Statistiche di base

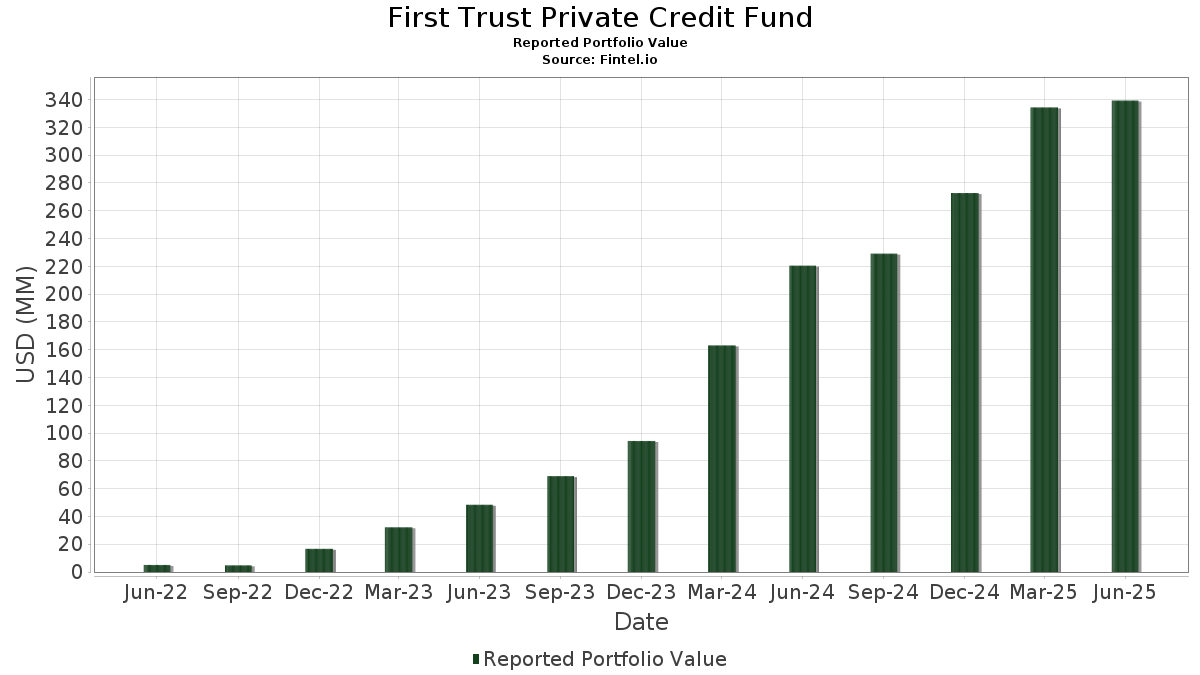

| Valore del portafoglio | $ 339.221.566 |

| Posizioni attuali | 326 |

Ultime partecipazioni, performance, AUM (da depositi 13F, 13D)

First Trust Private Credit Fund ha dichiarato un totale di 326 partecipazioni negli ultimi documenti depositati presso la SEC. Il valore più recente del portafoglio è pari a $ 339.221.566 USD. Il patrimonio gestito effettivo (AUM) corrisponde a questo valore più la liquidità (che non viene dichiarata). Le principali partecipazioni di First Trust Private Credit Fund sono Deerpath Capital CLO 2020-1, Ltd. (KY:US24460RBE27) , Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class (US:US61747C7074) , Credit Linked Note (CA:XS2608243098) , Project Leopard Holdings, Inc. - First Lien (US:US74338UAG67) , and Palmer Square Capital BDC Inc. (US:PSBD) . Le nuove posizioni di First Trust Private Credit Fund includono Deerpath Capital CLO 2020-1, Ltd. (KY:US24460RBE27) , Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class (US:US61747C7074) , Credit Linked Note (CA:XS2608243098) , Project Leopard Holdings, Inc. - First Lien (US:US74338UAG67) , and MCF CLO LLC SERIES: 2018-1A CLASS: SUB (US:USG59314AB30) .

Gli aumenti più importanti di questo trimestre

Utilizziamo la variazione dell'allocazione del portafoglio perché è l'indicatore più significativo. Le variazioni possono essere dovute a transazioni o a variazioni dei prezzi delle azioni.

| Titolo | Azioni (in milioni) |

Valore (in milioni di $) |

Portafoglio % | ΔPortafoglio % |

|---|---|---|---|---|

| 8,96 | 2,1375 | 2,1375 | ||

| 8,88 | 2,1190 | 2,1190 | ||

| 8,49 | 2,0272 | 2,0272 | ||

| 8,08 | 1,9291 | 1,9291 | ||

| 7,67 | 1,8318 | 1,8318 | ||

| 6,80 | 1,6226 | 1,6226 | ||

| 6,18 | 1,4739 | 1,4739 | ||

| 6,13 | 1,4620 | 1,4620 | ||

| 5,89 | 1,4058 | 1,4058 | ||

| 5,55 | 1,3254 | 1,3254 |

Gli aumenti più importanti di questo trimestre

Utilizziamo la variazione dell'allocazione del portafoglio perché è l'indicatore più significativo. Le variazioni possono essere dovute a transazioni o a variazioni dei prezzi delle azioni.

| Titolo | Azioni (in milioni) |

Valore (in milioni di $) |

Portafoglio % | ΔPortafoglio % |

|---|---|---|---|---|

| -35,47 | -8,4651 | -8,4651 | ||

| -18,00 | -4,2962 | -4,2962 | ||

| -11,96 | -2,8544 | -2,8544 | ||

| -10,40 | -2,4812 | -2,4812 | ||

| -3,27 | -0,7804 | -0,7804 | ||

| -3,16 | -0,7532 | -0,7532 | ||

| -2,56 | -0,6112 | -0,6112 | ||

| 23,18 | 5,5319 | -0,5984 | ||

| -2,41 | -0,5744 | -0,5744 | ||

| -2,08 | -0,4955 | -0,4955 |

13F e depositi di fondi

Questo modulo è stato depositato il 2025-08-29 per il periodo di riferimento 2025-06-30. Fai clic sull'icona del link per visualizzare la cronologia completa delle transazioni.

Esegui l'upgrade per sbloccare i dati premium ed esportarli in Excel ![]() .

.

| Titolo | Tipo | Prezzo medio dell'azione | Azioni (in milioni) |

ΔAzioni (%) |

ΔAzioni (%) |

Valore (in milioni di $) |

Portafoglio (%) |

ΔPortafoglio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| UMB MONEY MARKET II SPECIAL / / STIV (SF8888628) | 23,18 | -5,49 | 5,5319 | -0,5984 | |||||

| GREGORY SPV SRL VAR RT12/30/2045 / / ABS-MBS (BCC3LJFB9) | 11,78 | 8,93 | 2,8116 | 0,1086 | |||||

| Audax Private Credit FTPC / / (999999999) | 8,96 | 2,1375 | 2,1375 | ||||||

| DSC MERIDIAN LP / / (999999999) | 8,88 | 2,1190 | 2,1190 | ||||||

| LINDEN INVESTORS LP / / (999999999) | 8,49 | 2,0272 | 2,0272 | ||||||

| ACER TREE CREDIT OPP PARTNERS LP / / (999999999) | 8,08 | 1,9291 | 1,9291 | ||||||

| TCW DIRECT LENING VIII LLC FTPC / / (999999999) | 7,67 | 1,8318 | 1,8318 | ||||||

| OLD ORCHARD CRDIT FUND LP FTPCF / / (999999999) | 6,80 | 1,6226 | 1,6226 | ||||||

| WHITEHAWK SHRYNE TERM LOAN / / LON (999999999) | 6,18 | 1,4739 | 1,4739 | ||||||

| PYMES Magdalena / ABS-CBDO (ES0305901003) | 6,13 | 1,4620 | 1,4620 | ||||||

| ARTS SPV SRL VAR RT11/30/2041 / / ABS-MBS (999999999) | 5,89 | 1,4058 | 1,4058 | ||||||

| US24460RBE27 / Deerpath Capital CLO 2020-1, Ltd. | 5,55 | 1,3254 | 1,3254 | ||||||

| Russell Investments U.S. Institutional Holdco, Inc. / LON (US78249LAE02) | 5,34 | -2,25 | 1,2752 | -0,0911 | |||||

| LEGO 2023-1 B VAR RT 6/25/2035 / / ABS-MBS (999999999) | 5,23 | 1,2484 | 1,2484 | ||||||

| GRANVILLE USD Ltd. VAR RT 02/15/2030 / / ABS-MBS (BCC3KJ828) | 5,00 | 0,00 | 1,1934 | -0,0565 | |||||

| RHF VI FUNDING LLC ROCKBRIDGE FM / / LON (999999999) | 5,00 | 1,1934 | 1,1934 | ||||||

| WHITEHAWK NEPH TERM LOAN / / LON (999999999) | 4,97 | 1,1874 | 1,1874 | ||||||

| Resolute Investment Managers, Inc. / LON (US04635WAL81) | 4,94 | -0,30 | 1,1786 | -0,0597 | |||||

| LBBW LION-6 SNR 10/30/2036 / / ABS-MBS (BCC3JWDF6) | 4,73 | -2,86 | 1,1281 | -0,0883 | |||||

| PMA - PROJECT PINNAC TERM LOAN 1/31/31 / / LON (999999999) | 4,61 | 1,1008 | 1,1008 | ||||||

| Palmer Square Loan Funding 2025-1 Ltd. / ABS-CBDO (US69703VAC00) | 4,17 | 0,46 | 0,9952 | -0,0422 | |||||

| SEER CAPITAL REG CAPITAL RELIEF FUND / / (999999999) | 4,14 | 0,9877 | 0,9877 | ||||||

| LLOYDS BANK PLC 12/16/2030 / / ABS-MBS (BCC3JSBN0) | 4,13 | 6,44 | 0,9866 | 0,0157 | |||||

| Ducati 2024-1 CLN VAR 06/20/2030 / / ABS-MBS (BCC3F2FG2) | 4,13 | 6,49 | 0,9866 | 0,0162 | |||||

| TCW IPSEN TL LLC / / LON (999999999) | 4,03 | 0,9620 | 0,9620 | ||||||

| Palmer Square European Loan Funding 2024-2 DAC / ABS-CBDO (XS2865670454) | 4,01 | 6,83 | 0,9563 | 0,0188 | |||||

| TCW RESCUE FINANCING / / (999999999) | 3,99 | 0,9512 | 0,9512 | ||||||

| RISKONNECT DDTL 12/07/28 / / LON (999999999) | 3,97 | 0,9476 | 0,9476 | ||||||

| COOPER MACH TL 12/13/27 / / LON (999999999) | 3,96 | 0,9452 | 0,9452 | ||||||

| TCW Co.-Invest TL CONNECT AMERICA / / LON (999999999) | 3,91 | 0,9321 | 0,9321 | ||||||

| TCW KICHLER LIGHTING / / LON (999999999) | 3,89 | 0,9290 | 0,9290 | ||||||

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 3,89 | 318,28 | 0,9285 | 0,6960 | |||||

| SYNAMEDIA AMERICAS HOLDINGS T/L / / LON (999999999) | 3,79 | 0,9056 | 0,9056 | ||||||

| CB_Buyer_TL_7/1/31 TERM LOAN / / LON (999999999) | 3,78 | 0,9025 | 0,9025 | ||||||

| NEPTUNE BIDCO US, Inc. Nielsen_2L_TL_10/11/ / / LON (999999999) | 3,52 | 0,8407 | 0,8407 | ||||||

| Neuberger Berman Loan Advisers Clo 61 Ltd. / ABS-CBDO (US640985AE71) | 3,45 | 0,8236 | 0,8236 | ||||||

| IDC INFUSION TL 2 7/7/28 TERM LOAN / / LON (999999999) | 3,45 | 0,8228 | 0,8228 | ||||||

| LLOYDS BANK PLC 12/16/2030 / / ABS-MBS (BCC3JSBM2) | 3,44 | 6,31 | 0,8203 | 0,0122 | |||||

| XS2608243098 / Credit Linked Note | 3,10 | -0,74 | 0,7393 | -0,0406 | |||||

| NXT CAPITAL CLO 2026-1 CLO EQUITY / / ABS-MBS (999999999) | 3,08 | 0,7359 | 0,7359 | ||||||

| Fondo de Titulizacion Magdalena 11 / ABS-CBDO (ES0305863005) | 3,06 | -5,67 | 0,7304 | -0,0806 | |||||

| AUDAX Co.-INVEST TL / / LON (999999999) | 3,06 | 0,7302 | 0,7302 | ||||||

| APOGEM MCF CLO 12 CLO / / ABS-MBS (999999999) | 3,03 | 0,7242 | 0,7242 | ||||||

| SEPRO HOLDINGS TERM LOAN / / LON (999999999) | 2,97 | 0,7086 | 0,7086 | ||||||

| Palmer Square European CLO 2024-2 DAC / ABS-CBDO (XS2849655076) | 2,97 | 1,40 | 0,7079 | -0,0232 | |||||

| Dentive_IncrDDTL 12/26/28 / / LON (999999999) | 2,92 | 0,6962 | 0,6962 | ||||||

| TCW ACCURAY, Inc. TL / / LON (999999999) | 2,89 | 0,6890 | 0,6890 | ||||||

| Palmer Square CLO 2024-4 Ltd. / ABS-CBDO (US69703XAC65) | 2,88 | -5,33 | 0,6874 | -0,0730 | |||||

| Deutsche Bank A.G./CRAFT / ABS-CBDO (XS2387449890) | 2,86 | -0,38 | 0,6822 | -0,0351 | |||||

| TCW FROST BUYER T/L LLC / / LON (999999999) | 2,81 | 0,6705 | 0,6705 | ||||||

| AUDAX SUMMIT SPINE TL / / LON (999999999) | 2,71 | 0,6473 | 0,6473 | ||||||

| COLSS 2024-2 F Mtge VAR RT 05/22/2034 / / ABS-MBS (BCC3GBMB4) | 2,69 | -2,29 | 0,6415 | -0,0460 | |||||

| MESP 2024-1 B MTGE VAR 07/28/2032 / / ABS-MBS (BCC3G0FW0) | 2,68 | -7,83 | 0,6407 | -0,0874 | |||||

| WEG_JAN2024_DDTL 10/4/27 DDTL / / LON (999999999) | 2,60 | 0,6210 | 0,6210 | ||||||

| US74338UAG67 / Project Leopard Holdings, Inc. - First Lien | 2,53 | 4,59 | 0,6034 | -0,0010 | |||||

| Palmer Square Loan Funding 2024-2 Ltd. / ABS-CBDO (US69703HAC16) | 2,52 | -16,27 | 0,6010 | -0,1506 | |||||

| USN GloNeph TL MATURITY 12/21/26 / / LON (999999999) | 2,47 | 0,5885 | 0,5885 | ||||||

| Palmer Square CLO 2024-2 Ltd. / ABS-CBDO (US69703MAC01) | 2,47 | -6,38 | 0,5884 | -0,0700 | |||||

| H.W LOCHNER LLC TERM LOAN / / LON (999999999) | 2,43 | 0,5791 | 0,5791 | ||||||

| Palmer Square Loan Funding 2024-3 Ltd. / ABS-CBDO (US69690RAC43) | 2,37 | -13,88 | 0,5657 | -0,1223 | |||||

| Deutsche Bank A.G./GATE 2025-1 / ABS-CBDO (XS3046287747) | 2,36 | 0,5623 | 0,5623 | ||||||

| Palmer Square European Loan Funding 2025-2 DAC / ABS-CBDO (XS3070650455) | 2,36 | 0,5623 | 0,5623 | ||||||

| Palmer Square European Loan Funding 2024-1 DAC / ABS-CBDO (XS2775058782) | 2,35 | 10,07 | 0,5609 | 0,0270 | |||||

| AUDAX MEDTECH TL / / LON (999999999) | 2,33 | 0,5568 | 0,5568 | ||||||

| Palmer Square European Loan Funding 2024-3 DAC / ABS-CBDO (XS2921573551) | 2,28 | 9,83 | 0,5443 | 0,0251 | |||||

| LBBW LION-5 MEZ MTGE VAR 07/31/2034 / / ABS-MBS (999999999) | 2,27 | 0,5425 | 0,5425 | ||||||

| PSBD / Palmer Square Capital BDC Inc. | 0,16 | 0,00 | 2,27 | 4,80 | 0,5420 | 0,0004 | |||

| MCF CLO VIII Ltd. / ABS-CBDO (US55281QAG10) | 2,20 | -0,99 | 0,5263 | -0,0304 | |||||

| U.S. Bank N.A. / ABS-CBDO (US90357PBJ21) | 2,17 | -13,08 | 0,5188 | -0,1062 | |||||

| Palmer Square CLO 2025-1 Ltd. / ABS-CBDO (US69703UAC27) | 2,16 | -4,56 | 0,5153 | -0,0501 | |||||

| AUDAX NMA HOLDINGS TL / / LON (999999999) | 2,08 | 0,4964 | 0,4964 | ||||||

| Palmer Square European CLO 2024-1 DAC / ABS-CBDO (XS2815973024) | 2,02 | -0,88 | 0,4813 | -0,0272 | |||||

| WHITEHAWK C3 FINANCE TERM LOAN 04/22/2027 / / LON (999999999) | 2,01 | 0,4797 | 0,4797 | ||||||

| Palmer Square CLO 2025-2 Ltd. / ABS-CBDO (US69704DAC92) | 2,01 | 0,4790 | 0,4790 | ||||||

| LEONARD VALVE TERM LOAN 09/30/2027 / / LON (999999999) | 2,00 | 0,4762 | 0,4762 | ||||||

| Palmer Square Loan Funding 2024-1 Ltd. / ABS-CBDO (US69703QAE70) | 1,99 | -11,23 | 0,4739 | -0,0853 | |||||

| WHITEHAWK IV PLUS / / (999999999) | 1,98 | 0,4727 | 0,4727 | ||||||

| USG59314AB30 / MCF CLO LLC SERIES: 2018-1A CLASS: SUB | 1,94 | -3,30 | 0,4621 | -0,0384 | |||||

| US14153EAC93 / Cardinal Parent, Inc. | 1,93 | -0,21 | 0,4597 | -0,0227 | |||||

| WHITEHAWK STEWARD DI TERM LOAN 12/31/2024 / / LON (999999999) | 1,89 | 0,4522 | 0,4522 | ||||||

| US64069JAF93 / Neptune Bidco US Inc 2022 USD Term Loan A | 1,87 | 9,18 | 0,4457 | 0,0182 | |||||

| Palmer Square CLO 2024-3 Ltd. / ABS-CBDO (US69688HAC07) | 1,86 | -2,05 | 0,4449 | -0,0309 | |||||

| US64069JAC62 / Neptune Bidco US Inc 2022 USD Term Loan B | 1,86 | 9,40 | 0,4448 | 0,0189 | |||||

| SANTADER CONSUMER FINANCE24-1 12/25/34 / / ABS-MBS (BCC3JLXT8) | 1,81 | -7,03 | 0,4323 | -0,0547 | |||||

| BANCO SANTANDER TOTT VAR 12/27/2043 / / ABS-MBS (BCC3FHQ51) | 1,80 | 8,36 | 0,4300 | 0,0144 | |||||

| US24022KAJ88 / DCert Buyer, Inc. | 1,79 | 7,53 | 0,4264 | 0,0109 | |||||

| US87583FAN87 / Tank Holding Corp. 2022 Term Loan | 1,78 | -1,55 | 0,4238 | -0,0271 | |||||

| Neuberger Berman Loan Advisers CLO 60 Ltd. / ABS-CBDO (US640974AC50) | 1,77 | 0,4229 | 0,4229 | ||||||

| Palmer Square European CLO 2024-2 DAC / ABS-CBDO (XS2849654939) | 1,74 | 8,06 | 0,4162 | 0,0128 | |||||

| SILVER POINT LOAN NOTE LLC VIREMAIN / / ABS-MBS (999999999) | 1,71 | 0,4074 | 0,4074 | ||||||

| FORTRESS CREDIT OPP XXVII CLO EQUITY / / ABS-MBS (999999999) | 1,70 | 0,4057 | 0,4057 | ||||||

| Palmer Square European CLO 2025-2 DAC / ABS-CBDO (XS3086803395) | 1,68 | 0,4007 | 0,4007 | ||||||

| ARBOUR LANE CREDIT OPP FUND IV LP / / (999999999) | 1,67 | 0,3994 | 0,3994 | ||||||

| IVYFERT_INCR DDTL_01/03/29 / / LON (999999999) | 1,59 | 0,3802 | 0,3802 | ||||||

| KOHLBERG CLO / / ABS-MBS (999999999) | 1,57 | 0,3746 | 0,3746 | ||||||

| OTHERO NEBRASKA TL 7/31/28 TL / / LON (999999999) | 1,56 | 0,3722 | 0,3722 | ||||||

| WHITEHAWK WEST SIDE TERM LOAN 09/03/2027 / / LON (999999999) | 1,56 | 0,3716 | 0,3716 | ||||||

| Palmer Square CLO 2024-1 Ltd. / ABS-CBDO (US69703KAC45) | 1,45 | -0,62 | 0,3472 | -0,0185 | |||||

| IDC INFUSION TL 7/7/28 TERM LOAN / / LON (999999999) | 1,45 | 0,3456 | 0,3456 | ||||||

| US42351EAB20 / HS Purchaser LLC | 1,42 | 3,81 | 0,3384 | -0,0031 | |||||

| IVYFERT_INCR TL_01/03/29 / / LON (999999999) | 1,33 | 0,3163 | 0,3163 | ||||||

| AUDAX RICCOBENE TL / / LON (999999999) | 1,30 | 0,3108 | 0,3108 | ||||||

| ABPCI Direct Lending Fund CLO II LLC / ABS-CBDO (US000840AG30) | 1,27 | 0,79 | 0,3041 | -0,0121 | |||||

| Maranon Loan Funding 2021-3 Ltd. / ABS-CBDO (US56577NBA19) | 1,27 | 0,95 | 0,3041 | -0,0112 | |||||

| Palmer Square European CLO 2025-1 DAC / ABS-CBDO (XS2989762187) | 1,27 | 4,36 | 0,3029 | -0,0012 | |||||

| Palmer Square CLO 2023-4 Ltd. / ABS-CBDO (US696925AC03) | 1,21 | 1,68 | 0,2883 | -0,0086 | |||||

| CCLF SPV LLC CLO EQUITY 4/29/34 / / LON (999999999) | 1,18 | 0,2822 | 0,2822 | ||||||

| Palmer Square European Loan Funding 2025-1 DAC / ABS-CBDO (XS2999625556) | 1,18 | 9,16 | 0,2817 | 0,0114 | |||||

| BNP Paribas - Broadway / ABS-CBDO (FR001400OP09) | 1,16 | -18,19 | 0,2769 | -0,0776 | |||||

| Palmer Square European CLO 2023-2 DAC / ABS-CBDO (XS2697592595) | 1,13 | 2,17 | 0,2701 | -0,0067 | |||||

| Fortress Credit Opportunities XIX CLO LLC / ABS-CBDO (US34964RAY99) | 1,03 | 1,68 | 0,2450 | -0,0073 | |||||

| Palmer Square European Loan Funding 2023-3 DAC / ABS-CBDO (XS2712146930) | 1,02 | 5,28 | 0,2426 | 0,0013 | |||||

| Trinitas CLO XXXIV Ltd. / ABS-CBDO (US89643KAG67) | 1,01 | 0,2420 | 0,2420 | ||||||

| Regatta XIII Funding Ltd. / ABS-CBDO (US75888FAS48) | 1,01 | 0,20 | 0,2400 | -0,0107 | |||||

| PHYNET DERMATOLOGY 8TH DDTL 10/20/2029 / / LON (999999999) | 1,00 | 0,2399 | 0,2399 | ||||||

| US92915PAR64 / Voya CLO Ltd., Series 2014-1A, Class CR2 | 1,00 | 0,50 | 0,2398 | -0,0099 | |||||

| Neuberger Berman CLO XVI-S Ltd. / ABS-CBDO (US64131TBG85) | 1,00 | 0,40 | 0,2398 | -0,0102 | |||||

| Neuberger Berman CLO XVI-S Ltd. / ABS-CBDO (US64131TBG85) | 1,00 | 0,40 | 0,2398 | -0,0102 | |||||

| Voya CLO 2017-3 Ltd. / ABS-CBDO (US92915QBN25) | 1,00 | 0,50 | 0,2398 | -0,0101 | |||||

| Silver Point CLO 9 Ltd. / ABS-CBDO (US82809VAA08) | 1,00 | 0,2397 | 0,2397 | ||||||

| New Mountain CLO 6 Ltd. / ABS-CBDO (US647908AG78) | 1,00 | -0,99 | 0,2397 | -0,0140 | |||||

| US14314LAL99 / CARLYLE GLOBAL MARKET STRATEGIES CLO 2014-2R LTD CGMS 2014-2RA C | 1,00 | 0,30 | 0,2397 | -0,0106 | |||||

| Bain Capital Credit CLO 2023-1 Ltd. / ABS-CBDO (US05685NAN03) | 1,00 | 0,2394 | 0,2394 | ||||||

| Empower CLO 2025-1 Ltd. / ABS-CBDO (US29249DAG60) | 1,00 | 0,2392 | 0,2392 | ||||||

| Rad CLO 15 Ltd. / ABS-CBDO (US750103AJ21) | 1,00 | 0,2387 | 0,2387 | ||||||

| Magnetite XXVI Ltd. / ABS-CBDO (US55954YBC84) | 1,00 | -0,60 | 0,2379 | -0,0127 | |||||

| Apidos CLO XXIII / ABS-CBDO (US03765YBN31) | 0,99 | -1,10 | 0,2361 | -0,0139 | |||||

| US26245MAL54 / Dryden 55 Clo Ltd Frn 04/15/2031 144a 18-55a D Bond | 0,99 | 0,2354 | 0,2354 | ||||||

| CPC CIRTEC HOLDINGS TL 1/30/29 / / LON (12652MAG2) | 0,97 | -0,72 | 0,2311 | -0,0127 | |||||

| RISKONNECT TL 12/07/28 / / LON (999999999) | 0,97 | 0,2310 | 0,2310 | ||||||

| SFENTA_5th_TL TERM LOAN 3/4/25 / / LON (999999999) | 0,97 | 0,2308 | 0,2308 | ||||||

| PHYNET DERMATOLOGY TL 8/16/24 / / LON (999999999) | 0,96 | 0,2287 | 0,2287 | ||||||

| Palmer Square European Loan Funding 2023-2 DAC / ABS-CBDO (XS2648492416) | 0,95 | 4,97 | 0,2268 | 0,0004 | |||||

| US46583DAG43 / Ivanti Software Inc | 0,92 | 17,97 | 0,2195 | 0,0247 | |||||

| US62188AAC53 / Mount Logan Funding 2018-1 LP | 0,90 | -9,11 | 0,2145 | -0,0327 | |||||

| Palmer Square European CLO 2023-1 DAC / ABS-CBDO (XS2618889633) | 0,84 | -2,90 | 0,2002 | -0,0157 | |||||

| TCW FENIX TOPCO B TL B 3/28/2029 / / LON (999999999) | 0,82 | 0,1958 | 0,1958 | ||||||

| CB_Buyer_DDTL_7/1/31 DELAYED DRAW / / LON (999999999) | 0,79 | 0,1888 | 0,1888 | ||||||

| ARES CAPITAL 2023-1 SUBORDINATED NOTE / / ABS-MBS (999999999) | 0,77 | 0,1847 | 0,1847 | ||||||

| TAOGLAS_IRISH_TL 2/28/29 / / LON (999999999) | 0,76 | 0,1810 | 0,1810 | ||||||

| US14316CAL72 / Carlyle Global Market Strategies Clo 2014-4-r Ltd Frn 07/15/2030 2014-4ra C 144a Bond | 0,75 | 0,13 | 0,1797 | -0,0081 | |||||

| Bain Capital Credit CLO 2018-2 / ABS-CBDO (US05682VAU98) | 0,75 | 0,13 | 0,1796 | -0,0082 | |||||

| US75888NAA63 / Regatta XIV Funding Ltd | 0,75 | 1,63 | 0,1792 | -0,0055 | |||||

| Dryden 54 Senior Loan Fund / ABS-CBDO (US26244RAD35) | 0,75 | 50,00 | 0,1790 | 0,0540 | |||||

| Trestles CLO VI Ltd. / ABS-CBDO (US894940AQ82) | 0,75 | 0,27 | 0,1788 | -0,0079 | |||||

| RoyalPalmI_TL 1 MATURITY 10/24/2033 / / LON (999999999) | 0,69 | 0,1642 | 0,1642 | ||||||

| TANK HOLDING Corp. TERM LOAN 5/11/29 / / LON (999999999) | 0,65 | 0,1555 | 0,1555 | ||||||

| US14315LAJ35 / Carlyle Global Market Strategies CLO 2014-3-R Ltd | 0,63 | 0,32 | 0,1498 | -0,0066 | |||||

| ANTARES LOAN FUNDING CLO EQUITY / / ABS-MBS (03690BAA2) | 0,58 | 1,22 | 0,1384 | -0,0047 | |||||

| ACCORDION TL 2 PRE-FUNDING 11/17/31 / / LON (999999999) | 0,58 | 0,1379 | 0,1379 | ||||||

| Palmer Square European CLO 2023-1 DAC / ABS-CBDO (XS2944935225) | 0,57 | 5,76 | 0,1360 | 0,0014 | |||||

| IDC INFUSION DDTL 7/7/28 DDTERM LOAN / / LON (999999999) | 0,53 | 0,1270 | 0,1270 | ||||||

| Trinitas CLO XXXIV Ltd. / ABS-CBDO (US89643LAA70) | 0,51 | 0,1229 | 0,1229 | ||||||

| PHYNET DERMATOLOGY DDTL 8/16/24 / / LON (999999999) | 0,51 | 0,1222 | 0,1222 | ||||||

| Voya CLO 2022-4 Ltd. / ABS-CBDO (US92920MAE57) | 0,51 | 1,59 | 0,1222 | -0,0038 | |||||

| Neuberger Berman CLO XXII Ltd. / ABS-CBDO (US64131CAG69) | 0,51 | 0,1217 | 0,1217 | ||||||

| OHA Credit Partners XII Ltd. / ABS-CBDO (US67110BAJ08) | 0,51 | 0,1211 | 0,1211 | ||||||

| Post CLO 2024-1 Ltd. / ABS-CBDO (US73743FAA30) | 0,51 | -0,39 | 0,1211 | -0,0062 | |||||

| US15033QAA94 / Cedar Funding XVII CLO Ltd | 0,51 | -0,59 | 0,1209 | -0,0064 | |||||

| US36321MAA53 / Galaxy XXVI CLO Ltd | 0,50 | 0,00 | 0,1204 | -0,0057 | |||||

| US37147WAA36 / Generate CLO 12, Ltd. | 0,50 | -0,98 | 0,1204 | -0,0071 | |||||

| US46091TAA79 / Invesco US CLO 2023-3 Ltd | 0,50 | -0,40 | 0,1204 | -0,0062 | |||||

| Voya CLO 2019-1 Ltd. / ABS-CBDO (US92917NBC11) | 0,50 | -0,59 | 0,1203 | -0,0065 | |||||

| US55955BAA26 / Magnetite XX Ltd | 0,50 | 0,00 | 0,1200 | -0,0055 | |||||

| Regatta XXI Funding Ltd. / ABS-CBDO (US75889JAS50) | 0,50 | -0,59 | 0,1200 | -0,0065 | |||||

| Alinea CLO 2018-1 Ltd. / ABS-CBDO (US016269AL64) | 0,50 | 0,40 | 0,1199 | -0,0051 | |||||

| Goldentree Loan Management U.S. CLO 5 Ltd. / ABS-CBDO (US38138DBE58) | 0,50 | 0,20 | 0,1199 | -0,0054 | |||||

| Bryant Park Funding 2023-20 Ltd. / ABS-CBDO (US117919AJ92) | 0,50 | 0,1199 | 0,1199 | ||||||

| Neuberger Berman Loan Advisers CLO 36 Ltd. / ABS-CBDO (US64133JAQ76) | 0,50 | 0,1199 | 0,1199 | ||||||

| Cedar Funding IV CLO Ltd. / ABS-CBDO (US150323BL64) | 0,50 | 0,40 | 0,1198 | -0,0053 | |||||

| US67111VAJ52 / OZLM XXII, Ltd. | 0,50 | 0,40 | 0,1198 | -0,0053 | |||||

| US92917CAN20 / Voya CLO 2013-1 Ltd | 0,50 | 0,40 | 0,1198 | -0,0053 | |||||

| US67590GBQ10 / OCT17 2013-1A DR2 | 0,50 | -0,20 | 0,1198 | -0,0059 | |||||

| Voya CLO 2019-2 Ltd. / ABS-CBDO (US92917RAJ86) | 0,50 | 0,20 | 0,1198 | -0,0054 | |||||

| US65023QAA67 / Newark BSL CLO 2 Ltd | 0,50 | 1,21 | 0,1198 | -0,0041 | |||||

| US92916MAD39 / Voya CLO LTD VOYA 2017 1A C 144A | 0,50 | 0,20 | 0,1198 | -0,0053 | |||||

| US03767CAE03 / Apidos CLO XXVIII | 0,50 | 0,20 | 0,1198 | -0,0052 | |||||

| US542798AJ22 / Long Point Park CLO Ltd | 0,50 | -0,20 | 0,1197 | -0,0059 | |||||

| Cedar Funding IV CLO Ltd. / ABS-CBDO (US150323BS18) | 0,50 | -0,40 | 0,1197 | -0,0062 | |||||

| US06760XAJ37 / Barings CLO Ltd 2018-IV | 0,50 | 0,00 | 0,1197 | -0,0056 | |||||

| Galaxy Xxiv Clo Ltd. / ABS-CBDO (US36321BAG68) | 0,50 | 0,00 | 0,1197 | -0,0056 | |||||

| New Mountain CLO 1 Ltd. / ABS-CBDO (US64755RBJ14) | 0,50 | 0,00 | 0,1197 | -0,0056 | |||||

| US67112MAG06 / OZLM XX Ltd | 0,50 | 0,00 | 0,1197 | -0,0057 | |||||

| US27830KBA16 / Eaton Vance Clo 2015-1 Ltd. | 0,50 | 0,20 | 0,1197 | -0,0055 | |||||

| US29003XAA19 / Elmwood CLO 14 Ltd | 0,50 | -0,60 | 0,1197 | -0,0065 | |||||

| US26249BAW19 / Dryden 30 Senior Loan Fund | 0,50 | 0,00 | 0,1196 | -0,0058 | |||||

| US75888ABE55 / Regatta VII Funding Ltd | 0,50 | 0,00 | 0,1196 | -0,0055 | |||||

| US12551KAA16 / CIFC Funding 2017-IV Ltd | 0,50 | -0,40 | 0,1195 | -0,0061 | |||||

| Morgan Stanley Eaton Vance CLO 2023-19 Ltd. / ABS-CBDO (US617934AW46) | 0,50 | 0,1195 | 0,1195 | ||||||

| Morgan Stanley Eaton Vance CLO 2023-19 Ltd. / ABS-CBDO (US617934AU89) | 0,50 | 0,1195 | 0,1195 | ||||||

| Benefit Street Partners CLO XX Ltd. / ABS-CBDO (US08182FAW95) | 0,50 | -0,40 | 0,1195 | -0,0060 | |||||

| US09630QAS03 / BLUEMOUNTAIN CLO XXX LTD BLUEM 2020-30A DR | 0,50 | 0,1195 | 0,1195 | ||||||

| Voya CLO 2020-3 Ltd. / ABS-CBDO (US92918NBE67) | 0,50 | -0,79 | 0,1195 | -0,0067 | |||||

| US860443AE06 / Stewart Park CLO Ltd | 0,50 | 0,81 | 0,1195 | -0,0045 | |||||

| Whitebox CLO IV Ltd. / ABS-CBDO (US96467KAU34) | 0,50 | 0,1194 | 0,1194 | ||||||

| Voya CLO 2020-3 Ltd. / ABS-CBDO (US92918NAY31) | 0,50 | 0,00 | 0,1194 | -0,0056 | |||||

| US15032DAX93 / Cedar Funding VI CLO Ltd | 0,50 | -0,20 | 0,1194 | -0,0059 | |||||

| US92913UAW62 / Voya CLO 2015-3 Ltd | 0,50 | 0,00 | 0,1194 | -0,0056 | |||||

| Morgan Stanley Eaton Vance CLO 2022-18 Ltd. / ABS-CBDO (US617924AU99) | 0,50 | -1,19 | 0,1193 | -0,0074 | |||||

| CIFC Funding 2018-II Ltd. / ABS-CBDO (US17180WAS44) | 0,50 | -0,99 | 0,1193 | -0,0071 | |||||

| Oaktree CLO 2022-1 Ltd. / ABS-CBDO (US67402NAE22) | 0,50 | 0,1193 | 0,1193 | ||||||

| Elmwood CLO X Ltd. / ABS-CBDO (US29002VAW81) | 0,50 | 0,1193 | 0,1193 | ||||||

| US14317KAJ34 / Carlyle US CLO 2021-9 Ltd | 0,50 | 0,1193 | 0,1193 | ||||||

| Battalion Clo XV Ltd. / ABS-CBDO (US07131AAR59) | 0,50 | -0,20 | 0,1193 | -0,0059 | |||||

| Neuberger Berman Loan Advisers CLO 28 Ltd. / ABS-CBDO (US64130PAU75) | 0,50 | -1,58 | 0,1192 | -0,0076 | |||||

| US65023PAU49 / Newark BSL CLO 2 Ltd | 0,50 | 0,00 | 0,1191 | -0,0057 | |||||

| Verdelite Static CLO 2024-1 Ltd. / ABS-CBDO (US92338VAG68) | 0,50 | -0,99 | 0,1191 | -0,0067 | |||||

| Apidos CLO XLII Ltd. / ABS-CBDO (US03770GAU04) | 0,50 | -0,60 | 0,1189 | -0,0064 | |||||

| Dryden 45 Senior Loan Fund / ABS-CBDO (US26244MBE12) | 0,50 | -0,60 | 0,1188 | -0,0064 | |||||

| US92915HAU77 / Voya CLO Ltd., Series 2016-3A, Class CR | 0,50 | 0,00 | 0,1188 | -0,0056 | |||||

| US77340HAE99 / Rockford Tower CLO 2017-2 Ltd | 0,50 | 0,1182 | 0,1182 | ||||||

| US12552NAA46 / CIFC Funding 2013-III-R, Ltd. | 0,49 | -0,80 | 0,1181 | -0,0066 | |||||

| Symphony CLO XXI Ltd. / ABS-CBDO (US87166RGE18) | 0,49 | -0,81 | 0,1176 | -0,0065 | |||||

| Monroe_2nd_DDTL 12/20/28 DD TL / / LON (999999999) | 0,49 | 0,1174 | 0,1174 | ||||||

| Palmer Square CLO 2023-3 Ltd. / ABS-CBDO (US696927AC68) | 0,49 | 3,81 | 0,1172 | -0,0009 | |||||

| Monroe 2nd TL 12/20/28 TERM LOAN / / LON (999999999) | 0,49 | 0,1170 | 0,1170 | ||||||

| NEUBERGER BERMAN LOAN ADVISERS CLO 62 / / ABS-MBS (999999999) | 0,48 | 0,1146 | 0,1146 | ||||||

| PHYNET DERMATOLOGY 8TH TL 10/20/2029 / / LON (999999999) | 0,48 | 0,1137 | 0,1137 | ||||||

| Fingerpaint_DDTL 12/20/26 DD TL / / LON (999999999) | 0,46 | 0,1107 | 0,1107 | ||||||

| Palmer Square CLO 2023-2 Ltd. / ABS-CBDO (US69703CAC29) | 0,44 | -12,94 | 0,1060 | -0,0215 | |||||

| EURO FORWARD CONTRACT 11/06/26 / / DFE (999999999) | 0,44 | 0,1059 | 0,1059 | ||||||

| Venture 38 CLO Ltd. / ABS-CBDO (US92332NBC83) | 0,44 | -12,02 | 0,1050 | -0,0198 | |||||

| GBP FWD CONTRACT 08/14/2025 / / DFE (999999999) | 0,44 | 0,1049 | 0,1049 | ||||||

| SEPRO DDTL DD 7/26/2030 / / LON (999999999) | 0,43 | 0,1020 | 0,1020 | ||||||

| 74339YAB8 / Project Castle, Inc., Term Loan | 0,43 | -7,21 | 0,1017 | -0,0129 | |||||

| Royal Palm I 1L DDTL 10/24/33 MATURITY / / LON (999999999) | 0,42 | 0,1012 | 0,1012 | ||||||

| WHWK STEW HEA BRIDGE BRIDGE 10/31/2024 / / LON (999999999) | 0,42 | 0,1005 | 0,1005 | ||||||

| Palmer Square Loan Funding 2023-2 Ltd. / ABS-CBDO (US69703GAC33) | 0,42 | -7,13 | 0,0997 | -0,0126 | |||||

| SFENTA_DDTL 12/31/25 / / LON (999999999) | 0,42 | 0,0993 | 0,0993 | ||||||

| Arini U.S. CLO I Ltd. / ABS-CBDO (US04039AAG94) | 0,40 | 0,0965 | 0,0965 | ||||||

| CB_Buyer_RCF_7/1/31 REVOLVER / / LON (999999999) | 0,39 | 0,0941 | 0,0941 | ||||||

| US87232TAE38 / TCI-Flatiron Clo 2018-1 Ltd. | 0,38 | 0,00 | 0,0901 | -0,0043 | |||||

| TA/WEG HOLDINGS LLC 10/2/2027 DDTL / / LON (999999999) | 0,37 | 0,0881 | 0,0881 | ||||||

| TA/WEG HOLDINGS LLC 10/04/27 DDTL / / LON (999999999) | 0,37 | 0,0878 | 0,0878 | ||||||

| CIRE ALTO OpCo LLC TL 11/29/2024 / / LON (999999999) | 0,36 | 0,0867 | 0,0867 | ||||||

| Palmer Square Loan Funding 2022-4 Ltd. / ABS-CBDO (US69702XAC74) | 0,36 | -8,40 | 0,0861 | -0,0124 | |||||

| Fingerpaint_TL 12/20/26 TERM LOAN / / LON (999999999) | 0,35 | 0,0834 | 0,0834 | ||||||

| US34068GAD43 / Florida Food Products, LLC, First Lien Term Loan | 0,33 | -20,33 | 0,0797 | -0,0248 | |||||

| Elevation CLO 2018-10 Ltd. / ABS-CBDO (US28623CAL54) | 0,33 | -34,80 | 0,0780 | -0,0470 | |||||

| PMA - PROJECT PINNAC REVOLVER 01/31/2031 / / LON (999999999) | 0,32 | 0,0775 | 0,0775 | ||||||

| BCP SPECIAL OPP LP OFFSHORE FEEDER III / / (999999999) | 0,32 | 0,0763 | 0,0763 | ||||||

| Wynwood BN LLC / / (999999999) | 0,30 | 0,0719 | 0,0719 | ||||||

| TANK HOLDING Corp. DELAYED DRAW / / LON (999999999) | 0,28 | 0,0674 | 0,0674 | ||||||

| DENTIVE TL 12/23/28 TERM LOAN / / LON (999999999) | 0,27 | 0,0642 | 0,0642 | ||||||

| H.W LOCHNER LLC TERM LOAN / / LON (999999999) | 0,26 | 0,0626 | 0,0626 | ||||||

| Invesco U.S. CLO 2023-2 Ltd. / ABS-CBDO (US46147LAE02) | 0,26 | 0,0609 | 0,0609 | ||||||

| AIMCO CLO 10 Ltd. / ABS-CBDO (US00900UAG94) | 0,25 | 0,00 | 0,0604 | -0,0029 | |||||

| Symphony CLO 34-PS Ltd. / ABS-CBDO (US87170AAW80) | 0,25 | -0,79 | 0,0599 | -0,0034 | |||||

| US14310MBE66 / Carlyle Global Market Strategies CLO Ltd., Series 2014-1A, Class DR | 0,25 | 0,00 | 0,0597 | -0,0029 | |||||

| INVESCO U.S. CLO 2025-1 Ltd. / ABS-CBDO (US46151PAA21) | 0,25 | 0,0597 | 0,0597 | ||||||

| US22616TAG13 / Crestline Denali CLO XVII, Ltd. | 0,25 | -0,40 | 0,0595 | -0,0030 | |||||

| US92917JAN72 / Voya CLO 2018-2 Ltd | 0,25 | -0,80 | 0,0592 | -0,0032 | |||||

| TA/WEG HOLDINGS LLC 10/04/27 DDTL / / LON (999999999) | 0,25 | 0,0587 | 0,0587 | ||||||

| US08180YAE05 / Benefit Street Partners CLO VIII Ltd | 0,25 | -1,21 | 0,0586 | -0,0037 | |||||

| Palmer Square Loan Funding 2024-1 Ltd. / ABS-CBDO (US69703QAC15) | 0,24 | -2,82 | 0,0576 | -0,0044 | |||||

| WEG_JAN2024_RCF 10/04/27 RC / / LON (999999999) | 0,22 | 0,0529 | 0,0529 | ||||||

| GBP SPOT FORWARD CONTRACT / / STIV (999999999) | 0,22 | 0,0524 | 0,0524 | ||||||

| TAOGLAS_RC_2/28/29 / / LON (999999999) | 0,21 | 0,0506 | 0,0506 | ||||||

| EURO FORWARD CONTRACT 06/18/26 / / DFE (999999999) | 0,17 | 0,0413 | 0,0413 | ||||||

| IRRADIANT_FRG_SPV FUNDED / / EC (999999999) | 2,82 | 0,16 | 0,0389 | 0,0389 | |||||

| DENTIVE TL 12/23/28 DELAYED DRAW TL / / LON (999999999) | 0,13 | 0,0319 | 0,0319 | ||||||

| Audax-Riccobene Co. DDTL Audax Private / / LON (999999999) | 0,11 | 0,0264 | 0,0264 | ||||||

| EURO CURRENCY / / STIV (999999999) | 0,09 | 0,0210 | 0,0210 | ||||||

| ACCORDION DDTL 2 PRE-FUNDING 11/17/31 / / LON (999999999) | 0,09 | 0,0207 | 0,0207 | ||||||

| RoyalPalmI TL2 MATURITY 10/24/2033 / / LON (999999999) | 0,09 | 0,0203 | 0,0203 | ||||||

| TCW FROST BUYER DDTL LLC / / LON (999999999) | 0,08 | 0,0196 | 0,0196 | ||||||

| IvantiNewCoTL_6/1/29 TL_06/01/29 / / LON (999999999) | 0,08 | 0,0196 | 0,0196 | ||||||

| RoyalPalm II_TL_ MATURITY 10/24/2028 / / LON (999999999) | 0,05 | 0,0122 | 0,0122 | ||||||

| TCW FENIX DDTL B-1 TOPCO LLC / / LON (999999999) | 0,05 | 0,0117 | 0,0117 | ||||||

| AUDAX SUMMIT SPINE REVOLVER / / LON (999999999) | 0,02 | 0,0058 | 0,0058 | ||||||

| US87583FAM05 / Tank Holding Corp., Revolver Loan | 0,01 | 0,00 | 0,0034 | -0,0004 | |||||

| DANISH KRONE / / STIV (999999999) | 0,00 | 0,0012 | 0,0012 | ||||||

| Palmer Square European Loan Funding / ABS-CBDO (XS2593623007) | 0,00 | 0,0000 | 0,0000 | ||||||

| Palmer Square Loan Funding 2023-1 Ltd. / ABS-CBDO (US69703EAC84) | 0,00 | -100,00 | 0,0000 | -0,0050 | |||||

| EURO FORWARDVIREMAIN CONTRACT 07/22/2025 / / DFE (999999999) | -0,02 | -0,0056 | -0,0056 | ||||||

| EURO FORWARDVIREMAIN CONTRACT 07/22/2025 / / DFE (999999999) | -0,02 | -0,0056 | -0,0056 | ||||||

| EURO FORWARDVIREMAIN CONTRACT 10/22/2025 / / DFE (999999999) | -0,02 | -0,0057 | -0,0057 | ||||||

| EURO FORWARDVIREMAIN CONTRACT 8/22/2025 / / DFE (999999999) | -0,04 | -0,0085 | -0,0085 | ||||||

| EURO FORWARDVIREMAIN CONTRACT 11/21/2025 / / DFE (999999999) | -0,04 | -0,0085 | -0,0085 | ||||||

| EURO FORWARD CONTRACT 1/24/28 / / DFE (999999999) | -0,05 | -0,0118 | -0,0118 | ||||||

| EURO FORWARDVIREMAIN CONTRACT 04/22/2026 / / DFE (999999999) | -0,06 | -0,0143 | -0,0143 | ||||||

| EURO FORWARDVIREMAIN CONTRACT 04/22/2026 / / DFE (999999999) | -0,06 | -0,0143 | -0,0143 | ||||||

| EURO FORWARD FTPC CONTRACT 7/22/2026 / / DFE (999999999) | -0,06 | -0,0143 | -0,0143 | ||||||

| EURO FORWARD FTPC CONTRACT 10/22/2026 / / DFE (999999999) | -0,06 | -0,0144 | -0,0144 | ||||||

| EUR FWD CONTRACT 10/22/2027 / / DFE (999999999) | -0,06 | -0,0146 | -0,0146 | ||||||

| EURO FORWARD CONTRACT 05/21/2027 / / DFE (999999999) | -0,07 | -0,0174 | -0,0174 | ||||||

| EUR FORWARD FTPC CONTRACT 7/22/2025 / / DFE (999999999) | -0,08 | -0,0197 | -0,0197 | ||||||

| EURO FORWARD CONTRACT 11/24/25 / / DFE (999999999) | -0,08 | -0,0199 | -0,0199 | ||||||

| EURO FORWARD CONTRACT 08/24/2026 / / DFE (999999999) | -0,08 | -0,0201 | -0,0201 | ||||||

| EURO FORWARDVIREMAIN CONTRACT 01/22/2026 / / DFE (999999999) | -0,10 | -0,0228 | -0,0228 | ||||||

| EURO FORWARDVIREMAIN CONTRACT 01/22/2026 / / DFE (999999999) | -0,10 | -0,0228 | -0,0228 | ||||||

| EURO FORWARD CONTRACT 11/23/26 / / DFE (999999999) | -0,10 | -0,0230 | -0,0230 | ||||||

| EURO FORWARD CONTRACT 05/24/27 / / DFE (999999999) | -0,11 | -0,0261 | -0,0261 | ||||||

| EUR FWD CONTRACT 07/22/2025 / / DFE (999999999) | -0,13 | -0,0310 | -0,0310 | ||||||

| GBP SPOT FORWARD CONTRACT / / STIV (999999999) | -0,22 | -0,0524 | -0,0524 | ||||||

| EUR FWD CONTRACT 1/22/2027 / / DFE (999999999) | -0,24 | -0,0578 | -0,0578 | ||||||

| EUR FWD CONTRACT 4/22/2026 / / DFE (999999999) | -0,25 | -0,0600 | -0,0600 | ||||||

| EUR FWD CONTRACT 10/22/2026 / / DFE (999999999) | -0,25 | -0,0604 | -0,0604 | ||||||

| EUR FWD CONTRACT 4/22/2027 / / DFE (999999999) | -0,27 | -0,0638 | -0,0638 | ||||||

| EUR FWD CONTRACT 01/22/2026 / / DFE (999999999) | -0,27 | -0,0654 | -0,0654 | ||||||

| EUR FWD CONTRACT 7/22/2026 / / DFE (999999999) | -0,29 | -0,0687 | -0,0687 | ||||||

| EUR FWD CONTRACT 10/22/2025 / / DFE (999999999) | -0,32 | -0,0765 | -0,0765 | ||||||

| EURO FORWARD CONTRACT 08/21/2026 / / DFE (999999999) | -0,43 | -0,1032 | -0,1032 | ||||||

| EURO FORWARD CONTRACT 12/23/2026 / / DFE (999999999) | -0,59 | -0,1399 | -0,1399 | ||||||

| EURO FORWARD CONTRACT 11/21/25 / / DFE (999999999) | -0,64 | -0,1532 | -0,1532 | ||||||

| EURO FORWARD CONTRACT 02/20/2026 / / DFE (999999999) | -0,66 | -0,1567 | -0,1567 | ||||||

| EURO FORWARD CONTRACT 08/22/2025 / / DFE (999999999) | -0,79 | -0,1891 | -0,1891 | ||||||

| EURO FORWARDVIREMAIN CONTRACT 2/20/2026 / / DFE (999999999) | -0,81 | -0,1938 | -0,1938 | ||||||

| EURO FORWARDVIREMAIN CONTRACT 2/20/2026 / / DFE (999999999) | -0,81 | -0,1938 | -0,1938 | ||||||

| EUR FORWARD FTPC CONTRACT 10/22/2025 / / DFE (999999999) | -0,82 | -0,1949 | -0,1949 | ||||||

| EUR FWD CONTRACT 7/22/2027 / / DFE (999999999) | -1,02 | -0,2424 | -0,2424 | ||||||

| EURO FORWARDVIREMAIN CONTRACT 06/18/2026 / / DFE (999999999) | -1,13 | -0,2708 | -0,2708 | ||||||

| EURO FORWARDVIREMAIN CONTRACT 06/18/2026 / / DFE (999999999) | -1,13 | -0,2708 | -0,2708 | ||||||

| EURO FORWARD CONTRACT 03/13/28 / / DFE (999999999) | -1,25 | -0,2994 | -0,2994 | ||||||

| EUR FWD CONTRACT 07/17/2025 / / DFE (999999999) | -1,68 | -0,4011 | -0,4011 | ||||||

| EURO FORWARD FTPC CONTRACT 11/6/2026 / / DFE (999999999) | -1,70 | -0,4052 | -0,4052 | ||||||

| EURO FORWARD CONTRACT 02/23/2026 / / DFE (999999999) | -1,80 | -0,4289 | -0,4289 | ||||||

| EURO FORWARD CONTRACT 02/22/2027 / / DFE (999999999) | -1,80 | -0,4299 | -0,4299 | ||||||

| EURO FORWARD CONTRACT 08/20/2027 / / DFE (999999999) | -1,81 | -0,4318 | -0,4318 | ||||||

| SEK FORWARD CONTRACT 08/14/2025 / / DFE (999999999) | -2,08 | -0,4955 | -0,4955 | ||||||

| EUR FWD CONTRACT 06/04/27 / / DFE (999999999) | -2,41 | -0,5744 | -0,5744 | ||||||

| EURO FORWARD CONTRACT 05/22/2026 / / DFE (999999999) | -2,56 | -0,6112 | -0,6112 | ||||||

| EUR FWD CONTRACT 7/30/2027 / / DFE (999999999) | -3,16 | -0,7532 | -0,7532 | ||||||

| EURO FORWARD CONTRACT 11/20/2026 / / DFE (999999999) | -3,27 | -0,7804 | -0,7804 | ||||||

| GBP FWD CONTRACT 08/14/2025 / / DFE (999999999) | -10,40 | -2,4812 | -2,4812 | ||||||

| EURO FORWARD CONTRACT 09/15/2025 / / DFE (999999999) | -11,96 | -2,8544 | -2,8544 | ||||||

| TRISTATE CAPITAL BAN LINE OF CREDIT - VIV / / STIV (999999999) | -18,00 | -4,2962 | -4,2962 | ||||||

| EURO FWD CONTRACT 08/14/2025 / / DFE (999999999) | -35,47 | -8,4651 | -8,4651 |