Statistiche di base

| Valore del portafoglio | $ 240.790.534 |

| Posizioni attuali | 781 |

Ultime partecipazioni, performance, AUM (da depositi 13F, 13D)

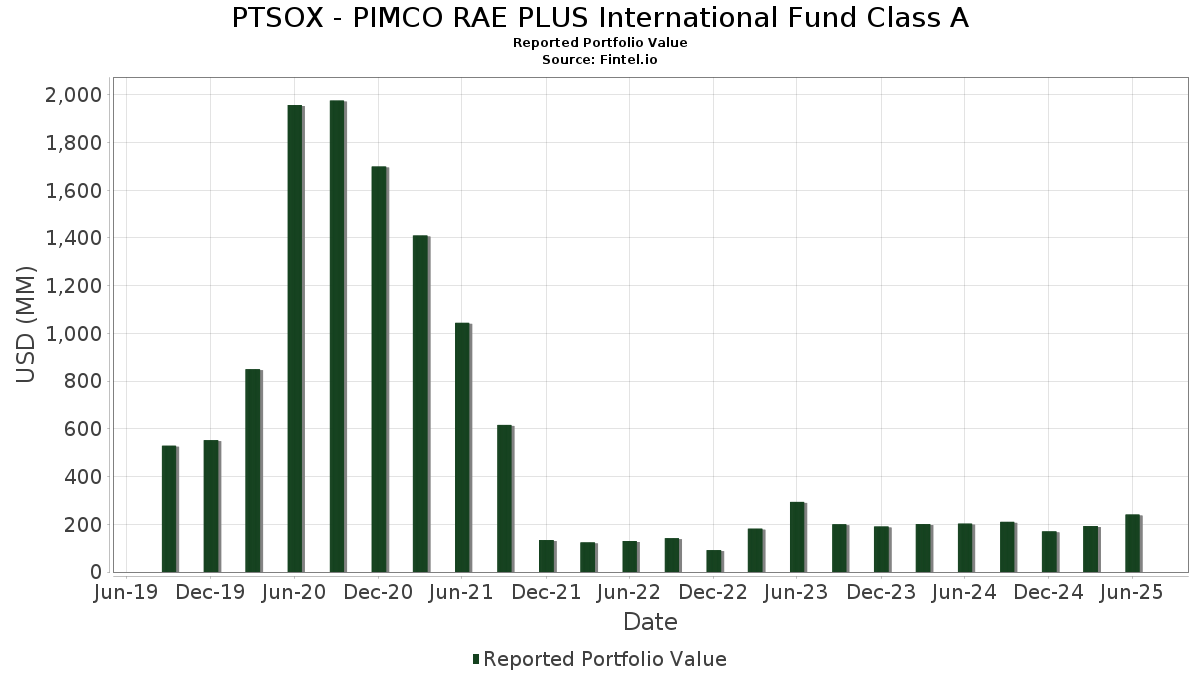

PTSOX - PIMCO RAE PLUS International Fund Class A ha dichiarato un totale di 781 partecipazioni negli ultimi documenti depositati presso la SEC. Il valore più recente del portafoglio è pari a $ 240.790.534 USD. Il patrimonio gestito effettivo (AUM) corrisponde a questo valore più la liquidità (che non viene dichiarata). Le principali partecipazioni di PTSOX - PIMCO RAE PLUS International Fund Class A sono Uniform Mortgage-Backed Security, TBA (US:US01F0626899) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , Uniform Mortgage-Backed Security, TBA (US:US01F0526800) , UMBS TBA (US:US01F0506844) , and UMBS TBA (US:US01F0426811) . Le nuove posizioni di PTSOX - PIMCO RAE PLUS International Fund Class A includono Uniform Mortgage-Backed Security, TBA (US:US01F0626899) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , Uniform Mortgage-Backed Security, TBA (US:US01F0526800) , UMBS TBA (US:US01F0506844) , and UMBS TBA (US:US01F0426811) .

Gli aumenti più importanti di questo trimestre

Utilizziamo la variazione dell'allocazione del portafoglio perché è l'indicatore più significativo. Le variazioni possono essere dovute a transazioni o a variazioni dei prezzi delle azioni.

| Titolo | Azioni (in milioni) |

Valore (in milioni di $) |

Portafoglio % | ΔPortafoglio % |

|---|---|---|---|---|

| 33,40 | 22,9387 | 22,9387 | ||

| 33,40 | 22,9387 | 22,9387 | ||

| 21,92 | 15,0553 | 9,3852 | ||

| 9,53 | 6,5477 | 6,5477 | ||

| 8,70 | 5,9748 | 5,9748 | ||

| 14,92 | 10,2503 | 3,9275 | ||

| 2,95 | 2,0294 | 2,0294 | ||

| 2,60 | 1,7883 | 1,7883 | ||

| 2,44 | 1,6785 | 1,6785 | ||

| 2,42 | 1,6643 | 1,6643 |

Gli aumenti più importanti di questo trimestre

Utilizziamo la variazione dell'allocazione del portafoglio perché è l'indicatore più significativo. Le variazioni possono essere dovute a transazioni o a variazioni dei prezzi delle azioni.

| Titolo | Azioni (in milioni) |

Valore (in milioni di $) |

Portafoglio % | ΔPortafoglio % |

|---|---|---|---|---|

| -5,04 | -3,4620 | -3,5292 | ||

| 5,69 | 3,9112 | -1,2965 | ||

| 1,38 | 0,9511 | -1,1431 | ||

| 4,34 | 2,9801 | -0,9181 | ||

| 1,45 | 0,9985 | -0,4833 | ||

| 3,79 | 2,6011 | -0,2811 | ||

| -0,31 | -0,2113 | -0,2028 | ||

| 0,33 | 0,2235 | -0,1764 | ||

| 0,59 | 0,4038 | -0,1729 | ||

| 0,14 | 0,0950 | -0,1224 |

13F e depositi di fondi

Questo modulo è stato depositato il 2025-08-28 per il periodo di riferimento 2025-06-30. Questo investitore non ha divulgato titoli conteggiati in azioni, pertanto le colonne relative alle azioni nella tabella seguente sono state omesse. Fai clic sull'icona del link per visualizzare la cronologia completa delle transazioni.

Esegui l'upgrade per sbloccare i dati premium ed esportarli in Excel ![]() .

.

| Titolo | Tipo | ΔAzioni (%) |

Valore (in milioni di $) |

Portafoglio (%) |

ΔPortafoglio (%) |

|

|---|---|---|---|---|---|---|

| REPO BANK AMERICA REPO / RA (000000000) | 33,40 | 22,9387 | 22,9387 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 33,40 | 22,9387 | 22,9387 | |||

| US01F0626899 / Uniform Mortgage-Backed Security, TBA | 21,92 | 183,55 | 15,0553 | 9,3852 | ||

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | 14,92 | 73,11 | 10,2503 | 3,9275 | ||

| TREASURY BILL 07/25 0.00000 / DBT (US912797NX17) | 9,53 | 6,5477 | 6,5477 | |||

| ERADXULT TRS EQUITY FEDL01+90*BULLET*JPM / DE (000000000) | 8,70 | 5,9748 | 5,9748 | |||

| US01F0526800 / Uniform Mortgage-Backed Security, TBA | 5,69 | -19,80 | 3,9112 | -1,2965 | ||

| US01F0506844 / UMBS TBA | 4,34 | -18,36 | 2,9801 | -0,9181 | ||

| TSY INFL IX N/B 07/34 1.875 / DBT (US91282CLE92) | 3,79 | 0,16 | 2,6011 | -0,2811 | ||

| US01F0426811 / UMBS TBA | 3,41 | 24,84 | 2,3444 | 0,3386 | ||

| FNMA POOL FA1296 FN 08/51 FIXED VAR / ABS-MBS (US3140W1NN98) | 2,95 | 2,0294 | 2,0294 | |||

| US21H0406734 / Ginnie Mae | 2,60 | 1,7883 | 1,7883 | |||

| FNMA POOL FS2937 FN 04/43 FIXED VAR / ABS-MBS (US3140XJHP17) | 2,44 | 1,6785 | 1,6785 | |||

| US01F0306781 / UMBS TBA | 2,42 | 1,6643 | 1,6643 | |||

| US715638BY77 / REPUBLIC OF PERU SR UNSECURED 144A 08/32 6.15 | 2,19 | 6,78 | 1,5041 | -0,0594 | ||

| US21H0506806 / GNMA | 2,11 | 1,4498 | 1,4498 | |||

| TREASURY BILL 10/25 0.00000 / DBT (US912797RC34) | 1,88 | 1,2889 | 1,2889 | |||

| EW / Edwards Lifesciences Corporation | 1,72 | -220,79 | 1,1816 | 1,3159 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 1,53 | 1,0476 | 1,0476 | |||

| RFR USD SOFR/1.75000 06/15/22-10Y CME / DIR (EZQ6DKJXZ1C9) | 1,45 | -25,22 | 0,9985 | -0,4833 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 1,38 | -49,62 | 0,9511 | -1,1431 | ||

| FNMA POOL BM7581 FN 09/31 VARIABLE / ABS-MBS (US3140JCM768) | 1,32 | 0,84 | 0,9098 | -0,0918 | ||

| US16165AAD63 / CHASEFLEX TRUST CFLX 2007 3 2A1 | 1,23 | -0,40 | 0,8467 | -0,0968 | ||

| RFR USD SOFR/1.75000 06/15/22-30Y CME / DIR (EZ2TNCR649W7) | 1,21 | -2,18 | 0,8331 | -0,1127 | ||

| US04541GJT04 / ASSET BACKED SECURITIES CORP H ABSHE 2004 HE3 M1 | 1,06 | -0,19 | 0,7279 | -0,0813 | ||

| CBRE SVCS INC / DBT (US12610BUA87) | 1,05 | 0,7202 | 0,7202 | |||

| DIAMETER CAPITAL CLO DCLO 2024 6A A1 144A / ABS-CBDO (US25255UAA07) | 1,00 | 0,20 | 0,6889 | -0,0745 | ||

| US21H0426799 / Ginnie Mae | 0,95 | 0,6509 | 0,6509 | |||

| US939355AB98 / Washington Mutual Mortgage Pass-Through Certificates WMALT Series 2007-OA3 Trust | 0,88 | -2,34 | 0,6011 | -0,0824 | ||

| FNMA POOL BS9669 FN 10/28 FIXED 4.72 / ABS-MBS (US3140LLW723) | 0,81 | 0,25 | 0,5596 | -0,0596 | ||

| US61753KAB26 / MORGAN STANLEY CAPITAL INC MSAC 2007 HE5 A2A | 0,78 | -0,77 | 0,5330 | -0,0632 | ||

| FED HM LN PC POOL SD7399 FR 12/54 FIXED 4.5 / ABS-MBS (US3132DVGG41) | 0,76 | -0,65 | 0,5219 | -0,0610 | ||

| CDX ITRAXX XOV42 5Y 35-100% SP JPM / DCR (EZ2BLZ4YH9B3) | 0,75 | 0,5136 | 0,5136 | |||

| CDX ITRAXX XOV42 5Y 35-100% SP JPM / DCR (EZ2BLZ4YH9B3) | 0,75 | 0,5136 | 0,5136 | |||

| US12644WAT36 / CSMC Trust 2010-16 | 0,75 | 0,40 | 0,5121 | -0,0537 | ||

| US59024FAE43 / MERRILL LYNCH ALTERNATIVE NOTE MANA 2007 A2 A3B | 0,75 | -1,32 | 0,5120 | -0,0640 | ||

| 4020 / Saudi Real Estate Company | 0,73 | 1,39 | 0,5018 | -0,0470 | ||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVN09) | 0,72 | 0,4977 | 0,4977 | |||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 0,72 | 0,4944 | 0,4944 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0,72 | 0,4940 | 0,4940 | |||

| JONES LANG LASALLE FIN BV 4/A2 07/25 ZCP / DBT (US48002AU933) | 0,72 | 0,4939 | 0,4939 | |||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUG52) | 0,72 | 0,4935 | 0,4935 | |||

| ENBRIDGE (US) INC / DBT (US29251UUB24) | 0,71 | 0,4869 | 0,4869 | |||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0,71 | 0,4867 | 0,4867 | |||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 0,71 | 0,4860 | 0,4860 | |||

| US525931AB72 / Lendbuzz Securitization Trust 2023-3 | 0,70 | 0,4841 | 0,4841 | |||

| FNMA POOL BM7579 FN 10/29 VARIABLE / ABS-MBS (US3140JCM503) | 0,70 | 1,01 | 0,4827 | -0,0477 | ||

| JAMESTOWN CLO LTD JTWN 2021 16A AR 144A / ABS-CBDO (US47048RAL96) | 0,70 | 0,00 | 0,4794 | -0,0525 | ||

| FCT / Fincantieri S.p.A. | 0,69 | 9,86 | 0,4748 | -0,0048 | ||

| FREDDIE MAC FHR 5484 FD / ABS-MBS (US3137HHKV29) | 0,68 | -8,77 | 0,4649 | -0,1005 | ||

| US17312TAA16 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2007 AHL2 A1 144A | 0,67 | -1,32 | 0,4625 | -0,0582 | ||

| US07387YAE32 / BEAR STEARNS ASSET BACKED SECU BSABS 2007 HE6 2A | 0,67 | -0,44 | 0,4616 | -0,0530 | ||

| USP78024AG45 / Peruvian Government International Bond | 0,67 | 7,74 | 0,4588 | -0,0145 | ||

| US25150RAF29 / Deutsche Alt-A Securities Mortgage Loan Trust Series 2006-AR6 | 0,65 | -1,37 | 0,4454 | -0,0560 | ||

| FNMA POOL BS9867 FN 11/30 FIXED 5.3 / ABS-MBS (US3140LL6D83) | 0,63 | 0,80 | 0,4307 | -0,0442 | ||

| XS2350860776 / CVC Cordatus Loan Fund XIV DAC | 0,62 | 1,64 | 0,4269 | -0,0394 | ||

| US17330VAA44 / CMLTI_22-A | 0,62 | -2,23 | 0,4230 | -0,0570 | ||

| CARLYLE GLOBAL MARKET STRATEGI CGMS 2016 3A ARRR / ABS-CBDO (US14311UBA51) | 0,60 | 0,50 | 0,4125 | -0,0432 | ||

| AMERICAN MONEY MANAGEMENT CORP AMMC 2021 24A AR 144A / ABS-CBDO (US00177LAJ98) | 0,60 | 0,33 | 0,4122 | -0,0438 | ||

| CQS US CLO LTD CQS 2021 1A AR 144A / ABS-CBDO (US12659UAL61) | 0,60 | -0,50 | 0,4122 | -0,0477 | ||

| FOUNDATION FINANCE TRUST FFIN 2025 2A A 144A / ABS-MBS (US35042NAA37) | 0,60 | 0,4120 | 0,4120 | |||

| US35729TAD46 / FREMONT HOME LOAN TRUST FHLT 2006 C 2A2 | 0,59 | -0,84 | 0,4069 | -0,0486 | ||

| CARLYLE GLOBAL MARKET STRATEGI CGMSE 2025 1A A1 144A / ABS-CBDO (XS3065225669) | 0,59 | 0,4045 | 0,4045 | |||

| PALMER SQUARE EUROPEAN LOAN FU PSTET 2025 2A B 144A / ABS-CBDO (XS3070649523) | 0,59 | 0,4045 | 0,4045 | |||

| ARCANO EURO CLO ARCAN 2A B / ABS-CBDO (XS3109623846) | 0,59 | 0,4045 | 0,4045 | |||

| TRINITAS EURO CLO TRNTE 1A AR 144A / ABS-CBDO (XS3086787259) | 0,59 | 0,4045 | 0,4045 | |||

| US08860DAB91 / BHG Securitization Trust 2022-C | 0,59 | -22,35 | 0,4038 | -0,1729 | ||

| ALBACORE EURO CLO ALBAC 1A AR 144A / ABS-CBDO (XS2368816109) | 0,59 | 8,70 | 0,4038 | -0,0082 | ||

| US32027NWP22 / FIRST FRANKLIN MTG LOAN ASSET FFML 2005 FF10 A5 | 0,58 | -2,84 | 0,3993 | -0,0572 | ||

| XS2683120211 / Avon Finance No.4 PLC | 0,58 | 0,87 | 0,3986 | -0,0397 | ||

| 5831 / Shizuoka Financial Group,Inc. | 0,57 | 0,3943 | 0,3943 | |||

| US05950PAK93 / BANC OF AMERICA FUNDING CORPOR BAFC 2006 H 4A1 | 0,57 | -0,87 | 0,3929 | -0,0471 | ||

| TRINITY SQUARE TRINI 2021 1A AR 144A / ABS-MBS (XS2783078087) | 0,55 | 0,73 | 0,3807 | -0,0392 | ||

| PK ALIFT LOAN FUNDING PKAIR 2024 2 A 144A / ABS-O (US69381EAA10) | 0,55 | -2,64 | 0,3798 | -0,0535 | ||

| US93934FJQ63 / WASHINGTON MUTUAL MORTGAGE PAS WMALT 2006 AR1 A1A | 0,54 | -0,74 | 0,3706 | -0,0439 | ||

| TOWD POINT MORTGAGE FUNDING TPMF 2024 GR6A A1 144A / ABS-MBS (XS2799791848) | 0,53 | -0,56 | 0,3650 | -0,0422 | ||

| ERADXULT TRS EQUITY SOFR+99.5 CBK / DE (000000000) | 0,53 | 0,3630 | 0,3630 | |||

| ZAG000125980 / Republic of South Africa Government Bond | 0,53 | 8,21 | 0,3623 | -0,0090 | ||

| CORDATUS CLO PLC CORDA 24A A 144A / ABS-CBDO (XS2511416906) | 0,53 | 4,58 | 0,3610 | -0,0218 | ||

| US3622M8AE61 / GSAMP TRUST GSAMP 2006 HE8 A2D | 0,52 | 0,58 | 0,3575 | -0,0370 | ||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 0,52 | 1,17 | 0,3567 | -0,0350 | ||

| FNMA POOL BZ2582 FN 12/29 FIXED 4.3 / ABS-MBS (US3140NW2Q77) | 0,50 | 1,00 | 0,3466 | -0,0342 | ||

| HYUNDAI AUTO RECEIVABLES TRUST HART 2024 A A3 / ABS-O (US448973AD90) | 0,50 | 0,00 | 0,3466 | -0,0382 | ||

| CARVANA AUTO RECEIVABLES TRUST CRVNA 2025 N1 B 144A / ABS-O (US14688XAD93) | 0,50 | 0,40 | 0,3461 | -0,0364 | ||

| US902613AP31 / UBS Group AG | 0,50 | 0,60 | 0,3455 | -0,0359 | ||

| CAPITAL FOUR US CLO C4US 2022 1A AR 144A / ABS-CBDO (US14016CAN65) | 0,50 | -0,20 | 0,3447 | -0,0382 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2025 4 A2 144A / ABS-O (US69547DAB29) | 0,50 | 0,3441 | 0,3441 | |||

| EXETER AUTOMOBILE RECEIVABLES EART 2024 5A C / ABS-O (US30165BAF04) | 0,50 | 0,20 | 0,3440 | -0,0371 | ||

| AIMCO AIMCO 2015 AA AR3 144A / ABS-CBDO (US00900LAY02) | 0,50 | 0,00 | 0,3439 | -0,0373 | ||

| JAMESTOWN CLO LTD JTWN 2022 18A AR 144A / ABS-CBDO (US47047RAN61) | 0,50 | 0,00 | 0,3439 | -0,0373 | ||

| US12663BAD01 / CPS AUTO TRUST 08/15/2028 5.19% MTGE | 0,50 | 0,00 | 0,3437 | -0,0380 | ||

| 37 CAPITAL CLO LTD PUTNM 2021 1A AR 144A / ABS-CBDO (US88430TAQ40) | 0,50 | 0,20 | 0,3437 | -0,0373 | ||

| SANDSTONE PEAK LTD. SAND 2021 1A A1R 144A / ABS-CBDO (US800130AN66) | 0,50 | 0,00 | 0,3436 | -0,0376 | ||

| US576339DJ15 / MASTER CR CARD TR II 23-2A A SOFR30A+85 01/21/2027 144A | 0,50 | -0,20 | 0,3433 | -0,0384 | ||

| BAIN CAPITAL CREDIT CLO, LIMIT BCC 2021 2A A1R 144A / ABS-CBDO (US05684RAL69) | 0,50 | 0,00 | 0,3431 | -0,0374 | ||

| EXETER AUTOMOBILE RECEIVABLES EART 2024 5A B / ABS-O (US30165BAE39) | 0,50 | 0,20 | 0,3431 | -0,0372 | ||

| US02146TAG22 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 24CB A7 | 0,50 | -1,98 | 0,3411 | -0,0453 | ||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 0,49 | 0,41 | 0,3372 | -0,0355 | ||

| FREDDIE MAC FHR 5513 MF / ABS-MBS (US3137HKEX87) | 0,47 | -5,24 | 0,3234 | -0,0551 | ||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q034 APT2 / ABS-MBS (US3137HLY301) | 0,47 | 0,3222 | 0,3222 | |||

| US83613FAD33 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2007 OPT5 2A3 | 0,46 | -2,15 | 0,3139 | -0,0414 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2019 9A AV 144A / ABS-CBDO (US03330HAA59) | 0,45 | -9,16 | 0,3065 | -0,0685 | ||

| US3137AFHT27 / FREDDIE MAC FHR 3922 GS | 0,44 | 1,38 | 0,3035 | -0,0281 | ||

| US41161PVF79 / HARBORVIEW MORTGAGE LOAN TRUST HVMLT 2005 12 1A1A | 0,44 | -7,93 | 0,3034 | -0,0622 | ||

| US525161AN53 / LEHMAN XS TRUST LXS 2006 GP4 3A5 | 0,44 | -2,00 | 0,3025 | -0,0402 | ||

| US06738ECG89 / Barclays PLC | 0,42 | 1,92 | 0,2917 | -0,0261 | ||

| US12628LAJ98 / CSAB MORTGAGE-BACKED TRUST 2006-4 SER 2006-4 CL A6A S/UP REGD 5.68370000 | 0,42 | -2,78 | 0,2887 | -0,0408 | ||

| POLAND GOVERNMENT BOND BONDS 07/29 4.75 / DBT (PL0000116760) | 0,42 | 9,50 | 0,2856 | -0,0038 | ||

| US38141GZS64 / GOLDMAN SACHS GROUP INC SR UNSECURED 03/28 VAR | 0,41 | -0,25 | 0,2800 | -0,0313 | ||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 0,41 | 1,50 | 0,2782 | -0,0267 | ||

| RFR USD SOFR/2.75000 06/21/23-30Y CME / DIR (EZM2L9TGLT92) | 0,40 | 0,75 | 0,2759 | -0,0277 | ||

| ARES STRATEGIC INCOME FU SR UNSECURED 144A 09/28 5.45 / DBT (US04020EAL11) | 0,40 | 0,2749 | 0,2749 | |||

| US62956BAA70 / NYMT Loan Trust 2022-SP1 | 0,39 | -2,02 | 0,2668 | -0,0351 | ||

| US86358EEC66 / STRUCTURED ASSET INVESTMENT LO SAIL 2003 BC8 M3 | 0,38 | 0,00 | 0,2611 | -0,0286 | ||

| US53948HAA41 / LoanCore 2021-CRE6 Issuer Ltd | 0,38 | -8,70 | 0,2602 | -0,0561 | ||

| US68389FGK49 / OPTION ONE MORTGAGE LOAN TRUST OOMLT 2005 1 M1 | 0,37 | -5,33 | 0,2563 | -0,0445 | ||

| CL0002454248 / Bonos de la Tesoreria de la Republica en pesos | 0,36 | 4,97 | 0,2466 | -0,0141 | ||

| US84751PKW85 / SPECIALTY UNDERWRITING + RESID SURF 2006 AB1 A4 | 0,36 | -1,66 | 0,2445 | -0,0314 | ||

| MX0SGO0000M6 / Mexican Udibonos | 0,35 | 12,03 | 0,2438 | 0,0022 | ||

| OCTAGON INVESTMENT PARTNERS 39 OCT39 2018 3A AR 144A / ABS-CBDO (US67592CAL00) | 0,35 | -25,37 | 0,2426 | -0,1186 | ||

| COL17CT02914 / Colombian TES | 0,35 | 3,55 | 0,2407 | -0,0172 | ||

| FED HM LN PC POOL QE8001 FR 08/52 FIXED 4.5 / ABS-MBS (US3133BH3J35) | 0,35 | -1,42 | 0,2376 | -0,0301 | ||

| US320516AA56 / First Horizon Alternative Mortgage Securities Trust 2006-AA3 | 0,34 | -2,59 | 0,2327 | -0,0325 | ||

| US45660LGV53 / INDYMAC INDX MORTGAGE LOAN TRU INDX 2005 AR5 4A1 | 0,33 | 1,22 | 0,2273 | -0,0224 | ||

| US126697AA90 / CWABS ASSET-BACKED CERTIFICATES TRUST 2007-12 SER 2007-12 CL 1A1 V/R REGD 2.44800000 | 0,33 | -2,38 | 0,2254 | -0,0308 | ||

| US3128MMWV14 / Freddie Mac Gold Pool | 0,33 | -5,23 | 0,2244 | -0,0380 | ||

| US66988UAA88 / NOVASTAR MORTGAGE BACKED NOTES NMFT 2006 MTA1 1A1 | 0,33 | 0,62 | 0,2242 | -0,0233 | ||

| RFR USD SOFR/3.00000 06/21/23-10Y CME / DIR (EZVCRM3XZB08) | 0,33 | -37,98 | 0,2235 | -0,1764 | ||

| US81375WFJ09 / SECURITIZED ASSET BACKED RECEI SABR 2005 FR4 M2 | 0,32 | -3,33 | 0,2197 | -0,0325 | ||

| US12669LAD29 / COUNTRYWIDE ASSET BACKED CERTI CWL 2007 6 2A3 | 0,32 | -2,15 | 0,2196 | -0,0295 | ||

| US04002VAA98 / AREIT Trust, Series 2022-CRE6, Class A | 0,32 | -0,31 | 0,2180 | -0,0246 | ||

| US12551YAA10 / CIFC 2018-3A A | 0,31 | -17,24 | 0,2143 | -0,0736 | ||

| US05377RHL15 / Avis Budget Rental Car Funding AESOP LLC | 0,31 | 0,33 | 0,2119 | -0,0229 | ||

| FNMA POOL BZ1029 FN 06/29 FIXED 4.93 / ABS-MBS (US3140NVEB95) | 0,31 | 0,33 | 0,2114 | -0,0226 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 0,30 | 0,33 | 0,2082 | -0,0220 | ||

| US36267FAE88 / GLS AUTO SELECT RECEIVABLES TR GSAR 2023 1A A3 144A | 0,30 | -0,66 | 0,2080 | -0,0238 | ||

| JACKSON NATL LIFE GLOBAL JACKSON NATL LIFE GLOBAL / DBT (US46849LUZ20) | 0,30 | 0,00 | 0,2078 | -0,0230 | ||

| CARVANA AUTO RECEIVABLES TRUST CRVNA 2023 P5 A3 144A / ABS-O (US14687RAC51) | 0,30 | -0,33 | 0,2077 | -0,0237 | ||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/28 5.05 / DBT (US928668CP53) | 0,30 | 0,67 | 0,2073 | -0,0214 | ||

| US42806MBS70 / Hertz Vehicle Financing III LLC | 0,30 | -0,33 | 0,2072 | -0,0231 | ||

| GM FINANCIAL CONSUMER AUTOMOBI GMCAR 2024 1 A3 / ABS-O (US36268GAD79) | 0,30 | 0,00 | 0,2071 | -0,0229 | ||

| US694308KK29 / Pacific Gas and Electric Co | 0,30 | -3,53 | 0,2068 | -0,0314 | ||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 0,29 | 0,2002 | 0,2002 | |||

| US12668AZ650 / Alternative Loan Trust 2005-65CB | 0,29 | -4,03 | 0,1966 | -0,0308 | ||

| US26251NAB64 / Dryden 60 CLO Ltd | 0,28 | -16,22 | 0,1954 | -0,0633 | ||

| US81377AAE29 / SECURITIZED ASSET BACKED RECEI SABR 2006 HE2 A2D | 0,28 | -0,35 | 0,1932 | -0,0225 | ||

| PEP01000C5I0 / BONOS DE TESORERIA | 0,28 | 7,36 | 0,1904 | -0,0068 | ||

| US12669HAA77 / Countrywide Asset-Backed Certificates | 0,27 | 0,00 | 0,1836 | -0,0204 | ||

| RFR USD SOFR/3.50000 12/18/24-30Y CME / DIR (EZ4089K4KC85) | 0,27 | 42,25 | 0,1833 | 0,0401 | ||

| US35729VAA52 / Fremont Home Loan Trust, Series 2006-D, Class 1A1 | 0,25 | -0,79 | 0,1733 | -0,0207 | ||

| FREDDIE MAC FHR 5480 FG / ABS-MBS (US3137HHUD11) | 0,25 | -9,82 | 0,1710 | -0,0387 | ||

| US14686TAC27 / CARVANA AUTO RECEIVABLES TRUST CRVNA 2023 P2 A3 144A | 0,25 | -22,57 | 0,1702 | -0,0734 | ||

| SAGB / Republic of South Africa Government Bond | 0,24 | 6,55 | 0,1679 | -0,0075 | ||

| ACHV ABS TRUST ACHV 2024 2PL B 144A / ABS-O (US00092HAB78) | 0,24 | -18,40 | 0,1620 | -0,0582 | ||

| US76089RAA23 / Research-Driven Pagaya Motor Asset Trust 2023-3 | 0,24 | -16,96 | 0,1617 | -0,0541 | ||

| US45660LMG13 / IndyMac INDX Mortgage Loan Trust 2005-AR12 | 0,23 | -0,85 | 0,1595 | -0,0195 | ||

| US3622ECAF39 / GSAA HOME EQUITY TRUST GSAA 2007 5 2A3A | 0,23 | -2,16 | 0,1562 | -0,0209 | ||

| US88522XAC56 / Thornburg Mortgage Securities Trust 2007-3 | 0,23 | -9,60 | 0,1554 | -0,0358 | ||

| US12481QAC96 / CBAM 2018-5 Ltd | 0,22 | -24,58 | 0,1543 | -0,0724 | ||

| XS2318315921 / Asian Infrastructure Investment Bank/The | 0,22 | -1,77 | 0,1530 | -0,0199 | ||

| US3622ECAA42 / GSAA Home Equity Trust, Series 2007-5, Class 1AV1 | 0,21 | -2,34 | 0,1442 | -0,0190 | ||

| US31397U3F44 / FNR 2011-60 OA 8/39 | 0,21 | -1,42 | 0,1436 | -0,0185 | ||

| FNMA POOL AL6924 FN 01/45 FIXED VAR / ABS-MBS (US3138EPVS07) | 0,21 | 0,1419 | 0,1419 | |||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 0,21 | 0,49 | 0,1414 | -0,0147 | ||

| US92922F4C97 / WaMu Mortgage Pass-Through Certificates Trust, Series 2005-AR14, Class 1A3 | 0,20 | -0,98 | 0,1398 | -0,0171 | ||

| US404280DZ92 / HSBC HOLDINGS PLC REGD V/R 5.88700000 | 0,20 | -0,49 | 0,1393 | -0,0155 | ||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,20 | 0,50 | 0,1385 | -0,0147 | ||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,20 | 1,01 | 0,1377 | -0,0133 | ||

| US3137A9D525 / Freddie Mac REMICS | 0,19 | -2,51 | 0,1337 | -0,0183 | ||

| US06051GJS93 / Bank of America Corp | 0,19 | 1,04 | 0,1335 | -0,0134 | ||

| ZAG000077470 / Republic of South Africa Government Bond | 0,19 | 7,26 | 0,1320 | -0,0046 | ||

| ERADXULT TRS EQUITY SOFR+97 MYI / DE (000000000) | 0,19 | 0,1282 | 0,1282 | |||

| HYUNDAI AUTO RECEIVABLES TRUST HART 2024 A A2A / ABS-O (US448973AB35) | 0,19 | -35,64 | 0,1282 | -0,0929 | ||

| US74958XAB01 / RESIDENTIAL FUNDING MTG SEC I RFMSI 2007 SA2 2A1 | 0,19 | -1,07 | 0,1274 | -0,0156 | ||

| US12566VAJ17 / CITIMORTGAGE ALTERNATIVE LOAN CMALT 2007 A4 1A9 | 0,18 | -4,66 | 0,1265 | -0,0209 | ||

| IRS EUR 2.25000 09/17/25-30Y LCH / DIR (EZV4L1QCFM97) | 0,18 | 50,42 | 0,1236 | 0,0323 | ||

| US93935HAB33 / WASHINGTON MUTUAL MORTGAGE PAS WMALT 2006 7 A1B | 0,18 | -2,21 | 0,1221 | -0,0166 | ||

| US17309YAC12 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2006 FX1 A3 | 0,18 | -1,67 | 0,1219 | -0,0154 | ||

| US16678RDL87 / CHEVY CHASE MORTGAGE FUNDING C CCMFC 2005 2A A2 144A | 0,18 | -5,41 | 0,1207 | -0,0207 | ||

| US12668BDC46 / Alternative Loan Trust 2005-76 | 0,17 | -5,03 | 0,1172 | -0,0193 | ||

| OPORTUN FUNDING LLC OPTN 2024 2 A 144A / ABS-O (US68377KAA51) | 0,17 | -37,64 | 0,1165 | -0,0905 | ||

| MX0SGO0000K0 / Mexican Udibonos | 0,16 | 11,56 | 0,1131 | 0,0007 | ||

| US55284AAA60 / MF1 2021-FL7 Ltd | 0,16 | -36,14 | 0,1094 | -0,0810 | ||

| US12543XAG16 / COUNTRYWIDE HOME LOANS CWHL 2006 19 1A7 | 0,16 | -1,27 | 0,1078 | -0,0127 | ||

| US12544AAW53 / COUNTRYWIDE HOME LOANS CWHL 2006 20 1A21 | 0,15 | -2,56 | 0,1047 | -0,0149 | ||

| TRT061124T11 / Turkey Government Bond | 0,15 | -1,95 | 0,1037 | -0,0141 | ||

| US76089EAA10 / RESEARCH DRIVEN PAGAYA MOTOR A RPM 2022 1A A 144A | 0,15 | -12,50 | 0,1016 | -0,0267 | ||

| US45661VAA44 / IndyMac INDX Mortgage Loan Trust 2006-AR12 | 0,15 | -2,01 | 0,1003 | -0,0139 | ||

| BOUGHT BRL SOLD USD 20251002 / DFE (000000000) | 0,14 | 0,0992 | 0,0992 | |||

| US026935AH97 / AMERICAN HOME MORTGAGE ASSETS AHMA 2007 3 21A1 | 0,14 | -2,70 | 0,0990 | -0,0141 | ||

| US35104AAB44 / FOURSIGHT CAPITAL AUTOMOBILE RECEIVABLES TRUST 202 FCRT 2023-2 A2 | 0,14 | -26,42 | 0,0976 | -0,0499 | ||

| MX0MGO0001F1 / Mexican Bonos | 0,14 | -51,58 | 0,0950 | -0,1224 | ||

| US75971FAD50 / RENAISSANCE HOME EQUITY LOAN T RAMC 2007 3 AF1 | 0,14 | -1,45 | 0,0940 | -0,0119 | ||

| US02149HAJ95 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2007 2CB 1A9 | 0,14 | -2,86 | 0,0937 | -0,0133 | ||

| US18976GAG10 / CITIMORTGAGE ALTERNATIVE LOAN CMALT 2007 A6 1A7 | 0,13 | -2,19 | 0,0924 | -0,0121 | ||

| US16163CAN20 / CHASE MORTGAGE FINANCE CORPORA CHASE 2006 A1 4A1 | 0,13 | -5,00 | 0,0914 | -0,0158 | ||

| TRT061124T11 / Turkey Government Bond | 0,13 | -2,94 | 0,0911 | -0,0128 | ||

| US32027GAE61 / First Franklin Mortgage Loan Trust 2006-FF12 | 0,13 | -2,99 | 0,0897 | -0,0129 | ||

| US45254NLJ45 / IMPAC CMB TRUST SERIES 2004-10 SER 2004-10 CL 1A1 V/R REGD 2.34800000 | 0,13 | -1,53 | 0,0892 | -0,0114 | ||

| US92927XAC83 / WAMU MORTGAGE PASS THROUGH CER WAMU 2007 HY6 2A1 | 0,13 | -3,01 | 0,0889 | -0,0127 | ||

| R2037 / South Africa - Sovereign or Government Agency Debt | 0,13 | 8,55 | 0,0878 | -0,0021 | ||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 0,12 | 0,82 | 0,0851 | -0,0083 | ||

| US715638BE14 / Peruvian Government International Bond | 0,12 | -15,17 | 0,0845 | -0,0264 | ||

| US07387AGE91 / BEAR STEARNS ADJUSTABLE RATE M BSARM 2005 12 23A1 | 0,12 | 0,00 | 0,0818 | -0,0094 | ||

| US52520QAB05 / LEHMAN MORTGAGE TRUST LMT 2006 7 1A2 | 0,12 | -0,85 | 0,0808 | -0,0094 | ||

| US3140X6JR36 / Fannie Mae Pool | 0,11 | 0,0789 | 0,0789 | |||

| US362375AD97 / GSAA HOME EQUITY TRUST GSAA 2006 10 AF4 | 0,11 | -2,63 | 0,0768 | -0,0106 | ||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0,11 | 0,93 | 0,0747 | -0,0071 | ||

| US46630GAD79 / JP Morgan Mortgage Trust, Series 2007-A1, Class 2A2 | 0,11 | -0,93 | 0,0734 | -0,0087 | ||

| CDX ITRAXX XOV42 5Y 35-100% SP BOA / DCR (EZ2BLZ4YH9B3) | 0,11 | 0,0734 | 0,0734 | |||

| US67571BAA17 / Octane Receivables Trust 2023-1 | 0,11 | -36,36 | 0,0724 | -0,0539 | ||

| IRS AUD 4.50000 09/20/23-10Y LCH / DIR (EZGXS4F4YYN6) | 0,10 | 101,96 | 0,0713 | 0,0318 | ||

| CZECH / Czech Republic Government Bond | 0,10 | 9,57 | 0,0709 | -0,0007 | ||

| CRB SECURITIZATION TRUST CRB 2023 1 A 144A / ABS-O (US12670DAA37) | 0,10 | -46,32 | 0,0702 | -0,0750 | ||

| E1IX34 / Edison International - Depositary Receipt (Common Stock) | 0,10 | 0,00 | 0,0698 | -0,0075 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 0,10 | 0,00 | 0,0691 | -0,0074 | ||

| US925650AB99 / VICI Properties LP | 0,10 | 0,00 | 0,0691 | -0,0072 | ||

| EXTRA SPACE STORAGE LP COMPANY GUAR 06/35 5.4 / DBT (US30225VAU17) | 0,10 | 1,01 | 0,0691 | -0,0067 | ||

| CITIZENS AUTO RECEIVABLES TRUS CITZN 2024 1 A3 144A / ABS-O (US17331QAD88) | 0,10 | 0,00 | 0,0691 | -0,0077 | ||

| UNITED AIR 2024 1 AA PTT PASS THRU CE 08/38 5.45 / DBT (US90932WAA18) | 0,10 | 0,00 | 0,0689 | -0,0075 | ||

| PROLOGIS LP SR UNSECURED 01/35 5 / DBT (US74340XCN93) | 0,10 | 1,01 | 0,0687 | -0,0070 | ||

| T MOBILE USA INC T MOBILE USA INC / DBT (US87264ADL61) | 0,10 | 1,02 | 0,0682 | -0,0067 | ||

| US59024FAD69 / Merrill Lynch Alternative Note Asset Trust Series 2007-A2 | 0,10 | -2,00 | 0,0680 | -0,0085 | ||

| US87264ABF12 / CORP. NOTE | 0,10 | 2,11 | 0,0667 | -0,0064 | ||

| R2032 / South Africa - Corporate Bond/Note | 0,10 | 7,78 | 0,0667 | -0,0022 | ||

| US3622MGAC20 / GSAMP TRUST GSAMP 2007 NC1 A2B | 0,10 | 2,13 | 0,0664 | -0,0052 | ||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0,09 | -4,12 | 0,0642 | -0,0105 | ||

| US29444UBL98 / Equinix, Inc. | 0,09 | 2,20 | 0,0640 | -0,0059 | ||

| US46629QAW69 / J.P. Morgan Mortgage Acquisition Trust 2006-Ch2 | 0,09 | -14,81 | 0,0634 | -0,0194 | ||

| US31394TYD17 / Freddie Mac REMICS | 0,09 | -3,23 | 0,0622 | -0,0089 | ||

| US12669GYY15 / CHL Mortgage Pass-Through Trust 2005-9 | 0,09 | -2,17 | 0,0621 | -0,0082 | ||

| US59023CAK80 / Merrill Lynch Mortgage Investors Trust Series 2006-A3 | 0,09 | -1,11 | 0,0615 | -0,0076 | ||

| US55274QBB05 / MASTR ASSET SECURITIZATION TRU MASTR 2006 2 1A26 | 0,09 | -5,38 | 0,0611 | -0,0100 | ||

| US362334GR95 / GSAA Home Equity Trust, Series 2006-5, Class 2A1 | 0,09 | -2,22 | 0,0611 | -0,0078 | ||

| US46632TAA34 / JP Morgan Mortgage Trust Series 2008-R2 | 0,09 | -1,12 | 0,0606 | -0,0079 | ||

| TRICOLOR AUTO SECURITIZATION T TAST 2024 1A A 144A / ABS-O (US89616LAA08) | 0,09 | -43,51 | 0,0601 | -0,0576 | ||

| US38380VEU17 / GOVERNMENT NATIONAL MORTGAGE A GNR 2018 19 WF | 0,08 | -3,45 | 0,0580 | -0,0086 | ||

| US31396VDT26 / FANNIE MAE FNR 2007 32 JS | 0,08 | -1,18 | 0,0578 | -0,0076 | ||

| US3137AHVF23 / FREDDIE MAC FHR 3951 US | 0,08 | -2,33 | 0,0577 | -0,0079 | ||

| US694308JQ18 / PACIFIC GAS + ELECTRIC 1ST MORTGAGE 07/40 4.5 | 0,08 | -2,35 | 0,0573 | -0,0075 | ||

| US74923HAL50 / RALI Trust, Series 2007-QS4, Class 3A2 | 0,08 | -3,61 | 0,0554 | -0,0084 | ||

| US76110WRT52 / RESIDENTIAL ASSET SECURITIES C RASC 2003 KS4 AIIB | 0,08 | -1,27 | 0,0541 | -0,0066 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,08 | 0,0525 | 0,0525 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,08 | 0,0525 | 0,0525 | |||

| US02147QAC69 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 19CB A3 | 0,08 | -1,30 | 0,0522 | -0,0071 | ||

| US65535AAA25 / NOMURA HOME EQUITY LOAN INC NHELI 2006 AF1 A1 | 0,07 | -2,67 | 0,0507 | -0,0068 | ||

| US12668ACP84 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 51 2A1 | 0,07 | -11,11 | 0,0501 | -0,0119 | ||

| US362334FF66 / GSAA HOME EQUITY TRUST GSAA 2006 4 2A1 | 0,07 | -1,37 | 0,0501 | -0,0056 | ||

| RFR USD SOFR/3.00000 06/21/23-7Y CME / DIR (EZWF2F56KP17) | 0,07 | -57,65 | 0,0500 | -0,0800 | ||

| US93934FMN95 / WMALT_06-AR2 | 0,07 | 7,46 | 0,0500 | -0,0012 | ||

| US84751WAD65 / SPECIALTY UNDERWRITING + RESID SURF 2006 BC3 A2C | 0,07 | -2,70 | 0,0498 | -0,0069 | ||

| US885220GF47 / Thornburg Mortgage Securities Trust, Series 2004-4, Class 3A | 0,07 | -15,29 | 0,0495 | -0,0153 | ||

| US81744HAH66 / Sequoia Mortgage Trust | 0,07 | -8,00 | 0,0478 | -0,0095 | ||

| US12668AFH32 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 48T1 A2 | 0,07 | -2,90 | 0,0461 | -0,0069 | ||

| US92925CDA71 / WaMu Mortgage Pass-Through Certificates Series 2006-AR3 Trust | 0,07 | -2,99 | 0,0452 | -0,0065 | ||

| FNMA POOL AX2488 FN 10/44 FIXED 4 / ABS-MBS (US3138Y3XS57) | 0,06 | 0,0443 | 0,0443 | |||

| US855541AA68 / SUNTRUST ADJUSTABLE RATE MORTG STARM 2007 S1 1A | 0,06 | -1,54 | 0,0443 | -0,0060 | ||

| US 10YR NOTE (CBT)SEP25 XCBT 20250919 / DIR (000000000) | 0,06 | 0,0443 | 0,0443 | |||

| CDX ITRAXX XOV42 5Y 35-100% SP GST / DCR (EZ2BLZ4YH9B3) | 0,06 | 0,0440 | 0,0440 | |||

| US17309BAL18 / Citigroup Mortgage Loan Trust, Series 2006-WF2, Class A1 | 0,06 | -1,59 | 0,0426 | -0,0059 | ||

| US35729PHN33 / Fremont Home Loan Trust 2005-A | 0,06 | -40,21 | 0,0402 | -0,0344 | ||

| US61746WWR77 / Morgan Stanley Dean Witter Capital I Inc Trust 2002-AM3 | 0,05 | -11,48 | 0,0374 | -0,0092 | ||

| US45254TRR76 / IMPAC SECURED ASSETS CORP. IMSA 2005 1 4A | 0,05 | -3,64 | 0,0368 | -0,0056 | ||

| MX0SGO0000F0 / Mexican Udibonos | 0,05 | 12,77 | 0,0366 | 0,0001 | ||

| US02151GAK31 / Countrywide Alternative Loan Trust | 0,05 | -3,85 | 0,0347 | -0,0051 | ||

| US61749WAP23 / MORGAN STANLEY MORTGAGE LOAN T MSM 2006 11 2A2 | 0,05 | -1,96 | 0,0347 | -0,0044 | ||

| US12669GN644 / Reperforming Loan REMIC Trust 2005-R2 | 0,05 | -5,66 | 0,0345 | -0,0064 | ||

| 317U7IQA6 PIMCO SWAPTION 3.75 CALL USD 2025103 / DIR (000000000) | 0,05 | 0,0342 | 0,0342 | |||

| RFR USD SOFR/3.80902 12/02/24-7Y* LCH / DIR (EZQXPTG0Q2X2) | 0,05 | 250,00 | 0,0338 | 0,0227 | ||

| US939336V916 / WAMU MORTGAGE PASS-THROUGH CERTIFICATES SERIES 200 WAMU 2004-AR14 A1 | 0,05 | -4,00 | 0,0336 | -0,0052 | ||

| US61760JAA88 / MORGAN STANLEY REREMIC TRUST MSRR 2011 R2 1A 144A | 0,05 | -2,04 | 0,0335 | -0,0043 | ||

| US12667GL840 / Alternative Loan Trust 2005-43 | 0,05 | -2,17 | 0,0314 | -0,0036 | ||

| US885220EW97 / Thornburg Mortgage Securities Trust, Series 2004-1, Class II2A | 0,04 | -2,22 | 0,0308 | -0,0042 | ||

| US76088TAA97 / RPM 22-3 A 144A 5.38% 11-25-30 | 0,04 | -44,30 | 0,0306 | -0,0298 | ||

| US92922FQ504 / WAMU MORTGAGE PASS THROUGH CER WAMU 2005 AR7 A4 | 0,04 | 0,00 | 0,0295 | -0,0035 | ||

| IRS AUD 4.50000 06/18/25-10Y LCH / DIR (EZ3K0DGVSD24) | 0,04 | 0,0293 | 0,0293 | |||

| FNMA POOL AJ7522 FN 01/27 FIXED 3 / ABS-MBS (US3138E0LC13) | 0,04 | -18,00 | 0,0283 | -0,0103 | ||

| US92927XAE40 / WAMU MORTGAGE PASS THROUGH CER WAMU 2007 HY6 2A3 | 0,04 | -2,44 | 0,0279 | -0,0037 | ||

| US23292HAB78 / DLLAA 2023-1 LLC | 0,04 | -68,25 | 0,0277 | -0,0689 | ||

| US32051GA887 / First Horizon Alternative Mortgage Securities Trust 2005-AA10 | 0,04 | -2,50 | 0,0274 | -0,0034 | ||

| US83162CRY11 / United States Small Business Administration | 0,04 | 0,00 | 0,0273 | -0,0031 | ||

| US LONG BOND(CBT) SEP25 XCBT 20250919 / DIR (000000000) | 0,04 | 0,0270 | 0,0270 | |||

| US251510DG50 / DEUTSCHE ALT A SECURITIES INC DBALT 2005 1 1A4 | 0,04 | -2,56 | 0,0264 | -0,0037 | ||

| US14686RAA05 / Carvana Auto Receivables Trust 2023-N3 | 0,04 | -52,50 | 0,0263 | -0,0351 | ||

| US36267FAC23 / GLS Auto Select Receivables Trust 2023-1 | 0,04 | -63,73 | 0,0258 | -0,0524 | ||

| US32028GAE52 / First Franklin Mortgage Loan Trust 2006-FF15 | 0,04 | -37,29 | 0,0255 | -0,0195 | ||

| INF SWAP US IT 2.487 12/07/21-30Y LCH / DIR (000000000) | 0,04 | 0,0248 | 0,0248 | |||

| US23243AAD81 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 OA12 A2 | 0,04 | 0,00 | 0,0248 | -0,0031 | ||

| US86360KAA60 / Structured Asset Mortgage Investments II Trust 2006-AR3 | 0,04 | -2,78 | 0,0242 | -0,0035 | ||

| US9292274D55 / WAMU MORTGAGE PASS-THROUGH CERTIFICATES SERIES 200 WAMU 2003-AR6 A1 | 0,03 | -22,73 | 0,0238 | -0,0099 | ||

| US362341SF70 / GSR Mortgage Loan Trust 2005-AR6 | 0,03 | 0,00 | 0,0235 | -0,0028 | ||

| US31396VDR69 / FANNIE MAE FNR 2007 32 SA | 0,03 | -2,94 | 0,0231 | -0,0031 | ||

| US74922KAA34 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2007 QS1 1A1 | 0,03 | 0,00 | 0,0229 | -0,0030 | ||

| US161546DB96 / Chase Funding Trust Series 2002-3 | 0,03 | -5,88 | 0,0226 | -0,0035 | ||

| US91683TAB52 / UPSTART SECURITIZATION TRUST UPST 2022 3 A 144A | 0,03 | -58,97 | 0,0220 | -0,0375 | ||

| US12668BZM89 / CWALT 2006 13T1 A11 | 0,03 | -9,09 | 0,0210 | -0,0041 | ||

| US92925DAB64 / WaMu Mortgage Pass-Through Certificates Series 2006-AR17 Trust | 0,03 | -3,23 | 0,0210 | -0,0031 | ||

| US585525FX10 / MRFC Mortgage Pass-Through Trust Series 2002-TBC2 | 0,03 | 0,00 | 0,0202 | -0,0023 | ||

| US31398G7B90 / FANNIE MAE FNR 2010 2 LS | 0,03 | 0,00 | 0,0200 | -0,0026 | ||

| US36298GAA76 / GSPA MONETIZATION TRUST PASS THRU CE 144A 10/29 6.422 | 0,03 | -3,45 | 0,0197 | -0,0031 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,03 | 0,0196 | 0,0196 | |||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 0,03 | 0,0194 | 0,0194 | |||

| US362341XG98 / GSR Mortgage Loan Trust 2005-AR7 | 0,03 | -6,67 | 0,0194 | -0,0039 | ||

| US3136BBAR38 / Fannie Mae-Aces | 0,03 | -7,14 | 0,0180 | -0,0035 | ||

| US59023YAG98 / Merrill Lynch Alternative Note Asset Trust Series 2007-F1 | 0,03 | -3,85 | 0,0175 | -0,0027 | ||

| US863579HD34 / Structured Adjustable Rate Mortgage Loan Trust Series 2004-20 | 0,03 | 0,00 | 0,0172 | -0,0021 | ||

| US05952GAT85 / BANC OF AMERICA FUNDING CORPOR BAFC 2007 D 3A1 | 0,02 | 0,00 | 0,0171 | -0,0020 | ||

| US17307G2Z05 / Citigroup Mortgage Loan Trust, Inc., Series 2006-AR1, Class 1A1 | 0,02 | -4,00 | 0,0165 | -0,0029 | ||

| RFR USD SOFR/4.0535* 09/02/25-27Y* LCH / DIR (EZRQXB0T6JR0) | 0,02 | 0,0158 | 0,0158 | |||

| US75115LAA52 / RALI Series 2007-QH7 Trust | 0,02 | -12,00 | 0,0156 | -0,0038 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,02 | 0,0154 | 0,0154 | |||

| US17307GW795 / Citigroup Mortgage Loan Trust 2005-11 | 0,02 | 0,00 | 0,0152 | -0,0019 | ||

| US3622MPAN83 / GSR MORTGAGE LOAN TRUST 2007-1F GSR 2007-1F 2A4 | 0,02 | -4,55 | 0,0150 | -0,0024 | ||

| US863579VV75 / STRUCTURED ADJUSTABLE RATE MOR SARM 2005 17 5A1 | 0,02 | 0,00 | 0,0150 | -0,0018 | ||

| US92922F3L06 / WAMU MORTGAGE PASS THROUGH CER WAMU 2005 AR12 1A6 | 0,02 | -4,55 | 0,0149 | -0,0021 | ||

| US22942KAJ97 / CREDIT SUISSE MORTGAGE TRUST CSMC 2006 7 2A6 | 0,02 | 5,00 | 0,0145 | -0,0015 | ||

| RFR USD SOFR/4.04638 09/02/25-27Y* LCH / DIR (EZRQXB0T6JR0) | 0,02 | 0,0142 | 0,0142 | |||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0,02 | 0,0136 | 0,0136 | |||

| BOUGHT TWD SOLD USD 20250709 / DFE (000000000) | 0,02 | 0,0133 | 0,0133 | |||

| US589929M969 / Merrill Lynch Mortgage Investors Trust MLMI Series 2003-A2 | 0,02 | 0,00 | 0,0126 | -0,0017 | ||

| US23345WAA36 / DT Auto Owner Trust 2023-3 | 0,02 | -82,52 | 0,0124 | -0,0668 | ||

| US05950RBJ77 / BANC OF AMERICA FUNDING CORPOR BAFC 2006 6 3A4 | 0,02 | 0,00 | 0,0121 | -0,0013 | ||

| US65535VLL08 / NOMURA ASSET ACCEPTANCE CORPOR NAA 2005 AP2 A5 | 0,02 | 0,00 | 0,0118 | -0,0015 | ||

| US17313QAL23 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2007 10 22AA | 0,02 | -5,88 | 0,0114 | -0,0018 | ||

| US92925CBA99 / WaMu Mortgage Pass-Through Certificates Series 2005-AR19 Trust | 0,02 | -5,88 | 0,0112 | -0,0019 | ||

| US36228FD453 / GSR MORTGAGE LOAN TRUST GSR 2004 4 2A2 | 0,02 | 0,00 | 0,0112 | -0,0016 | ||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,02 | 0,0108 | 0,0108 | |||

| CITIZENS AUTO RECEIVABLES TRUS CITZN 2024 1 A2A 144A / ABS-O (US17331QAB23) | 0,02 | -58,33 | 0,0107 | -0,0172 | ||

| US12668AVL69 / Alternative Loan Trust, Series 2005-61, Class 1A1 | 0,01 | -6,67 | 0,0101 | -0,0017 | ||

| US91680YAY77 / UPSTART STRUCTURED PASS THROUG USPTT 2022 2A A 144A | 0,01 | -17,65 | 0,0100 | -0,0036 | ||

| US31398NWE02 / FANNIE MAE FNR 2010 111 FC | 0,01 | 0,00 | 0,0093 | -0,0013 | ||

| US88339FAA12 / Theorem Funding Trust 2022-2 | 0,01 | -68,29 | 0,0092 | -0,0227 | ||

| US576433UM63 / MASTR Adjustable Rate Mortgages Trust, Series 2004-13, Class 3A7 | 0,01 | 0,00 | 0,0092 | -0,0012 | ||

| US31396PWK38 / FANNIE MAE FNR 2007 15 AI | 0,01 | -7,69 | 0,0089 | -0,0012 | ||

| RFR USD SOFR/3.84199 12/02/24-4Y* LCH / DIR (EZSGM4VHBMV4) | 0,01 | 100,00 | 0,0088 | 0,0040 | ||

| US16162WPX10 / Chase Mortgage Finance Trust, Series 2005-A2, Class 1A3 | 0,01 | -7,69 | 0,0087 | -0,0012 | ||

| US12669FL509 / COUNTRYWIDE HOME LOANS CWHL 2004 15 4A | 0,01 | 0,00 | 0,0084 | -0,0013 | ||

| US31397BJY83 / FREDDIE MAC FHR 3218 SA | 0,01 | 0,00 | 0,0084 | -0,0011 | ||

| RFR USD SOFR/3.50000 12/20/23-7Y CME / DIR (EZPR4RDSDSJ6) | 0,01 | -80,00 | 0,0081 | -0,0344 | ||

| US268668BD18 / EMC MORTGAGE LOAN TRUST EMCM 2002 B A1 144A | 0,01 | 0,00 | 0,0077 | -0,0009 | ||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,01 | 0,0075 | 0,0075 | |||

| ZCS BRL 13.3537 05/12/25-01/02/29 CME / DIR (EZSPJ72GL6V3) | 0,01 | 0,0074 | 0,0074 | |||

| US05949AHA16 / Banc of America Mortgage 2004-E Trust | 0,01 | -9,09 | 0,0074 | -0,0016 | ||

| US31396PT920 / FANNIE MAE FNR 2007 22 SW | 0,01 | 0,00 | 0,0069 | -0,0009 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0069 | 0,0069 | |||

| US59020UVJ14 / Merrill Lynch Mortgage Investors Trust, Series 2005-1, Class 2A2 | 0,01 | 0,00 | 0,0068 | -0,0008 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0067 | 0,0067 | |||

| US05948XT270 / Banc of America Mortgage Trust, Series 2004-A, Class 2A2 | 0,01 | 0,00 | 0,0067 | -0,0009 | ||

| EZW8XKN63668 / GENERAL ELECTRIC COMPANY SNR S* ICE | 0,01 | -10,00 | 0,0063 | -0,0019 | ||

| US466247ZP16 / J.P. Morgan Mortgage Trust 2005-A1 | 0,01 | 0,00 | 0,0060 | -0,0008 | ||

| OIS COP IBR/7.49800 11/25/24-3Y* CME / DIR (EZK9X312V5L2) | 0,01 | -11,11 | 0,0060 | -0,0013 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0058 | 0,0058 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0058 | 0,0058 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0057 | 0,0057 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0057 | 0,0057 | |||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0056 | 0,0056 | |||

| US05949AZE36 / BANC OF AMERICA MORTGAGE SECUR BOAMS 2004 L 2A1 | 0,01 | -12,50 | 0,0054 | -0,0007 | ||

| ERADXULT TRS EQUITY SOFR+70 MEI / DE (000000000) | 0,01 | 0,0053 | 0,0053 | |||

| US46630GAC96 / J.P. Morgan Mortgage Trust | 0,01 | 0,00 | 0,0052 | -0,0006 | ||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0051 | 0,0051 | |||

| US31396PMQ18 / FANNIE MAE FNR 2007 4 SL | 0,01 | -14,29 | 0,0048 | -0,0007 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0047 | 0,0047 | |||

| US12669GJB86 / CHL Mortgage Pass-Through Trust 2004-29 | 0,01 | -14,29 | 0,0047 | -0,0014 | ||

| INF SWAP US IT 2.58125 05/16/25-5Y LCH / DIR (EZ4DL37DCX93) | 0,01 | 0,0046 | 0,0046 | |||

| US362341WZ88 / GSR MORTGAGE LOAN TRUST | 0,01 | 0,00 | 0,0044 | -0,0005 | ||

| ZCS BRL 13.2914 05/08/25-01/02/29 CME / DIR (EZYLW2ZWVNG8) | 0,01 | 0,0044 | 0,0044 | |||

| ZCS BRL 13.2914 05/08/25-01/02/29 CME / DIR (EZYLW2ZWVNG8) | 0,01 | 0,0044 | 0,0044 | |||

| INF SWAP US IT 2.477 11/07/24-5Y LCH / DIR (000000000) | 0,01 | 0,0044 | 0,0044 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0041 | 0,0041 | |||

| BANK OF AMERICA CORPORATION SNR S* ICE / DCR (EZJY8RTJK2L1) | 0,01 | -16,67 | 0,0039 | -0,0008 | ||

| US12544VCN73 / CWHL 2007-5 A51 | 0,01 | 0,00 | 0,0039 | -0,0005 | ||

| US31398FR459 / FANNIE MAE FNR 2009 87 HS | 0,01 | 0,00 | 0,0039 | -0,0005 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0037 | 0,0037 | |||

| US07387AGZ21 / Bear Stearns Adjustable Rate Mortgage Trust, Series 2006-1, Class A1 | 0,01 | 0,00 | 0,0035 | -0,0004 | ||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0035 | 0,0035 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0034 | 0,0034 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0034 | 0,0034 | |||

| US83162CRR69 / UNITED STATES SMALL BUSINESS ADMINISTRATION SBAP 2008-20C 1 | 0,00 | 0,00 | 0,0034 | -0,0004 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0033 | 0,0033 | |||

| US94984GAD97 / WELLS FARGO MORTGAGE BACKED SE WFMBS 2006 AR12 2A1 | 0,00 | 0,00 | 0,0033 | -0,0004 | ||

| BOUGHT BRL SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0032 | 0,0032 | |||

| US61749LAP67 / MORGAN STANLEY MORTGAGE LOAN TRUST 2006-8AR | 0,00 | 0,00 | 0,0031 | -0,0006 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0031 | 0,0031 | |||

| US46630GAJ40 / JP Morgan Mortgage Trust 2007-A1 | 0,00 | 0,00 | 0,0031 | -0,0007 | ||

| US31397H6P87 / FREDDIE MAC REMICS FHR 3311 FN | 0,00 | 0,00 | 0,0030 | -0,0005 | ||

| US31396WRQ14 / Fannie Mae REMICS | 0,00 | 0,00 | 0,0030 | -0,0004 | ||

| MSCI EAFE SEP25 IFUS 20250919 / DE (000000000) | 0,00 | 0,0028 | 0,0028 | |||

| RFR GBP SONIO/4.32000 10/20/23-10Y LCH / DIR (EZ49Z4HPK8R0) | 0,00 | 200,00 | 0,0027 | 0,0014 | ||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0027 | 0,0027 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0026 | 0,0026 | |||

| US126673J373 / ENCORE CREDIT RECEIVABLES TRUS ECR 2005 2 M3 | 0,00 | -70,00 | 0,0024 | -0,0060 | ||

| US362341FR55 / GSR Mortgage Loan Trust, Series 2005-AR, Class 6A1 | 0,00 | 0,00 | 0,0024 | -0,0003 | ||

| RFR USD SOFR/4.10000 01/21/25-10Y LCH / DIR (EZ7J947QTC64) | 0,00 | 50,00 | 0,0023 | 0,0002 | ||

| BOUGHT TRY SOLD USD 20250729 / DFE (000000000) | 0,00 | 0,0023 | 0,0023 | |||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0023 | 0,0023 | |||

| RFR USD SOFR/3.98235 12/02/24-2Y* LCH / DIR (EZ1P2MZR4KH2) | 0,00 | -50,00 | 0,0023 | -0,0029 | ||

| RFR USD SOFR/4.09000 01/22/25-10Y LCH / DIR (EZFR659WJHH9) | 0,00 | 50,00 | 0,0023 | 0,0003 | ||

| US31393C4W07 / FANNIE MAE FNR 2003 66 SA | 0,00 | 0,00 | 0,0022 | -0,0003 | ||

| US31396VCB27 / Fannie Mae REMICS | 0,00 | 0,00 | 0,0022 | -0,0003 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0022 | 0,0022 | |||

| RFR USD SOFR/3.88000 01/13/25-10Y LCH / DIR (EZB2C5X6RDC5) | 0,00 | 200,00 | 0,0021 | 0,0007 | ||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0020 | 0,0020 | |||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0020 | 0,0020 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0020 | 0,0020 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0019 | 0,0019 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0019 | 0,0019 | |||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0018 | 0,0018 | |||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0018 | 0,0018 | |||

| RFR USD SOFR/4.01500 12/30/24-10Y LCH / DIR (EZVY5NK4YWD2) | 0,00 | 100,00 | 0,0018 | 0,0003 | ||

| RFR USD SOFR/4.01300 01/15/25-10Y LCH / DIR (EZZWCBP8MVY9) | 0,00 | 100,00 | 0,0018 | 0,0003 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0018 | 0,0018 | |||

| TRT061124T11 / Turkey Government Bond | 0,00 | 0,00 | 0,0017 | -0,0003 | ||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0016 | 0,0016 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0016 | 0,0016 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0015 | 0,0015 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0015 | 0,0015 | |||

| US31397SWJ94 / FANNIE MAE FNR 2011 40 SX | 0,00 | 0,00 | 0,0015 | -0,0001 | ||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0015 | 0,0015 | |||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0,00 | 0,0014 | 0,0014 | |||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0,00 | 0,0014 | 0,0014 | |||

| RFR USD SOFR/3.93300 01/06/25-10Y LCH / DIR (EZK6LHB5L486) | 0,00 | 0,00 | 0,0013 | 0,0003 | ||

| US3137A7VH01 / Freddie Mac REMICS | 0,00 | 0,00 | 0,0013 | -0,0001 | ||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0013 | 0,0013 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0013 | 0,0013 | |||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0,00 | 0,0012 | 0,0012 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0012 | 0,0012 | |||

| RFR USD SOFR/3.90000 01/08/25-10Y LCH / DIR (EZKP2JSHK8F5) | 0,00 | 0,0011 | 0,0004 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0012 | 0,0012 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0011 | 0,0011 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0011 | 0,0011 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0011 | 0,0011 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0011 | 0,0011 | |||

| RFR USD SOFR/3.89000 01/08/25-10Y LCH / DIR (EZKP2JSHK8F5) | 0,00 | 0,0011 | 0,0004 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0010 | 0,0010 | |||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0,00 | 0,0010 | 0,0010 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0010 | 0,0010 | |||

| BOUGHT KRW SOLD USD 20250710 / DFE (000000000) | 0,00 | 0,0010 | 0,0010 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0009 | 0,0009 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0009 | 0,0009 | |||

| RFR USD SOFR/3.86600 11/14/24-10Y LCH / DIR (EZCMSCQLNL34) | 0,00 | 0,0009 | 0,0004 | |||

| US59020U4S19 / Merrill Lynch Mortgage Investors Trust Series MLCC 2006-1 | 0,00 | 0,00 | 0,0009 | -0,0002 | ||

| RFR USD SOFR/3.86000 11/14/24-10Y LCH / DIR (EZCMSCQLNL34) | 0,00 | 0,0009 | 0,0004 | |||

| RFR USD SOFR/3.85500 11/19/24-10Y LCH / DIR (EZVRNR667250) | 0,00 | 0,0008 | 0,0004 | |||

| RFR USD SOFR/3.84000 01/08/25-10Y LCH / DIR (EZKP2JSHK8F5) | 0,00 | 0,0008 | 0,0001 | |||

| OIS MXN TIIE1/7.76000 04/09/25-4Y* CME / DIR (EZ8RRKWFNPF8) | 0,00 | 0,0007 | 0,0007 | |||

| SOLD NOK BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0007 | 0,0007 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0007 | 0,0007 | |||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| BOUGHT NZD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| RFR USD SOFR/3.79250 11/19/24-10Y LCH / DIR (EZVRNR667250) | 0,00 | 0,0005 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| RFR USD SOFR/3.75000 05/07/25-10Y LCH / DIR (EZ61ZS50J0P1) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT PEN SOLD USD 20250730 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT TRY SOLD USD 20251217 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| IRS EUR 2.39000 10/01/24-10Y LCH / DIR (EZHK1QM5FKM1) | 0,00 | -100,00 | 0,0003 | -0,0017 | ||

| SOLD COP BOUGHT USD 20250917 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| IRS EUR 2.55000 04/16/25-10Y LCH / DIR (EZ15F0SX71M6) | 0,00 | 0,0002 | 0,0002 | |||

| US88522YAB56 / Thornburg Mortgage Securities Trust 2007-4 | 0,00 | 0,0002 | -0,0001 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT NOK SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT ILS SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| SOLD HKD BOUGHT USD 20250716 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| US05948XBS99 / BANC OF AMERICA MORTGAGE SECUR BOAMS 2003 D 2A1 | 0,00 | 0,0001 | -0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT TRY SOLD USD 20250725 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT TRY SOLD USD 20250811 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT TRY SOLD USD 20250701 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT TRY SOLD USD 20250718 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT PEN SOLD USD 20250707 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT TRY SOLD USD 20250807 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US023138AA88 / Ambac Assurance Corp | 0,00 | 0,0000 | -0,0000 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT KRW SOLD USD 20250708 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT TRY SOLD USD 20250814 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT TRY SOLD USD 20250701 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT NOK SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| SOLD SEK BOUGHT USD 20250804 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| 317U7NKA1 PIMCO SWAPTION 5.85 PUT USD 20251121 / DIR (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| 317U7NNA8 PIMCO SWAPTION 5.85 PUT USD 20251124 / DIR (EZZ8D3GWSG66) | 0,00 | 0,0000 | -0,0000 | |||

| WMT / Walmart Inc. | 0,00 | -100,00 | -0,0186 | |||

| BOUGHT SEK SOLD USD 20250702 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| 31750QMB2 PIMCO CDSOPT PUT USD 0.9 20250716 / DCR (EZ967XY50V92) | -0,00 | -0,0000 | 0,0003 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| 31750QMA4 PIMCO CDSOPT PUT USD 1.0 20250716 / DCR (EZ967XY50V92) | -0,00 | -0,0000 | 0,0003 | |||

| 31750QN88 PIMCO CDSOPT PUT USD 0.85 20250716 / DCR (EZ967XY50V92) | -0,00 | -0,0000 | 0,0003 | |||

| 31750QN05 PIMCO CDSOPT PUT USD 0.85 20250716 / DCR (EZ967XY50V92) | -0,00 | -0,0000 | 0,0003 | |||

| SOLD NOK BOUGHT USD 20250804 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| 31750QM06 PIMCO CDSOPT PUT USD 0.9 20250716 / DCR (EZ967XY50V92) | -0,00 | -0,0000 | 0,0003 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD TRY BOUGHT USD 20250729 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD TRY BOUGHT USD 20250729 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD DKK BOUGHT USD 20250804 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD KRW BOUGHT USD 20250714 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD DKK BOUGHT USD 20250804 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD KRW BOUGHT USD 20250708 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD SEK BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| IRS EUR 2.28000 03/04/25-5Y LCH / DIR (EZQH3P2675Q7) | -0,00 | -0,0001 | -0,0005 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD ILS BOUGHT USD 20250709 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | |||

| SOLD TRY BOUGHT USD 20250725 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | |||

| ZCS BRL 14.0087 05/12/25-01/04/27 CME / DIR (EZHTRBH6Z688) | -0,00 | -0,0002 | -0,0002 | |||

| SOLD MXN BOUGHT USD 20250917 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | |||

| SOLD MXN BOUGHT USD 20250917 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | |||

| ZCS BRL 13.9255 05/08/25-01/04/27 CME / DIR (EZ6MPDHN98L0) | -0,00 | -0,0002 | -0,0002 | |||

| ZCS BRL 13.9255 05/08/25-01/04/27 CME / DIR (EZ6MPDHN98L0) | -0,00 | -0,0002 | -0,0002 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | |||

| SOLD TRY BOUGHT USD 20250707 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| SOFTBANK GROUP CORP SNR JP SP GST / DCR (EZ1K1NTX2WN0) | -0,00 | -0,0003 | -0,0000 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| SOLD TRY BOUGHT USD 20251217 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| SOLD PEN BOUGHT USD 20250929 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| SOLD PEN BOUGHT USD 20250808 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | |||

| SOLD CZK BOUGHT USD 20250822 / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | |||

| IRS EUR 2.35000 04/29/25-5Y LCH / DIR (EZ74X71XY4J2) | -0,00 | -0,0004 | -0,0004 | |||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | |||

| SOLD TRY BOUGHT USD 20250729 / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | |||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0005 | -0,0005 | |||

| IRS EUR 2.52000 03/27/25-10Y LCH / DIR (EZ84ZR69LPH2) | -0,00 | -100,00 | -0,0005 | 0,0004 | ||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0005 | -0,0005 | |||

| RFR GBP SONIO/3.93000 01/06/25-10Y LCH / DIR (EZTXWKTD4706) | -0,00 | -100,00 | -0,0005 | 0,0014 | ||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0005 | -0,0005 | |||

| SOLD NZD BOUGHT USD 20250804 / DFE (000000000) | -0,00 | -0,0005 | -0,0005 | |||

| RFR USD SOFR/3.89000 03/03/25-10Y LCH / DIR (EZ6496BPGLD0) | -0,00 | -0,0006 | -0,0002 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0006 | -0,0006 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0006 | -0,0006 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0006 | -0,0006 | |||

| SOLD ILS BOUGHT USD 20250718 / DFE (000000000) | -0,00 | -0,0006 | -0,0006 | |||

| SOLD TRY BOUGHT USD 20250717 / DFE (000000000) | -0,00 | -0,0007 | -0,0007 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0008 | -0,0008 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0008 | -0,0008 | |||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0,00 | -0,0008 | -0,0008 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0008 | -0,0008 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0008 | -0,0008 | |||

| IRS EUR 2.65000 01/08/24-10Y LCH / DIR (EZGRMVPMTWZ4) | -0,00 | -0,0008 | -0,0005 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0008 | -0,0008 | |||

| SOLD ZAR BOUGHT USD 20250723 / DFE (000000000) | -0,00 | -0,0009 | -0,0009 | |||

| IRS CZK 3.76000 11/01/24-10Y CME / DIR (EZZDBNZ60DY7) | -0,00 | -0,0009 | -0,0010 | |||

| SOLD NZD BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0009 | -0,0009 | |||

| IRS EUR 2.46000 03/13/25-10Y LCH / DIR (EZYS5KMNTTM6) | -0,00 | 0,00 | -0,0009 | 0,0005 | ||

| IRS EUR 2.46000 04/01/25-10Y LCH / DIR (EZ53SKB9GFZ1) | -0,00 | 0,00 | -0,0009 | 0,0004 | ||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0009 | -0,0009 | |||

| RFR USD SOFR/3.87000 03/05/25-10Y LCH / DIR (EZMZ9H14KX59) | -0,00 | -0,0010 | -0,0004 | |||

| SOLD BRL BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0010 | -0,0010 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0,00 | -0,0010 | -0,0010 | |||

| SOLD MXN BOUGHT USD 20250917 / DFE (000000000) | -0,00 | -0,0010 | -0,0010 | |||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0,00 | -0,0011 | -0,0011 | |||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0,00 | -0,0011 | -0,0011 | |||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0,00 | -0,0011 | -0,0011 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0011 | -0,0011 | |||

| RFR USD SOFR/3.88400 03/25/25-10Y LCH / DIR (EZH2QB9TLWH9) | -0,00 | -0,0011 | -0,0003 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0011 | -0,0011 | |||

| IRS EUR 2.40000 04/09/25-5Y LCH / DIR (EZVHX3M64G11) | -0,00 | -0,0011 | -0,0011 | |||

| SOLD TRY BOUGHT USD 20250709 / DFE (000000000) | -0,00 | -0,0011 | -0,0011 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0011 | -0,0011 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0011 | -0,0011 | |||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0011 | -0,0011 | |||

| RFR USD SOFR/3.51500 11/06/24-10Y LCH / DIR (EZH37Z857HQ2) | -0,00 | -75,00 | -0,0012 | 0,0021 | ||

| RFR USD SOFR/3.89900 03/11/25-10Y LCH / DIR (EZXJC61P0SN9) | -0,00 | 0,00 | -0,0012 | -0,0003 | ||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0,00 | -0,0012 | -0,0012 | |||

| RFR USD SOFR/3.90500 03/12/25-10Y LCH / DIR (EZ2V6Q3C4Q52) | -0,00 | 0,00 | -0,0012 | -0,0003 | ||

| SOLD IDR BOUGHT USD 20250711 / DFE (000000000) | -0,00 | -0,0012 | -0,0012 | |||

| RFR USD SOFR/3.90750 03/04/25-10Y LCH / DIR (EZP5RC766JJ0) | -0,00 | 0,00 | -0,0012 | -0,0003 | ||

| SOLD PLN BOUGHT USD 20250710 / DFE (000000000) | -0,00 | -0,0013 | -0,0013 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0013 | -0,0013 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0013 | -0,0013 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0013 | -0,0013 | |||

| SOLD INR BOUGHT USD 20250709 / DFE (000000000) | -0,00 | -0,0014 | -0,0014 | |||

| RFR USD SOFR/3.48500 10/30/24-10Y LCH / DIR (EZ6NZKJMK5Y6) | -0,00 | -50,00 | -0,0014 | 0,0006 | ||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0014 | -0,0014 | |||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0014 | -0,0014 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0015 | -0,0015 | |||

| RFR USD SOFR/3.46500 10/30/24-10Y LCH / DIR (EZ6NZKJMK5Y6) | -0,00 | 0,00 | -0,0015 | 0,0005 | ||

| RFR USD SOFR/3.46300 10/23/24-10Y LCH / DIR (EZ0G93G4TB83) | -0,00 | 0,00 | -0,0015 | 0,0007 | ||

| RFR USD SOFR/3.46300 10/23/24-10Y LCH / DIR (EZ0G93G4TB83) | -0,00 | 0,00 | -0,0015 | 0,0007 | ||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0015 | -0,0015 | |||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0015 | -0,0015 | |||

| RFR USD SOFR/3.45500 11/01/24-10Y LCH / DIR (EZLFRJ136TH4) | -0,00 | 0,00 | -0,0015 | 0,0006 | ||

| RFR USD SOFR/3.45500 11/01/24-10Y LCH / DIR (EZLFRJ136TH4) | -0,00 | 0,00 | -0,0015 | 0,0006 | ||

| RFR USD SOFR/3.45000 10/11/24-10Y LCH / DIR (EZSSZHJJP5K5) | -0,00 | 0,00 | -0,0016 | 0,0006 | ||

| INF SWAP US IT 2.5025 03/25/25-5Y LCH / DIR (EZCD1478Q5K2) | -0,00 | -125,00 | -0,0016 | -0,0083 | ||

| RFR USD SOFR/3.97500 03/21/25-10Y LCH / DIR (EZSTF4LLCQZ1) | -0,00 | 100,00 | -0,0016 | -0,0003 | ||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0,00 | -0,0016 | -0,0016 | |||

| SOLD PEN BOUGHT USD 20250730 / DFE (000000000) | -0,00 | -0,0017 | -0,0017 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0018 | -0,0018 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0018 | -0,0018 | |||

| SOLD CLP BOUGHT USD 20250723 / DFE (000000000) | -0,00 | -0,0019 | -0,0019 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0019 | -0,0019 | |||

| SOLD PLN BOUGHT USD 20250710 / DFE (000000000) | -0,00 | -0,0019 | -0,0019 | |||

| SOLD PLN BOUGHT USD 20250710 / DFE (000000000) | -0,00 | -0,0019 | -0,0019 | |||

| SOLD ILS BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0020 | -0,0020 | |||

| SOLD ILS BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0020 | -0,0020 | |||

| RFR USD SOFR/3.38500 10/17/24-10Y LCH / DIR (EZQ8GN13B6X9) | -0,00 | -33,33 | -0,0020 | 0,0007 | ||

| SOLD PEN BOUGHT USD 20251128 / DFE (000000000) | -0,00 | -0,0020 | -0,0020 | |||

| SOLD CHF BOUGHT USD 20250804 / DFE (000000000) | -0,00 | -0,0020 | -0,0020 | |||

| RFR USD SOFR/3.37500 10/15/24-10Y LCH / DIR (EZW0Y59ZCKK7) | -0,00 | -33,33 | -0,0020 | 0,0007 | ||

| SOLD ZAR BOUGHT USD 20250723 / DFE (000000000) | -0,00 | -0,0021 | -0,0021 | |||

| RFR USD SOFR/3.53500 11/06/24-10Y LCH / DIR (EZH37Z857HQ2) | -0,00 | -25,00 | -0,0021 | 0,0012 | ||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0,00 | -0,0022 | -0,0022 | |||

| CMBX.NA.AAA.16 SP SAL / DCR (EZJ2X064YKF7) | -0,00 | -50,00 | -0,0024 | 0,0023 | ||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0,00 | -0,0024 | -0,0024 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0024 | -0,0024 | |||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0,00 | -0,0025 | -0,0025 | |||

| IRS EUR 2.22000 01/08/25-10Y LCH / DIR (EZHH63XJ2WL4) | -0,00 | -25,00 | -0,0026 | 0,0005 | ||

| SOLD PEN BOUGHT USD 20250910 / DFE (000000000) | -0,00 | -0,0026 | -0,0026 | |||

| RFR USD SOFR/3.49500 10/30/24-10Y LCH / DIR (EZ6NZKJMK5Y6) | -0,00 | 50,00 | -0,0026 | -0,0006 | ||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0027 | -0,0027 | |||

| RFR USD SOFR/3.93000 03/24/25-10Y LCH / DIR (EZKR9TWV5646) | -0,00 | 50,00 | -0,0027 | -0,0006 | ||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0,00 | -0,0027 | -0,0027 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0028 | -0,0028 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0028 | -0,0028 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0029 | -0,0029 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0,00 | -0,0029 | -0,0029 | |||

| SOLD ZAR BOUGHT USD 20250723 / DFE (000000000) | -0,00 | -0,0032 | -0,0032 | |||

| SOLD ZAR BOUGHT USD 20250723 / DFE (000000000) | -0,00 | -0,0032 | -0,0032 | |||

| RFR USD SOFR/4.00000 06/20/24-2Y CME / DIR (EZ33002G9XM4) | -0,00 | -114,81 | -0,0033 | -0,0246 | ||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | -0,00 | -0,0033 | -0,0033 | |||

| IRS EUR 2.89000 12/22/23-10Y LCH / DIR (EZ9WG6DNS963) | -0,01 | 150,00 | -0,0034 | -0,0015 | ||

| RFR USD SOFR/3.84200 03/04/25-5Y LCH / DIR (EZSYJ06JDLK1) | -0,01 | 150,00 | -0,0035 | -0,0016 | ||

| SOLD GBP BOUGHT USD 20250702 / DFE (000000000) | -0,01 | -0,0035 | -0,0035 | |||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0,01 | -0,0036 | -0,0036 | |||

| IRS EUR 2.91000 12/29/23-10Y LCH / DIR (EZ6S054Q5KZ9) | -0,01 | 150,00 | -0,0036 | -0,0015 | ||

| SOLD CZK BOUGHT USD 20250822 / DFE (000000000) | -0,01 | -0,0037 | -0,0037 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,01 | -0,0037 | -0,0037 | |||

| 31750R3X3 PIMCO FXVAN CALL USD TRY 54.00000000 / DFE (EZP38740M526) | -0,01 | -0,0038 | -0,0038 | |||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0,01 | -0,0038 | -0,0038 | |||

| RFR USD SOFR/3.39500 10/17/24-10Y LCH / DIR (EZQ8GN13B6X9) | -0,01 | 66,67 | -0,0038 | -0,0012 | ||

| SOLD PEN BOUGHT USD 20250717 / DFE (000000000) | -0,01 | -0,0040 | -0,0040 | |||

| IRS EUR 2.97000 12/15/23-10Y LCH / DIR (EZ47DRZSK7H4) | -0,01 | 66,67 | -0,0040 | -0,0015 | ||

| IRS CLP 5.02000 11/05/24-6Y* CME / DIR (000000000) | -0,01 | -0,0041 | -0,0041 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,01 | -0,0041 | -0,0041 | |||

| IRS EUR 2.99000 12/08/23-10Y LCH / DIR (EZVMLNBFB1H7) | -0,01 | 100,00 | -0,0041 | -0,0015 | ||

| INF SWAP US IT 2.52 03/27/25-5Y LCH / DIR (EZWDN00FCNN2) | -0,01 | -160,00 | -0,0043 | -0,0125 | ||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0,01 | -0,0045 | -0,0045 | |||

| SOLD ILS BOUGHT USD 20250718 / DFE (000000000) | -0,01 | -0,0045 | -0,0045 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0,01 | -0,0046 | -0,0046 | |||

| IRS EUR 3.06300 12/06/23-10Y LCH / DIR (EZCXF38PCGV4) | -0,01 | 50,00 | -0,0046 | -0,0015 | ||

| RFR USD SOFR/3.43500 11/05/24-10Y LCH / DIR (EZQZ2X045HL2) | -0,01 | -22,22 | -0,0050 | 0,0019 | ||

| SOLD CAD BOUGHT USD 20250805 / DFE (000000000) | -0,01 | -0,0051 | -0,0051 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0,01 | -0,0051 | -0,0051 | |||

| IRS EUR 3.14800 11/20/23-10Y LCH / DIR (EZ0D281GPH91) | -0,01 | 75,00 | -0,0052 | -0,0015 | ||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0,01 | -0,0052 | -0,0052 | |||

| SOLD AUD BOUGHT USD 20250805 / DFE (000000000) | -0,01 | -0,0056 | -0,0056 | |||

| RFR USD SOFR/3.75000 12/18/24-10Y CME / DIR (EZ7K2W20N534) | -0,01 | -200,00 | -0,0057 | -0,0123 | ||

| 317U7ISA4 PIMCO SWAPTION 2.83 CALL USD 2025103 / DIR (000000000) | -0,01 | -0,0058 | -0,0058 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0,01 | -0,0060 | -0,0060 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0,01 | -0,0061 | -0,0061 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,01 | -0,0062 | -0,0062 | |||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0,01 | -0,0063 | -0,0063 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,01 | -0,0064 | -0,0064 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0,01 | -0,0069 | -0,0069 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0,01 | -0,0075 | -0,0075 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0,01 | -0,0075 | -0,0075 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,01 | -0,0079 | -0,0079 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,01 | -0,0079 | -0,0079 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,01 | -0,0080 | -0,0080 | |||

| SOLD GBP BOUGHT USD 20250804 / DFE (000000000) | -0,01 | -0,0081 | -0,0081 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,01 | -0,0084 | -0,0084 | |||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0,01 | -0,0090 | -0,0090 | |||

| OIS MXN TIIE1/9.00000 12/24/24-4Y* CME / DIR (EZM51TDSF7W6) | -0,01 | 44,44 | -0,0094 | -0,0022 | ||

| IRS PLN 4.93000 11/04/24-5Y* CME / DIR (000000000) | -0,01 | -0,0096 | -0,0096 | |||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0,01 | -0,0096 | -0,0096 | |||

| SOLD PEN BOUGHT USD 20250731 / DFE (000000000) | -0,01 | -0,0098 | -0,0098 | |||

| SOLD PEN BOUGHT USD 20250804 / DFE (000000000) | -0,01 | -0,0098 | -0,0098 | |||

| SOLD GBP BOUGHT USD 20250702 / DFE (000000000) | -0,01 | -0,0098 | -0,0098 | |||

| SOLD GBP BOUGHT USD 20250702 / DFE (000000000) | -0,01 | -0,0098 | -0,0098 | |||

| SOLD PEN BOUGHT USD 20251114 / DFE (000000000) | -0,01 | -0,0101 | -0,0101 | |||

| SOLD EUR BOUGHT USD 20250804 / DFE (000000000) | -0,02 | -0,0108 | -0,0108 | |||

| CDX IG43 5Y ICE / DCR (EZ10N17RBN04) | -0,02 | 14,29 | -0,0116 | -0,0007 | ||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0,02 | -0,0117 | -0,0117 | |||

| US 10YR ULTRA FUT SEP25 XCBT 20250919 / DIR (000000000) | -0,02 | -0,0119 | -0,0119 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0,02 | -0,0120 | -0,0120 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0,02 | -0,0122 | -0,0122 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,02 | -0,0122 | -0,0122 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0,02 | -0,0122 | -0,0122 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0,02 | -0,0125 | -0,0125 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,02 | -0,0127 | -0,0127 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,02 | -0,0128 | -0,0128 | |||

| RFR USD SOFR/3.75000 12/18/24-7Y LCH / DIR (EZQ9TQ7T4F86) | -0,02 | 500,00 | -0,0128 | -0,0105 | ||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0,02 | -0,0130 | -0,0130 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,02 | -0,0132 | -0,0132 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0,02 | -0,0133 | -0,0133 | |||

| RFR USD SOFR/3.75000 06/20/24-10Y CME / DIR (EZ52H44WTW83) | -0,02 | -186,36 | -0,0133 | -0,0303 | ||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,02 | -0,0134 | -0,0134 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0,02 | -0,0134 | -0,0134 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0,02 | -0,0134 | -0,0134 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,02 | -0,0135 | -0,0135 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,02 | -0,0135 | -0,0135 | |||

| 317U7IRA5 PIMCO SWAPTION 3.29 CALL USD 2025103 / DIR (000000000) | -0,02 | -0,0137 | -0,0137 | |||

| SOLD BRL BOUGHT USD 20250702 / DFE (000000000) | -0,02 | -0,0138 | -0,0138 | |||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | -0,02 | -0,0139 | -0,0139 | |||

| SOLD BRL BOUGHT USD 20260402 / DFE (000000000) | -0,02 | -0,0151 | -0,0151 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,02 | -0,0153 | -0,0153 | |||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | -0,02 | -0,0158 | -0,0158 | |||

| SOLD CHF BOUGHT USD 20250702 / DFE (000000000) | -0,02 | -0,0159 | -0,0159 | |||

| SOLD CHF BOUGHT USD 20250702 / DFE (000000000) | -0,02 | -0,0159 | -0,0159 | |||

| SOLD BRL BOUGHT USD 20250702 / DFE (000000000) | -0,03 | -0,0173 | -0,0173 | |||

| SOLD PEN BOUGHT USD 20250917 / DFE (000000000) | -0,03 | -0,0214 | -0,0214 | |||

| SOLD PEN BOUGHT USD 20250917 / DFE (000000000) | -0,03 | -0,0214 | -0,0214 | |||

| SOLD PEN BOUGHT USD 20250918 / DFE (000000000) | -0,04 | -0,0256 | -0,0256 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,04 | -0,0278 | -0,0278 | |||

| ABX.HE.AAA.06-2 SP BOA / DCR (000000000) | -0,07 | -0,0513 | -0,0513 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,09 | -0,0635 | -0,0635 | |||

| IRS EUR 2.25000 09/17/25-10Y LCH / DIR (EZNLCZXFPVL3) | -0,14 | -4,86 | -0,0946 | 0,0153 | ||

| RFR GBP SONIO/3.50000 03/19/25-5Y LCH / DIR (EZ4P0PH8GZ40) | -0,15 | -28,50 | -0,1020 | 0,0561 | ||

| CDX IG44 5Y ICE / DCR (EZPF6RHH0ZV8) | -0,31 | 2.690,91 | -0,2113 | -0,2028 | ||

| US01F0326821 / Fannie Mae or Freddie Mac | -5,04 | -5.350,00 | -3,4620 | -3,5292 |