Statistiche di base

| Azioni istituzionali (Long) | 109.188.133 - 1,89% (ex 13D/G) - change of -10,48MM shares -9,51% MRQ |

| Valore istituzionale (Long) | $ 1.602.666 USD ($1000) |

Proprietà istituzionale e azionisti

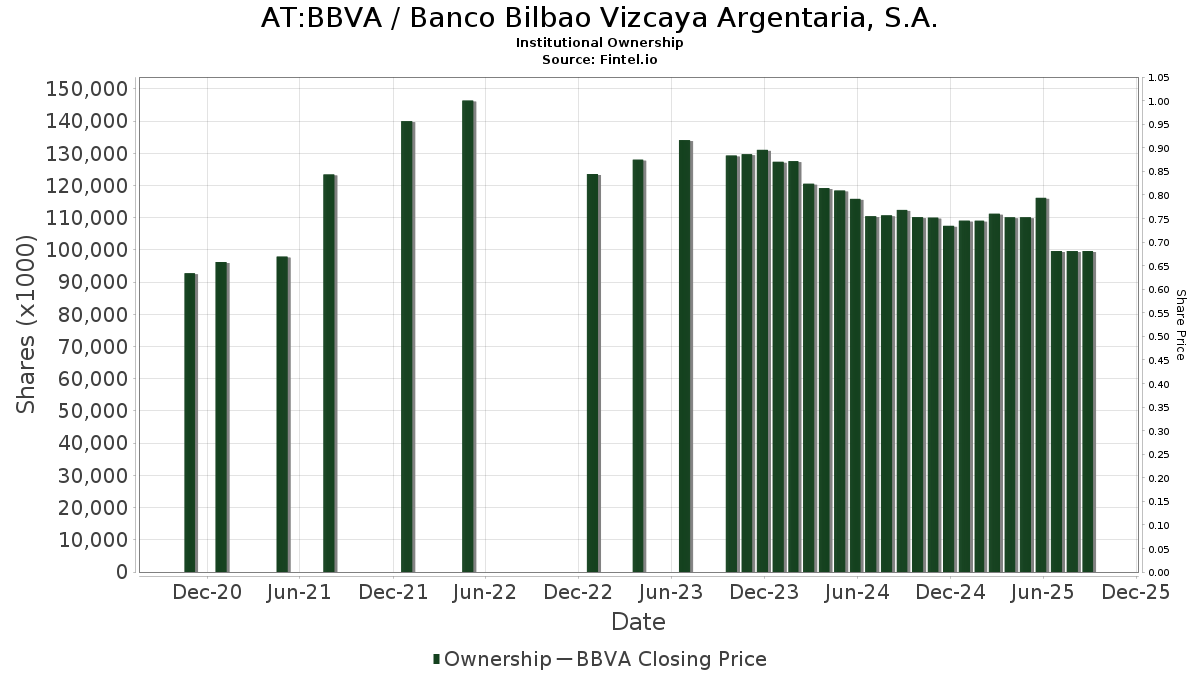

Banco Bilbao Vizcaya Argentaria, S.A. (AT:BBVA) ha 60 proprietari istituzionali e azionisti che hanno presentato i moduli 13D/G o 13F alla Securities Exchange Commission (SEC). Queste istituzioni detengono un totale di 109,188,133 azioni. I maggiori azionisti includono QCSTRX - Stock Account Class R1, HLMIX - Harding Loevner International Equity Portfolio Institutional, TIIEX - TIAA-CREF International Equity Fund Institutional Class, TCIEX - TIAA-CREF International Equity Index Fund Institutional Class, QCGLRX - Global Equities Account Class R1, CIUEX - Six Circles International Unconstrained Equity Fund, JAOSX - Janus Henderson Overseas Fund Class T, JDIBX - John Hancock Disciplined Value International Fund Class A, CMIUX - Six Circles Managed Equity Portfolio International Unconstrained Fund, and JORNX - Janus Henderson Global Select Fund Class T .

(Banco Bilbao Vizcaya Argentaria, S.A. (WBAG:BBVA) la struttura proprietaria istituzionale mostra le attuali posizioni nella società da parte di istituzioni e fondi, nonché le ultime variazioni nella dimensione della posizione. I principali azionisti possono essere singoli investitori, fondi comuni, hedge fund o istituzioni. L'allegato 13D indica che l'investitore detiene (o ha detenuto) più del 5% della società e intende (o intendeva) perseguire attivamente un cambiamento nella strategia aziendale. L'allegato 13G indica un investimento passivo superiore al 5%.

Indice del sentiment dei fondi

L'indice del sentiment dei fondi (anche noto come "indice di accumulo di proprietà") individua i titoli più acquistati dai fondi. È il risultato di un sofisticato modello quantitativo multi-fattore che identifica le società con i più alti livelli di accumulo istituzionale. Il modello utilizza una combinazione dell'aumento totale dei proprietari dichiarati, delle variazioni nelle allocazioni di portafoglio di tali proprietari e di altre metriche. Il punteggio varia da 0 a 100: i numeri più alti indicano un livello di accumulo superiore ad altre società, mentre 50 rappresenta la media.

Frequenza di aggiornamento: giornaliera

Consulta Ownership Explorer per visualizzare l'elenco delle aziende con il ranking più alto.

Depositi 13F e NPORT

Le informazioni relative ai depositi 13F sono gratuite. Per accedere alle informazioni relative ai depositi NP è necessario un'abbonamento premium. Le righe verdi indicano le nuove posizioni. Le righe rosse indicano le posizioni chiuse. Fai clic sull'icona del link per visualizzare la cronologia completa delle transazioni.

Esegui l'upgrade

per sbloccare i dati premium ed esportarli in Excel ![]() .

.