Statistiche di base

| Valore del portafoglio | $ 332.332.364 |

| Posizioni attuali | 873 |

Ultime partecipazioni, performance, AUM (da depositi 13F, 13D)

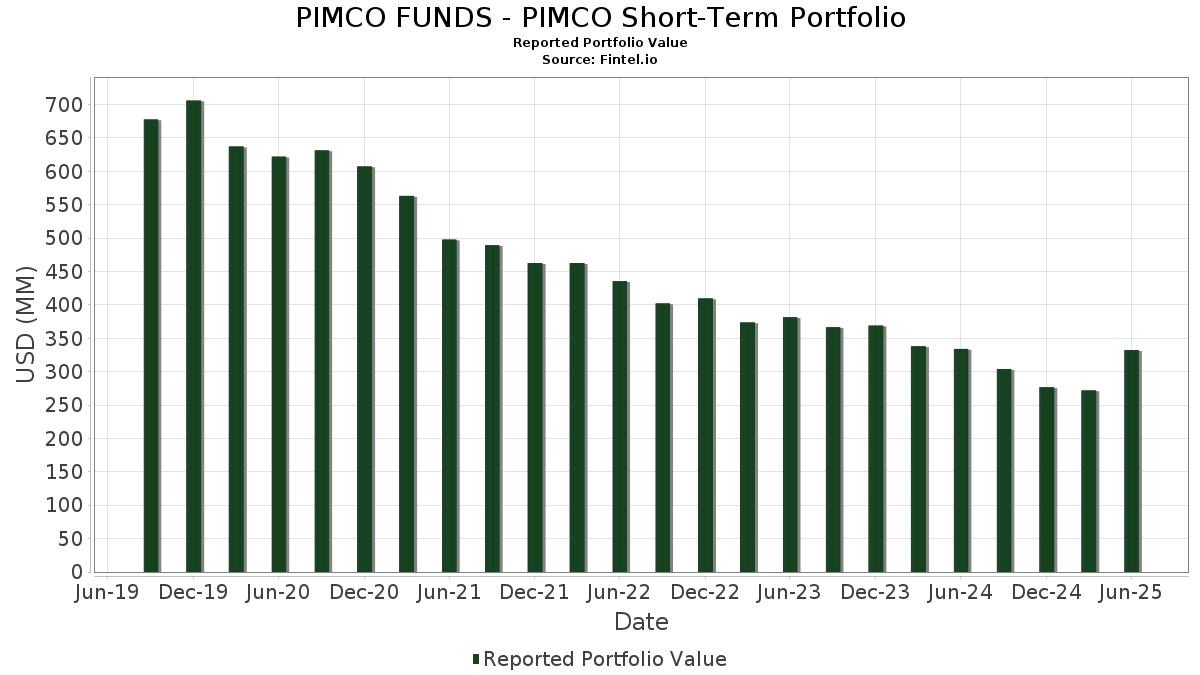

PIMCO FUNDS - PIMCO Short-Term Portfolio ha dichiarato un totale di 873 partecipazioni negli ultimi documenti depositati presso la SEC. Il valore più recente del portafoglio è pari a $ 332.332.364 USD. Il patrimonio gestito effettivo (AUM) corrisponde a questo valore più la liquidità (che non viene dichiarata). Le principali partecipazioni di PIMCO FUNDS - PIMCO Short-Term Portfolio sono Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , Uniform Mortgage-Backed Security, TBA (US:US01F0626899) , PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , Ginnie Mae (US:US21H0426799) , and UMBS 15YR TBA(REG B) 3.0 UMBS TBA 07-01-35 (US:US01F0304703) . Le nuove posizioni di PIMCO FUNDS - PIMCO Short-Term Portfolio includono Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , Uniform Mortgage-Backed Security, TBA (US:US01F0626899) , PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , Ginnie Mae (US:US21H0426799) , and UMBS 15YR TBA(REG B) 3.0 UMBS TBA 07-01-35 (US:US01F0304703) .

Gli aumenti più importanti di questo trimestre

Utilizziamo la variazione dell'allocazione del portafoglio perché è l'indicatore più significativo. Le variazioni possono essere dovute a transazioni o a variazioni dei prezzi delle azioni.

| Titolo | Azioni (in milioni) |

Valore (in milioni di $) |

Portafoglio % | ΔPortafoglio % |

|---|---|---|---|---|

| 3,73 | 2,1168 | 4,3565 | ||

| 27,82 | 15,7961 | 3,5589 | ||

| 6,06 | 3,4399 | 3,4399 | ||

| 14,36 | 8,1541 | 3,0254 | ||

| 16,39 | 9,3091 | 2,9692 | ||

| 6,56 | 3,7264 | 1,2873 | ||

| 1,61 | 0,9129 | 0,9129 | ||

| 1,61 | 0,9129 | 0,9129 | ||

| 1,50 | 0,8541 | 0,8541 | ||

| 1,50 | 0,8541 | 0,8541 |

Gli aumenti più importanti di questo trimestre

Utilizziamo la variazione dell'allocazione del portafoglio perché è l'indicatore più significativo. Le variazioni possono essere dovute a transazioni o a variazioni dei prezzi delle azioni.

| Titolo | Azioni (in milioni) |

Valore (in milioni di $) |

Portafoglio % | ΔPortafoglio % |

|---|---|---|---|---|

| -0,37 | -0,2112 | -15,0253 | ||

| -0,10 | -0,0543 | -4,8147 | ||

| -1,94 | -1,0989 | -2,5353 | ||

| 0,58 | 0,3297 | -1,3968 | ||

| -1,19 | -0,6766 | -0,6766 | ||

| -1,19 | -0,6766 | -0,6766 | ||

| 3,46 | 1,9657 | -0,3261 | ||

| 3,46 | 1,9657 | -0,3261 | ||

| -5,31 | -3,0137 | -0,3116 | ||

| -0,39 | -0,2228 | -0,2228 |

13F e depositi di fondi

Questo modulo è stato depositato il 2025-08-28 per il periodo di riferimento 2025-06-30. Questo investitore non ha divulgato titoli conteggiati in azioni, pertanto le colonne relative alle azioni nella tabella seguente sono state omesse. Fai clic sull'icona del link per visualizzare la cronologia completa delle transazioni.

Esegui l'upgrade per sbloccare i dati premium ed esportarli in Excel ![]() .

.

| Titolo | Tipo | ΔAzioni (%) |

Valore (in milioni di $) |

Portafoglio (%) |

ΔPortafoglio (%) |

|

|---|---|---|---|---|---|---|

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | 27,82 | 17,09 | 15,7961 | 3,5589 | ||

| US01F0626899 / Uniform Mortgage-Backed Security, TBA | 16,39 | 33,20 | 9,3091 | 2,9692 | ||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 14,36 | 62,08 | 8,1541 | 3,0254 | ||

| US21H0426799 / Ginnie Mae | 12,92 | -2,90 | 7,3387 | 0,4827 | ||

| US01F0304703 / UMBS 15YR TBA(REG B) 3.0 UMBS TBA 07-01-35 | 12,49 | 3,08 | 7,0936 | 0,8511 | ||

| US01F0526800 / Uniform Mortgage-Backed Security, TBA | 12,19 | -4,92 | 6,9211 | 0,3176 | ||

| US01F0506844 / UMBS TBA | 6,56 | 38,59 | 3,7264 | 1,2873 | ||

| US01F0306781 / UMBS TBA | 6,06 | 3,4399 | 3,4399 | |||

| RFR USD SOFR/1.75000 06/15/22-30Y LCH / DIR (EZ2TNCR649W7) | 4,98 | -2,58 | 2,8258 | -0,1311 | ||

| RFR USD SOFR/1.75000 06/15/22-30Y LCH / DIR (EZ2TNCR649W7) | 4,98 | -2,58 | 2,8258 | -0,1311 | ||

| TCW LTD TCW 2024 1A A1 144A / ABS-CBDO (US87252MAC73) | 4,01 | 0,02 | 2,2752 | -0,0432 | ||

| TCW LTD TCW 2024 1A A1 144A / ABS-CBDO (US87252MAC73) | 4,01 | 0,02 | 2,2752 | -0,0432 | ||

| US912810QZ49 / United States Treas Bds Bond | 3,81 | -2,01 | 2,1607 | -0,0875 | ||

| US21H0326700 / GNMA2 30YR TBA(REG C) 3.5 TBA 07-01-50 | 3,73 | -177,65 | 2,1168 | 4,3565 | ||

| RFRF USD SF+26.161/0.50 9/16/23-5Y* CME / DIR (EZTP4L47M699) | 3,46 | -12,58 | 1,9657 | -0,3261 | ||

| RFRF USD SF+26.161/0.50 9/16/23-5Y* CME / DIR (EZTP4L47M699) | 3,46 | -12,58 | 1,9657 | -0,3261 | ||

| US06051GDM87 / Banc of America Funding 2005-D Trust | 2,99 | -5,74 | 1,6976 | -0,1380 | ||

| US89177HAA05 / Towd Point Mortgage Trust, Series 2019-HY2, Class A1 | 2,96 | -7,15 | 1,6820 | -0,1650 | ||

| US912810TM09 / United States Treasury Note/Bond | 2,83 | -2,18 | 1,6064 | -0,0681 | ||

| US126673AW27 / CWABS INC ASSET-BACKED CERTIFICATES TRUST 2004-6 CWL 2004-6 1A1 | 2,80 | -3,81 | 1,5926 | -0,0950 | ||

| RFRF USD SF+26.161/1.2* 9/17/23-7Y* CME / DIR (EZ9PFGBJFFW1) | 2,77 | -9,93 | 1,5720 | -0,2070 | ||

| RFRF USD SF+26.161/1.2* 9/17/23-7Y* CME / DIR (EZ9PFGBJFFW1) | 2,77 | -9,93 | 1,5720 | -0,2070 | ||

| US21H0306827 / Ginnie Mae | 2,56 | 1,42 | 1,4564 | 0,1540 | ||

| US93363TAB89 / WaMu Mortgage Pass-Through Certificates Series 2006-AR11 Trust | 2,33 | -1,31 | 1,3250 | -0,0438 | ||

| US52474XAA37 / LEGACY MORTGAGE ASSET TRUST SER 2021-GS3 CL A1 V/R REGD 144A P/P 0.00000000 | 2,31 | -2,74 | 1,3123 | -0,0634 | ||

| US62955RAA32 / NEW YORK MORTGAGE TRUST 08/51 1.6696 | 2,30 | -4,17 | 1,3041 | -0,0830 | ||

| GS MORTGAGE BACKED SECURITIES GSMBS 2024 RPL4 A1 144A / ABS-MBS (US362948AA98) | 2,23 | -2,11 | 1,2673 | -0,0522 | ||

| GS MORTGAGE BACKED SECURITIES GSMBS 2024 RPL4 A1 144A / ABS-MBS (US362948AA98) | 2,23 | -2,11 | 1,2673 | -0,0522 | ||

| US64828XAA19 / NEW RESIDENTIAL MORTGAGE LOAN TRUST 2020-RPL1 SER 2020-RPL1 CL A1 V/R REGD 144A P/P 2.75000000 | 2,17 | -4,11 | 1,2336 | -0,0780 | ||

| US67114BAA52 / OBX 2021-NQM1 Trust | 2,15 | -2,10 | 1,2191 | -0,0503 | ||

| US74143JAA97 / PRET 2021-RN3 LLC | 2,09 | -4,08 | 1,1891 | -0,0749 | ||

| US912810TL26 / TREASURY BOND | 2,01 | -2,99 | 1,1426 | -0,0584 | ||

| US36261WAA53 / GS MORTGAGE BACKED SECURITIES GSMBS 2021 RPL1 A1 144A | 1,96 | -3,55 | 1,1126 | -0,0635 | ||

| US78443CCL63 / SLM Private Credit Student Loan Trust 2006-A | 1,84 | -4,36 | 1,0474 | -0,0688 | ||

| US3128MJ3H14 / Freddie Mac Gold Pool | 1,83 | -1,67 | 1,0384 | -0,0380 | ||

| MADISON PARK FUNDING LTD MDPK 2020 46A ARR 144A / ABS-CBDO (US55822AAW71) | 1,70 | 0,59 | 0,9664 | -0,0125 | ||

| MADISON PARK FUNDING LTD MDPK 2020 46A ARR 144A / ABS-CBDO (US55822AAW71) | 1,70 | 0,59 | 0,9664 | -0,0125 | ||

| US64830NAA90 / New Residential Mortgage Loan Trust 2019-RPL3 | 1,67 | -5,32 | 0,9496 | -0,0727 | ||

| MERCEDES BENZ AUTO LEASE TRUST MBALT 2025 A A2A / ABS-O (US58768YAB11) | 1,61 | 0,9129 | 0,9129 | |||

| MERCEDES BENZ AUTO LEASE TRUST MBALT 2025 A A2A / ABS-O (US58768YAB11) | 1,61 | 0,9129 | 0,9129 | |||

| US61770YAA38 / Morgan Stanley Capital I Trust 2020-CNP | 1,57 | 2,14 | 0,8932 | 0,0020 | ||

| US55819MAN65 / Madison Park Funding XXXV Ltd | 1,55 | -3,98 | 0,8774 | -0,0540 | ||

| TOWD POINT MORTGAGE TRUST TPMT 2024 5 A1A 144A / ABS-MBS (US891944AA82) | 1,54 | -4,42 | 0,8719 | -0,0580 | ||

| TOWD POINT MORTGAGE TRUST TPMT 2024 5 A1A 144A / ABS-MBS (US891944AA82) | 1,54 | -4,42 | 0,8719 | -0,0580 | ||

| US69381AAA97 / PRPM 2023-RCF1 LLC SER 2023-RCF1 CL A1 V/R REGD 144A P/P 4.00000000 | 1,51 | -4,74 | 0,8568 | -0,0596 | ||

| NISSAN AUTO RECEIVABLES OWNER NAROT 2025 A A2A / ABS-O (US65481GAB14) | 1,50 | 0,8541 | 0,8541 | |||

| NISSAN AUTO RECEIVABLES OWNER NAROT 2025 A A2A / ABS-O (US65481GAB14) | 1,50 | 0,8541 | 0,8541 | |||

| DRIVE AUTO RECEIVABLES TRUST DRIVE 2025 1 A2 / ABS-O (US262102AB26) | 1,50 | 0,8531 | 0,8531 | |||

| DRIVE AUTO RECEIVABLES TRUST DRIVE 2025 1 A2 / ABS-O (US262102AB26) | 1,50 | 0,8531 | 0,8531 | |||

| US362341RX95 / GSR Mortgage Loan Trust, Series 2005-AR6, Class 2A1 | 1,39 | -3,33 | 0,7911 | -0,0432 | ||

| US66987XDE22 / NOVASTAR HOME EQUITY LOAN NHEL 2003 4 A1 | 1,36 | -8,04 | 0,7738 | -0,0840 | ||

| US75971FAD50 / RENAISSANCE HOME EQUITY LOAN T RAMC 2007 3 AF1 | 1,27 | -1,47 | 0,7239 | -0,0250 | ||

| US36257CAG24 / GS Mortgage Securities Corp Trust 2017-GPTX | 1,16 | 27,31 | 0,6566 | 0,1307 | ||

| US64034QAB41 / Nelnet Student Loan Trust | 1,14 | -7,23 | 0,6489 | -0,0643 | ||

| US03881BAE39 / Arbor Multifamily Mortgage Securities Trust 2020-MF1 | 1,11 | 1,37 | 0,6293 | -0,0035 | ||

| US87276WAA18 / TPG Real Estate Finance Issuer LTD | 1,09 | -4,95 | 0,6215 | -0,0453 | ||

| US1266714L71 / Countrywide Asset-Backed Certificates | 1,06 | -5,93 | 0,6037 | -0,0507 | ||

| LENDMARK FUNDING TRUST LFT 2024 1A A 144A / ABS-O (US52603DAA19) | 1,02 | 0,20 | 0,5778 | -0,0097 | ||

| LENDMARK FUNDING TRUST LFT 2024 1A A 144A / ABS-O (US52603DAA19) | 1,02 | 0,20 | 0,5778 | -0,0097 | ||

| SPACE COAST CREDIT UNION SCCU 2024 1A A3 144A / ABS-O (US78436RAE09) | 1,01 | -0,30 | 0,5713 | -0,0128 | ||

| SPACE COAST CREDIT UNION SCCU 2024 1A A3 144A / ABS-O (US78436RAE09) | 1,01 | -0,30 | 0,5713 | -0,0128 | ||

| BRYANT PARK FUNDING LTD BRYPK 2024 22A A1 144A / ABS-CBDO (US11766CAA27) | 1,00 | 0,10 | 0,5694 | -0,0103 | ||

| BRYANT PARK FUNDING LTD BRYPK 2024 22A A1 144A / ABS-CBDO (US11766CAA27) | 1,00 | 0,10 | 0,5694 | -0,0103 | ||

| LCM LTD PARTNERSHIP LCM 31A AR 144A / ABS-CBDO (US50201QAL86) | 1,00 | 0,20 | 0,5682 | -0,0100 | ||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2021 17A AR 144A / ABS-CBDO (US04942FAL31) | 1,00 | 0,40 | 0,5678 | -0,0087 | ||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2021 17A AR 144A / ABS-CBDO (US04942FAL31) | 1,00 | 0,40 | 0,5678 | -0,0087 | ||

| VENTURE CDO LTD VENTR 2021 44A A1NR 144A / ABS-CBDO (US92332KAQ40) | 1,00 | 0,10 | 0,5672 | -0,0100 | ||

| VENTURE CDO LTD VENTR 2021 44A A1NR 144A / ABS-CBDO (US92332KAQ40) | 1,00 | 0,10 | 0,5672 | -0,0100 | ||

| LCM LTD PARTNERSHIP LCM 36A A1R 144A / ABS-CBDO (US50190LAL27) | 1,00 | 0,10 | 0,5659 | -0,0102 | ||

| LCM LTD PARTNERSHIP LCM 36A A1R 144A / ABS-CBDO (US50190LAL27) | 1,00 | 0,10 | 0,5659 | -0,0102 | ||

| CENTERBRIDGE CREDIT FUNDING LT CBCF 2021 1A A 144A / ABS-CBDO (US15186PAA66) | 0,96 | 1,37 | 0,5465 | -0,0030 | ||

| CENTERBRIDGE CREDIT FUNDING LT CBCF 2021 1A A 144A / ABS-CBDO (US15186PAA66) | 0,96 | 1,37 | 0,5465 | -0,0030 | ||

| US03329TAG94 / Anchorage Credit Funding 4 Ltd. | 0,95 | 2,59 | 0,5405 | 0,0039 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2015 1A ARE 144A / ABS-CBDO (US033296AS36) | 0,95 | -0,63 | 0,5372 | -0,0144 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2015 1A ARE 144A / ABS-CBDO (US033296AS36) | 0,95 | -0,63 | 0,5372 | -0,0144 | ||

| US36179W5D62 / Ginnie Mae II Pool | 0,93 | 0,5288 | 0,5288 | |||

| US86359LEW54 / STRUCTURED ASSET MORTGAGE INVE SAMI 2004 AR6 A2 | 0,92 | -0,65 | 0,5203 | -0,0136 | ||

| ATLX TRUST ATLX 2024 RPL2 A1 144A / ABS-MBS (US049919AA13) | 0,91 | -2,26 | 0,5154 | -0,0223 | ||

| ATLX TRUST ATLX 2024 RPL2 A1 144A / ABS-MBS (US049919AA13) | 0,91 | -2,26 | 0,5154 | -0,0223 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2020 10A AV 144A / ABS-CBDO (US03332AAA88) | 0,89 | 1,03 | 0,5028 | -0,0044 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2020 10A AV 144A / ABS-CBDO (US03332AAA88) | 0,89 | 1,03 | 0,5028 | -0,0044 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2015 2A ARV 144A / ABS-CBDO (US03329LAS07) | 0,88 | 1,26 | 0,5020 | -0,0037 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2015 2A ARV 144A / ABS-CBDO (US03329LAS07) | 0,88 | 1,26 | 0,5020 | -0,0037 | ||

| US89177BAA35 / Towd Point Mortgage Trust 2019-1 | 0,87 | -3,33 | 0,4949 | -0,0268 | ||

| US92922F7P73 / WAMU_05-AR17 | 0,87 | -0,34 | 0,4947 | -0,0112 | ||

| MFRA TRUST MFRA 2024 RPL1 A1 144A / ABS-MBS (US55287AAA34) | 0,87 | -3,67 | 0,4919 | -0,0287 | ||

| MFRA TRUST MFRA 2024 RPL1 A1 144A / ABS-MBS (US55287AAA34) | 0,87 | -3,67 | 0,4919 | -0,0287 | ||

| US12663TAA79 / CSMC_22-RPL4 | 0,86 | -3,25 | 0,4897 | -0,0261 | ||

| US83206NAB38 / SMB PRIVATE EDUCATION LOAN TRUST 2022-B SER 2022-B CL A1B V/R REGD 144A P/P 1.83000000 | 0,86 | -5,08 | 0,4880 | -0,0360 | ||

| US93363DAB38 / WaMu Mortgage Pass-Through Certificates Series 2006-AR9 Trust | 0,86 | -0,58 | 0,4860 | -0,0123 | ||

| SFS AUTO RECEIVABLES SECURITIZ SFAST 2025 2A A2 144A / ABS-O (US78398HAB42) | 0,85 | 0,4835 | 0,4835 | |||

| SFS AUTO RECEIVABLES SECURITIZ SFAST 2025 2A A2 144A / ABS-O (US78398HAB42) | 0,85 | 0,4835 | 0,4835 | |||

| BRIDGECREST LENDING AUTO SECUR BLAST 2025 2 A2 / ABS-O (US10807HAB24) | 0,85 | 0,4827 | 0,4827 | |||

| BRIDGECREST LENDING AUTO SECUR BLAST 2025 2 A2 / ABS-O (US10807HAB24) | 0,85 | 0,4827 | 0,4827 | |||

| GUGGENHEIM CLO LTD GUGG 2022 2A A1R 144A / ABS-CBDO (US40172PAL67) | 0,85 | -0,24 | 0,4818 | -0,0102 | ||

| BAIN CAPITAL CREDIT CLO, LIMIT BCC 2019 4A A1RR 144A / ABS-CBDO (US05684AAY55) | 0,85 | -0,24 | 0,4812 | -0,0108 | ||

| BDS LTD BDS 2025 FL14 A 144A / ABS-CBDO (US072921AA78) | 0,85 | -0,12 | 0,4810 | -0,0103 | ||

| BDS LTD BDS 2025 FL14 A 144A / ABS-CBDO (US072921AA78) | 0,85 | -0,12 | 0,4810 | -0,0103 | ||

| US92922F4M79 / WaMu Mortgage Pass-Through Certificates Series 2005-AR13 Trust | 0,84 | -4,64 | 0,4791 | -0,0327 | ||

| WIND RIVER CLO LTD WINDR 2016 1KRA A1R3 144A / ABS-CBDO (US97314DAN84) | 0,84 | -0,47 | 0,4786 | -0,0114 | ||

| WIND RIVER CLO LTD WINDR 2016 1KRA A1R3 144A / ABS-CBDO (US97314DAN84) | 0,84 | -0,47 | 0,4786 | -0,0114 | ||

| VERDELITE STATIC CLO LTD BVSTAT 2024 1A A 144A / ABS-CBDO (US92338VAA98) | 0,84 | -5,94 | 0,4769 | -0,0399 | ||

| VERDELITE STATIC CLO LTD BVSTAT 2024 1A A 144A / ABS-CBDO (US92338VAA98) | 0,84 | -5,94 | 0,4769 | -0,0399 | ||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2024 RPL3 A1A 144A / ABS-MBS (US161917AB58) | 0,83 | -1,77 | 0,4725 | -0,0178 | ||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2024 RPL3 A1A 144A / ABS-MBS (US161917AB58) | 0,83 | -1,77 | 0,4725 | -0,0178 | ||

| US31395A3J20 / Freddie Mac Structured Pass-Through Certificates | 0,83 | -2,93 | 0,4711 | -0,0237 | ||

| US36242DFP33 / GSR Mortgage Loan Trust 2004-11 | 0,83 | -1,66 | 0,4697 | -0,0172 | ||

| VERUS SECURITIZATION TRUST VERUS 2024 6 A1 144A / ABS-MBS (US92540JAA07) | 0,82 | -7,06 | 0,4639 | -0,0446 | ||

| RFR USD SOFR/3.25000 06/18/25-10Y LCH / DIR (EZXZ4DC8KGZ4) | 0,81 | 0,4604 | 0,4604 | |||

| RFR USD SOFR/3.25000 06/18/25-10Y LCH / DIR (EZXZ4DC8KGZ4) | 0,81 | 0,4604 | 0,4604 | |||

| US19421UAB08 / COLLEGE AVE STUDENT LOANS CASL 2019 A A2 144A | 0,81 | -4,38 | 0,4593 | -0,0300 | ||

| AFFIRM MASTER TRUST AFRMT 2025 1A A 144A / ABS-O (US00833BAA61) | 0,81 | 0,25 | 0,4580 | -0,0078 | ||

| AFFIRM MASTER TRUST AFRMT 2025 1A A 144A / ABS-O (US00833BAA61) | 0,81 | 0,25 | 0,4580 | -0,0078 | ||

| SFS AUTO RECEIVABLES SECURITIZ SFAST 2024 3A A3 144A / ABS-O (US78436XAC11) | 0,80 | 0,00 | 0,4563 | -0,0087 | ||

| SFS AUTO RECEIVABLES SECURITIZ SFAST 2024 3A A3 144A / ABS-O (US78436XAC11) | 0,80 | 0,00 | 0,4563 | -0,0087 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2019 9A AV 144A / ABS-CBDO (US03330HAA59) | 0,80 | -9,27 | 0,4561 | -0,0565 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2019 9A AV 144A / ABS-CBDO (US03330HAA59) | 0,80 | -9,27 | 0,4561 | -0,0565 | ||

| HONDA AUTO RECEIVABLES OWNER T HAROT 2024 4 A3 / ABS-O (US43816DAC92) | 0,80 | 0,38 | 0,4555 | -0,0074 | ||

| HONDA AUTO RECEIVABLES OWNER T HAROT 2024 4 A3 / ABS-O (US43816DAC92) | 0,80 | 0,38 | 0,4555 | -0,0074 | ||

| NISSAN AUTO RECEIVABLES OWNER NAROT 2024 B A3 / ABS-O (US65479WAD65) | 0,80 | 0,25 | 0,4554 | -0,0078 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2025 4 A2 144A / ABS-O (US69547DAB29) | 0,80 | 0,4552 | 0,4552 | |||

| PAGAYA AI DEBT SELECTION TRUST PAID 2025 4 A2 144A / ABS-O (US69547DAB29) | 0,80 | 0,4552 | 0,4552 | |||

| M+T BANK AUTO RECEIVABLES TRUS MTBAT 2025 1A A2A 144A / ABS-O (US55287XAB10) | 0,80 | 0,13 | 0,4549 | -0,0087 | ||

| SANTANDER DRIVE AUTO RECEIVABL SDART 2024 5 A3 / ABS-O (US802920AD01) | 0,80 | -0,12 | 0,4548 | -0,0090 | ||

| SANTANDER DRIVE AUTO RECEIVABL SDART 2024 5 A3 / ABS-O (US802920AD01) | 0,80 | -0,12 | 0,4548 | -0,0090 | ||

| ARES CLO LTD ARES 2013 2A AR3 144A / ABS-CBDO (US00190YBP97) | 0,80 | 0,38 | 0,4548 | -0,0068 | ||

| ARES CLO LTD ARES 2013 2A AR3 144A / ABS-CBDO (US00190YBP97) | 0,80 | 0,38 | 0,4548 | -0,0068 | ||

| BRIDGECREST LENDING AUTO SECUR BLAST 2024 4 A3 / ABS-O (US10806EAC84) | 0,80 | -0,12 | 0,4546 | -0,0094 | ||

| BRIDGECREST LENDING AUTO SECUR BLAST 2024 4 A3 / ABS-O (US10806EAC84) | 0,80 | -0,12 | 0,4546 | -0,0094 | ||

| LAD AUTO RECEIVABLES TRUST LADAR 2025 1A A2 144A / ABS-O (US505712AB53) | 0,80 | 0,13 | 0,4543 | -0,0086 | ||

| LAD AUTO RECEIVABLES TRUST LADAR 2025 1A A2 144A / ABS-O (US505712AB53) | 0,80 | 0,13 | 0,4543 | -0,0086 | ||

| PARALLEL LTD PARL 2021 1A AR 144A / ABS-CBDO (US69916HAL42) | 0,80 | 0,13 | 0,4535 | -0,0081 | ||

| PARALLEL LTD PARL 2021 1A AR 144A / ABS-CBDO (US69916HAL42) | 0,80 | 0,13 | 0,4535 | -0,0081 | ||

| PRP ADVISORS, LLC PRPM 2024 RCF5 A1 144A / ABS-MBS (US69381JAA07) | 0,78 | -4,39 | 0,4454 | -0,0294 | ||

| PRP ADVISORS, LLC PRPM 2024 RCF5 A1 144A / ABS-MBS (US69381JAA07) | 0,78 | -4,39 | 0,4454 | -0,0294 | ||

| US29425AAD54 / Citigroup Commercial Mortgage Trust 2015-GC33 | 0,78 | -12,43 | 0,4443 | -0,0727 | ||

| TESLA SUSTAINABLE ENERGY TRUST TSET 2024 1A A2 144A / ABS-O (US88164AAB08) | 0,78 | -3,36 | 0,4410 | -0,0238 | ||

| TESLA SUSTAINABLE ENERGY TRUST TSET 2024 1A A2 144A / ABS-O (US88164AAB08) | 0,78 | -3,36 | 0,4410 | -0,0238 | ||

| NMLT TRUST NLT 2023 1 A1 144A / ABS-MBS (US62917MAA18) | 0,77 | -1,66 | 0,4361 | -0,0160 | ||

| NMLT TRUST NLT 2023 1 A1 144A / ABS-MBS (US62917MAA18) | 0,77 | -1,66 | 0,4361 | -0,0160 | ||

| OCTANE RECEIVABLES TRUST OCTL 2024 3A A2 144A / ABS-O (US67571GAB86) | 0,76 | -4,86 | 0,4336 | -0,0308 | ||

| OCTANE RECEIVABLES TRUST OCTL 2024 3A A2 144A / ABS-O (US67571GAB86) | 0,76 | -4,86 | 0,4336 | -0,0308 | ||

| PRP ADVISORS, LLC PRPM 2024 RCF4 A1 144A / ABS-MBS (US74448JAA16) | 0,76 | -6,16 | 0,4329 | -0,0371 | ||

| US78443CCB81 / SLM Private Credit Student Loan Trust 2005-B | 0,74 | -6,69 | 0,4200 | -0,0386 | ||

| US12667GL923 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 27 1A3 | 0,73 | -0,68 | 0,4167 | -0,0106 | ||

| US83206NAA54 / SMB Private Education Loan Trust 2022-B | 0,73 | -4,10 | 0,4126 | -0,0256 | ||

| NISSAN AUTO RECEIVABLES OWNER NAROT 2024 B A2A / ABS-O (US65479WAB00) | 0,71 | -10,64 | 0,4057 | -0,0573 | ||

| NISSAN AUTO RECEIVABLES OWNER NAROT 2024 B A2A / ABS-O (US65479WAB00) | 0,71 | -10,64 | 0,4057 | -0,0573 | ||

| US98162JAA43 / Worldwide Plaza Trust 2017-WWP | 0,71 | 2,75 | 0,4037 | 0,0034 | ||

| FIRST HELP FINANCIAL LLC FHF 2024 3A A2 144A / ABS-O (US30339EAB48) | 0,71 | -11,49 | 0,4031 | -0,0611 | ||

| PORSCHE INNOVATIVE LEASE OWNER PILOT 2025 1A A2A 144A / ABS-O (US73329KAB26) | 0,70 | 0,3984 | 0,3984 | |||

| PORSCHE INNOVATIVE LEASE OWNER PILOT 2025 1A A2A 144A / ABS-O (US73329KAB26) | 0,70 | 0,3984 | 0,3984 | |||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2019 H11 FM / ABS-MBS (US38380LVB60) | 0,70 | -8,53 | 0,3961 | -0,0452 | ||

| US63941CAB90 / NAVIENT STUDENT LOAN TRUST NAVSL 2019 D A2A 144A | 0,69 | -5,98 | 0,3932 | -0,0333 | ||

| US31418CU779 / FANNIE MAE 3.50% 03/01/2048 FNMA | 0,68 | -2,03 | 0,3845 | -0,0160 | ||

| US78449XAA00 / SMB PRIVATE EDUCATION LOAN TRUST 2020-B 1.29% 07/15/2053 144A | 0,67 | -8,32 | 0,3818 | -0,0429 | ||

| SOFI CONSUMER LOAN PROGRAM TRU SCLP 2025 1 A 144A / ABS-O (US83406YAA91) | 0,67 | -21,53 | 0,3791 | -0,1133 | ||

| SOFI CONSUMER LOAN PROGRAM TRU SCLP 2025 1 A 144A / ABS-O (US83406YAA91) | 0,67 | -21,53 | 0,3791 | -0,1133 | ||

| HONDA AUTO RECEIVABLES OWNER T HAROT 2024 4 A2 / ABS-O (US43816DAB10) | 0,67 | -16,75 | 0,3785 | -0,0847 | ||

| HONDA AUTO RECEIVABLES OWNER T HAROT 2024 4 A2 / ABS-O (US43816DAB10) | 0,67 | -16,75 | 0,3785 | -0,0847 | ||

| US542514HN71 / Long Beach Mortgage Loan Trust 2004-4 | 0,64 | -2,14 | 0,3644 | -0,0149 | ||

| US92925CBB72 / WaMu Mortgage Pass-Through Certificates Series 2005-AR19 Trust | 0,64 | -4,63 | 0,3629 | -0,0254 | ||

| FNMA TBA 30 YR 7 SINGLE FAMILY MORTGAGE / ABS-MBS (US01F0706907) | 0,63 | 0,3570 | 0,3570 | |||

| FNMA TBA 30 YR 7 SINGLE FAMILY MORTGAGE / ABS-MBS (US01F0706907) | 0,63 | 0,3570 | 0,3570 | |||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2024 9 A11 144A / ABS-MBS (US16160QAX25) | 0,61 | -10,12 | 0,3484 | -0,0466 | ||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2024 9 A11 144A / ABS-MBS (US16160QAX25) | 0,61 | -10,12 | 0,3484 | -0,0466 | ||

| US01F0226831 / FEDERAL NATIONAL MORTGAGE ASSOCIATION 30YR TBA AUG | 0,58 | -82,69 | 0,3297 | -1,3968 | ||

| US31393RG383 / FHLMC STRUCTURED PASS THROUGH FSPC T 56 2AF | 0,56 | -1,92 | 0,3200 | -0,0128 | ||

| US02150PAB40 / Alternative Loan Trust 2007-OA6 | 0,56 | -1,06 | 0,3186 | -0,0100 | ||

| US95002EBB20 / WELLS FARGO TR 2013-LC12 2.725% 02/15/2053 | 0,55 | 1,47 | 0,3135 | -0,0018 | ||

| US12669F6Z19 / CWMBS, Inc. | 0,53 | -3,12 | 0,3000 | -0,0156 | ||

| RFRF USD SF+26.161/1.7* 7/15/23-7Y* CME / DIR (EZMBPFMCJ2B0) | 0,52 | -18,31 | 0,2966 | -0,0734 | ||

| RFRF USD SF+26.161/1.7* 7/15/23-7Y* CME / DIR (EZMBPFMCJ2B0) | 0,52 | -18,31 | 0,2966 | -0,0734 | ||

| US881561RD83 / TERWIN MORTGAGE TRUST TMTS 2005 6HE M5 | 0,52 | -15,33 | 0,2947 | -0,0607 | ||

| US21H0226892 / Ginnie Mae | 0,51 | 0,99 | 0,2895 | 0,0294 | ||

| US92943AAA25 / WSTN_23-MAUI | 0,51 | -0,39 | 0,2882 | -0,0064 | ||

| TESLA AUTO LEASE TRUST TESLA 2024 B A2A 144A / ABS-O (US881934AB92) | 0,50 | -28,61 | 0,2867 | -0,1224 | ||

| TESLA AUTO LEASE TRUST TESLA 2024 B A2A 144A / ABS-O (US881934AB92) | 0,50 | -28,61 | 0,2867 | -0,1224 | ||

| US21H0506806 / GNMA | 0,49 | 0,2788 | 0,2788 | |||

| US19424KAB98 / COLLEGE AVE STUDENT LOANS CASL 2021 A A2 144A | 0,48 | -4,16 | 0,2754 | -0,0174 | ||

| BRIDGECREST LENDING AUTO SECUR BLAST 2024 4 A2 / ABS-O (US10806EAB02) | 0,48 | -31,56 | 0,2710 | -0,1326 | ||

| BRIDGECREST LENDING AUTO SECUR BLAST 2024 4 A2 / ABS-O (US10806EAB02) | 0,48 | -31,56 | 0,2710 | -0,1326 | ||

| US78449VAB27 / SMB Private Education Loan Trust 2020-PT-A | 0,48 | -6,85 | 0,2708 | -0,0251 | ||

| US3138WDD655 / FNMA POOL AS3724 FN 11/44 FIXED 3.5 | 0,47 | -2,11 | 0,2644 | -0,0106 | ||

| MADISON PARK FUNDING LTD MDPK 2021 49A AR 144A / ABS-CBDO (US55820VAL71) | 0,45 | 0,22 | 0,2552 | -0,0043 | ||

| MADISON PARK FUNDING LTD MDPK 2021 49A AR 144A / ABS-CBDO (US55820VAL71) | 0,45 | 0,22 | 0,2552 | -0,0043 | ||

| AG TRUST AG 2024 NLP A 144A / ABS-MBS (US00792MAA18) | 0,43 | 0,23 | 0,2436 | -0,0045 | ||

| US19423DAB64 / COLLEGE AVE STUDENT LOANS 2018-A LLC CASL 2018-A A2 | 0,42 | -5,80 | 0,2397 | -0,0199 | ||

| US61748HGR66 / Morgan Stanley Mortgage Loan Trust 2004-11AR | 0,42 | -2,58 | 0,2357 | -0,0115 | ||

| US03764QBC50 / Apidos CLO XV | 0,41 | -1,92 | 0,2318 | -0,0093 | ||

| US3138L6BR82 / Fannie Mae Pool | 0,41 | 0,49 | 0,2311 | -0,0038 | ||

| SOFI CONSUMER LOAN PROGRAM TRU SCLP 2025 2 A 144A / ABS-O (US83407HAA59) | 0,40 | 0,2276 | 0,2276 | |||

| SOFI CONSUMER LOAN PROGRAM TRU SCLP 2025 2 A 144A / ABS-O (US83407HAA59) | 0,40 | 0,2276 | 0,2276 | |||

| US63941UAA16 / Navient Private Education Refi Loan Trust 2020-G | 0,39 | -7,08 | 0,2238 | -0,0218 | ||

| US12515HAZ82 / CD 2017-CD5 Mortgage Trust | 0,39 | 1,30 | 0,2220 | -0,0017 | ||

| GLS AUTO SELECT RECEIVABLES TR GSAR 2024 3A A2 144A / ABS-O (US37989EAC03) | 0,38 | -13,51 | 0,2184 | -0,0387 | ||

| GLS AUTO SELECT RECEIVABLES TR GSAR 2024 3A A2 144A / ABS-O (US37989EAC03) | 0,38 | -13,51 | 0,2184 | -0,0387 | ||

| SANTANDER DRIVE AUTO RECEIVABL SDART 2024 5 A2 / ABS-O (US802920AC28) | 0,38 | -40,16 | 0,2177 | -0,1528 | ||

| SANTANDER DRIVE AUTO RECEIVABL SDART 2024 5 A2 / ABS-O (US802920AC28) | 0,38 | -40,16 | 0,2177 | -0,1528 | ||

| US31381R4L52 / FNMA, Other | 0,37 | -1,07 | 0,2109 | -0,0063 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2024 10 A 144A / ABS-O (US69544MAA71) | 0,37 | -36,33 | 0,2093 | -0,1257 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2024 10 A 144A / ABS-O (US69544MAA71) | 0,37 | -36,33 | 0,2093 | -0,1257 | ||

| US939336X813 / WaMu Mortgage Pass-Through Certificates Series 2005-AR1 Trust | 0,37 | -4,17 | 0,2092 | -0,0135 | ||

| US59981TAC99 / MILL CITY MORTGAGE LOAN TRUST 2019-GS2 SER 2019-GS2 CL A1 V/R REGD 144A P/P 2.75000000 | 0,36 | -9,39 | 0,2033 | -0,0254 | ||

| US45254NPU53 / Impac CMB Trust, Series 2005-5, Class A1 | 0,35 | -5,93 | 0,1983 | -0,0168 | ||

| GREENSKY HOME IMPROVEMENT ISSU GSKY 2024 2 A2 144A / ABS-O (US39571XAB01) | 0,34 | -36,65 | 0,1958 | -0,1191 | ||

| GREENSKY HOME IMPROVEMENT ISSU GSKY 2024 2 A2 144A / ABS-O (US39571XAB01) | 0,34 | -36,65 | 0,1958 | -0,1191 | ||

| US05608XAA00 / BXMT LTD BXMT 2020 FL3 A 144A | 0,34 | -2,56 | 0,1950 | -0,0091 | ||

| US20267WAA36 / Commonbond Student Loan Trust 2020-A-GS | 0,34 | -2,62 | 0,1906 | -0,0087 | ||

| RFRF USD SF+26.161/1.7* 12/21/16-10Y LCH / DIR (EZ78XQS0BTY4) | 0,33 | -32,80 | 0,1899 | -0,0983 | ||

| RFRF USD SF+26.161/1.7* 12/21/16-10Y LCH / DIR (EZ78XQS0BTY4) | 0,33 | -32,80 | 0,1899 | -0,0983 | ||

| FLAGSHIP CREDIT AUTO TRUST FCAT 2024 3 A 144A / ABS-O (US33843YAA55) | 0,33 | -17,12 | 0,1898 | -0,0437 | ||

| FLAGSHIP CREDIT AUTO TRUST FCAT 2024 3 A 144A / ABS-O (US33843YAA55) | 0,33 | -17,12 | 0,1898 | -0,0437 | ||

| US63890BAB27 / NAVIENT STUDENT LOAN TRUST 2018-EA NAVSL 2018-EA A2 | 0,33 | -26,17 | 0,1878 | -0,0709 | ||

| US552757AA45 / MFA 2020-NQM3 Trust | 0,33 | -10,63 | 0,1866 | -0,0264 | ||

| US46652DAA37 / JP Morgan Chase Commercial Mortgage Securities Corp | 0,31 | -5,44 | 0,1782 | -0,0136 | ||

| US19423DAA81 / COLLEGE AVE STUDENT LOANS 2018-A LLC CASL 2018-A A1 | 0,31 | -6,31 | 0,1776 | -0,0154 | ||

| US41161PG725 / HARBORVIEW MORTGAGE LOAN TRUST HVMLT 2006 BU1 2A1A | 0,31 | 0,00 | 0,1743 | -0,0038 | ||

| US004375CG41 / Accredited Mortgage Loan Trust, Series 2004-4, Class M1 | 0,30 | -7,60 | 0,1732 | -0,0177 | ||

| US3140J9UZ29 / FNMA POOL BM5099 FN 07/48 FIXED VAR | 0,30 | -1,63 | 0,1719 | -0,0062 | ||

| US19424KAA16 / College Ave Student Loans 2021-A LLC | 0,30 | -5,03 | 0,1716 | -0,0130 | ||

| US21H0526788 / Ginnie Mae | 0,30 | -56,77 | 0,1706 | -0,1871 | ||

| US95000AAU16 / Wells Fargo & Company | 0,30 | 0,34 | 0,1693 | -0,0027 | ||

| US95001WBB37 / Wells Fargo Commercial Mortgage Trust 2019-C49 | 0,29 | 1,03 | 0,1671 | -0,0018 | ||

| RFRF USD SF+26.161/3.00 9/19/23-3Y* CME / DIR (EZ5KQYKN8LY5) | 0,29 | 60,11 | 0,1666 | 0,0601 | ||

| US3140MNN361 / Federal National Mortgage Association, Inc. | 0,29 | -1,71 | 0,1634 | -0,0059 | ||

| US3140X6S931 / FANNIE MAE POOL UMBS P#FM3243 3.50000000 | 0,27 | -2,17 | 0,1537 | -0,0065 | ||

| US31412YTJ19 / FNMA POOL 938953 FN 08/37 FLOATING VAR | 0,27 | -1,47 | 0,1529 | -0,0052 | ||

| RFRF USD SF+26.161/2.00 8/12/23-7Y* CME / DIR (EZXZXW7G14V3) | 0,27 | -20,94 | 0,1524 | -0,0439 | ||

| RFRF USD SF+26.161/2.00 8/12/23-7Y* CME / DIR (EZXZXW7G14V3) | 0,27 | -20,94 | 0,1524 | -0,0439 | ||

| US92922F3K23 / WAMU MORTGAGE PASS THROUGH CER WAMU 2005 AR12 1A5 | 0,26 | -2,94 | 0,1501 | -0,0074 | ||

| US12489WJP05 / Credit-Based Asset Servicing & Securitization LLC, Series 2004-CB4, Class A5 | 0,26 | -6,18 | 0,1469 | -0,0125 | ||

| US07389QAL23 / BEAR STEARNS ASSET BACKED SECU BSABS 2007 SD1 21A1 | 0,22 | -2,19 | 0,1271 | -0,0051 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2024 7 A 144A / ABS-O (US69545AAA25) | 0,21 | -15,10 | 0,1183 | -0,0239 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2024 7 A 144A / ABS-O (US69545AAA25) | 0,21 | -15,10 | 0,1183 | -0,0239 | ||

| US87241EAQ89 / TCW CLO 2019-1 AMR Ltd | 0,20 | 0,50 | 0,1137 | -0,0019 | ||

| US89173UAA51 / Towd Point Mortgage Trust 2017-4 | 0,19 | -10,19 | 0,1105 | -0,0150 | ||

| US78449UAB44 / SMB Private Education Loan Trust 2020-A | 0,19 | -10,23 | 0,1100 | -0,0146 | ||

| US50189XAA37 / LCM LOAN INCOME FUND I LTD SER 1A CL A V/R REGD 144A P/P 6.61775000 | 0,19 | -34,69 | 0,1093 | -0,0609 | ||

| US12596WAC82 / CSAIL 2019-C16 Commercial Mortgage Trust | 0,19 | 1,60 | 0,1079 | -0,0005 | ||

| US43708AAD46 / INDYMAC HOME EQUITY LOAN ASSET INHEL 2002 A AF4 | 0,19 | -3,08 | 0,1076 | -0,0059 | ||

| US21H0406734 / Ginnie Mae | 0,19 | 0,54 | 0,1056 | 0,0104 | ||

| US22541QFE70 / CREDIT SUISSE FIRST BOSTON MOR CSFB 2003 AR18 3A1 | 0,19 | -2,12 | 0,1056 | -0,0043 | ||

| US45661VAA44 / IndyMac INDX Mortgage Loan Trust 2006-AR12 | 0,18 | -2,70 | 0,1025 | -0,0046 | ||

| US3128NKHZ28 / FED HM LN PC POOL 1J2948 FH 09/37 FLOATING VAR | 0,18 | -1,65 | 0,1022 | -0,0034 | ||

| REACH FINANCIAL LLC REACH 2024 1A A 144A / ABS-O (US75526PAA93) | 0,18 | -41,14 | 0,1005 | -0,0729 | ||

| REACH FINANCIAL LLC REACH 2024 1A A 144A / ABS-O (US75526PAA93) | 0,18 | -41,14 | 0,1005 | -0,0729 | ||

| US3133BBF535 / Federal Home Loan Mortgage Corporation | 0,18 | -1,13 | 0,0994 | -0,0032 | ||

| US78471CAB54 / SOFI PROFESSIONAL LOAN PROGRAM 2017-D LLC SOFI 2017-D A2FX | 0,17 | -21,82 | 0,0979 | -0,0294 | ||

| US83192CAB37 / SMB Private Education Loan Trust 2019-B | 0,17 | -10,42 | 0,0979 | -0,0136 | ||

| US31395HHV50 / Freddie Mac Structured Pass-Through Certificates | 0,17 | -2,84 | 0,0972 | -0,0049 | ||

| US05532WBS35 / BCAP LLC TRUST BCAP 2010 RR3 4A5 144A | 0,17 | -2,89 | 0,0959 | -0,0044 | ||

| US3133BANT43 / Federal Home Loan Mortgage Corporation | 0,17 | -1,18 | 0,0957 | -0,0032 | ||

| US31404CGB00 / FNMA POOL 764394 FN 03/34 FLOATING VAR | 0,17 | -2,34 | 0,0951 | -0,0039 | ||

| US576433PQ33 / MASTR ADJUSTABLE RATE MORTGAGE MARM 2004 7 2A1 | 0,16 | -1,80 | 0,0932 | -0,0038 | ||

| WOODWARD CAPITAL MANAGEMENT RCKT 2024 CES5 A1A 144A / ABS-MBS (US74938KAA51) | 0,16 | -8,43 | 0,0929 | -0,0104 | ||

| WOODWARD CAPITAL MANAGEMENT RCKT 2024 CES5 A1A 144A / ABS-MBS (US74938KAA51) | 0,16 | -8,43 | 0,0929 | -0,0104 | ||

| US542514GM08 / Long Beach Mortgage Loan Trust, Series 2004-3, Class M1 | 0,16 | -0,62 | 0,0918 | -0,0025 | ||

| US76112BBS88 / RESIDENTIAL ASSET MORTGAGE PRO RAMP 2004 SL3 A4 | 0,15 | -9,09 | 0,0857 | -0,0100 | ||

| US92922FAV04 / WAMU MORTGAGE PASS THROUGH CER WAMU 2003 AR8 B2 | 0,15 | -2,63 | 0,0844 | -0,0036 | ||

| RFR USD SOFR/3.56673 09/02/25-4Y* LCH / DIR (EZNQ4Z4QT3L7) | 0,15 | 0,0844 | 0,0844 | |||

| RFR USD SOFR/3.56673 09/02/25-4Y* LCH / DIR (EZNQ4Z4QT3L7) | 0,15 | 0,0844 | 0,0844 | |||

| GREENSKY HOME IMPROVEMENT ISSU GSKY 2024 1 A2 144A / ABS-O (US39571MAB46) | 0,15 | -43,08 | 0,0843 | -0,0665 | ||

| US31411N6Y83 / FNMA POOL 912687 FN 05/37 FLOATING VAR | 0,15 | -1,36 | 0,0828 | -0,0028 | ||

| US3140JANZ71 / FNMA POOL BM5807 FN 04/48 FIXED VAR | 0,14 | -2,05 | 0,0818 | -0,0032 | ||

| US48251JAL70 / KKR CLO 18 Ltd | 0,14 | -32,69 | 0,0798 | -0,0409 | ||

| US31409U6W01 / FNMA POOL 879385 FN 12/35 FLOATING VAR | 0,14 | -1,43 | 0,0784 | -0,0028 | ||

| US30166TAD54 / Exeter Automobile Receivables Trust 2023-4 | 0,13 | -59,15 | 0,0765 | -0,1137 | ||

| RFRF USD SF+26.161/2.00 9/10/23-6Y* CME / DIR (EZRYHL92YXM0) | 0,13 | -10,67 | 0,0762 | -0,0111 | ||

| RFRF USD SF+26.161/2.00 9/10/23-6Y* CME / DIR (EZRYHL92YXM0) | 0,13 | -10,67 | 0,0762 | -0,0111 | ||

| US78443CCU62 / SLM Private Credit Student Loan Trust 2006-B | 0,13 | -4,38 | 0,0747 | -0,0051 | ||

| US63940YAB20 / Navient Private Education Refi Loan Trust 2019-C | 0,13 | -13,42 | 0,0736 | -0,0131 | ||

| US07384MZV70 / BEAR STEARNS ARM TRUST 2003-8 BSARM 2003-8 4A1 | 0,13 | -1,53 | 0,0735 | -0,0025 | ||

| RFRF USD SF+26.161/1.50 9/18/23-6Y* CME / DIR (EZGBCVNDZ8C6) | 0,13 | -11,19 | 0,0724 | -0,0103 | ||

| RFRF USD SF+26.161/1.50 9/18/23-6Y* CME / DIR (EZGBCVNDZ8C6) | 0,13 | -11,19 | 0,0724 | -0,0103 | ||

| RFRF USD SF+26.161/2.00 9/10/23-6Y* CME / DIR (EZ2FT1HSMJX3) | 0,13 | -21,38 | 0,0711 | -0,0212 | ||

| RFRF USD SF+26.161/2.00 9/10/23-6Y* CME / DIR (EZ2FT1HSMJX3) | 0,13 | -21,38 | 0,0711 | -0,0212 | ||

| US31393XFT90 / FNMA, Grantor Trust, Whole Loan, Series 2004-T1, Class 1A2 | 0,12 | -5,47 | 0,0693 | -0,0052 | ||

| US576433JG25 / MASTR Adjustable Rate Mortgages Trust 2004-10 | 0,12 | -1,63 | 0,0693 | -0,0020 | ||

| US31381JU758 / FANNIE MAE 4.757% 09/01/2037 FAR FNARM | 0,12 | -1,63 | 0,0690 | -0,0024 | ||

| US552757AC01 / MFA 2020-NQM3 Trust | 0,12 | -10,61 | 0,0671 | -0,0094 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2023 3 AB 144A / ABS-O (US69548BAC37) | 0,12 | -43,54 | 0,0671 | -0,0539 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2023 3 AB 144A / ABS-O (US69548BAC37) | 0,12 | -43,54 | 0,0671 | -0,0539 | ||

| US552757AB28 / MFRA TRUST MFRA 2020 NQM3 A2 144A | 0,12 | -10,69 | 0,0669 | -0,0094 | ||

| US92922FW460 / CORP CMO | 0,12 | -0,85 | 0,0667 | -0,0018 | ||

| US85573EAA55 / Starwood Mortgage Residential Trust 2020-INV | 0,12 | -15,44 | 0,0655 | -0,0138 | ||

| US552754AA14 / MFA 2020-NQM1 TRUST SER 2020-NQM1 CL A1 V/R REGD 144A P/P 0.00000000 | 0,11 | -8,87 | 0,0642 | -0,0080 | ||

| US31410UGH95 / FNMA POOL 897600 FN 11/36 FLOATING VAR | 0,11 | -1,75 | 0,0641 | -0,0022 | ||

| US073868BE01 / BEAR STEARNS ALT A TRUST BALTA 2006 6 32A1 | 0,11 | -1,75 | 0,0639 | -0,0024 | ||

| US86359AYX52 / Structured Asset Securities Corp Mortgage Pass-Through Ctfs Ser 2003-22A | 0,11 | -0,91 | 0,0619 | -0,0023 | ||

| US59020UVJ14 / Merrill Lynch Mortgage Investors Trust, Series 2005-1, Class 2A2 | 0,11 | -1,85 | 0,0607 | -0,0020 | ||

| US466247WQ26 / JP MORGAN MORTGAGE TRUST JPMMT 2005 A7 2A3 | 0,11 | 0,00 | 0,0603 | -0,0016 | ||

| US3133TSQG11 / Freddie Mac Structured Pass-Through Certificates | 0,11 | -11,76 | 0,0597 | -0,0093 | ||

| US31413YWD92 / FNMA POOL 959744 FN 11/47 FLOATING VAR | 0,10 | 0,00 | 0,0593 | -0,0014 | ||

| RFRF USD SF+26.161/1.4* 09/07/23-8Y CME / DIR (EZBB8XR0NRT7) | 0,10 | -12,71 | 0,0588 | -0,0099 | ||

| RFRF USD SF+26.161/1.4* 09/07/23-8Y CME / DIR (EZBB8XR0NRT7) | 0,10 | -12,71 | 0,0588 | -0,0099 | ||

| US89177XAA54 / TOWD POINT MORTGAGE TRUST 2019-HY3 SER 2019-HY3 CL A1A V/R REGD 144A P/P 2.70800000 | 0,10 | -9,01 | 0,0578 | -0,0069 | ||

| US3128QPUG59 / FED HM LN PC POOL 1B7432 FH 11/34 FLOATING VAR | 0,10 | -2,88 | 0,0577 | -0,0027 | ||

| CARMAX SELECT RECEIVABLES TRUS CMXS 2024 A A3 / ABS-O (US14319FAD50) | 0,10 | 0,00 | 0,0574 | -0,0011 | ||

| US31336CNW90 / FED HM LN PC POOL 972205 FH 03/36 FLOATING VAR | 0,10 | -1,96 | 0,0573 | -0,0018 | ||

| US85573MAA71 / STARWOOD MORTGAGE RESIDENTIAL STAR 2020 3 A1 144A | 0,10 | -9,17 | 0,0563 | -0,0069 | ||

| US07384MB277 / BEAR STEARNS ADJUSTABLE RATE M BSARM 2003 9 1A2 | 0,10 | 0,00 | 0,0563 | -0,0016 | ||

| US07387QAX88 / Bear Stearns ALT-A Trust, Series 2006-8, Class 3A1 | 0,10 | -3,96 | 0,0556 | -0,0032 | ||

| RFR USD SOFR/3.75000 12/20/23-5Y LCH / DIR (EZQ1LP9YKNN9) | 0,10 | 361,90 | 0,0555 | 0,0430 | ||

| RFR USD SOFR/3.75000 12/20/23-5Y LCH / DIR (EZQ1LP9YKNN9) | 0,10 | 361,90 | 0,0555 | 0,0430 | ||

| RFRF USD SF+26.161/1.00 9/16/23-7Y* CME / DIR (EZ4FYS5F94M8) | 0,10 | -8,57 | 0,0547 | -0,0065 | ||

| RFRF USD SF+26.161/1.00 9/16/23-7Y* CME / DIR (EZ4FYS5F94M8) | 0,10 | -8,57 | 0,0547 | -0,0065 | ||

| US589929V218 / Merrill Lynch Mortgage Investors Trust Series MLCC 2003-D | 0,10 | -7,77 | 0,0543 | -0,0057 | ||

| US01F0224778 / UMBS TBA | 0,09 | 3,33 | 0,0530 | 0,0065 | ||

| US46630GAJ40 / JP Morgan Mortgage Trust 2007-A1 | 0,09 | -9,80 | 0,0525 | -0,0068 | ||

| US36225CLH78 / GNMA II POOL 080327 G2 10/29 FLOATING VAR | 0,09 | -8,91 | 0,0524 | -0,0062 | ||

| RFR USD SOFR/3.57234 09/02/25-4Y* LCH / DIR (EZNQ4Z4QT3L7) | 0,09 | 0,0523 | 0,0523 | |||

| RFR USD SOFR/3.57234 09/02/25-4Y* LCH / DIR (EZNQ4Z4QT3L7) | 0,09 | 0,0523 | 0,0523 | |||

| RFR USD SOFR/3.70520 09/02/25-7Y* LCH / DIR (EZ3JC37DJDV5) | 0,09 | 0,0499 | 0,0499 | |||

| US31349TVP38 / FED HM LN PC POOL 782422 FH 09/34 FLOATING VAR | 0,09 | -3,37 | 0,0493 | -0,0027 | ||

| UPSTART PASS THROUGH TRUST UPSPT 2022 SB1 A 144A / ABS-O (US91682PAA66) | 0,09 | -21,10 | 0,0492 | -0,0141 | ||

| UPSTART PASS THROUGH TRUST UPSPT 2022 SB1 A 144A / ABS-O (US91682PAA66) | 0,09 | -21,10 | 0,0492 | -0,0141 | ||

| US161630AB47 / CHASE MORTGAGE FINANCE CORPORA CHASE 2007 A1 1A2 | 0,09 | -2,27 | 0,0490 | -0,0022 | ||

| RFR USD SOFR/3.67951 09/02/25-7Y* LCH / DIR (EZ3JC37DJDV5) | 0,09 | 0,0489 | 0,0489 | |||

| RFR USD SOFR/3.67951 09/02/25-7Y* LCH / DIR (EZ3JC37DJDV5) | 0,09 | 0,0489 | 0,0489 | |||

| US3133BBPP85 / Federal Home Loan Mortgage Corporation | 0,09 | -2,30 | 0,0487 | -0,0019 | ||

| US576433DY94 / MASTR ADJUSTABLE RATE MORTGAGE MARM 2003 3 1A1 | 0,08 | 0,00 | 0,0460 | -0,0014 | ||

| US22541Q2A91 / CREDIT SUISSE FIRST BOSTON MOR CSFB 2003 AR30 2A1 | 0,08 | -2,44 | 0,0456 | -0,0020 | ||

| US31407EV420 / FNMA POOL 828735 FN 11/33 FLOATING VAR | 0,08 | -1,27 | 0,0443 | -0,0019 | ||

| US3128QPGM83 / FED HM LN PC POOL 1B7053 FH 04/36 FLOATING VAR | 0,08 | -1,28 | 0,0439 | -0,0014 | ||

| US42704RAA95 / HERA COMMERCIAL MORTGAGE LTD HERA 2021 FL1 A 144A | 0,08 | 0,00 | 0,0439 | -0,0007 | ||

| US31395M2F53 / Freddie Mac Structured Pass-Through Certificates | 0,08 | -3,75 | 0,0438 | -0,0025 | ||

| US63941FAC05 / Navient Private Education Refi Loan Trust 2020-A | 0,08 | -8,43 | 0,0436 | -0,0047 | ||

| US31392XUX47 / FHLMC, REMIC, Series 2525, Class AM | 0,08 | -6,17 | 0,0434 | -0,0036 | ||

| US31393BX754 / Fannie Mae Trust 2003-W6 | 0,08 | -3,80 | 0,0433 | -0,0029 | ||

| RFR USD SOFR/3.6942* 09/02/25-7Y* LCH / DIR (EZSCMPYF3PP3) | 0,08 | 0,0432 | 0,0432 | |||

| US3128QPUK61 / FED HM LN PC POOL 1B7435 FH 08/35 FLOATING VAR | 0,08 | -1,32 | 0,0428 | -0,0016 | ||

| US36179RPM50 / GNMA II POOL MA3128 G2 09/45 FLOATING VAR | 0,07 | -6,58 | 0,0408 | -0,0035 | ||

| US576433PD20 / MASTR Adjustable Rate Mortgages Trust 2004-6 | 0,07 | -6,67 | 0,0401 | -0,0037 | ||

| US36179RV224 / GNMA II POOL MA3333 G2 12/45 FLOATING VAR | 0,07 | -1,45 | 0,0387 | -0,0018 | ||

| US86359AMR13 / STRUCTURED ASSET SECURITIES CO SASC 2003 6A 2A1 | 0,06 | -3,08 | 0,0359 | -0,0017 | ||

| US46630GAW50 / JP MORGAN MORTGAGE TRUST JPMMT 2007 A1 5A6 | 0,06 | -4,62 | 0,0357 | -0,0023 | ||

| US576433QU36 / MASTR Adjustable Rate Mortgages Trust 2004-8 | 0,06 | -1,59 | 0,0356 | -0,0014 | ||

| US31402CN653 / FNMA POOL 725013 FN 04/33 FLOATING VAR | 0,06 | -3,12 | 0,0355 | -0,0016 | ||

| US3133KYXK09 / Freddie Mac Pool | 0,06 | 0,00 | 0,0352 | -0,0011 | ||

| US31413BD653 / FNMA POOL 940325 FN 02/35 FLOATING VAR | 0,06 | -1,61 | 0,0351 | -0,0013 | ||

| US36225CSN73 / G2 80524 | 0,06 | -3,17 | 0,0349 | -0,0020 | ||

| RFR USD SOFR/3.67444 09/02/25-7Y* LCH / DIR (EZ3JC37DJDV5) | 0,06 | 0,0347 | 0,0347 | |||

| US36179RJ427 / GNMA II POOL MA2983 G2 07/45 FLOATING VAR | 0,06 | 0,00 | 0,0342 | -0,0008 | ||

| US64830TAD00 / NRZT 2020-1A A1B | 0,06 | -3,23 | 0,0341 | -0,0021 | ||

| US863579BZ00 / STRUCTURED ADJUSTABLE RATE MOR SARM 2004 13 A3 | 0,06 | -1,67 | 0,0336 | -0,0012 | ||

| US3132D9MZ45 / FREDDIE MAC POOL UMBS P#SC0376 4.00000000 | 0,06 | -7,81 | 0,0336 | -0,0040 | ||

| US86359LGE39 / STRUCTURED ASSET MORTGAGE INVESTMENTS II TRUST 200 SAMI 2004-AR8 A1 | 0,06 | -1,69 | 0,0332 | -0,0014 | ||

| US31405PRS10 / Fannie Mae Pool | 0,06 | -1,69 | 0,0331 | -0,0016 | ||

| US85573EAC12 / Starwood Mortgage Residential Trust 2020-INV | 0,06 | -14,71 | 0,0330 | -0,0070 | ||

| US85573EAB39 / STARWOOD MORTGAGE RESIDENTIAL STAR 2020 INV1 A2 144A | 0,06 | -14,71 | 0,0329 | -0,0069 | ||

| US07384YGX85 / BEAR STEARNS ASSET BACKED SECU BSABS 2003 1 A1 | 0,06 | -5,08 | 0,0321 | -0,0026 | ||

| US3128NC2K96 / FED HM LN PC POOL 1G0778 FH 03/36 FLOATING VAR | 0,06 | -1,75 | 0,0321 | -0,0011 | ||

| US31385WZU60 / FANNIE MAE 3.589% 04/01/2040 FAR FNARM | 0,05 | -3,64 | 0,0304 | -0,0016 | ||

| US31381JRV60 / FANNIE MAE 4.155% 10/01/2035 FNMA | 0,05 | -1,85 | 0,0302 | -0,0013 | ||

| CARMAX SELECT RECEIVABLES TRUS CMXS 2024 A A2A / ABS-O (US14319FAB94) | 0,05 | -31,08 | 0,0295 | -0,0136 | ||

| CARMAX SELECT RECEIVABLES TRUS CMXS 2024 A A2A / ABS-O (US14319FAB94) | 0,05 | -31,08 | 0,0295 | -0,0136 | ||

| CARMAX SELECT RECEIVABLES TRUS CMXS 2024 A A2B / ABS-O (US14319FAC77) | 0,05 | -31,08 | 0,0294 | -0,0135 | ||

| CARMAX SELECT RECEIVABLES TRUS CMXS 2024 A A2B / ABS-O (US14319FAC77) | 0,05 | -31,08 | 0,0294 | -0,0135 | ||

| US92922FEB04 / WAMU Mortgage Pass-Through Certificates Trust, Series 2003-AR10, Class A7 | 0,05 | -3,77 | 0,0293 | -0,0014 | ||

| US31409FVH80 / FNMA POOL 870116 FN 09/35 FLOATING VAR | 0,05 | -1,92 | 0,0292 | -0,0009 | ||

| US76111XG987 / RFMSI Series 2006-SA1 Trust | 0,05 | -2,00 | 0,0282 | -0,0008 | ||

| US31349SUX97 / FED HM LN PC POOL 781498 FH 01/34 FLOATING VAR | 0,05 | -2,00 | 0,0282 | -0,0011 | ||

| US31400H5W99 / FANNIE MAE 3.703% 03/01/2033 FAR FNARM | 0,05 | -2,00 | 0,0281 | -0,0013 | ||

| US31418EGF16 / Fannie Mae Pool | 0,05 | -2,00 | 0,0281 | -0,0010 | ||

| US31392GVX05 / FANNIEMAE WHOLE LOAN FNW 2003 W1 1A1 | 0,05 | -2,00 | 0,0278 | -0,0012 | ||

| US007036QH22 / Adjustable Rate Mortgage Trust 2005-8 | 0,05 | -2,04 | 0,0278 | -0,0009 | ||

| RFR USD SOFR/3.25000 12/20/23-30Y LCH / DIR (EZ3BPZ7JX2D9) | 0,05 | 20,00 | 0,0278 | 0,0044 | ||

| RFR USD SOFR/3.25000 12/20/23-30Y LCH / DIR (EZ3BPZ7JX2D9) | 0,05 | 20,00 | 0,0278 | 0,0044 | ||

| US31406YTJ90 / FNMA POOL 824153 FN 06/34 FLOATING VAR | 0,05 | -5,88 | 0,0277 | -0,0022 | ||

| EZ4YGY9ZBMF1 / CMBX.NA.AAA.12 SP SAL | 0,05 | -580,00 | 0,0277 | 0,0335 | ||

| US313398VT33 / FSPC T-35 A V/R 9/25/31 1.84800000 | 0,05 | -16,07 | 0,0270 | -0,0055 | ||

| CMBX.NA.AAA.10 SP GST / DCR (000000000) | 0,05 | 0,0267 | 0,0267 | |||

| CMBX.NA.AAA.10 SP GST / DCR (000000000) | 0,05 | 0,0267 | 0,0267 | |||

| US466247YS63 / JP MORGAN MORTGAGE TRUST JPMMT 2005 A8 2A6 | 0,05 | 0,00 | 0,0264 | -0,0008 | ||

| RFRF USD SF+26.161/1.3* 9/22/23-5Y* CME / DIR (EZBJCCT971J0) | 0,05 | -11,76 | 0,0257 | -0,0040 | ||

| RFRF USD SF+26.161/1.3* 9/22/23-5Y* CME / DIR (EZBJCCT971J0) | 0,05 | -11,76 | 0,0257 | -0,0040 | ||

| US3133KYXC82 / UMBS, 20 Year | 0,04 | 0,00 | 0,0250 | -0,0009 | ||

| US32051GDX07 / FIRST HORIZON MORTGAGE PASS TH FHASI 2004 FL1 2A1 | 0,04 | -2,27 | 0,0248 | -0,0008 | ||

| US05948XTL54 / BANC OF AMERICA MORTGAGE 2003-H TRUST | 0,04 | 0,00 | 0,0248 | -0,0005 | ||

| US3133BASY82 / Federal Home Loan Mortgage Corporation | 0,04 | -2,27 | 0,0247 | -0,0010 | ||

| US3128JNXL43 / FED HM LN PC POOL 1B3482 FH 07/37 FLOATING VAR | 0,04 | 0,00 | 0,0241 | -0,0008 | ||

| US31407K6Q79 / FNMA POOL 833479 FN 09/35 FLOATING VAR | 0,04 | -2,44 | 0,0231 | -0,0009 | ||

| US3138YEGY72 / Fannie Mae Pool | 0,04 | -4,76 | 0,0227 | -0,0016 | ||

| CPS AUTO TRUST CPS 2024 C A 144A / ABS-O (US223920AA78) | 0,04 | -30,91 | 0,0219 | -0,0105 | ||

| CPS AUTO TRUST CPS 2024 C A 144A / ABS-O (US223920AA78) | 0,04 | -30,91 | 0,0219 | -0,0105 | ||

| US3133TKPF11 / FHLMC STRUCTURED PASS THROUGH FSPC T 16 A | 0,04 | -2,63 | 0,0215 | -0,0008 | ||

| US61746WA750 / MORGAN STANLEY DEAN WITTER CAP MSDWC 2003 NC2 M1 | 0,04 | -10,00 | 0,0208 | -0,0026 | ||

| US31418EFC93 / FNMA POOL MA4662 FN 07/42 FIXED 4 | 0,04 | -2,70 | 0,0206 | -0,0008 | ||

| US929227XB72 / WAMU MORTGAGE PASS-THROUGH CERTIFICATES SERIES 2002-AR17 SER 2002-AR17 CL 1A V/R REGD 3.52644500 | 0,04 | 0,00 | 0,0205 | -0,0009 | ||

| US31404MPT98 / FNMA POOL 772734 FN 03/34 FLOATING VAR | 0,04 | -2,78 | 0,0203 | -0,0008 | ||

| US07384MZS42 / Bear Stearns ARM Trust 2003-8 | 0,04 | -2,78 | 0,0203 | -0,0009 | ||

| US81744FGZ45 / Sequoia Mortgage Trust, Series 2005-2, Class A2 | 0,04 | -2,78 | 0,0202 | -0,0010 | ||

| US3128NCHJ69 / FED HM LN PC POOL 1G0233 FH 05/35 FLOATING VAR | 0,03 | -2,86 | 0,0197 | -0,0008 | ||

| US863579NA21 / STRUCTURED ADJUSTABLE RATE MOR SARM 2005 4 6A3 | 0,03 | -8,11 | 0,0196 | -0,0023 | ||

| RFR USD SOFR/3.25000 03/19/25-7Y LCH / DIR (EZXW94GLV2L5) | 0,03 | -29,79 | 0,0191 | -0,0083 | ||

| RFR USD SOFR/3.25000 03/19/25-7Y LCH / DIR (EZXW94GLV2L5) | 0,03 | -29,79 | 0,0191 | -0,0083 | ||

| US3128NGC296 / Federal Home Loan Mortgage Corporation | 0,03 | -2,94 | 0,0191 | -0,0008 | ||

| US31418EMN75 / Federal National Mortgage Association, Inc. | 0,03 | -2,94 | 0,0191 | -0,0007 | ||

| RFR USD SOFR/3.00000 03/19/25-5Y LCH / DIR (EZ9JNZJCQVZ3) | 0,03 | -20,00 | 0,0187 | -0,0046 | ||

| RFR USD SOFR/3.00000 03/19/25-5Y LCH / DIR (EZ9JNZJCQVZ3) | 0,03 | -20,00 | 0,0187 | -0,0046 | ||

| US59020USJ50 / MERRILL LYNCH MORTGAGE INVESTORS TRUST SERIES MLMI MLMI 2005-A2 A2 | 0,03 | -3,03 | 0,0185 | -0,0011 | ||

| US31405MA231 / FANNIE MAE 3.443% 07/01/2034 FNMA ARM | 0,03 | 0,00 | 0,0183 | -0,0008 | ||

| US32051GPJ84 / FIRST HORIZON ALTERNATIVE MORT FHAMS 2005 AA5 1A1 | 0,03 | 0,00 | 0,0179 | -0,0006 | ||

| RFRF USD SF+26.161/2.0* 8/09/23-9Y* CME / DIR (EZYBN0P9F1K0) | 0,03 | -13,89 | 0,0177 | -0,0035 | ||

| RFRF USD SF+26.161/2.0* 8/09/23-9Y* CME / DIR (EZYBN0P9F1K0) | 0,03 | -13,89 | 0,0177 | -0,0035 | ||

| US126694HQ49 / CHL Mortgage Pass-Through Trust, Series 2005-25, Class A11 | 0,03 | -3,23 | 0,0176 | -0,0005 | ||

| US31389L4R78 / FNMA POOL 629132 FN 05/32 FLOATING VAR | 0,03 | -3,23 | 0,0173 | -0,0008 | ||

| RFRF USD SF+26.161/0.9* 8/06/23-3Y* CME / DIR (EZRY3SP5T516) | 0,03 | -14,71 | 0,0169 | -0,0030 | ||

| US31406L3G17 / FANNIE MAE 3.538% 01/01/2036 FNMA ARM | 0,03 | -3,33 | 0,0169 | -0,0006 | ||

| US17307GY692 / Citigroup Mortgage Loan Trust, Series 2005-12, Class 2A1 | 0,03 | -14,71 | 0,0169 | -0,0034 | ||

| US12669GA765 / CHL Mortgage Pass-Through Trust, Series 2005-HYB3, Class 2A1A | 0,03 | -12,12 | 0,0168 | -0,0024 | ||

| US32051D4S87 / First Horizon Alternative Mortgage Securities Trust 2004-AA2 | 0,03 | 0,00 | 0,0166 | -0,0007 | ||

| US31295NLN65 / FED HM LN PC POOL 789333 FH 04/32 FLOATING VAR | 0,03 | -3,45 | 0,0161 | -0,0009 | ||

| US31403CWW71 / FANNIE MAE 3.375% 03/01/2035 FAR FNARM | 0,03 | -24,32 | 0,0160 | -0,0057 | ||

| US3140XLCS56 / FANNIE MAE POOL UMBS P#FS4580 4.00000000 | 0,03 | 0,00 | 0,0160 | -0,0004 | ||

| US31402RPT04 / FANNIE MAE 3.269% 10/01/2034 FNMA ARM | 0,03 | 0,00 | 0,0159 | -0,0006 | ||

| US3128Q2C921 / FED HM LN PC POOL 1L0096 FH 02/35 FLOATING VAR | 0,03 | -3,57 | 0,0157 | -0,0006 | ||

| US31404SCY90 / FNMA POOL 776887 FN 02/34 FLOATING VAR | 0,03 | -3,57 | 0,0157 | -0,0006 | ||

| US31403KDN00 / FNMA POOL 750809 FN 11/33 FLOATING VAR | 0,03 | -7,14 | 0,0153 | -0,0012 | ||

| US31407EZZ95 / FNMA POOL 828860 FN 05/35 FLOATING VAR | 0,03 | 0,00 | 0,0149 | -0,0006 | ||

| US31396L4T48 / FNMA, REMIC, Series 2006-118, Class A2 | 0,03 | -7,41 | 0,0147 | -0,0013 | ||

| US31409GR320 / FNMA POOL 870906 FN 12/36 FLOATING VAR | 0,03 | 0,00 | 0,0144 | -0,0005 | ||

| US36229RLG29 / GSR MORTGAGE LOAN TRUST GSR 2004 2F 4A1 | 0,03 | -7,41 | 0,0144 | -0,0014 | ||

| US31413FYF34 / FNMA POOL 944510 FN 07/37 FLOATING VAR | 0,03 | 0,00 | 0,0144 | -0,0005 | ||

| US31348MWV52 / FED HM LN PC POOL 765160 FH 09/30 FLOATING VAR | 0,03 | -3,85 | 0,0143 | -0,0012 | ||

| US31404Q5M78 / Fannie Mae Pool | 0,03 | -3,85 | 0,0143 | -0,0010 | ||

| US3128HDZB88 / FED HM LN PC POOL 847038 FH 01/30 FLOATING VAR | 0,03 | -7,41 | 0,0143 | -0,0014 | ||

| US31349SEZ20 / FED HM LN PC POOL 781052 FH 11/33 FLOATING VAR | 0,03 | -26,47 | 0,0142 | -0,0055 | ||

| US36242D4W09 / GSR Mortgage Loan Trust 2005-AR3 | 0,02 | -4,00 | 0,0139 | -0,0008 | ||

| US31401G4N18 / FANNIE MAE 4.145% 07/01/2033 FNMA ARM | 0,02 | 0,00 | 0,0138 | -0,0006 | ||

| US31336CL350 / FED HM LN PC POOL 972146 FH 04/34 FLOATING VAR | 0,02 | -11,11 | 0,0138 | -0,0021 | ||

| US3140H3YY67 / FNMA POOL BJ2526 FN 12/47 FIXED 3.5 | 0,02 | 0,00 | 0,0134 | -0,0003 | ||

| RFR USD SOFR/3.75000 12/18/24-2Y LCH / DIR (EZHML4QNCYC1) | 0,02 | -11,54 | 0,0133 | -0,0019 | ||

| US29445FAH10 / EQUIFIRST MORTGAGE LOAN TRUST EMLT 2003 2 3A3 | 0,02 | 0,00 | 0,0132 | -0,0007 | ||

| US31403NSL28 / FANNIE MAE 3.489% 11/01/2033 FAR FNARM | 0,02 | -4,35 | 0,0131 | -0,0006 | ||

| US31404ECQ70 / FANNIE MAE 3.752% 02/01/2034 FNMA ARM | 0,02 | 0,00 | 0,0126 | -0,0006 | ||

| US17307GW951 / Citigroup Mortgage Loan Trust 2005-11 | 0,02 | -4,55 | 0,0124 | -0,0004 | ||

| US17307GXP89 / Citigroup Mortgage Loan Trust Inc | 0,02 | -8,70 | 0,0123 | -0,0014 | ||

| US31406DJP24 / FNMA POOL 806770 FN 11/34 FLOATING VAR | 0,02 | 0,00 | 0,0122 | -0,0005 | ||

| US31402TQD09 / Fannie Mae Pool | 0,02 | 0,00 | 0,0121 | -0,0005 | ||

| RFRF USD SF+26.161/1.9* 02/09/22-10Y LCH / DIR (EZ9TV9KD87J7) | 0,02 | -16,67 | 0,0119 | -0,0024 | ||

| RFRF USD SF+26.161/1.9* 02/09/22-10Y LCH / DIR (EZ9TV9KD87J7) | 0,02 | -16,67 | 0,0119 | -0,0024 | ||

| US07384MC754 / BEAR STEARNS ADJUSTABLE RATE M BSARM 2003 9 3A3 | 0,02 | 0,00 | 0,0116 | -0,0004 | ||

| US31405MA561 / FNMA POOL 793028 FN 07/34 FLOATING VAR | 0,02 | 0,00 | 0,0114 | -0,0005 | ||

| US3138W9B746 / FNMA POOL AS0061 FN 08/28 FIXED 3 | 0,02 | -9,52 | 0,0113 | -0,0014 | ||

| US12669FBQ54 / COUNTRYWIDE HOME LOANS CWHL 2003 56 5A1 | 0,02 | -13,64 | 0,0113 | -0,0016 | ||

| US32051GDV41 / FIRST HORIZON MORTGAGE PASS TH FHASI 2004 FL1 1A1 | 0,02 | 0,00 | 0,0112 | -0,0003 | ||

| RFR USD SOFR/2.30000 01/17/24-2Y LCH / DIR (EZ7DPVG1XS64) | 0,02 | 5,56 | 0,0112 | 0,0007 | ||

| RFR USD SOFR/2.30000 01/17/24-2Y LCH / DIR (EZ7DPVG1XS64) | 0,02 | 5,56 | 0,0112 | 0,0007 | ||

| US31406AV669 / FNMA POOL 804437 FN 12/34 FLOATING VAR | 0,02 | -5,00 | 0,0112 | -0,0004 | ||

| US05948XT502 / BANC OF AMERICA MORTGAGE SECUR BOAMS 2004 A 3A1 | 0,02 | -9,52 | 0,0112 | -0,0011 | ||

| US16162WPJ26 / Chase Mortgage Finance Trust, Series 2005-A1, Class 3A1 | 0,02 | 0,00 | 0,0110 | -0,0003 | ||

| US31390STH49 / FNMA POOL 654952 FN 07/42 FLOATING VAR | 0,02 | -9,52 | 0,0110 | -0,0014 | ||

| US31403A5J04 / FNMA POOL 743449 FN 10/33 FLOATING VAR | 0,02 | -5,26 | 0,0106 | -0,0005 | ||

| US36185MBL54 / GMAC MORTGAGE CORPORATION LOAN TRUST | 0,02 | 0,00 | 0,0106 | -0,0003 | ||

| US576433WL62 / MASTR ADJUSTABLE RATE MORTGAGES TRUST 2004-13 MARM 2004-13 3A7A | 0,02 | 0,00 | 0,0104 | -0,0005 | ||

| US589929S412 / MLCC MORTGAGE INVESTORS INC MLCC 2003 C A1 | 0,02 | -5,26 | 0,0104 | -0,0011 | ||

| US31402DKS89 / FNMA POOL 725805 FN 09/34 FLOATING VAR | 0,02 | 0,00 | 0,0099 | -0,0004 | ||

| US93363DAA54 / WaMu Mortgage Pass-Through Certificates Series 2006-AR9 Trust | 0,02 | 0,00 | 0,0099 | -0,0005 | ||

| US36225CA890 / GNMA II POOL 080030 G2 01/27 FLOATING VAR | 0,02 | -23,81 | 0,0094 | -0,0029 | ||

| US36225CV524 / GNMA II POOL 080635 G2 09/32 FLOATING VAR | 0,02 | -5,88 | 0,0094 | -0,0007 | ||

| US31371MQL45 / FNMA POOL 256159 FN 02/36 FLOATING VAR | 0,02 | 0,00 | 0,0093 | -0,0003 | ||

| US41161PLR28 / HARBORVIEW MORTGAGE LOAN TRUST 2005-2 SER 2005-2 CL 2A1A V/R REGD 2.17325000 | 0,02 | -6,25 | 0,0091 | -0,0006 | ||

| US31384WE718 / FNMA POOL 535758 FN 03/30 FLOATING VAR | 0,02 | -16,67 | 0,0090 | -0,0014 | ||

| RFR USD SOFR/3.75000 06/20/24-10Y LCH / DIR (EZ52H44WTW83) | 0,02 | -400,00 | 0,0090 | 0,0123 | ||

| RFR USD SOFR/3.75000 06/20/24-10Y LCH / DIR (EZ52H44WTW83) | 0,02 | -400,00 | 0,0090 | 0,0123 | ||

| US31393JPL60 / Freddie Mac REMICS | 0,02 | -21,05 | 0,0090 | -0,0022 | ||

| US16162WPE39 / CHASE MORTGAGE FINANCE CORPORA CHASE 2005 A1 2A2 | 0,02 | 0,00 | 0,0089 | -0,0002 | ||

| US542514BQ66 / LONG BEACH MORTGAGE LOAN TRUST LBMLT 2001 4 2A1 | 0,02 | 0,00 | 0,0089 | -0,0001 | ||

| US07384M5Y44 / BEAR STEARNS ADJUSTABLE RATE M BSARM 2004 10 12A5 | 0,02 | 0,00 | 0,0087 | -0,0002 | ||

| US59020UAA34 / MLMI 2004 A1 1A | 0,02 | 0,00 | 0,0087 | -0,0001 | ||

| US31405GQ379 / FNMA POOL 788974 FN 04/34 FLOATING VAR | 0,02 | 0,00 | 0,0086 | -0,0003 | ||

| US05948XYD73 / BANC OF AMERICA MORTGAGE SECUR BOAMS 2003 J 2A2 | 0,01 | 0,00 | 0,0083 | -0,0003 | ||

| CMBX.NA.AAA.11 SP SAL / DCR (000000000) | 0,01 | 0,0082 | 0,0082 | |||

| CMBX.NA.AAA.11 SP SAL / DCR (000000000) | 0,01 | 0,0082 | 0,0082 | |||

| US589929G367 / Merrill Lynch Mortgage Investors Trust, Series 2003-A, Class 2A2 | 0,01 | -6,67 | 0,0082 | -0,0009 | ||

| US126670LE60 / CHL Mortgage Pass-Through Trust 2005-HYB9 | 0,01 | 0,00 | 0,0082 | -0,0005 | ||

| US863579AQ10 / Structured Adjustable Rate Mortgage Loan Trust, Series 2004-12, Class 3A2 | 0,01 | -23,53 | 0,0078 | -0,0022 | ||

| US36225CXP66 / GNMA II POOL 080685 G2 04/33 FLOATING VAR | 0,01 | 0,00 | 0,0076 | -0,0004 | ||

| CMBX.NA.AAA.10 SP SAL / DCR (000000000) | 0,01 | 0,0075 | 0,0075 | |||

| US31407ANB34 / FANNIE MAE 3.445% 11/01/2033 FAR FNARM | 0,01 | -7,69 | 0,0072 | -0,0003 | ||

| US36225CVW36 / GNMA II POOL 080628 G2 08/32 FLOATING VAR | 0,01 | -7,69 | 0,0072 | -0,0005 | ||

| US31406Q7B74 / FNMA POOL 817290 FN 06/35 FLOATING VAR | 0,01 | 0,00 | 0,0072 | -0,0003 | ||

| US17307GEB05 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2004 HYB2 1A | 0,01 | 0,00 | 0,0072 | -0,0002 | ||

| US3133KYXR51 / Freddie Mac Pool | 0,01 | -7,69 | 0,0072 | -0,0004 | ||

| US939335N683 / Washington Mutual MSC Mortgage Pass-Through Certificates Series 2002-AR1 Trust | 0,01 | -20,00 | 0,0072 | -0,0020 | ||

| US86359AS462 / STRUCTURED ASSET SECURITIES CO SASC 2003 26A 2A | 0,01 | 0,00 | 0,0072 | -0,0002 | ||

| US31385HU597 / FANNIE MAE 3.25% 05/01/2036 FNMA ARM | 0,01 | -7,69 | 0,0070 | -0,0011 | ||

| US31390WRA26 / FNMA | 0,01 | 0,00 | 0,0070 | -0,0003 | ||

| US45660N2Y00 / IndyMac INDX Mortgage Loan Trust, Series 2004-AR10, Class 2A2A | 0,01 | 0,00 | 0,0070 | -0,0002 | ||

| US07384M4J85 / Bear Stearns ARM Trust 2004-10 | 0,01 | 9,09 | 0,0069 | 0,0000 | ||

| US31403GWC22 / Fannie Mae Pool | 0,01 | 0,00 | 0,0068 | -0,0003 | ||

| US31374GRC32 / Fannie Mae Pool | 0,01 | -8,33 | 0,0067 | -0,0006 | ||

| US31406H3D75 / FNMA | 0,01 | -15,38 | 0,0066 | -0,0010 | ||

| US3133KYYA18 / Federal Home Loan Mortgage Corporation | 0,01 | 0,00 | 0,0065 | -0,0001 | ||

| US3128QS2Z80 / FED HM LN PC POOL 1G2592 FH 12/36 FLOATING VAR | 0,01 | 0,00 | 0,0065 | -0,0003 | ||

| US31403H3P37 / FNMA POOL 749706 FN 11/33 FLOATING VAR | 0,01 | 0,00 | 0,0065 | -0,0003 | ||

| US939336P801 / Washington Mutual MSC Mortgage Pass-Through Certificates Series 2004-RA1 Trust | 0,01 | 0,00 | 0,0065 | -0,0001 | ||

| US3140H3W856 / FNMA POOL BJ2470 FN 12/47 FIXED 3.5 | 0,01 | 0,00 | 0,0064 | -0,0003 | ||

| US31409UUP82 / FNMA POOL 879090 FN 05/36 FLOATING VAR | 0,01 | 0,00 | 0,0064 | -0,0002 | ||

| US31295NEY04 / Freddie Mac Non Gold Pool | 0,01 | -35,29 | 0,0064 | -0,0036 | ||

| US36225CK709 / GNMA II POOL 080317 G2 09/29 FLOATING VAR | 0,01 | 0,00 | 0,0064 | -0,0005 | ||

| US07384MTN29 / Bear Stearns ARM Trust 2003-1 | 0,01 | 0,00 | 0,0064 | -0,0003 | ||

| US576438AD71 / MASTR ADJUSTABLE RATE MORTGAGE MARM 2006 2 3A1 | 0,01 | -8,33 | 0,0063 | -0,0011 | ||

| US31407X3X76 / FNMA POOL 844214 FN 11/35 FLOATING VAR | 0,01 | 0,00 | 0,0061 | -0,0002 | ||

| US126694AN80 / COUNTRYWIDE HOME LOANS CWHL 2005 19 2A2 | 0,01 | 0,00 | 0,0061 | -0,0002 | ||

| US31392DUF76 / FANNIEMAE WHOLE LOAN FNW 2002 W4 A4 | 0,01 | 0,00 | 0,0060 | -0,0003 | ||

| US31392DUA89 / FANNIEMAE WHOLE LOAN FNW 2002 W4 A5 | 0,01 | -9,09 | 0,0060 | -0,0007 | ||

| US31392ADL98 / Fannie Mae REMICS | 0,01 | -9,09 | 0,0059 | -0,0005 | ||

| US31403GZT20 / FNMA POOL 748754 FN 10/33 FIXED 7 | 0,01 | 0,00 | 0,0059 | -0,0004 | ||

| US576433GC48 / MASTR Adjustable Rate Mortgages Trust 2003-6 | 0,01 | 0,00 | 0,0058 | -0,0003 | ||

| US31407YHH53 / FNMA POOL 844532 FN 11/35 FLOATING VAR | 0,01 | 0,00 | 0,0058 | -0,0002 | ||

| US65535VPU60 / NAA 2005-AR5 2A1 | 0,01 | -10,00 | 0,0057 | -0,0002 | ||

| US05949AGR59 / BANK OF AMERICA MORRTGAGE SECURITIES | 0,01 | -10,00 | 0,0057 | -0,0001 | ||

| US31346VHH50 / FED HM LN PC POOL 390232 FH 01/30 FLOATING VAR | 0,01 | -10,00 | 0,0057 | -0,0004 | ||

| US31394BZ641 / FANNIEMAE WHOLE LOAN FNW 2004 W15 1A1 | 0,01 | -10,00 | 0,0056 | -0,0003 | ||

| US31358SNY36 / Fannie Mae REMICS | 0,01 | -18,18 | 0,0056 | -0,0012 | ||

| US36242DBM48 / GSR Mortgage Loan Trust 2004-9 | 0,01 | 0,00 | 0,0056 | -0,0001 | ||

| US31401L6D00 / FNMA POOL 711968 FN 05/33 FLOATING VAR | 0,01 | 0,00 | 0,0055 | -0,0002 | ||

| US31339LN716 / FREDDIE MAC FHR 2395 FA | 0,01 | -10,00 | 0,0055 | -0,0006 | ||

| US31349UMJ42 / FED HM LN PC POOL 783061 FH 03/35 FLOATING VAR | 0,01 | 0,00 | 0,0052 | -0,0002 | ||

| US36228F4R42 / GSR MORTGAGE LOAN TRUST GSR 2004 7 3A1 | 0,01 | 0,00 | 0,0052 | -0,0002 | ||

| US007036DN37 / Adjustable Rate Mortgage Trust 2004-4 | 0,01 | 0,00 | 0,0052 | -0,0002 | ||

| US3133TJN583 / FREDDIE MAC FHR 2130 FD | 0,01 | 0,00 | 0,0052 | -0,0004 | ||

| US759950AG37 / RENAISSANCE HOME EQUITY LOAN T RAMC 2002 2 A | 0,01 | 0,00 | 0,0052 | -0,0001 | ||

| US31408FPH63 / FNMA ARM 5.16% 9/35 #850124 | 0,01 | 0,00 | 0,0052 | -0,0001 | ||

| US31385CDK62 / FNMA | 0,01 | -11,11 | 0,0050 | -0,0003 | ||

| US05948XR290 / BANC OF AMERICA MORTGAGE SECUR BOAMS 2003 L 2A2 | 0,01 | 0,00 | 0,0050 | -0,0002 | ||

| US17307GW530 / Citigroup Mortgage Loan Trust 2005-11 | 0,01 | 0,00 | 0,0050 | -0,0001 | ||

| US31348UHU60 / FED HM LN PC POOL 865643 FH 04/30 FLOATING VAR | 0,01 | -20,00 | 0,0050 | -0,0009 | ||

| US31371MFZ59 / FNMA POOL 255884 FN 08/35 FLOATING VAR | 0,01 | 0,00 | 0,0050 | -0,0002 | ||

| US31404EQE94 / FANNIE MAE 3.736% 03/01/2034 FAR FNARM | 0,01 | 0,00 | 0,0049 | -0,0002 | ||

| US07384MS784 / BEAR STEARNS ARM TRUST 2004-5 BSARM 2004-5 2A | 0,01 | 0,00 | 0,0049 | -0,0001 | ||

| US86358HUT49 / Structured Asset Mortgage Investments Trust 2003-AR3 | 0,01 | 0,00 | 0,0049 | -0,0002 | ||

| US31402CVD19 / FNMA POOL 725212 FN 03/33 FLOATING VAR | 0,01 | 0,00 | 0,0048 | -0,0002 | ||

| US81743VAA17 / SEQUOIA MORTGAGE TRUST 10 SEMT 10 1A | 0,01 | -27,27 | 0,0048 | -0,0017 | ||

| US31378A3P93 / FANNIE MAE 3.341% 11/01/2026 FAR FNARM | 0,01 | -11,11 | 0,0047 | -0,0009 | ||

| US31358SSV42 / Fannie Mae REMICS | 0,01 | 0,00 | 0,0047 | -0,0004 | ||

| US81744FCG00 / Sequoia Mortgage Trust 2004-6 | 0,01 | 0,00 | 0,0046 | -0,0004 | ||

| US3128M6PE23 / Freddie Mac Gold Pool | 0,01 | 0,00 | 0,0046 | -0,0003 | ||

| US31336CLM37 / FED HM LN PC POOL 972132 FH 11/33 FLOATING VAR | 0,01 | 0,00 | 0,0046 | -0,0004 | ||

| US31406QGB77 / FNMA | 0,01 | 0,00 | 0,0046 | -0,0002 | ||

| US31402QUH28 / FNMA POOL 735084 FN 02/34 FLOATING VAR | 0,01 | -11,11 | 0,0046 | -0,0007 | ||

| US466285AK96 / J.P. MORGAN ALTERNATIVE LOAN T JPALT 2006 A6 2A1 | 0,01 | 0,00 | 0,0046 | -0,0001 | ||

| RFRF USD SF+26.161/1.2* 9/15/23-3Y* CME / DIR (EZ8H8SK9HY04) | 0,01 | -12,50 | 0,0044 | -0,0007 | ||

| RFRF USD SF+26.161/1.2* 9/15/23-3Y* CME / DIR (EZ8H8SK9HY04) | 0,01 | -12,50 | 0,0044 | -0,0007 | ||

| US31393CX406 / FNMA, Series 2003-W8, Class 3F2 | 0,01 | -12,50 | 0,0044 | -0,0003 | ||

| US31402QX488 / FANNIE MAE 3.339% 01/01/2035 FAR FNARM | 0,01 | -22,22 | 0,0043 | -0,0011 | ||

| US31407A7K18 / Fannie Mae Pool | 0,01 | 0,00 | 0,0042 | -0,0002 | ||

| US31339NE851 / FREDDIE MAC FHR 2413 FB | 0,01 | -12,50 | 0,0042 | -0,0005 | ||

| US74160MDL37 / Prime Mortgage Trust 2004-CL1 | 0,01 | -12,50 | 0,0042 | -0,0006 | ||

| US31574PAA30 / Ellington Financial Mortgage Trust 2020-1 | 0,01 | -50,00 | 0,0042 | -0,0041 | ||

| US3128NC6C35 / Freddie Mac Non Gold Pool | 0,01 | -36,36 | 0,0042 | -0,0025 | ||

| US31410GDL41 / FANNIE MAE 3.608% 02/01/2035 FAR FNARM | 0,01 | 0,00 | 0,0042 | -0,0003 | ||

| US22541NAD12 / Home Equity Asset Trust | 0,01 | 0,00 | 0,0042 | -0,0001 | ||

| US22541QUQ36 / CREDIT SUISSE FIRST BOSTON MOR CSFB 2003 AR24 4A1 | 0,01 | 0,00 | 0,0041 | -0,0005 | ||

| US3128QLQU85 / FED HM LN PC POOL 1H2567 FH 09/35 FLOATING VAR | 0,01 | 0,00 | 0,0040 | -0,0002 | ||

| US12669F6Y44 / COUNTRYWIDE HOME LOANS CWHL 2004 22 A2 | 0,01 | 0,00 | 0,0040 | -0,0002 | ||

| US31404JS976 / FNMA POOL 770144 FN 02/34 FLOATING VAR | 0,01 | -14,29 | 0,0039 | -0,0002 | ||

| US31391XDM83 / FNMA POOL 679708 FN 09/41 FLOATING VAR | 0,01 | -14,29 | 0,0039 | -0,0003 | ||

| US78448WAB19 / SMB Private Education Loan Trust 2017-A | 0,01 | -60,00 | 0,0038 | -0,0049 | ||

| US31392HGV96 / FANNIE MAE FNR 2002 95 FK | 0,01 | -14,29 | 0,0038 | -0,0003 | ||

| US45660UAT60 / IndyMac ARM Trust 2001-H2 | 0,01 | 0,00 | 0,0037 | -0,0002 | ||

| US31392CKL71 / FANNIE MAE FNR 2002 15 FA | 0,01 | 0,00 | 0,0036 | -0,0004 | ||

| US05949CHX74 / Banc of America Mortgage 2005-I Trust | 0,01 | 0,00 | 0,0036 | -0,0001 | ||

| US3128QGDW93 / FED HM LN PC POOL 1N0117 FH 12/35 FLOATING VAR | 0,01 | 0,00 | 0,0036 | -0,0001 | ||

| US31393BW764 / FANNIE MAE WHOLE LOAN | 0,01 | 0,00 | 0,0035 | -0,0003 | ||

| US81743PAA49 / SEMT_03-1 | 0,01 | 0,00 | 0,0035 | -0,0003 | ||

| US86359A4Z37 / STRUCTURED ASSET SECURITIES CO SASC 2003 34A 3A1 | 0,01 | -16,67 | 0,0034 | -0,0001 | ||

| US31358SH879 / FANNIE MAE REMICS SER 2000-47 CL FD V/R 2.56838000 | 0,01 | -28,57 | 0,0033 | -0,0011 | ||

| 3 MONTH SOFR FUT JUN25 XCME 20250916 / DIR (000000000) | 0,01 | 0,0033 | 0,0033 | |||

| 3 MONTH SOFR FUT JUN25 XCME 20250916 / DIR (000000000) | 0,01 | 0,0033 | 0,0033 | |||

| US31409JLH13 / FANNIE MAE 4.475% 06/01/2036 FNMA ARM | 0,01 | 0,00 | 0,0033 | -0,0001 | ||

| US31406WEF77 / FANNIE MAE 4.384% 06/01/2035 FNMA ARM | 0,01 | 0,00 | 0,0033 | -0,0001 | ||

| US31410GEU31 / FNMA POOL 888547 FN 06/37 FLOATING VAR | 0,01 | 0,00 | 0,0032 | -0,0001 | ||

| US31393T7H31 / Fannie Mae REMICS | 0,01 | -28,57 | 0,0032 | -0,0009 | ||

| US31371LLA51 / FANNIE MAE 3.50% 12/01/2033 FAR FNARM | 0,01 | -16,67 | 0,0032 | -0,0003 | ||

| US3128QLRA13 / Freddie Mac Non Gold Pool | 0,01 | 0,00 | 0,0032 | -0,0001 | ||

| US31402RTV14 / FNMA POOL 735964 FN 10/35 FLOATING VAR | 0,01 | 0,00 | 0,0032 | -0,0001 | ||

| US31295NJV10 / FED HM LN PC POOL 789276 FH 04/32 FLOATING VAR | 0,01 | 0,00 | 0,0031 | -0,0001 | ||

| US31385HN329 / FANNIE MAE 3.981% 05/01/2036 FAR FNARM | 0,01 | -16,67 | 0,0031 | -0,0004 | ||

| US31389F3V26 / FNMA POOL 624612 FN 04/28 FLOATING VAR | 0,01 | -16,67 | 0,0031 | -0,0004 | ||

| US12667G5V16 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 43 2A1 | 0,01 | 0,00 | 0,0031 | -0,0001 | ||

| US3128JRHJ84 / FED HM LN PC POOL 847433 FH 07/35 FLOATING VAR | 0,01 | 0,00 | 0,0030 | -0,0003 | ||

| US31390RWU30 / FNMA POOL 654159 FN 10/32 FLOATING VAR | 0,01 | 0,00 | 0,0030 | -0,0001 | ||

| US31400SJE00 / FNMA POOL 696061 FN 04/33 FLOATING VAR | 0,01 | 0,00 | 0,0030 | -0,0001 | ||

| US83611MAQ15 / Soundview Home Loan Trust, Series 2003-2, Class A2 | 0,01 | -50,00 | 0,0030 | -0,0031 | ||

| US3128NCCU69 / FED HM LN PC POOL 1G0083 FH 03/35 FLOATING VAR | 0,01 | 0,00 | 0,0029 | -0,0001 | ||

| US31392C6T69 / FANNIE MAE FNR 2002 25 FX | 0,01 | 0,00 | 0,0029 | -0,0002 | ||

| US31339D7C66 / FREDDIE MAC FHR 2417 FY | 0,01 | 0,00 | 0,0028 | -0,0003 | ||

| US31406DG672 / FANNIE MAE 3.42% 11/01/2034 FAR FNARM | 0,01 | 0,00 | 0,0028 | -0,0001 | ||

| RFR USD SOFR/3.75000 06/20/24-10Y CME / DIR (EZ52H44WTW83) | 0,00 | -180,00 | 0,0028 | 0,0061 | ||

| RFR USD SOFR/3.75000 06/20/24-10Y CME / DIR (EZ52H44WTW83) | 0,00 | -180,00 | 0,0028 | 0,0061 | ||

| US31385HZV76 / FNMA POOL 545356 FN 11/31 FLOATING VAR | 0,00 | -20,00 | 0,0028 | -0,0003 | ||

| US3133TLPG76 / FREDDIE MAC FHR 2177 FA | 0,00 | -20,00 | 0,0028 | -0,0006 | ||

| US939336G495 / WASHINGTON MUTUAL MSC MORTGAGE WAMMS 2003 AR3 2A2 | 0,00 | 0,00 | 0,0028 | -0,0000 | ||

| US31393USE46 / FANNIE MAE FNR 2003 124 F | 0,00 | -20,00 | 0,0027 | -0,0002 | ||

| US31393UMM26 / FANNIE MAE FNR 2003 118 FD | 0,00 | 0,00 | 0,0026 | -0,0002 | ||

| US31400YDR45 / FNMA POOL 701312 FN 08/33 FLOATING VAR | 0,00 | 0,00 | 0,0026 | -0,0001 | ||

| RFR USD SOFR/3.25000 06/18/25-7Y LCH / DIR (EZNM897HLTQ3) | 0,00 | 0,0026 | 0,0026 | |||

| RFR USD SOFR/3.25000 06/18/25-7Y LCH / DIR (EZNM897HLTQ3) | 0,00 | 0,0026 | 0,0026 | |||

| US31392CQ311 / FANNIE MAE FNR 2002 34 FE | 0,00 | -20,00 | 0,0025 | -0,0005 | ||

| US31406MER34 / FANNIE MAE 3.661% 01/01/2035 FNMA ARM | 0,00 | 0,00 | 0,0024 | -0,0001 | ||

| US31411SM868 / FNMA POOL 913983 FN 02/37 FLOATING VAR | 0,00 | 0,00 | 0,0024 | -0,0001 | ||

| US31401Y6R15 / FNMA POOL 722780 FN 09/33 FLOATING VAR | 0,00 | 0,00 | 0,0024 | -0,0001 | ||

| US31405ARU96 / FNMA POOL 783599 FN 04/35 FLOATING VAR | 0,00 | 0,00 | 0,0024 | -0,0001 | ||

| US31393FGG54 / Freddie Mac REMICS | 0,00 | 0,00 | 0,0024 | -0,0001 | ||

| US31358SVW87 / FANNIE MAE FNR 2000 38 F | 0,00 | 0,00 | 0,0023 | -0,0003 | ||

| US31402RBC25 / FANNIE MAE 3.894% 02/01/2035 FNMA ARM | 0,00 | -25,00 | 0,0022 | -0,0001 | ||

| US31359V6Z11 / FANNIE MAE FNR 1999 37 F | 0,00 | -25,00 | 0,0022 | -0,0003 | ||

| US36228F4P85 / GSR Mortgage Loan Trust 2004-7 | 0,00 | 0,00 | 0,0022 | -0,0001 | ||

| US31395B6R90 / Fannie Mae REMICS | 0,00 | 0,00 | 0,0022 | -0,0001 | ||

| US76111JZ721 / RESIDENTIAL FUNDING MTG SEC I RFMSI 2003 S9 A1 | 0,00 | 0,00 | 0,0022 | -0,0001 | ||

| US31342AYG83 / FED HM LN PC POOL 780711 FH 07/33 FLOATING VAR | 0,00 | 0,00 | 0,0022 | -0,0001 | ||

| US31400QX813 / FNMA POOL 694703 FN 04/33 FLOATING VAR | 0,00 | 0,00 | 0,0022 | -0,0001 | ||

| US31404J2J30 / FNMA | 0,00 | 0,00 | 0,0021 | -0,0001 | ||

| US31408GJF54 / FANNIE MAE 3.509% 12/01/2035 FNMA ARM | 0,00 | -25,00 | 0,0021 | -0,0003 | ||

| US22541NNN56 / CREDIT SUISSE FIRST BOSTON MOR CSFB 2002 AR28 1A2 | 0,00 | 0,00 | 0,0021 | -0,0001 | ||

| US5899294G05 / MERRILL LYNCH MORTGAGE INVESTO MLMI 2003 A6 1A | 0,00 | 0,00 | 0,0020 | -0,0001 | ||

| US31407MSF31 / FANNIE MAE 3.634% 07/01/2035 FNMA ARM | 0,00 | 0,00 | 0,0020 | -0,0001 | ||

| US9393357P40 / WAMU 02-AR9 1A V/R 8/25/42 3.72644500 | 0,00 | 0,00 | 0,0019 | -0,0001 | ||

| US576433GH35 / MASTR ADJUSTABLE RATE MORTGAGE MARM 2003 6 4A2 | 0,00 | 0,00 | 0,0018 | -0,0001 | ||

| US31393YU521 / FNGT 2004-T3 1A1 6% 2/25/44 6.00000000 | 0,00 | 0,00 | 0,0018 | -0,0001 | ||

| US31385WXC80 / FANNIE MAE 3.563% 01/01/2033 FNMA | 0,00 | 0,00 | 0,0016 | -0,0001 | ||

| US31405U6G90 / Fannie Mae Pool | 0,00 | 0,00 | 0,0016 | -0,0001 | ||

| US161630AC20 / Chase Mortgage Finance Trust Series 2007-A1 | 0,00 | 0,00 | 0,0016 | -0,0001 | ||

| US073873AA90 / BEAR STEARNS ALT A TRUST BALTA 2006 5 1A1 | 0,00 | 0,00 | 0,0016 | -0,0001 | ||

| US31418EHF07 / Fannie Mae Pool | 0,00 | 0,00 | 0,0016 | -0,0001 | ||

| US3133TLPF93 / FREDDIE MAC FHR 2177 F | 0,00 | -33,33 | 0,0016 | -0,0004 | ||

| US3128JRHC32 / FED HM LN PC POOL 847427 FH 09/34 FLOATING VAR | 0,00 | 0,00 | 0,0016 | -0,0001 | ||

| US31406GD557 / Fannie Mae Pool | 0,00 | 0,00 | 0,0015 | -0,0001 | ||

| US31392WJU53 / FREDDIE MAC FHR 2509 ZQ | 0,00 | 0,00 | 0,0015 | -0,0001 | ||

| US31392KGB61 / FREDDIE MAC FHR 2451 FB | 0,00 | 0,00 | 0,0015 | -0,0001 | ||

| US31402DLH16 / FNMA ARM 3.99% 5/34 #725828 | 0,00 | 0,00 | 0,0015 | -0,0001 | ||

| US31359QF339 / FANNIE MAE FNR 1997 65 FK | 0,00 | -33,33 | 0,0015 | -0,0003 | ||

| US74160MDK53 / PRIME MORTGAGE TRUST | 0,00 | 0,00 | 0,0014 | -0,0002 | ||

| US94982DAA46 / Wells Fargo Mortgage Backed Securities Trust, Series 2005-AR14, Class A1 | 0,00 | 0,00 | 0,0014 | -0,0001 | ||

| US31407UMR58 / Fannie Mae Pool | 0,00 | 0,00 | 0,0014 | -0,0001 | ||

| US31391MKY83 / FNMA POOL 670911 FN 12/32 FLOATING VAR | 0,00 | -66,67 | 0,0014 | -0,0022 | ||

| US3128NCY406 / FED HM LN PC POOL 1G0731 FH 02/36 FLOATING VAR | 0,00 | 0,00 | 0,0014 | -0,0001 | ||

| US466247K778 / JP Morgan Mortgage Trust 2006-A2 | 0,00 | 0,00 | 0,0014 | -0,0001 | ||

| 3 MONTH SOFR FUT SEP25 XCME 20251216 / DIR (000000000) | 0,00 | 0,0013 | 0,0013 | |||

| 3 MONTH SOFR FUT SEP25 XCME 20251216 / DIR (000000000) | 0,00 | 0,0013 | 0,0013 | |||

| US31402DLJ71 / Fannie Mae Pool | 0,00 | 0,00 | 0,0013 | -0,0000 | ||

| US31392JY294 / FNMA, REMIC, Series 2003-21, Class FK | 0,00 | 0,00 | 0,0013 | -0,0001 | ||

| US3128NCTE45 / FED HM LN PC POOL 1G0549 FH 06/35 FLOATING VAR | 0,00 | 0,00 | 0,0012 | -0,0001 | ||

| US07384MYS50 / Bear Stearns ARM Trust, Series 2003-7, Class 3A | 0,00 | 0,00 | 0,0012 | -0,0000 | ||

| US31393XGQ43 / FANNIEMAE WHOLE LOAN FNW 2004 W2 2A2 | 0,00 | 0,00 | 0,0012 | -0,0001 | ||

| US31342AB577 / FED HM LN PC POOL 780060 FH 12/32 FLOATING VAR | 0,00 | 0,00 | 0,0012 | -0,0001 | ||

| US31407XWM90 / FANNIE MAE 3.456% 11/01/2035 FNMA ARM | 0,00 | 0,00 | 0,0012 | -0,0000 | ||

| US31390NJT00 / FANNIE MAE 2.145% 06/01/2032 FAR FNARM | 0,00 | 0,00 | 0,0012 | -0,0001 | ||

| RFR USD SOFR/3.55016 03/01/24-7Y* LCH / DIR (EZBKXTPHC9Q8) | 0,00 | -91,30 | 0,0012 | -0,0127 | ||

| US3128LUKS48 / FED HM LN PC POOL 1J0305 FH 02/37 FLOATING VAR | 0,00 | 0,00 | 0,0011 | -0,0000 | ||

| US31418EJZ43 / Fannie Mae Pool | 0,00 | 0,00 | 0,0011 | -0,0000 | ||

| US31389AZQ92 / FNMA POOL 620051 FN 08/32 FLOATING VAR | 0,00 | 0,00 | 0,0011 | -0,0001 | ||

| US3133TAC429 / FREDDIE MAC FHR 1968 FC | 0,00 | -50,00 | 0,0011 | -0,0005 | ||

| US3128QJUA20 / FED HM LN PC POOL 1G1477 FH 01/37 FLOATING VAR | 0,00 | 0,00 | 0,0011 | -0,0000 | ||

| US36228FNB84 / GSR MORTGAGE LOAN TRUST | 0,00 | 0,00 | 0,0010 | -0,0000 | ||

| US31404XJD75 / FNMA POOL 781560 FN 10/34 FLOATING VAR | 0,00 | 0,00 | 0,0010 | -0,0001 | ||

| US31390S3K53 / FANNIE MAE 3.519% 05/01/2032 FNMA ARM | 0,00 | 0,00 | 0,0010 | -0,0001 | ||

| US44328AAB61 / HSI Asset Securitization Corp Trust 2006-HE1 | 0,00 | 0,00 | 0,0010 | -0,0000 | ||

| US466247AZ62 / JP MORGAN MORTGAGE TRUST 2003-A2 SER 2003-A2 CL 3A1 V/R REGD 3.76336000 | 0,00 | -66,67 | 0,0010 | -0,0009 | ||

| US31401CCQ42 / FNMA POOL 703979 FN 05/33 FLOATING VAR | 0,00 | 0,00 | 0,0010 | -0,0001 | ||

| US3133TAG222 / FREDDIE MAC FHR 1980 Z | 0,00 | 0,00 | 0,0009 | -0,0002 | ||

| US31407MSU08 / FANNIE MAE 3.687% 07/01/2035 FAR FNARM | 0,00 | 0,00 | 0,0009 | -0,0000 | ||

| US31402DRT99 / FNMA POOL 725998 FN 11/34 FLOATING VAR | 0,00 | 0,00 | 0,0009 | -0,0000 | ||

| US3128NVMC33 / FED HM LN PC POOL 1K1255 FH 11/36 FLOATING VAR | 0,00 | 0,00 | 0,0009 | -0,0000 | ||

| US3128QLRW33 / Freddie Mac Non Gold Pool | 0,00 | 0,00 | 0,0009 | -0,0000 | ||

| US31406NL937 / FNMA POOL 814952 FN 04/35 FLOATING VAR | 0,00 | 0,00 | 0,0009 | -0,0000 | ||

| US313920QJ21 / FNMA, REMIC, Series 2001-38, Class FB | 0,00 | -50,00 | 0,0009 | -0,0004 | ||

| US31385WXE47 / FANNIE MAE 3.442% 01/01/2033 FAR FNARM | 0,00 | 0,00 | 0,0008 | -0,0000 | ||

| US31411DCZ06 / FNMA POOL 904688 FN 12/36 FLOATING VAR | 0,00 | 0,00 | 0,0008 | -0,0002 | ||

| RFR USD SOFR/3.54542 03/01/24-7Y* LCH / DIR (EZBKXTPHC9Q8) | 0,00 | -95,65 | 0,0008 | -0,0131 | ||

| US31384QRC95 / FNMA POOL 530683 FN 07/29 FLOATING VAR | 0,00 | 0,00 | 0,0008 | -0,0001 | ||

| US31408JAX90 / FANNIE MAE 3.809% 01/01/2036 FAR FNARM | 0,00 | 0,00 | 0,0007 | -0,0000 | ||

| US525ESC6Y09 / ESC LEHMAN BRTH HLDH PROD | 0,00 | -50,00 | 0,0007 | -0,0007 | ||

| US3133TJFT51 / FREDDIE MAC FHR 2129 F | 0,00 | 0,00 | 0,0007 | -0,0001 | ||

| US3128Q2FY42 / Freddie Mac Non Gold Pool | 0,00 | 0,00 | 0,0007 | -0,0000 | ||

| US31385WTG41 / FNMA POOL 555051 FN 11/32 FLOATING VAR | 0,00 | 0,00 | 0,0007 | -0,0001 | ||

| US31396L4R81 / FNMA, REMIC, Series 2006-118, Class A1 | 0,00 | 0,00 | 0,0007 | -0,0000 | ||

| US3128NGBF16 / FED HM LN PC POOL 1H1238 FH 12/34 FLOATING VAR | 0,00 | 0,00 | 0,0007 | -0,0000 | ||

| US3128S4AA56 / FED HM LN PC POOL 1Q0001 FH 01/36 FLOATING VAR | 0,00 | 0,00 | 0,0007 | -0,0003 | ||

| US36229RJJ95 / GSR MORTGAGE LOAN TRUST GSR 2003 1 A2 | 0,00 | 0,00 | 0,0007 | -0,0000 | ||

| US3128NCB370 / FED HM LN PC POOL 1G0058 FH 01/35 FLOATING VAR | 0,00 | 0,00 | 0,0007 | -0,0000 | ||

| US31392RUA75 / FREDDIE MAC FHR 2490 FB | 0,00 | 0,00 | 0,0007 | -0,0004 | ||

| US31392EVN74 / Fannie Mae REMICS | 0,00 | 0,00 | 0,0006 | -0,0000 | ||

| US31386G7J63 / FNMA | 0,00 | 0,00 | 0,0006 | -0,0000 | ||

| US939336PL10 / Washington Mutual MSC Mortgage Pass-Through Certificates Series 2003-AR1 Trust | 0,00 | 0,00 | 0,0006 | -0,0000 | ||

| US31406L2T47 / FNMA POOL 813586 FN 03/35 FLOATING VAR | 0,00 | -100,00 | 0,0006 | -0,0000 | ||

| US3128JMN943 / FED HM LN PC POOL 1B2315 FH 09/35 FLOATING VAR | 0,00 | -100,00 | 0,0006 | -0,0000 | ||

| US36225CMN38 / Ginnie Mae II Pool | 0,00 | -100,00 | 0,0006 | -0,0001 | ||

| US31406MEP77 / Fannie Mae Pool | 0,00 | 0,0005 | -0,0000 | |||

| US31410FWC57 / FNMA | 0,00 | -100,00 | 0,0005 | -0,0002 | ||

| US31396J4X04 / FREDDIE MAC REMICS | 0,00 | 0,0005 | -0,0000 | |||

| US31400AMS41 / Fannie Mae Pool | 0,00 | 0,0005 | -0,0000 | |||

| US31336CLF85 / FED HM LN PC POOL 972126 FH 08/33 FLOATING VAR | 0,00 | 0,0005 | -0,0000 | |||

| US31410F3M54 / FNMA | 0,00 | 0,0005 | -0,0000 | |||

| US31402RTX79 / FNMA POOL 735966 FN 10/33 FLOATING VAR | 0,00 | 0,0005 | -0,0000 | |||

| US31404GV406 / Fannie Mae Pool | 0,00 | 0,0005 | -0,0000 | |||

| US31404WPZ31 / FANNIE MAE 4.402% 06/01/2034 FNMA ARM | 0,00 | 0,0004 | -0,0000 | |||

| US3128NVLF72 / FED HM LN PC POOL 1K1226 FH 02/36 FLOATING VAR | 0,00 | 0,0004 | -0,0000 | |||

| US31402CUL44 / FANNIE MAE 3.853% 07/01/2033 FAR FNARM | 0,00 | -100,00 | 0,0004 | -0,0002 | ||

| US3133T83D73 / FREDDIE MAC FHR 1885 FA | 0,00 | -100,00 | 0,0004 | -0,0002 | ||

| US31391MFS70 / FNMA POOL 670777 FN 11/32 FLOATING VAR | 0,00 | 0,0004 | -0,0002 | |||

| US3128QJ4L75 / FED HM LN PC POOL 1G1727 FH 07/35 FLOATING VAR | 0,00 | 0,0004 | -0,0000 | |||

| US31391MLM37 / FNMA POOL 670932 FN 01/33 FLOATING VAR | 0,00 | 0,0004 | -0,0000 | |||

| US31400HFH12 / Fannie Mae Pool | 0,00 | 0,0004 | -0,0000 | |||

| US31387UEQ04 / FNMA POOL 594243 FN 12/30 FLOATING VAR | 0,00 | 0,0004 | -0,0000 | |||

| US3128QJ5H54 / FED HM LN PC POOL 1G1748 FH 09/35 FLOATING VAR | 0,00 | 0,0003 | -0,0000 | |||

| US31407CEH60 / FNMA POOL 826436 FN 07/35 FLOATING VAR | 0,00 | -100,00 | 0,0003 | -0,0011 | ||

| US31342AXG92 / FED HM LN PC POOL 780679 FH 07/33 FLOATING VAR | 0,00 | 0,0003 | -0,0000 | |||

| US466247EH29 / JP MORGAN MORTGAGE TRUST JPMMT 2004 A4 2A2 | 0,00 | 0,0003 | -0,0000 | |||

| US31378C4V17 / FANNIE MAE 2.145% 07/01/2027 FNMA ARM | 0,00 | 0,0003 | -0,0001 | |||

| US31339NC798 / Freddie Mac REMICS | 0,00 | 0,0003 | -0,0001 | |||

| US31402TAD72 / FNMA POOL 737204 FN 08/33 FLOATING VAR | 0,00 | 0,0003 | -0,0000 | |||

| US17307GKZ09 / Citigroup Mortgage Loan Trust Inc | 0,00 | 0,0003 | -0,0000 | |||

| US31349UB562 / FHLMC | 0,00 | 0,0003 | -0,0000 | |||

| US31403CZ879 / FNMA POOL 745167 FN 01/36 FLOATING VAR | 0,00 | 0,0002 | -0,0000 | |||

| US31389AZ221 / FNMA | 0,00 | 0,0002 | -0,0000 | |||

| US31389AZ551 / FANNIE MAE 2.145% 01/01/2038 FAR FNARM | 0,00 | 0,0002 | -0,0000 | |||

| RFR USD SOFR/3.75000 12/18/24-10Y LCH / DIR (EZ7K2W20N534) | 0,00 | 0,0002 | 0,0004 | |||

| RFR USD SOFR/3.75000 12/18/24-10Y LCH / DIR (EZ7K2W20N534) | 0,00 | 0,0002 | 0,0004 | |||

| US36202K3W33 / GNMA II POOL 008913 G2 07/26 FLOATING VAR | 0,00 | 0,0002 | -0,0001 | |||

| US31408XS689 / FNMA POOL 863741 FN 12/35 FLOATING VAR | 0,00 | 0,0002 | -0,0000 | |||

| US69547MAD83 / PAID_22-3 | 0,00 | -100,00 | 0,0002 | -0,0351 | ||

| US31406KA266 / FANNIE MAE 4.307% 04/01/2035 FNMA ARM | 0,00 | 0,0002 | -0,0000 | |||

| US05948XBS99 / BANC OF AMERICA MORTGAGE SECUR BOAMS 2003 D 2A1 | 0,00 | 0,0002 | -0,0000 | |||

| US31407CD950 / FNMA POOL 826428 FN 07/35 FLOATING VAR | 0,00 | 0,0002 | -0,0000 | |||

| US31403DUV99 / FNMA POOL 745896 FN 09/36 FLOATING VAR | 0,00 | 0,0002 | -0,0000 | |||

| US31385XCM74 / FNMA POOL 555476 FN 04/33 FLOATING VAR | 0,00 | 0,0001 | -0,0000 | |||

| US31342ASB60 / FED HM LN PC POOL 780514 FH 05/33 FLOATING VAR | 0,00 | 0,0001 | -0,0000 | |||

| RFR USD SOFR/3.52500 03/02/23-7Y LCH / DIR (EZMHJQBYLCQ2) | 0,00 | 0,0001 | 0,0005 | |||

| RFR USD SOFR/3.52500 03/02/23-7Y LCH / DIR (EZMHJQBYLCQ2) | 0,00 | 0,0001 | 0,0005 | |||

| US3133THXQ54 / FREDDIE MAC FHR 2115 C | 0,00 | 0,0001 | -0,0000 | |||

| US939335N840 / Washington Mutual Mortgage Securities Corp. | 0,00 | 0,0001 | -0,0000 | |||

| US3128JRCM68 / FED HM LN PC POOL 847276 FH 04/34 FLOATING VAR | 0,00 | 0,0001 | -0,0000 | |||

| US07384MSH69 / Bear Stearns ARM Trust 2002-11 | 0,00 | 0,0001 | -0,0000 | |||

| US31349TWL15 / Freddie Mac Non Gold Pool | 0,00 | 0,0001 | -0,0000 | |||

| US07384MUM27 / BEAR STEARNS ADJUSTABLE RATE M BSARM 2003 3 2A2 | 0,00 | 0,0001 | -0,0000 | |||

| US07384MYY29 / BEAR STEARNS ADJUSTABLE RATE M BSARM 2003 7 8A | 0,00 | 0,0000 | -0,0000 | |||

| CMBX.NA.AAA.9 SP GST / DCR (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US31403DLG24 / FNMA POOL 745627 FN 04/36 FLOATING VAR | 0,00 | 0,0000 | -0,0000 | |||

| US07386HXZ99 / BEAR STEARNS ALT A TRUST BALTA 2005 9 21A1 | 0,00 | 0,0000 | -0,0000 | |||