Statistiche di base

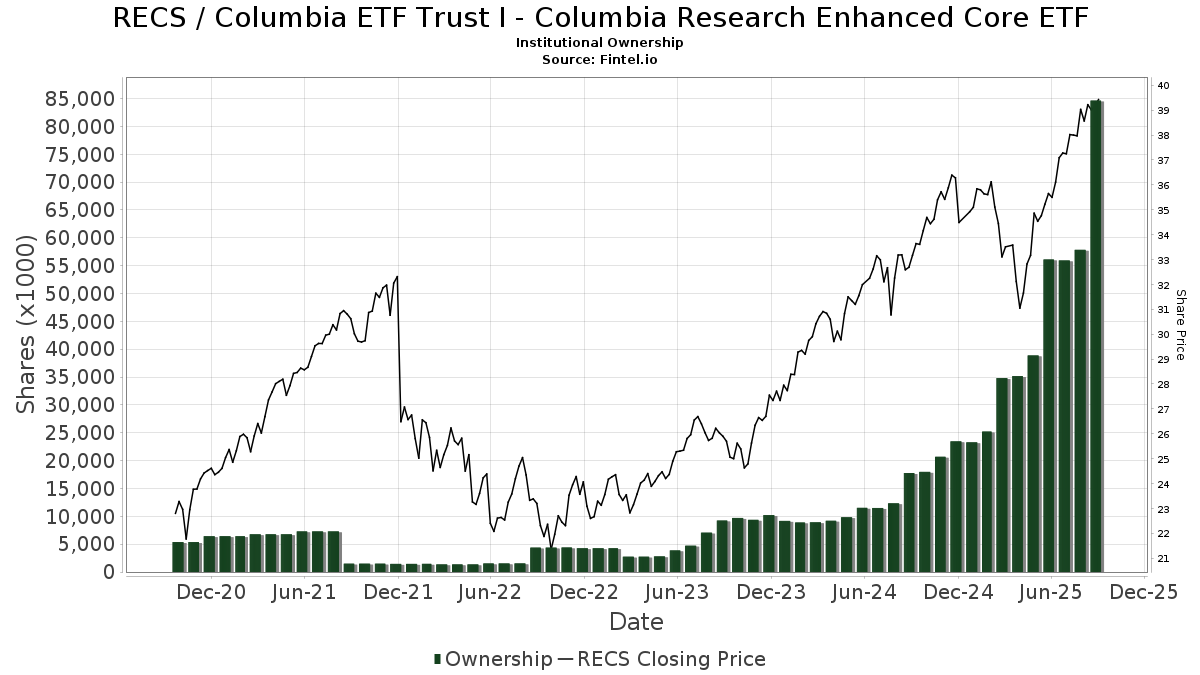

| Proprietari istituzionali | 140 total, 140 long only, 0 short only, 0 long/short - change of 9,38% MRQ |

| Allocazione media del portafoglio | 0.8982 % - change of 6,33% MRQ |

| Azioni istituzionali (Long) | 84.146.344 (ex 13D/G) - change of 28,04MM shares 49,97% MRQ |

| Valore istituzionale (Long) | $ 2.954.896 USD ($1000) |

Proprietà istituzionale e azionisti

Columbia ETF Trust I - Columbia Research Enhanced Core ETF (US:RECS) ha 140 proprietari istituzionali e azionisti che hanno presentato i moduli 13D/G o 13F alla Securities Exchange Commission (SEC). Queste istituzioni detengono un totale di 84,146,344 azioni. I maggiori azionisti includono Jane Street Group, Llc, Ameriprise Financial Inc, LPL Financial LLC, Bank Of America Corp /de/, Morgan Stanley, Raymond James Financial Inc, CTFAX - Columbia Thermostat Fund Class A, Commonwealth Equity Services, Llc, Gradient Investments LLC, and Fundamentun, Llc .

(Columbia ETF Trust I - Columbia Research Enhanced Core ETF (ARCA:RECS) la struttura proprietaria istituzionale mostra le attuali posizioni nella società da parte di istituzioni e fondi, nonché le ultime variazioni nella dimensione della posizione. I principali azionisti possono essere singoli investitori, fondi comuni, hedge fund o istituzioni. L'allegato 13D indica che l'investitore detiene (o ha detenuto) più del 5% della società e intende (o intendeva) perseguire attivamente un cambiamento nella strategia aziendale. L'allegato 13G indica un investimento passivo superiore al 5%.

The share price as of September 3, 2025 is 39,01 / share. Previously, on September 4, 2024, the share price was 32,59 / share. This represents an increase of 19,70% over that period.

Indice del sentiment dei fondi

L'indice del sentiment dei fondi (anche noto come "indice di accumulo di proprietà") individua i titoli più acquistati dai fondi. È il risultato di un sofisticato modello quantitativo multi-fattore che identifica le società con i più alti livelli di accumulo istituzionale. Il modello utilizza una combinazione dell'aumento totale dei proprietari dichiarati, delle variazioni nelle allocazioni di portafoglio di tali proprietari e di altre metriche. Il punteggio varia da 0 a 100: i numeri più alti indicano un livello di accumulo superiore ad altre società, mentre 50 rappresenta la media.

Frequenza di aggiornamento: giornaliera

Consulta Ownership Explorer per visualizzare l'elenco delle aziende con il ranking più alto.

Rapporto put/call istituzionale

Oltre a segnalare le emissioni standard di titoli azionari e di debito, gli istituti con più di 100 milioni di asset in gestione devono anche dichiarare le loro partecipazioni in opzioni put e call. Poiché le opzioni put indicano generalmente un sentiment negativo e le opzioni call un sentiment positivo, possiamo avere un'idea del sentiment istituzionale complessivo attraverso il rapporto tra put e call. Il grafico a destra mostra il rapporto storico put/call per questo strumento.

L'utilizzo del rapporto put/call come indicatore del sentiment degli investitori consente di superare una delle principali lacune dell'utilizzo della proprietà istituzionale totale, ovvero il fatto che una quantità significativa di asset in gestione viene investita passivamente per seguire gli indici. Generalmente, i fondi a gestione passiva non acquistano opzioni, per cui il rapporto put/call riflette più fedelmente il sentiment dei fondi a gestione attiva.

Depositi 13F e NPORT

Le informazioni relative ai depositi 13F sono gratuite. Per accedere alle informazioni relative ai depositi NP è necessario un'abbonamento premium. Le righe verdi indicano le nuove posizioni. Le righe rosse indicano le posizioni chiuse. Fai clic sull'icona del link per visualizzare la cronologia completa delle transazioni.

Esegui l'upgrade

per sbloccare i dati premium ed esportarli in Excel ![]() .

.

| Data di deposito | Fonte | Investitore | Tipo | Prezzo medio (Stima) |

Azioni | Δ Azioni (%) |

Valore dichiarato ($ 1000) |

Δ Valore (%) |

Allocazione del portafoglio (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 1.511.634 | -1,17 | 55.613 | 9,48 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 685.926 | 8,83 | 25.235 | 20,56 | ||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 14.303 | -91,10 | 526 | -90,14 | ||||

| 2025-07-23 | 13F | Heck Capital Advisors, LLC | 461.922 | 16.994 | ||||||

| 2025-07-29 | 13F | Fundamentun, Llc | 1.978.098 | 4,39 | 72.774 | 15,64 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 110.244 | -46,99 | 4.056 | -41,28 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 477.034 | -16,81 | 17.551 | -7,83 | ||||

| 2025-08-14 | 13F | LM Advisors LLC | 40.568 | 2,56 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 4.425.196 | -10,10 | 162.803 | -0,40 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 18.761 | 51,27 | 1 | |||||

| 2025-07-25 | 13F | Retirement Planning Group, Llc / Ny | 90.043 | 41,28 | 3.313 | 56,52 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 16.658.312 | 49.303,34 | 612.859 | 54.668,45 | ||||

| 2025-07-23 | 13F | Morey & Quinn Wealth Partners, LLC | 19.785 | 26,95 | 728 | 40,62 | ||||

| 2025-07-02 | 13F | Capital Market Strategies LLC | 10.558 | 388 | ||||||

| 2025-07-09 | 13F | WealthCare Investment Partners, LLC | 23.778 | 15,46 | 889 | 41,85 | ||||

| 2025-08-12 | 13F | Richmond Investment Services, LLC | 68.148 | 102,91 | 2.507 | 124,84 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 374.045 | 6,36 | 14 | 18,18 | ||||

| 2025-08-04 | 13F | Amplius Wealth Advisors, LLC | 1.533.039 | 1,36 | 56.396 | 12,27 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 258.054 | -24,01 | 9.494 | -15,82 | ||||

| 2025-08-14 | 13F | Comerica Bank | 4.737 | -26,38 | 174 | -18,31 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 220.971 | 173,50 | 8.130 | 202,98 | ||||

| 2025-07-29 | 13F | Stratos Wealth Advisors, LLC | 8.856 | 326 | ||||||

| 2025-08-13 | 13F | MONECO Advisors, LLC | 5.921 | -6,24 | 218 | 3,83 | ||||

| 2025-08-08 | 13F | Comprehensive Financial Planning, Inc./PA | 1.007 | -6,33 | 37 | 5,71 | ||||

| 2025-08-07 | 13F | Fidelis Capital Partners, LLC | 49.943 | 1.896 | ||||||

| 2025-08-22 | NP | CTFAX - Columbia Thermostat Fund Class A | 2.732.920 | 125,79 | 100.544 | 150,13 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 70.820 | 102,04 | 2.605 | 115,82 | ||||

| 2025-07-21 | 13F | DHJJ Financial Advisors, Ltd. | 5 | 0,00 | 0 | |||||

| 2025-07-29 | 13F | Empirical Asset Management, LLC | 69.125 | 1,37 | 2.543 | 12,32 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 20.580 | 13,53 | 757 | 26,59 | ||||

| 2025-08-14 | 13F | Graney & King, LLC | 5.447 | 444,70 | 200 | 506,06 | ||||

| 2025-08-14 | 13F | Byrne Financial Freedom, Llc | 73.933 | 328,75 | 2.720 | 375,35 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 2.517.266 | 77,26 | 93 | 95,74 | ||||

| 2025-08-13 | 13F | Dana Investment Advisors, Inc. | 18.951 | 63,55 | 697 | 81,51 | ||||

| 2025-08-18 | 13F | Tyler-Stone Wealth Management | 10.264 | 0,98 | 378 | 11,87 | ||||

| 2025-07-17 | 13F | Archford Capital Strategies, LLC | 269.439 | 2,56 | 9.913 | 13,60 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 117 | 4 | ||||||

| 2025-07-18 | 13F | Truist Financial Corp | 8.231 | 30,82 | 303 | 45,19 | ||||

| 2025-07-23 | 13F | RiverTree Advisors, LLC | 8.180 | -5,92 | 301 | 4,17 | ||||

| 2025-08-06 | 13F | Mark Sheptoff Financial Planning, Llc | 385 | 0,00 | 14 | 16,67 | ||||

| 2025-08-05 | 13F | Scarborough Advisors, LLC | 567.951 | 30,34 | 20.895 | 44,39 | ||||

| 2025-08-04 | 13F | Daymark Wealth Partners, Llc | 720.517 | 14,10 | 26.508 | 26,40 | ||||

| 2025-08-11 | 13F | Trajan Wealth LLC | 555.620 | 0,12 | 20.441 | 10,92 | ||||

| 2025-08-05 | 13F | Snider Financial Group | 123.818 | 4.555 | ||||||

| 2025-08-13 | 13F | Balance Wealth, LLC | 54.725 | -81,88 | 2.013 | -79,93 | ||||

| 2025-07-15 | 13F | Palumbo Wealth Management LLC | 11.916 | 438 | ||||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 196.458 | 7,83 | 7.228 | 19,45 | ||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 7.061 | 260 | ||||||

| 2025-08-11 | 13F | Citigroup Inc | 65.065 | 1.517,73 | 2.394 | 1.699,25 | ||||

| 2025-07-23 | 13F | Drake & Associates, LLC | 840.273 | 4,37 | 30.914 | 15,61 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 63.469 | 8,08 | 2.394 | 22,77 | ||||

| 2025-07-28 | 13F | Tower Wealth Partners, Inc. | 492.981 | 3,98 | 18.137 | 15,19 | ||||

| 2025-07-17 | 13F | KWB Wealth | 236.281 | 57,88 | 7.847 | 51,44 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 112.533 | 3,26 | 4.140 | 14,40 | ||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 94.953 | 3.493 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 3.401.063 | 41,84 | 125.125 | 57,13 | ||||

| 2025-05-15 | 13F | Ameriflex Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Thoroughbred Financial Services, Llc | 29.108 | 10,73 | 1 | |||||

| 2025-08-13 | 13F | Copley Financial Group, Inc. | 6.643 | -5,61 | 244 | 4,72 | ||||

| 2025-04-07 | 13F | AdvisorNet Financial, Inc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | BlueStem Wealth Partners, LLC | 1.062.939 | -32,72 | 39.106 | -25,47 | ||||

| 2025-05-09 | 13F | Goldman Sachs Group Inc | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Mma Asset Management Llc | 24.955 | -8,73 | 918 | 1,10 | ||||

| 2025-08-11 | 13F | Western Wealth Management, LLC | 110.174 | 3,02 | 4.053 | 14,14 | ||||

| 2025-08-11 | 13F | Advisor Resource Council | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Spectrum Wealth Advisory Group, LLC | 837.922 | -16,48 | 30.827 | -7,47 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 3.475 | 128 | ||||||

| 2025-07-29 | 13F | Riverbend Wealth Management, LLC | 14.803 | 38,60 | 545 | 53,67 | ||||

| 2025-07-11 | 13F | SILVER OAK SECURITIES, Inc | 80.568 | 2,77 | 2.964 | 14,57 | ||||

| 2025-08-13 | 13F | Denver Wealth Management, Inc. | 30.795 | 23,55 | 1.133 | 36,88 | ||||

| 2025-08-14 | 13F | Fmr Llc | 2.182 | 114,13 | 80 | 142,42 | ||||

| 2025-07-15 | 13F | Oxinas Partners Wealth Management LLC | 22.200 | 0,00 | 817 | 10,72 | ||||

| 2025-08-29 | 13F | Centaurus Financial, Inc. | 385.922 | 2,64 | 14 | 16,67 | ||||

| 2025-07-07 | 13F | RDA Financial Network | 105.535 | 6,41 | 3.883 | 17,89 | ||||

| 2025-08-14 | 13F | Paragon Private Wealth Management, LLC | 57.620 | 12,59 | 2.120 | 24,72 | ||||

| 2025-07-29 | 13F | Activest Wealth Management | 0 | 0 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 240.780 | 12,60 | 9 | 14,29 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 12.963.845 | 22,35 | 476.940 | 35,54 | ||||

| 2025-08-13 | 13F | Advisor Group Holdings, Inc. | 150.006 | -50,96 | 5.227 | -48,55 | ||||

| 2025-07-09 | 13F | Fiduciary Alliance LLC | 6.883 | -11,30 | 253 | -1,56 | ||||

| 2025-07-16 | 13F | Perigon Wealth Management, LLC | 6.927 | 10,64 | 255 | 22,71 | ||||

| 2025-07-22 | 13F | DAVENPORT & Co LLC | 131.024 | 90,96 | 4.820 | 111,59 | ||||

| 2025-05-08 | 13F | Us Bancorp \de\ | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 55.103 | 62,11 | 2.027 | 79,70 | ||||

| 2025-08-06 | 13F/A | Three Cord True Wealth Management, LLC | 523.209 | 7,65 | 19.249 | 19,25 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 27.900 | 1.026 | ||||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 3.167.950 | 15,28 | 116.549 | 27,70 | ||||

| 2025-08-14 | 13F | Dagco, Inc. | 80.985 | 25,84 | 2.979 | 39,40 | ||||

| 2025-05-15 | 13F | Old Mission Capital Llc | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 65.696 | 14,49 | 2.417 | 26,82 | ||||

| 2025-08-06 | 13F | Bensler, LLC | 227.616 | 3,67 | 8.374 | 14,84 | ||||

| 2025-07-08 | 13F | Paladin Wealth, LLC | 60.269 | 2,85 | 2.217 | 13,93 | ||||

| 2025-07-31 | 13F | Mason & Associates Inc | 1.029.239 | 37.866 | ||||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 36 | 1 | ||||||

| 2025-07-31 | 13F | Richards, Merrill & Peterson, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | USAdvisors Wealth Management, LLC | 160.450 | 5,13 | 6 | 0,00 | ||||

| 2025-08-14 | 13F | Keystone Financial Services, LLC | 6.698 | 246 | ||||||

| 2025-05-12 | 13F | Independent Advisor Alliance | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Atria Investments Llc | 190.216 | 6,16 | 6.998 | 17,61 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 603.600 | 544,87 | 22.206 | 614,48 | ||||

| 2025-07-15 | 13F | Axis Wealth Partners, LLC | 33.241 | 13,75 | 1.223 | 25,98 | ||||

| 2025-08-18 | 13F | Arq Wealth Advisors, Llc | 214.206 | 0,00 | 7.114 | 0,00 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 145.845 | 36,98 | 5.366 | 51,77 | ||||

| 2025-05-01 | 13F | Fulcrum Equity Management | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 10.820.984 | 20,41 | 398.104 | 33,38 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 230.633 | 41,60 | 8.455 | 57,27 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 55.754 | -51,17 | 2.051 | -45,91 | ||||

| 2025-07-10 | 13F | Sovran Advisors, LLC | 92.334 | 33,27 | 3.417 | 58,86 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 2.277 | -39,92 | 84 | -33,60 | ||||

| 2025-08-14 | 13F | UBS Group AG | 366.954 | 159,97 | 13.500 | 188,03 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 17.151 | 16,67 | 631 | 29,10 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 5.912 | 218 | ||||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 24.351 | 125,26 | 896 | 139,30 | ||||

| 2025-08-05 | 13F | Flynn Zito Capital Management, Llc | 155.216 | -0,15 | 5.710 | 10,62 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 12.430 | 85,52 | 457 | 105,86 | ||||

| 2025-08-13 | 13F | Congress Wealth Management LLC / DE / | 99.278 | 10,30 | 3.652 | 22,18 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 241.380 | 34,51 | 8.880 | 49,02 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 1.961 | 38,39 | 72 | 60,00 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 2.732 | 2,32 | 101 | 8,70 | ||||

| 2025-08-12 | 13F | Gladstone Institutional Advisory LLC | 491.805 | 22,81 | 18.094 | 36,05 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 31.536 | 16,06 | 1.160 | 23,40 | ||||

| 2025-08-05 | 13F | Smith Shellnut Wilson Llc /adv | 23.069 | 22,94 | 849 | 36,12 | ||||

| 2025-04-24 | NP | NSGAX - Columbia Select Large Cap Equity Fund Class A | 43.258 | -60,52 | 1.520 | -61,51 | ||||

| 2025-07-08 | 13F | Gradient Investments LLC | 2.031.726 | 1,17 | 74.747 | 12,08 | ||||

| 2025-07-09 | 13F | Fermata Advisors, LLC | 101.501 | -0,73 | 3.734 | 9,99 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 106 | 0,00 | 4 | 0,00 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 320.671 | 394,61 | 11.983 | 456,57 | ||||

| 2025-07-31 | 13F | Leavell Investment Management, Inc. | 125.694 | 39,50 | 4.624 | 54,55 | ||||

| 2025-07-30 | 13F/A | KPP Advisory Services LLC | 45.678 | 196,11 | 1.680 | 228,13 | ||||

| 2025-08-12 | 13F | Cornerstone Wealth Management, LLC | 14.683 | 12,12 | 540 | 24,42 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 2.376 | -23,67 | 87 | -15,53 | ||||

| 2025-07-09 | 13F | Pines Wealth Management, LLC | 35.328 | 9,89 | 1.320 | 39,68 | ||||

| 2025-07-29 | 13F | Mattson Financial Services, LLC | 64.709 | -5,47 | 2.381 | 4,71 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1.522.931 | 67,65 | 56.029 | 85,72 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 357.751 | -0,73 | 13.162 | 9,97 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 8.201 | 13,12 | 302 | 25,42 | ||||

| 2025-07-16 | 13F | Essex Financial Services, Inc. | 213.424 | 22,60 | 7.852 | 35,81 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 196 | 0,00 | 0 | |||||

| 2025-08-15 | 13F | Brown Financial Advisors | 115.356 | -2,38 | 4.244 | 8,13 | ||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 152.094 | -0,83 | 5.596 | 9,86 | ||||

| 2025-08-01 | 13F | PCA Investment Advisory Services Inc. | 17.464 | 24,71 | 643 | 38,06 | ||||

| 2025-04-17 | 13F | Tcfg Wealth Management, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | IAG Wealth Partners, LLC | 296.568 | 143,19 | 10.911 | 169,45 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 179.979 | 898,88 | 6.621 | 1.007,19 | ||||

| 2025-07-30 | 13F | Prosperity Financial Group, Inc. | 39.656 | 32,34 | 1.459 | 46,53 | ||||

| 2025-08-12 | 13F | Inscription Capital, LLC | 39.399 | 1.449 | ||||||

| 2025-08-14 | 13F | Mariner, LLC | 126.650 | 31,44 | 4.659 | 45,59 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 22.849 | 841 | ||||||

| 2025-07-16 | 13F | Spirepoint Private Client, Llc | 64.672 | -8,88 | 2.379 | 0,93 | ||||

| 2025-06-25 | NP | LEGAX - Columbia Large Cap Growth Fund Class A | 169.788 | -50,53 | 5.572 | -54,33 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 90.084 | 13,78 | 3.314 | 26,06 |