Statistiche di base

| Azioni istituzionali (Long) | 2.954.475 - 6,26% (ex 13D/G) - change of 0,41MM shares 16,28% MRQ |

| Valore istituzionale (Long) | $ 26.362 USD ($1000) |

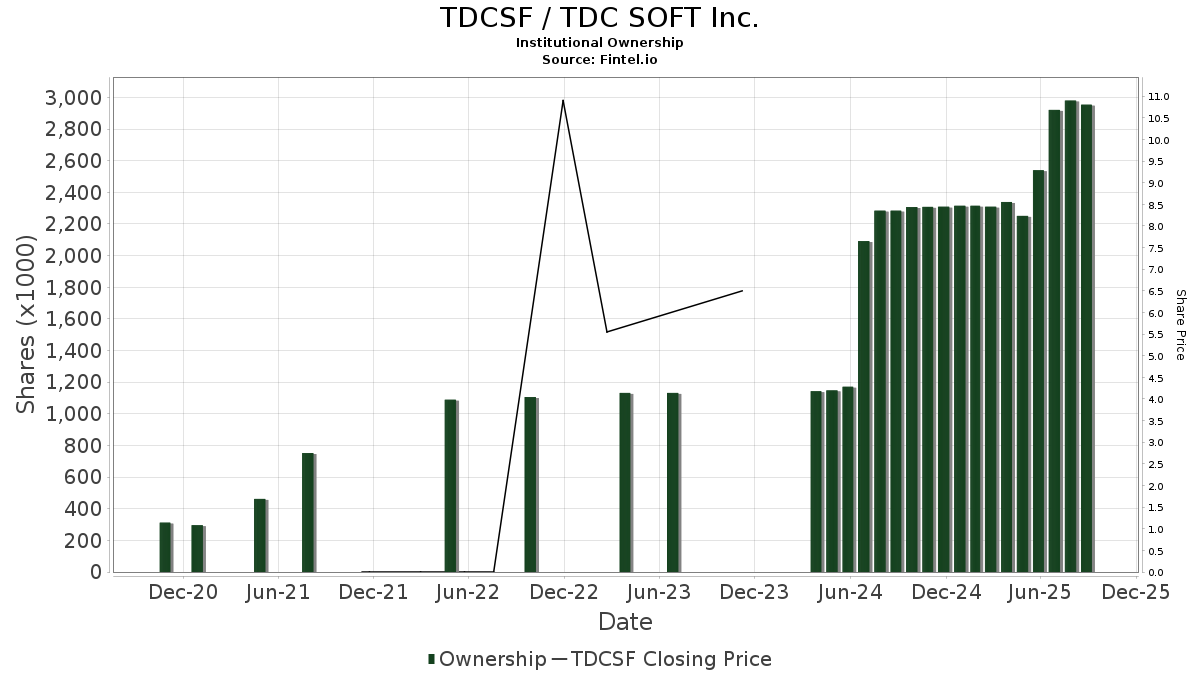

Proprietà istituzionale e azionisti

TDC SOFT Inc. (US:TDCSF) ha 35 proprietari istituzionali e azionisti che hanno presentato i moduli 13D/G o 13F alla Securities Exchange Commission (SEC). Queste istituzioni detengono un totale di 2,954,475 azioni. I maggiori azionisti includono FLPSX - Fidelity Low-Priced Stock Fund, VGTSX - Vanguard Total International Stock Index Fund Investor Shares, FCTDX - Strategic Advisers Fidelity U.S. Total Stock Fund, VTMGX - Vanguard Developed Markets Index Fund Admiral Shares, FDMLX - Fidelity Series Intrinsic Opportunities Fund, Dfa Investment Trust Co - The Japanese Small Company Series, FLKSX - Fidelity Low-Priced Stock K6 Fund, VFSNX - Vanguard FTSE All-World ex-US Small-Cap Index Fund Institutional Shares, DFIEX - International Core Equity Portfolio - Institutional Class, and SCHC - Schwab International Small-Cap Equity ETF .

(TDC SOFT Inc. (OTCPK:TDCSF) la struttura proprietaria istituzionale mostra le attuali posizioni nella società da parte di istituzioni e fondi, nonché le ultime variazioni nella dimensione della posizione. I principali azionisti possono essere singoli investitori, fondi comuni, hedge fund o istituzioni. L'allegato 13D indica che l'investitore detiene (o ha detenuto) più del 5% della società e intende (o intendeva) perseguire attivamente un cambiamento nella strategia aziendale. L'allegato 13G indica un investimento passivo superiore al 5%.

Indice del sentiment dei fondi

L'indice del sentiment dei fondi (anche noto come "indice di accumulo di proprietà") individua i titoli più acquistati dai fondi. È il risultato di un sofisticato modello quantitativo multi-fattore che identifica le società con i più alti livelli di accumulo istituzionale. Il modello utilizza una combinazione dell'aumento totale dei proprietari dichiarati, delle variazioni nelle allocazioni di portafoglio di tali proprietari e di altre metriche. Il punteggio varia da 0 a 100: i numeri più alti indicano un livello di accumulo superiore ad altre società, mentre 50 rappresenta la media.

Frequenza di aggiornamento: giornaliera

Consulta Ownership Explorer per visualizzare l'elenco delle aziende con il ranking più alto.

Rapporto put/call istituzionale

Oltre a segnalare le emissioni standard di titoli azionari e di debito, gli istituti con più di 100 milioni di asset in gestione devono anche dichiarare le loro partecipazioni in opzioni put e call. Poiché le opzioni put indicano generalmente un sentiment negativo e le opzioni call un sentiment positivo, possiamo avere un'idea del sentiment istituzionale complessivo attraverso il rapporto tra put e call. Il grafico a destra mostra il rapporto storico put/call per questo strumento.

L'utilizzo del rapporto put/call come indicatore del sentiment degli investitori consente di superare una delle principali lacune dell'utilizzo della proprietà istituzionale totale, ovvero il fatto che una quantità significativa di asset in gestione viene investita passivamente per seguire gli indici. Generalmente, i fondi a gestione passiva non acquistano opzioni, per cui il rapporto put/call riflette più fedelmente il sentiment dei fondi a gestione attiva.

Depositi 13F e NPORT

Le informazioni relative ai depositi 13F sono gratuite. Per accedere alle informazioni relative ai depositi NP è necessario un'abbonamento premium. Le righe verdi indicano le nuove posizioni. Le righe rosse indicano le posizioni chiuse. Fai clic sull'icona del link per visualizzare la cronologia completa delle transazioni.

Esegui l'upgrade

per sbloccare i dati premium ed esportarli in Excel ![]() .

.

Other Listings

| JP:4687 | 1.384,00 JPY |