Oracle (WBAG:ORCL) Price Target Increased by 10.01% to 215.03

The average one-year price target for Oracle (WBAG:ORCL) has been revised to € 215,03 / share. This is an increase of 10.01% from the prior estimate of € 195,46 dated July 17, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of € 149,91 to a high of € 289,42 / share. The average price target represents an increase of 6.50% from the latest reported closing price of € 201,90 / share.

What is the Fund Sentiment?

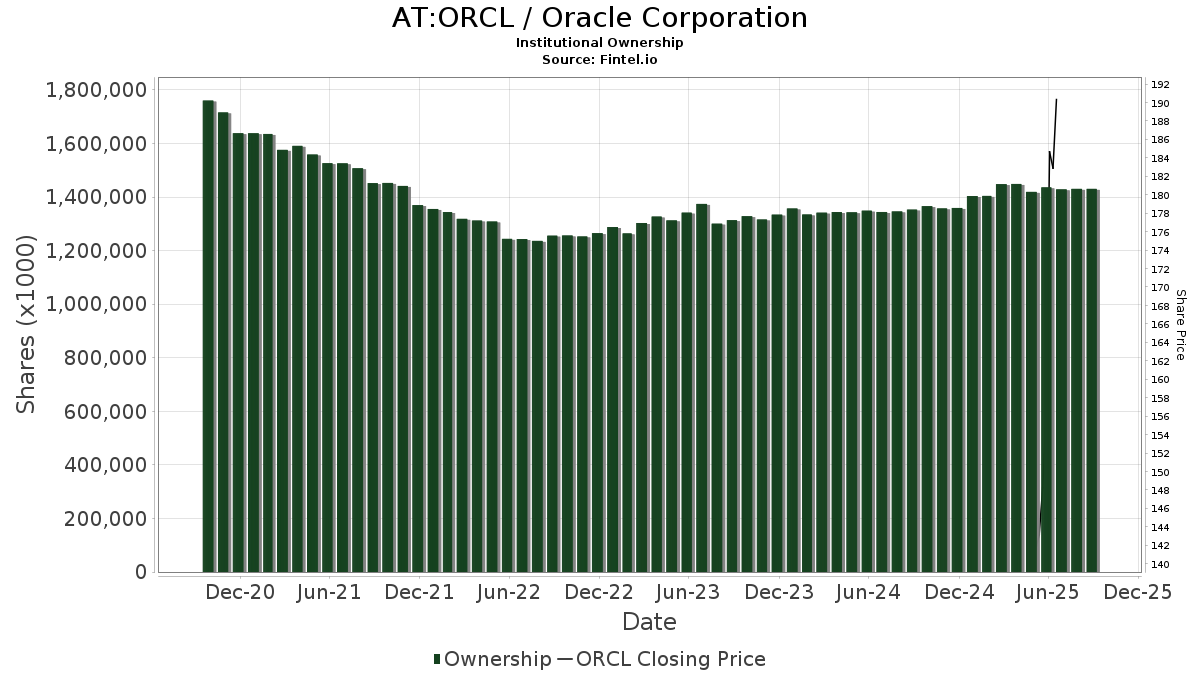

There are 4,714 funds or institutions reporting positions in Oracle. This is an increase of 38 owner(s) or 0.81% in the last quarter. Average portfolio weight of all funds dedicated to ORCL is 0.60%, an increase of 11.07%. Total shares owned by institutions decreased in the last three months by 0.21% to 1,430,645K shares.

What are Other Shareholders Doing?

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 53,016K shares representing 1.89% ownership of the company. In its prior filing, the firm reported owning 52,079K shares , representing an increase of 1.77%. The firm decreased its portfolio allocation in ORCL by 10.90% over the last quarter.

Jpmorgan Chase holds 45,650K shares representing 1.63% ownership of the company. In its prior filing, the firm reported owning 43,033K shares , representing an increase of 5.73%. The firm increased its portfolio allocation in ORCL by 48.56% over the last quarter.

VFINX - Vanguard 500 Index Fund Investor Shares holds 45,076K shares representing 1.60% ownership of the company. In its prior filing, the firm reported owning 43,506K shares , representing an increase of 3.48%. The firm decreased its portfolio allocation in ORCL by 11.24% over the last quarter.

Geode Capital Management holds 36,323K shares representing 1.29% ownership of the company. In its prior filing, the firm reported owning 37,583K shares , representing a decrease of 3.47%. The firm increased its portfolio allocation in ORCL by 34.56% over the last quarter.

Capital Research Global Investors holds 23,044K shares representing 0.82% ownership of the company. In its prior filing, the firm reported owning 19,011K shares , representing an increase of 17.50%. The firm increased its portfolio allocation in ORCL by 74.54% over the last quarter.