Statistiche di base

| Proprietari istituzionali | 9 total, 9 long only, 0 short only, 0 long/short - change of -24,64% MRQ |

| Allocazione media del portafoglio | 0.0681 % - change of -41,53% MRQ |

| Azioni istituzionali (Long) | 659.000 (ex 13D/G) - change of -0,03MM shares -3,65% MRQ |

| Valore istituzionale (Long) | $ 3.198 USD ($1000) |

Proprietà istituzionale e azionisti

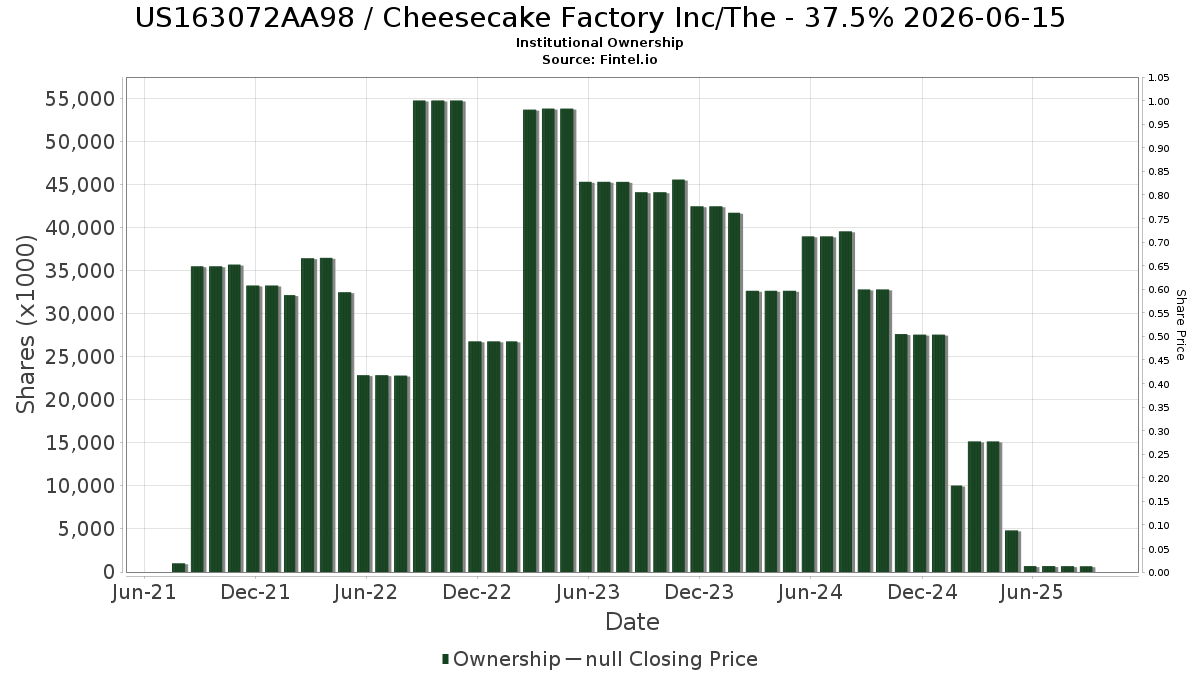

Cheesecake Factory Inc/The (US:US163072AA98) ha 9 proprietari istituzionali e azionisti che hanno presentato i moduli 13D/G o 13F alla Securities Exchange Commission (SEC). Queste istituzioni detengono un totale di 659,000 azioni. I maggiori azionisti includono Oppenheimer Asset Management Inc., Sei Investments Co, Sonora Investment Management Group, LLC, Stephens Inc /ar/, Kestra Private Wealth Services, Llc, Sowell Financial Services LLC, Colony Group, LLC, Peapack Gladstone Financial Corp, and Wiley Bros.-aintree Capital, Llc .

(Cheesecake Factory Inc/The (US163072AA98) la struttura proprietaria istituzionale mostra le attuali posizioni nella società da parte di istituzioni e fondi, nonché le ultime variazioni nella dimensione della posizione. I principali azionisti possono essere singoli investitori, fondi comuni, hedge fund o istituzioni. L'allegato 13D indica che l'investitore detiene (o ha detenuto) più del 5% della società e intende (o intendeva) perseguire attivamente un cambiamento nella strategia aziendale. L'allegato 13G indica un investimento passivo superiore al 5%.

Depositi 13F e NPORT

Le informazioni relative ai depositi 13F sono gratuite. Per accedere alle informazioni relative ai depositi NP è necessario un'abbonamento premium. Le righe verdi indicano le nuove posizioni. Le righe rosse indicano le posizioni chiuse. Fai clic sull'icona del link per visualizzare la cronologia completa delle transazioni.

Esegui l'upgrade

per sbloccare i dati premium ed esportarli in Excel ![]() .

.