Statistiche di base

| Proprietari istituzionali | 189 total, 186 long only, 1 short only, 2 long/short - change of 0,53% MRQ |

| Allocazione media del portafoglio | 0.2127 % - change of -14,93% MRQ |

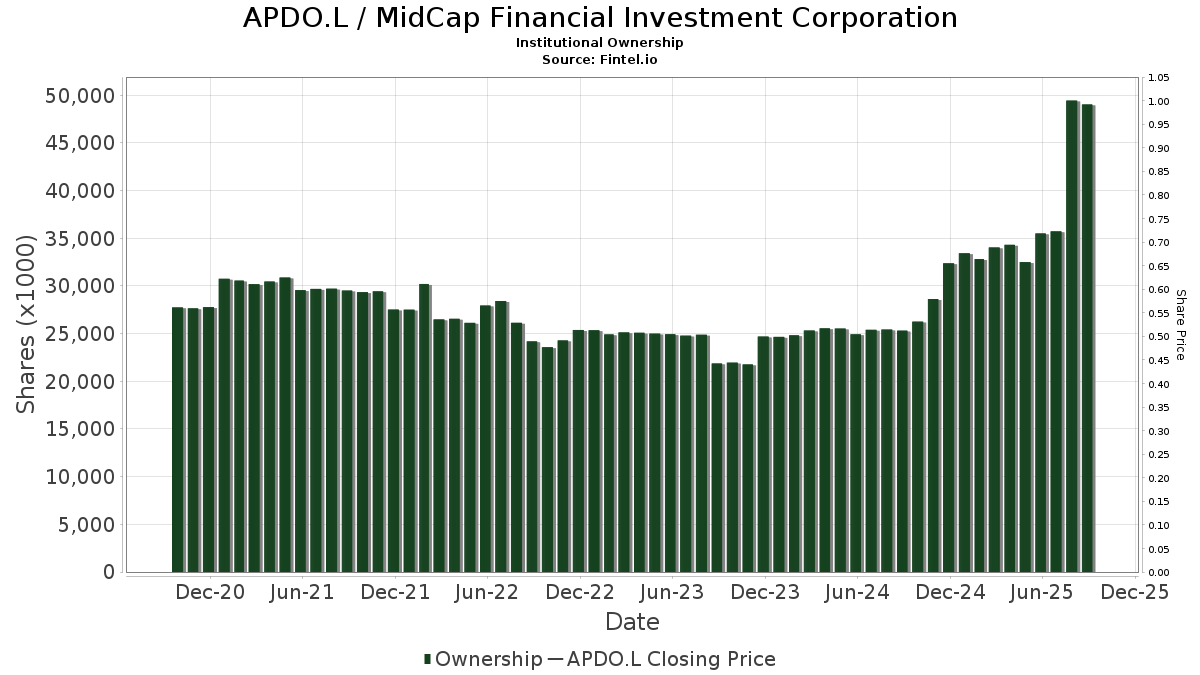

| Azioni istituzionali (Long) | 49.031.651 (ex 13D/G) - change of 13,53MM shares 38,12% MRQ |

| Valore istituzionale (Long) | $ 398.449 USD ($1000) |

Proprietà istituzionale e azionisti

MidCap Financial Investment Corporation (US:APDO.L) ha 189 proprietari istituzionali e azionisti che hanno presentato i moduli 13D/G o 13F alla Securities Exchange Commission (SEC). Queste istituzioni detengono un totale di 49,031,651 azioni. I maggiori azionisti includono Kingstone Capital Partners Texas, LLC, Thornburg Investment Management Inc, TIBAX - Thornburg Investment Income Builder Fund - Class A, Van Eck Associates Corp, Apollo Management Holdings, L.P., BIZD - VanEck Vectors BDC Income ETF, Morgan Stanley, UBS Group AG, KBWD - Invesco KBW High Dividend Yield Financial ETF, and Franklin Resources Inc .

(MidCap Financial Investment Corporation (OTCPK:APDO.L) la struttura proprietaria istituzionale mostra le attuali posizioni nella società da parte di istituzioni e fondi, nonché le ultime variazioni nella dimensione della posizione. I principali azionisti possono essere singoli investitori, fondi comuni, hedge fund o istituzioni. L'allegato 13D indica che l'investitore detiene (o ha detenuto) più del 5% della società e intende (o intendeva) perseguire attivamente un cambiamento nella strategia aziendale. L'allegato 13G indica un investimento passivo superiore al 5%.

Indice del sentiment dei fondi

L'indice del sentiment dei fondi (anche noto come "indice di accumulo di proprietà") individua i titoli più acquistati dai fondi. È il risultato di un sofisticato modello quantitativo multi-fattore che identifica le società con i più alti livelli di accumulo istituzionale. Il modello utilizza una combinazione dell'aumento totale dei proprietari dichiarati, delle variazioni nelle allocazioni di portafoglio di tali proprietari e di altre metriche. Il punteggio varia da 0 a 100: i numeri più alti indicano un livello di accumulo superiore ad altre società, mentre 50 rappresenta la media.

Frequenza di aggiornamento: giornaliera

Consulta Ownership Explorer per visualizzare l'elenco delle aziende con il ranking più alto.

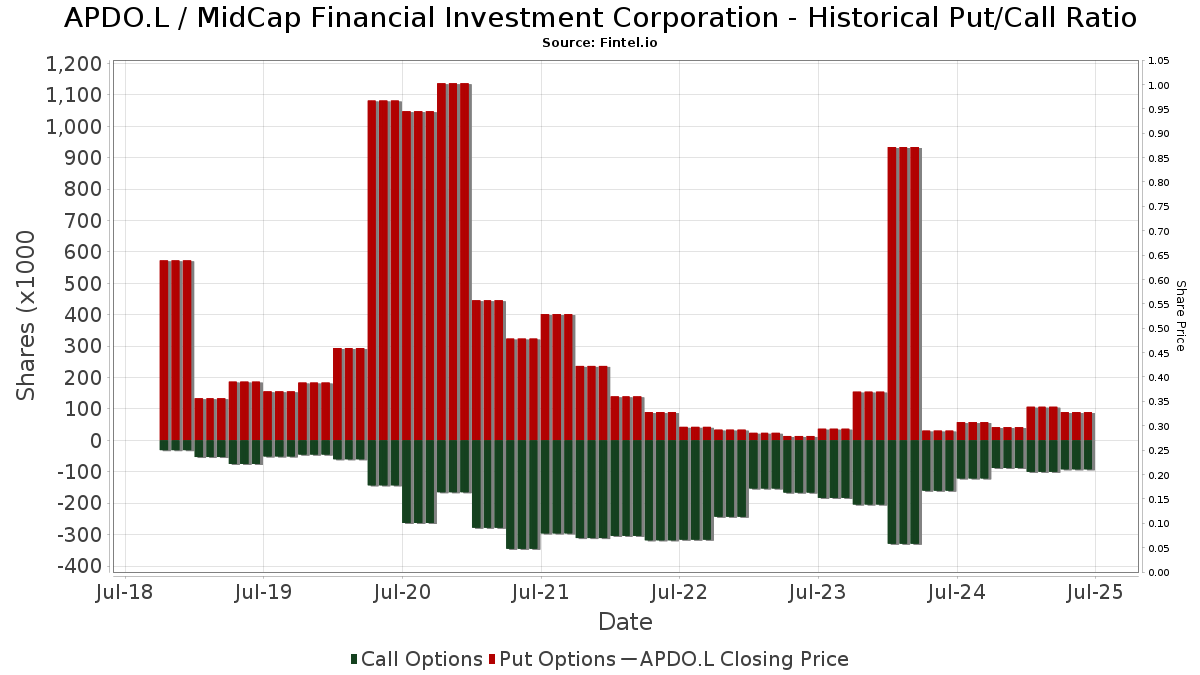

Rapporto put/call istituzionale

Oltre a segnalare le emissioni standard di titoli azionari e di debito, gli istituti con più di 100 milioni di asset in gestione devono anche dichiarare le loro partecipazioni in opzioni put e call. Poiché le opzioni put indicano generalmente un sentiment negativo e le opzioni call un sentiment positivo, possiamo avere un'idea del sentiment istituzionale complessivo attraverso il rapporto tra put e call. Il grafico a destra mostra il rapporto storico put/call per questo strumento.

L'utilizzo del rapporto put/call come indicatore del sentiment degli investitori consente di superare una delle principali lacune dell'utilizzo della proprietà istituzionale totale, ovvero il fatto che una quantità significativa di asset in gestione viene investita passivamente per seguire gli indici. Generalmente, i fondi a gestione passiva non acquistano opzioni, per cui il rapporto put/call riflette più fedelmente il sentiment dei fondi a gestione attiva.

Depositi 13F e NPORT

Le informazioni relative ai depositi 13F sono gratuite. Per accedere alle informazioni relative ai depositi NP è necessario un'abbonamento premium. Le righe verdi indicano le nuove posizioni. Le righe rosse indicano le posizioni chiuse. Fai clic sull'icona del link per visualizzare la cronologia completa delle transazioni.

Esegui l'upgrade

per sbloccare i dati premium ed esportarli in Excel ![]() .

.

| Data di deposito | Fonte | Investitore | Tipo | Prezzo medio (Stima) |

Azioni | Δ Azioni (%) |

Valore dichiarato ($ 1000) |

Δ Valore (%) |

Allocazione del portafoglio (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Group One Trading, L.p. | 699 | 9 | ||||||

| 2025-08-14 | 13F | Crawford Fund Management, LLC | Put | 62.400 | -23,81 | 787 | -25,26 | |||

| 2025-07-31 | 13F | Sumitomo Mitsui Trust Holdings, Inc. | 334.994 | 44,03 | 4.228 | 41,32 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 276 | 3 | ||||||

| 2025-07-16 | 13F | Essex Financial Services, Inc. | 10.621 | 0,18 | 134 | -1,47 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 472.254 | 0,10 | 5.960 | -1,78 | ||||

| 2025-07-29 | NP | SLPAX - Siit Small Cap Fund - Class A | 21.366 | 0,00 | 280 | -4,76 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 1.050 | 0 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 15.105 | 191 | ||||||

| 2025-08-18 | 13F | N.E.W. Advisory Services LLC | 48 | 0,00 | 1 | |||||

| 2025-08-06 | 13F | Ethos Financial Group, LLC | 421.901 | 1,43 | 5.324 | -0,69 | ||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 109.666 | 0,00 | 1.384 | -1,91 | ||||

| 2025-06-18 | NP | Putnam ETF Trust - Putnam BDC ETF - | 709.025 | 28,11 | 8.409 | 8,53 | ||||

| 2025-08-14 | 13F | CF Capital LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 1.667.288 | 32,19 | 21.041 | 29,72 | ||||

| 2025-08-04 | 13F | Muzinich & Co., Inc. | 401.393 | 68,35 | 5.066 | 65,20 | ||||

| 2025-08-14 | 13F | First Commonwealth Financial Corp /pa/ | 24.175 | 0,00 | 305 | -1,61 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 2.518 | 32 | ||||||

| 2025-07-29 | 13F | International Assets Investment Management, Llc | 25.996 | 1,57 | 328 | -0,30 | ||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 11.529 | -36,97 | 145 | -38,30 | ||||

| 2025-05-13 | 13F | Sterling Capital Management LLC | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Tudor Investment Corp Et Al | 0 | -100,00 | 0 | |||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 7.680 | -8,08 | 97 | -10,28 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 3.304 | 0,00 | 0 | |||||

| 2025-08-05 | 13F | Access Investment Management LLC | 4.000 | 0,00 | 50 | -5,66 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 1.132 | 0,00 | 14 | 0,00 | ||||

| 2025-07-10 | 13F | Security National Bank | 6.044 | 6,11 | 76 | 4,11 | ||||

| 2025-08-13 | 13F | Congress Wealth Management LLC / DE / | 76.278 | 158,23 | 963 | 153,83 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 9.513 | 20.580,43 | 120 | |||||

| 2025-08-26 | NP | WCERX - WCM Alternatives: Event-Driven Fund - Investor Class Shares | 7.702 | 0,00 | 97 | -2,02 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 563 | -25,73 | 7 | -22,22 | ||||

| 2025-06-26 | NP | DVDN - Kingsbarn Dividend Opportunity ETF | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Lansforsakringar Fondforvaltning AB (publ) | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | Stephens Inc /ar/ | 84.191 | 0,00 | 1.062 | -1,85 | ||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 18.246 | 230 | ||||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 112.935 | 44,54 | 1 | 0,00 | ||||

| 2025-08-12 | 13F | Legal & General Group Plc | 616.852 | -1,30 | 7.791 | -3,11 | ||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | Graypoint LLC | 186.797 | 3,06 | 2.357 | 1,16 | ||||

| 2025-07-18 | 13F | Generali Investments CEE, investicni spolecnost, a.s. | 24.139 | 6,25 | 305 | 4,11 | ||||

| 2025-08-12 | 13F | Private Management Group Inc | 10.317 | 130 | ||||||

| 2025-08-13 | 13F | Thornburg Investment Management Inc | 2.937.783 | 0,00 | 37.075 | -90,19 | ||||

| 2025-08-07 | 13F | ProShare Advisors LLC | 18.546 | -4,36 | 234 | -6,02 | ||||

| 2025-08-14 | 13F | Comerica Bank | 91.955 | 10,91 | 1.160 | 8,82 | ||||

| 2025-05-12 | 13F | Entropy Technologies, LP | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 2.390.155 | 6,81 | 30 | 7,14 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 402.636 | 16,63 | 5.081 | 14,44 | ||||

| 2025-07-10 | 13F | Capital Advisory Group Advisory Services, LLC | 34.677 | 0,00 | 438 | -1,80 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 3.224 | 26,04 | 41 | 33,33 | ||||

| 2025-07-28 | 13F | Frazier Financial Advisors, LLC | 0 | 0 | ||||||

| 2025-08-07 | 13F | Panoramic Investment Advisors, Llc | 53.630 | 0,00 | 677 | -1,89 | ||||

| 2025-05-14 | 13F | CIBC World Markets Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 6.409 | 0,00 | 81 | -2,44 | ||||

| 2025-08-08 | 13F | Creative Planning | 14.539 | 5,62 | 183 | 3,39 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | United Advisor Group, LLC | 256.852 | 0,24 | 3.241 | -1,64 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Shufro Rose & Co Llc | 41.834 | -5,23 | 538 | -5,29 | ||||

| 2025-08-18 | 13F/A | Apollo Management Holdings, L.P. | 2.388.857 | 0,00 | 30.147 | -1,87 | ||||

| 2025-07-30 | 13F | Denali Advisors Llc | 87.681 | -2,58 | 1.107 | -4,41 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 150 | 0,00 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | Advisor Group Holdings, Inc. | 93.256 | -1,00 | 1.254 | 3,55 | ||||

| 2025-04-11 | 13F | Stablepoint Partners, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 69.513 | -2,23 | 877 | -4,05 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 30.384 | 2,09 | 383 | 0,26 | ||||

| 2025-07-25 | NP | First Trust Specialty Finance & Financial Opportunities Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 140.000 | 115,38 | 1.838 | 105,25 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 328.055 | 4,84 | 4.140 | 2,88 | ||||

| 2025-07-09 | 13F | Westbourne Investments, Inc. | 18.930 | -72,49 | 239 | -73,08 | ||||

| 2025-08-06 | 13F | Axim Planning & Wealth | 11.780 | 149 | ||||||

| 2025-08-05 | 13F | Castlekeep Investment Advisors Llc | 388.911 | 0,02 | 4.908 | -1,84 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 10.500 | -40,68 | 133 | -41,85 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 52.000 | -19,25 | 656 | -20,77 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | 24.371 | 308 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 26.400 | -26,05 | 333 | -27,45 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 17.800 | 140,54 | 225 | 135,79 | |||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 14.142 | 0,00 | 178 | -1,66 | ||||

| 2025-08-13 | 13F | Cheviot Value Management, LLC | 333 | 0,00 | 4 | 33,33 | ||||

| 2025-06-25 | NP | VPC - Virtus Private Credit Strategy ETF | 64.946 | -5,82 | 770 | -20,21 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 3.675 | 0,00 | 46 | 21,05 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 334.446 | -0,20 | 4.221 | -2,07 | ||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 362.391 | -23,53 | 4.573 | -24,96 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 58.763 | -49,81 | 742 | -50,76 | ||||

| 2025-08-14 | 13F | Ausdal Financial Partners, Inc. | 10.999 | -10,95 | 139 | -12,66 | ||||

| 2025-07-28 | NP | PEX - ProShares Global Listed Private Equity ETF | 19.829 | 1,22 | 260 | -3,35 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 89.492 | 4,59 | 1.129 | 2,64 | ||||

| 2025-08-12 | 13F | Walled Lake Planning & Wealth Management, Llc | 22.271 | 0,00 | 281 | -1,75 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 194.265 | -48,38 | 2.452 | -49,35 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 223.220 | -0,34 | 2.817 | -2,19 | ||||

| 2025-08-05 | 13F | Sigma Planning Corp | 73.046 | 3,08 | 922 | 1,10 | ||||

| 2025-08-14 | 13F | Arete Wealth Advisors, LLC | 15.938 | 3,24 | 0 | |||||

| 2025-04-28 | 13F | Redmont Wealth Advisors Llc | 13.054 | 0,00 | 168 | -5,11 | ||||

| 2025-08-13 | 13F | Everstar Asset Management, LLC | 20.850 | -12,58 | 263 | -14,05 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 15.743 | 1,94 | 199 | 0,00 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 611.877 | 32,91 | 7.722 | 30,42 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 660 | 8 | ||||||

| 2025-05-27 | NP | Brighthouse Funds Trust I - Brighthouse Small Cap Value Portfolio Class A | 131.542 | 0,00 | 1.692 | -4,68 | ||||

| 2025-07-28 | 13F | Naviter Wealth, LLC | 203.259 | 2,92 | 2.565 | -0,39 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 7.276 | 3,00 | 92 | 1,11 | ||||

| 2025-08-14 | 13F | Williams Jones Wealth Management, LLC. | 10.901 | 0,00 | 138 | -2,14 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 300 | 0,00 | 0 | |||||

| 2025-07-18 | 13F | Founders Capital Management | 1.500 | 0,00 | 19 | -5,26 | ||||

| 2025-07-11 | 13F | Orrstown Financial Services Inc | 13.640 | 0,00 | 172 | -1,71 | ||||

| 2025-07-23 | 13F | Tcfg Wealth Management, Llc | 41.656 | 0,00 | 526 | -1,87 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 19.102 | 241 | ||||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 1.514 | 0,93 | 19 | 0,00 | ||||

| 2025-08-14 | 13F | Westchester Capital Management, LLC | 7.702 | 0,00 | 97 | -2,02 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 6.614 | 26,85 | 83 | 22,39 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 36.999 | 37,40 | 467 | 28,37 | ||||

| 2025-07-15 | 13F | DKM Wealth Management, Inc. | 23.500 | 0,00 | 297 | -1,99 | ||||

| 2025-08-11 | 13F | Anfield Capital Management, LLC | 8.804 | 5,41 | 111 | 3,74 | ||||

| 2025-08-13 | 13F | StoneX Group Inc. | 13.956 | 4,42 | 176 | 2,92 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 1.079 | 0,00 | 14 | 0,00 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 246.923 | 1.100,93 | 3.116 | 1.080,30 | ||||

| 2025-07-08 | 13F | Ransom Advisory, Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 35.291 | 1,13 | 445 | -0,67 | ||||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 103.954 | 4,97 | 1.312 | 2,99 | ||||

| 2025-08-06 | 13F | LeClair Wealth Partners LLC | 40.885 | 0,00 | 516 | -1,90 | ||||

| 2025-07-17 | 13F/A | Capital Investment Advisors, LLC | 70.434 | -4,03 | 889 | -5,83 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-15 | 13F | Aquatic Capital Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Transce3nd, LLC | 5.439 | 269,75 | 69 | 277,78 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 584 | -73,56 | 7 | -75,00 | ||||

| 2025-05-15 | 13F | Nebula Research & Development LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 764 | -22,83 | 0 | |||||

| 2025-05-09 | 13F | TD Waterhouse Canada Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-11 | 13F | Kingstone Capital Partners Texas, LLC | 13.812.738 | 189 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 237.209 | 17,79 | 2.994 | 15,60 | ||||

| 2025-08-11 | 13F | Wealthspire Advisors, LLC | 10.018 | 126 | ||||||

| 2025-08-14 | 13F | Cura Wealth Advisors, Llc | 708.959 | 9,31 | 8.947 | 7,28 | ||||

| 2025-08-08 | 13F | Condor Capital Management | 412.875 | 3,98 | 5.210 | 2,04 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 222.459 | 5,80 | 2.807 | 3,81 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 36.643 | 0,97 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 1.887.140 | 3,52 | 23.816 | 1,58 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 38 | 0,00 | 0 | |||||

| 2025-08-15 | 13F | Caxton Associates Llp | 12.886 | 0,00 | 163 | -1,82 | ||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-15 | 13F | Great West Life Assurance Co /can/ | 93.857 | 5,07 | 1 | 0,00 | ||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 51.851 | -50,00 | 654 | -50,94 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 10.561 | 133 | ||||||

| 2025-08-13 | 13F | Northern Trust Corp | 33.081 | 417 | ||||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 23.530 | 12,00 | 296 | 9,63 | ||||

| 2025-08-28 | NP | Monachil Credit Income Fund | 10.000 | 126 | ||||||

| 2025-08-07 | 13F | Evoke Wealth, Llc | 36.800 | 0,00 | 464 | -1,90 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 77.277 | 1,46 | 975 | -0,41 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 25.850 | -6,51 | 326 | -8,17 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 500 | 6 | ||||||

| 2025-08-13 | 13F | M Holdings Securities, Inc. | 72.318 | -3,06 | 1 | |||||

| 2025-08-21 | NP | TIBAX - Thornburg Investment Income Builder Fund - Class A | 2.937.783 | 0,00 | 37.075 | -1,87 | ||||

| 2025-04-25 | NP | VSSVX - Small Cap Special Values Fund | 62.406 | -2,28 | 860 | -4,98 | ||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 12.819 | 3,00 | 162 | 0,63 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 584.965 | 0,12 | 7.382 | -1,74 | ||||

| 2025-08-14 | 13F | Brevan Howard Capital Management LP | 23.780 | 9,01 | 300 | 7,14 | ||||

| 2025-07-31 | 13F | MQS Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-25 | 13F/A | Promus Capital, LLC | 5.300 | 0,00 | 67 | -2,94 | ||||

| 2025-08-15 | 13F | WFA of San Diego, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | Trust Co Of Vermont | 466 | 6 | ||||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 47.589 | 601 | ||||||

| 2025-07-30 | 13F | Onyx Bridge Wealth Group LLC | 17.539 | 1,44 | 221 | -0,45 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 0 | -100,00 | 0 | |||||

| 2025-08-21 | NP | BIZD - VanEck Vectors BDC Income ETF | 2.113.835 | 2,33 | 26.677 | 0,42 | ||||

| 2025-08-13 | 13F | Garner Asset Management Corp | 111.631 | -15,34 | 1.409 | -16,93 | ||||

| 2025-08-14 | 13F | NCP Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Sovereign Financial Group, Inc. | 12.113 | 0,00 | 153 | -1,94 | ||||

| 2025-05-15 | 13F | WPG Advisers, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 18.947 | -29,58 | 239 | -30,92 | ||||

| 2025-07-28 | NP | KBWD - Invesco KBW High Dividend Yield Financial ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 864.454 | 13,13 | 11.346 | 7,75 | ||||

| 2025-06-27 | NP | LBO - WHITEWOLF Publicly Listed Private Equity ETF | 6.075 | 14,28 | 72 | -2,70 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 23.359 | -7,59 | 295 | -9,54 | ||||

| 2025-08-14 | 13F | Peak6 Llc | Call | 13.900 | 175 | |||||

| 2025-07-16 | 13F | Signaturefd, Llc | 3.387 | 88,48 | 43 | 82,61 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 445 | 6 | ||||||

| 2025-08-15 | 13F | Provenance Wealth Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Accel Wealth Management | 13.731 | 0,59 | 173 | -1,14 | ||||

| 2025-08-13 | 13F | Callodine Capital Management, LP | 500.000 | 22,00 | 6.310 | 19,73 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 538.467 | -4,21 | 6.795 | -6,00 | ||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | 1832 Asset Management L.P. | 0 | -100,00 | 0 | |||||

| 2025-08-21 | NP | MOFTX - Mercer Opportunistic Fixed Income Fund Class I | 42.000 | 530 | ||||||

| 2025-05-15 | 13F | Barclays Plc | 0 | -100,00 | 0 | |||||

| 2025-04-30 | 13F | POM Investment Strategies, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Sharpepoint Llc | 80.563 | 17,49 | 1.017 | 23,00 | ||||

| 2025-07-29 | 13F | Activest Wealth Management | 2.266 | 0,00 | 29 | -3,45 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 48.311 | -23,74 | 610 | -25,18 | ||||

| 2025-08-12 | 13F | DnB Asset Management AS | 164.114 | 0,00 | 2.071 | -1,85 | ||||

| 2025-08-14 | 13F | Almitas Capital LLC | 92.717 | -35,11 | 1.170 | -36,31 | ||||

| 2025-05-13 | 13F | Sei Investments Co | 49.089 | 0,00 | 662 | 0,00 | ||||

| 2025-08-11 | 13F | Lsv Asset Management | 104.866 | 0,00 | 1 | 0,00 | ||||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 223.557 | -27,97 | 2.821 | -29,32 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 770.438 | -12,31 | 9.723 | -13,95 | ||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 371.828 | -13,00 | 4.692 | -14,63 | ||||

| 2025-05-12 | 13F | Virtu Financial LLC | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 500 | 0,00 | 0 | |||||

| 2025-07-23 | 13F | Tyche Wealth Partners LLC | 23.500 | 20,51 | 297 | 18,40 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Global Wealth Management Investment Advisory, Inc. | 85.220 | 7,73 | 1.075 | 5,70 | ||||

| 2025-05-14 | 13F | Credit Agricole S A | 28.265 | 0,00 | 363 | -4,72 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 119.168 | 12,80 | 1.504 | 10,68 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 48.838 | 8,96 | 616 | 6,94 | ||||

| 2025-08-12 | 13F | Trexquant Investment LP | 13.777 | 174 | ||||||

| 2025-04-28 | 13F | Strategic Financial Concepts, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 6.706 | 20,63 | 85 | 18,31 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 69.158 | 13,65 | 873 | 11,51 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 56.575 | -2,33 | 1 | |||||

| 2025-07-16 | 13F | Meridian Investment Counsel Inc. | 42.045 | -21,33 | 531 | -22,85 | ||||

| 2025-08-14 | 13F | Wealth Preservation Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 157.228 | -7,98 | 1.984 | -9,70 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 19.263 | 43,28 | 243 | 41,28 | ||||

| 2025-08-14 | 13F | Ares Management Llc | 545.532 | 13,17 | 6.885 | 11,07 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 11.358 | -45,04 | 0 | |||||

| 2025-05-12 | 13F | National Bank Of Canada /fi/ | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 466.028 | 33,05 | 6 | 25,00 | ||||

| 2025-08-19 | 13F | Anchor Investment Management, LLC | 2.577 | 0,00 | 33 | -3,03 | ||||

| 2025-05-02 | 13F | Transcendent Capital Group LLC | 0 | -100,00 | 0 | |||||

| 2025-05-30 | NP | ERNZ - TrueShares Active Yield ETF | 8.773 | 113 | ||||||

| 2025-08-19 | 13F | Cape Investment Advisory, Inc. | 1.784 | 0,00 | 23 | 0,00 | ||||

| 2025-04-25 | 13F | Smallwood Wealth Investment Management, LLC | 16 | 0 | ||||||

| 2025-08-12 | 13F | Franklin Resources Inc | 772.538 | 18,27 | 9.749 | 16,06 | ||||

| 2025-07-17 | 13F | Camelot Portfolios, LLC | 61.884 | -4,18 | 781 | -6,02 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 24.430 | 4,27 | 308 | 2,33 | ||||

| 2025-08-14 | 13F | BI Asset Management Fondsmaeglerselskab A/S | 271.547 | 11,49 | 3 | 0,00 | ||||

| 2025-07-17 | 13F | Melfa Wealth Management, Llc | 13.718 | 0,00 | 173 | -1,70 | ||||

| 2025-08-05 | 13F | Next Capital Management LLC | 725.401 | 329,02 | 9.155 | 321,07 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 38.624 | 17,96 | 487 | 14,32 | ||||

| 2025-07-31 | 13F | Whipplewood Advisors, LLC | 63.341 | 2.111.266,67 | 799 | -16,34 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 10.443 | -1,15 | 132 | -2,96 | ||||

| 2025-07-01 | 13F | Confluence Investment Management Llc | 165.155 | 84,02 | 2.084 | 80,59 |