Statistiche di base

| Valore del portafoglio | $ 77.238.081 |

| Posizioni attuali | 328 |

Ultime partecipazioni, performance, AUM (da depositi 13F, 13D)

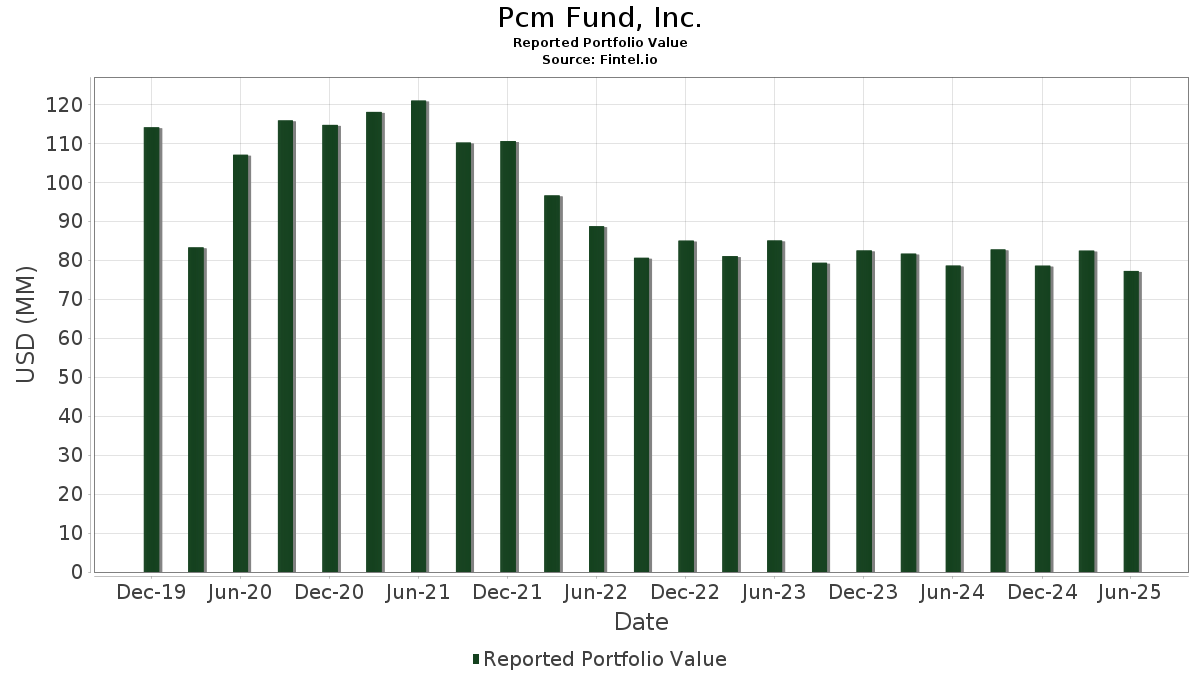

Pcm Fund, Inc. ha dichiarato un totale di 328 partecipazioni negli ultimi documenti depositati presso la SEC. Il valore più recente del portafoglio è pari a $ 77.238.081 USD. Il patrimonio gestito effettivo (AUM) corrisponde a questo valore più la liquidità (che non viene dichiarata). Le principali partecipazioni di Pcm Fund, Inc. sono PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , COUNTRYWIDE ASSET BACKED CERTI CWL 2006 ABC1 A3 (US:US23242NAC39) , MORGAN STANLEY CAPITAL INC MSAC 2006 HE8 A2C (US:US61750SAE28) , COUNTRYWIDE ASSET BACKED CERTI CWL 2006 11 MV1 (US:US12666TAL08) , and WAMU MORTGAGE PASS THROUGH CER WAMU 2005 AR13 B1 (US:US92922F4Y18) . Le nuove posizioni di Pcm Fund, Inc. includono PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , COUNTRYWIDE ASSET BACKED CERTI CWL 2006 ABC1 A3 (US:US23242NAC39) , MORGAN STANLEY CAPITAL INC MSAC 2006 HE8 A2C (US:US61750SAE28) , COUNTRYWIDE ASSET BACKED CERTI CWL 2006 11 MV1 (US:US12666TAL08) , and WAMU MORTGAGE PASS THROUGH CER WAMU 2005 AR13 B1 (US:US92922F4Y18) .

Gli aumenti più importanti di questo trimestre

Utilizziamo la variazione dell'allocazione del portafoglio perché è l'indicatore più significativo. Le variazioni possono essere dovute a transazioni o a variazioni dei prezzi delle azioni.

| Titolo | Azioni (in milioni) |

Valore (in milioni di $) |

Portafoglio % | ΔPortafoglio % |

|---|---|---|---|---|

| 0,97 | 1,3310 | 1,3310 | ||

| 0,50 | 0,6886 | 0,6886 | ||

| 0,50 | 0,6827 | 0,6827 | ||

| 0,94 | 1,2822 | 0,4724 | ||

| 0,30 | 0,4035 | 0,4035 | ||

| 0,29 | 0,3923 | 0,3923 | ||

| 0,28 | 0,3888 | 0,3888 | ||

| 0,28 | 0,3841 | 0,3841 | ||

| 0,25 | 0,3376 | 0,3376 | ||

| 1,71 | 2,3319 | 0,2733 |

Gli aumenti più importanti di questo trimestre

Utilizziamo la variazione dell'allocazione del portafoglio perché è l'indicatore più significativo. Le variazioni possono essere dovute a transazioni o a variazioni dei prezzi delle azioni.

| Titolo | Azioni (in milioni) |

Valore (in milioni di $) |

Portafoglio % | ΔPortafoglio % |

|---|---|---|---|---|

| -4,12 | -5,6243 | -5,6243 | ||

| -2,63 | -3,5949 | -3,5949 | ||

| 7,11 | 9,7114 | -3,4532 | ||

| -2,10 | -2,8729 | -2,8729 | ||

| -1,62 | -2,2101 | -2,2101 | ||

| -1,55 | -2,1204 | -2,1204 | ||

| -1,34 | -1,8229 | -1,8229 | ||

| -1,29 | -1,7546 | -1,7546 | ||

| -0,99 | -1,3564 | -1,3564 | ||

| -0,99 | -1,3458 | -1,3458 |

13F e depositi di fondi

Questo modulo è stato depositato il 2025-08-29 per il periodo di riferimento 2025-06-30. Fai clic sull'icona del link per visualizzare la cronologia completa delle transazioni.

Esegui l'upgrade per sbloccare i dati premium ed esportarli in Excel ![]() .

.

| Titolo | Tipo | Prezzo medio dell'azione | Azioni (in milioni) |

ΔAzioni (%) |

ΔAzioni (%) |

Valore (in milioni di $) |

Portafoglio (%) |

ΔPortafoglio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 7,11 | -26,72 | 9,7114 | -3,4532 | |||||

| US23242NAC39 / COUNTRYWIDE ASSET BACKED CERTI CWL 2006 ABC1 A3 | 5,54 | -1,46 | 7,5613 | -0,0603 | |||||

| AMSURG EQUITY EQTYAS910 / EC (902RDL901) | 0,08 | 0,00 | 3,66 | -3,43 | 4,9966 | -0,1436 | |||

| US61750SAE28 / MORGAN STANLEY CAPITAL INC MSAC 2006 HE8 A2C | 3,42 | -1,30 | 4,6702 | -0,0303 | |||||

| US12666TAL08 / COUNTRYWIDE ASSET BACKED CERTI CWL 2006 11 MV1 | 3,27 | -0,27 | 4,4714 | 0,0177 | |||||

| US92922F4Y18 / WAMU MORTGAGE PASS THROUGH CER WAMU 2005 AR13 B1 | 2,04 | 1,04 | 2,7800 | 0,0458 | |||||

| US43710BAD82 / INDYMAC RESIDENTIAL ASSET BACK INABS 2007 A 2A3 | 1,99 | -1,14 | 2,7153 | -0,0138 | |||||

| US90290PAS39 / U.S. Renal Care, Inc., 1st Lien Term Loan C | 1,93 | 1,20 | 2,6418 | 0,0494 | |||||

| US126673R533 / COUNTRYWIDE ASSET BACKED CERTI CWL 2005 4 MV7 | 1,85 | 1,09 | 2,5260 | 0,0434 | |||||

| ENVISION HEALTHCARE CORPORTION 2023 LAST OUT TERM LOAN / LON (949ABFII9) | 1,84 | 1,49 | 2,5063 | 0,0528 | |||||

| US64828XAJ28 / NEW RESIDENTIAL MORTGAGE LOAN NRZT 2020 RPL1 B5 144A | 1,71 | 12,52 | 2,3319 | 0,2733 | |||||

| US36242DWF67 / GSAMP TRUST GSAMP 2005 SD1 M3 144A | 1,68 | -5,52 | 2,2887 | -0,1178 | |||||

| INCORA NEW EQUITY / EC (955PRF008) | 0,05 | 0,00 | 1,59 | -5,46 | 2,1756 | -0,1105 | |||

| INCORA INTERMEDIATE II SR SECURED 144A 01/30 VAR / DBT (US45338XAA37) | 1,40 | 3,16 | 1,9178 | 0,0710 | |||||

| INCORA TOP HOLDCO LLC CONV PIK PRE COMP / DBT (955PRK007) | 1,40 | -4,04 | 1,9151 | -0,0678 | |||||

| US61763PAU75 / MORGAN STANLEY REREMIC TRUST MSRR 2014 R3 3B 144A | 1,34 | -0,67 | 1,8344 | 0,0004 | |||||

| US40430RAB24 / HSI ASSET SECURITIZATION CORPO HASC 2007 HE2 2A1 | 1,30 | -3,71 | 1,7717 | -0,0556 | |||||

| US75971FAF09 / RENAISSANCE HOME EQUITY LOAN T RAMC 2007 3 AF3 | 1,28 | -1,92 | 1,7429 | -0,0227 | |||||

| ABSLT DE 2024 LLC CLN 2024 1 05/33 1 / DBT (US00401BAF76) | 1,22 | 1,84 | 1,6657 | 0,0409 | |||||

| US35564KNE54 / Freddie Mac Structured Agency Credit Risk Debt Notes | 1,18 | -0,34 | 1,6080 | 0,0058 | |||||

| RFR USD SOFR/1.75000 06/15/22-30Y CME / DIR (EZ2TNCR649W7) | 1,18 | -2,24 | 1,6062 | -0,0259 | |||||

| US35564KLV97 / Freddie Mac STACR REMIC Trust 2021-DNA6 | 1,17 | -0,17 | 1,5970 | 0,0081 | |||||

| US83613FAC59 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2007 OPT5 2A2 | 1,09 | -1,90 | 1,4828 | -0,0196 | |||||

| RFR USD SOFR/1.75000 12/21/22-30Y CME / DIR (EZ000VCFPMC7) | 1,07 | 6,34 | 1,4665 | 0,0962 | |||||

| US71103XAB01 / PEOPLE S FINANCIAL REALTY MORT PFRMS 2006 1 1A2 | 1,04 | -0,76 | 1,4178 | -0,0019 | |||||

| NCDL / Nuveen Churchill Direct Lending Corp. | 1,03 | 1,28 | 1,4029 | 0,0269 | |||||

| US87168TAB70 / Syniverse Holdings, Inc. 2022 Term Loan | 1,02 | -3,50 | 1,3944 | -0,0412 | |||||

| US12668BMJ97 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 8T1 1A5 | 1,00 | -0,40 | 1,3643 | 0,0029 | |||||

| US91327AAB89 / Uniti Group LP | 1,00 | 8,13 | 1,3638 | 0,1117 | |||||

| US44328BAE83 / HSI ASSET SECURITIZATION CORPO HASC 2006 HE2 2A3 | 0,98 | -1,90 | 1,3420 | -0,0169 | |||||

| IVANTI SOFTWARE INC 2025 1ST LIEN TERM LOAN / LON (US46583DAH26) | 0,97 | 1,3310 | 1,3310 | ||||||

| US95003WAG15 / WELLS FARGO COMMERCIAL MORTGAG WFCM 2022 ONL C 144A | 0,96 | 1,70 | 1,3098 | 0,0296 | |||||

| TWITTER INC TERM LOAN / LON (US90184NAG34) | 0,94 | 57,29 | 1,2822 | 0,4724 | |||||

| RFR USD SOFR/1.75000 06/15/22-30Y LCH / DIR (EZ2TNCR649W7) | 0,91 | -24,02 | 1,2491 | -0,3830 | |||||

| US17312WAB28 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2007 SHL1 M1 144A | 0,90 | -4,17 | 1,2256 | -0,0452 | |||||

| US04410RAJ59 / Ashford Hospitality Trust 2018-ASHF | 0,89 | -0,22 | 1,2169 | 0,0044 | |||||

| US3137FUQK39 / FREDDIE MAC FHR 4988 LI | 0,88 | 2,44 | 1,2033 | 0,0367 | |||||

| US46654PAU03 / JP MORGAN CHASE COMMERCIAL MOR JPMCC 2021 HTL5 H 144A | 0,86 | -0,58 | 1,1728 | 0,0012 | |||||

| 952YSX903 / WINDSTREAM UNITS EQUITY | 0,04 | 0,00 | 0,85 | -12,60 | 1,1647 | -0,1596 | |||

| US55275BAC19 / Mastr Asset Backed Securities Trust 2006-NC2 | 0,85 | -1,17 | 1,1590 | -0,0055 | |||||

| US05492TBF66 / BBCMS Trust | 0,85 | 3,80 | 1,1574 | 0,0502 | |||||

| US55285TAC09 / MFRA 2022-RPL1 M1 | 0,84 | -1,41 | 1,1438 | -0,0085 | |||||

| US55284PAG00 / MFRA TRUST MFRA 2022 NQM1 B1 144A | 0,84 | 0,00 | 1,1406 | 0,0079 | |||||

| US25470MAG42 / DISH Network Corp | 0,83 | -2,02 | 1,1268 | -0,0166 | |||||

| US20754RAF38 / Connecticut Avenue Securities Trust 2021-R01 | 0,82 | 0,61 | 1,1194 | 0,0152 | |||||

| US91327TAA97 / Uniti Group LP / Uniti Group Finance Inc / CSL Capital LLC | 0,82 | -0,24 | 1,1182 | 0,0050 | |||||

| COREWEAVE CMPTE ACQU CO II LLC 2024 DELAYED DRAW TERM LOAN / LON (BA0004JK4) | 0,82 | 1,87 | 1,1179 | 0,0279 | |||||

| US30227FAN06 / Extended Stay America Trust | 0,77 | -0,90 | 1,0558 | -0,0029 | |||||

| US46645WAC73 / JP Morgan Chase Commercial Mortgage Securities Trust 2018-WPT | 0,73 | -5,29 | 1,0034 | -0,0478 | |||||

| US46649JAQ13 / JPMCC_18-ASH8 | 0,70 | -0,98 | 0,9618 | -0,0033 | |||||

| US02151GAA58 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2007 24 A1 | 0,70 | -2,64 | 0,9583 | -0,0195 | |||||

| US17307GZG62 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2005 5 3A2A | 0,69 | -10,75 | 0,9410 | -0,1064 | |||||

| US63874EAN04 / Natixis Commercial Mortgage Securities Trust 2017-75B | 0,63 | 8,25 | 0,8602 | 0,0706 | |||||

| RFRF USD SF+26.161/3.00 9/19/23-15Y* CME / DIR (EZ8KNX8TZ7X1) | 0,62 | 4,70 | 0,8522 | 0,0438 | |||||

| US07386HL669 / BEAR STEARNS ALT A TRUST BALTA 2006 3 23A1 | 0,62 | -1,27 | 0,8489 | -0,0052 | |||||

| US20846QJZ28 / CONSECO FINANCE SECURITIZATION CNF 2002 2 M2 | 0,62 | -4,63 | 0,8445 | -0,0357 | |||||

| US90187LAN91 / 245 Park Avenue Trust 2017-245P | 0,61 | 1,32 | 0,8373 | 0,0158 | |||||

| US25470XBE40 / DISH DBS Corp | 0,60 | -1,15 | 0,8195 | -0,0040 | |||||

| RFRF USD SF+26.161/1.4* 04/07/21-30Y LCH / DIR (EZWV4QZ1M0S5) | 0,59 | 3,66 | 0,8122 | 0,0338 | |||||

| US53219LAW90 / LIFEPOINT HEALTH INC | 0,55 | 1,47 | 0,7540 | 0,0159 | |||||

| DRYDEN SENIOR LOAN FUND DRSLF 2025 123A SUB 144A / ABS-CBDO (US26253PAC77) | 0,55 | 1,49 | 0,7445 | 0,0161 | |||||

| US17311BAS25 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2007 AMC1 A1 144A | 0,53 | -0,94 | 0,7226 | -0,0021 | |||||

| US001406AA55 / AIM Aviation Finance Ltd. | 0,53 | -4,36 | 0,7205 | -0,0278 | |||||

| US63875JAN81 / Natixis Commercial Mortgage Securities Trust | 0,52 | -0,76 | 0,7157 | -0,0009 | |||||

| 938DREII2 / ENCINA PRIVATE CREDIT LLC NOTE | 0,51 | -0,78 | 0,6950 | -0,0010 | |||||

| RFR USD SOFR/4.50000 03/20/24-6Y* CME / DIR (000000000) | 0,50 | 0,6886 | 0,6886 | ||||||

| 944YFGII6 / SOFTBANK VISION FUND II FIXED TERM LOAN | 0,50 | -4,20 | 0,6860 | -0,0248 | |||||

| CENTRAL PARENT INC 2024 TERM LOAN B / LON (US15477BAE74) | 0,50 | -2,91 | 0,6827 | -0,0165 | |||||

| DEUTSCHE BANK AG CRFT 2025 2A CLN 144A / ABS-CBDO (XS3093668831) | 0,50 | 0,6827 | 0,6827 | ||||||

| PRIME HEALTHCARE SERVICE PRIME HEALTHCARE SERVICE / DBT (US74165HAC25) | 0,50 | 5,08 | 0,6781 | 0,0374 | |||||

| VERUS SECURITIZATION TRUST VERUS 2024 5 B2 144A / ABS-MBS (US92540HAF38) | 0,50 | 0,61 | 0,6778 | 0,0084 | |||||

| US17322WAK09 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2014 6 3A3 144A | 0,50 | -2,56 | 0,6763 | -0,0139 | |||||

| US00162DAB10 / ALGXCC TL B 1L USD | 0,49 | -1,01 | 0,6688 | -0,0018 | |||||

| US93935GAA76 / WASHINGTON MUTUAL MORTGAGE PAS WMALT 2006 6 1CB1 | 0,48 | -0,82 | 0,6602 | -0,0004 | |||||

| MODENA BUYER LLC TERM LOAN / LON (US60753DAC83) | 0,48 | -0,83 | 0,6559 | -0,0006 | |||||

| RIGG34 / Transocean Ltd. - Depositary Receipt (Common Stock) | 0,46 | -5,52 | 0,6317 | -0,0317 | |||||

| VICI / VICI Properties Inc. | 0,01 | 0,00 | 0,44 | 0,00 | 0,6023 | 0,0036 | |||

| US12669QAA76 / COUNTRYWIDE ASSET BACKED CERTI CWL 2007 BC2 1A | 0,43 | -1,36 | 0,5939 | -0,0031 | |||||

| US36267QAA22 / Forward Air Corp | 0,42 | 6,00 | 0,5795 | 0,0363 | |||||

| 936UVD902 / SYNIVERSE PFD PIK PFDJJZ917 | 0,45 | 6,25 | 0,42 | 3,41 | 0,5795 | 0,0226 | |||

| DATABRICKS INC LAST OUT TERM LOAN / LON (BA000D206) | 0,41 | 0,24 | 0,5646 | 0,0051 | |||||

| QUIKRETE HOLDINGS INC SR SECURED 144A 03/32 6.375 / DBT (US74843PAA84) | 0,41 | 2,24 | 0,5620 | 0,0155 | |||||

| US126650BC35 / CVS PASS THROUGH TRUST PASS THRU CE 01/28 5.88 | 0,39 | -8,22 | 0,5349 | -0,0435 | |||||

| JETBLUE AIRWAYS/LOYALTY JETBLUE AIRWAYS/LOYALTY / DBT (US476920AA15) | 0,39 | -1,52 | 0,5317 | -0,0043 | |||||

| US22942JAC71 / CREDIT SUISSE MORTGAGE TRUST CSMC 2006 6 1A3 | 0,38 | -4,24 | 0,5253 | -0,0186 | |||||

| CLARITEV CORP SR SECURED 144A 03/31 6.75 / DBT (US62548MAA80) | 0,38 | 17,23 | 0,5211 | 0,0801 | |||||

| US61691KAQ40 / MORGAN STANLEY CAPITAL I TRUST 2017-ASHF SER 2017-ASHF CL F V/R REGD 144A P/P 6.11538000 | 0,38 | -0,79 | 0,5177 | -0,0015 | |||||

| US31556TAC36 / Fertitta Entertainment LLC / Fertitta Entertainment Finance Co Inc | 0,37 | 6,65 | 0,5044 | 0,0348 | |||||

| US50168EAN22 / MULTI-COLOR TERM B 1LN 10/22/2028 | 0,36 | 8,16 | 0,4889 | 0,0398 | |||||

| US83410JAA60 / SOHO TRUST 2021-SOHO SER 2021-SOHO CL A V/R REGD 144A P/P 2.78647500 | 0,36 | 0,85 | 0,4871 | 0,0078 | |||||

| US46627MER43 / JP Morgan Alternative Loan Trust 2006-S1 | 0,36 | -8,48 | 0,4867 | -0,0414 | |||||

| US71360HAB33 / PERATON CORP | 0,35 | -0,85 | 0,4811 | -0,0017 | |||||

| US35563CAB46 / FREDDIE MAC MILITARY HOUSING B FMMHR 2015 R1 XA1 144A | 0,35 | -2,23 | 0,4786 | -0,0072 | |||||

| US694308HL49 / PACIFIC GAS + ELECTRIC SR UNSECURED 03/45 4.3 | 0,35 | -3,59 | 0,4778 | -0,0141 | |||||

| US25470XBF15 / DISH DBS Corp. | 0,35 | 2,66 | 0,4738 | 0,0152 | |||||

| US893790AA34 / Transocean Aquila Ltd | 0,33 | -0,90 | 0,4500 | -0,0015 | |||||

| US69526PAC86 / Padagis LLC Term B Loan | 0,33 | -0,91 | 0,4440 | -0,0016 | |||||

| US92332YAD31 / Venture Global LNG Inc | 0,32 | 1,89 | 0,4426 | 0,0102 | |||||

| US073870AA51 / BEAR STEARNS ALT A TRUST BALTA 2007 2 1A1 | 0,32 | -0,32 | 0,4312 | 0,0016 | |||||

| US75605VAD47 / REALPAGE INC | 0,31 | 0,32 | 0,4299 | 0,0044 | |||||

| MNSH / MNSN Holdings Inc. | 0,00 | 0,00 | 0,31 | 8,07 | 0,4219 | 0,0344 | |||

| US362290AC25 / GSR Mortgage Loan Trust 2007-AR1 | 0,31 | -5,56 | 0,4183 | -0,0220 | |||||

| MAN GLG US CLO 2021 1 LTD GLGU 2021 1A SUB 144A / ABS-CBDO (US56166XAC39) | 0,30 | -12,43 | 0,4146 | -0,0555 | |||||

| US12668BRG04 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 OC2 2A3 | 0,30 | -0,67 | 0,4060 | -0,0005 | |||||

| US04649VBB53 / Asurion LLC, Term Loan B10 | 0,30 | 0,4035 | 0,4035 | ||||||

| US32027NTC55 / FIRST FRANKLIN MTG LOAN ASSET FFML 2005 FFH1 M3 | 0,29 | 0,3923 | 0,3923 | ||||||

| US525221DJ39 / Lehman XS Trust Series 2005-6 | 0,28 | -2,41 | 0,3891 | -0,0061 | |||||

| TREASURY BILL 08/25 0.00000 / DBT (US912797MG92) | 0,28 | 0,3888 | 0,3888 | ||||||

| US45567YAN58 / MH Sub I, LLC 2023 Term Loan | 0,28 | 0,3841 | 0,3841 | ||||||

| RFRF USD SF+26.161/1.7* 7/22/23-27Y* CME / DIR (EZPNTT021H26) | 0,28 | 2,22 | 0,3774 | 0,0105 | |||||

| US3137FURT39 / FREDDIE MAC FHR 4990 BI | 0,27 | 3,01 | 0,3750 | 0,0136 | |||||

| US63875JAL26 / NATIXIS COMMERCIAL MORTGAGE SE NCMS 2022 RRI D 144A | 0,26 | -0,38 | 0,3589 | 0,0012 | |||||

| US17315QAN60 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2010 4 3A6 144A | 0,26 | -3,33 | 0,3570 | -0,0095 | |||||

| RFR USD SOFR/4.25000 03/20/24-5Y* CME / DIR (000000000) | 0,25 | 0,3376 | 0,3376 | ||||||

| US22823JAC18 / CROWN CITY CLO CCITY 2020 2A SUB 144A | 0,25 | -6,82 | 0,3372 | -0,0213 | |||||

| US41161PYZ07 / HARBORVIEW MORTGAGE LOAN TRUST HVMLT 2005 16 3A1A | 0,23 | -0,43 | 0,3201 | 0,0005 | |||||

| APEX CREDIT CLO LLC APEXC 2021 2A SUB 144A / ABS-CBDO (US58406DAC39) | 0,23 | -14,87 | 0,3134 | -0,0525 | |||||

| US073868BE01 / BEAR STEARNS ALT A TRUST BALTA 2006 6 32A1 | 0,22 | -1,77 | 0,3037 | -0,0034 | |||||

| US92332YAC57 / Venture Global LNG Inc | 0,22 | 1,87 | 0,2977 | 0,0066 | |||||

| US17311BAC72 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2007 AMC1 A2C | 0,22 | -1,83 | 0,2942 | -0,0032 | |||||

| US90355YAA55 / US Renal Care Inc | 0,21 | 0,00 | 0,2913 | 0,0023 | |||||

| US89054XAD75 / Topaz Solar Farms LLC | 0,21 | -3,23 | 0,2878 | -0,0078 | |||||

| WASTE PRO USA INC SR UNSECURED 144A 02/33 7 / DBT (US94107JAC71) | 0,21 | 3,48 | 0,2842 | 0,0113 | |||||

| OLYMPUS WTR US HLDG CORP OLYMPUS WTR US HLDG CORP / DBT (US681639AD27) | 0,20 | 4,08 | 0,2788 | 0,0122 | |||||

| ASPIRE BAKERIES HOLDINGS LLC TERM LOAN / LON (BA00008X6) | 0,20 | 0,00 | 0,2724 | 0,0015 | |||||

| US46635TAR32 / JP MORGAN CHASE COMMERCIAL MOR JPMCC 2011 C3 XB 144A | 0,20 | -21,12 | 0,2716 | -0,0698 | |||||

| CENGAGE LEARNING INC 2024 1ST LIEN TERM LOAN B / LON (US15131YAQ89) | 0,20 | 0,51 | 0,2706 | 0,0032 | |||||

| US3137F9BQ35 / FREDDIE MAC FHR 5069 DI | 0,20 | -4,88 | 0,2662 | -0,0120 | |||||

| US46649JAL26 / J.P. Morgan Chase Commercial Mortgage Securities Trust 2018-ASH8 | 0,19 | -1,52 | 0,2662 | -0,0013 | |||||

| US71677KAB44 / PETM 7 3/4 02/15/29 | 0,19 | 6,01 | 0,2656 | 0,0163 | |||||

| US04625PAA93 / ARMOR HOLDCO IN 8.5 11/29 | 0,19 | -1,55 | 0,2620 | -0,0018 | |||||

| ENVISION HEALTHCARE CORPORATIO 2023 EXIT TERM LOAN / LON (US29414YAB02) | 0,19 | -0,52 | 0,2607 | 0,0016 | |||||

| US63546GAA13 / NATIONAL COLLEGIATE V COMMUTAT NCVCT 2007 43A6 1O 144A | 0,19 | -9,52 | 0,2596 | -0,0256 | |||||

| US31935HAD98 / First Brands Group LLC, First Lien Term Loan | 0,19 | 1,08 | 0,2554 | 0,0040 | |||||

| US31935HAG20 / First Brands Group, LLC, Senior Secured First Lien Term Loan | 0,19 | 0,54 | 0,2552 | 0,0041 | |||||

| US83206NAF42 / SMB PRIVATE EDUCATION LOAN TRU SMB 2022 B R 144A | 0,18 | -2,19 | 0,2453 | -0,0031 | |||||

| US29279XAA81 / ENDURANCE ACQ MERGER 6% 02/15/2029 144A | 0,18 | -2,78 | 0,2396 | -0,0045 | |||||

| US05953LAD10 / BANC OF AMERICA FUNDING CORPOR BAFC 2007 8 2A1 | 0,17 | 0,00 | 0,2373 | 0,0020 | |||||

| WINDSTREAMWARRANTS SLDENVWINDSTREAMWARRANTS / DE (000000000) | 0,17 | 0,2316 | 0,2316 | ||||||

| US3137FUYG35 / FREDDIE MAC FHR 4990 SN | 0,17 | 1,21 | 0,2285 | 0,0041 | |||||

| RFRF USD SF+26.161/1.6* 7/16/23-27Y* CME / DIR (EZGZ9MG6FMK3) | 0,17 | 2,47 | 0,2269 | 0,0062 | |||||

| US63546EAA64 / NATIONAL COLLEGIATE V COMMUTAT NCVCT 2007 33A6 1O 144A | 0,17 | -9,34 | 0,2266 | -0,0216 | |||||

| RFRF USD SF+26.161/1.6* 8/03/23-27Y* CME / DIR (EZ6355JKWWQ8) | 0,17 | 1,85 | 0,2262 | 0,0061 | |||||

| US63546CAA09 / NATIONAL COLLEGIATE V COMMUTAT NCVCT 2007 33A5 1O 144A | 0,16 | -9,55 | 0,2204 | -0,0216 | |||||

| IVANTI SOFTWARE INC 2025 NEWCO TERM LOAN / LON (US46583VAB53) | 0,16 | 0,2194 | 0,2194 | ||||||

| US12667F2R58 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 1CB 2A2 | 0,15 | -1,91 | 0,2108 | -0,0024 | |||||

| UNIT / Unity Group LLC | 0,03 | 0,00 | 0,15 | -14,29 | 0,2049 | -0,0326 | |||

| US126694U970 / COUNTRYWIDE HOME LOANS CWHL 2006 TM1 A1 | 0,15 | -0,68 | 0,2020 | 0,0010 | |||||

| US29279UAB26 / ENDURE DIGITAL INC TLB 3.5 | 0,15 | 2,84 | 0,1987 | 0,0072 | |||||

| US268668BD18 / EMC MORTGAGE LOAN TRUST EMCM 2002 B A1 144A | 0,14 | -0,69 | 0,1973 | -0,0004 | |||||

| US17025RAA32 / COUNTRYWIDE HOME LOANS CWHL 2007 HY4 1A1 | 0,14 | -2,82 | 0,1888 | -0,0042 | |||||

| US92922FUP16 / WAMU MORTGAGE PASS THROUGH CER WAMU 2004 AR8 A3 | 0,13 | -0,75 | 0,1804 | -0,0004 | |||||

| CCO / Clear Channel Outdoor Holdings, Inc. | 0,11 | 0,00 | 0,13 | 5,88 | 0,1725 | 0,0099 | |||

| US98162JAQ94 / Worldwide Plaza Trust 2017-WWP | 0,13 | -8,70 | 0,1721 | -0,0159 | |||||

| US92926UAA97 / WAMU MORTGAGE PASS THROUGH CER WAMU 2007 HY2 1A1 | 0,13 | -0,79 | 0,1708 | -0,0002 | |||||

| US61748HHP91 / MORGAN STANLEY MORTGAGE LOAN T MSM 2004 11AR B1 | 0,12 | 1,72 | 0,1612 | 0,0038 | |||||

| XAN5200EAB73 / Lealand Finance Company BV, Term Loan | 0,12 | 21,88 | 0,1605 | 0,0294 | |||||

| US96106JAE91 / WESTMORELAND COAL CO PIK TERM LOAN | 0,11 | 5,83 | 0,1494 | 0,0085 | |||||

| US53219LAV18 / LifePoint Health Inc | 0,11 | 2,86 | 0,1479 | 0,0046 | |||||

| US3136B9T562 / FANNIE MAE FNR 2020 37 IA | 0,11 | -3,64 | 0,1460 | -0,0037 | |||||

| CHOBANI LLC/FINANCE CORP CHOBANI LLC/FINANCE CORP / DBT (US17027NAC65) | 0,10 | 1,96 | 0,1425 | 0,0029 | |||||

| P2OD34 / Insulet Corporation - Depositary Receipt (Common Stock) | 0,10 | 2,97 | 0,1424 | 0,0045 | |||||

| BGC / BGC Group, Inc. | 0,10 | 0,98 | 0,1416 | 0,0021 | |||||

| C2AC34 / CACI International Inc - Depositary Receipt (Common Stock) | 0,10 | 0,1411 | 0,1411 | ||||||

| QUIKRETE HOLDINGS INC SR UNSECURED 144A 03/33 6.75 / DBT (US74843PAB67) | 0,10 | 4,04 | 0,1410 | 0,0058 | |||||

| RHP HOTEL PPTY/RHP FINAN COMPANY GUAR 144A 06/33 6.5 / DBT (US749571AL97) | 0,10 | 0,1405 | 0,1405 | ||||||

| US91889FAC59 / Valaris Ltd | 0,10 | 2,00 | 0,1402 | 0,0043 | |||||

| US761118TB44 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2006 QA1 A21 | 0,10 | -1,92 | 0,1402 | -0,0013 | |||||

| PERFORMANCE FOOD GROUP I PERFORMANCE FOOD GROUP I / DBT (US71376LAF76) | 0,10 | 3,03 | 0,1398 | 0,0049 | |||||

| AVNT / Avient Corporation | 0,10 | 1,01 | 0,1379 | 0,0034 | |||||

| VISTA MANAGEMENT HOLDING INC 2025 TERM LOAN B / LON (US92842EAB48) | 0,10 | 1,01 | 0,1370 | 0,0022 | |||||

| SPECIALTY BUILDING PRODU SR SECURED 144A 10/29 7.75 / DBT (US84749AAC18) | 0,10 | 6,52 | 0,1343 | 0,0089 | |||||

| US26881KAD63 / EP Purchaser, LLC 2023 Term Loan B | 0,10 | -2,02 | 0,1338 | -0,0017 | |||||

| TWITTER INC 2025 FIXED TERM LOAN / LON (US90184NAK46) | 0,10 | 0,1330 | 0,1330 | ||||||

| CTEV / Claritev Corporation | 0,10 | 14,46 | 0,1300 | 0,0169 | |||||

| DATABRICKS INC DELAYED DRAW TERM LOAN / LON (BA000D1C1) | 0,09 | 0,00 | 0,1250 | 0,0011 | |||||

| US09774XBP69 / BOMBARDIER CAPITAL MORTGAGE SE BCM 2000 A A3 | 0,09 | -7,53 | 0,1186 | -0,0077 | |||||

| US863579L482 / STRUCTURED ADJUSTABLE RATE MOR SARM 2005 23 3A1 | 0,09 | -3,37 | 0,1180 | -0,0038 | |||||

| US52520MGG24 / LEHMAN MORTGAGE TRUST LMT 2006 2 1A1 | 0,09 | -1,16 | 0,1169 | -0,0006 | |||||

| US16163EAD04 / CHASE MORTGAGE FINANCE CORPORA CHASE 2007 S2 1A4 | 0,08 | 0,00 | 0,1137 | 0,0002 | |||||

| US12668BBN29 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 81 A1 | 0,08 | -3,53 | 0,1124 | -0,0035 | |||||

| US86359A2N25 / STRUCTURED ASSET INVESTMENT LO SAIL 2003 BC10 B | 0,08 | 1,25 | 0,1113 | 0,0027 | |||||

| ENVISION HEALTHCARE CORPORTION 2023 1ST LIEN FIRST OUT TL / LON (949ABEII2) | 0,08 | 0,00 | 0,1111 | 0,0007 | |||||

| US74924DAA72 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2007 QS10 A1 | 0,08 | 0,00 | 0,1109 | 0,0006 | |||||

| US761118CW63 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2005 QS10 2A | 0,08 | -2,41 | 0,1106 | -0,0032 | |||||

| US55274QAL95 / MASTR ASSET SECURITIZATION TRU MASTR 2006 2 1A11 | 0,08 | -4,82 | 0,1087 | -0,0047 | |||||

| US073873AK72 / BEAR STEARNS ALT A TRUST BALTA 2006 5 2A2 | 0,08 | -4,82 | 0,1083 | -0,0045 | |||||

| US12544RAA68 / COUNTRYWIDE HOME LOANS CWHL 2007 4 1A1 | 0,08 | -1,30 | 0,1041 | -0,0013 | |||||

| US863579Y691 / STRUCTURED ADJUSTABLE RATE MOR SARM 2006 3 4A | 0,07 | -2,63 | 0,1020 | -0,0017 | |||||

| US57645WAA80 / MASTR ADJUSTABLE RATE MORTGAGE MARM 2007 R5 A1 144A | 0,07 | -2,82 | 0,0954 | -0,0012 | |||||

| US225470M675 / CREDIT SUISSE MORTGAGE TRUST CSMC 2006 3 1A4A | 0,07 | -1,52 | 0,0898 | -0,0000 | |||||

| US20846QEQ73 / CONSECO FINANCE SECURITIZATION CNF 2000 5 A6 | 0,06 | -5,88 | 0,0886 | -0,0040 | |||||

| US05946XHW65 / BANC OF AMERICA FUNDING CORPOR BAFC 2004 B 1A2 | 0,06 | 1,59 | 0,0876 | 0,0009 | |||||

| US456679AA77 / INDYMAC INDA MORTGAGE LOAN TRU INDA 2007 AR2 A1 | 0,06 | -1,56 | 0,0870 | -0,0001 | |||||

| US74957EAM93 / RESIDENTIAL FUNDING MTG SEC I RFMSI 2006 S5 A12 | 0,06 | -1,56 | 0,0870 | -0,0008 | |||||

| US06050HJH21 / BANC OF AMERICA MORTGAGE SECUR BOAMS 2002 E A1 | 0,06 | -4,62 | 0,0850 | -0,0035 | |||||

| US07386HUN96 / BEAR STEARNS ALT A TRUST BALTA 2005 5 26A1 | 0,06 | -1,64 | 0,0832 | -0,0002 | |||||

| US14983CAA36 / CBA COMMERCIAL SMALL BALANCE C CBAC 2006 2A A 144A | 0,06 | -9,09 | 0,0827 | -0,0072 | |||||

| US12637HAY45 / CREDIT SUISSE MORTGAGE TRUST CSMC 2006 4 9A1 | 0,06 | -1,67 | 0,0815 | -0,0007 | |||||

| US61744CKQ86 / MORGAN STANLEY CAPITAL INC MSAC 2005 HE1 M3 | 0,06 | -21,13 | 0,0774 | -0,0191 | |||||

| US04541GAL68 / ASSET BACKED SECURITIES CORP H ABSHE 1999 LB1 B1 | 0,06 | 0,00 | 0,0751 | -0,0005 | |||||

| US761136AH39 / RESIDENTIAL ASSET SECURITIZATI RAST 2007 A1 A8 | 0,05 | -3,64 | 0,0734 | -0,0013 | |||||

| US07386HKY61 / BEAR STEARNS ALT A TRUST BALTA 2004 9 1A1 | 0,05 | 0,00 | 0,0712 | -0,0001 | |||||

| CTEV / Claritev Corporation | 0,05 | 13,33 | 0,0706 | 0,0088 | |||||

| US12669GRM59 / COUNTRYWIDE HOME LOANS CWHL 2005 1 1A1 | 0,05 | -1,96 | 0,0684 | -0,0008 | |||||

| US059496AC37 / BANC OF AMERICA ALTERNATIVE LO BOAA 2007 1 2A1 | 0,05 | -2,00 | 0,0671 | -0,0018 | |||||

| US45661EDC57 / INDYMAC INDX MORTGAGE LOAN TRU INDX 2006 AR7 4A1 | 0,05 | 2,13 | 0,0656 | 0,0007 | |||||

| US14986DAJ90 / CD COMMERCIAL MORTGAGE TRUST CD 2006 CD3 AJ | 0,05 | -2,17 | 0,0621 | -0,0011 | |||||

| US3137FCLG73 / FHLMC MULTIFAMILY STRUCTURED P FHMS K071 X3 | 0,05 | -8,16 | 0,0620 | -0,0052 | |||||

| IHRT / iHeartMedia, Inc. | 0,03 | 0,00 | 0,05 | 7,14 | 0,0619 | 0,0042 | |||

| US61755GAJ22 / MORGAN STANLEY MORTGAGE LOAN T MSM 2007 12 3A1 | 0,04 | -6,38 | 0,0607 | -0,0032 | |||||

| US170256AD31 / COUNTRYWIDE HOME LOANS CWHL 2006 HYB5 2A1 | 0,04 | 0,00 | 0,0582 | 0,0000 | |||||

| US007036TA42 / ADJUSTABLE RATE MORTGAGE TRUST ARMT 2005 10 1A1 | 0,04 | -2,38 | 0,0571 | -0,0004 | |||||

| US748940AA13 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2006 QS7 A1 | 0,04 | -2,44 | 0,0550 | -0,0012 | |||||

| 952XGJII0 / EQTYWM927 WESTMORELAND MINING | 0,02 | 0,00 | 0,04 | -27,78 | 0,0536 | -0,0209 | |||

| RFRF USD SF+26.161/2.00 7/15/23-27Y* CME / DIR (EZCKQSYF2CV2) | 0,04 | 2,94 | 0,0485 | 0,0014 | |||||

| US878048AH04 / TBW MORTGAGE BACKED PASS THROU TBW 2006 2 4A1 | 0,04 | 0,00 | 0,0481 | -0,0003 | |||||

| US17307GB807 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2005 7 2A3A | 0,03 | -8,11 | 0,0472 | -0,0039 | |||||

| US05949A6L94 / BANC OF AMERICA MORTGAGE SECUR BOAMS 2005 E 3A1 | 0,03 | 0,00 | 0,0458 | -0,0001 | |||||

| US05533FCN96 / BCAP LLC TRUST BCAP 2011 R11 8A7 144A | 0,03 | -5,88 | 0,0437 | -0,0026 | |||||

| US59020UL375 / MLCC MORTGAGE INVESTORS INC MLCC 2005 3 1A | 0,03 | 0,00 | 0,0427 | -0,0003 | |||||

| IHRTB / iHeartMedia, Inc. | 0,02 | 0,00 | 0,03 | 3,45 | 0,0423 | 0,0029 | |||

| US57109J1088 / MARLETTE FUNDING TRUST MFT 2020 1A CERT 144A | 0,03 | -42,55 | 0,0374 | -0,0269 | |||||

| US058928AN26 / BANC OF AMERICA FUNDING CORPOR BAFC 2006 B 7A1 | 0,03 | 0,00 | 0,0369 | 0,0000 | |||||

| US61911BAA35 / MORTGAGE EQUITY CONVERSION ASS MECA 2010 1A A 144A | 0,03 | -3,70 | 0,0360 | -0,0009 | |||||

| CLOVER HOLDINGS SPV III LLC 2024 USD TERM LOAN / LON (BA000CCJ6) | 0,03 | 4,00 | 0,0360 | 0,0020 | |||||

| US05951GAB86 / BANC OF AMERICA FUNDING CORPOR BAFC 2007 2 TA1B | 0,03 | -3,70 | 0,0360 | -0,0019 | |||||

| US78471C1099 / SOCIAL PROFESSIONAL LOAN PROGR SOFI 2017 D R1 144A | 0,03 | -10,71 | 0,0355 | -0,0028 | |||||

| US2254W0FJ95 / CREDIT SUISSE FIRST BOSTON MOR CSFB 2003 1 1A1 | 0,02 | 0,00 | 0,0330 | -0,0002 | |||||

| RFR USD SOFR/3.75000 12/20/23-5Y LCH / DIR (EZQ1LP9YKNN9) | 0,02 | 666,67 | 0,0314 | 0,0266 | |||||

| RFR USD SOFR/3.50000 12/20/23-10Y LCH / DIR (EZ4G8FZQ8LF2) | 0,02 | -37,14 | 0,0313 | -0,0175 | |||||

| US59020UJP12 / MLCC MORTGAGE INVESTORS INC MLCC 2004 E A1 | 0,02 | -8,33 | 0,0308 | -0,0030 | |||||

| US12668AA620 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 64CB 2A1 | 0,02 | 0,00 | 0,0304 | -0,0003 | |||||

| XAN5200EAC56 / McDermott Technology Americas Inc 2020 Make Whole Term Loan | 0,02 | 21,43 | 0,0243 | 0,0048 | |||||

| 902LVFII8 / WEST MARINE NEW COMMON STOCK EQTYWM9A9 | 0,00 | 0,00 | 0,02 | 0,00 | 0,0237 | 0,0002 | |||

| RFR USD SOFR/3.75000 12/20/23-5Y CME / DIR (EZQ1LP9YKNN9) | 0,02 | 466,67 | 0,0234 | 0,0186 | |||||

| US07388NAH98 / BEAR STEARNS COMMERCIAL MORTGA BSCMS 2006 T24 B 144A | 0,02 | -10,53 | 0,0233 | -0,0033 | |||||

| CLOVER 2024 HOLDINGS INC VERITAS G PREFERRED / EP (955EHZ901) | 0,00 | 0,00 | 0,02 | 6,25 | 0,0232 | 0,0010 | |||

| US07386HL339 / BEAR STEARNS ALT A TRUST BALTA 2006 3 22A1 | 0,02 | 0,00 | 0,0211 | 0,0000 | |||||

| US90263AAF75 / UCFC MANUFACTURED HOUSING CONT UCFCM 1996 1 M | 0,01 | -26,32 | 0,0195 | -0,0073 | |||||

| US07387UCT60 / BEAR STEARNS ASSET BACKED SECU BSABS 2006 AC1 21A1 | 0,01 | 0,00 | 0,0187 | -0,0002 | |||||

| RFRF USD SF+26.161/1.3* 07/20/23-8Y CME / DIR (EZ9FNSJ35BR1) | 0,01 | -13,33 | 0,0182 | -0,0024 | |||||

| RFRF USD SF+26.161/1.3* 07/19/23-8Y CME / DIR (EZRK184JRG97) | 0,01 | -13,33 | 0,0181 | -0,0024 | |||||

| CLOVER 2024 HOLDINGS INC VERITAS G 1 PREFERRED / EP (955EKAII3) | 0,00 | 0,00 | 0,01 | 0,00 | 0,0160 | 0,0007 | |||

| US36157RD939 / GE CAPITAL MTG SERVICES INC GECMS 1999 HE1 M | 0,01 | -8,33 | 0,0157 | -0,0009 | |||||

| 3 MONTH SOFR FUT JUN25 XCME 20250916 / DIR (000000000) | 0,01 | 0,0148 | 0,0148 | ||||||

| US86361JAY64 / STRUCTURED ADJUSTABLE RATE MOR SARM 2006 8 4A3 | 0,01 | 0,00 | 0,0147 | -0,0002 | |||||

| US07386XAH98 / BEAR STEARNS ALT A TRUST BALTA 2007 1 21A1 | 0,01 | 0,00 | 0,0132 | 0,0000 | |||||

| US758842AA60 / REGAL TRUST IV REGAL 1999 1 A 144A | 0,01 | -14,29 | 0,0095 | -0,0006 | |||||

| US59020UWU59 / MLCC MORTGAGE INVESTORS INC MLCC 2005 B A1 | 0,01 | -14,29 | 0,0095 | -0,0003 | |||||

| RFR USD SOFR/2.30000 01/17/24-2Y LCH / DIR (EZ7DPVG1XS64) | 0,01 | 0,00 | 0,0081 | 0,0007 | |||||

| 935ZXN908 / WESTMORELAND MINING HOLDINGS L COMMON | 0,01 | 0,00 | 0,01 | -44,44 | 0,0078 | -0,0054 | |||

| US46630GAM78 / JP MORGAN MORTGAGE TRUST JPMMT 2007 A1 4A1 | 0,01 | 0,00 | 0,0076 | -0,0001 | |||||

| US589929W877 / Merrill Lynch Mortgage Investors Trust MLMI, Series 2003-A4, Class 3A | 0,01 | 0,00 | 0,0074 | -0,0000 | |||||

| 3 MONTH SOFR FUT SEP25 XCME 20251216 / DIR (000000000) | 0,00 | 0,0065 | 0,0065 | ||||||

| 3 MONTH SOFR FUT DEC25 XCME 20260317 / DIR (000000000) | 0,00 | 0,0053 | 0,0053 | ||||||

| US3137B5RQ89 / FREDDIE MAC FHR 4265 IA | 0,00 | 0,00 | 0,0045 | -0,0008 | |||||

| 3 MONTH SOFR FUT MAR26 XCME 20260616 / DIR (000000000) | 0,00 | 0,0043 | 0,0043 | ||||||

| MNSH / MNSN Holdings Inc. | 0,00 | 0,00 | 0,00 | 0,00 | 0,0028 | -0,0003 | |||

| US126670JY52 / COUNTRYWIDE HOME LOANS CWHL 2005 HYB9 3A2A | 0,00 | 0,00 | 0,0022 | -0,0000 | |||||

| US59020UAC99 / MLCC MORTGAGE INVESTORS, INC. - SERIES 2004 | 0,00 | 0,00 | 0,0021 | -0,0000 | |||||

| US30162RAD35 / Exela Intermediate LLC/Exela Finance, Inc. | 0,00 | -100,00 | 0,0010 | -0,0020 | |||||

| MCDIF / Mcdermott International Ltd. | 0,00 | 0,00 | 0,00 | 0,0009 | -0,0004 | ||||

| US57109H1023 / MARLETTE FUNDING TRUST MFT 2019 2A CERT 144A | 0,00 | -100,00 | 0,0008 | -0,0043 | |||||

| US23308LAC81 / DBGS MORTGAGE TRUST DBGS 2021 W52 XCP 144A | 0,00 | 0,0002 | 0,0000 | ||||||

| US32051GPZ27 / FIRST HORIZON ALTERNATIVE MORT FHAMS 2005 AA6 2A2 | 0,00 | 0,0001 | -0,0000 | ||||||

| US36249KAE01 / GS MORTGAGE SECURITIES TRUST GSMS 2010 C1 X 144A | 0,00 | 0,0000 | -0,0010 | ||||||

| MNSH / MNSN Holdings Inc. | 0,00 | 0,00 | 0,00 | 0,0000 | 0,0000 | ||||

| US61751XAX84 / MORGAN STANLEY CAPITAL I TRUST MSC 2007 T25 X 144A | 0,00 | 0,0000 | 0,0000 | ||||||

| US33845V1017 / FLAGSHIP CREDIT AUTO TRUST FCAT 2022 1 R 144A | 0,00 | -100,00 | 0,0000 | -0,0497 | |||||

| US92918XAA37 / Voyager Aviation Holdings LLC | 0,00 | 0,0000 | 0,0000 | ||||||

| WEST MARINE NEW WARRANT WARRWM911 / DE (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| RFRF USD SF+26.161/1.2* 9/15/23-3Y* CME / DIR (EZ8H8SK9HY04) | -0,01 | -12,50 | -0,0107 | 0,0013 | |||||

| ABX.HE.PENAAA.07-1 SP GST / DCR (000000000) | -0,01 | -0,0108 | -0,0108 | ||||||

| RFRF USD SF+26.161/0.50 9/16/23-5Y* CME / DIR (EZTP4L47M699) | -0,01 | -14,29 | -0,0173 | 0,0024 | |||||

| BONYTORONTO DOMINION SECURITIE REPO - 31Dec34 / RA (000000000) | -0,02 | -0,0257 | -0,0257 | ||||||

| RFR USD SOFR/3.25000 06/18/25-5Y LCH / DIR (EZH1N8KH2K02) | -0,06 | -0,0800 | -0,0800 | ||||||

| RFRF USD SF+26.161/1.5* 7/20/23-4Y* CME / DIR (EZSDJCSH40R0) | -0,07 | -24,73 | -0,0965 | 0,0301 | |||||

| CREDIT AGRICOLE SECURITIES (US REPO - 04Sep25 / RA (000000000) | -0,09 | -0,1176 | -0,1176 | ||||||

| CREDIT AGRICOLE SECURITIES (US REPO - 27Oct25 / RA (000000000) | -0,10 | -0,1332 | -0,1332 | ||||||

| UBS SECURITIES LLC REPO - 19Nov25 / RA (000000000) | -0,10 | -0,1356 | -0,1356 | ||||||

| ABX.HE.AA.06-1 SP GST / DCR (000000000) | -0,11 | -0,1455 | -0,1455 | ||||||

| RFRF USD SF+26.161/1.70 7/12/23-6Y* CME / DIR (EZXVK45PR3N6) | -0,13 | -20,71 | -0,1837 | 0,0456 | |||||

| BNYMELLONRE RBC BARBADOS REPO - 08Aug25 / RA (000000000) | -0,16 | -0,2143 | -0,2143 | ||||||

| CREDIT AGRICOLE SECURITIES (US REPO - 04Sep25 / RA (000000000) | -0,17 | -0,2387 | -0,2387 | ||||||

| CREDIT AGRICOLE SECURITIES (US REPO - 04Sep25 / RA (000000000) | -0,18 | -0,2495 | -0,2495 | ||||||

| THE BANK OF NYDBAG LONDON GLOB REPO - 22Aug25 / RA (000000000) | -0,22 | -0,3048 | -0,3048 | ||||||

| MIZUHO SECURITIES USAFIXED INC REPO - 19Dec25 / RA (000000000) | -0,27 | -0,3628 | -0,3628 | ||||||

| SCOTIA CAPITAL (USA) INC.AS AG REPO - 31Dec35 / RA (000000000) | -0,29 | -0,3894 | -0,3894 | ||||||

| CREDIT AGRICOLE SECURITIES (US REPO - 04Sep25 / RA (000000000) | -0,29 | -0,3941 | -0,3941 | ||||||

| MIZUHO SECURITIES USAFIXED INC REPO - 19Dec25 / RA (000000000) | -0,30 | -0,4105 | -0,4105 | ||||||

| BOFA SECURITIES, INC. FIXED I REPO - 31Dec35 / RA (000000000) | -0,31 | -0,4252 | -0,4252 | ||||||

| BARCLAYS BANK PLC LONDON BRANC REPO - 31Dec35 / RA (000000000) | -0,34 | -0,4710 | -0,4710 | ||||||

| CREDIT AGRICOLE SECURITIES (US REPO - 04Sep25 / RA (000000000) | -0,35 | -0,4733 | -0,4733 | ||||||

| THE BANK OF NEW YORK MELLON REPO - 07Jul25 / RA (000000000) | -0,35 | -0,4824 | -0,4824 | ||||||

| UBS SECURITIES LLC REPO - 08Jul25 / RA (000000000) | -0,36 | -0,4880 | -0,4880 | ||||||

| SG AMERICAS SECURITIES LLC REPO - 24Sep25 / RA (000000000) | -0,36 | -0,4977 | -0,4977 | ||||||

| BNP PARIBAS NY BRANCHPARIS BON REPO - 23Oct25 / RA (000000000) | -0,40 | -0,5474 | -0,5474 | ||||||

| BNP PARIBAS NY BRANCHPARIS BON REPO - 23Oct25 / RA (000000000) | -0,40 | -0,5483 | -0,5483 | ||||||

| BARCLAYS BANK PLC LONDON BRANC REPO - 22Oct25 / RA (000000000) | -0,42 | -0,5726 | -0,5726 | ||||||

| BNY CLEARING SERVICES LLC REPO - 21Oct25 / RA (000000000) | -0,46 | -0,6311 | -0,6311 | ||||||

| SCOTIA CAPITAL (USA) INC.AS AG REPO - 21Jul25 / RA (000000000) | -0,51 | -0,7017 | -0,7017 | ||||||

| BNY CLEARING SERVICES LLC REPO - 21Oct25 / RA (000000000) | -0,52 | -0,7058 | -0,7058 | ||||||

| GOLDMAN SACHS BANK USA 2 REPO - 04Mar26 / RA (000000000) | -0,52 | -0,7157 | -0,7157 | ||||||

| THE BANK OF NYDBAG LONDON GLOB REPO - 31Dec35 / RA (000000000) | -0,57 | -0,7754 | -0,7754 | ||||||

| THE BANK OF NEW YORK MELLON REPO - 07Jul25 / RA (000000000) | -0,60 | -0,8195 | -0,8195 | ||||||

| BARCLAYS BANK PLC LONDON BRANC REPO - 22Oct25 / RA (000000000) | -0,61 | -0,8315 | -0,8315 | ||||||

| THE BANK OF NEW YORK MELLON REPO - 14Oct25 / RA (000000000) | -0,62 | -0,8422 | -0,8422 | ||||||

| BARCLAYS BANK PLC LONDON BRANC REPO - 04Aug25 / RA (000000000) | -0,62 | -0,8492 | -0,8492 | ||||||

| BARCLAYS BANK PLC LONDON BRANC REPO - 15Sep25 / RA (000000000) | -0,63 | -0,8597 | -0,8597 | ||||||

| MIZUHO SECURITIES USAFIXED INC REPO - 19Dec25 / RA (000000000) | -0,63 | -0,8658 | -0,8658 | ||||||

| CREDIT AGRICOLE SECURITIES (US REPO - 17Sep25 / RA (000000000) | -0,67 | -0,9145 | -0,9145 | ||||||

| SG AMERICAS SECURITIES LLC REPO - 19Nov25 / RA (000000000) | -0,68 | -0,9249 | -0,9249 | ||||||

| CREDIT AGRICOLE SECURITIES (US REPO - 10Jul25 / RA (000000000) | -0,69 | -0,9443 | -0,9443 | ||||||

| UBS SECURITIES LLC REPO - 10Sep25 / RA (000000000) | -0,73 | -0,9998 | -0,9998 | ||||||

| CREDIT AGRICOLE SECURITIES (US REPO - 17Sep25 / RA (000000000) | -0,77 | -1,0448 | -1,0448 | ||||||

| BNP PARIBAS NY BRANCHPARIS BON REPO - 22Jul25 / RA (000000000) | -0,77 | -1,0457 | -1,0457 | ||||||

| BNP PARIBAS NY BRANCHPARIS BON REPO - 22Jul25 / RA (000000000) | -0,77 | -1,0532 | -1,0532 | ||||||

| MIZUHO SECURITIES USAFIXED INC REPO - 19Dec25 / RA (000000000) | -0,80 | -1,0900 | -1,0900 | ||||||

| BARCLAYS BANK PLC LONDON BRANC REPO - 31Dec34 / RA (000000000) | -0,81 | -1,1094 | -1,1094 | ||||||

| THE BANK OF NEW YORK MELLON REPO - 07Jul25 / RA (000000000) | -0,82 | -1,1143 | -1,1143 | ||||||

| UBS SECURITIES LLC REPO - 08Jul25 / RA (000000000) | -0,82 | -1,1255 | -1,1255 | ||||||

| BNY CLEARING SERVICES LLC REPO - 21Oct25 / RA (000000000) | -0,99 | -1,3458 | -1,3458 | ||||||

| UBS SECURITIES LLC REPO - 08Jul25 / RA (000000000) | -0,99 | -1,3564 | -1,3564 | ||||||

| BNP PARIBAS NY BRANCHPARIS BON REPO - 23Oct25 / RA (000000000) | -1,29 | -1,7546 | -1,7546 | ||||||

| BNP PARIBAS NY BRANCHPARIS BON REPO - 23Oct25 / RA (000000000) | -1,34 | -1,8229 | -1,8229 | ||||||

| UBS SECURITIES LLC REPO - 10Sep25 / RA (000000000) | -1,55 | -2,1204 | -2,1204 | ||||||

| BNP PARIBAS NY BRANCHPARIS BON REPO - 23Oct25 / RA (000000000) | -1,62 | -2,2101 | -2,2101 | ||||||

| MIZUHO SECURITIES USAFIXED INC REPO - 19Dec25 / RA (000000000) | -2,10 | -2,8729 | -2,8729 | ||||||

| BNP PARIBAS NY BRANCHPARIS BON REPO - 23Oct25 / RA (000000000) | -2,63 | -3,5949 | -3,5949 | ||||||

| UBS SECURITIES LLC REPO - 08Jul25 / RA (000000000) | -4,12 | -5,6243 | -5,6243 |