Statistiche di base

| Valore del portafoglio | $ 1.807.699.366 |

| Posizioni attuali | 1.153 |

Ultime partecipazioni, performance, AUM (da depositi 13F, 13D)

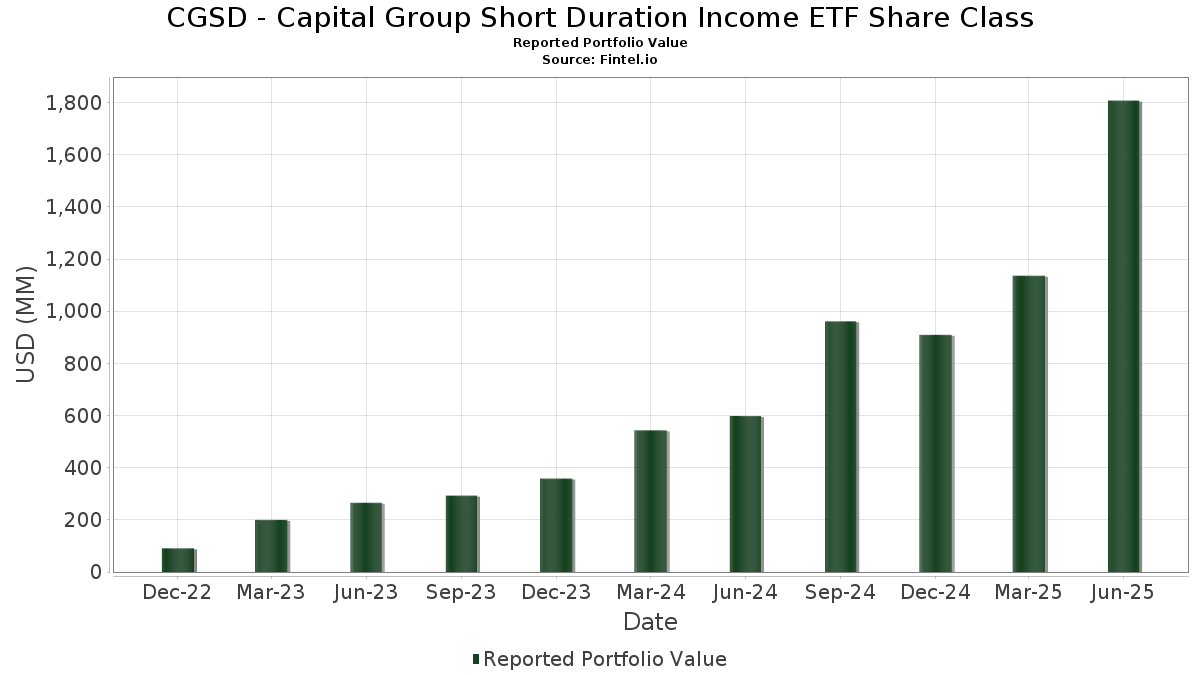

CGSD - Capital Group Short Duration Income ETF Share Class ha dichiarato un totale di 1.153 partecipazioni negli ultimi documenti depositati presso la SEC. Il valore più recente del portafoglio è pari a $ 1.807.699.366 USD. Il patrimonio gestito effettivo (AUM) corrisponde a questo valore più la liquidità (che non viene dichiarata). Le principali partecipazioni di CGSD - Capital Group Short Duration Income ETF Share Class sono CAPITAL GROUP CENTRAL CASH FUND (US:US14020B1026) , Uniform Mortgage-Backed Security, TBA (US:US01F0606750) , Charter Communications Operating LLC / Charter Communications Operating Capital (US:US161175CM43) , Boeing Co/The (US:US097023DG73) , and Truist Financial Corp (US:US89788MAN20) . Le nuove posizioni di CGSD - Capital Group Short Duration Income ETF Share Class includono Uniform Mortgage-Backed Security, TBA (US:US01F0606750) , Charter Communications Operating LLC / Charter Communications Operating Capital (US:US161175CM43) , Boeing Co/The (US:US097023DG73) , Truist Financial Corp (US:US89788MAN20) , and Bank of America Corp. (US:US06051GKW86) .

Gli aumenti più importanti di questo trimestre

Utilizziamo la variazione dell'allocazione del portafoglio perché è l'indicatore più significativo. Le variazioni possono essere dovute a transazioni o a variazioni dei prezzi delle azioni.

| Titolo | Azioni (in milioni) |

Valore (in milioni di $) |

Portafoglio % | ΔPortafoglio % |

|---|---|---|---|---|

| 45,68 | 3,4489 | 3,4489 | ||

| 14,76 | 1,1143 | 1,1143 | ||

| 13,52 | 1,0204 | 1,0204 | ||

| 13,52 | 1,0204 | 1,0204 | ||

| 12,11 | 0,9144 | 0,9144 | ||

| 5,04 | 0,3804 | 0,3804 | ||

| 5,04 | 0,3804 | 0,3804 | ||

| 4,62 | 0,3489 | 0,3489 | ||

| 4,62 | 0,3489 | 0,3489 | ||

| 4,02 | 0,3032 | 0,3032 |

Gli aumenti più importanti di questo trimestre

Utilizziamo la variazione dell'allocazione del portafoglio perché è l'indicatore più significativo. Le variazioni possono essere dovute a transazioni o a variazioni dei prezzi delle azioni.

| Titolo | Azioni (in milioni) |

Valore (in milioni di $) |

Portafoglio % | ΔPortafoglio % |

|---|---|---|---|---|

| 24,90 | 1,8797 | -1,9328 | ||

| 0,82 | 81,97 | 6,1884 | -1,2238 | |

| 4,17 | 0,3146 | -0,4287 | ||

| 0,87 | 0,0658 | -0,3762 | ||

| 12,16 | 0,9180 | -0,2277 | ||

| 12,16 | 0,9180 | -0,2277 | ||

| 0,10 | 0,0076 | -0,1726 | ||

| -1,85 | -0,1399 | -0,1399 | ||

| -1,85 | -0,1399 | -0,1399 | ||

| 4,39 | 0,3312 | -0,1292 |

13F e depositi di fondi

Questo modulo è stato depositato il 2025-08-20 per il periodo di riferimento 2025-06-30. Fai clic sull'icona del link per visualizzare la cronologia completa delle transazioni.

Esegui l'upgrade per sbloccare i dati premium ed esportarli in Excel ![]() .

.

| Titolo | Tipo | Prezzo medio dell'azione | Azioni (in milioni) |

ΔAzioni (%) |

ΔAzioni (%) |

Valore (in milioni di $) |

Portafoglio (%) |

ΔPortafoglio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US14020B1026 / CAPITAL GROUP CENTRAL CASH FUND | 0,82 | 1,81 | 81,97 | 1,81 | 6,1884 | -1,2238 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 45,68 | 3,4489 | 3,4489 | ||||||

| US01F0606750 / Uniform Mortgage-Backed Security, TBA | 24,90 | 18,22 | 1,8797 | -1,9328 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 14,76 | 1,1143 | 1,1143 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 13,52 | 1,0204 | 1,0204 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 13,52 | 1,0204 | 1,0204 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 12,16 | -2,29 | 0,9180 | -0,2277 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 12,16 | -2,29 | 0,9180 | -0,2277 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 12,11 | 0,9144 | 0,9144 | ||||||

| US161175CM43 / Charter Communications Operating LLC / Charter Communications Operating Capital | 9,55 | 47,83 | 0,7210 | 0,1263 | |||||

| US097023DG73 / Boeing Co/The | 7,88 | 25,06 | 0,5948 | 0,0149 | |||||

| US89788MAN20 / Truist Financial Corp | 7,43 | 11,60 | 0,5606 | -0,0519 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 6,77 | 44,99 | 0,5112 | 0,0812 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 6,77 | 44,99 | 0,5112 | 0,0812 | |||||

| US06051GKW86 / Bank of America Corp. | 6,76 | 66,72 | 0,5105 | 0,1370 | |||||

| US75513ECT64 / RTX CORP SR UNSEC 5.75% 11-08-26 | 6,55 | 20,66 | 0,4943 | -0,0052 | |||||

| US00206RML32 / AT&T Inc | 6,49 | 17,35 | 0,4896 | -0,0191 | |||||

| US071813CL19 / Baxter International Inc | 6,17 | 12,34 | 0,4661 | -0,0399 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 5,96 | 26,13 | 0,4502 | 0,0149 | |||||

| US29444UBQ85 / EQUINIX INC 1.45% 05/15/2026 | 5,81 | 9,13 | 0,4388 | -0,0515 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 5,72 | 52,68 | 0,4317 | 0,0869 | |||||

| US502431AP47 / L3Harris Technologies, Inc. | 5,58 | 38,35 | 0,4210 | 0,0499 | |||||

| US031162CT53 / Amgen Inc | 5,55 | 18,30 | 0,4187 | -0,0129 | |||||

| NRM FHT1 Excess Owner LLC / ABS-MBS (US64832EAA73) | 5,52 | -5,64 | 0,4169 | -0,1218 | |||||

| NRM FHT1 Excess Owner LLC / ABS-MBS (US64832EAA73) | 5,52 | -5,64 | 0,4169 | -0,1218 | |||||

| Bravo Residential Funding Trust Series 2025-NQM1 / ABS-MBS (US10569MAC73) | 5,52 | -4,27 | 0,4164 | -0,1140 | |||||

| Bravo Residential Funding Trust Series 2025-NQM1 / ABS-MBS (US10569MAC73) | 5,52 | -4,27 | 0,4164 | -0,1140 | |||||

| US345397D260 / Ford Motor Credit Co LLC | 5,23 | 8,58 | 0,3948 | -0,0486 | |||||

| US05571AAQ85 / BPCE SA | 5,18 | 39,68 | 0,3907 | 0,0496 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 5,15 | 31,61 | 0,3891 | 0,0286 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 5,15 | 31,61 | 0,3891 | 0,0286 | |||||

| FARM 2025-1 Mortgage Trust / ABS-MBS (US30768CAA09) | 5,04 | 0,3804 | 0,3804 | ||||||

| FARM 2025-1 Mortgage Trust / ABS-MBS (US30768CAA09) | 5,04 | 0,3804 | 0,3804 | ||||||

| OBX 2025-NQM1 Trust / ABS-MBS (US673914AC13) | 5,00 | -4,43 | 0,3775 | -0,1042 | |||||

| OBX 2025-NQM1 Trust / ABS-MBS (US673914AC13) | 5,00 | -4,43 | 0,3775 | -0,1042 | |||||

| Avant Credit Card Master Trust / ABS-O (US05351KAK51) | 4,99 | -0,04 | 0,3765 | -0,0828 | |||||

| ACHV ABS Trust 2025-1PL / ABS-O (US00112MAC01) | 4,98 | -0,14 | 0,3763 | -0,0833 | |||||

| US694308JL21 / PACIFIC GAS and ELECTRIC CO 3.45% 07/01/2025 | 4,82 | 5,19 | 0,3640 | -0,0580 | |||||

| MO / Altria Group, Inc. - Depositary Receipt (Common Stock) | 4,76 | 47,64 | 0,3596 | 0,0626 | |||||

| MO / Altria Group, Inc. - Depositary Receipt (Common Stock) | 4,76 | 47,64 | 0,3596 | 0,0626 | |||||

| SWCH Commercial Mortgage Trust 2025-DATA / ABS-MBS (US78489CAA71) | 4,76 | 0,38 | 0,3590 | -0,0771 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 4,66 | 20,15 | 0,3516 | -0,0052 | |||||

| US693475BT12 / PNC Financial Services Group Inc/The | 4,63 | 31,78 | 0,3497 | 0,0261 | |||||

| Affirm Asset Securitization Trust 2025-X1 / ABS-O (US00834MAA18) | 4,62 | 0,3489 | 0,3489 | ||||||

| Affirm Asset Securitization Trust 2025-X1 / ABS-O (US00834MAA18) | 4,62 | 0,3489 | 0,3489 | ||||||

| US842400HW63 / Southern California Edison Co | 4,56 | 6,54 | 0,3443 | -0,0497 | |||||

| US12803RAB06 / CaixaBank SA | 4,52 | 64,16 | 0,3413 | 0,0878 | |||||

| Huntington Bank Auto Credit-Linked Notes Series 2025-1 / ABS-O (US446438SX24) | 4,50 | -9,81 | 0,3400 | -0,1197 | |||||

| Huntington Bank Auto Credit-Linked Notes Series 2025-1 / ABS-O (US446438SX24) | 4,50 | -9,81 | 0,3400 | -0,1197 | |||||

| US539439AY57 / LLOYDS BANKING GROUP PLC 5.985000% 08/07/2027 | 4,43 | 35,41 | 0,3346 | 0,0332 | |||||

| US281020AU14 / Edison International | 4,42 | 1,33 | 0,3335 | -0,0679 | |||||

| Tricolor Auto Securitization Trust 2025-1 / ABS-O (US89617CAA99) | 4,39 | -12,28 | 0,3312 | -0,1292 | |||||

| Tricolor Auto Securitization Trust 2025-1 / ABS-O (US89617CAA99) | 4,39 | -12,28 | 0,3312 | -0,1292 | |||||

| Fifth Third Bank NA / DBT (US31677QBU22) | 4,37 | 80,82 | 0,3295 | 0,1073 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 4,34 | -4,85 | 0,3275 | -0,0922 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 4,34 | -4,85 | 0,3275 | -0,0922 | |||||

| MFA 2024-NQM2 Trust / ABS-MBS (US58004JAA07) | 4,18 | -4,72 | 0,3156 | -0,0884 | |||||

| MFA 2024-NQM2 Trust / ABS-MBS (US58004JAA07) | 4,18 | -4,72 | 0,3156 | -0,0884 | |||||

| US88167AAE10 / Teva Pharmaceutical Fin Neth 10/01/2026 3.150 Bond | 4,17 | -48,38 | 0,3146 | -0,4287 | |||||

| US37045XEF96 / General Motors Financial Co Inc | 4,12 | 19,11 | 0,3111 | -0,0074 | |||||

| ACHV ABS Trust 2025-1PL / ABS-O (US00112MAB28) | 4,10 | -13,36 | 0,3098 | -0,1263 | |||||

| M1CH34 / Microchip Technology Incorporated - Depositary Receipt (Common Stock) | 4,10 | 142,94 | 0,3093 | 0,1540 | |||||

| Aon North America Inc / DBT (US03740MAA80) | 4,05 | 18,64 | 0,3057 | -0,0085 | |||||

| FS Trust 2024-HULA / ABS-MBS (US30338DAA90) | 4,02 | 0,10 | 0,3034 | -0,0662 | |||||

| FS Trust 2024-HULA / ABS-MBS (US30338DAA90) | 4,02 | 0,10 | 0,3034 | -0,0662 | |||||

| BOCA Commercial Mortgage Trust 2024-BOCA / ABS-MBS (US096817AA90) | 4,02 | -0,20 | 0,3032 | -0,0672 | |||||

| BOCA Commercial Mortgage Trust 2024-BOCA / ABS-MBS (US096817AA90) | 4,02 | -0,20 | 0,3032 | -0,0672 | |||||

| BX Trust 2025-GW / ABS-MBS (US12433GAA40) | 4,02 | 0,3032 | 0,3032 | ||||||

| A1JG34 / Arthur J. Gallagher & Co. - Depositary Receipt (Common Stock) | 3,97 | 21,88 | 0,2998 | -0,0001 | |||||

| BRAVO Residential Funding Trust 2025-NQM5 / ABS-MBS (US10569RAC60) | 3,96 | 0,2988 | 0,2988 | ||||||

| BRAVO Residential Funding Trust 2025-NQM5 / ABS-MBS (US10569RAC60) | 3,96 | 0,2988 | 0,2988 | ||||||

| OBX 2024-NQM11 Trust / ABS-MBS (US67119EAA47) | 3,93 | -9,60 | 0,2964 | -0,1033 | |||||

| CFMT 2024-NR1 LLC / ABS-MBS (US12531DAA28) | 3,90 | 87,92 | 0,2947 | 0,1034 | |||||

| Nelnet Student Loan Trust 2025-A / ABS-O (US64033XAD66) | 3,88 | -3,62 | 0,2932 | -0,0778 | |||||

| Nelnet Student Loan Trust 2025-A / ABS-O (US64033XAD66) | 3,88 | -3,62 | 0,2932 | -0,0778 | |||||

| BX Commercial Mortgage Trust 2024-BIO2 / ABS-MBS (US05613GAA04) | 3,86 | 1,42 | 0,2913 | -0,0590 | |||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 3,84 | 33,39 | 0,2896 | 0,0249 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 3,81 | -2,66 | 0,2877 | -0,0727 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 3,77 | 73,92 | 0,2845 | 0,0850 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 3,77 | 73,92 | 0,2845 | 0,0850 | |||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MCU18) | 3,76 | 0,62 | 0,2837 | -0,0602 | |||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MCU18) | 3,76 | 0,62 | 0,2837 | -0,0602 | |||||

| Hudson Yards 2025-SPRL Mortgage Trust / ABS-MBS (US44855PAA66) | 3,74 | 1,30 | 0,2824 | -0,0575 | |||||

| Hudson Yards 2025-SPRL Mortgage Trust / ABS-MBS (US44855PAA66) | 3,74 | 1,30 | 0,2824 | -0,0575 | |||||

| US842400HS51 / Southern California Edison Co. | 3,74 | 62,33 | 0,2824 | 0,0702 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 3,74 | 91,74 | 0,2821 | 0,1027 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 3,74 | 91,74 | 0,2821 | 0,1027 | |||||

| C1PB34 / The Campbell's Company - Depositary Receipt (Common Stock) | 3,73 | 29,09 | 0,2818 | 0,0156 | |||||

| US693475BL85 / PNC Financial Services Group, Inc. (The) | 3,67 | 21,68 | 0,2772 | -0,0006 | |||||

| SCF Equipment Trust 2016-1 LLC / ABS-O (US78437DAC48) | 3,64 | 0,86 | 0,2751 | -0,0574 | |||||

| US87264ABR59 / T-MOBILE USA INC 2.25% 02/15/2026 | 3,63 | 40,18 | 0,2742 | 0,0357 | |||||

| US031162DP23 / Amgen Inc | 3,62 | 57,07 | 0,2735 | 0,0612 | |||||

| ALA Trust 2025-OANA / ABS-MBS (US009920AA71) | 3,57 | 0,2699 | 0,2699 | ||||||

| ALA Trust 2025-OANA / ABS-MBS (US009920AA71) | 3,57 | 0,2699 | 0,2699 | ||||||

| OBX 2025-NQM3 Trust / ABS-MBS (US67448YAC84) | 3,55 | -3,74 | 0,2683 | -0,0716 | |||||

| Citibank NA / DBT (US17325FBF45) | 3,53 | -0,31 | 0,2663 | -0,0594 | |||||

| Citibank NA / DBT (US17325FBF45) | 3,53 | -0,31 | 0,2663 | -0,0594 | |||||

| Post Road Equipment Finance 2025-1 LLC / ABS-O (US73747LAD01) | 3,50 | 0,57 | 0,2642 | -0,0561 | |||||

| Post Road Equipment Finance 2025-1 LLC / ABS-O (US73747LAD01) | 3,50 | 0,57 | 0,2642 | -0,0561 | |||||

| US225401AT54 / Credit Suisse Group AG | 3,48 | 13,71 | 0,2630 | -0,0191 | |||||

| US71654QCB68 / Petroleos Mexicanos | 3,47 | 0,2623 | 0,2623 | ||||||

| Bank of America Corp / DBT (US06051GML04) | 3,47 | 18,03 | 0,2620 | -0,0087 | |||||

| BX 2025-BIO3 Mortgage Trust / ABS-MBS (US123911AA71) | 3,45 | 0,20 | 0,2608 | -0,0565 | |||||

| Verus Securitization Trust 2024-3 / ABS-MBS (US92540MAA36) | 3,44 | -12,77 | 0,2595 | -0,1032 | |||||

| Verdant Receivables 2025-1 LLC / ABS-O (US92340GAC42) | 3,41 | 0,2571 | 0,2571 | ||||||

| World Financial Network Credit Card Master Note Trust 2024-B / ABS-O (US981464HU72) | 3,40 | 0,24 | 0,2568 | -0,0556 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 3,37 | 0,2545 | 0,2545 | ||||||

| US59217GBY44 / Metropolitan Life Global Funding I | 3,30 | 57,70 | 0,2491 | 0,0564 | |||||

| US06406RBJ59 / Bank of New York Mellon Corp/The | 3,29 | 11,93 | 0,2486 | -0,0222 | |||||

| Verus Securitization Trust 2025-5 / ABS-MBS (US92540XAA90) | 3,28 | 0,2477 | 0,2477 | ||||||

| Verus Securitization Trust 2025-5 / ABS-MBS (US92540XAA90) | 3,28 | 0,2477 | 0,2477 | ||||||

| FUTURES USD CITI COC / STIV (000000000) | 3,28 | 3,28 | 0,2473 | 0,2473 | |||||

| JETD / MAX Airlines -3X Inverse Leveraged ETNs due May 28, 2043 - Structured Product | 3,25 | 46,29 | 0,2456 | 0,0409 | |||||

| JETD / MAX Airlines -3X Inverse Leveraged ETNs due May 28, 2043 - Structured Product | 3,25 | 46,29 | 0,2456 | 0,0409 | |||||

| OBX 2024-NQM8 Trust / ABS-MBS (US67119CAA80) | 3,24 | -7,76 | 0,2449 | -0,0788 | |||||

| OBX 2024-NQM8 Trust / ABS-MBS (US67119CAA80) | 3,24 | -7,76 | 0,2449 | -0,0788 | |||||

| VICI Properties LP / DBT (US925650AJ26) | 3,23 | 81,76 | 0,2438 | 0,0802 | |||||

| Thompson Park CLO Ltd / ABS-CBDO (US884887AN08) | 3,23 | 0,25 | 0,2435 | -0,0527 | |||||

| US161175AY09 / Charter Communications Operating LLC / Charter Communications Operating Capital | 3,19 | 5,60 | 0,2406 | -0,0372 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 3,18 | 43,79 | 0,2403 | 0,0365 | |||||

| US06051GLA57 / Bank of America Corp. | 3,17 | 3,49 | 0,2396 | -0,0428 | |||||

| US95000U3A91 / Wells Fargo & Co. | 3,17 | 37,49 | 0,2395 | 0,0270 | |||||

| US25160PAH01 / Deutsche Bank AG/New York NY | 3,17 | 56,01 | 0,2391 | 0,0522 | |||||

| US345397B280 / FORD MTR CR CO LLC 3.375% 11/13/2025 | 3,16 | 29,43 | 0,2387 | 0,0138 | |||||

| US126650DS68 / CVS Health Corp | 3,15 | 28,47 | 0,2382 | 0,0121 | |||||

| Cascade Funding Mortgage Trust 2024-RM5 / ABS-MBS (US147275AA96) | 3,08 | -2,37 | 0,2328 | -0,0580 | |||||

| GLS Auto Receivables Issuer Trust 2025-1 / ABS-O (US36271KAL52) | 3,05 | 0,36 | 0,2306 | -0,0497 | |||||

| GLS Auto Receivables Issuer Trust 2025-1 / ABS-O (US36271KAJ07) | 3,03 | 0,07 | 0,2286 | -0,0500 | |||||

| GLS Auto Receivables Issuer Trust 2025-1 / ABS-O (US36271KAJ07) | 3,03 | 0,07 | 0,2286 | -0,0500 | |||||

| Citibank NA / DBT (US17325FBN78) | 3,02 | 0,2278 | 0,2278 | ||||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MDB28) | 3,02 | 0,2276 | 0,2276 | ||||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MDB28) | 3,02 | 0,2276 | 0,2276 | ||||||

| Affirm Asset Securitization Trust 2024-A / ABS-O (US00834BAF40) | 3,01 | -0,20 | 0,2276 | -0,0505 | |||||

| Affirm Asset Securitization Trust 2024-A / ABS-O (US00834BAF40) | 3,01 | -0,20 | 0,2276 | -0,0505 | |||||

| Parallel 2023-1 Ltd / ABS-CBDO (US69915NAJ72) | 3,00 | 0,2265 | 0,2265 | ||||||

| PFS Financing Corp / ABS-O (US69335PFP53) | 3,00 | 0,17 | 0,2261 | -0,0492 | |||||

| INTOWN 2025-STAY Mortgage Trust / ABS-MBS (US46117WAA09) | 2,99 | 0,10 | 0,2255 | -0,0492 | |||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RKQ64) | 2,98 | 0,2247 | 0,2247 | ||||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 2,95 | 95,42 | 0,2225 | 0,0837 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 2,95 | 95,42 | 0,2225 | 0,0837 | |||||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 2,94 | 13,68 | 0,2222 | -0,0161 | |||||

| US42806MBT53 / Hertz Vehicle Financing III LLC | 2,93 | -0,37 | 0,2216 | -0,0496 | |||||

| US29250NBW48 / ENBRIDGE INC 5.9% 11/15/2026 | 2,93 | 100,82 | 0,2215 | 0,0870 | |||||

| US172967NX53 / Citigroup, Inc. | 2,91 | 57,95 | 0,2198 | 0,0501 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2,90 | -3,84 | 0,2191 | -0,0588 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2,90 | -3,84 | 0,2191 | -0,0588 | |||||

| US11135FBB67 / Broadcom Inc | 2,89 | 11,94 | 0,2180 | -0,0195 | |||||

| Synchrony Card Funding LLC / ABS-O (US87166PAN15) | 2,88 | 0,17 | 0,2173 | -0,0472 | |||||

| Verizon Master Trust / ABS-O (US92348KEC36) | 2,88 | 0,95 | 0,2171 | -0,0452 | |||||

| Verizon Master Trust / ABS-O (US92348KEC36) | 2,88 | 0,95 | 0,2171 | -0,0452 | |||||

| US98389BAU44 / Xcel Energy Inc | 2,83 | 98,80 | 0,2133 | 0,0824 | |||||

| US718172CU19 / Philip Morris International Inc | 2,80 | -0,18 | 0,2115 | -0,0469 | |||||

| AASET MT-1 Ltd / ABS-O (US00039NAA28) | 2,80 | 0,2111 | 0,2111 | ||||||

| ATLX 2024-RPL1 Trust / ABS-MBS (US049915AA90) | 2,79 | -1,72 | 0,2108 | -0,0508 | |||||

| HCA Inc / DBT (US404119CY34) | 2,79 | 17,81 | 0,2108 | -0,0074 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 2,76 | 27,12 | 0,2085 | 0,0085 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 2,76 | 27,12 | 0,2085 | 0,0085 | |||||

| US913017DD80 / United Technologies Corp | 2,75 | 36,80 | 0,2074 | 0,0225 | |||||

| US29444UBK16 / Equinix Inc | 2,74 | 7,16 | 0,2067 | -0,0285 | |||||

| OBX 2025-NQM8 Trust / ABS-MBS (US67449AAA34) | 2,73 | 0,2063 | 0,2063 | ||||||

| OBX 2025-NQM8 Trust / ABS-MBS (US67449AAA34) | 2,73 | 0,2063 | 0,2063 | ||||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 2,73 | 10,41 | 0,2057 | -0,0215 | |||||

| Capteris Equipment Finance 2024-1 LLC / ABS-O (US14077AAB26) | 2,70 | -6,41 | 0,2041 | -0,0617 | |||||

| GLS Auto Receivables Issuer Trust 2025-2 / ABS-O (US37989BAG77) | 2,68 | 0,2021 | 0,2021 | ||||||

| MMC / Marsh & McLennan Companies, Inc. - Depositary Receipt (Common Stock) | 2,67 | 10,74 | 0,2016 | -0,0204 | |||||

| MMC / Marsh & McLennan Companies, Inc. - Depositary Receipt (Common Stock) | 2,67 | 10,74 | 0,2016 | -0,0204 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 2,65 | 0,2004 | 0,2004 | ||||||

| Consumer Portfolio Services Auto Trust 2025-B / ABS-O (US12630SAC52) | 2,65 | 0,2000 | 0,2000 | ||||||

| S1YK34 / Stryker Corporation - Depositary Receipt (Common Stock) | 2,64 | 30,90 | 0,1990 | 0,0136 | |||||

| BRO / Brown & Brown, Inc. | 2,61 | 0,1973 | 0,1973 | ||||||

| US025816DL03 / American Express Co | 2,60 | 10,91 | 0,1965 | -0,0196 | |||||

| US24023AAA88 / DC_23-DC | 2,60 | 1,80 | 0,1963 | -0,0388 | |||||

| Mission Lane Credit Card Master Trust / ABS-O (US60510MBU18) | 2,59 | 0,1957 | 0,1957 | ||||||

| NEW Residential Mortgage Loan Trust 2025-Nqm2 / ABS-MBS (US64831XAC20) | 2,58 | -4,55 | 0,1951 | -0,0541 | |||||

| NEW Residential Mortgage Loan Trust 2025-Nqm2 / ABS-MBS (US64831XAC20) | 2,58 | -4,55 | 0,1951 | -0,0541 | |||||

| Fashion Show Mall LLC / ABS-MBS (US50245XAA54) | 2,58 | 0,94 | 0,1946 | -0,0405 | |||||

| Fashion Show Mall LLC / ABS-MBS (US50245XAA54) | 2,58 | 0,94 | 0,1946 | -0,0405 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 2,55 | 31,07 | 0,1927 | 0,0134 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 2,55 | 31,07 | 0,1927 | 0,0134 | |||||

| OBX 2024-NQM10 Trust / ABS-MBS (US67119MAA62) | 2,55 | -7,45 | 0,1922 | -0,0611 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 2,54 | 153,29 | 0,1920 | 0,0995 | |||||

| OBX 2024-NQM17 Trust / ABS-MBS (US673911AC73) | 2,50 | -5,24 | 0,1886 | -0,0541 | |||||

| CIM TRUST 2025-R1 / ABS-MBS (US12575LAA17) | 2,49 | -1,74 | 0,1882 | -0,0453 | |||||

| CIM TRUST 2025-R1 / ABS-MBS (US12575LAA17) | 2,49 | -1,74 | 0,1882 | -0,0453 | |||||

| US21036PBB31 / Constellation Brands Inc | 2,49 | 39,93 | 0,1878 | 0,0241 | |||||

| US694308HP52 / PACIFIC GAS + ELECTRIC SR UNSECURED 03/26 2.95 | 2,45 | 1,07 | 0,1851 | -0,0382 | |||||

| US22003BAL09 / Corporate Office Properties LP | 2,45 | 4,89 | 0,1846 | -0,0300 | |||||

| Steele Creek CLO 2019-1 LTD / ABS-CBDO (US85817BAQ23) | 2,44 | -18,56 | 0,1842 | -0,0916 | |||||

| Steele Creek CLO 2019-1 LTD / ABS-CBDO (US85817BAQ23) | 2,44 | -18,56 | 0,1842 | -0,0916 | |||||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 2,43 | 0,1837 | 0,1837 | ||||||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 2,43 | 0,1837 | 0,1837 | ||||||

| SCE.PRK / SCE Trust V - Preferred Security | 2,43 | 13,52 | 0,1833 | -0,0136 | |||||

| Hawaii Hotel Trust 2025-MAUI / ABS-MBS (US419909AA44) | 2,42 | 0,41 | 0,1830 | -0,0392 | |||||

| United Auto Credit Securitization Trust 2025-1 / ABS-O (US90945JAB35) | 2,42 | -0,04 | 0,1828 | -0,0402 | |||||

| United Auto Credit Securitization Trust 2025-1 / ABS-O (US90945JAB35) | 2,42 | -0,04 | 0,1828 | -0,0402 | |||||

| US205887CB65 / Conagra Brands Inc | 2,42 | 29,42 | 0,1824 | 0,0106 | |||||

| Mercedes-Benz Auto Lease Trust 2024-A / ABS-O (US58770JAD63) | 2,42 | 0,04 | 0,1823 | -0,0400 | |||||

| Mercedes-Benz Auto Lease Trust 2024-A / ABS-O (US58770JAD63) | 2,42 | 0,04 | 0,1823 | -0,0400 | |||||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 2,40 | 11,74 | 0,1811 | -0,0165 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,39 | -28,80 | 0,1803 | -0,1286 | |||||

| US694308JP35 / PACIFIC GAS + ELECTRIC 1ST MORTGAGE 01/26 3.15 | 2,39 | 8,75 | 0,1802 | -0,0219 | |||||

| Atrium Hotel Portfolio Trust 2024-ATRM / ABS-MBS (US04963XAA28) | 2,39 | 2,01 | 0,1801 | -0,0352 | |||||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 2,38 | 0,00 | 0,1797 | -0,0394 | |||||

| US00180UAA34 / AMSR 2021-SFR3 Trust | 2,38 | 0,98 | 0,1797 | -0,0373 | |||||

| Mars Inc / DBT (US571676AX38) | 2,37 | 34,83 | 0,1789 | 0,0171 | |||||

| Mars Inc / DBT (US571676AX38) | 2,37 | 34,83 | 0,1789 | 0,0171 | |||||

| Castlelake Aircraft Structured Trust 2025-1 / ABS-O (US14856VAA52) | 2,34 | -1,22 | 0,1770 | -0,0415 | |||||

| Castlelake Aircraft Structured Trust 2025-1 / ABS-O (US14856VAA52) | 2,34 | -1,22 | 0,1770 | -0,0415 | |||||

| National Australia Bank Ltd/New York / DBT (US63253QAJ31) | 2,34 | 0,26 | 0,1770 | -0,0383 | |||||

| Finance of America HECM Buyout 2024-HB1 / ABS-O (US31737DAA46) | 2,33 | -7,88 | 0,1756 | -0,0569 | |||||

| M&T Equipment 2024-LEAF1 Notes / ABS-O (US55376YAC93) | 2,31 | 0,61 | 0,1747 | -0,0370 | |||||

| OWN Equipment Fund I LLC / ABS-O (US69121NAA63) | 2,29 | -4,10 | 0,1731 | -0,0470 | |||||

| OWN Equipment Fund I LLC / ABS-O (US69121NAA63) | 2,29 | -4,10 | 0,1731 | -0,0470 | |||||

| Verus Securitization Trust 2024-8 / ABS-MBS (US92540PAA66) | 2,29 | -5,02 | 0,1727 | -0,0491 | |||||

| Steele Creek CLO 2019-2 LTD / ABS-CBDO (US85817EAU73) | 2,26 | -8,00 | 0,1710 | -0,0556 | |||||

| US694308JC22 / Pacific Gas and Electric Co | 2,26 | 0,1708 | 0,1708 | ||||||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 2,26 | 97,89 | 0,1704 | 0,0654 | |||||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 2,26 | 97,89 | 0,1704 | 0,0654 | |||||

| NMEF Funding 2025-A LLC / ABS-O (US62919VAB71) | 2,26 | 0,09 | 0,1703 | -0,0372 | |||||

| BANK5 2024-5YR11 / ABS-MBS (US06644WBD92) | 2,25 | 0,63 | 0,1696 | -0,0359 | |||||

| Tricon Residential 2024-SFR3 Trust / ABS-O (US89616YAA29) | 2,23 | 0,90 | 0,1684 | -0,0351 | |||||

| SWAP CCPC MORGAN STANLEY COC / STIV (000000000) | 2,22 | 2,22 | 0,1674 | 0,1674 | |||||

| SWAP CCPC MORGAN STANLEY COC / STIV (000000000) | 2,22 | 2,22 | 0,1674 | 0,1674 | |||||

| Crockett Partners Equipment Co IIA LLC / ABS-O (US22689LAA35) | 2,21 | -5,47 | 0,1672 | -0,0485 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,21 | -5,60 | 0,1667 | -0,0486 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,21 | -5,60 | 0,1667 | -0,0486 | |||||

| World Financial Network Credit Card Master Trust / ABS-O (US981464HR44) | 2,20 | 0,18 | 0,1664 | -0,0362 | |||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 2,18 | 16,63 | 0,1647 | -0,0076 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 2,18 | 0,1642 | 0,1642 | ||||||

| BX Commercial Mortgage Trust 2024-GPA3 / ABS-MBS (US123910AA98) | 2,17 | 0,32 | 0,1638 | -0,0353 | |||||

| BX Commercial Mortgage Trust 2024-GPA3 / ABS-MBS (US123910AA98) | 2,17 | 0,32 | 0,1638 | -0,0353 | |||||

| Wheels Fleet Lease Funding 1 LLC / ABS-O (US96328GBT31) | 2,17 | -3,13 | 0,1636 | -0,0423 | |||||

| Subway Funding LLC / ABS-O (US864300AG32) | 2,17 | 0,65 | 0,1635 | -0,0346 | |||||

| US 2YR NOTE (CBT) SEP25 / DIR (000000000) | 2,16 | 0,1634 | 0,1634 | ||||||

| OBX 2024-HYB2 Trust / ABS-MBS (US67118RAA68) | 2,16 | -4,56 | 0,1627 | -0,0452 | |||||

| First National Master Note Trust / ABS-O (US32113CCB46) | 2,15 | 0,23 | 0,1626 | -0,0352 | |||||

| First National Master Note Trust / ABS-O (US32113CCB46) | 2,15 | 0,23 | 0,1626 | -0,0352 | |||||

| MFRA 2024-NQM3 Trust / ABS-MBS (US55287GAA04) | 2,15 | -8,62 | 0,1625 | -0,0543 | |||||

| MFRA 2024-NQM3 Trust / ABS-MBS (US55287GAA04) | 2,15 | -8,62 | 0,1625 | -0,0543 | |||||

| BX Commercial Mortgage Trust 2024-AIRC / ABS-MBS (US12433CAA36) | 2,15 | -2,58 | 0,1624 | -0,0409 | |||||

| BX Commercial Mortgage Trust 2024-AIRC / ABS-MBS (US12433CAA36) | 2,15 | -2,58 | 0,1624 | -0,0409 | |||||

| Long: BCGBEZXR4 IRS USD R V 00MSOFR BCGBEZXR4_FLO CCPOIS / Short: BCGBEZXR4 IRS USD P F 3.16650 BCGBEZXR4_FIX CCPOIS / DIR (000000000) | 2,15 | 0,1620 | 0,1620 | ||||||

| Long: BCGBEZXR4 IRS USD R V 00MSOFR BCGBEZXR4_FLO CCPOIS / Short: BCGBEZXR4 IRS USD P F 3.16650 BCGBEZXR4_FIX CCPOIS / DIR (000000000) | 2,15 | 0,1620 | 0,1620 | ||||||

| US89172YAD22 / Towd Point Mortgage Trust 2016-3 | 2,14 | -17,60 | 0,1619 | -0,0777 | |||||

| US14040HCU77 / Capital One Financial Corp | 2,14 | 14,24 | 0,1618 | -0,0109 | |||||

| NMEF Funding 2024-A LLC / ABS-O (US62919UAB98) | 2,13 | -14,28 | 0,1604 | -0,0678 | |||||

| NMEF Funding 2024-A LLC / ABS-O (US62919UAB98) | 2,13 | -14,28 | 0,1604 | -0,0678 | |||||

| Progress Residential 2024-SFR3 Trust / ABS-O (US74331VAA44) | 2,12 | 1,53 | 0,1601 | -0,0322 | |||||

| Progress Residential 2024-SFR3 Trust / ABS-O (US74331VAA44) | 2,12 | 1,53 | 0,1601 | -0,0322 | |||||

| US15089QAW42 / Celanese US Holdings LLC | 2,12 | 16,24 | 0,1600 | -0,0078 | |||||

| PEAC Solutions Receivables 2024-1 LLC / ABS-O (US69433BAB36) | 2,12 | -16,22 | 0,1599 | -0,0728 | |||||

| PEAC Solutions Receivables 2024-1 LLC / ABS-O (US69433BAB36) | 2,12 | -16,22 | 0,1599 | -0,0728 | |||||

| Merchants Fleet Funding LLC / ABS-O (US588926AF24) | 2,12 | -9,73 | 0,1597 | -0,0560 | |||||

| Merchants Fleet Funding LLC / ABS-O (US588926AF24) | 2,12 | -9,73 | 0,1597 | -0,0560 | |||||

| Finance of America Structured Securities Trust Series 2025-PC1 / ABS-MBS (US316929AA63) | 2,11 | 0,1596 | 0,1596 | ||||||

| US34528QGA67 / Ford Credit Floorplan Master Owner Trust A | 2,10 | 0,1587 | 0,1587 | ||||||

| American Credit Acceptance Receivables Trust 2024-3 / ABS-O (US02490BAC28) | 2,10 | -0,24 | 0,1587 | -0,0353 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 2,10 | 43,30 | 0,1582 | 0,0236 | |||||

| Bank of America Corp / DBT (US06051GMK21) | 2,08 | 17,66 | 0,1570 | -0,0057 | |||||

| Bank of America Corp / DBT (US06051GMK21) | 2,08 | 17,66 | 0,1570 | -0,0057 | |||||

| CPS Auto Receivables Trust 2024-B / ABS-O (US12627SAC08) | 2,04 | -0,24 | 0,1540 | -0,0342 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 2,03 | 23,72 | 0,1532 | 0,0023 | |||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MDF32) | 2,03 | 0,1531 | 0,1531 | ||||||

| Verus Securitization Trust 2024-9 / ABS-MBS (US92540RAC88) | 2,02 | -3,80 | 0,1528 | -0,0409 | |||||

| Bridgecrest Lending Auto Securitization Trust 2024-2 / ABS-O (US10805MAD92) | 2,02 | -0,49 | 0,1526 | -0,0344 | |||||

| Bridgecrest Lending Auto Securitization Trust 2024-2 / ABS-O (US10805MAD92) | 2,02 | -0,49 | 0,1526 | -0,0344 | |||||

| CPS Auto Receivables Trust 2024-B / ABS-O (US12627SAB25) | 2,02 | -0,20 | 0,1524 | -0,0339 | |||||

| CPS Auto Receivables Trust 2024-B / ABS-O (US12627SAB25) | 2,02 | -0,20 | 0,1524 | -0,0339 | |||||

| US69335PET84 / PFS Financing Corp | 2,02 | -0,30 | 0,1523 | -0,0340 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 2,01 | 0,50 | 0,1521 | -0,0325 | |||||

| TMCL VII Holdings Ltd / ABS-O (US87257FAA12) | 2,01 | 0,1520 | 0,1520 | ||||||

| TMCL VII Holdings Ltd / ABS-O (US87257FAA12) | 2,01 | 0,1520 | 0,1520 | ||||||

| Aero Capital Solutions Fund IV LP Term Loan / LON (000000000) | 2,01 | 0,1516 | 0,1516 | ||||||

| Aero Capital Solutions Fund IV LP Term Loan / LON (000000000) | 2,01 | 0,1516 | 0,1516 | ||||||

| Mars Inc / DBT (US571676AW54) | 2,01 | 0,15 | 0,1516 | -0,0329 | |||||

| Mars Inc / DBT (US571676AW54) | 2,01 | 0,15 | 0,1516 | -0,0329 | |||||

| Dell Equipment Finance Trust 2024-2 / ABS-O (US24704EAG35) | 2,01 | 0,25 | 0,1515 | -0,0328 | |||||

| Dell Equipment Finance Trust 2024-2 / ABS-O (US24704EAG35) | 2,01 | 0,25 | 0,1515 | -0,0328 | |||||

| Sycamore Tree CLO 2024-5 Ltd / ABS-CBDO (US87122YAA38) | 2,00 | 0,15 | 0,1513 | -0,0329 | |||||

| US716973AB84 / Pfizer Investment Enterprises Pte Ltd | 2,00 | 8,04 | 0,1512 | -0,0194 | |||||

| US46647PDU75 / JPMorgan Chase & Co. | 2,00 | 12,16 | 0,1512 | -0,0132 | |||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 1,98 | 10,28 | 0,1498 | -0,0158 | |||||

| Freddie Mac STACR REMIC Trust 2024-DNA2 / ABS-MBS (US35564NCW11) | 1,98 | -1,54 | 0,1495 | -0,0356 | |||||

| CFMT 2024-R1 LLC / ABS-MBS (US12530YAA73) | 1,98 | -7,49 | 0,1492 | -0,0475 | |||||

| NMEF Funding 2025-A LLC / ABS-O (US62919VAC54) | 1,97 | 0,15 | 0,1490 | -0,0324 | |||||

| NMEF Funding 2025-A LLC / ABS-O (US62919VAC54) | 1,97 | 0,15 | 0,1490 | -0,0324 | |||||

| OBX 2024-NQM13 Trust / ABS-MBS (US67119PAP62) | 1,96 | -11,39 | 0,1480 | -0,0556 | |||||

| OBX 2024-NQM13 Trust / ABS-MBS (US67119PAP62) | 1,96 | -11,39 | 0,1480 | -0,0556 | |||||

| BRO / Brown & Brown, Inc. | 1,95 | 0,1473 | 0,1473 | ||||||

| BRO / Brown & Brown, Inc. | 1,95 | 0,1473 | 0,1473 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1,95 | 0,1471 | 0,1471 | ||||||

| ELM Trust 2024-ELM / ABS-MBS (US26860XAA90) | 1,94 | -0,51 | 0,1468 | -0,0331 | |||||

| Verizon Master Trust / ABS-O (US92348KDE01) | 1,94 | 0,57 | 0,1466 | -0,0311 | |||||

| Verizon Master Trust / ABS-O (US92348KDE01) | 1,94 | 0,57 | 0,1466 | -0,0311 | |||||

| Consumer Portfolio Services Auto Trust 2025-B / ABS-O (US12630SAB79) | 1,93 | 0,1460 | 0,1460 | ||||||

| Consumer Portfolio Services Auto Trust 2025-B / ABS-O (US12630SAB79) | 1,93 | 0,1460 | 0,1460 | ||||||

| Fannie Mae Connecticut Avenue Securities / ABS-MBS (US20755RAA32) | 1,93 | -3,65 | 0,1456 | -0,0386 | |||||

| Mars Inc / DBT (US571676AY11) | 1,93 | 47,28 | 0,1454 | 0,0250 | |||||

| BRO / Brown & Brown, Inc. | 1,92 | 0,1449 | 0,1449 | ||||||

| US74333HAA32 / Progress Residential Trust | 1,91 | 0,74 | 0,1440 | -0,0303 | |||||

| GM Financial Revolving Receivables Trust 2024-2 / ABS-O (US379925AA81) | 1,90 | 0,64 | 0,1436 | -0,0304 | |||||

| GM Financial Revolving Receivables Trust 2024-2 / ABS-O (US379925AA81) | 1,90 | 0,64 | 0,1436 | -0,0304 | |||||

| MSBAM / ABS-MBS (US61778GAM87) | 1,87 | 0,59 | 0,1410 | -0,0300 | |||||

| MSBAM / ABS-MBS (US61778GAM87) | 1,87 | 0,59 | 0,1410 | -0,0300 | |||||

| American Credit Acceptance Receivables Trust 2024-2 / ABS-O (US02531BAG41) | 1,86 | -0,43 | 0,1408 | -0,0316 | |||||

| SFS Auto Receivables Securitization Trust 2024-3 / ABS-O (US78436XAE76) | 1,86 | 0,76 | 0,1405 | -0,0296 | |||||

| SFS Auto Receivables Securitization Trust 2024-3 / ABS-O (US78436XAE76) | 1,86 | 0,76 | 0,1405 | -0,0296 | |||||

| Drive Auto Receivables Trust / ABS-O (US262102AD81) | 1,86 | 0,1404 | 0,1404 | ||||||

| Drive Auto Receivables Trust / ABS-O (US262102AD81) | 1,86 | 0,1404 | 0,1404 | ||||||

| Fannie Mae Connecticut Avenue Securities / ABS-MBS (US20755JAA16) | 1,85 | -3,65 | 0,1394 | -0,0370 | |||||

| Fannie Mae Connecticut Avenue Securities / ABS-MBS (US20755JAA16) | 1,85 | -3,65 | 0,1394 | -0,0370 | |||||

| BX Trust 2024-CNYN / ABS-MBS (US05612HAA95) | 1,84 | -0,70 | 0,1392 | -0,0317 | |||||

| Bridgecrest Lending Auto Securitization Trust 2024-2 / ABS-O (US10805MAC10) | 1,84 | -8,59 | 0,1390 | -0,0464 | |||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 1,84 | 8,81 | 0,1389 | -0,0168 | |||||

| Porsche Innovative Lease Owner Trust 2024-1 / ABS-O (US73328AAD19) | 1,84 | 0,00 | 0,1389 | -0,0305 | |||||

| Rio Tinto Finance USA PLC / DBT (US76720AAS50) | 1,84 | 39,76 | 0,1386 | 0,0176 | |||||

| Rio Tinto Finance USA PLC / DBT (US76720AAS50) | 1,84 | 39,76 | 0,1386 | 0,0176 | |||||

| BMO 2024-5C6 Mortgage Trust / ABS-MBS (US05593QAC87) | 1,83 | 0,72 | 0,1380 | -0,0290 | |||||

| BMO 2024-5C6 Mortgage Trust / ABS-MBS (US05593QAC87) | 1,83 | 0,72 | 0,1380 | -0,0290 | |||||

| Verus Securitization Trust 2025-3 / ABS-MBS (US924928AA24) | 1,83 | 0,1378 | 0,1378 | ||||||

| Verus Securitization Trust 2025-3 / ABS-MBS (US924928AA24) | 1,83 | 0,1378 | 0,1378 | ||||||

| GreatAmerica Leasing Receivables Funding LLC / ABS-O (US39154GAJ58) | 1,81 | 0,22 | 0,1367 | -0,0297 | |||||

| CABK / CaixaBank, S.A. | 1,80 | 0,1363 | 0,1363 | ||||||

| CABK / CaixaBank, S.A. | 1,80 | 0,1363 | 0,1363 | ||||||

| US136385AZ48 / Canadian Natural Resources Ltd | 1,80 | 6,50 | 0,1362 | -0,0197 | |||||

| US71654QDH20 / Petroleos Mexicanos | 1,78 | 0,06 | 0,1346 | -0,0295 | |||||

| PG&E Recovery Funding LLC / DBT (US71710TAG31) | 1,78 | -7,94 | 0,1340 | -0,0436 | |||||

| PG&E Recovery Funding LLC / DBT (US71710TAG31) | 1,78 | -7,94 | 0,1340 | -0,0436 | |||||

| American Credit Acceptance Receivables Trust 2025-2 / ABS-O (US024938AE27) | 1,77 | 0,1338 | 0,1338 | ||||||

| ELM Trust 2024-ELM / ABS-MBS (US26860XAU54) | 1,77 | -0,23 | 0,1338 | -0,0297 | |||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 1,76 | 0,1328 | 0,1328 | ||||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 1,76 | 0,1328 | 0,1328 | ||||||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 1,75 | 13,47 | 0,1323 | -0,0099 | |||||

| US12595JAJ34 / CSAIL 2017-CX10 Commercial Mortgage Trust | 1,74 | 1,51 | 0,1316 | -0,0265 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 1,74 | 0,1316 | 0,1316 | ||||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 1,74 | 0,1316 | 0,1316 | ||||||

| PRPM 2025-RPL3 LLC / ABS-MBS (US69392NAA81) | 1,74 | 0,1313 | 0,1313 | ||||||

| PRPM 2025-RPL3 LLC / ABS-MBS (US69392NAA81) | 1,74 | 0,1313 | 0,1313 | ||||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 1,73 | 7,13 | 0,1305 | -0,0180 | |||||

| US94988J6D46 / WELLS FARGO BANK NA SR UNSEC 5.45% 08-07-26 | 1,72 | -0,06 | 0,1300 | -0,0287 | |||||

| PNC Bank NA / DBT (US69353RFY99) | 1,72 | 0,1299 | 0,1299 | ||||||

| US89114QCK22 / Toronto-Dominion Bank/The | 1,72 | 78,83 | 0,1295 | 0,0412 | |||||

| Towd Point Mortgage Trust 2024-3 / ABS-MBS (US89183FAP36) | 1,71 | -3,98 | 0,1293 | -0,0349 | |||||

| Towd Point Mortgage Trust 2024-3 / ABS-MBS (US89183FAP36) | 1,71 | -3,98 | 0,1293 | -0,0349 | |||||

| BRAVO Residential Funding Trust 2023-NQM8 / ABS-MBS (US10567MAA36) | 1,69 | -5,16 | 0,1277 | -0,0365 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 1,69 | 0,1276 | 0,1276 | ||||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 1,69 | 0,54 | 0,1275 | -0,0271 | |||||

| GPJA / Georgia Power Company - Preferred Security | 1,67 | 0,12 | 0,1261 | -0,0274 | |||||

| GPJA / Georgia Power Company - Preferred Security | 1,67 | 0,12 | 0,1261 | -0,0274 | |||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MDD83) | 1,66 | 0,1254 | 0,1254 | ||||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MDD83) | 1,66 | 0,1254 | 0,1254 | ||||||

| STAR 2024-SFR4 Trust / ABS-O (US85520AAA79) | 1,66 | -0,06 | 0,1253 | -0,0276 | |||||

| STAR 2024-SFR4 Trust / ABS-O (US85520AAA79) | 1,66 | -0,06 | 0,1253 | -0,0276 | |||||

| CABK / CaixaBank, S.A. | 1,66 | 0,1250 | 0,1250 | ||||||

| CABK / CaixaBank, S.A. | 1,66 | 0,1250 | 0,1250 | ||||||

| Mercury Financial Credit Card Master Trust / ABS-O (US58940BAZ94) | 1,65 | -0,48 | 0,1248 | -0,0282 | |||||

| Mercury Financial Credit Card Master Trust / ABS-O (US58940BAZ94) | 1,65 | -0,48 | 0,1248 | -0,0282 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 1,64 | 39,27 | 0,1240 | 0,0154 | |||||

| Battalion CLO XII Ltd / ABS-CBDO (US07133RAW51) | 1,64 | -16,66 | 0,1236 | -0,0572 | |||||

| US26441CBV63 / Duke Energy Corp | 1,63 | -0,24 | 0,1233 | -0,0274 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 1,63 | 94,29 | 0,1233 | 0,0459 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 1,63 | 94,29 | 0,1233 | 0,0459 | |||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MCT45) | 1,62 | 0,37 | 0,1226 | -0,0263 | |||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MCT45) | 1,62 | 0,37 | 0,1226 | -0,0263 | |||||

| ConocoPhillips Co / DBT (US20826FBJ49) | 1,62 | 24,01 | 0,1225 | 0,0021 | |||||

| ConocoPhillips Co / DBT (US20826FBJ49) | 1,62 | 24,01 | 0,1225 | 0,0021 | |||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MDC01) | 1,62 | 0,1224 | 0,1224 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1,62 | 22,41 | 0,1221 | 0,0005 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1,62 | 74,25 | 0,1221 | 0,0367 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1,62 | 74,25 | 0,1221 | 0,0367 | |||||

| Charter Communications Operating LLC / Charter Communications Operating Capital / DBT (US161175CQ56) | 1,62 | 124,93 | 0,1220 | 0,0558 | |||||

| US718172CY31 / Philip Morris International Inc | 1,61 | 17,92 | 0,1218 | -0,0041 | |||||

| MDLZ / Mondelez International, Inc. - Depositary Receipt (Common Stock) | 1,60 | 0,1207 | 0,1207 | ||||||

| Aon North America Inc / DBT (US03740MAB63) | 1,60 | 29,81 | 0,1206 | 0,0073 | |||||

| Navient Education Loan Trust 2025-A / ABS-O (US63943EAA55) | 1,60 | 0,1206 | 0,1206 | ||||||

| X1EL34 / Xcel Energy Inc. - Depositary Receipt (Common Stock) | 1,59 | 104,63 | 0,1202 | 0,0486 | |||||

| X1EL34 / Xcel Energy Inc. - Depositary Receipt (Common Stock) | 1,59 | 104,63 | 0,1202 | 0,0486 | |||||

| AASET 2025-1 / ABS-O (US00258PAA12) | 1,58 | -0,94 | 0,1193 | -0,0275 | |||||

| AASET 2025-1 / ABS-O (US00258PAA12) | 1,58 | -0,94 | 0,1193 | -0,0275 | |||||

| Angel Oak Mortgage Trust 2024-8 / ABS-MBS (US03465QAA22) | 1,57 | -5,72 | 0,1182 | -0,0347 | |||||

| Angel Oak Mortgage Trust 2024-8 / ABS-MBS (US03465QAA22) | 1,57 | -5,72 | 0,1182 | -0,0347 | |||||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 1,55 | 48,94 | 0,1167 | 0,0211 | |||||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 1,55 | 48,94 | 0,1167 | 0,0211 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 1,54 | 12,81 | 0,1164 | -0,0094 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 1,54 | 12,81 | 0,1164 | -0,0094 | |||||

| Santander Drive Auto Receivables Trust 2024-2 / ABS-O (US80286YAD40) | 1,54 | -0,26 | 0,1164 | -0,0259 | |||||

| Santander Drive Auto Receivables Trust 2024-2 / ABS-O (US80286YAD40) | 1,54 | -0,26 | 0,1164 | -0,0259 | |||||

| US Bank NA / ABS-O (US90357PBC77) | 1,53 | -12,49 | 0,1158 | -0,0456 | |||||

| US Bank NA / ABS-O (US90357PBC77) | 1,53 | -12,49 | 0,1158 | -0,0456 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,52 | -7,41 | 0,1151 | -0,0365 | |||||

| W1MC34 / Waste Management, Inc. - Depositary Receipt (Common Stock) | 1,52 | 16,46 | 0,1149 | -0,0054 | |||||

| Citibank NA / DBT (US17325FBJ66) | 1,52 | 3,47 | 0,1148 | -0,0205 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 1,52 | 24,59 | 0,1144 | 0,0024 | |||||

| NOCG34 / Northrop Grumman Corporation - Depositary Receipt (Common Stock) | 1,51 | 0,1143 | 0,1143 | ||||||

| United Auto Credit Securitization Trust 2024-1 / ABS-O (US90945DAC48) | 1,51 | -0,40 | 0,1141 | -0,0256 | |||||

| United Auto Credit Securitization Trust 2024-1 / ABS-O (US90945DAC48) | 1,51 | -0,40 | 0,1141 | -0,0256 | |||||

| Mercedes-Benz Auto Receivables Trust 2024-1 / ABS-O (US587918AD51) | 1,51 | 0,00 | 0,1139 | -0,0249 | |||||

| CFG Investments Ltd / ABS-O (US12528GAM42) | 1,51 | 0,67 | 0,1136 | -0,0240 | |||||

| CFG Investments Ltd / ABS-O (US12528GAM42) | 1,51 | 0,67 | 0,1136 | -0,0240 | |||||

| Golub Capital Partners Static 2024-1 Ltd / ABS-CBDO (US381929AN88) | 1,50 | 0,1133 | 0,1133 | ||||||

| Golub Capital Partners Static 2024-1 Ltd / ABS-CBDO (US381929AC24) | 1,50 | 0,00 | 0,1129 | -0,0248 | |||||

| Daimler Trucks Retail Trust 2024-1 / ABS-O (US233874AD88) | 1,49 | 0,34 | 0,1121 | -0,0242 | |||||

| Morgan Stanley Residential Mortgage Loan Trust 2024-NQM2 / ABS-MBS (US61776HAA41) | 1,49 | -9,73 | 0,1121 | -0,0394 | |||||

| Morgan Stanley Residential Mortgage Loan Trust 2024-NQM2 / ABS-MBS (US61776HAA41) | 1,49 | -9,73 | 0,1121 | -0,0394 | |||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MCK36) | 1,47 | 0,20 | 0,1112 | -0,0241 | |||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MCK36) | 1,47 | 0,20 | 0,1112 | -0,0241 | |||||

| Bridgecrest Lending Auto Securitization Trust 2024-3 / ABS-O (US10805NAF24) | 1,47 | 0,55 | 0,1111 | -0,0236 | |||||

| Bridgecrest Lending Auto Securitization Trust 2024-3 / ABS-O (US10805NAF24) | 1,47 | 0,55 | 0,1111 | -0,0236 | |||||

| Post Road Equipment Finance 2025-1 LLC / ABS-O (US73747LAC28) | 1,47 | 0,48 | 0,1110 | -0,0237 | |||||

| Post Road Equipment Finance 2025-1 LLC / ABS-O (US73747LAC28) | 1,47 | 0,48 | 0,1110 | -0,0237 | |||||

| Hyundai Capital America / DBT (US44891ADA25) | 1,47 | 0,00 | 0,1107 | -0,0243 | |||||

| Hyundai Capital America / DBT (US44891ADA25) | 1,47 | 0,00 | 0,1107 | -0,0243 | |||||

| AU3FN0029609 / AAI Ltd | 1,46 | 23,18 | 0,1100 | 0,0011 | |||||

| BANK5 2025-5YR14 / ABS-MBS (US06604MAH16) | 1,44 | 0,1091 | 0,1091 | ||||||

| BMO 2025-5C9 Mortgage Trust / ABS-MBS (US096933AC06) | 1,44 | 0,70 | 0,1089 | -0,0230 | |||||

| BMO 2025-5C9 Mortgage Trust / ABS-MBS (US096933AC06) | 1,44 | 0,70 | 0,1089 | -0,0230 | |||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 1,44 | 0,1087 | 0,1087 | ||||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 1,44 | 0,1087 | 0,1087 | ||||||

| American Credit Acceptance Receivables Trust 2024-4 / ABS-O (US024945AG26) | 1,44 | 0,07 | 0,1084 | -0,0237 | |||||

| Allegro CLO X Ltd / ABS-CBDO (US01750FAS56) | 1,43 | -4,34 | 0,1083 | -0,0297 | |||||

| BK / The Bank of New York Mellon Corporation - Depositary Receipt (Common Stock) | 1,43 | 77,08 | 0,1080 | 0,0336 | |||||

| BK / The Bank of New York Mellon Corporation - Depositary Receipt (Common Stock) | 1,43 | 77,08 | 0,1080 | 0,0336 | |||||

| Freddie Mac STACR REMIC Trust 2024-DNA3 / ABS-MBS (US35564NEY58) | 1,43 | -14,43 | 0,1079 | -0,0459 | |||||

| Freddie Mac STACR REMIC Trust 2024-DNA3 / ABS-MBS (US35564NEY58) | 1,43 | -14,43 | 0,1079 | -0,0459 | |||||

| S1YK34 / Stryker Corporation - Depositary Receipt (Common Stock) | 1,43 | 17,82 | 0,1079 | -0,0037 | |||||

| S1YK34 / Stryker Corporation - Depositary Receipt (Common Stock) | 1,43 | 17,82 | 0,1079 | -0,0037 | |||||

| Freddie Mac STACR REMIC Trust 2024-DNA1 / ABS-MBS (US35564NAW39) | 1,42 | -2,75 | 0,1069 | -0,0271 | |||||

| PK ALIFT Loan Funding 4 LP / ABS-O (US69381EAA10) | 1,41 | -2,70 | 0,1062 | -0,0269 | |||||

| PK ALIFT Loan Funding 4 LP / ABS-O (US69381EAA10) | 1,41 | -2,70 | 0,1062 | -0,0269 | |||||

| CPRL34 / Canadian Pacific Kansas City Limited - Depositary Receipt (Common Stock) | 1,40 | 28,34 | 0,1061 | 0,0053 | |||||

| CPRL34 / Canadian Pacific Kansas City Limited - Depositary Receipt (Common Stock) | 1,40 | 28,34 | 0,1061 | 0,0053 | |||||

| US12565KAE73 / CLI Funding LLC | 1,40 | -2,37 | 0,1060 | -0,0264 | |||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 1,40 | 0,1055 | 0,1055 | ||||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 1,40 | 0,1055 | 0,1055 | ||||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 1,40 | 0,58 | 0,1054 | -0,0224 | |||||

| Wheels Fleet Lease Funding 1 LLC / ABS-O (US96328GBZ90) | 1,38 | 0,15 | 0,1042 | -0,0227 | |||||

| Wheels Fleet Lease Funding 1 LLC / ABS-O (US96328GBZ90) | 1,38 | 0,15 | 0,1042 | -0,0227 | |||||

| Tricon Residential 2024-SFR2 Trust / ABS-O (US89616VAA89) | 1,38 | 0,73 | 0,1039 | -0,0218 | |||||

| US45290BAA70 / IMPRL 23-NQM1 A1 144A 5.941% 02-25-68/01-01-27 | 1,38 | -5,56 | 0,1038 | -0,0303 | |||||

| MMC / Marsh & McLennan Companies, Inc. - Depositary Receipt (Common Stock) | 1,37 | 29,61 | 0,1035 | 0,0062 | |||||

| MMC / Marsh & McLennan Companies, Inc. - Depositary Receipt (Common Stock) | 1,37 | 29,61 | 0,1035 | 0,0062 | |||||

| OBX 2024-NQM4 Trust / ABS-MBS (US67118TAA25) | 1,36 | -7,08 | 0,1030 | -0,0322 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 1,36 | 34,02 | 0,1030 | 0,0093 | |||||

| GWT 2024-WLF2 / ABS-MBS (US362414AA28) | 1,36 | 0,29 | 0,1028 | -0,0222 | |||||

| Hawaii Hotel Trust 2025-MAUI / ABS-MBS (US419909AG14) | 1,36 | 0,30 | 0,1025 | -0,0222 | |||||

| US89233FHN15 / Toyota Motor Credit Corporation | 1,36 | 0,74 | 0,1023 | -0,0215 | |||||

| US89233FHN15 / Toyota Motor Credit Corporation | 1,36 | 0,74 | 0,1023 | -0,0215 | |||||

| US06051GLG28 / Bank of America Corp | 1,35 | 30,15 | 0,1020 | 0,0064 | |||||

| US00185AAK07 / Aon PLC | 1,35 | 34,93 | 0,1018 | 0,0098 | |||||

| US12530MAA36 / CF Hippolyta LLC, Series 2020-1, Class A1 | 1,33 | 0,23 | 0,1008 | -0,0218 | |||||

| US87166FAD50 / Synchrony Bank | 1,33 | 33,17 | 0,1007 | 0,0085 | |||||

| Diageo Investment Corp / DBT (US25245BAC19) | 1,33 | 0,1006 | 0,1006 | ||||||

| PEAC Solutions Receivables 2025-1 LLC / ABS-O (US69392HAB96) | 1,33 | 0,08 | 0,1005 | -0,0220 | |||||

| GLS Auto Receivables Issuer Trust 2024-1 / ABS-O (US36269HAE27) | 1,32 | -0,30 | 0,0996 | -0,0222 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 1,32 | 19,40 | 0,0995 | -0,0021 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 1,32 | 19,40 | 0,0995 | -0,0021 | |||||

| MCD / McDonald's Corporation - Depositary Receipt (Common Stock) | 1,31 | 1,08 | 0,0992 | -0,0205 | |||||

| MCD / McDonald's Corporation - Depositary Receipt (Common Stock) | 1,31 | 1,08 | 0,0992 | -0,0205 | |||||

| P1EG34 / Public Service Enterprise Group Incorporated - Depositary Receipt (Common Stock) | 1,30 | 44,25 | 0,0985 | 0,0152 | |||||

| P1EG34 / Public Service Enterprise Group Incorporated - Depositary Receipt (Common Stock) | 1,30 | 44,25 | 0,0985 | 0,0152 | |||||

| Jamestown CLO XII Ltd / ABS-CBDO (US47047JAJ34) | 1,30 | -9,66 | 0,0982 | -0,0343 | |||||

| Toyota Auto Receivables 2024-A Owner Trust / ABS-O (US89238DAD03) | 1,29 | 0,00 | 0,0975 | -0,0214 | |||||

| Toyota Auto Receivables 2024-A Owner Trust / ABS-O (US89238DAD03) | 1,29 | 0,00 | 0,0975 | -0,0214 | |||||

| Exeter Select Automobile Receivables Trust 2025-1 / ABS-O (US30185AAB70) | 1,29 | 0,0971 | 0,0971 | ||||||

| BANK5 2025-5YR14 / ABS-MBS (US06604MAF59) | 1,28 | 0,0969 | 0,0969 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 1,27 | 48,59 | 0,0958 | 0,0172 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 1,27 | 48,59 | 0,0958 | 0,0172 | |||||

| SMB Private Education Loan Trust 2025-A / ABS-O (US83207EAA47) | 1,26 | 0,0953 | 0,0953 | ||||||

| Progress Residential 2024-SFR5 Trust / ABS-O (US74332HAC07) | 1,26 | 1,37 | 0,0951 | -0,0194 | |||||

| Progress Residential 2024-SFR5 Trust / ABS-O (US74332HAC07) | 1,26 | 1,37 | 0,0951 | -0,0194 | |||||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 1,26 | 0,0949 | 0,0949 | ||||||

| Ballyrock CLO 2019-2 Ltd / ABS-CBDO (US05875MAX02) | 1,25 | 0,32 | 0,0946 | -0,0205 | |||||

| US970648AL56 / WILLIS NORTH AMERICA INC | 1,25 | 25,33 | 0,0942 | 0,0025 | |||||

| US337964AC48 / FIVE 23-V1 A3 5.6679% 02-10-56/02-11-28 | 1,25 | 0,40 | 0,0941 | -0,0201 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 1,23 | 73,03 | 0,0931 | 0,0274 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 1,23 | 73,03 | 0,0931 | 0,0274 | |||||

| Mission Lane Credit Card Master Trust / ABS-O (US60510MAY49) | 1,22 | 0,00 | 0,0923 | -0,0203 | |||||

| Mission Lane Credit Card Master Trust / ABS-O (US60510MAY49) | 1,22 | 0,00 | 0,0923 | -0,0203 | |||||

| LLY / Eli Lilly and Company - Depositary Receipt (Common Stock) | 1,22 | 0,99 | 0,0923 | -0,0192 | |||||

| LLY / Eli Lilly and Company - Depositary Receipt (Common Stock) | 1,22 | 0,99 | 0,0923 | -0,0192 | |||||

| A1JG34 / Arthur J. Gallagher & Co. - Depositary Receipt (Common Stock) | 1,22 | 101,66 | 0,0920 | 0,0363 | |||||

| Exeter Automobile Receivables Trust 2024-4 / ABS-O (US30166UAD28) | 1,22 | 0,00 | 0,0919 | -0,0201 | |||||

| XS1040508167 / Imperial Brands Finance plc | 1,21 | 0,0915 | 0,0915 | ||||||

| XS1040508167 / Imperial Brands Finance plc | 1,21 | 0,0915 | 0,0915 | ||||||

| US50249AAF03 / LYB International Finance III LLC | 1,21 | 0,92 | 0,0913 | -0,0191 | |||||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 1,20 | -0,33 | 0,0909 | -0,0203 | |||||

| XS2291692890 / Chile Government International Bond | 1,20 | 43,73 | 0,0909 | 0,0138 | |||||

| XS2291692890 / Chile Government International Bond | 1,20 | 43,73 | 0,0909 | 0,0138 | |||||

| US61747YFF79 / Morgan Stanley | 1,20 | 104,59 | 0,0909 | 0,0367 | |||||

| E1IX34 / Edison International - Depositary Receipt (Common Stock) | 1,20 | 136,17 | 0,0903 | 0,0436 | |||||

| E1IX34 / Edison International - Depositary Receipt (Common Stock) | 1,20 | 136,17 | 0,0903 | 0,0436 | |||||

| E1IX34 / Edison International - Depositary Receipt (Common Stock) | 1,19 | 101,52 | 0,0901 | 0,0356 | |||||

| US30040WAW82 / EVERSOURCE ENERGY SR UNSEC 5.95% 02-01-29 | 1,19 | 10,29 | 0,0898 | -0,0095 | |||||

| Verus Securitization Trust 2024-2 / ABS-MBS (US92539UAA88) | 1,19 | -8,54 | 0,0898 | -0,0299 | |||||

| Verus Securitization Trust 2024-2 / ABS-MBS (US92539UAA88) | 1,19 | -8,54 | 0,0898 | -0,0299 | |||||

| Towd Point Mortgage Trust 2015-2 / ABS-MBS (US89171YAE14) | 1,19 | 1,02 | 0,0897 | -0,0186 | |||||

| Towd Point Mortgage Trust 2015-2 / ABS-MBS (US89171YAE14) | 1,19 | 1,02 | 0,0897 | -0,0186 | |||||

| Florida Power & Light Co / DBT (US341081GT84) | 1,19 | 10,34 | 0,0895 | -0,0094 | |||||

| S1TT34 / State Street Corporation - Depositary Receipt (Common Stock) | 1,17 | 0,0885 | 0,0885 | ||||||

| OBX 2024-NQM7 Trust / ABS-MBS (US67119FAA12) | 1,17 | -9,39 | 0,0882 | -0,0305 | |||||

| OBX 2024-NQM7 Trust / ABS-MBS (US67119FAA12) | 1,17 | -9,39 | 0,0882 | -0,0305 | |||||

| Apidos CLO XXXII / ABS-CBDO (US03768RAQ92) | 1,17 | -0,43 | 0,0881 | -0,0198 | |||||

| Apidos CLO XXXII / ABS-CBDO (US03768RAQ92) | 1,17 | -0,43 | 0,0881 | -0,0198 | |||||

| US86562MDB37 / Sumitomo Mitsui Financial Group Inc | 1,17 | 0,52 | 0,0881 | -0,0188 | |||||

| Benchmark 2025-V14 Mortgage Trust / ABS-MBS (US08164BAG59) | 1,16 | 1,22 | 0,0874 | -0,0178 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 1,15 | 22,95 | 0,0870 | 0,0008 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 1,15 | 22,95 | 0,0870 | 0,0008 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,15 | 0,0869 | 0,0869 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,15 | 0,0869 | 0,0869 | ||||||

| Voya CLO 2018-3 Ltd / ABS-CBDO (US92917KAQ76) | 1,14 | 0,09 | 0,0862 | -0,0189 | |||||

| Voya CLO 2018-3 Ltd / ABS-CBDO (US92917KAQ76) | 1,14 | 0,09 | 0,0862 | -0,0189 | |||||

| Auxilior Term Funding 2024-1 LLC / ABS-O (US05335FAB76) | 1,13 | -27,66 | 0,0854 | -0,0585 | |||||

| Auxilior Term Funding 2024-1 LLC / ABS-O (US05335FAB76) | 1,13 | -27,66 | 0,0854 | -0,0585 | |||||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 1,13 | 0,63 | 0,0850 | -0,0180 | |||||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 1,13 | 0,63 | 0,0850 | -0,0180 | |||||

| US42806MBS70 / Hertz Vehicle Financing III LLC | 1,12 | -0,09 | 0,0845 | -0,0187 | |||||

| Wisconsin Public Service Corp / DBT (US976843BQ43) | 1,11 | 1,18 | 0,0841 | -0,0173 | |||||

| Drive Auto Receivables Trust 2024-2 / ABS-O (US26207AAE38) | 1,11 | 0,18 | 0,0841 | -0,0183 | |||||

| Drive Auto Receivables Trust 2024-2 / ABS-O (US26207AAE38) | 1,11 | 0,18 | 0,0841 | -0,0183 | |||||

| US06541FBA66 / BANK 2017-BNK4 | 1,11 | 0,82 | 0,0838 | -0,0175 | |||||

| US05530QAQ38 / BAT International Finance plc | 1,11 | 30,32 | 0,0838 | 0,0054 | |||||

| Freddie Mac STACR REMIC Trust 2025-DNA2 / ABS-MBS (US35564NHY22) | 1,11 | 0,0837 | 0,0837 | ||||||

| Freddie Mac STACR REMIC Trust 2025-DNA2 / ABS-MBS (US35564NHY22) | 1,11 | 0,0837 | 0,0837 | ||||||

| US694308KL02 / Pacific Gas and Electric Co | 1,10 | 77,33 | 0,0833 | 0,0261 | |||||

| Progress Residential 2024-SFR1 Trust / ABS-O (US74331QAA58) | 1,10 | 1,20 | 0,0827 | -0,0169 | |||||

| Drive Auto Receivables Trust 2024-2 / ABS-O (US26207AAF03) | 1,09 | 0,46 | 0,0824 | -0,0177 | |||||

| Fortress Credit BSL VIII Ltd / ABS-CBDO (US34962DAN66) | 1,09 | -23,28 | 0,0824 | -0,0485 | |||||

| GLS Auto Receivables Issuer Trust 2025-1 / ABS-O (US36271KAG67) | 1,09 | 0,09 | 0,0824 | -0,0180 | |||||

| GLS Auto Receivables Issuer Trust 2025-1 / ABS-O (US36271KAG67) | 1,09 | 0,09 | 0,0824 | -0,0180 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1,09 | 93,06 | 0,0819 | 0,0302 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1,09 | 93,06 | 0,0819 | 0,0302 | |||||

| Multifamily Connecticut Avenue Securities Trust 2025-01 / ABS-MBS (US62549CAA99) | 1,09 | 0,0819 | 0,0819 | ||||||

| Multifamily Connecticut Avenue Securities Trust 2025-01 / ABS-MBS (US62549CAA99) | 1,09 | 0,0819 | 0,0819 | ||||||

| US35564KH362 / Freddie Mac STACR REMIC Trust 2022-DNA6 | 1,08 | -16,86 | 0,0816 | -0,0380 | |||||

| US44891ABN63 / Hyundai Capital America | 1,08 | 10,88 | 0,0816 | -0,0081 | |||||

| United Auto Credit Securitization Trust 2024-1 / ABS-O (US90945DAB64) | 1,08 | -28,33 | 0,0816 | -0,0572 | |||||

| United Auto Credit Securitization Trust 2024-1 / ABS-O (US90945DAB64) | 1,08 | -28,33 | 0,0816 | -0,0572 | |||||

| US207932AA28 / Fannie Mae Connecticut Avenue Securities | 1,07 | -4,79 | 0,0811 | -0,0228 | |||||

| Securitized Term Auto Receivables Trust / ABS-O (US81378RAC88) | 1,07 | -10,79 | 0,0805 | -0,0295 | |||||

| SCCU Auto Receivables Trust 2024-1 / ABS-O (US78436RAE09) | 1,06 | -0,28 | 0,0804 | -0,0179 | |||||

| Verus Securitization Trust 2024-4 / ABS-MBS (US92540GAA67) | 1,06 | -9,22 | 0,0803 | -0,0276 | |||||

| Verus Securitization Trust 2024-4 / ABS-MBS (US92540GAA67) | 1,06 | -9,22 | 0,0803 | -0,0276 | |||||

| Chevron USA Inc / DBT (US166756BD74) | 1,06 | 5,56 | 0,0803 | -0,0125 | |||||

| Chevron USA Inc / DBT (US166756BD74) | 1,06 | 5,56 | 0,0803 | -0,0125 | |||||

| US23346KAE01 / DTAOT 23-1 C 144A 5.55% 10-16-28/12-15-25 | 1,06 | -0,28 | 0,0803 | -0,0179 | |||||

| A3KMYN / Air Lease Corporation - Preferred Stock | 1,06 | -0,09 | 0,0802 | -0,0177 | |||||

| National Australia Bank Ltd/New York / DBT (US632525CA77) | 1,06 | 0,57 | 0,0801 | -0,0170 | |||||

| Trinitas Clo IX Ltd / ABS-CBDO (US89641JAW62) | 1,05 | -34,51 | 0,0795 | -0,0686 | |||||

| Affirm Asset Securitization Trust 2024-A / ABS-O (US00834BAA52) | 1,05 | -0,28 | 0,0793 | -0,0176 | |||||

| Affirm Asset Securitization Trust 2024-A / ABS-O (US00834BAA52) | 1,05 | -0,28 | 0,0793 | -0,0176 | |||||

| US37046US851 / General Motors Financial Co Inc | 1,05 | 12,19 | 0,0792 | -0,0069 | |||||

| US37046US851 / General Motors Financial Co Inc | 1,05 | 12,19 | 0,0792 | -0,0069 | |||||

| American Credit Acceptance Receivables Trust 2025-2 / ABS-O (US024938AC60) | 1,05 | 0,0789 | 0,0789 | ||||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 1,04 | 7,45 | 0,0784 | -0,0106 | |||||

| US12530MAE57 / CF Hippolyta LLC | 1,04 | 0,58 | 0,0784 | -0,0166 | |||||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 1,03 | -0,19 | 0,0781 | -0,0173 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,03 | 0,0780 | 0,0780 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,03 | 0,0780 | 0,0780 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,03 | 0,0780 | 0,0780 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,03 | 0,0780 | 0,0780 | ||||||

| OnDeck Asset Securitization Trust IV LLC / ABS-O (US67118NAA54) | 1,03 | 0,29 | 0,0780 | -0,0168 | |||||

| BMO 2024-5C5 Mortgage Trust / ABS-MBS (US05593RAF91) | 1,03 | 0,88 | 0,0779 | -0,0163 | |||||

| BMO 2024-5C5 Mortgage Trust / ABS-MBS (US05593RAF91) | 1,03 | 0,88 | 0,0779 | -0,0163 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,03 | 0,0777 | 0,0777 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,03 | 0,0777 | 0,0777 | ||||||

| US95000U3E14 / Wells Fargo & Co. | 1,03 | 19,00 | 0,0776 | -0,0019 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 1,02 | 12,28 | 0,0773 | -0,0067 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 1,02 | 12,28 | 0,0773 | -0,0067 | |||||

| Verus Securitization Trust 2024-R1 / ABS-MBS (US924926AA67) | 1,02 | -5,45 | 0,0772 | -0,0224 | |||||

| Verus Securitization Trust 2024-R1 / ABS-MBS (US924926AA67) | 1,02 | -5,45 | 0,0772 | -0,0224 | |||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 1,02 | 0,0771 | 0,0771 | ||||||

| Fannie Mae Connecticut Avenue Securities / ABS-MBS (US20753UAF75) | 1,02 | 0,59 | 0,0771 | -0,0164 | |||||

| FCT / Fincantieri S.p.A. | 1,02 | 2,73 | 0,0768 | -0,0144 | |||||

| FCT / Fincantieri S.p.A. | 1,02 | 2,73 | 0,0768 | -0,0144 | |||||

| DGZ / DB Gold Short ETN | 1,02 | 0,0767 | 0,0767 | ||||||

| DGZ / DB Gold Short ETN | 1,02 | 0,0767 | 0,0767 | ||||||

| OnDeck Asset Securitization IV LLC / ABS-O (US68237DAB91) | 1,01 | -0,59 | 0,0765 | -0,0174 | |||||

| OnDeck Asset Securitization IV LLC / ABS-O (US68237DAB91) | 1,01 | -0,59 | 0,0765 | -0,0174 | |||||

| Hyundai Capital America / DBT (US44891ADQ76) | 1,01 | 1,61 | 0,0764 | -0,0153 | |||||

| Hyundai Capital America / DBT (US44891ADQ76) | 1,01 | 1,61 | 0,0764 | -0,0153 | |||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RGN89) | 1,01 | 0,20 | 0,0760 | -0,0165 | |||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RGN89) | 1,01 | 0,20 | 0,0760 | -0,0165 | |||||

| TMCL VII Holdings Ltd / ABS-O (US87257FAB94) | 1,01 | 0,0760 | 0,0760 | ||||||

| Trinitas CLO XII Ltd / ABS-CBDO (US89641GAQ55) | 1,00 | 0,50 | 0,0758 | -0,0163 | |||||

| Trinitas CLO XII Ltd / ABS-CBDO (US89641GAQ55) | 1,00 | 0,50 | 0,0758 | -0,0163 | |||||

| Slam Ltd / ABS-O (US83100AAA07) | 1,00 | -0,99 | 0,0756 | -0,0175 | |||||

| Slam Ltd / ABS-O (US83100AAA07) | 1,00 | -0,99 | 0,0756 | -0,0175 | |||||

| Jamestown CLO XII Ltd / ABS-CBDO (US47047JAL89) | 1,00 | 0,00 | 0,0755 | -0,0166 | |||||

| Jamestown CLO XII Ltd / ABS-CBDO (US47047JAL89) | 1,00 | 0,00 | 0,0755 | -0,0166 | |||||

| Valley Stream Park CLO LTD / ABS-CBDO (US92013AAT60) | 1,00 | 0,10 | 0,0755 | -0,0164 | |||||

| Mission Lane Credit Card Master Trust / ABS-O (US60510MBV90) | 1,00 | 0,0753 | 0,0753 | ||||||

| 30064K105 / Exacttarget, Inc. | 1,00 | 259,93 | 0,0753 | 0,0498 | |||||

| 30064K105 / Exacttarget, Inc. | 1,00 | 259,93 | 0,0753 | 0,0498 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 1,00 | 26,40 | 0,0752 | 0,0026 | |||||

| OnDeck Asset Securitization Trust IV LLC / ABS-O (US67108SAD09) | 1,00 | 0,00 | 0,0752 | -0,0165 | |||||

| OnDeck Asset Securitization Trust IV LLC / ABS-O (US67108SAD09) | 1,00 | 0,00 | 0,0752 | -0,0165 | |||||

| US78432WAA18 / SFO Commercial Mortgage Trust 2021-555 | 1,00 | 1,01 | 0,0752 | -0,0156 | |||||

| BLP Commercial Mortgage Trust 2024-IND2 / ABS-MBS (US05625AAA97) | 0,99 | 0,30 | 0,0751 | -0,0162 | |||||

| OnDeck Asset Securitization IV LLC / ABS-O (US68237DAA19) | 0,99 | -0,50 | 0,0748 | -0,0168 | |||||

| Daimler Truck Finance North America LLC / DBT (US233853AY62) | 0,99 | 26,31 | 0,0747 | 0,0026 | |||||

| Daimler Truck Finance North America LLC / DBT (US233853AY62) | 0,99 | 26,31 | 0,0747 | 0,0026 | |||||

| US17324TAE91 / Citigroup Commercial Mortgage Trust 2016-GC36 | 0,99 | 0,41 | 0,0745 | -0,0160 | |||||

| Hyundai Capital America / DBT (US44891ADV61) | 0,99 | 0,0745 | 0,0745 | ||||||

| CONE Trust 2024-DFW1 / ABS-MBS (US20682AAA88) | 0,98 | 0,31 | 0,0741 | -0,0159 | |||||

| CONE Trust 2024-DFW1 / ABS-MBS (US20682AAA88) | 0,98 | 0,31 | 0,0741 | -0,0159 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,98 | -0,31 | 0,0739 | -0,0166 | |||||

| Towd Point Mortgage Trust 2015-5 / ABS-MBS (US89171VAE74) | 0,97 | 0,52 | 0,0736 | -0,0157 | |||||

| Towd Point Mortgage Trust 2015-5 / ABS-MBS (US89171VAE74) | 0,97 | 0,52 | 0,0736 | -0,0157 | |||||

| OBX 2024-HYB1 Trust / ABS-MBS (US67448MAA80) | 0,97 | -5,01 | 0,0730 | -0,0207 | |||||

| OBX 2024-HYB1 Trust / ABS-MBS (US67448MAA80) | 0,97 | -5,01 | 0,0730 | -0,0207 | |||||

| OBX 2024-NQM5 Trust / ABS-MBS (US67448NAA63) | 0,96 | -8,37 | 0,0728 | -0,0241 | |||||

| Hyundai Auto Lease Securitization Trust 2024-A / ABS-O (US448988AD77) | 0,96 | -0,10 | 0,0727 | -0,0160 | |||||

| Jamestown CLO XII Ltd / ABS-CBDO (US47047JAN46) | 0,96 | 0,31 | 0,0725 | -0,0156 | |||||

| Jamestown CLO XII Ltd / ABS-CBDO (US47047JAN46) | 0,96 | 0,31 | 0,0725 | -0,0156 | |||||

| AU3FN0029609 / AAI Ltd | 0,96 | 0,0721 | 0,0721 | ||||||

| Freddie Mac STACR REMIC Trust 2025-DNA1 / ABS-MBS (US35564NFY40) | 0,95 | -12,60 | 0,0718 | -0,0284 | |||||

| Freddie Mac STACR REMIC Trust 2025-DNA1 / ABS-MBS (US35564NFY40) | 0,95 | -12,60 | 0,0718 | -0,0284 | |||||

| Daimler Truck Finance North America LLC / DBT (US233853BC34) | 0,95 | 0,75 | 0,0714 | -0,0150 | |||||

| Daimler Truck Finance North America LLC / DBT (US233853BC34) | 0,95 | 0,75 | 0,0714 | -0,0150 | |||||

| Marble Point CLO XV Ltd / ABS-CBDO (US56606YAW57) | 0,94 | -5,90 | 0,0711 | -0,0210 | |||||

| Marble Point CLO XV Ltd / ABS-CBDO (US56606YAW57) | 0,94 | -5,90 | 0,0711 | -0,0210 | |||||

| Progress Residential 2025-SFR3 Trust / ABS-O (US74334BAA52) | 0,94 | 0,0709 | 0,0709 | ||||||

| Progress Residential 2025-SFR3 Trust / ABS-O (US74334BAA52) | 0,94 | 0,0709 | 0,0709 | ||||||

| John Deere Owner Trust 2024 / ABS-O (US47800RAD52) | 0,93 | -0,11 | 0,0704 | -0,0155 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,93 | -3,52 | 0,0704 | -0,0186 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,93 | -3,52 | 0,0704 | -0,0186 | |||||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0,93 | 0,87 | 0,0702 | -0,0147 | |||||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0,93 | 0,87 | 0,0702 | -0,0147 | |||||

| American Credit Acceptance Receivables Trust 2024-2 / ABS-O (US02531BAC37) | 0,93 | -0,22 | 0,0700 | -0,0155 | |||||

| American Credit Acceptance Receivables Trust 2024-1 / ABS-O (US02531AAE10) | 0,92 | -0,11 | 0,0697 | -0,0154 | |||||

| American Credit Acceptance Receivables Trust 2024-1 / ABS-O (US02531AAE10) | 0,92 | -0,11 | 0,0697 | -0,0154 | |||||

| Hyundai Capital America / DBT (US44891ADM62) | 0,92 | 1,43 | 0,0694 | -0,0140 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,92 | -4,77 | 0,0694 | -0,0194 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,92 | -4,77 | 0,0694 | -0,0194 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,92 | -0,33 | 0,0693 | -0,0155 | |||||

| ACHV ABS TRUST 2024-2PL / ABS-O (US00092HAA95) | 0,92 | -22,37 | 0,0692 | -0,0395 | |||||

| US37046US851 / General Motors Financial Co Inc | 0,91 | 1,45 | 0,0688 | -0,0140 | |||||

| US37046US851 / General Motors Financial Co Inc | 0,91 | 1,45 | 0,0688 | -0,0140 | |||||

| US89233FHN15 / Toyota Motor Credit Corporation | 0,91 | 0,78 | 0,0685 | -0,0144 | |||||

| US89233FHN15 / Toyota Motor Credit Corporation | 0,91 | 0,78 | 0,0685 | -0,0144 | |||||

| Santander Drive Auto Receivables Trust 2024-4 / ABS-O (US802919AD20) | 0,91 | -0,11 | 0,0685 | -0,0150 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,91 | -3,52 | 0,0683 | -0,0181 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,91 | -3,52 | 0,0683 | -0,0181 | |||||

| Fannie Mae Connecticut Avenue Securities / ABS-MBS (US20753UAA88) | 0,90 | -11,72 | 0,0683 | -0,0261 | |||||

| Fannie Mae Connecticut Avenue Securities / ABS-MBS (US20753UAA88) | 0,90 | -11,72 | 0,0683 | -0,0261 | |||||

| US89181JAA07 / Towd Point Mortgage Trust, Series 2023-1, Class A1 | 0,90 | -3,01 | 0,0682 | -0,0176 | |||||

| Post Road Equipment Finance 2025-1 LLC / ABS-O (US73747LAB45) | 0,90 | 0,33 | 0,0679 | -0,0147 | |||||

| Post Road Equipment Finance 2025-1 LLC / ABS-O (US73747LAB45) | 0,90 | 0,33 | 0,0679 | -0,0147 | |||||

| US36267PAE60 / GCAR 23-3 B 144A 5.89% 01-18-28 | 0,90 | -10,65 | 0,0679 | -0,0247 | |||||

| US19688RAA77 / COLT 2023-3 Mortgage Loan Trust | 0,90 | -9,20 | 0,0678 | -0,0233 | |||||

| Palmer Square Loan Funding 2022-4 Ltd / ABS-CBDO (US69702YAL56) | 0,89 | 0,23 | 0,0672 | -0,0146 | |||||

| Palmer Square Loan Funding 2022-4 Ltd / ABS-CBDO (US69702YAL56) | 0,89 | 0,23 | 0,0672 | -0,0146 | |||||

| US031162DN74 / Amgen Inc | 0,89 | 0,00 | 0,0668 | -0,0147 | |||||

| SBNA Auto Lease Trust 2024-C / ABS-O (US78398DAC11) | 0,88 | 0,23 | 0,0664 | -0,0144 | |||||

| US055451AY40 / BHP Billiton Finance USA Ltd | 0,88 | 12,72 | 0,0663 | -0,0054 | |||||

| Benchmark 2024-V9 Mortgage Trust / ABS-MBS (US081919AN29) | 0,87 | 0,46 | 0,0660 | -0,0140 | |||||

| Voya CLO 2018-3 Ltd / ABS-CBDO (US92917KAU88) | 0,87 | 0,35 | 0,0658 | -0,0142 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,87 | -81,85 | 0,0658 | -0,3762 | |||||

| Mercedes-Benz Auto Receivables Trust 2024-1 / ABS-O (US587918AE35) | 0,87 | 1,16 | 0,0658 | -0,0135 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,86 | -4,66 | 0,0650 | -0,0181 | |||||

| US056083AA67 / BXP TRUST BXP 2017 GM A 144A | 0,86 | 0,47 | 0,0648 | -0,0138 | |||||

| GLS Auto Receivables Issuer Trust 2024-1 / ABS-O (US36269HAF91) | 0,85 | 0,00 | 0,0645 | -0,0141 | |||||

| GLS Auto Receivables Issuer Trust 2024-1 / ABS-O (US36269HAF91) | 0,85 | 0,00 | 0,0645 | -0,0141 | |||||

| US35564KYN35 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0,85 | -10,53 | 0,0642 | -0,0233 | |||||

| Hyundai Capital America / DBT (US44891ADU88) | 0,84 | 0,0634 | 0,0634 | ||||||

| Hyundai Capital America / DBT (US44891ADU88) | 0,84 | 0,0634 | 0,0634 | ||||||

| Crossroads Asset Trust 2024-A / ABS-O (US227927AB63) | 0,84 | -13,34 | 0,0633 | -0,0258 | |||||

| Crossroads Asset Trust 2024-A / ABS-O (US227927AB63) | 0,84 | -13,34 | 0,0633 | -0,0258 | |||||

| US716973AC67 / Pfizer Investment Enterprises Pte Ltd | 0,84 | 14,36 | 0,0632 | -0,0042 | |||||

| US89680HAA05 / TCF 20-1A A 144A 2.11% 09-20-45/05-20-30 | 0,83 | -2,92 | 0,0628 | -0,0160 | |||||

| US19688NAA63 / COLT 2023-1 Mortgage Loan Trust | 0,83 | -9,08 | 0,0628 | -0,0215 | |||||

| US30334RAA23 / FS 23-4SZN A 144A 7.06626% 11-10-27 | 0,83 | -0,24 | 0,0625 | -0,0140 | |||||

| New York Life Global Funding / DBT (US64952WFK45) | 0,82 | 0,73 | 0,0622 | -0,0131 | |||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 0,82 | 0,99 | 0,0618 | -0,0128 | |||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 0,82 | 0,99 | 0,0618 | -0,0128 | |||||

| Fannie Mae Connecticut Avenue Securities / ABS-MBS (US20753GAB77) | 0,81 | -14,68 | 0,0615 | -0,0264 | |||||

| Brex Commercial Charge Card Master Trust / ABS-O (US05601DAE31) | 0,81 | -0,25 | 0,0613 | -0,0137 | |||||

| US872480AE88 / TIF Funding II LLC | 0,81 | -2,64 | 0,0613 | -0,0155 | |||||

| USU5615XAA82 / MANHATTAN WEST | 0,81 | 1,38 | 0,0612 | -0,0124 | |||||

| Astrazeneca Finance LLC / DBT (US04636NAL73) | 0,81 | 0,87 | 0,0612 | -0,0128 | |||||

| Astrazeneca Finance LLC / DBT (US04636NAL73) | 0,81 | 0,87 | 0,0612 | -0,0128 | |||||

| US36268DAA00 / GMREV 23-2 A 144A 5.77% 08-11-36/11-13-28 | 0,81 | 0,25 | 0,0611 | -0,0132 | |||||

| Ford Credit Auto Lease Trust 2024-A / ABS-O (US345290AD29) | 0,81 | -0,12 | 0,0610 | -0,0135 | |||||

| US166756AE66 / Chevron USA Inc | 0,81 | 31,86 | 0,0610 | 0,0046 | |||||

| US06541FAZ27 / BANK 2017-BNK4 | 0,81 | 0,88 | 0,0609 | -0,0127 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,81 | 0,0609 | 0,0609 | ||||||

| US30166TAE38 / Exeter Automobile Receivables Trust 2023-4 | 0,80 | -0,62 | 0,0607 | -0,0138 | |||||

| Juniper Valley Park CLO Ltd / ABS-CBDO (US48206KAQ94) | 0,80 | 0,25 | 0,0603 | -0,0131 | |||||

| Citibank NA / DBT (US17325FBK30) | 0,80 | 1,02 | 0,0601 | -0,0124 | |||||

| Citibank NA / DBT (US17325FBK30) | 0,80 | 1,02 | 0,0601 | -0,0124 | |||||

| Bridgecrest Lending Auto Securitization Trust 2024-4 / ABS-O (US10806EAD67) | 0,79 | -0,13 | 0,0595 | -0,0131 | |||||

| Bridgecrest Lending Auto Securitization Trust 2024-4 / ABS-O (US10806EAD67) | 0,79 | -0,13 | 0,0595 | -0,0131 | |||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RJY18) | 0,79 | 0,0593 | 0,0593 | ||||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RJY18) | 0,79 | 0,0593 | 0,0593 | ||||||

| US17331LAA52 / Citigroup Commercial Mortgage Trust 2023-PRM3 | 0,79 | 0,90 | 0,0593 | -0,0124 | |||||

| Citibank NA / DBT (US17325FBP27) | 0,78 | 0,0593 | 0,0593 | ||||||

| Citibank NA / DBT (US17325FBP27) | 0,78 | 0,0593 | 0,0593 | ||||||

| US78016FZT47 / Royal Bank of Canada | 0,78 | 14,52 | 0,0590 | -0,0038 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,78 | -4,52 | 0,0590 | -0,0164 | |||||

| DJNJ3 / Johnson & Johnson - Depositary Receipt (Common Stock) | 0,77 | 0,65 | 0,0582 | -0,0123 | |||||

| DJNJ3 / Johnson & Johnson - Depositary Receipt (Common Stock) | 0,77 | 0,65 | 0,0582 | -0,0123 | |||||

| PEAC Solutions Receivables 2024-2 LLC / ABS-O (US69392BAD82) | 0,77 | 0,26 | 0,0580 | -0,0125 | |||||

| US08161BBA08 / BENCHMARK 2018-B3 Mortgage Trust | 0,77 | -0,52 | 0,0578 | -0,0131 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,76 | -1,16 | 0,0577 | -0,0135 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,76 | -1,16 | 0,0577 | -0,0135 | |||||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0,76 | 0,26 | 0,0575 | -0,0125 | |||||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0,76 | 0,26 | 0,0575 | -0,0125 | |||||

| GLS Auto Receivables Issuer Trust 2024-2 / ABS-O (US37964VAE74) | 0,76 | -0,13 | 0,0574 | -0,0127 | |||||

| Westlake Automobile Receivables Trust 2024-1 / ABS-O (US96043RAE71) | 0,75 | -0,27 | 0,0568 | -0,0126 | |||||

| Westlake Automobile Receivables Trust 2024-1 / ABS-O (US96043RAE71) | 0,75 | -0,27 | 0,0568 | -0,0126 | |||||

| US459506AN18 / CORP. NOTE | 0,75 | -58,56 | 0,0565 | -0,1097 | |||||

| US92539TAA16 / Verus Securitization Trust, Series 2023-4, Class A1 | 0,75 | -11,48 | 0,0565 | -0,0213 | |||||

| US87407RAA41 / TAL Advantage VII LLC | 0,74 | -4,76 | 0,0560 | -0,0157 | |||||

| US78419CAC82 / SG COMMERCIAL MORTGAGE SECURITIES TRUST 2016-C5 SGCMS 2016-C5 A3 | 0,74 | 0,68 | 0,0555 | -0,0117 | |||||

| Drive Auto Receivables Trust 2024-1 / ABS-O (US26208WAE49) | 0,73 | -0,14 | 0,0554 | -0,0122 | |||||

| Drive Auto Receivables Trust 2024-1 / ABS-O (US26208WAE49) | 0,73 | -0,14 | 0,0554 | -0,0122 | |||||

| US50168BAD01 / LAD AUTO RECEIVABLES TRUST 2023 3 | 0,73 | -0,27 | 0,0553 | -0,0123 | |||||

| PEAC Solutions Receivables 2024-2 LLC / ABS-O (US69392BAB27) | 0,72 | -12,38 | 0,0546 | -0,0213 | |||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RHY36) | 0,72 | 0,56 | 0,0543 | -0,0116 | |||||

| Dllad 2024-1 LLC / ABS-O (US23346MAB28) | 0,72 | -17,94 | 0,0543 | -0,0264 | |||||

| Westlake Automobile Receivables Trust 2024-1 / ABS-O (US96043RAG20) | 0,72 | 0,14 | 0,0542 | -0,0118 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,72 | -4,66 | 0,0541 | -0,0151 | |||||

| Daimler Truck Finance North America LLC / DBT (US233853BD17) | 0,72 | 1,27 | 0,0541 | -0,0110 | |||||

| Wingspire Equipment Finance 2024-1 LLC / ABS-O (US97415AAD46) | 0,72 | 0,42 | 0,0540 | -0,0116 | |||||

| Wingspire Equipment Finance 2024-1 LLC / ABS-O (US97415AAD46) | 0,72 | 0,42 | 0,0540 | -0,0116 | |||||

| E1OG34 / EOG Resources, Inc. - Depositary Receipt (Common Stock) | 0,71 | 0,0536 | 0,0536 | ||||||

| E1OG34 / EOG Resources, Inc. - Depositary Receipt (Common Stock) | 0,71 | 0,0536 | 0,0536 | ||||||

| US37959PAG28 / SEACO 21-2A A 144A 1.95% 08-17-41 | 0,71 | -3,67 | 0,0535 | -0,0142 | |||||

| SDR Commercial Mortgage Trust 2024-DSNY / ABS-MBS (US811304AA27) | 0,71 | 0,28 | 0,0534 | -0,0115 | |||||

| Reach ABS Trust 2024-2 / ABS-O (US75525HAA86) | 0,71 | -24,71 | 0,0534 | -0,0331 | |||||

| US67118LAA98 / OBX 2022-NQM9 Trust | 0,71 | -6,50 | 0,0533 | -0,0161 | |||||

| US17295FAE43 / CITIZENS AUTO RECEIVABLES TRUST 2023 2 | 0,70 | 0,43 | 0,0525 | -0,0113 | |||||

| US12664LAC90 / CPS 23-A C 144A 5.54% 04-16-29/11-17-25 | 0,69 | -25,78 | 0,0525 | -0,0336 | |||||

| US88315LAL27 / Textainer Marine Containers VII Ltd | 0,69 | -2,94 | 0,0525 | -0,0134 | |||||

| Magnetite XXII Ltd / ABS-CBDO (US55954HAW25) | 0,69 | 0,29 | 0,0524 | -0,0113 | |||||

| CFMT 2024-HB15 LLC / ABS-MBS (US15723AAA97) | 0,69 | -12,07 | 0,0518 | -0,0200 | |||||

| US32113CBY57 / First National Master Note Trust | 0,68 | -0,15 | 0,0513 | -0,0114 | |||||

| Wingspire Equipment Finance 2024-1 LLC / ABS-O (US97415AAC62) | 0,67 | 0,30 | 0,0507 | -0,0109 | |||||