Statistiche di base

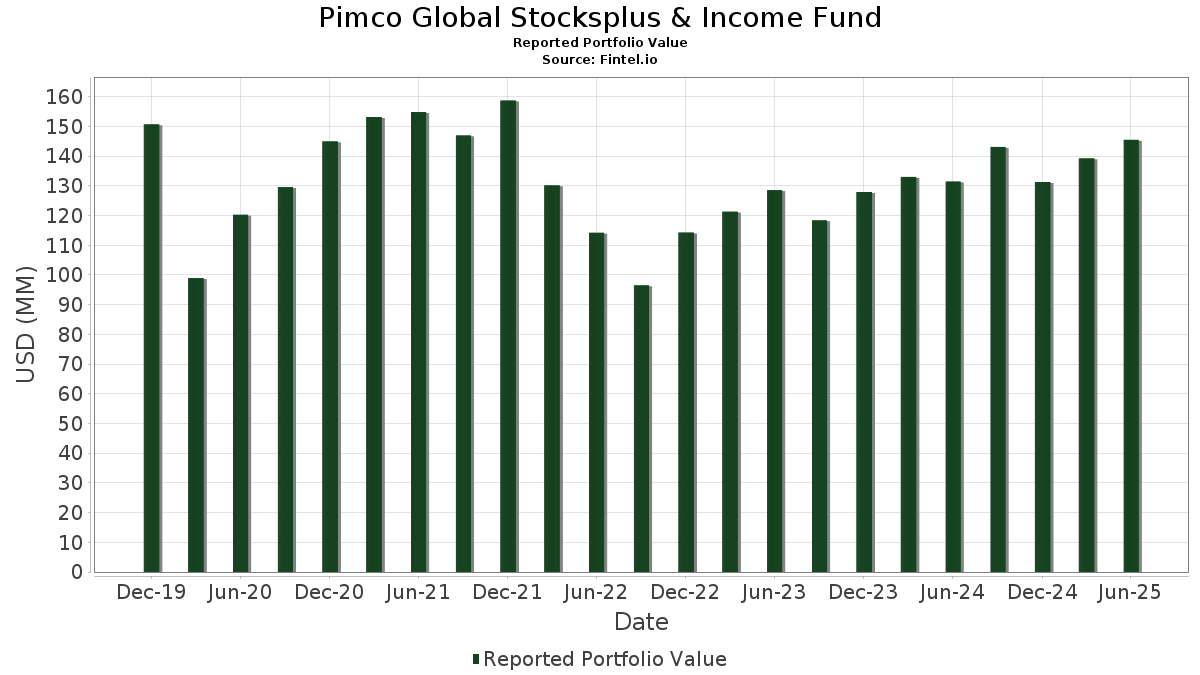

| Valore del portafoglio | $ 145.473.250 |

| Posizioni attuali | 466 |

Ultime partecipazioni, performance, AUM (da depositi 13F, 13D)

Pimco Global Stocksplus & Income Fund ha dichiarato un totale di 466 partecipazioni negli ultimi documenti depositati presso la SEC. Il valore più recente del portafoglio è pari a $ 145.473.250 USD. Il patrimonio gestito effettivo (AUM) corrisponde a questo valore più la liquidità (che non viene dichiarata). Le principali partecipazioni di Pimco Global Stocksplus & Income Fund sono PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , Uniform Mortgage-Backed Security, TBA (US:US01F0626899) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , Uniform Mortgage-Backed Security, TBA (US:US01F0526800) , and Fannie Mae or Freddie Mac (US:US01F0326821) . Le nuove posizioni di Pimco Global Stocksplus & Income Fund includono PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , Uniform Mortgage-Backed Security, TBA (US:US01F0626899) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , Uniform Mortgage-Backed Security, TBA (US:US01F0526800) , and Fannie Mae or Freddie Mac (US:US01F0326821) .

Gli aumenti più importanti di questo trimestre

Utilizziamo la variazione dell'allocazione del portafoglio perché è l'indicatore più significativo. Le variazioni possono essere dovute a transazioni o a variazioni dei prezzi delle azioni.

| Titolo | Azioni (in milioni) |

Valore (in milioni di $) |

Portafoglio % | ΔPortafoglio % |

|---|---|---|---|---|

| 6,08 | 6,4662 | 6,4662 | ||

| 4,02 | 4,2735 | 4,2735 | ||

| 2,35 | 2,5011 | 2,5011 | ||

| 2,01 | 2,1390 | 2,1390 | ||

| 2,20 | 2,3421 | 1,9622 | ||

| 1,77 | 1,8859 | 1,8859 | ||

| 1,87 | 1,9855 | 1,6056 | ||

| 1,46 | 1,5483 | 1,5483 | ||

| 2,79 | 2,9698 | 1,3373 | ||

| 1,08 | 1,1510 | 1,1510 |

Gli aumenti più importanti di questo trimestre

Utilizziamo la variazione dell'allocazione del portafoglio perché è l'indicatore più significativo. Le variazioni possono essere dovute a transazioni o a variazioni dei prezzi delle azioni.

| Titolo | Azioni (in milioni) |

Valore (in milioni di $) |

Portafoglio % | ΔPortafoglio % |

|---|---|---|---|---|

| 4,50 | 4,7886 | -3,6263 | ||

| -3,13 | -3,3291 | -3,3291 | ||

| -1,56 | -1,6556 | -1,6556 | ||

| -1,48 | -1,5786 | -1,5786 | ||

| 1,53 | 1,6326 | -1,0896 | ||

| -0,95 | -1,0076 | -1,0076 | ||

| -0,95 | -1,0076 | -1,0076 | ||

| 5,50 | 5,8464 | -0,9815 | ||

| -0,90 | -0,9556 | -0,9556 | ||

| -0,89 | -0,9441 | -0,9441 |

13F e depositi di fondi

Questo modulo è stato depositato il 2025-08-29 per il periodo di riferimento 2025-06-30. Fai clic sull'icona del link per visualizzare la cronologia completa delle transazioni.

Esegui l'upgrade per sbloccare i dati premium ed esportarli in Excel ![]() .

.

| Titolo | Tipo | Prezzo medio dell'azione | Azioni (in milioni) |

ΔAzioni (%) |

ΔAzioni (%) |

Valore (in milioni di $) |

Portafoglio (%) |

ΔPortafoglio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 10,14 | -1,65 | 10,7846 | -0,7876 | |||||

| US01F0626899 / Uniform Mortgage-Backed Security, TBA | 7,94 | 1,37 | 8,4472 | -0,7444 | |||||

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | 6,80 | 1,28 | 7,2375 | -0,6440 | |||||

| NDDUEAFE TRS EQUITY FEDL01+51 *BULLET* M / DE (000000000) | 6,08 | 6,4662 | 6,4662 | ||||||

| US01F0526800 / Uniform Mortgage-Backed Security, TBA | 5,50 | -5,55 | 5,8464 | -0,9815 | |||||

| US01F0326821 / Fannie Mae or Freddie Mac | 4,50 | -37,25 | 4,7886 | -3,6263 | |||||

| PRS / Promotora de Informaciones, S.A. | 4,02 | 4,2735 | 4,2735 | ||||||

| AMSURG EQUITY EQTYAS910 / EC (902RDL901) | 0,07 | 0,00 | 3,22 | -3,42 | 3,4304 | -0,3187 | |||

| US21H0326700 / GNMA2 30YR TBA(REG C) 3.5 TBA 07-01-50 | 3,00 | -6,45 | 3,1924 | -0,7508 | |||||

| EW / Edwards Lifesciences Corporation | 2,79 | 81,94 | 2,9698 | 1,3373 | |||||

| US01F0506844 / UMBS TBA | 2,35 | 2,5011 | 2,5011 | ||||||

| RFR USD SOFR/1.50000 06/15/22-30Y LCH / DIR (EZ2TNCR649W7) | 2,20 | 551,18 | 2,3421 | 1,9622 | |||||

| ENVISION HEALTHCARE CORPORTION 2023 LAST OUT TERM LOAN / LON (949ABFII9) | 2,05 | 1,48 | 2,1862 | -0,0874 | |||||

| US83743YAS28 / SOUTH COAST FUNDING SCF 7A A1AN 144A | 2,03 | 1,15 | 2,1614 | -0,0933 | |||||

| US21H0426799 / Ginnie Mae | 2,01 | 2,1390 | 2,1390 | ||||||

| US87168TAB70 / Syniverse Holdings, Inc. 2022 Term Loan | 1,94 | -3,53 | 2,0660 | -0,1937 | |||||

| RFR USD SOFR/1.75000 06/15/22-30Y LCH / DIR (EZ2TNCR649W7) | 1,87 | 452,07 | 1,9855 | 1,6056 | |||||

| US25470XBE40 / DISH DBS Corp | 1,82 | -1,14 | 1,9350 | -0,1306 | |||||

| ADLER FINANCING SARL SR SECURED 12/28 8.25 / DBT (DE000A4D5RA0) | 1,77 | 1,8859 | 1,8859 | ||||||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 1,72 | 94,57 | 1,8309 | 0,8383 | |||||

| INCORA NEW EQUITY / EC (955PRF008) | 0,05 | 0,00 | 1,69 | -5,49 | 1,7969 | -0,2090 | |||

| US3136BAGT56 / FANNIE MAE FNR 2020 38 NI | 1,56 | 3,17 | 1,6603 | -0,0378 | |||||

| EW / Edwards Lifesciences Corporation | 1,53 | -33,85 | 1,6326 | -1,0896 | |||||

| INCORA INTERMEDIATE II SR SECURED 144A 01/30 VAR / DBT (US45338XAA37) | 1,49 | 3,12 | 1,5841 | -0,0365 | |||||

| US90290PAS39 / U.S. Renal Care, Inc., 1st Lien Term Loan C | 1,49 | 1,22 | 1,5833 | -0,0673 | |||||

| INCORA TOP HOLDCO LLC CONV PIK PRE COMP / DBT (955PRK007) | 1,49 | -4,07 | 1,5818 | -0,1582 | |||||

| S+P500 EMINI FUT SEP25 XCME 20250919 / DE (000000000) | 1,46 | 1,5483 | 1,5483 | ||||||

| OCS GROUP HOLDINGS LTD GBP TERM LOAN B / LON (BA000BQB0) | 1,37 | 6,20 | 1,4579 | 0,0084 | |||||

| COREWEAVE CMPTE ACQU CO II LLC 2024 DELAYED DRAW TERM LOAN / LON (BA0004JK4) | 1,33 | 1,92 | 1,4155 | -0,0507 | |||||

| US35564KLV97 / Freddie Mac STACR REMIC Trust 2021-DNA6 | 1,28 | -0,16 | 1,3576 | -0,0774 | |||||

| BRVALEDBS028 / VALE SA SUBORDINATED 12/49 VAR | 1,27 | 3,92 | 1,3561 | -0,0213 | |||||

| LU2445093128 / INTELSAT EMERGENCE SA | 0,03 | 0,00 | 1,19 | 2,42 | 1,2609 | -0,0385 | |||

| TWITTER INC TERM LOAN / LON (US90184NAG34) | 1,17 | 30,50 | 1,2433 | 0,2378 | |||||

| US01F0426811 / UMBS TBA | 1,15 | -28,45 | 1,2208 | -0,6606 | |||||

| US040114HU71 / Argentine Republic Government International Bond | 1,14 | 7,98 | 1,2105 | 0,0271 | |||||

| US01F0306781 / UMBS TBA | 1,08 | 1,1510 | 1,1510 | ||||||

| US91327AAB89 / Uniti Group LP | 1,06 | 8,20 | 1,1246 | 0,0277 | |||||

| BMPS / Banca Monte dei Paschi di Siena S.p.A. | 0,12 | 0,00 | 1,05 | 7,69 | 1,1178 | 0,0229 | |||

| US45824TBC80 / INTELSAT JACKSON HOLDINGS S.A. | 1,05 | 7,27 | 1,1147 | 0,0184 | |||||

| 952YSX903 / WINDSTREAM UNITS EQUITY | 0,05 | 0,00 | 1,03 | -12,65 | 1,0956 | -0,2278 | |||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 1,01 | 1,0776 | 1,0776 | ||||||

| US281020AY36 / EDISON INTERNATIONAL | 0,99 | 0,41 | 1,0535 | -0,0541 | |||||

| 948FWKII5 / STEENBOK LUX FINCO 2 SARL 2023 EUR PIK TL A2 RESTRUCTURE | 0,99 | 6,47 | 1,0520 | 0,0090 | |||||

| DOMINICAN REPUBLIC SR UNSECURED 144A 03/37 10.5 / DBT (US25714PFD50) | 0,99 | 5,44 | 1,0517 | -0,0009 | |||||

| US95003WAG15 / WELLS FARGO COMMERCIAL MORTGAG WFCM 2022 ONL C 144A | 0,98 | 1,66 | 1,0432 | -0,0400 | |||||

| US02156LAF85 / Altice France SA/France | 0,93 | 5,44 | 0,9905 | -0,0008 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 0,93 | 11,27 | 0,9880 | 0,0512 | |||||

| US20754RAF38 / Connecticut Avenue Securities Trust 2021-R01 | 0,92 | 0,77 | 0,9813 | -0,0471 | |||||

| US654744AD34 / Nissan Motor Co Ltd | 0,92 | -3,37 | 0,9768 | -0,0904 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,89 | -0,89 | 0,9441 | -0,0609 | |||||

| BAUSCH HEALTH COMPANIES INC 2025 TERM LOAN B / LON (XAC6903HAB06) | 0,87 | 0,9256 | 0,9256 | ||||||

| XS1970750151 / AVOCA CLO AVOCA 20A SUB 144A | 0,87 | 3,70 | 0,9248 | -0,0172 | |||||

| IRS EUR 1.25000 08/19/19-30Y LCH / DIR (EZKSF9W1N569) | 0,86 | 16,62 | 0,9187 | 0,0870 | |||||

| US30227FAN06 / Extended Stay America Trust | 0,86 | -0,92 | 0,9141 | -0,0597 | |||||

| UNICORN BAY HKD FIXED TERM LOAN A / LON (BA00077Z7) | 0,85 | -11,92 | 0,9047 | -0,1799 | |||||

| GATEWY CSINS + ENTRTINMNT LTD 2024 TERM LOAN B / LON (BA000DCX3) | 0,83 | -1,20 | 0,8780 | -0,0598 | |||||

| US88880LAB99 / TOBACCO SETTLEMENT FIN AUTH WV TOBGEN 06/47 ZEROCPNOID 0 | 0,81 | -2,90 | 0,8567 | -0,0744 | |||||

| CLOVER HOLDINGS 2 LLC TERM LOAN B / LON (US18914DAB47) | 0,80 | 0,8535 | 0,8535 | ||||||

| USP7721BAE13 / Peru LNG Srl | 0,78 | 1,29 | 0,8345 | -0,0346 | |||||

| CTEV / Claritev Corporation | 0,74 | -0,80 | 0,7921 | -0,0508 | |||||

| OIBR4 / Oi S.A. - Preferred Stock | 0,74 | -19,52 | 0,7861 | -0,2446 | |||||

| BAUSCH + LOMB CORP SR SECURED 144A 01/31 VAR / DBT (XS3102032110) | 0,71 | 0,7581 | 0,7581 | ||||||

| US00846NAA54 / AGFC CAPITAL TRUST I LIMITD GUARA 144A 01/67 VAR | 0,70 | -0,85 | 0,7438 | -0,0486 | |||||

| MANUCHAR GROUP SARL MANUCHAR GROUP SARL / DBT (BE6365837184) | 0,69 | 0,7369 | 0,7369 | ||||||

| US71360HAB33 / PERATON CORP | 0,66 | 0,7048 | 0,7048 | ||||||

| US90355YAA55 / US Renal Care Inc | 0,65 | 0,15 | 0,6890 | -0,0371 | |||||

| CA125491AG54 / CI FINANCIAL CO | 0,63 | 0,64 | 0,6739 | -0,0328 | |||||

| US694308HL49 / PACIFIC GAS + ELECTRIC SR UNSECURED 03/45 4.3 | 0,63 | -3,40 | 0,6650 | -0,0624 | |||||

| IVANTI SOFTWARE INC 2025 1ST LIEN TERM LOAN / LON (US46583DAH26) | 0,62 | 0,6622 | 0,6622 | ||||||

| 743424AA1 / Proofpoint, Inc. 1.25% Convertible Bond due 2018-12-15 | 0,60 | 0,6395 | 0,6395 | ||||||

| CZECHOSLOVAK GROUP CZECHOSLOVAK GROUP / DBT (XS3105190816) | 0,60 | 0,6391 | 0,6391 | ||||||

| US02147RAN08 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 23CB 2A1 | 0,60 | -2,14 | 0,6339 | -0,0499 | |||||

| US449652AG10 / ILPT COML MTG TR 2022-LPF2 6.442% 10/15/2039 144A | 0,59 | 0,68 | 0,6325 | -0,0301 | |||||

| TRT061124T11 / Turkey Government Bond | 0,58 | -2,67 | 0,6210 | -0,0527 | |||||

| US04965JAC71 / Atrium Hotel Portfolio Trust 2017-ATRM | 0,58 | -0,85 | 0,6182 | -0,0408 | |||||

| 944YFGII6 / SOFTBANK VISION FUND II FIXED TERM LOAN | 0,57 | -4,07 | 0,6014 | -0,0606 | |||||

| US46115HCD70 / Intesa Sanpaolo SpA | 0,56 | 1,26 | 0,5976 | -0,0254 | |||||

| US75524MBL37 / RBSSP RESECURITIZATION TRUST RBSSP 2009 7 9A3 144A | 0,56 | 1,08 | 0,5969 | -0,0263 | |||||

| TREASURY BILL 09/25 0.00000 / DBT (US912797PW16) | 0,56 | 0,5908 | 0,5908 | ||||||

| US02156LAA98 / Altice France SA/France | 0,54 | 0,75 | 0,5750 | -0,0280 | |||||

| US92332YAD31 / Venture Global LNG Inc | 0,54 | 1,69 | 0,5748 | -0,0218 | |||||

| US67092H2094 / OCP CLO 2016 11 LTD PREFERRED STOCK 04/28 0.00000 | 0,53 | -7,48 | 0,5666 | -0,0795 | |||||

| US02156TAB08 / Altice France Holding SA | 0,52 | 18,64 | 0,5558 | 0,0613 | |||||

| C2AC34 / CACI International Inc - Depositary Receipt (Common Stock) | 0,52 | 0,5496 | 0,5496 | ||||||

| US07387UGW53 / BEAR STEARNS ASSET BACKED SECU BSABS 2006 AC2 22A2 | 0,51 | -3,06 | 0,5402 | -0,0477 | |||||

| RFR GBP SONIO/0.75000 09/21/22-30Y LCH / DIR (EZBHYJ02MR92) | 0,51 | 8,33 | 0,5397 | 0,0133 | |||||

| VENTURE GLOBAL LNG INC VENTURE GLOBAL LNG INC / DBT (US92332YAE14) | 0,51 | 2,64 | 0,5382 | -0,0153 | |||||

| CZECHOSLOVAK GROUP CZECHOSLOVAK GROUP / DBT (XS3105190147) | 0,50 | 0,5373 | 0,5373 | ||||||

| US25470MAB54 / DISH Network Corp. 3.375% Bond | 0,50 | 0,00 | 0,5349 | -0,0293 | |||||

| ALIGNED DATA CENTERS INTER LP 2024 TERM LOAN / LON (BA000JN59) | 0,50 | 0,5334 | 0,5334 | ||||||

| US863579QX96 / STRUCTURED ADJUSTABLE RATE MOR SARM 2005 9 2A2A | 0,49 | -1,82 | 0,5172 | -0,0397 | |||||

| US45670AAB70 / INDYMAC INDX MORTGAGE LOAN TRU INDX 2007 FLX3 A2 | 0,48 | -0,41 | 0,5148 | -0,0307 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 0,48 | 10,32 | 0,5125 | 0,0229 | |||||

| CHEPLAPHARM ARZNEIMITTEL CHEPLAPHARM ARZNEIMITTEL / DBT (XS3087221043) | 0,47 | 0,5053 | 0,5053 | ||||||

| US17322WAK09 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2014 6 3A3 144A | 0,47 | -2,69 | 0,5019 | -0,0423 | |||||

| CARLYLE GLOBAL MARKET STRATEGI CGMSE 2014 1A SUBR 144A / ABS-CBDO (XS3017869309) | 0,47 | 140,31 | 0,5012 | 0,2808 | |||||

| US91327TAA97 / Uniti Group LP / Uniti Group Finance Inc / CSL Capital LLC | 0,47 | -0,21 | 0,4966 | -0,0286 | |||||

| MARICOPA CNTY AZ INDL DEV AUTH MAREDU 10/29 FIXED 7.375 / DBT (US56681NJD03) | 0,47 | 0,43 | 0,4961 | -0,0256 | |||||

| UZBEKNEFTEGAZ SR UNSECURED 144A 05/30 8.75 / DBT (US91825MAC73) | 0,46 | 0,4935 | 0,4935 | ||||||

| H1FC34 / HF Sinclair Corporation - Depositary Receipt (Common Stock) | 0,46 | 1,11 | 0,4863 | -0,0218 | |||||

| WAYFAIR LLC SR SECURED 144A 09/30 7.75 / DBT (US94419NAB38) | 0,45 | 4,14 | 0,4829 | -0,0061 | |||||

| STELLANTIS FIN US INC COMPANY GUAR 144A 03/35 6.45 / DBT (US85855CAL46) | 0,45 | 0,4813 | 0,4813 | ||||||

| CHILE ELECTRICITY LUX GOVT GUARANT 144A 10/35 5.58 / DBT (US16882LAA08) | 0,44 | -2,22 | 0,4687 | -0,0368 | |||||

| NEW YORK NY NYC 02/55 FIXED 6.385 / DBT (US64966SNJ14) | 0,44 | 0,4650 | 0,4650 | ||||||

| YINSON BORONIA PRODUCTIO SR SECURED 144A 07/42 8.947 / DBT (US98584XAA37) | 0,42 | 0,96 | 0,4495 | -0,0209 | |||||

| FNMA TBA 30 YR 7 SINGLE FAMILY MORTGAGE / ABS-MBS (US01F0706907) | 0,42 | 0,4460 | 0,4460 | ||||||

| CENTRAL PARENT INC 2024 TERM LOAN B / LON (US15477BAE74) | 0,42 | -3,03 | 0,4433 | -0,0390 | |||||

| US65505PAA57 / Noble Finance II LLC | 0,41 | 1,75 | 0,4337 | -0,0155 | |||||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 0,40 | 0,4259 | 0,4259 | ||||||

| 18948EAC0 / Forward Air 9/23 Cov-Lite TLB | 0,40 | 2,58 | 0,4237 | -0,0123 | |||||

| PRIME HEALTHCARE SERVICE PRIME HEALTHCARE SERVICE / DBT (US74165HAC25) | 0,40 | 5,31 | 0,4227 | -0,0016 | |||||

| 936UVD902 / SYNIVERSE PFD PIK PFDJJZ917 | 0,42 | 6,25 | 0,39 | 3,41 | 0,4200 | -0,0088 | |||

| US78448P1003 / SMB PRIVATE EDUCATION LOAN TRU SMB 2015 A R 144A | 0,38 | -1,54 | 0,4080 | -0,0299 | |||||

| RFR USD SOFR/4.25000 03/20/24-3Y* LCH / DIR (EZ5VXGJ62MT7) | 0,37 | 123,17 | 0,3905 | 0,2054 | |||||

| XAF6628DAN49 / Numericable U.S. LLC, Term Loan B14 | 0,36 | 0,84 | 0,3828 | -0,0179 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 0,36 | 10,56 | 0,3798 | 0,0180 | |||||

| SOFTBANK VISION FUND II TRANCHE B1 TERM LOAN / LON (BA000KP88) | 0,35 | 0,3773 | 0,3773 | ||||||

| IRS EUR 0.15000 06/17/20-10Y LCH / DIR (EZ2BX250L4K9) | 0,35 | -7,14 | 0,3740 | -0,0511 | |||||

| VIRI / Viridien Société anonyme | 0,35 | 5,41 | 0,3740 | -0,0001 | |||||

| TITANIUM 2L BONDCO S.? R.L. EO 01/31 6.25 / DBT (DE000A3L3AG9) | 0,34 | 2,76 | 0,3574 | -0,0094 | |||||

| RFR USD SOFR/1.75000 06/15/22-30Y CME / DIR (EZ2TNCR649W7) | 0,33 | -2,37 | 0,3520 | -0,0280 | |||||

| POSEIDON BIDCO SASU 2023 EUR TERM LOAN B / LON (953RGXII1) | 0,32 | 5,57 | 0,3434 | 0,0000 | |||||

| US92332YAC57 / Venture Global LNG Inc | 0,32 | 1,58 | 0,3433 | -0,0133 | |||||

| US35563CAB46 / FREDDIE MAC MILITARY HOUSING B FMMHR 2015 R1 XA1 144A | 0,32 | -2,15 | 0,3390 | -0,0266 | |||||

| US71654QDL32 / Petroleos Mexicanos | 0,32 | 3,59 | 0,3375 | -0,0062 | |||||

| US12668BSL89 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 6CB 2A6 | 0,32 | -0,94 | 0,3366 | -0,0217 | |||||

| RFRF USD SF+26.161/2.00 8/12/23-7Y* CME / DIR (EZXZXW7G14V3) | 0,31 | -20,92 | 0,3307 | -0,1103 | |||||

| MNSH / MNSN Holdings Inc. | 0,00 | 0,00 | 0,31 | 8,13 | 0,3265 | 0,0079 | |||

| ARARGE3209S6 / REPUBLIC OF ARGENTINA BONDS 07/30 VAR | 0,31 | 6,62 | 0,3264 | 0,0033 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,30 | 0,66 | 0,3225 | -0,0160 | |||||

| AVENIR ISSUER IV IRLND SR SECURED REGS 10/27 6 / DBT (XS2933572856) | 0,30 | -36,86 | 0,3176 | -0,2126 | |||||

| US12667GLD33 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 23CB A3 | 0,30 | -1,34 | 0,3148 | -0,0215 | |||||

| OIBR4 / Oi S.A. - Preferred Stock | 0,28 | -19,60 | 0,3019 | -0,0939 | |||||

| US12667G3L51 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 44 1A1 | 0,26 | -2,23 | 0,2804 | -0,0222 | |||||

| US78448R1068 / SMB PRIVATE EDUCATION LOAN TRU SMB 2015 C R 144A | 0,26 | -1,52 | 0,2768 | -0,0207 | |||||

| US2620512044 / Drillco Holdings Luxembourg SA | 0,01 | 0,00 | 0,25 | -18,75 | 0,2637 | -0,0782 | |||

| ENVISION HEALTHCARE CORPORTION 2023 1ST LIEN FIRST OUT TL / LON (949ABEII2) | 0,23 | 0,00 | 0,2408 | -0,0133 | |||||

| US45669FAA12 / INDYMAC INDX MORTGAGE LOAN TRU INDX 2007 AR11 1A1 | 0,22 | 0,92 | 0,2331 | -0,0108 | |||||

| US3140JANZ71 / FNMA POOL BM5807 FN 04/48 FIXED VAR | 0,22 | -2,27 | 0,2298 | -0,0174 | |||||

| US761118TB44 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2006 QA1 A21 | 0,21 | -1,40 | 0,2245 | -0,0162 | |||||

| REPUBLIC OF EL SALVADOR SR UNSECURED 144A 11/54 9.65 / DBT (US283875CG53) | 0,21 | 3,00 | 0,2197 | -0,0058 | |||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,21 | 0,2184 | 0,2184 | ||||||

| WINDSTREAMWARRANTS SLDENVWINDSTREAMWARRANTS / DE (000000000) | 0,20 | 0,2179 | 0,2179 | ||||||

| GR0128015725 / Hellenic Republic Government Bond | 0,20 | 10,99 | 0,2158 | 0,0106 | |||||

| VIRI / Viridien Société anonyme | 0,20 | -4,39 | 0,2096 | -0,0208 | |||||

| BD2CBK1 / Hellenic Republic Government Bond | 0,20 | 12,64 | 0,2090 | 0,0126 | |||||

| STEPSTNE GRUP MDCO 2 GMBH THE USD TERM LOAN / LON (BA000BVC2) | 0,19 | -1,52 | 0,2069 | -0,0151 | |||||

| US71654QDC33 / Petroleos Mexicanos | 0,19 | 5,46 | 0,2057 | -0,0003 | |||||

| US04625PAA93 / ARMOR HOLDCO IN 8.5 11/29 | 0,19 | -1,55 | 0,2041 | -0,0142 | |||||

| ASTON MARTIN CAPITAL HOL ASTON MARTIN CAPITAL HOL / DBT (US04625HAJ86) | 0,19 | -6,90 | 0,2017 | -0,0287 | |||||

| IRS EUR 0.83000 12/09/42-10Y LCH / DIR (EZPRCT6S2FJ7) | 0,19 | 30,99 | 0,1986 | 0,0382 | |||||

| DUN + BRADSTREET CORPOR THE 2025 TERM LOAN / LON (BA000K739) | 0,19 | 0,1982 | 0,1982 | ||||||

| US83206NAF42 / SMB PRIVATE EDUCATION LOAN TRU SMB 2022 B R 144A | 0,18 | -2,20 | 0,1902 | -0,0144 | |||||

| US59023MAB63 / MERRILL LYNCH ALTERNATIVE NOTE MANA 2007 A1 A2A | 0,18 | -0,56 | 0,1897 | -0,0118 | |||||

| US29279XAA81 / ENDURANCE ACQ MERGER 6% 02/15/2029 144A | 0,18 | -2,78 | 0,1867 | -0,0154 | |||||

| IRS EUR -0.15000 03/18/20-10Y LCH / DIR (EZ489JQF3VQ3) | 0,17 | 3,57 | 0,1862 | -0,0027 | |||||

| US262051AA36 / FORESEA Holding SA | 0,17 | -1,72 | 0,1823 | -0,0133 | |||||

| US02156LAC54 / Altice France SA/France | 0,17 | 5,00 | 0,1793 | -0,0005 | |||||

| US14311CAA62 / CGMS 2014-1A INC MTGE 04/ PREFERRED STOCK | 0,17 | -22,43 | 0,1775 | -0,0630 | |||||

| DATABRICKS INC LAST OUT TERM LOAN / LON (BA000D206) | 0,17 | 0,61 | 0,1760 | -0,0093 | |||||

| US02156LAE11 / Altice France SA/France | 0,17 | 5,10 | 0,1759 | -0,0006 | |||||

| OIBR4 / Oi S.A. - Preferred Stock | 0,16 | -36,08 | 0,1745 | -0,1119 | |||||

| US22239EAA47 / COUNTRYWIDE HOME LOANS CWHL 2007 HYB1 1A1 | 0,16 | 0,62 | 0,1729 | -0,0086 | |||||

| US073888AC34 / BEAR STEARNS ASSET BACKED SECU BSABS 2006 SD3 1A3 | 0,16 | -2,47 | 0,1686 | -0,0135 | |||||

| GR0133011248 / Hellenic Republic Government Bond | 0,16 | 12,06 | 0,1684 | 0,0093 | |||||

| CTEV / Claritev Corporation | 0,16 | 8,97 | 0,1683 | 0,0054 | |||||

| US96106JAE91 / WESTMORELAND COAL CO PIK TERM LOAN | 0,16 | 5,41 | 0,1668 | -0,0003 | |||||

| US29279UAB26 / ENDURE DIGITAL INC TLB 3.5 | 0,15 | 3,38 | 0,1630 | -0,0039 | |||||

| US12667FMY87 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2004 14T2 A12 | 0,15 | -0,67 | 0,1582 | -0,0097 | |||||

| US3136AKDX86 / FANNIE MAE FNR 2014 31 US | 0,14 | 1,41 | 0,1538 | -0,0062 | |||||

| US80000XAC39 / SANDERS RE III LTD UNSECURED 144A 04/29 VAR | 0,14 | -42,34 | 0,1529 | -0,1263 | |||||

| IRS EUR 0.25000 09/21/22-10Y LCH / DIR (EZG64YQ7HVJ2) | 0,14 | 5,22 | 0,1506 | -0,0003 | |||||

| UNIT / Unity Group LLC | 0,03 | 0,00 | 0,14 | -14,02 | 0,1501 | -0,0347 | |||

| XS0767473852 / Russian Foreign Bond - Eurobond | 0,14 | 0,00 | 0,1490 | -0,0082 | |||||

| US92926UAA97 / WAMU MORTGAGE PASS THROUGH CER WAMU 2007 HY2 1A1 | 0,14 | -0,71 | 0,1488 | -0,0095 | |||||

| US07402FAA30 / BEAR STEARNS STRUCTURED PRODUC BSSP 2007 R6 1A1 | 0,14 | -2,13 | 0,1473 | -0,0119 | |||||

| NEW YORK NY NYC 02/45 FIXED 6.291 / DBT (US64966SNH57) | 0,14 | 0,1451 | 0,1451 | ||||||

| SPRUCE BIDCO II INC TERM LOAN / LON (BA000FPP1) | 0,13 | 0,00 | 0,1416 | -0,0087 | |||||

| US02147MAE12 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 20CB A5 | 0,13 | 1,54 | 0,1411 | -0,0053 | |||||

| US040114HV54 / Argentine Republic Government International Bond | 0,13 | 6,72 | 0,1358 | 0,0021 | |||||

| US01F0226757 / Uniform Mortgage-Backed Security, TBA | 0,12 | 0,1323 | 0,1323 | ||||||

| US3137FUYG35 / FREDDIE MAC FHR 4990 SN | 0,12 | 0,88 | 0,1228 | -0,0053 | |||||

| US89054XAD75 / Topaz Solar Farms LLC | 0,11 | -3,39 | 0,1223 | -0,0111 | |||||

| CCO / Clear Channel Outdoor Holdings, Inc. | 0,10 | 0,00 | 0,11 | 5,56 | 0,1219 | -0,0002 | |||

| TRT061124T11 / Turkey Government Bond | 0,11 | -1,83 | 0,1140 | -0,0091 | |||||

| XS1111617632 / CARLYLE GLOBAL MARKET STRATEGI CGMSE 2014 3A SUB 144A | 0,11 | 11,46 | 0,1139 | 0,0050 | |||||

| USL269151217 / DRILLCO HLDG LUX S A | 0,01 | 0,00 | 0,11 | -18,46 | 0,1133 | -0,0336 | |||

| CLOVER HOLDINGS 2 LLC REVOLVER / LON (US18914DAD03) | 0,11 | 0,1122 | 0,1122 | ||||||

| US09774XBP69 / BOMBARDIER CAPITAL MORTGAGE SE BCM 2000 A A3 | 0,10 | -6,31 | 0,1109 | -0,0146 | |||||

| IVANTI SOFTWARE INC 2025 NEWCO TERM LOAN / LON (US46583VAB53) | 0,10 | 0,1091 | 0,1091 | ||||||

| US86359LTG40 / STRUCTURED ASSET MORTGAGE INVE SAMI 2006 AR1 3A1 | 0,10 | -2,86 | 0,1090 | -0,0092 | |||||

| UNITI GROUP/CSL CAPITAL COMPANY GUAR 144A 06/32 8.625 / DBT (US91327TAC53) | 0,10 | 0,1076 | 0,1076 | ||||||

| XS2232102876 / Altice France SA/France | 0,10 | 15,12 | 0,1058 | 0,0087 | |||||

| US57645WAA80 / MASTR ADJUSTABLE RATE MORTGAGE MARM 2007 R5 A1 144A | 0,10 | -1,98 | 0,1057 | -0,0080 | |||||

| INTEGRITY RE LTD SR UNSECURED 144A 06/26 VAR / DBT (US45833UAM36) | 0,10 | -3,88 | 0,1057 | -0,0108 | |||||

| US14317QAC50 / CARLYLE GLOBAL MARKET STRATEGI CGMS 2018 2A SUB 144A | 0,10 | -41,07 | 0,1056 | -0,0838 | |||||

| CTEV / Claritev Corporation | 0,10 | 15,12 | 0,1056 | 0,0080 | |||||

| US21H0506806 / GNMA | 0,10 | 0,1045 | 0,1045 | ||||||

| TWITTER INC 2025 FIXED TERM LOAN / LON (US90184NAK46) | 0,10 | 0,1036 | 0,1036 | ||||||

| 952XGJII0 / EQTYWM927 WESTMORELAND MINING | 0,04 | 0,00 | 0,10 | -28,89 | 0,1030 | -0,0492 | |||

| US863579L482 / STRUCTURED ADJUSTABLE RATE MOR SARM 2005 23 3A1 | 0,10 | -4,04 | 0,1021 | -0,0099 | |||||

| US07402FAC95 / BEAR STEARNS STRUCTURED PRODUC BSSP 2007 R6 2A1 | 0,09 | 1,08 | 0,1002 | -0,0044 | |||||

| US71643VAB18 / Petroleos Mexicanos | 0,09 | 5,75 | 0,0989 | 0,0002 | |||||

| XS2161831776 / THAMES WATER UTL | 0,09 | -4,26 | 0,0967 | -0,0092 | |||||

| RFRF USD SF+26.161/1.50 9/15/23-5Y* CME / DIR (EZL6C00KXKG3) | 0,09 | -11,88 | 0,0953 | -0,0186 | |||||

| 948FWLII3 / STEENBOK LUX FINCO 2 SARL 2023 EUR PIK TL B2 RESTRUCTURE | 0,09 | -21,43 | 0,0941 | -0,0320 | |||||

| US25470XBF15 / DISH DBS Corp. | 0,09 | 2,38 | 0,0923 | -0,0026 | |||||

| GR0118020685 / Hellenic Republic Government Bond | 0,09 | 10,26 | 0,0915 | 0,0031 | |||||

| OIBR3 / Oi S.A. | 0,73 | 0,00 | 0,09 | -33,07 | 0,0909 | -0,0518 | |||

| XS2138128314 / ALTICE FRANCE HOLDING S.A. | 0,08 | 27,27 | 0,0904 | 0,0161 | |||||

| US126694YJ13 / CHL Mortgage Pass-Through Trust 2006-3 | 0,08 | -4,65 | 0,0875 | -0,0092 | |||||

| US32052MAE12 / FIRST HORIZON ALTERNATIVE MORT FHAMS 2006 AA6 2A1 | 0,08 | -3,57 | 0,0872 | -0,0073 | |||||

| US078452AA72 / BELLE HAVEN ABS CDO LTD BLHV 2006 1A A1 144A | 0,08 | -3,57 | 0,0867 | -0,0079 | |||||

| US32053AAB26 / FIRST HORIZON MORTGAGE PASS TH FHASI 2006 AR4 1A2 | 0,08 | -9,20 | 0,0845 | -0,0136 | |||||

| US761118JH24 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2005 QS14 2A1 | 0,08 | -4,88 | 0,0831 | -0,0090 | |||||

| US863579Y691 / STRUCTURED ADJUSTABLE RATE MOR SARM 2006 3 4A | 0,07 | -2,63 | 0,0795 | -0,0064 | |||||

| 61NM / KENNEDY WILSON EUR REAL SR UNSECURED REGS 11/25 3.25 | 0,07 | 8,96 | 0,0786 | 0,0029 | |||||

| US86361JAB61 / STRUCTURED ADJUSTABLE RATE MOR SARM 2006 8 1A2 | 0,07 | 0,00 | 0,0780 | -0,0049 | |||||

| US20846QEQ73 / CONSECO FINANCE SECURITIZATION CNF 2000 5 A6 | 0,07 | -3,95 | 0,0777 | -0,0086 | |||||

| US05951FAB04 / BANC OF AMERICA FUNDING CORPOR BAFC 2007 1 TA1B | 0,07 | -2,70 | 0,0776 | -0,0058 | |||||

| US040114HX11 / Argentine Republic Government International Bond | 0,07 | 7,46 | 0,0774 | 0,0015 | |||||

| US46630PAA30 / JP MORGAN MORTGAGE TRUST JPMMT 2007 A2 1A1 | 0,07 | -2,74 | 0,0759 | -0,0069 | |||||

| US38381BGP31 / Government National Mortgage Association | 0,07 | 2,94 | 0,0754 | -0,0010 | |||||

| US75115AAB70 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2006 QS8 A2 | 0,07 | -2,78 | 0,0749 | -0,0070 | |||||

| DE000A19YDA9 / CORESTATE CAPITAL HOLD SR UNSECURED REGS 04/23 3.5 | 0,07 | 9,38 | 0,0745 | 0,0023 | |||||

| US83743YAA10 / SOUTH COAST FUNDING SCF 7A A1AV 144A | 0,07 | 1,47 | 0,0737 | -0,0032 | |||||

| US86359LRW18 / STRUCTURED ASSET MORTGAGE INVE SAMI 2005 AR8 A1A | 0,07 | -2,86 | 0,0728 | -0,0061 | |||||

| US31418CU779 / FANNIE MAE 3.50% 03/01/2048 FNMA | 0,07 | -2,90 | 0,0720 | -0,0056 | |||||

| US058928AF91 / BANC OF AMERICA FUNDING CORPOR BAFC 2006 B 3A1 | 0,07 | 0,00 | 0,0708 | -0,0035 | |||||

| XS1710468239 / ADAGIO CLO ADAGI VI A SUB 144A | 0,07 | -15,38 | 0,0704 | -0,0174 | |||||

| US126380AC82 / CREDIT SUISSE MORTGAGE TRUST CSMC 2006 9 3A1 | 0,06 | -1,54 | 0,0685 | -0,0049 | |||||

| US05946XHW65 / BANC OF AMERICA FUNDING CORPOR BAFC 2004 B 1A2 | 0,06 | 1,59 | 0,0683 | -0,0035 | |||||

| US14983CAA36 / CBA COMMERCIAL SMALL BALANCE C CBAC 2006 2A A 144A | 0,06 | -9,09 | 0,0645 | -0,0100 | |||||

| US07386HQX25 / BEAR STEARNS ALT A TRUST BALTA 2005 2 2A2A | 0,06 | 1,75 | 0,0621 | -0,0026 | |||||

| US40431LAB45 / HSI ASSET LOAN OBLIGATION HALO 2007 AR1 2A1 | 0,06 | -1,72 | 0,0613 | -0,0041 | |||||

| US12667G5Y54 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 43 4A3 | 0,06 | 3,64 | 0,0610 | -0,0014 | |||||

| USL26915AA33 / FORESEA Holding SA | 0,06 | -1,75 | 0,0598 | -0,0044 | |||||

| RFRF USD SF+26.161/1.00 9/16/23-7Y* CME / DIR (EZ4FYS5F94M8) | 0,05 | -8,47 | 0,0581 | -0,0092 | |||||

| US31397LLL17 / FANNIE MAE FNR 2008 41 S | 0,05 | -3,64 | 0,0573 | -0,0047 | |||||

| US07388DAS71 / BEAR STEARNS ADJUSTABLE RATE M BSARM 2006 2 3A2 | 0,05 | 0,00 | 0,0545 | -0,0036 | |||||

| RFRF USD SF+26.161/1.7* 7/15/23-7Y* CME / DIR (EZMBPFMCJ2B0) | 0,05 | -18,33 | 0,0529 | -0,0154 | |||||

| US68384CAC01 / OPTEUM MORTGAGE ACCEPTANCE COR OPMAC 2006 2 A1C | 0,05 | -2,00 | 0,0528 | -0,0042 | |||||

| US61755CAA09 / MORGAN STANLEY CAPITAL INC MSAC 2007 HE6 A1 | 0,05 | -2,00 | 0,0523 | -0,0038 | |||||

| US14986DAJ90 / CD COMMERCIAL MORTGAGE TRUST CD 2006 CD3 AJ | 0,05 | -2,04 | 0,0516 | -0,0042 | |||||

| US17311WAD92 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2007 AR4 2A1A | 0,05 | -2,13 | 0,0495 | -0,0035 | |||||

| US126694BE72 / COUNTRYWIDE HOME LOANS CWHL 2005 HYB6 1A1 | 0,05 | -15,09 | 0,0485 | -0,0116 | |||||

| SOFTBANK VISION FUND II TRANCHE B2 TERM LOAN / LON (BA000KP70) | 0,05 | 0,0483 | 0,0483 | ||||||

| US76110HH857 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2004 QA6 NB4 | 0,05 | -2,17 | 0,0482 | -0,0039 | |||||

| US02149DAN93 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 HY13 4A1 | 0,04 | -2,22 | 0,0478 | -0,0029 | |||||

| US576433SV90 / MASTR ADJUSTABLE RATE MORTGAGE MARM 2004 10 2A1 | 0,04 | -2,22 | 0,0476 | -0,0036 | |||||

| US36242DH559 / GSR MORTGAGE LOAN TRUST GSR 2005 AR2 1A2 | 0,04 | 0,00 | 0,0475 | -0,0022 | |||||

| S+P EMINI 3RD WK JUL25P 5775 EXP 07/18/2025 / DE (000000000) | 0,04 | 0,0439 | 0,0439 | ||||||

| IHRT / iHeartMedia, Inc. | 0,02 | 0,00 | 0,04 | 8,11 | 0,0429 | 0,0005 | |||

| US83611DAA63 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2006 NLC1 A1 144A | 0,04 | -2,50 | 0,0425 | -0,0032 | |||||

| XAN5200EAB73 / Lealand Finance Company BV, Term Loan | 0,04 | 22,58 | 0,0411 | 0,0054 | |||||

| US17311FAB04 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2007 OPX1 A1B | 0,04 | -2,63 | 0,0401 | -0,0027 | |||||

| US12669GKG54 / COUNTRYWIDE HOME LOANS CWHL 2004 25 2A2 | 0,04 | 0,00 | 0,0395 | -0,0024 | |||||

| US07386HYE51 / BEAR STEARNS ALT A TRUST BALTA 2005 9 24A1 | 0,04 | 0,00 | 0,0394 | -0,0024 | |||||

| RFR USD SOFR/3.50000 12/20/23-10Y LCH / DIR (EZ4G8FZQ8LF2) | 0,04 | -220,00 | 0,0393 | 0,0738 | |||||

| RFR USD SOFR/3.50000 12/20/23-10Y LCH / DIR (EZ4G8FZQ8LF2) | 0,04 | -220,00 | 0,0393 | 0,0738 | |||||

| DATABRICKS INC DELAYED DRAW TERM LOAN / LON (BA000D1C1) | 0,04 | 0,00 | 0,0389 | -0,0021 | |||||

| US93364FAL58 / WAMU MORTGAGE PASS THROUGH CER WAMU 2007 HY7 4A1 | 0,04 | 0,00 | 0,0385 | -0,0028 | |||||

| OIS CAD CAONREPO/3.5000 06/19/24-10Y LCH / DIR (EZ7B7Z9XML74) | 0,03 | -27,66 | 0,0371 | -0,0164 | |||||

| RFRF USD SF+26.161/2.00 9/10/23-6Y* CME / DIR (EZ2FT1HSMJX3) | 0,03 | -22,73 | 0,0370 | -0,0127 | |||||

| US07386HVS74 / BEAR STEARNS ALT A TRUST BALTA 2005 7 22A1 | 0,03 | -3,12 | 0,0333 | -0,0032 | |||||

| SPRUCE BIDCO II INC REVOLVER / LON (BA000FL00) | 0,03 | -3,33 | 0,0319 | -0,0020 | |||||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 0,03 | -3,45 | 0,0308 | -0,0020 | |||||

| IHRTB / iHeartMedia, Inc. | 0,02 | 0,00 | 0,03 | 8,00 | 0,0294 | 0,0003 | |||

| US31396XUR33 / FANNIE MAE FNR 2007 88 JI | 0,03 | -3,57 | 0,0294 | -0,0022 | |||||

| US2620511053 / Drillco Holdings Luxembourg SA | 0,00 | 0,00 | 0,03 | -18,18 | 0,0293 | -0,0087 | |||

| US31397BA506 / FREDDIE MAC FHR 3211 SH | 0,03 | -3,85 | 0,0276 | -0,0021 | |||||

| US93934XAB91 / WASHINGTON MUTUAL ASSET BACKED WMABS 2006 HE5 2A1 | 0,03 | 0,00 | 0,0269 | -0,0020 | |||||

| US126673FK34 / COUNTRYWIDE ASSET BACKED CERTI CWL 2004 SD3 A2 144A | 0,02 | 0,00 | 0,0261 | -0,0013 | |||||

| 952NPK908 / CREDIT SUISSE GROUP AG COCO JRSUB 144A | 0,02 | 0,00 | 0,0255 | -0,0014 | |||||

| ESKOM GG LOAN SNR EM SP DUB / DCR (000000000) | 0,02 | 0,0252 | 0,0252 | ||||||

| US144528AC05 / CARRINGTON MORTGAGE LOAN TRUST CARR 2006 NC3 A3 | 0,02 | -8,33 | 0,0244 | -0,0026 | |||||

| US41161PHE60 / HARBORVIEW MORTGAGE LOAN TRUST HVMLT 2004 8 3A1 | 0,02 | 0,00 | 0,0242 | -0,0013 | |||||

| US12667FRD95 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2004 18CB 5A2 | 0,02 | -4,55 | 0,0234 | -0,0020 | |||||

| NDDUEAFE TRS EQUITY FEDL01+10 JPM / DE (000000000) | 0,02 | 0,0232 | 0,0232 | ||||||

| US31397FM742 / FREDDIE MAC FHR 3284 NI | 0,02 | 0,00 | 0,0224 | -0,0017 | |||||

| US31393CY313 / FANNIEMAE WHOLE LOAN FNW 2003 W8 PT1 | 0,02 | -4,55 | 0,0224 | -0,0025 | |||||

| US16678RBV87 / CHEVY CHASE MORTGAGE FUNDING C CCMFC 2004 3A A2 144A | 0,02 | -5,00 | 0,0211 | -0,0015 | |||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,02 | 0,0210 | 0,0210 | ||||||

| DUN + BRADSTREET CORPOR THE 2025 REVOLVER / LON (BA000K747) | 0,02 | 0,0198 | 0,0198 | ||||||

| RFR USD SOFR/3.75000 06/20/24-10Y LCH / DIR (EZ52H44WTW83) | 0,02 | -700,00 | 0,0192 | 0,0233 | |||||

| RFR USD SOFR/3.75000 06/20/24-10Y LCH / DIR (EZ52H44WTW83) | 0,02 | -700,00 | 0,0192 | 0,0233 | |||||

| SPRUCE BIDCO II INC JPY TERM LOAN / LON (BA000FPQ9) | 0,02 | 0,00 | 0,0190 | -0,0004 | |||||

| SPRUCE BIDCO II INC CAD TERM LOAN / LON (BA000FPR7) | 0,02 | 6,25 | 0,0188 | -0,0001 | |||||

| US863579WZ70 / STRUCTURED ADJUSTABLE RATE MOR SARM 2005 18 1A1 | 0,02 | 0,00 | 0,0186 | -0,0011 | |||||

| US023138AA88 / Ambac Assurance Corp | 0,02 | -5,88 | 0,0181 | -0,0013 | |||||

| US23244GAE26 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 OA18 A2 | 0,02 | -15,79 | 0,0179 | -0,0037 | |||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,02 | 0,0179 | 0,0179 | ||||||

| US126694BQ03 / COUNTRYWIDE HOME LOANS CWHL 2005 HYB6 4A1B | 0,01 | -22,22 | 0,0154 | -0,0051 | |||||

| US855541AA68 / SUNTRUST ADJUSTABLE RATE MORTG STARM 2007 S1 1A | 0,01 | 0,00 | 0,0152 | -0,0012 | |||||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0139 | 0,0139 | ||||||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0139 | 0,0139 | ||||||

| US52524PAL67 / LEHMAN XS TRUST LXS 2007 6 3A5 | 0,01 | -7,14 | 0,0139 | -0,0019 | |||||

| US922646AS37 / Venezuela Government International Bond | 0,01 | -7,69 | 0,0134 | -0,0012 | |||||

| US3136B62S11 / Fannie Mae REMICS | 0,01 | 0,00 | 0,0131 | -0,0004 | |||||

| USL269151134 / DRILLCO HLDG LUX SA | 0,00 | 0,00 | 0,01 | -21,43 | 0,0126 | -0,0037 | |||

| CCAPGR / CORESTATE CAPITAL HOLD SR UNSECURED REGS 11/22 1.375 | 0,01 | 10,00 | 0,0124 | 0,0004 | |||||

| US31397BJY83 / FREDDIE MAC FHR 3218 SA | 0,01 | 0,00 | 0,0123 | -0,0009 | |||||

| US31396YAW21 / FANNIE MAE FNR 2007 117 SG | 0,01 | 0,00 | 0,0120 | -0,0009 | |||||

| 3 MONTH SOFR FUT JUN25 XCME 20250916 / DIR (000000000) | 0,01 | 0,0116 | 0,0116 | ||||||

| US466247B280 / JP MORGAN MORTGAGE TRUST JPMMT 2005 S3 1A21 | 0,01 | 0,00 | 0,0112 | -0,0008 | |||||

| US31396PMQ18 / FANNIE MAE FNR 2007 4 SL | 0,01 | 0,00 | 0,0102 | -0,0009 | |||||

| US31396XY734 / FANNIE MAE FNR 2007 109 AI | 0,01 | 0,00 | 0,0102 | -0,0008 | |||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0096 | 0,0096 | ||||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0096 | 0,0096 | ||||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0096 | 0,0096 | ||||||

| US31396PWK38 / FANNIE MAE FNR 2007 15 AI | 0,01 | -11,11 | 0,0095 | -0,0007 | |||||

| 935ZXN908 / WESTMORELAND MINING HOLDINGS L COMMON | 0,01 | 0,00 | 0,01 | -38,46 | 0,0087 | -0,0069 | |||

| US31396PT920 / FANNIE MAE FNR 2007 22 SW | 0,01 | -12,50 | 0,0085 | -0,0006 | |||||

| US31398FR459 / FANNIE MAE FNR 2009 87 HS | 0,01 | 0,00 | 0,0084 | -0,0006 | |||||

| NDDUEAFE TRS EQUITY SOFR+26.5 ULO / DE (000000000) | 0,01 | 0,0074 | 0,0074 | ||||||

| US126694BS68 / COUNTRYWIDE HOME LOANS CWHL 2005 HYB6 5A1 | 0,01 | -14,29 | 0,0074 | -0,0005 | |||||

| NDDUEAFE TRS EQUITY SOFR+19 ULO / DE (000000000) | 0,01 | 0,0073 | 0,0073 | ||||||

| BOUGHT TRY SOLD USD 20250701 / DFE (000000000) | 0,01 | 0,0073 | 0,0073 | ||||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0072 | 0,0072 | ||||||

| THAMES SSNM 144A UNFUNDED COMM / DBT (955RVLII8) | 0,01 | 0,0069 | 0,0069 | ||||||

| US12668BFE83 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 86CB A5 | 0,01 | 0,00 | 0,0067 | -0,0005 | |||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0066 | 0,0066 | ||||||

| RFR USD SOFR/2.30000 01/17/24-2Y LCH / DIR (EZ7DPVG1XS64) | 0,01 | 0,00 | 0,0063 | 0,0002 | |||||

| US12669GR371 / COUNTRYWIDE HOME LOANS CWHL 2005 15 A7 | 0,01 | 0,00 | 0,0059 | -0,0004 | |||||

| NDDUEAFE TRS EQUITY FEDL01+35 GST / DE (000000000) | 0,01 | 0,0055 | 0,0055 | ||||||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0051 | 0,0051 | ||||||

| 3 MONTH SOFR FUT SEP25 XCME 20251216 / DIR (000000000) | 0,00 | 0,0050 | 0,0050 | ||||||

| XAN5200EAC56 / McDermott Technology Americas Inc 2020 Make Whole Term Loan | 0,00 | 33,33 | 0,0050 | 0,0007 | |||||

| BOUGHT TRY SOLD USD 20250813 / DFE (000000000) | 0,00 | 0,0046 | 0,0046 | ||||||

| THAMES WATER SUPER SEN SR SECURED 144A 10/27 9.75 / DBT (XS3017976054) | 0,00 | 0,0042 | 0,0042 | ||||||

| 3 MONTH SOFR FUT DEC25 XCME 20260317 / DIR (000000000) | 0,00 | 0,0041 | 0,0041 | ||||||

| US41161PJ380 / HarborView Mortgage Loan Trust 2006-2 | 0,00 | 0,00 | 0,0041 | -0,0003 | |||||

| THAMES WATER SUPER SEN SR SECURED 144A 10/27 9.75 / DBT (XS3060649830) | 0,00 | 0,0038 | 0,0038 | ||||||

| US31396WFM38 / FANNIE MAE FNR 2007 54 NI | 0,00 | 0,00 | 0,0038 | -0,0002 | |||||

| US42815KAA07 / HESTIA RE LTD UNSECURED 144A 04/25 VAR | 0,00 | -98,73 | 0,0034 | -0,2619 | |||||

| 3 MONTH SOFR FUT MAR26 XCME 20260616 / DIR (000000000) | 0,00 | 0,0033 | 0,0033 | ||||||

| US83743YAB92 / SOUTH COAST FUNDING SCF 7A A1B 144A | 0,00 | 0,00 | 0,0030 | -0,0001 | |||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0029 | 0,0029 | ||||||

| US41161PCX96 / HARBORVIEW MORTGAGE LOAN TRUST HVMLT 2004 1 1A | 0,00 | 0,00 | 0,0024 | -0,0002 | |||||

| BOUGHT TRY SOLD USD 20250807 / DFE (000000000) | 0,00 | 0,0023 | 0,0023 | ||||||

| MNSH / MNSN Holdings Inc. | 0,00 | 0,00 | 0,00 | 0,00 | 0,0022 | -0,0004 | |||

| BOUGHT TRY SOLD USD 20250808 / DFE (000000000) | 0,00 | 0,0021 | 0,0021 | ||||||

| US 10YR NOTE (CBT)SEP25 XCBT 20250919 / DIR (000000000) | 0,00 | 0,0021 | 0,0021 | ||||||

| SOLD HKD BOUGHT USD 20250716 / DFE (000000000) | 0,00 | 0,0018 | 0,0018 | ||||||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0,00 | 0,0017 | 0,0017 | ||||||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0016 | 0,0016 | ||||||

| US45660LEG05 / INDYMAC INDX MORTGAGE LOAN TRU INDX 2005 AR4 2A1A | 0,00 | 0,00 | 0,0015 | -0,0001 | |||||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0013 | 0,0013 | ||||||

| BOUGHT TRY SOLD USD 20250709 / DFE (000000000) | 0,00 | 0,0011 | 0,0011 | ||||||

| US41161UAJ16 / HARBORVIEW MORTGAGE LOAN TRUST HVMLT 2006 6 5A1A | 0,00 | 0,0009 | -0,0001 | ||||||

| THAMES WATER UTIL LTD SR SECURED 144A 03/27 0.00000 / DBT (XS3002255787) | 0,00 | 0,0009 | 0,0000 | ||||||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0009 | 0,0009 | ||||||

| BOUGHT TRY SOLD USD 20250818 / DFE (000000000) | 0,00 | 0,0008 | 0,0008 | ||||||

| US30162RAD35 / Exela Intermediate LLC/Exela Finance, Inc. | 0,00 | -100,00 | 0,0008 | -0,0017 | |||||

| US16678RAJ68 / CHEVY CHASE MORTGAGE FUNDING C CCMFC 2003 4A A1 144A | 0,00 | 0,0008 | -0,0001 | ||||||

| SOLD DOP BOUGHT USD 20251120 / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | ||||||

| SOLD DOP BOUGHT USD 20251120 / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | ||||||

| US05950GAQ64 / BANC OF AMERICA MORTGAGE SECUR BOAMS 2006 2 A15 | 0,00 | 0,0005 | -0,0000 | ||||||

| SOLD DOP BOUGHT USD 20250922 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | ||||||

| LU2445093987 / INTELSAT EMERGENCE SA CALL EXP17FEB27 | 0,00 | 0,0005 | -0,0000 | ||||||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | ||||||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | ||||||

| US57109H1023 / MARLETTE FUNDING TRUST MFT 2019 2A CERT 144A | 0,00 | -100,00 | 0,0003 | -0,0017 | |||||

| LBMLT 2003-3 M3 SP BOA / DCR (000000000) | 0,00 | 0,0002 | 0,0002 | ||||||

| BOUGHT TRY SOLD USD 20250811 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | ||||||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| SOLD DOP BOUGHT USD 20250711 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| US57109G1040 / MARLETTE FUNDING TRUST MFT 2018 4A CERT 144A | 0,00 | 0,0001 | -0,0005 | ||||||

| BOUGHT TRY SOLD USD 20250728 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| BOUGHT GBP SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| SOLD DOP BOUGHT USD 20250807 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| US31394VED82 / FANNIE MAE FNR 2005 122 SG | 0,00 | 0,0001 | -0,0001 | ||||||

| SOLD DOP BOUGHT USD 20250811 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| BOUGHT TRY SOLD USD 20250814 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| SOLD DOP BOUGHT USD 20250905 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| LU2445094365 / INTELSAT EMERGENCE SA | 0,00 | 0,0000 | -0,0000 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| US31359KGH41 / FANNIEMAE WHOLE LOAN FNW 1996 W2 A7 | 0,00 | 0,0000 | -0,0000 | ||||||

| 932BTZ902 / SIERRA HAMILTON HOLDER LLC | 0,10 | 0,00 | 0,00 | 0,0000 | -0,0000 | ||||

| MNSH / MNSN Holdings Inc. | 0,00 | 0,00 | 0,00 | 0,0000 | -0,0000 | ||||

| 948ECV905 / STEINHOFF CVR | 4,16 | 0,00 | 0,00 | 0,0000 | 0,0000 | ||||

| SOLD DOP BOUGHT USD 20250728 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| US57109X1072 / MARLETTE FUNDING TRUST MFT 2019 1A CERT 144A | 0,00 | 0,0000 | 0,0000 | ||||||

| US92918XAA37 / Voyager Aviation Holdings LLC | 0,00 | 0,0000 | 0,0000 | ||||||

| ADJ / Adler Group S.A. | 0,17 | 0,00 | 0,00 | 0,0000 | 0,0000 | ||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | ||||||

| SOLD GBP BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | ||||||

| SOLD TRY BOUGHT USD 20250709 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | ||||||

| SOLD AUD BOUGHT USD 20250805 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | ||||||

| SOLD TRY BOUGHT USD 20250808 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | ||||||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | ||||||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | ||||||

| SOLD CAD BOUGHT USD 20250805 / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | ||||||

| RFR USD SOFR/3.00000 06/21/23-10Y LCH / DIR (EZVCRM3XZB08) | -0,00 | -100,00 | -0,0004 | 0,0018 | |||||

| RFR USD SOFR/3.00000 06/21/23-10Y LCH / DIR (EZVCRM3XZB08) | -0,00 | -100,00 | -0,0004 | 0,0018 | |||||

| SOLD TRY BOUGHT USD 20250707 / DFE (000000000) | -0,00 | -0,0009 | -0,0009 | ||||||

| ZCS BRL 11.7 03/24/22-01/04/27 CME / DIR (EZQDNC1L61Z9) | -0,00 | -100,00 | -0,0009 | 0,0067 | |||||

| ZCS BRL 11.7 03/24/22-01/04/27 CME / DIR (EZQDNC1L61Z9) | -0,00 | -100,00 | -0,0009 | 0,0067 | |||||

| ZCS BRL 11.26 03/25/22-01/04/27 CME / DIR (EZTGJMP2L6K1) | -0,00 | 0,00 | -0,0012 | 0,0002 | |||||

| ZCS BRL 11.26 03/25/22-01/04/27 CME / DIR (EZTGJMP2L6K1) | -0,00 | 0,00 | -0,0012 | 0,0002 | |||||

| ZCS BRL 11.245 03/25/22-01/04/27 CME / DIR (EZTGJMP2L6K1) | -0,00 | 0,00 | -0,0012 | 0,0001 | |||||

| SOLD TRY BOUGHT USD 20250724 / DFE (000000000) | -0,00 | -0,0013 | -0,0013 | ||||||

| SOLD CHF BOUGHT USD 20250804 / DFE (000000000) | -0,00 | -0,0013 | -0,0013 | ||||||

| SOLD DOP BOUGHT USD 20250822 / DFE (000000000) | -0,00 | -0,0016 | -0,0016 | ||||||

| SOLD BRL BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0017 | -0,0017 | ||||||

| SOFTBANK GROUP CORP SNR JP SP GST / DCR (EZ1K1NTX2WN0) | -0,00 | 100,00 | -0,0023 | -0,0003 | |||||

| SOLD DOP BOUGHT USD 20250828 / DFE (000000000) | -0,00 | -0,0031 | -0,0031 | ||||||

| SOLD DOP BOUGHT USD 20250828 / DFE (000000000) | -0,00 | -0,0031 | -0,0031 | ||||||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0034 | -0,0034 | ||||||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0,00 | -0,0037 | -0,0037 | ||||||

| SOLD DOP BOUGHT USD 20250908 / DFE (000000000) | -0,00 | -0,0043 | -0,0043 | ||||||

| SOLD CHF BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0053 | -0,0053 | ||||||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0,01 | -0,0056 | -0,0056 | ||||||

| ZCS BRL 11.87 03/22/22-01/04/27 CME / DIR (EZQDNC1L61Z9) | -0,01 | -16,67 | -0,0062 | 0,0014 | |||||

| ABX.HE.PENAAA.07-1 SP GST / DCR (000000000) | -0,01 | -0,0090 | -0,0090 | ||||||

| PETROLEOS MEXICANOS (PEMEX) LA SP MYC / DCR (EZPSV8B3JWB3) | -0,01 | -20,00 | -0,0091 | 0,0027 | |||||

| SOLD GBP BOUGHT USD 20250804 / DFE (000000000) | -0,01 | -0,0139 | -0,0139 | ||||||

| SOLD DOP BOUGHT USD 20250818 / DFE (000000000) | -0,01 | -0,0156 | -0,0156 | ||||||

| OIS CAD CAONREPO/3.5000 06/20/14-30Y CME / DIR (000000000) | -0,01 | -0,0157 | -0,0157 | ||||||

| RFR USD SOFR/3.75000 06/20/24-5Y CME / DIR (EZN00HJGN4H7) | -0,02 | -350,00 | -0,0166 | -0,0234 | |||||

| SOLD EUR BOUGHT USD 20250804 / DFE (000000000) | -0,02 | -0,0179 | -0,0179 | ||||||

| SOLD EUR BOUGHT USD 20250804 / DFE (000000000) | -0,02 | -0,0179 | -0,0179 | ||||||

| RFR GBP SONIO/3.50000 03/19/25-5Y LCH / DIR (EZ4P0PH8GZ40) | -0,02 | -59,09 | -0,0197 | 0,0302 | |||||

| RFR USD SOFR/1.75000 06/15/22-7Y CME / DIR (EZ2KYVSDFJC8) | -0,02 | -39,39 | -0,0223 | 0,0154 | |||||

| SOLD GBP BOUGHT USD 20250702 / DFE (000000000) | -0,02 | -0,0253 | -0,0253 | ||||||

| RFR USD SOFR/1.75000 06/15/22-10Y LCH / DIR (EZQ6DKJXZ1C9) | -0,02 | -25,00 | -0,0259 | 0,0107 | |||||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0,04 | -0,0408 | -0,0408 | ||||||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0,04 | -0,0408 | -0,0408 | ||||||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0,04 | -0,0408 | -0,0408 | ||||||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0,04 | -0,0459 | -0,0459 | ||||||

| ABX.HE.AA.06-1 SP GST / DCR (000000000) | -0,05 | -0,0504 | -0,0504 | ||||||

| RFR USD SOFR/3.25000 06/18/25-5Y LCH / DIR (EZH1N8KH2K02) | -0,07 | -0,0718 | -0,0718 | ||||||

| REVERSE REPO SOCIETE GENERALE REVERSE REPO / RA (000000000) | -0,08 | -0,0836 | -0,0836 | ||||||

| REVERSE REPO PARIBAS / RA (000000000) | -0,13 | -0,1401 | -0,1401 | ||||||

| REVERSE REPO WARBURG REVERSE REPO / RA (000000000) | -0,19 | -0,2045 | -0,2045 | ||||||

| IRS EUR 0.25000 03/18/20-30Y LCH / DIR (EZJ3VB4GTK33) | -0,22 | 14,14 | -0,2321 | -0,0166 | |||||

| REVERSE REPO PARIBAS / RA (000000000) | -0,25 | -0,2678 | -0,2678 | ||||||

| REVERSE REPO PARIBAS / RA (000000000) | -0,25 | -0,2678 | -0,2678 | ||||||

| REVERSE REPO CREDIT AGRICOLE 03/14 VAR / RA (000000000) | -0,27 | -0,2882 | -0,2882 | ||||||

| REVERSE REPO CREDIT AGRICOLE 03/14 VAR / RA (000000000) | -0,27 | -0,2882 | -0,2882 | ||||||

| REVERSE REPO CREDIT AGRICOLE 03/14 VAR / RA (000000000) | -0,27 | -0,2882 | -0,2882 | ||||||

| REVERSE REPO DEUTSCHE REVERSE REPO / RA (000000000) | -0,33 | -0,3480 | -0,3480 | ||||||

| RFRF USD SF+26.161/0.7* 9/16/23-8Y* CME / DIR (EZCQ8PB28P30) | -0,36 | -8,12 | -0,3854 | 0,0570 | |||||

| RFRF USD SF+26.161/3.00 9/19/23-25Y* CME / DIR (EZBCL1HHZD83) | -0,37 | 11,89 | -0,3907 | -0,0217 | |||||

| IRS EUR 0.65000 02/26/19-10Y LCH / DIR (EZW669NQ6VK5) | -0,42 | 0,24 | -0,4494 | 0,0238 | |||||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0,47 | -0,5045 | -0,5045 | ||||||

| REVERSE REPO BANK OF NEW YORK / RA (000000000) | -0,48 | -0,5069 | -0,5069 | ||||||

| IRS EUR 0.50000 06/17/20-30Y LCH / DIR (EZHGNJ694Q00) | -0,49 | 11,93 | -0,5194 | -0,0298 | |||||

| REVERSE REPO DEUTSCHE REVERSE REPO / RA (000000000) | -0,50 | -0,5302 | -0,5302 | ||||||

| REVERSE REPO THE BANK OF NOVA REVERSE REPO / RA (000000000) | -0,53 | -0,5622 | -0,5622 | ||||||

| REVERSE REPO TORONTO DOMINIO / RA (000000000) | -0,59 | -0,6269 | -0,6269 | ||||||

| REVERSE REPO TORONTO DOMINIO / RA (000000000) | -0,59 | -0,6269 | -0,6269 | ||||||

| US01F0206874 / UMBS TBA 30YR 2% AUG 20 TO BE ANNOUNCED 2.00000000 | -0,63 | 1,12 | -0,6743 | 0,0608 | |||||

| REVERSE REPO BARCLAYS REVERSE REPO / RA (000000000) | -0,86 | -0,9148 | -0,9148 | ||||||

| REVERSE REPO BARCLAYS REVERSE REPO / RA (000000000) | -0,86 | -0,9148 | -0,9148 | ||||||

| REVERSE REPO DEUTSCHE REVERSE REPO / RA (000000000) | -0,86 | -0,9150 | -0,9150 | ||||||

| REVERSE REPO PARIBAS / RA (000000000) | -0,87 | -0,9270 | -0,9270 | ||||||

| HSBC REVERSE REPO EUR ZCP / RA (000000000) | -0,89 | -0,9441 | -0,9441 | ||||||

| REVERSE REPO TORONTO DOMINIO / RA (000000000) | -0,90 | -0,9556 | -0,9556 | ||||||

| REVERSE REPO JPM CHASE / RA (000000000) | -0,95 | -1,0076 | -1,0076 | ||||||

| REVERSE REPO JPM CHASE / RA (000000000) | -0,95 | -1,0076 | -1,0076 | ||||||

| S+P EMINI 3RD WK JUL25C 6075 EXP 07/18/2025 / DE (000000000) | -1,48 | -1,5786 | -1,5786 | ||||||

| REVERSE REPO GOLDMAN / RA (000000000) | -1,56 | -1,6556 | -1,6556 | ||||||

| REVERSE REPO THE BANK OF NOVA REVERSE REPO / RA (000000000) | -3,13 | -3,3291 | -3,3291 |