 0,00 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 2.102.054 | 7,57 | 53.287 | 7,87 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 414.771 | 9,32 | 10.514 | 9,62 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 13.392 | 19,57 | 339 | 19,79 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 201.049 | 4,58 | 5.097 | 4,88 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 131.364 | 2,34 | 3.330 | 2,62 | ||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 103 | 3 | ||||||

| 2025-08-14 | 13F | 10Elms LLP | 21.344 | 0,95 | 541 | 1,31 | ||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 69.859 | 60,26 | 1.771 | 60,76 | ||||

| 2025-05-16 | 13F/A | Kestra Investment Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 266.454 | -31,52 | 6.755 | -31,33 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 253.695 | 16,20 | 6.431 | 16,52 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 62.168 | 3,30 | 1.576 | 3,55 | ||||

| 2025-08-07 | 13F | Sound View Wealth Advisors Group, LLC | 154.864 | 27,07 | 3.926 | 27,44 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 28.066 | 200,20 | 1 | |||||

| 2025-07-29 | 13F | Accretive Wealth Partners, LLC | 8.252 | 209 | ||||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 24.647 | -57,33 | 625 | -57,26 | ||||

| 2025-07-28 | 13F | WJ Wealth Management, LLC | 52.833 | 36,05 | 1.339 | 36,49 | ||||

| 2025-08-01 | 13F | Paradigm, Strategies in Wealth Management, LLC | 8.838 | 224 | ||||||

| 2025-08-12 | 13F | Ameritas Investment Partners, Inc. | 6.549 | 0,05 | 166 | 0,61 | ||||

| 2025-07-18 | 13F | Foundry Financial Group, Inc. | 28.777 | -1,09 | 729 | -0,82 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 866.358 | 0,82 | 21.962 | 1,10 | ||||

| 2025-07-22 | 13F | Penobscot Investment Management Company, Inc. | 8.000 | 203 | ||||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 32.288 | 816 | ||||||

| 2025-07-16 | 13F | Novem Group | 9.997 | 0,60 | 253 | 0,80 | ||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 2.015 | 0,00 | 51 | 2,00 | ||||

| 2025-08-13 | 13F | Green Harvest Asset Management LLC | 14.881 | -1,44 | 377 | -1,05 | ||||

| 2025-07-07 | 13F | Vishria Bird Financial Group, LLC | 15.904 | 403 | ||||||

| 2025-08-11 | 13F | PFG Private Wealth Management, LLC | 11.643 | -3,07 | 295 | -2,64 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 53.314 | 366,48 | 1.352 | 369,10 | ||||

| 2025-07-25 | 13F | Commonwealth Financial Services, LLC | 10.251 | -4,12 | 260 | -4,07 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Envision Financial Planning, LLC | 64.334 | -9,89 | 1.631 | -9,65 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 94.355 | -27,72 | 2.392 | -27,55 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 9.849 | 250 | ||||||

| 2025-08-12 | 13F | Wealthbridge Capital Management, Llc | 14.143 | 5,82 | 359 | 6,23 | ||||

| 2025-07-21 | 13F | Atwater Malick LLC | 80.088 | 4,11 | 2.030 | 4,42 | ||||

| 2025-07-21 | 13F | Cliftonlarsonallen Wealth Advisors, Llc | 202.026 | 27,26 | 5.121 | 27,61 | ||||

| 2025-04-15 | 13F | Members Wealth Llc | 21.804 | 0,00 | 551 | 0,36 | ||||

| 2025-08-05 | 13F | Hills Bank & Trust Co | 399.047 | 17,67 | 10.116 | 18,00 | ||||

| 2025-07-23 | 13F | Prime Capital Investment Advisors, LLC | 13.576 | -8,19 | 344 | -7,77 | ||||

| 2025-04-16 | 13F | Wealth Enhancement Advisory Services, Llc | 0 | -100,00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 120.610 | 8,92 | 3.057 | 9,22 | ||||

| 2025-07-22 | 13F | Blue Square Asset Management, Llc | 45.097 | -1,96 | 1.143 | -1,64 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 10.631 | 270 | ||||||

| 2025-07-30 | 13F | Klingman & Associates, LLC | 17.490 | -11,82 | 443 | -11,58 | ||||

| 2025-08-07 | 13F | Hughes Financial Services, LLC | 7.550 | 5,73 | 192 | 6,11 | ||||

| 2025-07-14 | 13F | Sentinel Pension Advisors Inc | 58.098 | 0,73 | 1.473 | 0,96 | ||||

| 2025-07-30 | 13F | Brookstone Capital Management | 18.909 | 106,50 | 479 | 107,36 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 752.155 | 7,56 | 19.067 | 7,86 | ||||

| 2025-08-14 | 13F | Financial Engines Advisors L.L.C. | 31.236 | 31,89 | 792 | 32,22 | ||||

| 2025-07-29 | 13F | Regions Financial Corp | 51.223 | 3,13 | 1.299 | 3,43 | ||||

| 2025-07-01 | 13F | Confluence Investment Management Llc | 39.817 | -1,81 | 1.009 | -1,56 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 950.210 | -6,15 | 24.088 | -5,89 | ||||

| 2025-07-25 | 13F | Stephens Consulting, LLC | 314 | 0,00 | 8 | 0,00 | ||||

| 2025-07-11 | 13F | Lantz Financial LLC | 30.769 | 0,39 | 780 | 0,78 | ||||

| 2025-07-02 | 13F | Crumly & Associates Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | Newman Dignan & Sheerar, Inc. | 68.999 | -2,81 | 1.749 | -2,51 | ||||

| 2025-07-30 | 13F | Princeton Global Asset Management LLC | 3.950 | 0,00 | 100 | 1,01 | ||||

| 2025-08-07 | 13F | Addison Advisors LLC | 910 | 23 | ||||||

| 2025-08-15 | 13F | Howland Capital Management Llc | 185.945 | 5,29 | 4.714 | 5,58 | ||||

| 2025-08-14 | 13F | Snowden Capital Advisors LLC | 31.000 | 0,00 | 786 | 0,26 | ||||

| 2025-07-21 | 13F | Cornell Pochily Investment Advisors, Inc. | 8.040 | 204 | ||||||

| 2025-07-23 | 13F | Sax Wealth Advisors, Llc | 15.089 | 383 | ||||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 10.000 | 0,00 | 254 | 0,40 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 86.483 | 0,00 | 2.192 | 0,27 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 648.327 | 33,27 | 16.435 | 33,65 | ||||

| 2025-05-07 | 13F | Mb, Levis & Associates, Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Modern Wealth Management, LLC | 40.883 | 20,76 | 1.036 | 21,17 | ||||

| 2025-07-15 | 13F | Sightline Wealth Advisors, LLC | 10.086 | 0,61 | 256 | 0,79 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 2.357 | -4,11 | 60 | -3,28 | ||||

| 2025-08-14 | 13F | Fmr Llc | 649 | -92,13 | 16 | -92,31 | ||||

| 2025-07-17 | 13F | E Six Thirteen, Llc | 160.410 | 0,00 | 4.066 | 0,27 | ||||

| 2025-05-09 | 13F | Ogorek Anthony Joseph /ny/ /adv | 0 | -100,00 | 0 | |||||

| 2025-07-09 | 13F | Lbmc Investment Advisors, Llc | 424.215 | 13,99 | 10.754 | 14,31 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 8.134 | 0,00 | 206 | 0,49 | ||||

| 2025-07-21 | 13F | Exchange Capital Management, Inc. | 13.951 | -6,91 | 354 | -6,61 | ||||

| 2025-07-30 | 13F | Avidian Wealth Solutions, LLC | 8.656 | 219 | ||||||

| 2025-07-30 | 13F | Sonata Capital Group Inc | 92.603 | 0,00 | 2 | 0,00 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 13.926 | -13,80 | 0 | |||||

| 2025-08-14 | 13F | Glenview Trust Co | 83.324 | 0,00 | 2.112 | 0,28 | ||||

| 2025-07-18 | 13F | TPG Advisors LLC | 12.054 | 0,00 | 306 | 0,33 | ||||

| 2025-08-11 | 13F | CFS Investment Advisory Services, LLC | 24.393 | -0,62 | 1 | |||||

| 2025-08-14 | 13F | Godshalk Welsh Capital Management, Inc. | 27.750 | 109,43 | 703 | 110,48 | ||||

| 2025-08-05 | 13F | Gould Asset Management Llc /ca/ | 20.740 | 15,45 | 526 | 15,64 | ||||

| 2025-08-01 | 13F | Signature Wealth Management Group | 51.912 | 0,79 | 1.316 | 1,00 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 20.965 | 120,43 | 531 | 121,25 |