Statistiche di base

| Valore del portafoglio | $ 1.515.989.861 |

| Posizioni attuali | 1.215 |

Ultime partecipazioni, performance, AUM (da depositi 13F, 13D)

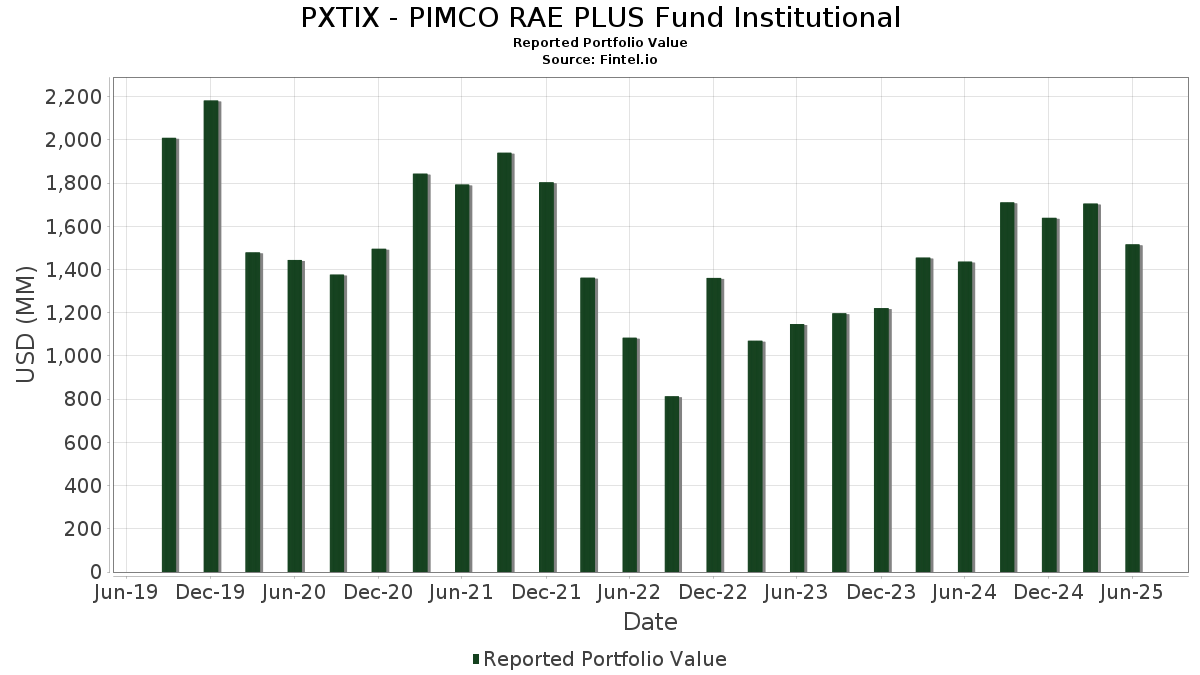

PXTIX - PIMCO RAE PLUS Fund Institutional ha dichiarato un totale di 1.215 partecipazioni negli ultimi documenti depositati presso la SEC. Il valore più recente del portafoglio è pari a $ 1.515.989.861 USD. Il patrimonio gestito effettivo (AUM) corrisponde a questo valore più la liquidità (che non viene dichiarata). Le principali partecipazioni di PXTIX - PIMCO RAE PLUS Fund Institutional sono Uniform Mortgage-Backed Security, TBA (US:US01F0626899) , PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , UMBS TBA (US:US01F0406854) , and Uniform Mortgage-Backed Security, TBA (US:US01F0526800) . Le nuove posizioni di PXTIX - PIMCO RAE PLUS Fund Institutional includono Uniform Mortgage-Backed Security, TBA (US:US01F0626899) , PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , UMBS TBA (US:US01F0406854) , and Uniform Mortgage-Backed Security, TBA (US:US01F0526800) .

Gli aumenti più importanti di questo trimestre

Utilizziamo la variazione dell'allocazione del portafoglio perché è l'indicatore più significativo. Le variazioni possono essere dovute a transazioni o a variazioni dei prezzi delle azioni.

| Titolo | Azioni (in milioni) |

Valore (in milioni di $) |

Portafoglio % | ΔPortafoglio % |

|---|---|---|---|---|

| 144,50 | 13,8412 | 13,8412 | ||

| 181,59 | 17,3939 | 12,5694 | ||

| 147,62 | 14,1403 | 11,8253 | ||

| 58,52 | 5,6054 | 7,5423 | ||

| 112,75 | 10,7999 | 5,7780 | ||

| 31,84 | 3,0500 | 2,3842 | ||

| 20,34 | 1,9481 | 1,9481 | ||

| 18,52 | 1,7744 | 1,7744 | ||

| 16,49 | 1,5791 | 1,5791 | ||

| 32,04 | 3,0690 | 1,5477 |

Gli aumenti più importanti di questo trimestre

Utilizziamo la variazione dell'allocazione del portafoglio perché è l'indicatore più significativo. Le variazioni possono essere dovute a transazioni o a variazioni dei prezzi delle azioni.

| Titolo | Azioni (in milioni) |

Valore (in milioni di $) |

Portafoglio % | ΔPortafoglio % |

|---|---|---|---|---|

| 18,71 | 1,7924 | -4,4619 | ||

| -42,31 | -4,0525 | -4,0849 | ||

| 38,77 | 3,7132 | -0,7622 | ||

| 0,77 | 0,0740 | -0,7264 | ||

| -3,32 | -0,3184 | -0,3184 | ||

| 0,08 | 0,0080 | -0,2489 | ||

| 2,78 | 0,2667 | -0,1501 | ||

| 0,29 | 0,0276 | -0,1479 | ||

| -0,82 | -0,0786 | -0,1096 | ||

| -1,14 | -0,1091 | -0,1091 |

13F e depositi di fondi

Questo modulo è stato depositato il 2025-08-29 per il periodo di riferimento 2025-06-30. Questo investitore non ha divulgato titoli conteggiati in azioni, pertanto le colonne relative alle azioni nella tabella seguente sono state omesse. Fai clic sull'icona del link per visualizzare la cronologia completa delle transazioni.

Esegui l'upgrade per sbloccare i dati premium ed esportarli in Excel ![]() .

.

| Titolo | Tipo | ΔAzioni (%) |

Valore (in milioni di $) |

Portafoglio (%) |

ΔPortafoglio (%) |

|

|---|---|---|---|---|---|---|

| US01F0626899 / Uniform Mortgage-Backed Security, TBA | 181,59 | 234,91 | 17,3939 | 12,5694 | ||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 147,62 | 492,17 | 14,1403 | 11,8253 | ||

| REPO BANK AMERICA REPO / RA (000000000) | 144,50 | 13,8412 | 13,8412 | |||

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | 112,75 | 99,77 | 10,7999 | 5,7780 | ||

| US01F0406854 / UMBS TBA | 58,52 | -357,93 | 5,6054 | 7,5423 | ||

| US01F0526800 / Uniform Mortgage-Backed Security, TBA | 38,77 | -22,93 | 3,7132 | -0,7622 | ||

| US01F0506844 / UMBS TBA | 32,04 | 108,22 | 3,0690 | 1,5477 | ||

| US01F0426811 / UMBS TBA | 31,84 | 372,91 | 3,0500 | 2,3842 | ||

| US01F0306781 / UMBS TBA | 20,34 | 1,9481 | 1,9481 | |||

| US72202G3801 / PIMCO ST FLOATING NAV PORT IV MUTUAL FUND | 18,71 | -72,22 | 1,7924 | -4,4619 | ||

| US21H0406734 / Ginnie Mae | 18,52 | 1,7744 | 1,7744 | |||

| US21H0506806 / GNMA | 16,49 | 1,5791 | 1,5791 | |||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 14,52 | 1,3912 | 1,3912 | |||

| XS2376115270 / Toro European CLO 6 DAC | 13,67 | 5,17 | 1,3090 | 0,1024 | ||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 13,23 | 1,2677 | 1,2677 | |||

| US TREASURY N/B 05/44 4.625 / DBT (US912810UB25) | 12,75 | -2,25 | 1,2215 | 0,0101 | ||

| FNMA POOL BM7581 FN 09/31 VARIABLE / ABS-MBS (US3140JCM768) | 10,19 | 0,82 | 0,9761 | 0,0375 | ||

| US78485KAE55 / STWD 2022-FL3 Ltd | 9,05 | -0,02 | 0,8668 | 0,0263 | ||

| US04541GWF52 / ASSET BACKED SECURITIES CORP H ABSHE 2006 HE2 A4 | 8,94 | -4,29 | 0,8565 | -0,0111 | ||

| ERAUSLT TRS EQUITY SOFR+72 *BULLET* JPM / DE (000000000) | 7,70 | 0,7374 | 0,7374 | |||

| ERAUSLT TRS EQUITY SOFR+53 MYI / DE (000000000) | 7,42 | 0,7106 | 0,7106 | |||

| US40430KAH41 / HASC 2006-OPT4 M1 | 7,40 | -2,85 | 0,7084 | 0,0015 | ||

| US45668GAD43 / INDYMAC INDX MORTGAGE LOAN TRU INDX 2006 AR14 1A3A | 7,05 | -4,69 | 0,6755 | -0,0116 | ||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 6,30 | 0,6035 | 0,6035 | |||

| TOYOTA AUTO RECEIVABLES OWNER TAOT 2024 C A3 / ABS-O (US89237QAD25) | 6,16 | 0,11 | 0,5901 | 0,0187 | ||

| 4020 / Saudi Real Estate Company | 6,05 | 1,48 | 0,5799 | 0,0259 | ||

| US045427AD39 / COUNTRYWIDE ASSET BACKED CERTI CWL 2006 8 2A4 | 5,93 | -3,20 | 0,5676 | -0,0009 | ||

| US55284JAC36 / MF1 2022-FL8 Ltd | 5,89 | -0,59 | 0,5641 | 0,0140 | ||

| US68389FJK12 / Option One Mortgage Loan Trust 2005-4 Asset-Backed Certificates Series 2005-4 | 5,82 | 0,81 | 0,5576 | 0,0214 | ||

| MF1 MULTIFAMILY HOUSING MORTGA MF1 2025 FL17 AS 144A / ABS-CBDO (US55287HAC43) | 5,77 | -0,21 | 0,5531 | 0,0158 | ||

| NISSAN AUTO LEASE TRUST NALT 2024 B A3 / ABS-O (US65481DAD49) | 5,66 | 0,21 | 0,5424 | 0,0177 | ||

| AMERICAN EXPRESS CREDIT ACCOUN AMXCA 2024 3 A / ABS-MBS (US02589BAE02) | 5,57 | 0,34 | 0,5333 | 0,0180 | ||

| FNMA POOL BM7579 FN 10/29 VARIABLE / ABS-MBS (US3140JCM503) | 5,52 | 1,01 | 0,5290 | 0,0213 | ||

| FCT / Fincantieri S.p.A. | 5,51 | 9,89 | 0,5281 | 0,0622 | ||

| RFRF USD SF+26.161/1.2* 9/16/23-28Y* CME / DIR (EZ31ZKH6CSJ5) | 5,51 | 3,54 | 0,5274 | 0,0335 | ||

| CDX ITRAXX XOV42 5Y 35-100% SP JPM / DCR (EZ2BLZ4YH9B3) | 5,49 | 0,5260 | 0,5260 | |||

| US902613AP31 / UBS Group AG | 5,33 | 0,55 | 0,5108 | 0,0183 | ||

| SYNCHRONY CARD ISSUANCE TRUST SYNIT 2024 A2 A / ABS-MBS (US87166PAN15) | 5,28 | 0,17 | 0,5058 | 0,0163 | ||

| 92780JUU3 / VIRGINIA ELECT.& PWR | 5,26 | 0,5040 | 0,5040 | |||

| BDS LTD BDS 2025 FL14 AS 144A / ABS-CBDO (US072921AC35) | 5,22 | -0,46 | 0,4998 | 0,0130 | ||

| USP78024AG45 / Peruvian Government International Bond | 5,21 | 7,60 | 0,4991 | 0,0494 | ||

| CBRE SVCS INC 07/25 ZCP / DBT (US12610BUQ30) | 5,15 | 0,4936 | 0,4936 | |||

| FNMA POOL BS9867 FN 11/30 FIXED 5.3 / ABS-MBS (US3140LL6D83) | 5,12 | 0,67 | 0,4906 | 0,0181 | ||

| CNQ / Canadian Natural Resources Limited | 5,10 | 0,4890 | 0,4890 | |||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVN09) | 5,08 | 0,4869 | 0,4869 | |||

| HERTZ VEHICLE FINANCING LLC HERTZ 2024 1A A 144A / ABS-O (US42806MCK36) | 5,08 | 0,22 | 0,4868 | 0,0159 | ||

| JONES LANG LASALLE FIN BV 4/A2 07/25 ZCP / DBT (US48002AU933) | 5,07 | 0,4860 | 0,4860 | |||

| RTX / RTX Corporation - Depositary Receipt (Common Stock) | 5,01 | 0,4799 | 0,4799 | |||

| ARBOUR CLO ARBR 6A AR 144A / ABS-CBDO (XS2900383915) | 4,95 | 8,77 | 0,4740 | 0,0515 | ||

| US05377RFV15 / AESOP_22-5A | 4,94 | -0,40 | 0,4732 | 0,0126 | ||

| US525931AB72 / Lendbuzz Securitization Trust 2023-3 | 4,93 | 0,4726 | 0,4726 | |||

| US05522RDH84 / BA Credit Card Trust | 4,85 | 0,00 | 0,4648 | 0,0143 | ||

| US17330VAA44 / CMLTI_22-A | 4,85 | -2,20 | 0,4646 | 0,0041 | ||

| US75889FAC86 / Regatta XXIII Funding Ltd | 4,82 | 0,40 | 0,4618 | 0,0158 | ||

| CARVAL CLO LTD CARVL 2018 1A AR 144A / ABS-CBDO (US146865AJ95) | 4,74 | -3,84 | 0,4537 | -0,0036 | ||

| RVPO STATE STREET GLOBAL MARKE USD RVPO FICC SSGM / RA (000000000) | 4,70 | 0,4502 | 0,4502 | |||

| ZAG000125980 / Republic of South Africa Government Bond | 4,64 | 8,31 | 0,4445 | 0,0466 | ||

| US55284AAC27 / MF1 Ltd., Series 2021-FL7, Class AS | 4,58 | 0,86 | 0,4390 | 0,0170 | ||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2024 RPL4 A1A 144A / ABS-MBS (US16160NAB73) | 4,56 | -2,21 | 0,4369 | 0,0037 | ||

| US17307GWU83 / CITIGROUP MORTGAGE LOAN TRUST INC SER 2005-HE3 CL M4 V/R REGD 2.91838000 | 4,54 | 0,02 | 0,4346 | 0,0134 | ||

| US55284AAE82 / MF1 MULTIFAMILY HOUSING MORTGA MF1 2021 FL7 B 144A | 4,49 | 0,18 | 0,4296 | 0,0138 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 4,46 | 8,58 | 0,4268 | 0,0457 | ||

| FREDDIE MAC FHR 5513 MF / ABS-MBS (US3137HKEX87) | 4,33 | -5,17 | 0,4150 | -0,0093 | ||

| FREDDIE MAC FHR 5473 FA / ABS-MBS (US3137HHFU01) | 4,32 | -3,98 | 0,4134 | -0,0040 | ||

| MERRION SQUARE RESIDENTIAL MERRI 2024 1A A 144A / ABS-MBS (XS2844411921) | 4,27 | 5,25 | 0,4094 | 0,0323 | ||

| 5831 / Shizuoka Financial Group,Inc. | 4,21 | 0,4033 | 0,4033 | |||

| US81879MAV19 / SG MORTGAGE SECURITIES TRUST SGMS 2006 FRE1 A2B | 4,18 | 0,31 | 0,4005 | 0,0134 | ||

| CROSS MORTGAGE TRUST CROSS 2024 H6 A1 144A / ABS-MBS (US227919AA56) | 4,00 | -6,78 | 0,3833 | -0,0153 | ||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 3,95 | 1,08 | 0,3781 | 0,0155 | ||

| CARMAX AUTO OWNER TRUST CARMX 2024 3 A3 / ABS-O (US14319GAD34) | 3,94 | 0,05 | 0,3776 | 0,0117 | ||

| US38141GZS64 / GOLDMAN SACHS GROUP INC SR UNSECURED 03/28 VAR | 3,87 | -0,18 | 0,3710 | 0,0107 | ||

| XS2683120211 / Avon Finance No.4 PLC | 3,87 | 0,94 | 0,3706 | 0,0146 | ||

| FNMA POOL BZ2582 FN 12/29 FIXED 4.3 / ABS-MBS (US3140NW2Q77) | 3,84 | 1,03 | 0,3675 | 0,0148 | ||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 3,80 | 0,82 | 0,3637 | 0,0139 | ||

| US813765AC80 / SECURITIZED ASSET BACKED RECEI SABR 2006 FR3 A3 | 3,77 | -1,80 | 0,3614 | 0,0046 | ||

| FANNIE MAE FNR 2024 77 FM / ABS-MBS (US3136BTRF25) | 3,73 | -13,32 | 0,3572 | -0,0423 | ||

| US48251JAN37 / KKR FINANCIAL CLO LTD KKR 18 BR 144A | 3,71 | 0,16 | 0,3555 | 0,0114 | ||

| 01626P148 / Alimentation Couche-Tard Inc | 3,62 | 0,3464 | 0,3464 | |||

| US3622M8AE61 / GSAMP TRUST GSAMP 2006 HE8 A2D | 3,61 | 0,58 | 0,3461 | 0,0125 | ||

| SBNA AUTO LEASE TRUST SBALT 2024 A A3 144A / ABS-O (US78414SAE46) | 3,44 | -23,69 | 0,3299 | -0,0892 | ||

| US12667AAD81 / COUNTRYWIDE ASSET BACKED CERTI CWL 2006 12 2A3 | 3,38 | -3,89 | 0,3240 | -0,0028 | ||

| US52524YAC75 / Lehman XS Trust Series 2007-12N | 3,37 | -2,72 | 0,3225 | 0,0012 | ||

| CBAMR LTD CBAMR 2019 9A AR 144A / ABS-CBDO (US14987VAN91) | 3,31 | 0,12 | 0,3170 | 0,0101 | ||

| US912810RR14 / United States Treasury Inflation Indexed Bonds | 3,28 | -2,99 | 0,3138 | 0,0002 | ||

| XS2357554679 / SEGOVIA EUROPEAN CLO 6 2019 SEGOV 2019 6A AR 144A | 3,26 | 8,95 | 0,3127 | 0,0345 | ||

| US85855CAB63 / Stellantis Finance US Inc | 3,21 | 1,39 | 0,3078 | 0,0135 | ||

| US70069FEM59 / PARK PLACE SECURITIES INC PPSI 2004 WHQ2 M5 | 3,08 | 0,33 | 0,2952 | 0,0100 | ||

| US004421UU52 / ACE SECURITIES CORP. ACE 2006 NC1 M1 | 3,08 | -4,74 | 0,2947 | -0,0052 | ||

| FNMA POOL BS9669 FN 10/28 FIXED 4.72 / ABS-MBS (US3140LLW723) | 3,06 | 0,30 | 0,2927 | 0,0098 | ||

| MADISON PARK FUNDING LTD MDPK 2021 39A AR 144A / ABS-CBDO (US55821LAJ35) | 3,00 | 0,07 | 0,2878 | 0,0090 | ||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 3,00 | 0,00 | 0,2874 | 0,0087 | ||

| TOWD POINT MORTGAGE FUNDING TPMF 2024 GR6A A1 144A / ABS-MBS (XS2799791848) | 2,98 | -0,53 | 0,2851 | 0,0073 | ||

| RFRF USD SF+26.161/1.0* 9/15/23-7Y* CME / DIR (EZCYB7578GQ7) | 2,97 | -11,84 | 0,2845 | -0,0283 | ||

| RELX INC 07/25 ZCP / DBT (US75955FU358) | 2,97 | 0,2844 | 0,2844 | |||

| E1SE34 / Eversource Energy - Depositary Receipt (Common Stock) | 2,95 | 1,20 | 0,2823 | 0,0119 | ||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q034 APT2 / ABS-MBS (US3137HLY301) | 2,91 | 0,2786 | 0,2786 | |||

| VOLKSWAGEN AUTO LEASE TRUST VWALT 2024 A A2A / ABS-O (US92866EAB56) | 2,85 | -26,56 | 0,2732 | -0,0873 | ||

| CARMAX AUTO OWNER TRUST CARMX 2024 3 A2A / ABS-O (US14319GAB77) | 2,81 | -26,91 | 0,2693 | -0,0879 | ||

| ARES CLO LTD ARES 2015 2A AR3 144A / ABS-CBDO (US04015GAX79) | 2,81 | 0,18 | 0,2691 | 0,0087 | ||

| RFR USD SOFR/3.00000 06/21/23-10Y CME / DIR (EZVCRM3XZB08) | 2,78 | -37,97 | 0,2667 | -0,1501 | ||

| US669971AA13 / NovaStar Mortgage Funding Trust, Series 2007-1, Class A1A | 2,76 | -1,22 | 0,2643 | 0,0049 | ||

| MX0SGO0000M6 / Mexican Udibonos | 2,71 | 12,00 | 0,2593 | 0,0349 | ||

| US36361UAQ31 / GALLATIN LOAN MANAGEMENT, LLC GALL 2017 1A B1R 144A | 2,71 | -0,07 | 0,2592 | 0,0078 | ||

| US70069FLK11 / PARK PLACE SECURITIES INC PPSI 2005 WCW2 M4 | 2,70 | 4,12 | 0,2590 | 0,0178 | ||

| NAVESINK CLO, LIMITED NAVS 2024 2A A1 144A / ABS-CBDO (US63942YAA29) | 2,70 | 0,15 | 0,2588 | 0,0083 | ||

| US55379AAC80 / M360 2021-CRE3 Ltd | 2,66 | -0,04 | 0,2543 | 0,0076 | ||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 2,65 | 0,45 | 0,2539 | 0,0088 | ||

| RFR USD SOFR/3.50000 12/18/24-30Y CME / DIR (EZ4089K4KC85) | 2,58 | 39,15 | 0,2469 | 0,0748 | ||

| US12598JAC53 / CSMC 2021-RPL7 Trust | 2,54 | -3,45 | 0,2437 | -0,0010 | ||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FU836) | 2,53 | 0,2421 | 0,2421 | |||

| US3140XH5X18 / UMBS, 30 Year | 2,52 | -2,78 | 0,2414 | 0,0007 | ||

| US02582JJZ49 / American Express Credit Account Master Trust 2023-1 | 2,51 | -0,04 | 0,2408 | 0,0072 | ||

| US05522RDG02 / BA Credit Card Trust | 2,51 | -0,04 | 0,2406 | 0,0073 | ||

| US67113DBA19 / OZLM LTD OZLM 2019 24A A1CR 144A | 2,50 | 0,04 | 0,2399 | 0,0074 | ||

| FNMA POOL BZ1029 FN 06/29 FIXED 4.93 / ABS-MBS (US3140NVEB95) | 2,46 | 0,29 | 0,2358 | 0,0078 | ||

| XS2390844780 / Black Diamond CLO 2019-1 DAC | 2,43 | -1,18 | 0,2332 | 0,0044 | ||

| JACKSON NATL LIFE GLOBAL JACKSON NATL LIFE GLOBAL / DBT (US46849LUZ20) | 2,42 | -0,08 | 0,2319 | 0,0069 | ||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2024 RPL2 A1A 144A / ABS-MBS (US161930AB85) | 2,38 | -1,86 | 0,2279 | 0,0028 | ||

| ERAUSLT TRS EQUITY SOFR+25 JPM / DE (000000000) | 2,34 | 0,2244 | 0,2244 | |||

| HYUNDAI AUTO RECEIVABLES TRUST HART 2024 A A3 / ABS-O (US448973AD90) | 2,32 | -0,04 | 0,2224 | 0,0067 | ||

| PEP01000C5I0 / BONOS DE TESORERIA | 2,28 | 7,15 | 0,2183 | 0,0208 | ||

| US93362YAA01 / WAMU MORTGAGE PASS THROUGH CER WAMU 2006 AR5 A1A | 2,26 | -1,18 | 0,2168 | 0,0041 | ||

| US05377RHL15 / Avis Budget Rental Car Funding AESOP LLC | 2,26 | 0,18 | 0,2167 | 0,0070 | ||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2019 15A A1R 144A / ABS-CBDO (US04942MAN48) | 2,25 | -13,05 | 0,2157 | -0,0248 | ||

| BAIN CAPITAL CREDIT CLO, LIMIT BCC 2021 4A BR 144A / ABS-CBDO (US05685AAU25) | 2,21 | 0,27 | 0,2116 | 0,0070 | ||

| BAIN CAPITAL CREDIT CLO, LIMIT BCC 2021 4A A2R 144A / ABS-CBDO (US05685AAS78) | 2,20 | 0,00 | 0,2109 | 0,0065 | ||

| ERAUSLT TRS EQUITY FEDL01+70 JPM / DE (000000000) | 2,19 | 0,2101 | 0,2101 | |||

| VCAT ASSET SECURITIZATION, LLC VCAT 2025 NPL2 A1 144A / ABS-MBS (US92243PAA66) | 2,12 | -8,48 | 0,2027 | -0,0120 | ||

| XS2418762923 / Madison Park Euro Funding XIV DAC | 2,11 | 8,26 | 0,2020 | 0,0211 | ||

| BACARDI MARTINI B V / DBT (US05634EUA80) | 2,07 | 0,1980 | 0,1980 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797NX17) | 2,04 | 0,1950 | 0,1950 | |||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 2,03 | 1,30 | 0,1940 | 0,0083 | ||

| ERAUSLT TRS EQUITY SOFR+18 JPM / DE (000000000) | 2,01 | 0,1921 | 0,1921 | |||

| OCEAN TRAILS CLO OCTR 2020 10A BR2 144A / ABS-CBDO (US67516CAY57) | 2,01 | 0,20 | 0,1921 | 0,0062 | ||

| DE000DL19VP0 / DEUTSCHE BANK AG SR UNSECURED REGS 09/26 VAR | 2,00 | 9,48 | 0,1915 | 0,0219 | ||

| US12669QAA76 / COUNTRYWIDE ASSET BACKED CERTI CWL 2007 BC2 1A | 1,96 | -1,16 | 0,1882 | 0,0036 | ||

| US3140JANZ71 / FNMA POOL BM5807 FN 04/48 FIXED VAR | 1,96 | -1,90 | 0,1881 | 0,0023 | ||

| RFR USD SOFR/2.75000 06/21/23-30Y CME / DIR (EZM2L9TGLT92) | 1,94 | 0,89 | 0,1854 | 0,0072 | ||

| US76112BRR32 / RESIDENTIAL ASSET MORTGAGE PRO RAMP 2005 EFC1 M6 | 1,93 | -0,67 | 0,1850 | 0,0045 | ||

| US17309TAC27 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2006 NC2 A2B | 1,90 | -0,42 | 0,1822 | 0,0048 | ||

| US12667GAW33 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 10CB 1A1 | 1,89 | -3,03 | 0,1808 | 0,0000 | ||

| US054561AJ49 / AXA EQUITABLE HOLDINGS I SR UNSECURED 04/28 4.35 | 1,87 | 0,70 | 0,1787 | 0,0066 | ||

| WOODWARD CAPITAL MANAGEMENT RCKT 2024 CES7 A1A 144A / ABS-MBS (US749414AA67) | 1,86 | -6,99 | 0,1786 | -0,0075 | ||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2023 RPL3 A1 144A / ABS-MBS (US161927AC22) | 1,82 | -2,15 | 0,1742 | 0,0017 | ||

| US925650AB99 / VICI Properties LP | 1,81 | 0,50 | 0,1734 | 0,0062 | ||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2024 6 A11 144A / ABS-MBS (US161931AP54) | 1,81 | -15,05 | 0,1730 | -0,0244 | ||

| US780097BG51 / NatWest Group PLC | 1,80 | 0,84 | 0,1726 | 0,0066 | ||

| US55275NAE13 / MARM 2006-0A2 2A1 | 1,79 | 7,31 | 0,1715 | 0,0166 | ||

| INVESCO EURO CLO INVSC 3A AR / ABS-CBDO (XS2867986593) | 1,76 | 8,83 | 0,1689 | 0,0185 | ||

| FNMA POOL BZ2331 FN 08/30 FIXED 4.86 / ABS-MBS (US3140NWSV86) | 1,75 | 0,52 | 0,1676 | 0,0059 | ||

| CDX ITRAXX XOV42 5Y 35-100% SP BPS / DCR (EZ2BLZ4YH9B3) | 1,73 | 0,1658 | 0,1658 | |||

| US06738ECE32 / Barclays PLC | 1,70 | 1,67 | 0,1631 | 0,0076 | ||

| US02150MAA36 / Alternative Loan Trust 2007-13 | 1,65 | -2,08 | 0,1577 | 0,0016 | ||

| US65541JAC18 / NOMURA RESECURITIZATION TRUST NMRR 2018 1R 3A1 144A | 1,62 | -1,75 | 0,1556 | 0,0021 | ||

| US36267FAE88 / GLS AUTO SELECT RECEIVABLES TR GSAR 2023 1A A3 144A | 1,62 | -0,37 | 0,1547 | 0,0041 | ||

| CPPIB CAPITAL INC COMPANY GUAR REGS 06/34 4.3 / DBT (CA12593CAY71) | 1,61 | 4,08 | 0,1541 | 0,0105 | ||

| GM FINANCIAL CONSUMER AUTOMOBI GMCAR 2024 1 A3 / ABS-O (US36268GAD79) | 1,61 | -0,06 | 0,1541 | 0,0046 | ||

| IRS EUR 2.25000 09/17/25-30Y LCH / DIR (EZV4L1QCFM97) | 1,60 | 50,33 | 0,1536 | 0,0545 | ||

| ZAG000077470 / Republic of South Africa Government Bond | 1,60 | 7,31 | 0,1533 | 0,0148 | ||

| US86364KAE47 / STRUCTURED ASSET MORTGAGE INVE SAMI 2007 AR7 2A1 | 1,60 | 1,14 | 0,1532 | 0,0064 | ||

| US44963BAD01 / IHO Verwaltungs GmbH | 1,57 | 3,57 | 0,1500 | 0,0096 | ||

| US31418CYL26 / Federal National Mortgage Association | 1,56 | -2,32 | 0,1496 | 0,0011 | ||

| FED HM LN PC POOL RJ0049 FR 10/53 FIXED 5 / ABS-MBS (US3142GQBT84) | 1,55 | -2,02 | 0,1486 | 0,0016 | ||

| US92925CBA99 / WaMu Mortgage Pass-Through Certificates Series 2005-AR19 Trust | 1,54 | -4,75 | 0,1479 | -0,0026 | ||

| SAGB / Republic of South Africa Government Bond | 1,53 | 6,31 | 0,1468 | 0,0129 | ||

| FNMA POOL BS9613 FN 10/28 FIXED 4.77 / ABS-MBS (US3140LLVF52) | 1,53 | 0,33 | 0,1466 | 0,0049 | ||

| US03512TAF84 / AngloGold Ashanti Holdings PLC | 1,53 | 1,19 | 0,1464 | 0,0061 | ||

| US31418CU779 / FANNIE MAE 3.50% 03/01/2048 FNMA | 1,52 | -2,13 | 0,1456 | 0,0014 | ||

| US14686TAD00 / Carvana Auto Receivables Trust, Series 2023-P2, Class A4 | 1,52 | -0,20 | 0,1455 | 0,0041 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 1,52 | 0,33 | 0,1452 | 0,0050 | ||

| US67113DBC74 / OZLM LTD OZLM 2019 24A A2AR 144A | 1,51 | 0,20 | 0,1442 | 0,0047 | ||

| US55275NAA90 / MASTR Adjustable Rate Mortgages Trust 2006-OA2 | 1,50 | 0,20 | 0,1435 | 0,0046 | ||

| US912810RL44 / United States Treasury Inflation Indexed Bonds | 1,49 | -2,80 | 0,1430 | 0,0003 | ||

| RFRF USD SF+26.161/0.9* 8/15/23-13Y* CME / DIR (EZ1HCDTY5BQ6) | 1,47 | -3,85 | 0,1413 | -0,0012 | ||

| US75575RAA59 / Ready Capital Mortgage Financing 2023-FL11 LLC | 1,45 | -28,15 | 0,1390 | -0,0484 | ||

| US05951KBD46 / BANC OF AMERICA FUNDING CORPOR BAFC 2006 7 T2A7 | 1,39 | -1,42 | 0,1329 | 0,0022 | ||

| US64830NAA90 / New Residential Mortgage Loan Trust 2019-RPL3 | 1,37 | -5,31 | 0,1317 | -0,0031 | ||

| US91282CEZ05 / U.S. Treasury Inflation Linked Notes | 1,34 | 0,90 | 0,1283 | 0,0050 | ||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 1,34 | 0,53 | 0,1282 | 0,0046 | ||

| TRINITY SQUARE TRINI 2021 1A AR 144A / ABS-MBS (XS2783078087) | 1,33 | 0,61 | 0,1274 | 0,0047 | ||

| FNMA POOL BS9073 FN 07/30 FIXED 4.54 / ABS-MBS (US3140LLCK58) | 1,32 | 0,61 | 0,1261 | 0,0047 | ||

| US94984UAE64 / WELLS FARGO ALTERNATIVE LOAN T WFALT 2007 PA4 2A1 | 1,31 | -0,61 | 0,1256 | 0,0032 | ||

| US44933XAD93 / Hyundai Auto Receivables Trust, Series 2023-B, Class A3 | 1,31 | -13,56 | 0,1253 | -0,0152 | ||

| US04542BHM72 / ASSET BACKED FUNDING CERTIFICA ABFC 2004 FF1 M1 | 1,30 | -3,12 | 0,1248 | -0,0000 | ||

| US3140GUMA21 / Federal National Mortgage Association | 1,29 | -1,45 | 0,1237 | 0,0020 | ||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVF74) | 1,28 | 0,1228 | 0,1228 | |||

| US80287DAC11 / SDART 23-6 A3 5.93% 07-17-28/07-15-26 | 1,27 | -9,58 | 0,1221 | -0,0088 | ||

| US36267KAD90 / GM Financial Consumer Automobile Receivables Trust, Series 2023-3, Class A3 | 1,27 | -10,35 | 0,1212 | -0,0099 | ||

| US83406TAB89 / SoFi Professional Loan Program 2020-ATrust | 1,25 | -7,32 | 0,1201 | -0,0054 | ||

| XS2167007918 / WELLS FARGO and CO NEW 1.741%/VAR 05/04/2030 REGS | 1,24 | 10,70 | 0,1190 | 0,0147 | ||

| US3622MHAC03 / GSAMP TRUST GSAMP 2007 FM2 A2B | 1,23 | -0,24 | 0,1183 | 0,0033 | ||

| US00075WAD11 / ASSET BACKED FUNDING CERTIFICA ABFC 2006 HE1 A2D | 1,23 | -1,91 | 0,1178 | 0,0013 | ||

| TRT061124T11 / Turkey Government Bond | 1,22 | -2,25 | 0,1164 | 0,0009 | ||

| PANAMA INFRASTRUCTURE SR SECURED 144A 04/32 0.00000 / DBT (US69828QAD97) | 1,21 | 0,92 | 0,1159 | 0,0045 | ||

| US31418CSG05 / Fannie Mae Pool | 1,21 | -4,52 | 0,1155 | -0,0017 | ||

| AGL CLO 5 LTD AGL 2020 5A BRR 144A / ABS-CBDO (US00119TAV61) | 1,20 | 0,17 | 0,1152 | 0,0037 | ||

| US02007WAC29 / Ally Auto Receivables Trust, Series 2023-1, Class A3 | 1,20 | -14,81 | 0,1152 | -0,0158 | ||

| REPUBLIC OF PANAMA EUR TERM LOAN 2 / LON (BA000HCH9) | 1,18 | 9,44 | 0,1134 | 0,0129 | ||

| MX0SGO0000K0 / Mexican Udibonos | 1,16 | 11,69 | 0,1108 | 0,0146 | ||

| 01626P148 / Alimentation Couche-Tard Inc | 1,15 | 0,1101 | 0,1101 | |||

| US3140GVZY43 / Fannie Mae Pool | 1,15 | -1,46 | 0,1098 | 0,0018 | ||

| US61753EAP51 / MORGAN STANLEY CAPITAL INC MSAC 2007 HE2 A1 144A | 1,14 | -0,17 | 0,1097 | 0,0032 | ||

| US86359YAD31 / STRUCTURED ASSET SECURITIES CO SASC 2006 BC1 A2 | 1,14 | -1,81 | 0,1095 | 0,0014 | ||

| XS2307740642 / JUBILEE CDO BV JUBIL 2016 17A A2RR 144A | 1,14 | 8,48 | 0,1092 | 0,0116 | ||

| US23246BAK70 / Countrywide Asset-Backed Certificates | 1,13 | -2,67 | 0,1083 | 0,0004 | ||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1,11 | 0,09 | 0,1064 | 0,0033 | ||

| US 10YR NOTE (CBT)SEP25 XCBT 20250919 / DIR (000000000) | 1,11 | 0,1059 | 0,1059 | |||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 1,10 | 0,1054 | 0,1054 | |||

| MX0MGO0001F1 / Mexican Bonos | 1,10 | -3,52 | 0,1050 | -0,0005 | ||

| US52475XAA28 / Legacy Mortgage Asset Trust 2021-GS5 | 1,08 | -2,95 | 0,1039 | 0,0001 | ||

| US863579YR37 / STRUCTURED ADJUSTABLE RATE MORTGAGE LOAN TRUST SER SARM 2005-19XS 1A1 | 1,07 | -1,02 | 0,1025 | 0,0022 | ||

| US61753KAD81 / Morgan Stanley ABS Capital I Inc Trust 2007-HE5 | 1,07 | -0,74 | 0,1021 | 0,0024 | ||

| US05592XAD21 / BMW Vehicle Owner Trust, Series 2023-A, Class A3 | 1,06 | -20,38 | 0,1015 | -0,0220 | ||

| TRT061124T11 / Turkey Government Bond | 1,06 | -2,67 | 0,1012 | 0,0004 | ||

| R2037 / South Africa - Sovereign or Government Agency Debt | 1,05 | 8,39 | 0,1003 | 0,0106 | ||

| US00191TAG04 / APS RESECURITIZATION TRUST APS 2015 1 2M 144A | 1,04 | -7,06 | 0,0996 | -0,0043 | ||

| MX0MGO000102 / Mexican Bonos | 1,03 | -25,29 | 0,0988 | -0,0294 | ||

| 01626P148 / Alimentation Couche-Tard Inc | 1,03 | 0,0985 | 0,0985 | |||

| CDX ITRAXX XOV42 5Y 35-100% SP BOA / DCR (EZ2BLZ4YH9B3) | 1,03 | 0,0982 | 0,0982 | |||

| US86358BAT98 / STRUCTURED ASSET SECURITIES CO SASC 2007 WF1 A6 | 1,02 | -5,89 | 0,0980 | -0,0029 | ||

| STRATTON MORTGAGE FUNDING PLC STRA 2024 1A A 144A / ABS-MBS (XS2728570248) | 1,02 | 0,20 | 0,0977 | 0,0032 | ||

| US25466AAP66 / Discover Bank | 1,01 | 1,40 | 0,0969 | 0,0043 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 1,01 | 0,30 | 0,0964 | 0,0032 | ||

| US31418CS476 / Fannie Mae Pool | 1,00 | -1,76 | 0,0963 | 0,0013 | ||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1,00 | 1,01 | 0,0960 | 0,0039 | ||

| US71429MAC91 / Perrigo Finance Unlimited Co | 0,98 | 2,82 | 0,0942 | 0,0055 | ||

| US12667GN580 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 27 2A3 | 0,98 | -4,56 | 0,0942 | -0,0015 | ||

| US437084EW27 / HOME EQUITY ASSET TRUST HEAT 2004 6 M4 | 0,96 | -2,34 | 0,0920 | 0,0007 | ||

| CARMAX AUTO OWNER TRUST CARMX 2024 1 A2A / ABS-O (US14318WAB37) | 0,95 | -44,75 | 0,0908 | -0,0684 | ||

| XS1794675931 / Fairfax Financial Holdings Ltd | 0,94 | 10,11 | 0,0898 | 0,0107 | ||

| RFR USD SOFR/1.75000 06/15/22-10Y CME / DIR (EZQ6DKJXZ1C9) | 0,93 | -25,20 | 0,0893 | -0,0264 | ||

| US23242FAA49 / COUNTRYWIDE ASSET BACKED CERTI CWL 2006 16 1A | 0,93 | -0,54 | 0,0888 | 0,0023 | ||

| FNMA POOL BZ0976 FN 05/29 FIXED 4.85 / ABS-MBS (US3140NVCN51) | 0,92 | 0,22 | 0,0882 | 0,0030 | ||

| ERAUSLT TRS EQUITY FEDL01+49 MYI / DE (000000000) | 0,92 | 0,0881 | 0,0881 | |||

| US55336VBQ23 / MPLX LP | 0,91 | 1,69 | 0,0867 | 0,0040 | ||

| R2032 / South Africa - Corporate Bond/Note | 0,90 | 7,57 | 0,0858 | 0,0084 | ||

| FREDDIE MAC FHR 5549 BF / ABS-MBS (US3137HLS527) | 0,89 | 0,0853 | 0,0853 | |||

| US251510LD38 / Deutsche Alt-A Securities Inc Mortgage Loan Trust Series 2006-AR1 | 0,88 | -2,00 | 0,0847 | 0,0009 | ||

| US87264ACQ67 / T-Mobile USA Inc | 0,88 | 1,85 | 0,0845 | 0,0041 | ||

| US694308JM04 / PACIFIC GAS and ELECTRIC CO 4.55% 07/01/2030 | 0,88 | 0,80 | 0,0842 | 0,0033 | ||

| CZECH / Czech Republic Government Bond | 0,87 | 9,87 | 0,0832 | 0,0098 | ||

| US74143FAA75 / PRET_21-RN2 | 0,87 | -8,27 | 0,0829 | -0,0047 | ||

| US912810SB52 / United States Treasury Inflation Indexed Bonds | 0,84 | -3,34 | 0,0804 | -0,0002 | ||

| US126670TW86 / COUNTRYWIDE ASSET BACKED CERTI CWL 2006 1 MV1 | 0,84 | -4,23 | 0,0802 | -0,0010 | ||

| US3128MMWV14 / Freddie Mac Gold Pool | 0,82 | -5,07 | 0,0788 | -0,0017 | ||

| HYUNDAI AUTO RECEIVABLES TRUST HART 2024 A A2A / ABS-O (US448973AB35) | 0,82 | -35,61 | 0,0786 | -0,0398 | ||

| EXTRA SPACE STORAGE LP COMPANY GUAR 06/35 5.4 / DBT (US30225VAU17) | 0,80 | 1,13 | 0,0771 | 0,0032 | ||

| US42806MBS70 / Hertz Vehicle Financing III LLC | 0,80 | -0,12 | 0,0770 | 0,0023 | ||

| HPS CORPORATE LENDING FU SR UNSECURED 04/32 5.95 / DBT (US40440VAK17) | 0,80 | 0,0763 | 0,0763 | |||

| US61752UAB17 / MORGAN STANLEY HOME EQUITY LOA MSHEL 2007 2 A2 | 0,79 | -1,00 | 0,0756 | 0,0016 | ||

| US05552CAA27 / BINOM Securitization Trust 2022-RPL1 | 0,78 | -1,76 | 0,0750 | 0,0010 | ||

| US92927XAE40 / WAMU MORTGAGE PASS THROUGH CER WAMU 2007 HY6 2A3 | 0,78 | -2,01 | 0,0748 | 0,0009 | ||

| BRSTNCLTN7Z6 / BRAZIL LTN BRL 0.0% 07-01-25 | 0,77 | -91,04 | 0,0740 | -0,7264 | ||

| US16412XAJ46 / Cheniere Corpus Christi Holdings LLC | 0,77 | 0,92 | 0,0739 | 0,0030 | ||

| US00774MAW55 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0,76 | 1,46 | 0,0730 | 0,0032 | ||

| US694308JW85 / Pacific Gas and Electric Co | 0,76 | 0,93 | 0,0728 | 0,0029 | ||

| AMERICREDIT AUTOMOBILE RECEIVA AMCAR 2024 1 A2A / ABS-O (US023947AB05) | 0,76 | -36,61 | 0,0724 | -0,0382 | ||

| XS1736667723 / OAK HILL EUROPEAN CREDIT PARTN OHECP 2015 4A A1RE 144A | 0,75 | -10,44 | 0,0715 | -0,0059 | ||

| US3128MJ2X72 / Freddie Mac Gold Pool | 0,74 | -2,23 | 0,0713 | 0,0006 | ||

| US912810RA88 / United States Treasury Inflation Indexed Bonds | 0,74 | -2,37 | 0,0711 | 0,0005 | ||

| WOODWARD CAPITAL MANAGEMENT RCKT 2024 CES4 A1A 144A / ABS-MBS (US74939FAA57) | 0,73 | -8,15 | 0,0702 | -0,0039 | ||

| FCT / Fincantieri S.p.A. | 0,73 | 1,95 | 0,0701 | 0,0034 | ||

| US00774MAX39 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0,73 | 2,26 | 0,0695 | 0,0036 | ||

| US41161PLD32 / HarborView Mortgage Loan Trust 2005-1 | 0,72 | -5,03 | 0,0688 | -0,0014 | ||

| US3128M6YJ19 / Freddie Mac Gold Pool | 0,71 | -2,87 | 0,0682 | 0,0001 | ||

| US35104AAB44 / FOURSIGHT CAPITAL AUTOMOBILE RECEIVABLES TRUST 202 FCRT 2023-2 A2 | 0,71 | -26,58 | 0,0681 | -0,0218 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 0,70 | 0,00 | 0,0674 | 0,0021 | ||

| PROLOGIS LP SR UNSECURED 01/35 5 / DBT (US74340XCN93) | 0,70 | 0,72 | 0,0671 | 0,0025 | ||

| BOUGHT PEN SOLD USD 20250730 / DFE (000000000) | 0,69 | 0,0656 | 0,0656 | |||

| US3622MGAA63 / GSAMP Trust | 0,68 | 3,98 | 0,0652 | 0,0044 | ||

| XS2326513269 / HARVEST CLO HARVT 21A A2R 144A | 0,68 | 1,95 | 0,0651 | 0,0031 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2020 12A A1 144A / ABS-CBDO (US03332DAA28) | 0,67 | -0,30 | 0,0643 | 0,0018 | ||

| US715638BE14 / Peruvian Government International Bond | 0,66 | -15,54 | 0,0635 | -0,0095 | ||

| CDX ITRAXX XOV42 5Y 35-100% SP GST / DCR (EZ2BLZ4YH9B3) | 0,66 | 0,0634 | 0,0634 | |||

| US842400FZ13 / Southern California Edison Co. Bond 4.65% Due 10/1/2043 | 0,65 | -3,43 | 0,0620 | -0,0002 | ||

| IRS AUD 4.50000 09/20/23-10Y LCH / DIR (EZGXS4F4YYN6) | 0,63 | 100,32 | 0,0607 | 0,0313 | ||

| US96041AAC09 / WESTLAKE AUTOMOBILE RECEIVABLES TRUST 2023-4 SER 2023-4A CL A2 REGD 144A P/P 6.23000000 | 0,63 | -62,08 | 0,0602 | -0,0936 | ||

| US61753NAA81 / MORGAN STANLEY CAPITAL INC MSAC 2007 NC2 A1 144A | 0,62 | -0,32 | 0,0597 | 0,0016 | ||

| US14686TAC27 / CARVANA AUTO RECEIVABLES TRUST CRVNA 2023 P2 A3 144A | 0,62 | -22,43 | 0,0593 | -0,0148 | ||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0,61 | 0,00 | 0,0587 | 0,0018 | ||

| CITIZENS AUTO RECEIVABLES TRUS CITZN 2024 1 A3 144A / ABS-O (US17331QAD88) | 0,60 | -0,17 | 0,0578 | 0,0017 | ||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,60 | 1,18 | 0,0576 | 0,0024 | ||

| FNMA POOL BS9220 FN 08/30 FIXED 4.72 / ABS-MBS (US3140LLG627) | 0,60 | 0,17 | 0,0573 | 0,0018 | ||

| US93934NAF24 / WASHINGTON MUTUAL MORTGAGE PAS WMALT 2006 5 1A6 | 0,59 | -0,17 | 0,0565 | 0,0016 | ||

| US87264ABV61 / T-Mobile USA Inc | 0,58 | 1,23 | 0,0553 | 0,0024 | ||

| US07388HAP47 / Bear Stearns Asset-Backed Securities I Trust, Series 2006-HE7, Class 2A2 | 0,56 | -3,45 | 0,0537 | -0,0002 | ||

| US751152AB50 / RALI 2006 QA7 2A1 | 0,56 | -3,63 | 0,0534 | -0,0003 | ||

| US040104FW65 / Argent Securities, Inc. Asset-Backed Pass-Through Certificates, Series 2004-W3, Class A3 | 0,55 | -0,36 | 0,0531 | 0,0015 | ||

| CAPE LOOKOUT RE LTD UNSECURED 144A 03/32 VAR / DBT (US13947LAG77) | 0,55 | 0,36 | 0,0529 | 0,0018 | ||

| GM FINANCIAL CONSUMER AUTOMOBI GMCAR 2024 1 A2A / ABS-O (US36268GAB14) | 0,55 | -52,60 | 0,0525 | -0,0549 | ||

| US LONG BOND(CBT) SEP25 XCBT 20250919 / DIR (000000000) | 0,54 | 0,0522 | 0,0522 | |||

| CHASE AUTO OWNER TRUST CHAOT 2024 1A A2 144A / ABS-O (US16144BAB45) | 0,54 | -54,68 | 0,0520 | -0,0591 | ||

| US84751PKW85 / SPECIALTY UNDERWRITING + RESID SURF 2006 AB1 A4 | 0,53 | -1,66 | 0,0512 | 0,0007 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,53 | 0,0510 | 0,0510 | |||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0,52 | 0,78 | 0,0498 | 0,0019 | ||

| US03065UAB52 / Americredit Automobile Receivables Trust 2023-2 | 0,52 | -58,31 | 0,0497 | -0,0659 | ||

| RFR USD SOFR/3.50000 06/20/24-30Y CME / DIR (EZV8ZC6L7CY8) | 0,52 | 15,40 | 0,0496 | 0,0079 | ||

| US073879R596 / BEAR STEARNS ASSET BACKED SECU BSABS 2005 HE9 M2 | 0,52 | -6,70 | 0,0493 | -0,0019 | ||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0,51 | 0,80 | 0,0486 | 0,0018 | ||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,51 | 0,0484 | 0,0484 | |||

| URSA RE LTD UNSECURED 144A 02/28 VAR / DBT (US90323WAR16) | 0,50 | -0,59 | 0,0482 | 0,0012 | ||

| FANNIE MAE FNR 2025 54 FM / ABS-MBS (US3136BWNW23) | 0,50 | 0,0479 | 0,0479 | |||

| FREDDIE MAC FHR 5557 FM / ABS-MBS (US3137HLZ217) | 0,50 | 0,0479 | 0,0479 | |||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2015 1A ARV 144A / ABS-CBDO (US033296AG97) | 0,47 | -0,63 | 0,0453 | 0,0011 | ||

| RFR USD SOFR/3.70000 02/20/24-25Y LCH / DIR (EZRM7DK4X894) | 0,47 | 54,93 | 0,0452 | 0,0169 | ||

| US12668BBN29 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 81 A1 | 0,47 | -3,50 | 0,0449 | -0,0003 | ||

| US07820QBL86 / BELLA VISTA MORTGAGE TRUST BVMBS 2005 1 1A1 | 0,46 | -9,55 | 0,0445 | -0,0032 | ||

| US38122NB769 / GOLDEN ST TOBACCO SECURITIZATI GLDGEN 06/46 FIXED 3 | 0,44 | -12,72 | 0,0421 | -0,0047 | ||

| ERAUSLT TRS EQUITY FEDL01+79 MYI / DE (000000000) | 0,43 | 0,0413 | 0,0413 | |||

| CDX HY44 5Y ICE / DCR (000000000) | 0,43 | 0,0412 | 0,0412 | |||

| US83207DAB47 / SMB 23-C A1B 144A (SOFR30A+155) FRN 11-15-52/10-17-33 | 0,43 | -5,75 | 0,0408 | -0,0012 | ||

| 317U7IQA6 PIMCO SWAPTION 3.75 CALL USD 2025103 / DIR (000000000) | 0,42 | 0,0398 | 0,0398 | |||

| FCT / Fincantieri S.p.A. | 0,41 | 0,0389 | 0,0389 | |||

| HYUNDAI CAPITAL AMERICA HYUNDAI CAPITAL AMERICA / DBT (US44891ADA25) | 0,40 | 0,00 | 0,0386 | 0,0012 | ||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,40 | 0,50 | 0,0386 | 0,0013 | ||

| MX0SGO0000F0 / Mexican Udibonos | 0,40 | 11,39 | 0,0385 | 0,0050 | ||

| UNITED AIR 2024 1 AA PTT PASS THRU CE 08/38 5.45 / DBT (US90932WAA18) | 0,40 | 0,00 | 0,0385 | 0,0012 | ||

| TREASURY BILL 09/25 0.00000 / DBT (US912797QU41) | 0,40 | 0,0383 | 0,0383 | |||

| US46625HRY89 / JPMorgan Chase & Co. | 0,40 | 0,51 | 0,0380 | 0,0013 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2015 2A ARV 144A / ABS-CBDO (US03329LAS07) | 0,39 | 1,03 | 0,0376 | 0,0016 | ||

| US345397A860 / Ford Motor Credit Co LLC | 0,39 | 1,30 | 0,0375 | 0,0016 | ||

| US43732VAT35 / Home Partners of America 2021-2 Trust | 0,39 | -4,91 | 0,0372 | -0,0007 | ||

| US36180WGF68 / Ginnie Mae I Pool | 0,38 | -1,29 | 0,0367 | 0,0006 | ||

| US76088TAA97 / RPM 22-3 A 144A 5.38% 11-25-30 | 0,38 | -43,82 | 0,0367 | -0,0265 | ||

| US03329TAG94 / Anchorage Credit Funding 4 Ltd. | 0,38 | 2,70 | 0,0365 | 0,0020 | ||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 0,38 | 0,0361 | 0,0361 | |||

| IRS AUD 4.50000 06/18/25-10Y LCH / DIR (EZ3K0DGVSD24) | 0,38 | 0,0359 | 0,0359 | |||

| PROLOGIS LP SR UNSECURED 02/33 4.2 / DBT (CA74340XCP48) | 0,37 | 5,73 | 0,0354 | 0,0030 | ||

| US93364EAD67 / WaMu Asset-Backed Certificates WaMu Series 2007-HE3 Trust | 0,36 | -1,09 | 0,0347 | 0,0006 | ||

| US76089EAA10 / RESEARCH DRIVEN PAGAYA MOTOR A RPM 2022 1A A 144A | 0,36 | -11,91 | 0,0340 | -0,0035 | ||

| US933637AA84 / WaMu Mortgage Pass-Through Certificates Series 2006-AR18 Trust | 0,34 | -2,57 | 0,0328 | 0,0002 | ||

| US345397C353 / Ford Motor Credit Co LLC | 0,31 | 0,32 | 0,0299 | 0,0010 | ||

| FCT / Fincantieri S.p.A. | 0,31 | 0,98 | 0,0297 | 0,0012 | ||

| S1MF34 / Sumitomo Mitsui Financial Group, Inc. - Depositary Receipt (Common Stock) | 0,31 | 0,65 | 0,0297 | 0,0011 | ||

| CDX HY43 5Y ICE / DCR (EZ4J83TSRL27) | 0,31 | -40,62 | 0,0294 | -0,0186 | ||

| E1IX34 / Edison International - Depositary Receipt (Common Stock) | 0,30 | -24,94 | 0,0292 | -0,0084 | ||

| US16165AAD63 / CHASEFLEX TRUST CFLX 2007 3 2A1 | 0,30 | -0,33 | 0,0292 | 0,0008 | ||

| MARS INC SR UNSECURED 144A 03/35 5.2 / DBT (US571676BA26) | 0,30 | 0,66 | 0,0291 | 0,0011 | ||

| CARVANA AUTO RECEIVABLES TRUST CRVNA 2023 P5 A3 144A / ABS-O (US14687RAC51) | 0,30 | -0,33 | 0,0290 | 0,0008 | ||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0,30 | 0,67 | 0,0290 | 0,0011 | ||

| QUERCUS RE DESIGNATED ACTIVITY 07/27 1 / DBT (XS2865536135) | 0,30 | 7,86 | 0,0290 | 0,0029 | ||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 0,30 | 7,12 | 0,0288 | 0,0027 | ||

| US45262BAB99 / IMPERIAL BRANDS FIN PLC REGD 144A P/P 3.50000000 | 0,30 | 0,34 | 0,0284 | 0,0009 | ||

| CRB SECURITIZATION TRUST CRB 2023 1 A 144A / ABS-O (US12670DAA37) | 0,30 | -46,36 | 0,0283 | -0,0228 | ||

| ORANGE CAPITAL RE DAC SR UNSECURED 144A 01/29 VAR / DBT (XS2931270180) | 0,29 | 8,49 | 0,0282 | 0,0029 | ||

| US93363RAA41 / WAMU MORTGAGE PASS THROUGH CER WAMU 2006 AR13 1A | 0,29 | -3,33 | 0,0278 | -0,0001 | ||

| CENTERBRIDGE CREDIT FUNDING LT CBCF 2021 1A A 144A / ABS-CBDO (US15186PAA66) | 0,29 | 1,41 | 0,0277 | 0,0012 | ||

| CDX IG43 5Y ICE / DCR (EZ10N17RBN04) | 0,29 | -84,76 | 0,0276 | -0,1479 | ||

| US48251JAL70 / KKR CLO 18 Ltd | 0,29 | -32,79 | 0,0276 | -0,0121 | ||

| US02147DAB73 / Alternative Loan Trust 2006-OA11 | 0,29 | -2,38 | 0,0276 | 0,0002 | ||

| US64032PAB85 / Nelnet Student Loan Trust 2023-A | 0,28 | -8,09 | 0,0273 | -0,0015 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2015 1A ARE 144A / ABS-CBDO (US033296AS36) | 0,28 | -0,70 | 0,0272 | 0,0006 | ||

| ROMARK CREDIT FUNDING, LTD. RCF 2021 2A A 144A / ABS-CBDO (US77588JAA43) | 0,28 | 1,08 | 0,0270 | 0,0011 | ||

| US03290AAA88 / Anchorage Credit Funding Ltd. | 0,28 | 1,08 | 0,0270 | 0,0012 | ||

| US64032PAA03 / Nelnet Student Loan Trust, Series 2023-AA, Class AFL | 0,28 | -8,50 | 0,0269 | -0,0015 | ||

| US033295AA45 / Anchorage Credit Funding 14 Ltd., Series 2021-14A, Class A | 0,28 | -0,36 | 0,0268 | 0,0007 | ||

| US144527AC22 / CARRINGTON MORTGAGE LOAN TRUST CARR 2007 FRE1 A3 | 0,28 | -2,80 | 0,0267 | 0,0000 | ||

| US404280CH04 / HSBC Holdings PLC | 0,27 | 1,86 | 0,0263 | 0,0012 | ||

| US36182WBC64 / GNMA POOL AJ1835 GN 09/44 FIXED 3.5 | 0,27 | -1,48 | 0,0256 | 0,0004 | ||

| US81375WGW01 / SECURITIZED ASSET BACKED RECEI SABR 2005 OP2 M3 | 0,26 | 0,38 | 0,0252 | 0,0009 | ||

| TRICOLOR AUTO SECURITIZATION T TAST 2024 1A A 144A / ABS-O (US89616LAA08) | 0,26 | -43,41 | 0,0252 | -0,0179 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2018 6A A 144A / ABS-CBDO (US03330LAA61) | 0,26 | -6,83 | 0,0249 | -0,0010 | ||

| POLESTAR RE LTD UNSECURED 144A 01/28 VAR / DBT (US73110JAC62) | 0,26 | -0,39 | 0,0247 | 0,0007 | ||

| MORGAN STANLEY BANK NA MORGAN STANLEY BANK NA / DBT (US61690U8B93) | 0,26 | 0,39 | 0,0245 | 0,0008 | ||

| US76112HAJ68 / RESIDENTIAL ASSET SECURITIZATI RAST 2006 A9CB A9 | 0,26 | -2,30 | 0,0244 | 0,0001 | ||

| US36267FAC23 / GLS Auto Select Receivables Trust 2023-1 | 0,25 | -63,56 | 0,0244 | -0,0403 | ||

| WINSTON RE LTD UNSECURED 144A 02/28 VAR / DBT (US975660AC59) | 0,25 | 1,60 | 0,0243 | 0,0011 | ||

| AU3FN0029609 / AAI Ltd | 0,25 | 0,00 | 0,0243 | 0,0008 | ||

| INTEGRITY RE III UNSECURED 144A 06/27 VAR / DBT (US45870GAC06) | 0,25 | 0,80 | 0,0241 | 0,0009 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,25 | 0,0241 | 0,0241 | |||

| NATURE COAST RE LTD UNSECURED 144A 04/33 VAR / DBT (US63901CAE12) | 0,25 | 0,40 | 0,0241 | 0,0008 | ||

| PALM RE LTD UNSECURED 144A 06/32 VAR / DBT (US69664FAB40) | 0,25 | 0,0240 | 0,0240 | |||

| ARMOR RE II LTD UNSECURED 144A 01/32 VAR / DBT (US04227FAF27) | 0,25 | -1,19 | 0,0240 | 0,0004 | ||

| VERAISON RE LTD UNSECURED 144A 03/33 VAR / DBT (US92335TAE91) | 0,25 | 0,00 | 0,0239 | 0,0007 | ||

| FNMA POOL AJ7522 FN 01/27 FIXED 3 / ABS-MBS (US3138E0LC13) | 0,25 | -18,75 | 0,0237 | -0,0046 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,25 | 0,0236 | 0,0236 | |||

| US225401AP33 / Credit Suisse Group AG | 0,24 | 1,24 | 0,0235 | 0,0011 | ||

| US93934NAQ88 / Washington Mutual Mortgage Pass-Through Certificates WMALT Series 2006-5 Trust | 0,24 | -1,22 | 0,0232 | 0,0004 | ||

| RFR USD SOFR/3.00000 06/21/23-7Y CME / DIR (EZWF2F56KP17) | 0,24 | -69,69 | 0,0231 | -0,0508 | ||

| US31418XMR60 / FNMA POOL AD9367 FN 09/30 FIXED 4.5 | 0,24 | -7,34 | 0,0230 | -0,0011 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2019 7A A 144A / ABS-CBDO (US03331FAA84) | 0,24 | -14,34 | 0,0230 | -0,0030 | ||

| US92925DAD21 / WAMU MORTGAGE PASS THROUGH CER WAMU 2006 AR17 2A | 0,24 | 0,00 | 0,0228 | 0,0007 | ||

| US76089RAA23 / Research-Driven Pagaya Motor Asset Trust 2023-3 | 0,24 | -16,96 | 0,0226 | -0,0037 | ||

| US76113NAC74 / RESIDENTIAL ASSET SECURITIZATI RAST 2006 A7CB 1A3 | 0,23 | -0,85 | 0,0225 | 0,0005 | ||

| US3132LAY638 / FED HM LN PC POOL V85233 FG 03/49 FIXED 4 | 0,23 | -5,76 | 0,0220 | -0,0007 | ||

| US61752JAA88 / MORGAN STANLEY MORTGAGE LOAN T MSM 2007 1XS 1A1 | 0,23 | -1,31 | 0,0217 | 0,0005 | ||

| US44328BAD01 / HSI ASSET SECURITIZATION CORPO HASC 2006 HE2 2A2 | 0,22 | -1,75 | 0,0215 | 0,0003 | ||

| US14686RAA05 / Carvana Auto Receivables Trust 2023-N3 | 0,22 | -52,48 | 0,0211 | -0,0219 | ||

| M+T BANK AUTO RECEIVABLES TRUS MTBAT 2024 1A A2 144A / ABS-O (US55286TAB17) | 0,22 | -36,55 | 0,0208 | -0,0110 | ||

| INF SWAP US IT 2.39 04/10/25-10Y LCH / DIR (EZXLF5NS1H20) | 0,22 | 0,0206 | 0,0206 | |||

| US07274EAL74 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.5% 11-21-33 | 0,21 | 1,90 | 0,0205 | 0,0010 | ||

| US07274EAK91 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.375% 11-21-30 | 0,21 | 1,44 | 0,0204 | 0,0009 | ||

| US41161PYZ07 / HARBORVIEW MORTGAGE LOAN TRUST HVMLT 2005 16 3A1A | 0,21 | -0,47 | 0,0202 | 0,0005 | ||

| CREDICORP CAPITAL SOCIED LOCAL GOVT G 144A 03/45 9.7 / DBT (US224939AB41) | 0,21 | 0,0198 | 0,0198 | |||

| JACKSON NATL LIFE GLOBAL SECURED 144A 01/30 5.35 / DBT (US46849LVE81) | 0,21 | 0,49 | 0,0197 | 0,0008 | ||

| F+G GLOBAL FUNDING SECURED 144A 01/30 5.875 / DBT (US30321L2J09) | 0,21 | 0,99 | 0,0197 | 0,0008 | ||

| US06738EBD67 / Barclays PLC | 0,20 | 1,00 | 0,0194 | 0,0007 | ||

| GLP CAPITAL LP / FIN II GLP CAPITAL LP / FIN II / DBT (US361841AT63) | 0,20 | 1,53 | 0,0191 | 0,0008 | ||

| US07274NAL73 / Bayer Us Finance Ii Llc 4.375% 12/15/2028 144a Bond | 0,20 | 2,06 | 0,0190 | 0,0009 | ||

| US61749NAD93 / MORGAN STANLEY CAPITAL INC MSAC 2006 HE5 A2C | 0,20 | -1,01 | 0,0189 | 0,0004 | ||

| US03027XAW02 / American Tower Corp | 0,19 | 1,08 | 0,0181 | 0,0008 | ||

| US31410FVW21 / Fnma Pl 888129 5.537 Due 02/01/37 Bond | 0,19 | -2,60 | 0,0179 | 0,0000 | ||

| US912810TE82 / United States Treasury Inflation Indexed Bonds | 0,18 | -5,15 | 0,0177 | -0,0003 | ||

| US92925CDA71 / WaMu Mortgage Pass-Through Certificates Series 2006-AR3 Trust | 0,18 | -3,17 | 0,0176 | 0,0000 | ||

| US3138AHS809 / FNMA POOL AI4142 FN 06/41 FIXED 4.5 | 0,18 | -8,08 | 0,0175 | -0,0009 | ||

| US12668AHE82 / Alternative Loan Trust 2005-56 | 0,18 | 1,12 | 0,0174 | 0,0007 | ||

| US924933AA27 / Veros Auto Receivables Trust, Series 2023-1, Class A | 0,18 | -65,97 | 0,0173 | -0,0319 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,18 | 0,0172 | 0,0172 | |||

| US05401AAR23 / Avolon Holdings Funding Ltd | 0,18 | 1,14 | 0,0170 | 0,0008 | ||

| US36184NEP24 / Ginnie Mae I Pool | 0,17 | -1,69 | 0,0167 | 0,0003 | ||

| US76114HAM79 / RESIDENTIAL ASSET SECURITIZATI RAST 2007 A5 2A5 | 0,17 | -0,59 | 0,0163 | 0,0004 | ||

| US41164YAB74 / HARBORVIEW MORTGAGE LOAN TRUST HVMLT 2007 4 2A1 | 0,17 | -1,18 | 0,0161 | 0,0003 | ||

| US38141GWZ35 / Goldman Sachs Group Inc/The | 0,17 | 1,23 | 0,0158 | 0,0006 | ||

| US06051GHQ55 / Bank of America Corp | 0,16 | 1,24 | 0,0157 | 0,0007 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,16 | 0,0153 | 0,0153 | |||

| US36178UUR21 / GNMA POOL AB7792 GN 11/42 FIXED 3.5 | 0,16 | -2,52 | 0,0149 | 0,0001 | ||

| US36183TYC79 / GNMA POOL AK9707 GN 02/45 FIXED 3.5 | 0,16 | -1,27 | 0,0149 | 0,0002 | ||

| RFR USD SOFR/4.0535* 09/02/25-27Y* LCH / DIR (EZRQXB0T6JR0) | 0,15 | 0,0148 | 0,0148 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,15 | 0,0143 | 0,0143 | |||

| US3137ADTZ01 / FREDDIE MAC REMICS FHR 3891 BF | 0,15 | -9,26 | 0,0141 | -0,0009 | ||

| US05952GAE17 / BANC OF AMERICA FUNDING CORPOR BAFC 2007 D 1A5 | 0,15 | 1,40 | 0,0140 | 0,0006 | ||

| US3140HMGY46 / Fannie Mae Pool | 0,14 | -0,70 | 0,0136 | 0,0003 | ||

| RFR USD SOFR/4.04638 09/02/25-27Y* LCH / DIR (EZRQXB0T6JR0) | 0,14 | 0,0134 | 0,0134 | |||

| US3137ADX446 / FREDDIE MAC FHR 3898 AF | 0,14 | -5,44 | 0,0133 | -0,0003 | ||

| US25151KAC36 / Deutsche Alt-A Securities Mortgage Loan Trust, Series 2007-3, Class 2A1 | 0,14 | -4,20 | 0,0132 | -0,0001 | ||

| US55275RAD44 / MASTR ASSET BACKED SECURITIES MABS 2006 NC3 A4 | 0,14 | -0,72 | 0,0132 | 0,0003 | ||

| EXETER AUTOMOBILE RECEIVABLES EART 2024 1A A3 / ABS-O (US30167PAC41) | 0,14 | -66,83 | 0,0131 | -0,0250 | ||

| RFRF USD SF+26.161/2.50 9/20/23-4Y* CME / DIR (EZJQDNYHCHJ9) | 0,14 | -8,72 | 0,0131 | -0,0008 | ||

| BOUGHT TWD SOLD USD 20250709 / DFE (000000000) | 0,14 | 0,0130 | 0,0130 | |||

| US16678REC79 / CHEVY CHASE MORTGAGE FUNDING C CCMFC 2005 BA A2 144A | 0,14 | -11,18 | 0,0129 | -0,0012 | ||

| US36295NCQ88 / GNMA POOL 675179 GN 03/38 FIXED 5 | 0,13 | -1,53 | 0,0124 | 0,0002 | ||

| US939355AB98 / Washington Mutual Mortgage Pass-Through Certificates WMALT Series 2007-OA3 Trust | 0,13 | -2,27 | 0,0124 | 0,0001 | ||

| US3622MWAR49 / GSR MORTGAGE LOAN TRUST GSR 2007 3F 3A5 | 0,13 | -5,19 | 0,0123 | -0,0003 | ||

| US83162CSA26 / SMALL BUSINESS ADMINISTRATION SBAP 2008 20I 1 | 0,13 | -0,79 | 0,0121 | 0,0003 | ||

| US36296A6T61 / GNMA POOL 685882 GN 05/38 FIXED 5 | 0,13 | -1,57 | 0,0121 | 0,0002 | ||

| CITIZENS AUTO RECEIVABLES TRUS CITZN 2024 1 A2A 144A / ABS-O (US17331QAB23) | 0,12 | -57,53 | 0,0119 | -0,0152 | ||

| US36176EM243 / GNMA POOL 763877 GN 09/43 FIXED 3.5 | 0,12 | -1,61 | 0,0117 | 0,0002 | ||

| US36295QA349 / GNMA POOL 676926 GN 04/38 FIXED 5 | 0,12 | -2,42 | 0,0117 | 0,0002 | ||

| US17311BAB99 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2007 AMC1 A2B | 0,12 | -1,65 | 0,0114 | 0,0002 | ||

| US92925GAA13 / WAMU MORTGAGE PASS THROUGH CER WAMU 2006 AR16 1A1 | 0,12 | -0,84 | 0,0114 | 0,0003 | ||

| BOUGHT PEN SOLD USD 20250929 / DFE (000000000) | 0,12 | 0,0112 | 0,0112 | |||

| US83611MKZ04 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2006 1 A5 | 0,12 | -5,74 | 0,0111 | -0,0003 | ||

| US74923GAC78 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2007 QA1 A3 | 0,11 | -1,72 | 0,0109 | 0,0001 | ||

| US36184CA477 / GNMA POOL AL5427 GN 02/45 FIXED 3.5 | 0,11 | -1,74 | 0,0108 | 0,0001 | ||

| US23345WAA36 / DT Auto Owner Trust 2023-3 | 0,11 | -82,72 | 0,0108 | -0,0495 | ||

| US61753EAC49 / MORGAN STANLEY CAPITAL INC MSAC 2007 HE2 A2C | 0,11 | 0,00 | 0,0103 | 0,0003 | ||

| BOUGHT PEN SOLD USD 20250703 / DFE (000000000) | 0,11 | 0,0103 | 0,0103 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,11 | 0,0102 | 0,0102 | |||

| US31296UAX90 / FED HM LN PC POOL A19022 FG 02/34 FIXED 6 | 0,10 | -1,89 | 0,0100 | 0,0001 | ||

| US59024FAE43 / MERRILL LYNCH ALTERNATIVE NOTE MANA 2007 A2 A3B | 0,10 | -0,97 | 0,0098 | 0,0002 | ||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 0,10 | 1,01 | 0,0097 | 0,0004 | ||

| US842400HQ95 / SOUTHERN CAL EDISON REGD SER D 4.70000000 | 0,10 | 1,01 | 0,0096 | 0,0003 | ||

| JACKSON NATL LIFE GLOBAL SECURED 144A 01/28 VAR / DBT (US46849CJN20) | 0,10 | 0,00 | 0,0096 | 0,0003 | ||

| US69337BAA26 / PHH Alternative Mortgage Trust Series 2007-1 | 0,10 | -1,00 | 0,0095 | 0,0002 | ||

| US31393BX754 / Fannie Mae Trust 2003-W6 | 0,10 | -4,81 | 0,0095 | -0,0001 | ||

| US66988WAD83 / NovaStar Mortgage Funding Trust, Series 2006-3 | 0,10 | 2,08 | 0,0094 | 0,0005 | ||

| US040104EN75 / ARGENT SECURITIES INC. ARSI 2003 W10 M1 | 0,10 | -1,02 | 0,0094 | 0,0002 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,10 | 0,0092 | 0,0092 | |||

| CPS AUTO TRUST CPS 2024 A A 144A / ABS-O (US22411CAA80) | 0,09 | -64,48 | 0,0089 | -0,0153 | ||

| US126680AA57 / Alternative Loan Trust 2007-OA7 | 0,09 | 0,00 | 0,0089 | 0,0002 | ||

| US81744LAA26 / SEQUOIA MORTGAGE TRUST SEMT 2007 2 1A1 | 0,09 | -10,78 | 0,0088 | -0,0007 | ||

| US61744CSY39 / MORGAN STANLEY CAPITAL INC MSAC 2005 WMC6 M4 | 0,09 | -14,95 | 0,0088 | -0,0012 | ||

| US12668BUK78 / Alternative Loan Trust 2006-HY10 | 0,09 | -5,32 | 0,0086 | -0,0002 | ||

| US3138LTLS55 / FNMA POOL AO3036 FN 05/42 FIXED 4.5 | 0,09 | 0,00 | 0,0086 | 0,0002 | ||

| US36184KB973 / Ginnie Mae I Pool | 0,09 | -1,11 | 0,0085 | 0,0001 | ||

| SFS AUTO RECEIVABLES SECURITIZ SFAST 2024 1A A2 144A / ABS-O (US78435VAB80) | 0,09 | -72,36 | 0,0085 | -0,0214 | ||

| US16678RDC88 / CHEVY CHASE MORTGAGE FUNDING C CCMFC 2005 AA A2 144A | 0,09 | -1,16 | 0,0082 | 0,0001 | ||

| US36183QPH29 / GNMA POOL AK6724 GN 01/45 FIXED 3.5 | 0,08 | -2,35 | 0,0080 | 0,0001 | ||

| ZCS BRL 13.3537 05/12/25-01/02/29 CME / DIR (EZSPJ72GL6V3) | 0,08 | 0,0080 | 0,0080 | |||

| FORD CREDIT AUTO LEASE TRUST FORDL 2024 A A2A / ABS-O (US345290AB62) | 0,08 | -97,00 | 0,0080 | -0,2489 | ||

| US36182QB883 / GNMA POOL AH7263 GN 01/45 FIXED 3.5 | 0,08 | -1,19 | 0,0080 | 0,0001 | ||

| US38380LFE83 / GOVERNMENT NATIONAL MORTGAGE A GNR 2018 H09 FA | 0,08 | -1,20 | 0,0079 | 0,0002 | ||

| US31409WLC37 / FNMA POOL 880623 FN 04/36 FIXED 5.5 | 0,08 | -1,20 | 0,0079 | 0,0001 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,08 | 0,0078 | 0,0078 | |||

| USY62014AA64 / NAKILAT INC SR SECURED REGS 12/33 6.067 | 0,08 | -3,61 | 0,0077 | -0,0000 | ||

| US88338QAA85 / THRM_23-1A | 0,08 | -45,95 | 0,0077 | -0,0061 | ||

| INF SWAP US IT 2.58125 05/16/25-5Y LCH / DIR (EZ4DL37DCX93) | 0,08 | 0,0076 | 0,0076 | |||

| US36180HHA95 / Ginnie Mae I Pool | 0,08 | -1,27 | 0,0075 | 0,0001 | ||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,08 | 0,0074 | 0,0074 | |||

| US542514RH93 / Long Beach Mortgage Loan Trust 2006-1 | 0,08 | -5,00 | 0,0073 | -0,0002 | ||

| US81744MAA09 / Sequoia Mortgage Trust 2007-3 | 0,08 | -6,25 | 0,0072 | -0,0002 | ||

| US3137A6R463 / Freddie Mac REMICS | 0,07 | -5,13 | 0,0072 | -0,0001 | ||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,07 | 0,0071 | 0,0071 | |||

| US36184K6K83 / Ginnie Mae I Pool | 0,07 | -2,67 | 0,0071 | 0,0001 | ||

| BOUGHT BRL SOLD USD 20250804 / DFE (000000000) | 0,07 | 0,0070 | 0,0070 | |||

| US007036TD80 / ADJUSTABLE RATE MORTGAGE TRUST ARMT 2005 10 2A1 | 0,07 | -1,35 | 0,0070 | 0,0001 | ||

| US36295QKC32 / GNMA POOL 677191 GN 06/38 FIXED 5 | 0,07 | -2,70 | 0,0070 | 0,0001 | ||

| US36184BZ674 / Ginnie Mae I Pool | 0,07 | -4,00 | 0,0070 | -0,0000 | ||

| US31403SD781 / FNMA POOL 756226 FN 01/34 FIXED 5.5 | 0,07 | -2,70 | 0,0070 | 0,0000 | ||

| US3132GDVQ23 / FED HM LN PC POOL Q00623 FG 04/41 FIXED 4.5 | 0,07 | -1,39 | 0,0069 | 0,0002 | ||

| US94985GAH92 / Wells Fargo Alternative Loan 2007-PA3 Trust | 0,07 | -1,39 | 0,0069 | 0,0002 | ||

| US36198N2C81 / GNMA POOL AI2571 GN 06/44 FIXED 3.5 | 0,07 | -1,41 | 0,0068 | 0,0001 | ||

| US3132XWE647 / Freddie Mac Gold Pool | 0,07 | -1,43 | 0,0067 | 0,0001 | ||

| US36182CAQ06 / GNMA POOL AG7215 GN 04/45 FIXED 3.5 | 0,07 | -1,43 | 0,0066 | 0,0001 | ||

| US31292KYV33 / FGOLD 30YR | 0,07 | -1,45 | 0,0066 | 0,0002 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,07 | 0,0066 | 0,0066 | |||

| US45660LV977 / IndyMac INDX Mortgage Loan Trust 2005-AR31 | 0,07 | -1,45 | 0,0065 | 0,0001 | ||

| BOUGHT PEN SOLD USD 20250714 / DFE (000000000) | 0,07 | 0,0065 | 0,0065 | |||

| US36178LMH32 / GNMA POOL AB1260 GN 07/42 FIXED 3.5 | 0,07 | -5,63 | 0,0064 | -0,0002 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,07 | 0,0064 | 0,0064 | |||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0,07 | 0,0064 | 0,0064 | |||

| US02146TAG22 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 24CB A7 | 0,07 | -2,94 | 0,0064 | 0,0001 | ||

| US863579JG47 / Structured Adjustable Rate Mortgage Loan Trust | 0,07 | -2,94 | 0,0064 | 0,0000 | ||

| US3138LQ2D56 / FANNIE MAE POOL FN AO0771 | 0,07 | 0,00 | 0,0063 | 0,0002 | ||

| US3128M4AX11 / Freddie Mac Gold Pool | 0,07 | -2,99 | 0,0062 | 0,0000 | ||

| EXETER AUTOMOBILE RECEIVABLES EART 2024 3A A2 / ABS-O (US30165AAB17) | 0,06 | -84,20 | 0,0062 | -0,0314 | ||

| US32051GQA66 / First Horizon Alternative Mortgage Securities Trust 2005-AA6 | 0,06 | -1,56 | 0,0061 | 0,0002 | ||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0,06 | 0,0060 | 0,0060 | |||

| US281020AN70 / EDISON INTERNATIONAL SR UNSECURED 06/27 5.75 | 0,06 | 0,00 | 0,0060 | 0,0002 | ||

| US3128KDFP57 / FED HM LN PC POOL A51074 FG 08/36 FIXED 6 | 0,06 | -3,23 | 0,0058 | 0,0000 | ||

| US3128M6MZ88 / FHLG 30YR 6% 09/01/2038# | 0,06 | -3,23 | 0,0058 | 0,0000 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,06 | 0,0058 | 0,0058 | |||

| US939336X409 / WaMu Mortgage Pass-Through Certificates Series 2005-AR1 Trust | 0,06 | -3,28 | 0,0057 | -0,0001 | ||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,06 | 0,0056 | 0,0056 | |||

| US36200JSC52 / GNMA POOL 602715 GN 02/45 FIXED 3.5 | 0,06 | -1,69 | 0,0056 | 0,0001 | ||

| US36184HY815 / GNMA POOL AL9735 GN 04/45 FIXED 3.5 | 0,06 | -1,69 | 0,0056 | 0,0001 | ||

| US3128M6E872 / Freddie Mac Gold Pool | 0,06 | -1,69 | 0,0056 | 0,0001 | ||

| US31404RCT23 / FNMA POOL 775982 FN 07/34 FLOATING VAR | 0,06 | -3,33 | 0,0056 | -0,0000 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,06 | 0,0056 | 0,0056 | |||

| US05951VAV18 / BANC OF AMERICA FUNDING CORPOR BAFC 2006 I 6A1 | 0,06 | -4,92 | 0,0056 | -0,0001 | ||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0,06 | 0,0055 | 0,0055 | |||

| US31397KC909 / Freddie Mac REMICS | 0,06 | -3,45 | 0,0054 | -0,0000 | ||

| US3128M5DD94 / Freddie Mac Gold Pool | 0,06 | -3,51 | 0,0054 | 0,0000 | ||

| US3140HPUD73 / FNMA POOL BK9579 FN 01/49 FIXED 3.5 | 0,05 | 0,00 | 0,0052 | 0,0001 | ||

| INF SWAP US IT 2.3475 04/11/25-5Y LCH / DIR (EZGH7137M9S3) | 0,05 | 0,0051 | 0,0051 | |||

| US31412TWX70 / FNMA POOL 934562 FN 08/38 FIXED 5.5 | 0,05 | 0,00 | 0,0051 | 0,0001 | ||

| US3620A2K214 / GOVT NATL MORTG ASSN 5.00% 04/15/2039 SF1 GNSF | 0,05 | -7,14 | 0,0050 | -0,0002 | ||

| US3128KYHK89 / FED HM LN PC POOL A67434 FG 11/37 FIXED 6 | 0,05 | -1,89 | 0,0050 | 0,0001 | ||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0,05 | 0,0050 | 0,0050 | |||

| US36295QKD15 / GNMA POOL 677192 GN 06/38 FIXED 5 | 0,05 | -1,96 | 0,0049 | 0,0001 | ||

| US31407T6R61 / FNMA POOL 840680 FN 09/35 FIXED 6 | 0,05 | -2,00 | 0,0048 | 0,0001 | ||

| BOUGHT PEN SOLD USD 20250701 / DFE (000000000) | 0,05 | 0,0048 | 0,0048 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,05 | 0,0047 | 0,0047 | |||

| US3138EKW351 / Fannie Mae Pool | 0,05 | -4,17 | 0,0045 | 0,0000 | ||

| US31416BNK07 / Fannie Mae Pool | 0,05 | -4,17 | 0,0045 | -0,0001 | ||

| ZCS BRL 13.2914 05/08/25-01/02/29 CME / DIR (EZYLW2ZWVNG8) | 0,05 | 0,0044 | 0,0044 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,04 | 0,0043 | 0,0043 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,04 | 0,0042 | 0,0042 | |||

| US36177WD986 / GNMA 30YR 3.5% 05/15/2042#AA0128 | 0,04 | -2,27 | 0,0042 | 0,0001 | ||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0,04 | 0,0041 | 0,0041 | |||

| US93363RAB24 / WaMu Mortgage Pass-Through Certificates Series 2006-AR13 Trust | 0,04 | 0,00 | 0,0041 | 0,0001 | ||

| US52524VAG41 / Lehman XS Trust, Series 2007-15N | 0,04 | -6,82 | 0,0040 | -0,0001 | ||

| US07402FAA30 / BEAR STEARNS STRUCTURED PRODUC BSSP 2007 R6 1A1 | 0,04 | -2,38 | 0,0040 | 0,0000 | ||

| US31408DLC64 / FNMA POOL 848223 FN 11/35 FIXED 6 | 0,04 | 0,00 | 0,0040 | 0,0001 | ||

| US31397KE236 / SINGLE FAMILY ARM | 0,04 | -4,76 | 0,0039 | 0,0000 | ||

| US585525EN47 / MRFC Mortgage Pass-Through Trust Series 2000-TBC3 | 0,04 | -6,98 | 0,0039 | -0,0002 | ||

| US41162DAA72 / HarborView Mortgage Loan Trust 2006-12 | 0,04 | 0,00 | 0,0039 | 0,0001 | ||

| US36183BCF31 / GNMA POOL AJ5470 GN 09/44 FIXED 3.5 | 0,04 | 0,00 | 0,0039 | 0,0001 | ||

| US23292HAB78 / DLLAA 2023-1 LLC | 0,04 | -68,25 | 0,0039 | -0,0079 | ||

| US36184MYF49 / Ginnie Mae I Pool | 0,04 | -2,50 | 0,0038 | 0,0001 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,04 | 0,0037 | 0,0037 | |||

| US36296QZG71 / Ginnie Mae I Pool | 0,04 | -5,00 | 0,0037 | -0,0001 | ||

| US31371MFZ59 / FNMA POOL 255884 FN 08/35 FLOATING VAR | 0,04 | -2,63 | 0,0036 | 0,0000 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,04 | 0,0036 | 0,0036 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,04 | 0,0036 | 0,0036 | |||

| US83612NAE58 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2007 WMC1 3A3 | 0,04 | 0,00 | 0,0035 | 0,0001 | ||

| US31412YFP25 / FN 938574 | 0,04 | -2,70 | 0,0035 | 0,0000 | ||

| US12668AWH49 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 58 A1 | 0,04 | -2,70 | 0,0035 | -0,0001 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,04 | 0,0035 | 0,0035 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,04 | 0,0034 | 0,0034 | |||

| US65535AAD63 / NOMURA HOME EQUITY LOAN INC NHELI 2006 AF1 A4 | 0,04 | 0,00 | 0,0034 | 0,0001 | ||

| US83612TAB89 / Soundview Home Loan Trust, Series 2007-OPT1, Class 2A1 | 0,03 | -2,86 | 0,0033 | 0,0001 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,03 | 0,0032 | 0,0032 | |||

| US31419J5L80 / FNMA POOL AE8050 FN 11/40 FIXED 4.5 | 0,03 | 0,00 | 0,0032 | 0,0000 | ||

| US863579VM76 / Structured Adjustable Rate Mortgage Loan Trust Series 2005-17 | 0,03 | -3,03 | 0,0031 | -0,0000 | ||

| US863579C309 / STRUCTURED ADJUSTABLE RATE MOR SARM 2005 21 6A3 | 0,03 | 0,00 | 0,0031 | 0,0000 | ||

| US64830TAD00 / NRZT 2020-1A A1B | 0,03 | -3,12 | 0,0030 | -0,0000 | ||

| US35729PNC04 / Fremont Home Loan Trust 2005-E | 0,03 | -9,09 | 0,0030 | -0,0002 | ||

| US576433EU63 / MASTR ADJUSTABLE RATE MORTGAGE MARM 2003 4 B1 | 0,03 | -3,23 | 0,0029 | -0,0000 | ||

| US12669FW829 / COUNTRYWIDE HOME LOANS CWHL 2004 16 1A1 | 0,03 | -3,33 | 0,0028 | 0,0000 | ||

| US31403NVY02 / FNMA POOL 754031 FN 12/33 FLOATING VAR | 0,03 | -3,33 | 0,0028 | 0,0000 | ||

| US36291UTY19 / GNMA POOL 638767 GN 07/37 FIXED 6 | 0,03 | 0,00 | 0,0028 | 0,0001 | ||

| US46628TAD37 / JP MORGAN MORTGAGE ACQUISITION JPMAC 2006 WMC2 A4 | 0,03 | 7,69 | 0,0027 | 0,0003 | ||

| BOUGHT TRY SOLD USD 20250729 / DFE (000000000) | 0,03 | 0,0027 | 0,0027 | |||

| US36296LSU51 / GNMA POOL 694531 GN 11/38 FIXED 5 | 0,03 | -10,00 | 0,0027 | -0,0002 | ||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0,03 | 0,0027 | 0,0027 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,03 | 0,0027 | 0,0027 | |||

| US31407NGX57 / FNMA POOL 835514 FN 08/35 FLOATING VAR | 0,03 | -3,57 | 0,0026 | 0,0000 | ||

| US3128M7ZR09 / Freddie Mac Gold Pool | 0,03 | -3,70 | 0,0026 | 0,0000 | ||

| US07384MTD47 / Bear Stearns ARM Trust, Series 2003-2, Class A5 | 0,03 | -3,70 | 0,0026 | 0,0000 | ||

| RFR USD SOFR/4.09000 01/22/25-10Y LCH / DIR (EZFR659WJHH9) | 0,03 | 23,81 | 0,0025 | 0,0006 | ||

| RFR USD SOFR/4.01300 01/15/25-10Y LCH / DIR (EZZWCBP8MVY9) | 0,03 | 36,84 | 0,0025 | 0,0007 | ||

| US542514KV50 / LONG BEACH MORTGAGE LOAN TRUST LBMLT 2005 2 M5 | 0,03 | -25,71 | 0,0025 | -0,0008 | ||

| US86359LRW18 / STRUCTURED ASSET MORTGAGE INVE SAMI 2005 AR8 A1A | 0,03 | -3,70 | 0,0025 | 0,0000 | ||

| US31397PST83 / FREDDIE MAC FHR 3404 AF | 0,03 | -3,70 | 0,0025 | -0,0001 | ||

| US36295QGF19 / Government National Mortgage Association | 0,03 | -7,41 | 0,0025 | -0,0001 | ||

| US3128M84A95 / Freddie Mac Gold Pool | 0,03 | -3,85 | 0,0025 | 0,0000 | ||

| BOUGHT PLN SOLD USD 20250710 / DFE (000000000) | 0,03 | 0,0025 | 0,0025 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,03 | 0,0025 | 0,0025 | |||

| US36179QUQ27 / GNMA II POOL MA2391 G2 11/44 FLOATING VAR | 0,03 | 0,00 | 0,0025 | 0,0001 | ||

| US36183QYH28 / GNMA POOL AK7012 GN 04/45 FIXED 3.5 | 0,03 | 0,00 | 0,0024 | 0,0000 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,03 | 0,0024 | 0,0024 | |||

| EZW8XKN63668 / GENERAL ELECTRIC COMPANY SNR S* ICE | 0,03 | -13,79 | 0,0024 | -0,0003 | ||

| US92927BAA08 / WAMU MORTGAGE PASS THROUGH CER WAMU 2007 OA6 1A | 0,02 | -4,00 | 0,0024 | 0,0000 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,02 | 0,0024 | 0,0024 | |||

| US04013BAB80 / ARGENT SECURITIES INC. ARSI 2006 M2 A2B | 0,02 | 0,00 | 0,0023 | 0,0000 | ||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0,02 | 0,0023 | 0,0023 | |||

| US69121PBU66 / OWNIT MORTGAGE LOAN ASSET BACK OWNIT 2005 5 M1 | 0,02 | -4,00 | 0,0023 | -0,0000 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,02 | 0,0023 | 0,0023 | |||

| US36176W5N74 / Ginnie Mae I Pool | 0,02 | -4,17 | 0,0023 | 0,0000 | ||

| US57643GAE70 / MASTR Asset-Backed Securities Trust, Series 2006-FRE2, Class A5 | 0,02 | -4,17 | 0,0023 | 0,0000 | ||

| US3620ASLC11 / GNMA POOL 738423 GN 06/41 FIXED 5 | 0,02 | -4,17 | 0,0023 | 0,0000 | ||

| US3129285R15 / FHLMC | 0,02 | -4,17 | 0,0023 | 0,0000 | ||

| US31418A4P05 / FNMA POOL MA1729 FN 11/28 FIXED 4 | 0,02 | -8,00 | 0,0022 | -0,0001 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,02 | 0,0022 | 0,0022 | |||

| US863579XK92 / Structured Adjustable Rate Mortgage Loan Trust Series 2005-18 | 0,02 | -4,17 | 0,0022 | -0,0000 | ||

| US31402LPB26 / FANNIE MAE 2.757% 06/01/2043 FAR FNARM | 0,02 | -4,17 | 0,0022 | -0,0000 | ||

| US36296JEM36 / GNMA POOL 692340 GN 02/39 FIXED 5 | 0,02 | -8,00 | 0,0022 | -0,0002 | ||

| US36183FTW94 / GNMA POOL AJ9565 GN 03/45 FIXED 3.5 | 0,02 | -4,35 | 0,0022 | 0,0000 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,02 | 0,0021 | 0,0021 | |||

| US31407MWT88 / FNMA POOL 835058 FN 06/35 FLOATING VAR | 0,02 | 0,00 | 0,0021 | 0,0000 | ||

| US31394FAF27 / FANNIE MAE FNR 2005 75 AF | 0,02 | -8,70 | 0,0021 | -0,0001 | ||

| US3138WAJ732 / FNMA POOL AS1185 FN 09/41 FIXED 4.5 | 0,02 | -4,55 | 0,0020 | -0,0000 | ||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0,02 | 0,0020 | 0,0020 | |||

| US3140JJHA04 / FNMA POOL BN2024 FN 02/49 FIXED 3.5 | 0,02 | -4,76 | 0,0020 | 0,0000 | ||

| US31403DGZ69 / Fannie Mae Pool | 0,02 | -4,76 | 0,0020 | -0,0000 | ||

| EZGB6C4Y7HX0 / CDX HY40 5Y ICE | 0,02 | 17,65 | 0,0020 | 0,0004 | ||

| US31406VP915 / FNMA POOL 821348 FN 05/35 FIXED 6 | 0,02 | 0,00 | 0,0020 | 0,0000 | ||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0,02 | 0,0019 | 0,0019 | |||

| BANK OF AMERICA CORPORATION SNR S* ICE / DCR (EZJY8RTJK2L1) | 0,02 | -4,76 | 0,0019 | -0,0001 | ||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0,02 | 0,0019 | 0,0019 | |||

| US161630AU28 / Chase Mortgage Finance Trust, Series 2007-A1, Class 7A1 | 0,02 | -13,64 | 0,0019 | -0,0002 | ||

| RFR USD SOFR/3.27750 09/16/24-10Y LCH / DIR (EZH06W9H2QV9) | 0,02 | -13,64 | 0,0019 | -0,0002 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,02 | 0,0019 | 0,0019 | |||

| US36183X2J85 / GNMA POOL AL2577 GN 03/45 FIXED 3.5 | 0,02 | 0,00 | 0,0019 | 0,0000 | ||

| US31407FYD67 / FANNIE MAE 4.392% 06/01/2035 FNMA ARM | 0,02 | 0,00 | 0,0018 | 0,0000 | ||

| US31407VMN28 / FNMA POOL 841965 FN 01/36 FIXED 6 | 0,02 | -5,00 | 0,0018 | -0,0001 | ||

| US3128M5R934 / Freddie Mac Gold Pool | 0,02 | -5,56 | 0,0017 | 0,0000 | ||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0,02 | 0,0017 | 0,0017 | |||

| US31412MTG32 / Fannie Mae Pool | 0,02 | -15,00 | 0,0017 | -0,0002 | ||

| US02660CAF77 / AMERICAN HOME MORTGAGE INVESTM AHM 2007 2 13A1 | 0,02 | 0,00 | 0,0017 | 0,0000 | ||

| US31410DJE13 / FNMA POOL 885961 FN 07/36 FLOATING VAR | 0,02 | 0,00 | 0,0017 | 0,0000 | ||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,02 | 0,0016 | 0,0016 | |||

| BOUGHT PLN SOLD USD 20250710 / DFE (000000000) | 0,02 | 0,0016 | 0,0016 | |||

| RFR USD SOFR/3.24000 09/16/24-10Y LCH / DIR (EZH06W9H2QV9) | 0,02 | -27,27 | 0,0016 | -0,0005 | ||

| US31396L4R81 / FNMA, REMIC, Series 2006-118, Class A1 | 0,02 | -5,88 | 0,0016 | 0,0000 | ||

| RFR USD SOFR/3.88000 01/13/25-10Y LCH / DIR (EZB2C5X6RDC5) | 0,02 | 77,78 | 0,0016 | 0,0007 | ||

| US36183XRC64 / Ginnie Mae I Pool | 0,02 | 0,00 | 0,0016 | 0,0000 | ||

| US3128L1WN61 / Freddie Mac Gold Pool | 0,02 | -6,25 | 0,0015 | 0,0000 | ||

| RFR USD SOFR/4.07100 01/15/25-10Y LCH / DIR (EZZWCBP8MVY9) | 0,02 | -21,05 | 0,0015 | -0,0003 | ||

| RFR USD SOFR/3.93300 01/06/25-10Y LCH / DIR (EZK6LHB5L486) | 0,02 | 50,00 | 0,0015 | 0,0005 | ||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0,02 | 0,0015 | 0,0015 | |||

| US542514HN71 / Long Beach Mortgage Loan Trust 2004-4 | 0,01 | -6,67 | 0,0014 | 0,0000 | ||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0014 | 0,0014 | |||

| US31407HAS58 / FNMA POOL 830817 FN 10/35 FIXED 6 | 0,01 | 0,00 | 0,0014 | 0,0000 | ||

| EZY2QJ3Z39M5 / CDX IG40 5Y ICE | 0,01 | 7,69 | 0,0014 | 0,0002 | ||

| US3622MGAD03 / GSAMP Trust 2007-NC1 | 0,01 | 7,69 | 0,0014 | 0,0001 | ||

| US36296DNG96 / GNMA POOL 688091 GN 11/38 FIXED 5 | 0,01 | 0,00 | 0,0014 | 0,0000 | ||

| US863579HD34 / Structured Adjustable Rate Mortgage Loan Trust Series 2004-20 | 0,01 | 0,00 | 0,0014 | 0,0000 | ||

| RFR USD SOFR/3.40750 09/05/24-10Y LCH / DIR (EZQK0T1M7D98) | 0,01 | -17,65 | 0,0013 | -0,0002 | ||

| RFR USD SOFR/3.86000 11/14/24-10Y LCH / DIR (EZCMSCQLNL34) | 0,01 | 180,00 | 0,0013 | 0,0008 | ||

| US31396XNT71 / FANNIE MAE FNR 2007 96 AF | 0,01 | -7,14 | 0,0013 | -0,0000 | ||

| US362341XG98 / GSR Mortgage Loan Trust 2005-AR7 | 0,01 | -7,14 | 0,0013 | -0,0001 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0013 | 0,0013 | |||

| US36296P6J53 / GNMA POOL 697573 GN 11/38 FIXED 5 | 0,01 | 0,00 | 0,0013 | 0,0000 | ||

| RFR USD SOFR/4.10000 01/21/25-10Y LCH / DIR (EZ7J947QTC64) | 0,01 | 30,00 | 0,0013 | 0,0003 | ||

| US31409JBD19 / FNMA POOL 872236 FN 05/36 FLOATING VAR | 0,01 | -7,14 | 0,0013 | -0,0000 | ||

| RFR USD SOFR/3.90000 01/08/25-10Y LCH / DIR (EZKP2JSHK8F5) | 0,01 | 85,71 | 0,0013 | 0,0006 | ||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0013 | 0,0013 | |||

| US395387AA13 / Greenpoint Mortgage Pass-Through Certificates | 0,01 | 0,00 | 0,0013 | 0,0000 | ||

| EZG1MXP5KL27 / CDX IG41 5Y ICE | 0,01 | 18,18 | 0,0013 | 0,0002 | ||

| US31396WLX29 / Fannie Mae REMICS | 0,01 | 0,00 | 0,0013 | 0,0000 | ||

| US3140JKMX15 / FNMA POOL BN3073 FN 02/49 FIXED 3.5 | 0,01 | 0,00 | 0,0012 | -0,0000 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0012 | 0,0012 | |||

| US3128L1WP10 / FGOLD 30YR | 0,01 | -7,69 | 0,0012 | 0,0000 | ||

| US3133TSQG11 / Freddie Mac Structured Pass-Through Certificates | 0,01 | -14,29 | 0,0012 | -0,0001 | ||

| US362382AE30 / GSAA HOME EQUITY TRUST GSAA 2006 9 A2 | 0,01 | 0,00 | 0,0012 | 0,0000 | ||

| US83162CRL99 / United States Small Business Administration | 0,01 | -20,00 | 0,0012 | -0,0002 | ||

| US36295QJT85 / GNMA POOL 677174 GN 06/38 FIXED 5 | 0,01 | -8,33 | 0,0011 | -0,0000 | ||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0011 | 0,0011 | |||

| RFR GBP SONIO/4.32000 10/20/23-10Y LCH / DIR (EZ49Z4HPK8R0) | 0,01 | 120,00 | 0,0011 | 0,0007 | ||

| US31397QZU56 / FANNIE MAE FNR 2011 17 KS | 0,01 | 0,00 | 0,0011 | 0,0000 | ||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 0,01 | 0,0011 | 0,0011 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0011 | 0,0011 | |||

| US31410KQX53 / FNMA POOL 889770 FN 06/38 FIXED VAR | 0,01 | 0,00 | 0,0011 | 0,0000 | ||

| RFR USD SOFR/3.89600 01/08/25-10Y LCH / DIR (EZKP2JSHK8F5) | 0,01 | 57,14 | 0,0011 | 0,0004 | ||

| RFR USD SOFR/3.47000 09/04/24-10Y LCH / DIR (EZSXZYY2VD17) | 0,01 | -21,43 | 0,0011 | -0,0003 | ||

| US3140FRCM58 / Fannie Mae Pool | 0,01 | 0,00 | 0,0011 | 0,0000 | ||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0,01 | 0,0011 | 0,0011 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0011 | 0,0011 | |||

| US31407VFQ32 / FNMA POOL 841775 FN 09/35 FLOATING VAR | 0,01 | -21,43 | 0,0011 | -0,0003 | ||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0011 | 0,0011 | |||

| RFR USD SOFR/3.23200 09/10/24-10Y LCH / DIR (EZ7VRSSQ00Z9) | 0,01 | -16,67 | 0,0010 | -0,0001 | ||

| RFR USD SOFR/3.86600 11/14/24-10Y LCH / DIR (EZCMSCQLNL34) | 0,01 | 100,00 | 0,0010 | 0,0005 | ||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0010 | 0,0010 | |||

| US31407YHH53 / FNMA POOL 844532 FN 11/35 FLOATING VAR | 0,01 | 0,00 | 0,0010 | 0,0000 | ||

| BOUGHT KRW SOLD USD 20250710 / DFE (000000000) | 0,01 | 0,0010 | 0,0010 | |||

| TRT061124T11 / Turkey Government Bond | 0,01 | 0,00 | 0,0010 | -0,0000 | ||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0010 | 0,0010 | |||

| US312935L988 / FED HM LN PC POOL A88452 FG 01/39 FIXED 5.5 | 0,01 | -10,00 | 0,0009 | -0,0000 | ||

| US3138YR5Y00 / Fannie Mae Pool | 0,01 | -10,00 | 0,0009 | 0,0000 | ||

| US36291US714 / GNMA POOL 638742 GN 05/37 FIXED 6 | 0,01 | 0,00 | 0,0009 | 0,0000 | ||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,01 | 0,0009 | 0,0009 | |||

| US3140GYJX82 / Fannie Mae Pool | 0,01 | 0,00 | 0,0009 | 0,0000 | ||

| US36178UBY82 / GNMA POOL AB7255 GN 10/42 FIXED 3.5 | 0,01 | 0,00 | 0,0009 | 0,0000 | ||

| US31410DXD73 / FANNIE MAE 3.932% 08/01/2036 FNMA ARM | 0,01 | 0,00 | 0,0009 | 0,0000 | ||

| US31408DLF95 / FNMA POOL 848226 FN 11/35 FIXED 6 | 0,01 | 0,00 | 0,0009 | 0,0000 | ||

| US3140FRH657 / FNMA POOL BE5652 FN 01/47 FIXED 3.5 | 0,01 | 0,00 | 0,0009 | 0,0000 | ||

| US61754HAD44 / MORGAN STANLEY MORTGAGE LOAN T MSM 2007 7AX 2A3 | 0,01 | 0,00 | 0,0009 | -0,0000 | ||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0009 | 0,0009 | |||

| US3138ANNY54 / FNMA POOL AI8506 FN 08/26 FIXED 4 | 0,01 | -27,27 | 0,0009 | -0,0002 | ||

| OIS MXN TIIE1/8.27000 03/19/25-10Y* CME / DIR (EZCJCJ68DC78) | 0,01 | 0,0008 | 0,0008 | |||

| US31417Y7A92 / Federal National Mortgage Association, Inc. | 0,01 | -20,00 | 0,0008 | -0,0002 | ||

| US31407BXK06 / FNMA POOL 826082 FN 07/35 FLOATING VAR | 0,01 | 0,00 | 0,0008 | 0,0000 | ||

| US12465MAA27 / C-BASS 2006-CB9 TRUST | 0,01 | 0,00 | 0,0008 | 0,0000 | ||

| BOUGHT NZD SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0008 | 0,0008 | |||

| US92922F4M79 / WaMu Mortgage Pass-Through Certificates Series 2005-AR13 Trust | 0,01 | 0,00 | 0,0008 | -0,0000 | ||

| US31403VDD82 / FNMA POOL 758900 FN 12/33 FLOATING VAR | 0,01 | 0,00 | 0,0008 | -0,0000 | ||

| RFR USD SOFR/3.55800 08/21/24-10Y LCH / DIR (EZHZRCBWPB39) | 0,01 | -36,36 | 0,0008 | -0,0003 | ||

| RFR USD SOFR/3.89000 01/08/25-10Y LCH / DIR (EZKP2JSHK8F5) | 0,01 | 0,00 | 0,0008 | 0,0001 | ||

| RFR USD SOFR/4.01500 12/30/24-10Y LCH / DIR (EZVY5NK4YWD2) | 0,01 | 40,00 | 0,0008 | 0,0002 | ||

| US31398F4R97 / FANNIE MAE FNR 2009 99 FC | 0,01 | -12,50 | 0,0008 | 0,0000 | ||

| US3140HATD24 / FNMA POOL BJ8647 FN 01/48 FIXED 3.5 | 0,01 | -30,00 | 0,0008 | -0,0002 | ||

| US3140H4B452 / Federal National Mortgage Association, Inc. | 0,01 | -12,50 | 0,0007 | -0,0000 | ||

| RFR USD SOFR/3.59500 08/19/24-10Y LCH / DIR (EZN7CQ0TS3K8) | 0,01 | -36,36 | 0,0007 | -0,0003 | ||

| RFR USD SOFR/3.79250 11/19/24-10Y LCH / DIR (EZVRNR667250) | 0,01 | 250,00 | 0,0007 | 0,0005 | ||

| IRS EUR 2.40000 02/12/25-10Y LCH / DIR (EZNHC24BF987) | 0,01 | -22,22 | 0,0007 | -0,0001 | ||

| TRT061124T11 / Turkey Government Bond | 0,01 | 0,00 | 0,0007 | 0,0000 | ||

| US31410EKC11 / FANNIE MAE 3.84% 09/01/2036 FNMA ARM | 0,01 | 0,00 | 0,0007 | 0,0000 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0007 | 0,0007 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0007 | 0,0007 | |||

| US3140HAC999 / FNMA POOL BJ8195 FN 01/48 FIXED 3.5 | 0,01 | 0,00 | 0,0007 | 0,0000 | ||

| US31407DSV81 / Fannie Mae Pool | 0,01 | 0,00 | 0,0007 | 0,0000 | ||

| US31407R2A19 / FNMA POOL 838769 FN 09/35 FLOATING VAR | 0,01 | 0,00 | 0,0007 | 0,0000 | ||

| RFR USD SOFR/3.75000 05/07/25-10Y LCH / DIR (EZ61ZS50J0P1) | 0,01 | 0,0007 | 0,0007 | |||

| US31395M2F53 / Freddie Mac Structured Pass-Through Certificates | 0,01 | 0,00 | 0,0007 | -0,0000 | ||

| RFR USD SOFR/3.84000 01/08/25-10Y LCH / DIR (EZKP2JSHK8F5) | 0,01 | -14,29 | 0,0007 | 0,0000 | ||

| US36184BZL43 / Ginnie Mae I Pool | 0,01 | -14,29 | 0,0007 | 0,0000 | ||

| US31396URJ15 / FREDDIE MAC FHR 3181 PS | 0,01 | 0,00 | 0,0007 | 0,0000 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0006 | 0,0006 | |||

| RFR USD SOFR/3.41000 09/05/24-10Y LCH / DIR (EZQK0T1M7D98) | 0,01 | -64,71 | 0,0006 | -0,0010 | ||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0006 | 0,0006 | |||

| US02152AAB52 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2007 16CB 1A2 | 0,01 | 0,00 | 0,0006 | 0,0000 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0006 | 0,0006 | |||

| US3128M75R30 / Freddie Mac Gold Pool | 0,01 | 0,00 | 0,0006 | 0,0000 | ||

| RFR USD SOFR/3.85500 11/19/24-10Y LCH / DIR (EZVRNR667250) | 0,01 | 200,00 | 0,0006 | 0,0003 | ||

| US31417YM954 / FNMA POOL MA0383 FN 04/30 FIXED 4.5 | 0,01 | 0,00 | 0,0006 | -0,0000 | ||

| US17307GW795 / Citigroup Mortgage Loan Trust 2005-11 | 0,01 | 0,00 | 0,0006 | 0,0000 | ||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0,01 | 0,0006 | 0,0006 | |||

| US31396WTU08 / Fannie Mae REMICS | 0,01 | 0,00 | 0,0006 | 0,0000 | ||

| US3128P7E661 / FED HM LN PC POOL C91057 FG 06/27 FIXED 5.5 | 0,01 | 0,00 | 0,0006 | -0,0001 | ||

| US92977TAC62 / Wachovia Mortgage Loan Trust, LLC | 0,01 | -14,29 | 0,0006 | -0,0001 | ||

| US36180HG513 / GNMA POOL AD5620 GN 04/43 FIXED 3.5 | 0,01 | -28,57 | 0,0006 | -0,0002 | ||

| US36180SNG56 / Ginnie Mae I Pool | 0,01 | -16,67 | 0,0006 | 0,0000 | ||

| US17307GW530 / Citigroup Mortgage Loan Trust 2005-11 | 0,01 | 0,00 | 0,0006 | 0,0000 | ||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0006 | 0,0006 | |||

| IRS EUR 2.45000 05/05/25-10Y LCH / DIR (EZCDFQCSBVM0) | 0,01 | 0,0005 | 0,0005 | |||

| US3140JGR644 / Fannie Mae Pool | 0,01 | 0,00 | 0,0005 | 0,0000 | ||

| US3138WG6G40 / Fannie Mae Pool | 0,01 | 0,00 | 0,0005 | 0,0000 | ||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0005 | 0,0005 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0005 | 0,0005 | |||

| PEMEX LCDS SP DUB / DCR (000000000) | 0,01 | 0,0005 | 0,0005 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0005 | 0,0005 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0005 | 0,0005 | |||

| XS0290416527 / EUROHOME UK MORTGAGES PLC EHMU 2007 1 A REGS | 0,01 | -16,67 | 0,0005 | -0,0001 | ||

| US3128KLML86 / FED HM LN PC POOL A57563 FG 02/37 FIXED 5.5 | 0,01 | 0,00 | 0,0005 | 0,0000 | ||

| US31404BQD72 / FNMA POOL 763752 FN 01/34 FIXED 5.5 | 0,01 | 0,00 | 0,0005 | 0,0000 | ||

| US31406F6N66 / FNMA POOL 809177 FN 01/35 FLOATING VAR | 0,01 | 0,00 | 0,0005 | -0,0000 | ||

| RFR USD SOFR/3.85000 01/08/25-10Y LCH / DIR (EZKP2JSHK8F5) | 0,00 | -42,86 | 0,0005 | -0,0002 | ||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| US12668AN276 / Alternative Loan Trust 2005-69 | 0,00 | 0,00 | 0,0005 | 0,0000 | ||

| US126670JY52 / COUNTRYWIDE HOME LOANS CWHL 2005 HYB9 3A2A | 0,00 | 0,00 | 0,0005 | 0,0000 | ||

| US3138AJMD15 / FNMA POOL AI4855 FN 06/26 FIXED 4 | 0,00 | -42,86 | 0,0005 | -0,0002 | ||

| RFR GBP SONIO/3.70000 03/28/24-10Y LCH / DIR (EZFCF73KNS79) | 0,00 | -50,00 | 0,0005 | -0,0003 | ||

| US3138A6LJ75 / FNMA POOL AH4828 FN 02/26 FIXED 4 | 0,00 | -42,86 | 0,0004 | -0,0003 | ||

| US07384MR877 / Bear Stearns ARM Trust 2004-3 | 0,00 | 0,00 | 0,0004 | 0,0000 | ||

| US3138A2U648 / FNMA POOL AH1504 FN 12/40 FIXED 4.5 | 0,00 | 0,00 | 0,0004 | 0,0000 | ||

| BARCLAYS BANK PLC SNR SE ICE / DCR (EZB88Z42LS80) | 0,00 | -20,00 | 0,0004 | -0,0001 | ||

| US35729NAB10 / Fremont Home Loan Trust, Series 2006-E, Class 2A1 | 0,00 | 0,00 | 0,0004 | 0,0000 | ||

| US31415LW863 / FNMA POOL 983671 FN 09/38 FIXED 5.5 | 0,00 | 0,00 | 0,0004 | 0,0000 | ||

| RFR USD SOFR/3.97000 01/15/25-10Y LCH / DIR (EZZWCBP8MVY9) | 0,00 | -78,95 | 0,0004 | -0,0014 | ||

| US3128M7P751 / FGLMC 5.5 G05546 07-01-39 | 0,00 | 0,00 | 0,0004 | 0,0000 | ||

| US466247ZP16 / J.P. Morgan Mortgage Trust 2005-A1 | 0,00 | 0,00 | 0,0004 | 0,0000 | ||

| US31398GRA93 / FANNIE MAE FNR 2009 111 FE | 0,00 | 0,00 | 0,0004 | 0,0000 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| US31405PRS10 / Fannie Mae Pool | 0,00 | 0,00 | 0,0004 | 0,0000 | ||

| BOUGHT PEN SOLD USD 20251105 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||