Statistiche di base

| Proprietari istituzionali | 186 total, 186 long only, 0 short only, 0 long/short - change of 3,31% MRQ |

| Allocazione media del portafoglio | 0.2536 % - change of -5,65% MRQ |

| Azioni istituzionali (Long) | 8.652.062 (ex 13D/G) - change of 1,10MM shares 14,64% MRQ |

| Valore istituzionale (Long) | $ 626.617 USD ($1000) |

Proprietà istituzionale e azionisti

iShares Trust - iShares Morningstar Mid-Cap ETF (US:IMCB) ha 186 proprietari istituzionali e azionisti che hanno presentato i moduli 13D/G o 13F alla Securities Exchange Commission (SEC). Queste istituzioni detengono un totale di 8,652,062 azioni. I maggiori azionisti includono UBS Group AG, Morgan Stanley, RMG Wealth Management LLC, LPL Financial LLC, Commonwealth Equity Services, Llc, Means Investment Co., Inc., Raymond James Financial Inc, Cetera Investment Advisers, Steele Capital Management, Inc., and Matrix Trust Co .

(iShares Trust - iShares Morningstar Mid-Cap ETF (ARCA:IMCB) la struttura proprietaria istituzionale mostra le attuali posizioni nella società da parte di istituzioni e fondi, nonché le ultime variazioni nella dimensione della posizione. I principali azionisti possono essere singoli investitori, fondi comuni, hedge fund o istituzioni. L'allegato 13D indica che l'investitore detiene (o ha detenuto) più del 5% della società e intende (o intendeva) perseguire attivamente un cambiamento nella strategia aziendale. L'allegato 13G indica un investimento passivo superiore al 5%.

The share price as of September 5, 2025 is 82,44 / share. Previously, on September 9, 2024, the share price was 72,77 / share. This represents an increase of 13,29% over that period.

Indice del sentiment dei fondi

L'indice del sentiment dei fondi (anche noto come "indice di accumulo di proprietà") individua i titoli più acquistati dai fondi. È il risultato di un sofisticato modello quantitativo multi-fattore che identifica le società con i più alti livelli di accumulo istituzionale. Il modello utilizza una combinazione dell'aumento totale dei proprietari dichiarati, delle variazioni nelle allocazioni di portafoglio di tali proprietari e di altre metriche. Il punteggio varia da 0 a 100: i numeri più alti indicano un livello di accumulo superiore ad altre società, mentre 50 rappresenta la media.

Frequenza di aggiornamento: giornaliera

Consulta Ownership Explorer per visualizzare l'elenco delle aziende con il ranking più alto.

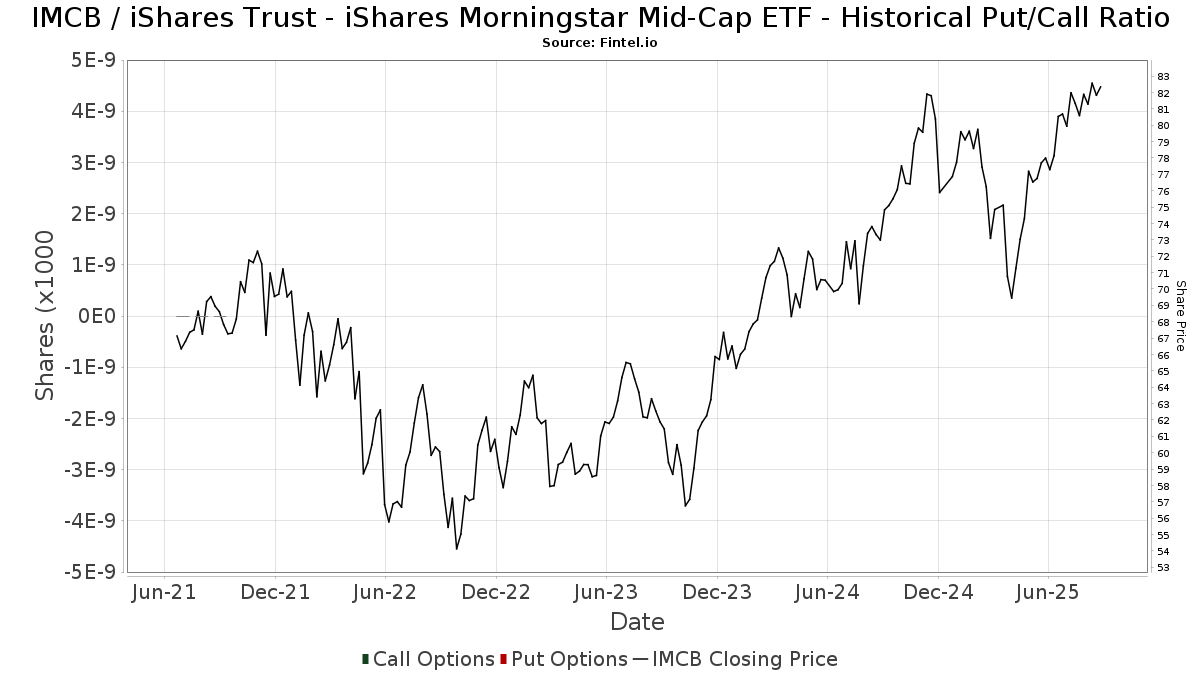

Rapporto put/call istituzionale

Oltre a segnalare le emissioni standard di titoli azionari e di debito, gli istituti con più di 100 milioni di asset in gestione devono anche dichiarare le loro partecipazioni in opzioni put e call. Poiché le opzioni put indicano generalmente un sentiment negativo e le opzioni call un sentiment positivo, possiamo avere un'idea del sentiment istituzionale complessivo attraverso il rapporto tra put e call. Il grafico a destra mostra il rapporto storico put/call per questo strumento.

L'utilizzo del rapporto put/call come indicatore del sentiment degli investitori consente di superare una delle principali lacune dell'utilizzo della proprietà istituzionale totale, ovvero il fatto che una quantità significativa di asset in gestione viene investita passivamente per seguire gli indici. Generalmente, i fondi a gestione passiva non acquistano opzioni, per cui il rapporto put/call riflette più fedelmente il sentiment dei fondi a gestione attiva.

Depositi 13F e NPORT

Le informazioni relative ai depositi 13F sono gratuite. Per accedere alle informazioni relative ai depositi NP è necessario un'abbonamento premium. Le righe verdi indicano le nuove posizioni. Le righe rosse indicano le posizioni chiuse. Fai clic sull'icona del link per visualizzare la cronologia completa delle transazioni.

Esegui l'upgrade

per sbloccare i dati premium ed esportarli in Excel ![]() .

.

| Data di deposito | Fonte | Investitore | Tipo | Prezzo medio (Stima) |

Azioni | Δ Azioni (%) |

Valore dichiarato ($ 1000) |

Δ Valore (%) |

Allocazione del portafoglio (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Diversify Advisory Services, LLC | 8.729 | -3,06 | 706 | 7,29 | ||||

| 2025-08-06 | 13F | Hoxton Planning & Management, LLC | 5.841 | 465 | ||||||

| 2025-08-11 | 13F | Synergy Investment Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Signaturefd, Llc | 1.596 | 1,79 | 127 | 9,48 | ||||

| 2025-07-15 | 13F | Pitti Group Wealth Management, LLC | 16.507 | -2,66 | 1.315 | 4,62 | ||||

| 2025-05-12 | 13F | C2P Capital Advisory Group, LLC d.b.a. Prosperity Capital Advisors | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 83.538 | 4,81 | 7 | 20,00 | ||||

| 2025-08-14 | 13F | UBS Group AG | 1.309.271 | 3,80 | 104.297 | 11,61 | ||||

| 2025-08-14 | 13F | Wealth Preservation Advisors, LLC | 705 | 0,43 | 56 | 7,69 | ||||

| 2025-08-08 | 13F | Good Life Advisors, LLC | 5.076 | 0,00 | 404 | 7,45 | ||||

| 2025-08-13 | 13F | Financial Freedom, LLC | 936 | 0,00 | 75 | 7,25 | ||||

| 2025-08-05 | 13F | Sigma Planning Corp | 3.911 | 0,10 | 312 | 7,61 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 6 | 0,00 | 0 | |||||

| 2025-08-08 | 13F | Financial Gravity Companies, Inc. | 328 | 0,00 | 26 | 8,33 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 74.517 | -1,10 | 5.936 | 6,36 | ||||

| 2025-08-11 | 13F | United Advisor Group, LLC | 22.837 | 16,99 | 1.819 | 25,80 | ||||

| 2025-08-05 | 13F | Ellevest, Inc. | 2.639 | 210 | ||||||

| 2025-07-21 | 13F | HighMark Wealth Management LLC | 1.297 | 0,00 | 103 | 7,29 | ||||

| 2025-07-21 | 13F | Barrett & Company, Inc. | 3.216 | 0,34 | 256 | 8,02 | ||||

| 2025-07-30 | 13F | Fingerlakes Wealth Management, Inc. | 2.618 | 209 | ||||||

| 2025-08-05 | 13F | Atlas Private Wealth Advisors | 3.882 | -34,82 | 309 | -29,93 | ||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 1.451 | 0,00 | 116 | 7,48 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 12.085 | -6,91 | 978 | 1,77 | ||||

| 2025-08-13 | 13F | Haverford Trust Co | 6.517 | 0,00 | 519 | 7,68 | ||||

| 2025-07-21 | 13F | Pacific Financial Group Inc | 64.764 | 1,21 | 5.159 | 8,84 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 1.348 | 97,65 | 107 | 114,00 | ||||

| 2025-07-28 | 13F | Private Wealth Asset Management, LLC | 1.245 | -23,85 | 99 | -18,18 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 12.425 | 990 | ||||||

| 2025-04-29 | 13F | Resources Investment Advisors, LLC. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-15 | 13F | Truefg, Llc | 9.332 | -0,70 | 743 | 6,75 | ||||

| 2025-07-23 | 13F | Detalus Advisors, LLC | 3.184 | 6,88 | 254 | 15,00 | ||||

| 2025-08-07 | 13F | Addison Advisors LLC | 2.650 | -33,50 | 211 | -28,47 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 13.933 | 3,84 | 1 | |||||

| 2025-04-10 | 13F | EWG Elevate Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Morton Brown Family Wealth, LLC | 482 | 0,21 | 38 | 8,57 | ||||

| 2025-07-23 | 13F | Opulen Financial Group LLC | 8.149 | -3,34 | 649 | 4,01 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 209 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 43.380 | 0,00 | 3.456 | 7,53 | ||||

| 2025-08-12 | 13F | PSI Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 692 | 0,29 | 55 | 7,84 | ||||

| 2025-08-12 | 13F | Ameritas Investment Partners, Inc. | 9.380 | 39,81 | 747 | 50,30 | ||||

| 2025-08-07 | 13F | Vise Technologies, Inc. | 4.978 | 397 | ||||||

| 2025-04-24 | 13F | Loring Wolcott & Coolidge Fiduciary Advisors Llp/ma | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Franklin Resources Inc | 2.000 | 0,00 | 159 | 7,43 | ||||

| 2025-07-29 | 13F | Financial Futures Ltd Liability Co. | 5.586 | 0,00 | 445 | 7,51 | ||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 184 | 0,00 | 15 | 7,69 | ||||

| 2025-08-08 | 13F | Evolution Wealth Advisors, LLC | 4.000 | 0,00 | 319 | 7,43 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 81.572 | 6.498 | ||||||

| 2025-08-05 | 13F | Huntington National Bank | 80 | 6,76 | ||||||

| 2025-08-07 | 13F | Summit Asset Management, LLC | 9.855 | 0,00 | 785 | 7,53 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 382.362 | -4,16 | 30 | 3,45 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Means Investment Co., Inc. | 319.053 | 5,32 | 25.416 | 13,25 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 439 | 0,00 | 35 | 9,68 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 1.360 | 0,00 | 108 | 8,00 | ||||

| 2025-08-04 | 13F | Wealth Management Associates, Inc. | 3.822 | 0,00 | 304 | 7,42 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 382 | 5,82 | 30 | 15,38 | ||||

| 2025-07-10 | 13F | Marshall Financial Group LLC | 5.600 | -9,98 | 450 | -2,17 | ||||

| 2025-08-12 | 13F | Archer Investment Corp | 1.099 | 242,37 | 88 | 278,26 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 11.659 | 4,57 | 1 | |||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 977 | 0,21 | 78 | 6,94 | ||||

| 2025-08-05 | 13F | Westside Investment Management, Inc. | 177 | 0,57 | 14 | 7,69 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 30.634 | -1,47 | 2.482 | 7,73 | ||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 957 | -2,15 | 76 | 2,70 | ||||

| 2025-08-08 | 13F | Creative Planning | 4.592 | 13,95 | 366 | 22,48 | ||||

| 2025-07-14 | 13F | Matrix Trust Co | 177.216 | 1,39 | 14 | 16,67 | ||||

| 2025-07-28 | 13F | Copia Wealth Management | 10 | 0,00 | 1 | |||||

| 2025-07-25 | 13F | Yarger Wealth Strategies, Llc | 68.964 | 0,25 | 5.494 | 7,79 | ||||

| 2025-07-29 | 13F | Woodard & Co Asset Management Group Inc /adv | 48.553 | -2,79 | 3.868 | 4,51 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 340 | 0,00 | 27 | 8,00 | ||||

| 2025-08-12 | 13F | Bedel Financial Consulting, Inc. | 47.512 | 2,22 | 3.785 | 10,39 | ||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 108.491 | 2,80 | 8.642 | 10,54 | ||||

| 2025-08-14 | 13F | Hilltop Holdings Inc. | 7.671 | 611 | ||||||

| 2025-08-18 | 13F | Tyler-Stone Wealth Management | 3.526 | 0,00 | 281 | 7,28 | ||||

| 2025-07-24 | 13F | Blair William & Co/il | 19 | 0,00 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 34.308 | 5,89 | 2.733 | 13,83 | ||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 42 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Capital Planning Advisors, LLC | 7.963 | 6,27 | 634 | 14,23 | ||||

| 2025-07-07 | 13F | Global Wealth Strategies & Associates | 1.100 | 0,00 | 88 | 7,41 | ||||

| 2025-07-18 | 13F | PFG Investments, LLC | 6.354 | 29,07 | 506 | 39,01 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 2 | 0 | ||||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 1.930 | -1,43 | 154 | 5,52 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 370 | 29 | ||||||

| 2025-07-30 | 13F | Financial Perspectives, Inc | 6.138 | 4,12 | 489 | 11,93 | ||||

| 2025-06-11 | 13F | Fortitude Financial, LLC | 70.502 | -85,42 | 5.223 | -85,82 | ||||

| 2025-07-22 | 13F | Olistico Wealth, LLC | 300 | 0,00 | 24 | 4,55 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 10.838 | 0,00 | 863 | 7,61 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 121.599 | 1,08 | 10 | 12,50 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 113.909 | -2,91 | 9.074 | 4,46 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - EQ/Mid Cap Value Managed Volatility Portfolio Class IB | 7.464 | 0,00 | 595 | 7,61 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 8.727 | -84,34 | 695 | -83,16 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 7.121 | -3,27 | 567 | 4,04 | ||||

| 2025-05-12 | 13F | Independent Advisor Alliance | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 153.163 | 2.080,88 | 12.201 | 2.246,15 | ||||

| 2025-08-13 | 13F | M&t Bank Corp | 6.162 | 69,47 | 491 | 82,16 | ||||

| 2025-08-05 | 13F | Plante Moran Financial Advisors, LLC | 1.675 | 0,00 | 133 | 7,26 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 11.938 | -16,70 | 951 | -12,92 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 13.139 | 1,99 | 1.047 | 9,64 | ||||

| 2025-07-25 | 13F | Lion Street Advisors, LLC | 2.880 | -18,53 | 229 | -12,26 | ||||

| 2025-07-14 | 13F | S.A. Mason LLC | 11.930 | 0,50 | 950 | 8,08 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 20.889 | 0,18 | 1.664 | 7,77 | ||||

| 2025-05-09 | 13F | Bouchey Financial Group Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Rede Wealth, LLC | 10.445 | 2,99 | 832 | 10,79 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 128.821 | 1,29 | 10.266 | 8,91 | ||||

| 2025-08-14 | 13F | Arete Wealth Advisors, LLC | 2.707 | 0,11 | 0 | |||||

| 2025-07-18 | 13F | Liberty Capital Management, Inc. | 10.200 | 0,00 | 813 | 7,55 | ||||

| 2025-07-24 | 13F | Robertson Stephens Wealth Management, LLC | 3.560 | 0,00 | 284 | 7,60 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 240 | 0,00 | 19 | 11,76 | ||||

| 2025-08-05 | 13F | Tsfg, Llc | 420 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Glenview Trust Co | 3.887 | 0,00 | 310 | 7,67 | ||||

| 2025-07-14 | 13F | Signature Securities Group Corporation | 23.750 | -1,80 | 1.892 | 5,58 | ||||

| 2025-08-05 | 13F | EPG Wealth Management LLC | 1.423 | -20,86 | 113 | -15,04 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 81.593 | -21,23 | 6.500 | -15,30 | ||||

| 2025-08-05 | 13F | Integrity Financial Corp /WA | 220 | 0,00 | 18 | 6,25 | ||||

| 2025-08-05 | 13F | Sunburst Financial Group, LLC | 107.230 | 2,84 | 8.542 | 10,58 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 67.204 | 31,88 | 5.353 | 41,80 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 27.254 | 10,63 | 2.171 | 18,96 | ||||

| 2025-05-08 | 13F | NorthRock Partners, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | Philip James Wealth Mangement, LLC | 5.694 | 0,33 | 454 | 7,86 | ||||

| 2025-08-12 | 13F | NFP Retirement, Inc. | 4.803 | 0,00 | 383 | 7,61 | ||||

| 2025-07-31 | 13F/A | Avion Wealth | 643 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 4.402 | 29,78 | 348 | 39,76 | ||||

| 2025-07-08 | 13F | Apella Capital, LLC | 11.532 | 0,00 | 928 | 13,60 | ||||

| 2025-08-12 | 13F | Clearwater Capital Advisors, LLC | 3.446 | 0,00 | 275 | 7,45 | ||||

| 2025-08-19 | 13F | Cape Investment Advisory, Inc. | 1.786 | 0,00 | 142 | 7,58 | ||||

| 2025-08-11 | 13F | Western Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 498.843 | 9,97 | 39.738 | 18,25 | ||||

| 2025-07-17 | 13F | Global Trust Asset Management, LLC | 12 | 0,00 | 1 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 4.103 | -2,10 | 327 | 5,16 | ||||

| 2025-04-30 | 13F | Sofos Investments, Inc. | 328 | 0,00 | 24 | 9,09 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 181.928 | 0,89 | 14.492 | 8,49 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 7.264 | -23,58 | 579 | -6,92 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 316 | -22,55 | 25 | -19,35 | ||||

| 2025-08-14 | 13F | Matrix Private Capital Group Llc | 2.617 | -3,25 | 208 | 4,00 | ||||

| 2025-07-31 | 13F | Carnegie Capital Asset Management, LLC | 6.935 | 552 | ||||||

| 2025-07-18 | 13F | Benchmark Wealth Management, LLC | 55.403 | 0,04 | 4.413 | 7,58 | ||||

| 2025-08-04 | 13F | Jim Saulnier & Associates, Llc | 17.856 | -7,91 | 1.422 | -0,97 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 1.254.715 | 5,02 | 99.951 | 12,93 | ||||

| 2025-08-12 | 13F | Howe & Rusling Inc | 1.736 | 138 | ||||||

| 2025-07-28 | 13F | RFG Advisory, LLC | 3.051 | -3,91 | 243 | 3,40 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 280 | 0,00 | 22 | 10,00 | ||||

| 2025-07-21 | 13F | Patriot Financial Group Insurance Agency, LLC | 38.738 | 8,69 | 3.086 | 16,86 | ||||

| 2025-08-01 | 13F | Boyd Watterson Asset Management Llc/oh | 184 | 0,00 | 15 | 7,69 | ||||

| 2025-08-04 | 13F | Adell Harriman & Carpenter Inc | 4.300 | 0,00 | 343 | 7,55 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 42.691 | 1.347,15 | 3.401 | 1.452,51 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 43.592 | 0,00 | 3.473 | 7,53 | ||||

| 2025-04-10 | 13F | Portside Wealth Group, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-18 | 13F | Centricity Wealth Management, LLC | 308 | 0,00 | 25 | 9,09 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 6.860 | 0,18 | 546 | 7,69 | ||||

| 2025-08-14 | 13F | Fmr Llc | 14.672 | -12,54 | 1.169 | -5,96 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 9.450 | 20,41 | 753 | 29,43 | ||||

| 2025-07-09 | 13F | Procyon Private Wealth Partners, LLC | 4.594 | 0,15 | 366 | 7,67 | ||||

| 2025-07-17 | 13F | XML Financial, LLC | 3.740 | -1,24 | 298 | 6,07 | ||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 19.056 | -7,99 | 1.518 | -1,04 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 83.245 | 1,08 | 6.631 | 8,69 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | 49 Wealth Management, Llc | 4.790 | 0,34 | 382 | 7,93 | ||||

| 2025-08-08 | 13F | Gts Securities Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 317.974 | -1,15 | 25.330 | 6,29 | ||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 4.711 | -0,32 | 375 | 7,14 | ||||

| 2025-08-06 | 13F | Decker Retirement Planning Inc. | 17 | 0,00 | 1 | 0,00 | ||||

| 2025-07-29 | 13F | Goldstein Advisors, LLC | 39.303 | 4,60 | 3.131 | 12,47 | ||||

| 2025-07-09 | 13F | Brand Asset Management Group, Inc. | 36.400 | 1,20 | 2.900 | 8,82 | ||||

| 2025-08-13 | 13F | Summit Wealth Group Llc / Co | 3.825 | 305 | ||||||

| 2025-05-14 | 13F | Jane Street Group, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 92.496 | 3,33 | 7.368 | 11,11 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 25.892 | 3,99 | 2.063 | 11,82 | ||||

| 2025-08-14 | 13F | Comerica Bank | 6.077 | 6,15 | 484 | 14,15 | ||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 3.161 | 0,00 | 252 | 7,26 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | 5.284 | 0,00 | 421 | 7,42 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 34.725 | 7,43 | 2.766 | 15,54 | ||||

| 2025-05-14 | 13F | Van Hulzen Asset Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | Truist Financial Corp | 23.209 | -1,44 | 1.849 | 5,96 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 53.929 | 16,56 | 4.296 | 25,32 | ||||

| 2025-07-23 | 13F | Kingswood Wealth Advisors, Llc | 0 | -100,00 | 0 | |||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | Parsons Capital Management Inc/ri | 17.498 | -1,80 | 1.394 | 5,53 | ||||

| 2025-07-28 | 13F | Mutual Advisors, LLC | 4.520 | 0,00 | 372 | 13,46 | ||||

| 2025-07-30 | 13F | Whittier Trust Co Of Nevada Inc | 68 | 0,00 | 5 | 0,00 | ||||

| 2025-07-09 | 13F | Pps&v Asset Management Consultants, Inc. | 3.851 | 0,00 | 307 | 7,37 | ||||

| 2025-08-14 | 13F | Silvercrest Asset Management Group Llc | 3.089 | 0,00 | 246 | 7,89 | ||||

| 2025-07-10 | 13F | Three Seasons Wealth, LLC | 4.686 | -0,66 | 373 | 6,88 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | GWM Advisors LLC | 2.001 | 0,25 | 159 | 8,16 | ||||

| 2025-08-08 | 13F | WASHINGTON TRUST Co | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Steele Capital Management, Inc. | 177.217 | 1,39 | 14.117 | 9,03 | ||||

| 2025-05-28 | 13F | Silicon Valley Capital Partners | 954 | 70 | ||||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 47.602 | 11,28 | 3.792 | 19,63 | ||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 96 | 8 | ||||||

| 2025-08-13 | 13F | Proactive Wealth Strategies LLC | 4.256 | 0,33 | 0 | |||||

| 2025-07-31 | 13F | Briaud Financial Planning, Inc | 60 | 0,00 | 0 | |||||

| 2025-05-08 | 13F | Empirical Financial Services, LLC d.b.a. Empirical Wealth Management | 0 | -100,00 | 0 | |||||

| 2025-07-21 | 13F | Triad Wealth Partners, LLC | 7.632 | 608 | ||||||

| 2025-07-22 | 13F | Miracle Mile Advisors, LLC | 8.522 | -18,80 | 679 | -12,74 | ||||

| 2025-04-30 | 13F | Stratos Wealth Partners, LTD. | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Assetmark, Inc | 2.383 | -76,52 | 190 | -74,83 | ||||

| 2025-07-23 | 13F | RMG Wealth Management LLC | 1.083.709 | 87.672 | ||||||

| 2025-07-29 | 13F | Salomon & Ludwin, LLC | 241 | 0,00 | 19 | 11,76 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 2.163 | 0,84 | 172 | 8,86 | ||||

| 2025-08-12 | 13F | Gladstone Institutional Advisory LLC | 67.124 | -0,44 | 5.347 | 7,07 | ||||

| 2025-07-14 | 13F | Farmers & Merchants Investments Inc | 3.012 | 0,00 | 240 | 7,17 | ||||

| 2025-07-31 | 13F | Schneider Downs Wealth Management Advisors, LP | 4.053 | 323 | ||||||

| 2025-07-11 | 13F | Kaydan Wealth Management, Inc. | 5.392 | 0,00 | 430 | 7,52 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 4.480 | 100,00 | 357 | 115,76 | ||||

| 2025-05-14 | 13F | Mission Creek Capital Partners, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Edge Financial Advisors LLC | 3.114 | 250 | ||||||

| 2025-07-10 | 13F | Security National Bank | 100 | 0,00 | 8 | 0,00 | ||||

| 2025-08-01 | 13F | SYM FINANCIAL Corp | 228 | 18 | ||||||

| 2025-07-14 | 13F | Sowell Financial Services LLC | 38.539 | 3.070 | ||||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 2.893 | 4,82 | 230 | 12,75 |