Statistiche di base

| Short Interest | 4.169.580 shares - source: NYSE |

| Short Interest Ratio | 11,36 Days to Cover |

| Short Interest % Float | 9,60 % - source: NYSE (short interest), Capital IQ (float) |

| Off-Exchange Short Volume | 281.693 shares - source: FINRA (inc. Dark Pool volume) |

| Off-Exchange Short Volume Ratio | 84,88 % - source: FINRA (inc. Dark Pool volume) |

Introduzione

Questo tracker degli interessi short fornisce una serie di dati relativi agli interessi short, provenienti da diversi partner. I dati sono organizzati in base alla frequenza di aggiornamento, con i dati infragiornalieri in alto (disponibilità di titoli short, tasso di interesse sui prestiti allo scoperto), i dati giornalieri (volume short, mancate consegne) al centro e i dati aggiornati più lentamente (interesse short) in basso. Si noti che l'interesse short viene pubblicato due volte al mese, secondo un programma stabilito dalla FINRA.

Short squeeze score

Lo Short Squeeze Score è il risultato di un sofisticato modello quantitativo multi-fattore che identifica le società che presentano il rischio più elevato di subire uno short squeeze. Il modello di punteggio utilizza una combinazione di interesse short, flottante, tassi di interessi sui prestiti allo scoperto e altri indicatori. Il numero varia da 0 a 100: i numeri più alti indicano un rischio più elevato di short squeeze rispetto ad altre società, mentre 50 rappresenta la media.

Frequenza di aggiornamento: più volte al giorno

Consulta le nostre classifiche Short Squeeze per Stati Uniti, Canada, Australia e Hong Kong

Tassi di interesse sui prestiti allo scoperto

I tassi di interesse sui prestiti allo scoperto di GVA / Granite Construction Incorporated sono riportati nella tabella seguente. La tabella indica il tasso di interesse che un venditore allo scoperto di US:GVA deve pagare al prestatore di quel titolo. Tale commissione è indicata come tasso percentuale annuo (APR). I prestatori sono fondi o individui che possiedono il titolo e che hanno indicato al broker la loro disponibilità a prestarlo. I dividendi pagati a un titolo shortato vanno al proprietario/prestatore del titolo, non al mutuatario.

- Inizio, Min, Max, Ultimo (Tassi di prestito)

- Questi rappresentano i tassi di prestito per il giorno, con il tasso all'inizio del giorno, alla fine del giorno (o l'ultimo per il giorno corrente), il tasso minimo e il tasso massimo del giorno. A differenza dei tassi di prestito impliciti nelle opzioni, la nostra fonte per questi dati li presenta sempre come numeri positivi e rappresentano un tasso di interesse annualizzato pagato dal mutuatario per le azioni.

Frequenza di aggiornamento: più volte al giorno, ogni 30 minuti.

| Data | Inizio | Min | Max | Ultimo |

|---|---|---|---|---|

| 2025-09-05 | 0,38 | 0,38 | 0,39 | 0,39 |

| 2025-09-04 | 0,38 | 0,38 | 0,38 | 0,38 |

| 2025-09-03 | 0,37 | 0,37 | 0,39 | 0,38 |

| 2025-09-02 | 0,37 | 0,37 | 0,37 | 0,37 |

| 2025-09-01 | 0,37 | 0,37 | 0,37 | 0,37 |

| 2025-08-29 | 0,37 | 0,37 | 0,37 | 0,37 |

| 2025-08-28 | 0,38 | 0,37 | 0,38 | 0,37 |

| 2025-08-27 | 0,38 | 0,38 | 0,39 | 0,38 |

| 2025-08-26 | 0,38 | 0,38 | 0,38 | 0,38 |

| 2025-08-25 | 0,38 | 0,38 | 0,38 | 0,38 |

Volume delle vendite allo scoperto (fuori borsa, fornito dalla FINRA)

Il grafico seguente mostra il volume delle vendite allo scoperto fuori borsa di GVA / Granite Construction Incorporated. Il volume delle vendite allo scoperto mostra il numero di operazioni contrassegnate come vendite allo scoperto nelle varie sedi di negoziazione. Per maggiori informazioni su come interpretare questi dati, leggi questa informativa fornita dalla FINRA.

Frequenza di aggiornamento: giornaliera, alla chiusura del giorno

- Volume non esente della FINRA

- Numero di azioni short vendute. Questo numero non è fornito dalla FINRA, ma noi lo calcoliamo sottraendo il "volume esente" dal "volume short".

- Volume esente della FINRA

- Numero di azioni short vendute che sono state esentate dalla regola uptick. Questo dato è fornito dalla FINRA. Questo numero è incluso sia nel "Volume short" che nel "Volume totale".

- Volume short della FINRA

- Numero di azioni short vendute riportato dalla FINRA. Sono comprese sia le transazioni esenti che quelle non esenti.

- Volume totale della FINRA

- Il totale delle azioni vendute fuori borsa riportato dalla FINRA

- Rapporto Volume short della FINRA

- Volume short della FINRA / Volume totale della FINRA

| Data del mercato | Volume non esente della FINRA |

Volume esente della FINRA |

Volume short della FINRA |

Volume totale della FINRA |

Rapporto volume short della FINRA |

||||

|---|---|---|---|---|---|---|---|---|---|

| 2025-09-05 | 281.693 | + | 0 | = | 281.693 | / | 331.858 | = | 84,88 |

| 2025-09-04 | 75.041 | + | 0 | = | 75.041 | / | 146.824 | = | 51,11 |

| 2025-09-03 | 72.107 | + | 0 | = | 72.107 | / | 109.691 | = | 65,74 |

| 2025-09-02 | 65.339 | + | 0 | = | 65.339 | / | 107.523 | = | 60,77 |

| 2025-08-29 | 61.235 | + | 0 | = | 61.235 | / | 120.483 | = | 50,82 |

| 2025-08-28 | 60.146 | + | 0 | = | 60.146 | / | 148.891 | = | 40,40 |

| 2025-08-27 | 39.359 | + | 0 | = | 39.359 | / | 90.569 | = | 43,46 |

| 2025-08-26 | 32.589 | + | 0 | = | 32.589 | / | 105.954 | = | 30,76 |

| 2025-08-25 | 43.216 | + | 214 | = | 43.430 | / | 89.983 | = | 48,26 |

| 2025-08-22 | 73.232 | + | 0 | = | 73.232 | / | 162.634 | = | 45,03 |

Volume delle vendite allo scoperto (combinate: in borsa + fuori borsa)

Il volume combinato di vendite allo scoperto in borsa e fuori borsa per GVA / Granite Construction Incorporated è riportato nella tabella sottostante. Per calcolare un rapporto accurato dei volumi short, raccogliamo i dati da un certo numero di sedi di negoziazione, ma non da TUTTE le sedi di negoziazione. Questo è importante perché significa che le colonne dei volumi short aggregati e totali non mostrano i volumi effettivi di tutte le sedi di negoziazione, ma solo delle sedi da noi monitorate.

- Volume short della FINRA

- Numero di azioni short vendute fuori borsa riportato dalla FINRA. Questo dato comprende sia le operazioni esenti che quelle non esenti.

- Volume short del CBOE

- Numero di azioni short vendute riportato dal CBOE

- Volume short del PSX/BX

- Numero di azioni short vendute riportato dal NASDAQ nelle sedi di negoziazione PSX/BX

- Volume short aggregato

- Volume short della FINRA + Volume short del CBOE + Volume short del PSX/BX. Non si tratta del volume totale degli short su tutte le sedi di negoziazione.

- Volume totale aggregato

- Volume totale della FINRA + Volume totale del CBOE + Volume totale del PSX/BX. Non si tratta del volume totale su tutte le sedi di negoziazione.

- Rapporto volume short aggregato

- Volume short aggregato / Volume totale aggregato

* Le colonne "volume short aggregato" e "volume totale aggregato" non mostrano il volume totale effettivo in tutte le sedi di negoziazione, ma solo nelle sedi da noi monitorate.

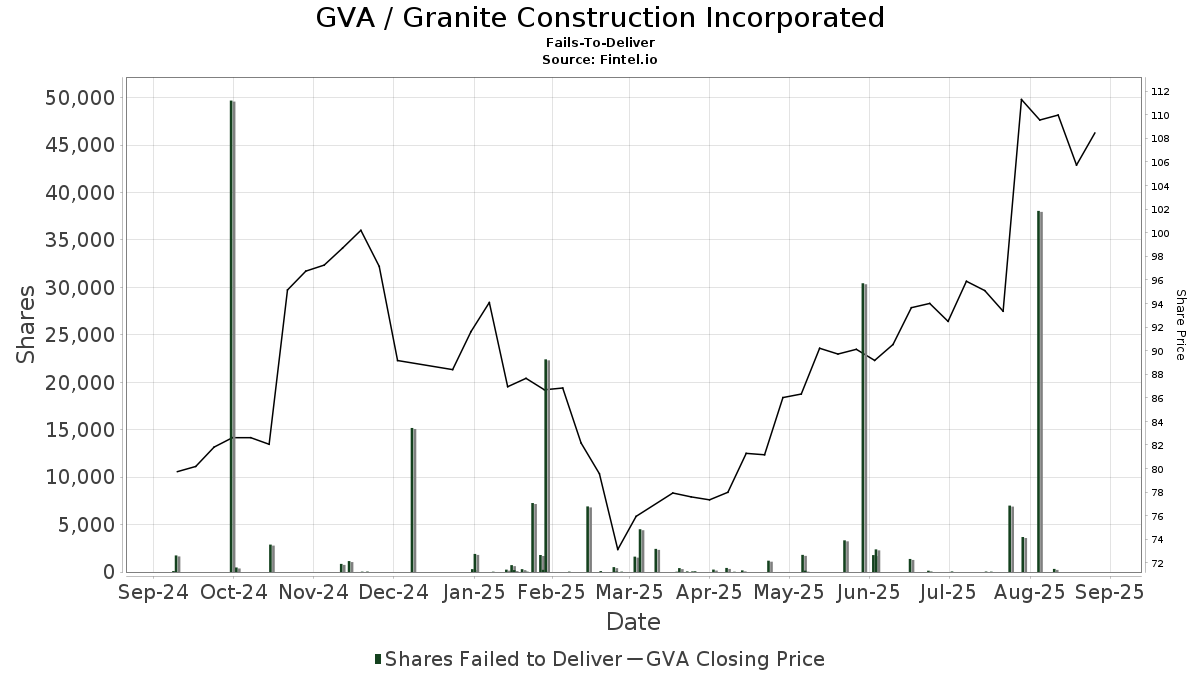

Impossibilitato a consegnare

Il valore delle azioni totali non consegnate rappresenta il saldo netto aggregato delle azioni non consegnate a una determinata data di regolamento. Le mancate consegne in un determinato giorno sono date dall'insieme delle mancate consegne in essere fino a quel giorno, più le nuove mancate consegne che si verificano in quel giorno, meno le mancate consegne che si risolvono in quello stesso giorno. Non si tratta di un numero giornaliero di mancate consegne, ma di una cifra combinata che include sia le nuove mancate consegne del giorno di riferimento che le mancate consegne esistenti. In altre parole, questi numeri riflettono i fallimenti di consegna aggregati in un momento specifico e possono avere una relazione minima o nulla con i fallimenti di consegna aggregati di ieri. È quindi importante notare che l'anzianità dei fallimenti non può essere determinata in base a questi numeri. Se tutte le azioni sono state consegnate in un determinato giorno, non ci sarà alcuna voce nella tabella.

Frequenza di aggiornamento: la SEC raggruppa i dati giornalieri e li pubblica due volte al mese con un ritardo di circa due settimane. Quindi, ad esempio, i dati giornalieri per il mese di marzo arriverebbero verso la metà di aprile.

Questi dati NON sono rettificati per il frazionamento azionario, ma riflettono i dati grezzi forniti dalla SEC.

| Data | Prezzo | Quantità | Valore |

|---|---|---|---|

| 2025-08-13 | 109,37 | 3.687 | 403.247,19 |

| 2025-08-08 | 100,94 | 7.000 | 706.580,00 |

| 2025-08-01 | 94,47 | 38 | 3.589,86 |

| 2025-07-30 | 94,71 | 51 | 4.830,21 |

| 2025-07-17 | 92,48 | 59 | 5.456,32 |

| 2025-07-09 | 92,65 | 33 | 3.057,45 |

| 2025-07-08 | 93,71 | 139 | 13.025,69 |

| 2025-07-01 | 93,51 | 1.376 | 128.669,76 |

| 2025-06-18 | 88,77 | 2.385 | 211.716,45 |

| 2025-06-17 | 89,22 | 1.782 | 158.990,04 |

| 2025-06-13 | 89,49 | 30.433 | 2.723.449,17 |

| 2025-06-06 | 90,66 | 3.339 | 302.713,74 |

| 2025-05-22 | 86,32 | 143 | 12.343,76 |

| 2025-05-21 | 87,00 | 1.806 | 157.122,00 |

| 2025-05-08 | 81,17 | 1.193 | 96.835,81 |

| 2025-04-28 | 79,92 | 172 | 13.746,24 |

| 2025-04-25 | 80,00 | 28 | 2.240,00 |

| 2025-04-22 | 75,18 | 429 | 32.252,22 |

| 2025-04-17 | 77,35 | 257 | 19.878,95 |

| 2025-04-10 | 77,60 | 78 | 6.052,80 |

GVA Interesse short (Aggiornamenti giornalieri di Fintel)

Questa sezione utilizza l'interesse short ufficiale fornito dalla NYSE e fornisce alcune metriche a valore aggiunto, calcolate giornalmente. L'interesse short viene aggiornato due volte al mese secondo un calendario prestabilito, mentre il float può essere aggiornato più frequentemente (anche se non cambia ogni giorno), per cui forniamo aggiornamenti giornalieri sulla percentuale di interesse short rispetto al flottante per gli ultimi quindici giorni. I giorni di copertura sono calcolati giornalmente in base al volume di trading degli ultimi cinque giorni.

Frequenza di aggiornamento: Interesse short - due volte al mese, Flottante - giornaliera (anche se cambia raramente) Short Interest Publication Schedule

Questi dati sono rettificati per il frazionamento azionario.

| Data del mercato | Interesse short (azioni) |

Giorni di copertura | Flottante (in milioni di azioni) |

Flottante meno short interest (in milioni di azioni) |

% Interesse short rispetto al flottante |

|---|---|---|---|---|---|

| 2025-09-05 | |||||

| 2025-09-04 | |||||

| 2025-09-03 | |||||

| 2025-09-02 | |||||

| 2025-09-01 | |||||

| 2025-08-29 | |||||

| 2025-08-28 | |||||

| 2025-08-27 | |||||

| 2025-08-26 | |||||

| 2025-08-25 |

Fonte: Interesse short fornito dalla NYSE-Azioni in circolazione e flottante forniti da Capital IQ.

Interesse short (dati ufficiali della NYSE)

Questi dati sono quelli ufficiali dello short interest, forniti dal NYSE. Lo short interest è il numero totale di posizioni corte aperte di un titolo. I giorni di copertura sono linteresse allo scoperto diviso per il volume medio. I giorni di copertura qui elencati sono il valore ufficiale fornito dal NYSE e possono differire dai giorni di copertura pubblicati altrove su Fintel, poiché nel calcolare il volume medio utilizziamo un periodo di riferimento più breve.

Frequenza di aggiornamento: due volte al mese

Questi dati NON sono rettificati per il frazionamento azionario, ma riflettono i dati grezzi forniti dalla borsa.

| Data di regolamento |

Interesse short | Variazione percentuale | Giorni di copertura | Flottante (in milioni di azioni) | % di interesse short rispetto al flottante |

Azioni in circolazione (in milioni di azioni) |

% Interesse short sulle azioni in circolazione |

|---|---|---|---|---|---|---|---|

| 2025-08-15 | 4.169.580 | 5,09 | 4,76 | ||||

| 2025-07-31 | 3.967.628 | 1,21 | 7,68 | ||||

| 2025-07-15 | 3.920.004 | 3,32 | 10,47 | ||||

| 2025-06-30 | 3.794.104 | -1,91 | 6,39 | ||||

| 2025-06-13 | 3.867.878 | -0,31 | 8,11 | ||||

| 2025-05-30 | 3.880.022 | -9,48 | 7,89 | ||||

| 2025-05-15 | 4.286.451 | -7,74 | 5,69 | ||||

| 2025-04-30 | 4.646.303 | -7,59 | 8,98 | ||||

| 2025-04-15 | 5.028.055 | 12,01 | 6,08 | ||||

| 2025-03-31 | 4.488.851 | 0,61 | 6,03 | ||||

| 2025-03-14 | 4.461.747 | 2,07 | 4,93 | ||||

| 2025-02-28 | 4.371.263 | -11,06 | 6,46 | ||||

| 2025-02-14 | 4.915.118 | 3,56 | 8,08 | ||||

| 2025-01-31 | 4.746.000 | 7,01 | 8,03 | ||||

| 2025-01-15 | 4.434.904 | -2,93 | 9,98 | ||||

| 2024-12-31 | 4.568.891 | 0,79 | 6,51 | ||||

| 2024-12-13 | 4.533.082 | 2,11 | 8,54 | ||||

| 2024-11-29 | 4.439.328 | 0,09 | 10,29 | ||||

| 2024-11-15 | 4.435.363 | 4,52 | 5,60 | ||||

| 2024-10-31 | 4.243.706 | -6,39 | 5,17 | ||||

| 2024-10-15 | 4.533.521 | 5,46 | 8,21 | ||||

| 2024-09-30 | 4.298.609 | -10,64 | 6,05 | ||||

| 2024-09-13 | 4.810.521 | -3,91 | 10,83 | ||||

| 2024-08-30 | 5.006.284 | -15,03 | 11,16 | ||||

| 2024-08-15 | 5.891.569 | -5,03 | 9,72 | ||||

| 2024-07-31 | 6.203.386 | 5,49 | 6,70 | ||||

| 2024-07-15 | 5.880.657 | 8,42 | 6,94 | ||||

| 2024-06-28 | 5.424.058 | 7,98 | 8,39 | ||||

| 2024-06-14 | 5.023.025 | 7,92 | 7,08 | ||||

| 2024-05-31 | 4.654.471 | -2,39 | 18,17 | ||||

| 2024-05-15 | 4.768.260 | 7,65 | 7,82 | ||||

| 2024-04-30 | 4.429.603 | 0,92 | 17,81 | ||||

| 2024-04-15 | 4.389.024 | 5,41 | 12,56 | ||||

| 2024-03-28 | 4.163.588 | -3,87 | 10,93 | ||||

| 2024-03-15 | 4.331.397 | 4,84 | 11,99 | ||||

| 2024-02-29 | 4.131.378 | 4,38 | 7,96 | ||||

| 2024-02-15 | 3.958.194 | -2,50 | 14,13 | ||||

| 2024-01-31 | 4.059.608 | 1,89 | 10,69 | ||||

| 2024-01-12 | 3.984.235 | -4,93 | 9,37 | ||||

| 2023-12-29 | 4.190.892 | -1,92 | 18,78 | ||||

| 2023-12-15 | 4.272.753 | 5,01 | 11,34 | ||||

| 2023-11-30 | 4.069.038 | -10,97 | 14,37 | ||||

| 2023-11-15 | 4.570.268 | 13,21 | 10,36 | ||||

| 2023-10-31 | 4.036.816 | 1,02 | 11,27 | ||||

| 2023-10-13 | 3.996.155 | -5,51 | 16,53 | ||||

| 2023-09-29 | 4.229.055 | 2,24 | 11,54 | ||||

| 2023-09-15 | 4.136.434 | 1,03 | 14,66 | ||||

| 2023-08-31 | 4.094.350 | -3,73 | 24,90 | ||||

| 2023-08-15 | 4.252.886 | -0,84 | 19,14 | ||||

| 2023-07-31 | 4.288.906 | 6,32 | 8,68 | ||||

| 2023-07-14 | 4.033.811 | 0,48 | 17,19 | ||||

| 2023-06-30 | 4.014.404 | 2,03 | 11,82 | ||||

| 2023-06-15 | 3.934.525 | -0,19 | 6,73 | ||||

| 2023-05-31 | 3.942.165 | -15,95 | 8,64 | ||||

| 2023-05-15 | 4.690.110 | -3,07 | 6,79 | ||||

| 2023-04-28 | 4.838.676 | 1,42 | 22,42 | ||||

| 2023-04-14 | 4.771.014 | -6,42 | 13,72 | ||||

| 2023-03-31 | 5.098.527 | -0,98 | 11,12 | ||||

| 2023-03-15 | 5.148.915 | 0,22 | 15,55 | ||||

| 2023-02-28 | 5.137.532 | 2,65 | 13,49 | ||||

| 2023-02-15 | 5.005.020 | -5,57 | 12,69 | ||||

| 2023-01-31 | 5.300.264 | -0,47 | 10,87 | ||||

| 2023-01-13 | 5.325.183 | 1,41 | 27,51 | ||||

| 2022-12-30 | 5.250.991 | 1,89 | 23,23 | ||||

| 2022-12-15 | 5.153.343 | 2,01 | 23,41 | ||||

| 2022-11-30 | 5.051.564 | -5,50 | 24,27 | ||||

| 2022-11-15 | 5.345.341 | 1,01 | 16,68 | ||||

| 2022-10-31 | 5.292.084 | 1,21 | 14,70 | ||||

| 2022-10-14 | 5.228.656 | 3,68 | 16,63 | ||||

| 2022-09-30 | 5.043.204 | -1,61 | 12,50 | ||||

| 2022-09-15 | 5.125.566 | 2,04 | 15,82 | ||||

| 2022-08-31 | 5.022.850 | 2,76 | 15,45 | ||||

| 2022-08-15 | 4.887.718 | 1,19 | 8,45 | ||||

| 2022-07-29 | 4.830.404 | 1,74 | 12,55 | ||||

| 2022-07-15 | 4.747.952 | 6,20 | 18,97 | ||||

| 2022-06-30 | 4.470.974 | -1,90 | 10,17 | ||||

| 2022-06-15 | 4.557.515 | -3,72 | 14,51 | ||||

| 2022-05-31 | 4.733.835 | 4,78 | 13,89 | ||||

| 2022-05-13 | 4.517.771 | -0,97 | 9,67 | ||||

| 2022-04-29 | 4.561.976 | -4,57 | 15,85 | ||||

| 2022-04-14 | 4.780.487 | 0,94 | 12,75 | ||||

| 2022-03-31 | 4.736.115 | 2,77 | 12,61 | ||||

| 2022-03-15 | 4.608.601 | 14,25 | 6,90 | ||||

| 2022-02-28 | 4.033.931 | -2,87 | 7,67 | ||||

| 2022-02-15 | 4.153.133 | 7,44 | 12,88 | ||||

| 2022-01-31 | 3.865.395 | 9,35 | 14,05 | ||||

| 2022-01-14 | 3.535.008 | 1,67 | 12,78 | ||||

| 2021-12-31 | 3.477.002 | 7,89 | 11,05 | ||||

| 2021-12-15 | 3.222.860 | -3,48 | 6,88 | ||||

| 2021-11-30 | 3.339.127 | 1,19 | 10,45 | ||||

| 2021-11-15 | 3.299.973 | 3,44 | 8,41 | ||||

| 2021-10-29 | 3.190.106 | 1,86 | 8,43 | ||||

| 2021-10-15 | 3.131.733 | 1,21 | 16,55 | ||||

| 2021-09-30 | 3.094.356 | 6,00 | 6,83 | ||||

| 2021-09-15 | 2.919.133 | 0,04 | 10,28 | ||||

| 2021-08-31 | 2.917.958 | -0,11 | 11,35 | ||||

| 2021-08-13 | 2.921.261 | 2,44 | 7,94 | ||||

| 2021-07-30 | 2.851.625 | 3,36 | 11,93 | ||||

| 2021-07-15 | 2.758.801 | -10,81 | 11,35 | ||||

| 2021-06-30 | 3.093.206 | -0,83 | 6,26 | ||||

| 2021-06-15 | 3.118.977 | 5,78 | 11,99 | ||||

| 2021-05-28 | 2.949.165 | 3,75 | 10,95 | ||||

| 2021-05-14 | 2.842.646 | -8,99 | 4,88 | ||||

| 2021-04-30 | 3.123.520 | -1,60 | 11,22 | ||||

| 2021-04-15 | 3.174.408 | -14,36 | 12,86 | ||||

| 2021-03-31 | 3.719.641 | 9,55 | 8,81 | ||||

| 2021-03-15 | 3.395.406 | 5,53 | 9,12 | ||||

| 2021-02-26 | 3.217.613 | -0,05 | 9,50 | ||||

| 2021-02-12 | 3.219.325 | -9,33 | 11,61 | ||||

| 2021-01-29 | 3.550.493 | -12,09 | 12,39 | ||||

| 2021-01-15 | 4.038.560 | -11,71 | 8,17 |

Fonte: Interesse short fornito dalla NYSE-Azioni in circolazione e flottante forniti da Capital IQ.

Funds Disclosing Short Positions - Europe

This section shows European institutions, funds, and major shareholders that have reported short positions in the security.

Upgrade to unlock premium data.

| File Date | Owner | Issuer | ISIN | Total Capitalization Shorted (%) |

|---|---|---|---|---|

| 2025-08-18 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,49 |

| 2025-08-14 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,51 |

| 2025-08-13 | JPMorgan Asset Management (UK) Ltd | GREGGS PLC | GB00B63QSB39 | 1,32 |

| 2025-08-08 | ExodusPoint Capital Management, LP | GREGGS PLC | GB00B63QSB39 | 0,74 |

| 2025-08-04 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,49 |

| 2025-07-31 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,86 |

| 2025-07-29 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,76 |

| 2025-07-28 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,56 |

| 2025-07-24 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,60 |

| 2025-07-23 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,50 |

| 2025-07-22 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,69 |

| 2025-07-21 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,70 |

| 2025-07-14 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,69 |

| 2025-07-09 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,70 |

| 2025-07-02 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,69 |

| 2025-06-27 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,59 |

| 2025-06-24 | Wellington Management International Ltd | GREGGS PLC | GB00B63QSB39 | 0,46 |

| 2025-06-16 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,60 |

| 2025-06-05 | JPMorgan Asset Management (UK) Ltd | GREGGS PLC | GB00B63QSB39 | 0,49 |

| 2025-06-02 | D. E. Shaw & Co. LP | GREGGS PLC | GB00B63QSB39 | 0,51 |

| 2025-05-12 | JPMorgan Asset Management (UK) Ltd | GREGGS PLC | GB00B63QSB39 | 0,58 |

| 2025-04-23 | GLG Partners LP | GREGGS PLC | GB00B63QSB39 | 0,46 |

| 2025-04-09 | JPMorgan Asset Management (UK) Ltd | GREGGS PLC | GB00B63QSB39 | 0,64 |

| 2025-04-08 | GLG Partners LP | GREGGS PLC | GB00B63QSB39 | 0,54 |

| 2025-03-04 | JPMorgan Asset Management (UK) Ltd | GREGGS PLC | GB00B63QSB39 | 0,70 |

| 2025-01-23 | JPMorgan Asset Management (UK) Ltd | GREGGS PLC | GB00B63QSB39 | 0,51 |

| 2024-01-10 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,44 |

| 2024-01-08 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,65 |

| 2023-06-23 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,49 |

| 2023-05-24 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,55 |

| 2023-05-22 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,69 |

| 2023-05-16 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,75 |

| 2023-04-17 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,81 |

| 2023-03-17 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,78 |

| 2023-02-17 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 0,87 |

| 2023-02-14 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 1,06 |

| 2023-02-10 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 1,13 |

| 2023-02-08 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 1,29 |

| 2023-02-06 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 1,38 |

| 2023-01-20 | Qube Research & Technologies Limited | GREGGS PLC | GB00B63QSB39 | 0,50 |

| 2023-01-13 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 1,48 |

| 2023-01-09 | BlackRock Investment Management (UK) Limited | GREGGS PLC | GB00B63QSB39 | 1,79 |

| 2022-12-28 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,88 |

| 2022-12-19 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,99 |

| 2022-12-08 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 2,09 |

| 2022-12-05 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 2,15 |

| 2022-12-02 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,46 |

| 2022-12-01 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,58 |

| 2022-11-15 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 2,21 |

| 2022-10-25 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,68 |

| 2022-10-21 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 2,10 |

| 2022-10-19 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,73 |

| 2022-10-07 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 2,04 |

| 2022-10-06 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,56 |

| 2022-08-02 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,44 |

| 2022-07-28 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 2,10 |

| 2022-07-25 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,69 |

| 2022-07-21 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,76 |

| 2022-07-19 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 2,03 |

| 2022-07-14 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,83 |

| 2022-07-07 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,93 |

| 2022-07-06 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,86 |

| 2022-06-30 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 1,00 |

| 2022-06-28 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,79 |

| 2022-06-22 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,90 |

| 2022-06-16 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,81 |

| 2022-06-15 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,71 |

| 2022-06-09 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,62 |

| 2022-05-17 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,67 |

| 2022-05-16 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,32 |

| 2022-05-13 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,24 |

| 2022-05-12 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,83 |

| 2022-05-11 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,69 |

| 2021-01-06 | ELEVA CAPITAL SAS | Greggs Plc | GB00B63QSB39 | 0,00 |

| 2020-10-15 | ELEVA CAPITAL SAS | Greggs Plc | GB00B63QSB39 | 0,62 |

| 2020-07-29 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,39 |

| 2020-07-28 | Citadel Advisors LLC | Greggs Plc | GB00B63QSB39 | 0,26 |

| 2020-07-22 | Citadel Advisors LLC | Greggs Plc | GB00B63QSB39 | 0,60 |

| 2020-07-21 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 1,03 |

| 2020-07-16 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,93 |

| 2020-07-15 | Citadel Advisors LLC | Greggs Plc | GB00B63QSB39 | 0,59 |

| 2020-07-13 | Citadel Advisors LLC | Greggs Plc | GB00B63QSB39 | 0,60 |

| 2020-07-02 | Citadel Advisors LLC | Greggs Plc | GB00B63QSB39 | 0,72 |

| 2020-07-01 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 1,13 |

| 2020-06-23 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 1,09 |

| 2020-06-22 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 1,11 |

| 2020-06-19 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 1,08 |

| 2020-06-16 | Citadel Advisors LLC | Greggs Plc | GB00B63QSB39 | 0,60 |

| 2020-06-09 | Citadel Advisors LLC | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2020-06-05 | Citadel Advisors LLC | Greggs Plc | GB00B63QSB39 | 0,49 |

| 2020-05-12 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 1,01 |

| 2020-05-11 | Citadel Advisors LLC | Greggs Plc | GB00B63QSB39 | 0,52 |

| 2020-05-06 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,80 |

| 2020-05-05 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,79 |

| 2020-05-01 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,91 |

| 2020-04-29 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,81 |

| 2020-04-28 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,78 |

| 2020-04-24 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,66 |

| 2020-04-23 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,53 |

| 2020-04-20 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,46 |

| 2020-04-17 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,52 |

| 2020-03-20 | KUVARI PARTNERS LLP | Greggs Plc | GB00B63QSB39 | 0,45 |

| 2020-03-18 | KUVARI PARTNERS LLP | Greggs Plc | GB00B63QSB39 | 0,56 |

| 2020-03-13 | Voleon Capital Management LP | Greggs Plc | GB00B63QSB39 | 0,45 |

| 2020-03-11 | Voleon Capital Management LP | Greggs Plc | GB00B63QSB39 | 0,52 |

| 2020-02-26 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,49 |

| 2020-02-20 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,49 |

| 2020-02-18 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2020-01-06 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,48 |

| 2019-12-09 | Citadel Europe LLP | Greggs Plc | GB00B63QSB39 | 0,51 |

| 2019-11-21 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,48 |

| 2019-11-12 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,51 |

| 2019-11-11 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,59 |

| 2019-10-29 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,49 |

| 2019-10-18 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2019-10-15 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,49 |

| 2019-10-14 | Public Equity Partners Management, L.P. | Greggs Plc | GB00B63QSB39 | 0,38 |

| 2019-10-11 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2019-10-10 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,49 |

| 2019-10-01 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,55 |

| 2019-09-25 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,77 |

| 2019-08-28 | Public Equity Partners Management, L.P. | Greggs Plc | GB00B63QSB39 | 0,72 |

| 2019-08-23 | Public Equity Partners Management, L.P. | Greggs Plc | GB00B63QSB39 | 0,57 |

| 2019-08-16 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,84 |

| 2019-08-15 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,67 |

| 2019-08-14 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,73 |

| 2019-08-13 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,89 |

| 2019-08-07 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,96 |

| 2019-08-05 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,07 |

| 2019-07-31 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,18 |

| 2019-07-30 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,22 |

| 2019-07-23 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,36 |

| 2019-06-21 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,45 |

| 2019-06-10 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 1,00 |

| 2019-05-15 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,95 |

| 2019-05-14 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 1,10 |

| 2019-04-23 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,56 |

| 2019-04-01 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 1,21 |

| 2019-03-11 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,67 |

| 2019-03-06 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 1,20 |

| 2019-02-19 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,70 |

| 2019-02-12 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,69 |

| 2019-01-28 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,79 |

| 2019-01-22 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,83 |

| 2019-01-09 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,75 |

| 2018-12-27 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,69 |

| 2018-11-27 | Jupiter Investment Management Limited | Greggs Plc | GB00B63QSB39 | 0,00 |

| 2018-11-20 | GSA Capital Partners LLP | Greggs Plc | GB00B63QSB39 | 0,41 |

| 2018-11-19 | GSA Capital Partners LLP | Greggs Plc | GB00B63QSB39 | 0,60 |

| 2018-11-09 | GSA Capital Partners LLP | Greggs Plc | GB00B63QSB39 | 0,59 |

| 2018-11-07 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,79 |

| 2018-11-05 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,80 |

| 2018-10-30 | GSA Capital Partners LLP | Greggs Plc | GB00B63QSB39 | 0,68 |

| 2018-10-16 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,73 |

| 2018-10-12 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,61 |

| 2018-10-10 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,51 |

| 2018-10-05 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,32 |

| 2018-10-04 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,49 |

| 2018-09-27 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,50 |

| 2018-08-31 | Jupiter Investment Management Limited | Greggs Plc | GB00B63QSB39 | 0,75 |

| 2018-08-28 | GSA Capital Partners LLP | Greggs Plc | GB00B63QSB39 | 0,79 |

| 2018-08-09 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,40 |

| 2018-07-31 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 1,02 |

| 2018-07-27 | GSA Capital Partners LLP | Greggs Plc | GB00B63QSB39 | 0,70 |

| 2018-07-20 | GSA Capital Partners LLP | Greggs Plc | GB00B63QSB39 | 0,61 |

| 2018-07-17 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,33 |

| 2018-07-16 | GSA Capital Partners LLP | Greggs Plc | GB00B63QSB39 | 0,52 |

| 2018-06-29 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,98 |

| 2018-06-25 | Marshall Wace LLP | Greggs Plc | GB00B63QSB39 | 0,48 |

| 2018-06-19 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,83 |

| 2018-06-14 | Marshall Wace LLP | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2018-06-08 | WorldQuant LLC | Greggs Plc | GB00B63QSB39 | 0,48 |

| 2018-05-30 | WorldQuant LLC | Greggs Plc | GB00B63QSB39 | 0,51 |

| 2018-05-22 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,71 |

| 2018-05-17 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,62 |

| 2018-05-15 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,25 |

| 2018-05-10 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,39 |

| 2018-04-19 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,39 |

| 2018-04-13 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,69 |

| 2018-04-11 | CZ Capital LLP | Greggs Plc | GB00B63QSB39 | 0,53 |

| 2018-04-09 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,85 |

| 2018-04-04 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,98 |

| 2018-03-28 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 1,03 |

| 2018-03-23 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,41 |

| 2018-03-02 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,91 |

| 2018-02-28 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,81 |

| 2018-02-27 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,79 |

| 2018-02-20 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,80 |

| 2018-02-13 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,37 |

| 2018-02-05 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,42 |

| 2018-01-18 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,70 |

| 2018-01-16 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,39 |

| 2017-12-07 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,61 |

| 2017-11-21 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,41 |

| 2017-11-09 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2017-09-28 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,31 |

| 2017-09-22 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,48 |

| 2017-09-08 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,53 |

| 2017-08-10 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,22 |

| 2017-08-09 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,12 |

| 2017-07-26 | Marshall Wace LLP | Greggs Plc | GB00B63QSB39 | 0,58 |

| 2017-07-24 | Marshall Wace LLP | Greggs Plc | GB00B63QSB39 | 0,60 |

| 2017-07-07 | Marshall Wace LLP | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2017-07-06 | Threadneedle Asset Management Limited | Greggs Plc | GB00B63QSB39 | 0,66 |

| 2017-06-20 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,00 |

| 2017-06-14 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,92 |

| 2017-06-02 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,87 |

| 2017-06-01 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,62 |

| 2017-05-31 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,53 |

| 2017-05-19 | Jupiter Investment Management Limited | Greggs Plc | GB00B63QSB39 | 0,47 |

| 2017-05-18 | Jupiter Investment Management Limited | Greggs Plc | GB00B63QSB39 | 0,54 |

| 2017-04-12 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,44 |

| 2017-03-01 | Jupiter Investment Management Limited | Greggs Plc | GB00B63QSB39 | 0,78 |

| 2017-02-22 | Jupiter Investment Management Limited | Greggs Plc | GB00B63QSB39 | 0,63 |

| 2017-02-01 | Jupiter Investment Management Limited | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2017-01-16 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2017-01-03 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,69 |

| 2016-12-06 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,70 |

| 2016-11-21 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,69 |

| 2016-11-18 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,77 |

| 2016-10-25 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,88 |

| 2016-10-21 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,63 |

| 2016-10-18 | Threadneedle Asset Management Limited | Greggs Plc | GB00B63QSB39 | 0,51 |

| 2016-10-10 | GLG Partners LP | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2016-02-08 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,46 |

| 2016-02-03 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,81 |

| 2016-01-22 | Farringdon Capital Management | Greggs Plc | GB00B63QSB39 | 0,37 |

| 2016-01-21 | Farringdon Capital Management | Greggs Plc | GB00B63QSB39 | 0,53 |

| 2016-01-19 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,70 |

| 2016-01-18 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,62 |

| 2016-01-15 | Farringdon Capital Management | Greggs Plc | GB00B63QSB39 | 0,94 |

| 2015-12-08 | Farringdon Capital Management | Greggs Plc | GB00B63QSB39 | 1,06 |

| 2015-11-04 | Farringdon Capital Management | Greggs Plc | GB00B63QSB39 | 0,90 |

| 2015-11-03 | Farringdon Capital Management | Greggs Plc | GB00B63QSB39 | 0,84 |

| 2015-08-04 | Farringdon Capital Management | Greggs Plc | GB00B63QSB39 | 0,77 |

| 2015-07-08 | Farringdon Capital Management | Greggs Plc | GB00B63QSB39 | 0,63 |

| 2015-05-01 | Farringdon Capital Management | Greggs Plc | GB00B63QSB39 | 0,55 |

| 2014-07-08 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,00 |

| 2014-07-01 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,95 |

| 2014-06-30 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,02 |

| 2014-06-24 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,94 |

| 2014-06-20 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,86 |

| 2014-06-19 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,78 |

| 2014-06-13 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,82 |

| 2014-06-10 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,91 |

| 2014-05-21 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,69 |

| 2014-05-19 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,81 |

| 2014-05-16 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,79 |

| 2014-05-14 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,84 |

| 2014-05-07 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,89 |

| 2014-05-01 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,97 |

| 2014-04-29 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,92 |

| 2014-04-24 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,02 |

| 2014-04-22 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,21 |

| 2014-04-08 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,01 |

| 2014-04-03 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,10 |

| 2014-03-31 | Cazenove Capital Management Limited | Greggs Plc | GB00B63QSB39 | 0,00 |

| 2014-03-28 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,03 |

| 2014-03-24 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,93 |

| 2014-03-18 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,81 |

| 2014-03-13 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,78 |

| 2014-03-05 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,81 |

| 2014-03-04 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,79 |

| 2014-02-26 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,95 |

| 2014-02-24 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 0,99 |

| 2014-02-20 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,13 |

| 2014-02-19 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,03 |

| 2014-02-12 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,19 |

| 2014-02-06 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,30 |

| 2014-02-05 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,27 |

| 2014-02-04 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,29 |

| 2014-01-31 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,30 |

| 2014-01-29 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,23 |

| 2014-01-28 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,18 |

| 2014-01-23 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,22 |

| 2014-01-21 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,43 |

| 2014-01-15 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,18 |

| 2014-01-14 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,25 |

| 2014-01-09 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,32 |

| 2014-01-03 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,20 |

| 2013-12-20 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,13 |

| 2013-11-27 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,30 |

| 2013-11-26 | JPMorgan Asset Management (UK) Ltd | Greggs Plc | GB00B63QSB39 | 0,69 |

| 2013-10-18 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,20 |

| 2013-10-10 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,72 |

| 2013-10-09 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,16 |

| 2013-10-04 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,04 |

| 2013-10-02 | Cazenove Capital Management Limited | Greggs Plc | GB00B63QSB39 | 0,70 |

| 2013-09-20 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,94 |

| 2013-09-16 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,80 |

| 2013-09-11 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,98 |

| 2013-09-10 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 2,04 |

| 2013-08-19 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,64 |

| 2013-08-12 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 2,01 |

| 2013-08-09 | JPMorgan Asset Management (UK) Ltd | Greggs Plc | GB00B63QSB39 | 0,79 |

| 2013-08-08 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,54 |

| 2013-08-06 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,47 |

| 2013-08-01 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,73 |

| 2013-07-29 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,61 |

| 2013-07-25 | Cazenove Capital Management Limited | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2013-07-18 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,84 |

| 2013-06-14 | ODEY ASSET MANAGEMENT LLP | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2013-05-16 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,79 |

| 2013-05-08 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,09 |

| 2013-05-07 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,78 |

| 2013-05-03 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,64 |

| 2013-05-02 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,54 |

| 2013-04-29 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,70 |

| 2013-04-18 | BlackRock Investment Management (UK) Limited | Greggs Plc | GB00B63QSB39 | 1,80 |

| 2013-04-09 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,68 |

| 2013-04-03 | ODEY ASSET MANAGEMENT LLP | Greggs Plc | GB00B63QSB39 | 0,56 |

| 2013-03-27 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,86 |

| 2013-03-20 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,98 |

| 2013-03-14 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 1,05 |

| 2013-03-07 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,91 |

| 2013-02-20 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,82 |

| 2013-01-10 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,72 |

| 2013-01-03 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,64 |

| 2012-12-24 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,92 |

| 2012-12-21 | Artemis Investment Management LLP | Greggs Plc | GB00B63QSB39 | 0,50 |

| 2012-11-20 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,84 |

| 2012-11-08 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,84 |

| 2012-11-01 | AlphaGen Capital Limited | Greggs Plc | GB00B63QSB39 | 0,98 |