Bufab AB (OM:BUFAB) Price Target Decreased by 80.44% to 90.41

The average one-year price target for Bufab AB (OM:BUFAB) has been revised to 90,41 kr / share. This is a decrease of 80.44% from the prior estimate of 462,26 kr dated May 4, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of 84,84 kr to a high of 103,95 kr / share. The average price target represents an increase of 8.15% from the latest reported closing price of 83,60 kr / share.

Bufab AB Maintains 1.26% Dividend Yield

At the most recent price, the company’s dividend yield is 1.26%.

Additionally, the company’s dividend payout ratio is 0.34. The payout ratio tells us how much of a company’s income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company’s income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company’s 3-Year dividend growth rate is 0.40% , demonstrating that it has increased its dividend over time.

What is the Fund Sentiment?

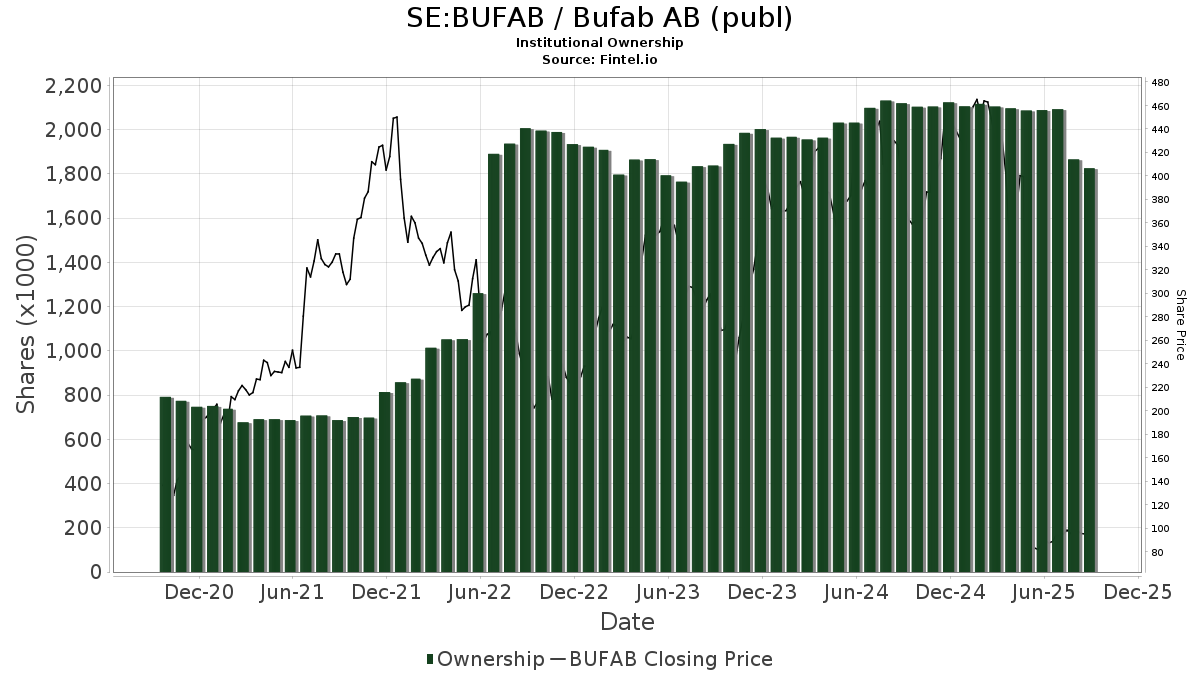

There are 54 funds or institutions reporting positions in Bufab AB. This is an increase of 1 owner(s) or 1.89% in the last quarter. Average portfolio weight of all funds dedicated to BUFAB is 0.07%, an increase of 13.34%. Total shares owned by institutions decreased in the last three months by 0.72% to 2,090K shares.

What are Other Shareholders Doing?

VGTSX - Vanguard Total International Stock Index Fund Investor Shares holds 396K shares representing 0.21% ownership of the company. In its prior filing, the firm reported owning 411K shares , representing a decrease of 3.57%. The firm increased its portfolio allocation in BUFAB by 12.12% over the last quarter.

VTMGX - Vanguard Developed Markets Index Fund Admiral Shares holds 229K shares representing 0.12% ownership of the company. No change in the last quarter.

Dfa Investment Trust Co - The Continental Small Company Series holds 215K shares representing 0.11% ownership of the company. In its prior filing, the firm reported owning 233K shares , representing a decrease of 8.71%. The firm increased its portfolio allocation in BUFAB by 24.97% over the last quarter.

AVDV - Avantis International Small Cap Value ETF holds 190K shares representing 0.10% ownership of the company. In its prior filing, the firm reported owning 188K shares , representing an increase of 0.92%. The firm increased its portfolio allocation in BUFAB by 0.24% over the last quarter.

IEFA - iShares Core MSCI EAFE ETF holds 148K shares representing 0.08% ownership of the company. In its prior filing, the firm reported owning 147K shares , representing an increase of 0.77%. The firm increased its portfolio allocation in BUFAB by 16.14% over the last quarter.